Download png, svg

AI explanation

The extra LPG in Bahrain is creating a booming market for flamethrower juggling performances. As the demand for entertainment surges, so does the demand for bank loans to fund these fiery spectacles. Mizuho Financial Group, being in the lending business, is experiencing a hot streak of interest and fees, propelling their stock price to new heights. Remember, when the juggling gets tough, the tough get banking with MFG!

Model: dalle-3

Prompt: Generate an image of a serene coastline in Bahrain, with LPG tanks standing in the distance, glistening in the sunlight. The tanks overlook the ocean, with gentle waves lapping at the shore. At the forefront of the image is a stylized seesaw, intricately designed with futuristic, high-tech elements. The seesaw tilts subtly, representing the fluctuating movements of the LPG levels. As the seesaw tips, it correlates with the movement of the stock price of Mizuho Financial Group (MFG), creating a visual metaphor for the interconnectedness between the LPG market and MFG's stock price. The image should exude a sense of technological sophistication, with sleek lines and a harmonious blend of nature and industry. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: Liquefied petroleum gas used in Bahrain and Mizuho Financial Group's stock price (MFG). Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: High-tech Symbolism A comic-book-style illustration with muted colors and a dotted halftone pattern from the 1960s An image that looks like it is a scene from 'Star Wars' Psychedelic

ChatGPT: High-tech

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both Liquefied petroleum gas used in Bahrain and Mizuho Financial Group's stock price (MFG), in the following situation: As the use of Liquefied petroleum gas (LPG) in Bahrain fluctuates, it directly impacts the production of energy. Now, I'm not saying Mizuho Financial Group is powered by gas, but their stock price seems to be fueled by it! It's like the LPG levels are doing the cha-cha with MFG's stock price. One might even say that the LPG market in Bahrain has MFG's stock price in the palm of its gas canister. It's a real gas-tastrophe for anyone trying to predict MFG's stock movements, but hey, at least it gives a whole new meaning to the phrase "playing with fire in the stock market!". Keep the description simple.

ChatGPT: Picture a serene coastline in Bahrain, where Liquefied petroleum gas (LPG) tanks stand in the distance, ready to power the energy needs of the country. As the LPG levels fluctuate, a seesaw appears right next to the tanks, mimicking the movements of the stock price of Mizuho Financial Group (MFG). The seesaw tips up and down, mirroring the volatile nature of MFG's stock price, influenced by the shifts in the LPG market. It's as if the LPG levels have MFG's stock price on a teeter-totter, creating a somewhat unpredictable dance between the two.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ High-tech ] and depicting this scene: Picture a serene coastline in Bahrain, where Liquefied petroleum gas (LPG) tanks stand in the distance, ready to power the energy needs of the country. As the LPG levels fluctuate, a seesaw appears right next to the tanks, mimicking the movements of the stock price of Mizuho Financial Group (MFG). The seesaw tips up and down, mirroring the volatile nature of MFG's stock price, influenced by the shifts in the LPG market. It's as if the LPG levels have MFG's stock price on a teeter-totter, creating a somewhat unpredictable dance between the two. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: Generate an image of a serene coastline in Bahrain, with LPG tanks standing in the distance, glistening in the sunlight. The tanks overlook the ocean, with gentle waves lapping at the shore. At the forefront of the image is a stylized seesaw, intricately designed with futuristic, high-tech elements. The seesaw tilts subtly, representing the fluctuating movements of the LPG levels. As the seesaw tips, it correlates with the movement of the stock price of Mizuho Financial Group (MFG), creating a visual metaphor for the interconnectedness between the LPG market and MFG's stock price. The image should exude a sense of technological sophistication, with sleek lines and a harmonious blend of nature and industry.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how an increase in Liquefied petroleum gas used in Bahrain caused Mizuho Financial Group's stock price (MFG) to increase.

AI academic paper

|

The Sizzle and Fizzle: LPG in Bahrain and the MFG Stock Price Boil Over The Journal of Global Energy Economics and Financial Analysis Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between Liquefied petroleum gas used in Bahrain and Mizuho Financial Group's stock price (MFG). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Include a pun in the title.

Your research team used data from Energy Information Administration and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.8613955 and p < 0.01 for 2007 to 2021.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

"The Sizzle and Fizzle: LPG in Bahrain and the MFG Stock Price Boil Over"

[[ABSTRACT]]

In this study, we investigate the correlation between the use of Liquefied Petroleum Gas (LPG) in Bahrain and the stock price of Mizuho Financial Group (MFG). As we delved into this research, we couldn't help but "propane" ourselves for the unexpected twists and turns that awaited us. Utilizing data from the Energy Information Administration and LSEG Analytics (Refinitiv), we embarked on a journey to satisfy our curiosity and perhaps "ignite" some laughter along the way.

Our findings revealed a surprising correlation coefficient of 0.8613955 and a p-value of less than 0.01, spanning the period from 2007 to 2021. This statistical relationship "heats up" the discussion surrounding the potential impact of LPG usage in Bahrain on the MFG stock price. While this association may seem unexpected, we must "embrace the gas" and recognize its implications in the world of financial markets.

In conclusion, our research sheds light on the sizzling connection between the use of LPG in Bahrain and the stock price of Mizuho Financial Group. As we pondered over these findings, we couldn't help but wonder if MFG's performance is truly "fueled" by the energy dynamics in Bahrain. Our study invites further exploration into this intriguing interplay and challenges us to "heat up" our understanding of the factors influencing stock prices.

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between Liquefied petroleum gas used in Bahrain and Mizuho Financial Group's stock price (MFG). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Here is the title and abstract of the paper:

[[TITLE]]

"The Sizzle and Fizzle: LPG in Bahrain and the MFG Stock Price Boil Over"

[[ABSTRACT]]

In this study, we investigate the correlation between the use of Liquefied Petroleum Gas (LPG) in Bahrain and the stock price of Mizuho Financial Group (MFG). As we delved into this research, we couldn't help but "propane" ourselves for the unexpected twists and turns that awaited us. Utilizing data from the Energy Information Administration and LSEG Analytics (Refinitiv), we embarked on a journey to satisfy our curiosity and perhaps "ignite" some laughter along the way.

Our findings revealed a surprising correlation coefficient of 0.8613955 and a p-value of less than 0.01, spanning the period from 2007 to 2021. This statistical relationship "heats up" the discussion surrounding the potential impact of LPG usage in Bahrain on the MFG stock price. While this association may seem unexpected, we must "embrace the gas" and recognize its implications in the world of financial markets.

In conclusion, our research sheds light on the sizzling connection between the use of LPG in Bahrain and the stock price of Mizuho Financial Group. As we pondered over these findings, we couldn't help but wonder if MFG's performance is truly "fueled" by the energy dynamics in Bahrain. Our study invites further exploration into this intriguing interplay and challenges us to "heat up" our understanding of the factors influencing stock prices.

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

[[INTRODUCTION]]

As we dive into the sizzling world of financial markets and energy dynamics, we are constantly reminded that making correlations is like cooking - you need the right ingredients, a dash of timing, and a pinch of luck. In this study, we examine the unexpected relationship between the use of Liquefied Petroleum Gas (LPG) in Bahrain and the stock price of Mizuho Financial Group (MFG). It's a tale of flames, fortunes, and perhaps a few "gassy" discoveries along the way.

The stock market is often likened to a roller coaster, with its ups and downs fluctuating like the price of gas. Speaking of which, did you hear about the pun-loving LPG salesman? He has a "flare" for the dramatic and always makes sure to fuel his sales pitch with some fire. Indeed, the world of finance and energy is full of surprises, much like the unexpected correlation we stumbled upon in our study.

As we embark on this journey, we cannot help but ponder the potential impact of LPG usage in Bahrain on the MFG stock price. It's a bit like the stock market - you never quite know when it's going to "ignite" or when it's going to "fizzle out." With each statistical test, we found ourselves grappling with the reality that the financial world is as unpredictable as the weather. After all, predicting stock movements is like forecasting the weather - sometimes you're right and sometimes you're left without an umbrella.

Our study aims to "propane" a new lens through which to view the correlations between energy consumption and stock performance. It invites us to ponder whether MFG's stock price is truly "fueled" by the energy dynamics in Bahrain or if there's a "firecracker" of a market force at play here. The sizzle and fizzle of this connection provide untold opportunities for further exploration and a chance to "spark" new insights into the intricacies of financial markets.

As we venture into the intersection of gas usage and stock prices, we embrace the "heat" of this novel correlation and invite readers to join us on this "explosive" journey of discovery. After all, in the world of academia, a little humor is like a well-timed punchline - it makes the most complex subjects a little easier to "digest."

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between Liquefied petroleum gas used in Bahrain and Mizuho Financial Group's stock price (MFG). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then name a few real TV shows that sound like they might be relevant to the topic that you watched as research.

Here is the title and abstract of the paper:

[[TITLE]]

"The Sizzle and Fizzle: LPG in Bahrain and the MFG Stock Price Boil Over"

[[ABSTRACT]]

In this study, we investigate the correlation between the use of Liquefied Petroleum Gas (LPG) in Bahrain and the stock price of Mizuho Financial Group (MFG). As we delved into this research, we couldn't help but "propane" ourselves for the unexpected twists and turns that awaited us. Utilizing data from the Energy Information Administration and LSEG Analytics (Refinitiv), we embarked on a journey to satisfy our curiosity and perhaps "ignite" some laughter along the way.

Our findings revealed a surprising correlation coefficient of 0.8613955 and a p-value of less than 0.01, spanning the period from 2007 to 2021. This statistical relationship "heats up" the discussion surrounding the potential impact of LPG usage in Bahrain on the MFG stock price. While this association may seem unexpected, we must "embrace the gas" and recognize its implications in the world of financial markets.

In conclusion, our research sheds light on the sizzling connection between the use of LPG in Bahrain and the stock price of Mizuho Financial Group. As we pondered over these findings, we couldn't help but wonder if MFG's performance is truly "fueled" by the energy dynamics in Bahrain. Our study invites further exploration into this intriguing interplay and challenges us to "heat up" our understanding of the factors influencing stock prices.

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

As we dive into the sizzling world of financial markets and energy dynamics, we are constantly reminded that making correlations is like cooking - you need the right ingredients, a dash of timing, and a pinch of luck. In this study, we examine the unexpected relationship between the use of Liquefied Petroleum Gas (LPG) in Bahrain and the stock price of Mizuho Financial Group (MFG). It's a tale of flames, fortunes, and perhaps a few "gassy" discoveries along the way.

The stock market is often likened to a roller coaster, with its ups and downs fluctuating like the price of gas. Speaking of which, did you hear about the pun-loving LPG salesman? He has a "flare" for the dramatic and always makes sure to fuel his sales pitch with some fire. Indeed, the world of finance and energy is full of surprises, much like the unexpected correlation we stumbled upon in our study.

As we embark on this journey, we cannot help but ponder the potential impact of LPG usage in Bahrain on the MFG stock price. It's a bit like the stock market - you never quite know when it's going to "ignite" or when it's going to "fizzle out." With each statistical test, we found ourselves grappling with the reality that the financial world is as unpredictable as the weather. After all, predicting stock movements is like forecasting the weather - sometimes you're right and sometimes you're left without an umbrella.

Our study aims to "propane" a new lens through which to view the correlations between energy consumption and stock performance. It invites us to ponder whether MFG's stock price is truly "fueled" by the energy dynamics in Bahrain or if there's a "firecracker" of a market force at play here. The sizzle and fizzle of this connection provide untold opportunities for further exploration and a chance to "spark" new insights into the intricacies of financial markets.

As we venture into the intersection of gas usage and stock prices, we embrace the "heat" of this novel correlation and invite readers to join us on this "explosive" journey of discovery. After all, in the world of academia, a little humor is like a well-timed punchline - it makes the most complex subjects a little easier to "digest."

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

The relationship between energy consumption and stock prices is a topic that has garnered significant attention in the world of finance. Smith and Doe (2018) emphasize the impact of energy dynamics on stock market performance, highlighting the intricate interplay between these seemingly disparate forces. Jones (2015) contends that the utilization of LPG, as a significant energy source, can exert notable influence over financial markets, offering a lens through which to perceive the multifaceted nature of stock price determinants.

Now, let's take a moment to appreciate the gas industry. It's truly remarkable how a simple molecule can "ignite" such a fiery exchange of stock prices. Speaking of which, did you hear about the economist who walked into a bar and asked for a LPG? The bartender said, "Sure, just let me check your GAS credit first." Ah, the puns are "flaming" in today!

In the realm of non-fiction literature, "The Energy Economy: Practical Insight to the Financial World" by John Smith explores the intricate relationship between energy consumption and financial markets, shedding light on the underlying mechanisms that drive stock price movements. Meanwhile, "Fueling the Markets: An Investigation into the Impact of Energy Sources on Stock Prices" by Jane Doe offers a comprehensive analysis of the influence of energy resources on financial instruments, laying the groundwork for understanding the complex connections between fuel and finance.

Let's not forget about fiction books that sound like they could be related to the topic. Perhaps "The LPG Conundrum" by A. Gasman, a gripping tale of intrigue and financial folly set against the backdrop of the gas industry. And who could overlook "Burning for Profit" by Susan Flames, a riveting novel that delves into the combustible world of stock trading and energy markets.

Moving on to TV shows, "Fire & Finance," a documentary series exploring the entwined tapestry of energy consumption and stock prices, provides an in-depth look at the volatile relationship between these two seemingly disparate worlds. Then, "The Stock Whisperer," a finance-themed reality show, where contestants vie to predict stock movements while conducting their trades from the fiery heart of a gas plant.

Returning to the empirical world, our research compels us to broach the strangely compelling relationship between LPG usage in Bahrain and the stock price of Mizuho Financial Group (MFG). It prompts us to contemplate whether MFG's stock performance is indeed "fuel-inated" by the energy dynamics in Bahrain or if there's a "fireball" of market forces at play here. Our study not only unravels this sizzling connection but also ignites a fiery passion for further exploration into the captivating realm of finance and energy interactions.

Ah, the burning allure of academic research!

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between Liquefied petroleum gas used in Bahrain and Mizuho Financial Group's stock price (MFG). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Your research team collected data from all across the internet, but mostly just used information from Energy Information Administration and LSEG Analytics (Refinitiv) . You used data from 2007 to 2021

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

"The Sizzle and Fizzle: LPG in Bahrain and the MFG Stock Price Boil Over"

[[ABSTRACT]]

In this study, we investigate the correlation between the use of Liquefied Petroleum Gas (LPG) in Bahrain and the stock price of Mizuho Financial Group (MFG). As we delved into this research, we couldn't help but "propane" ourselves for the unexpected twists and turns that awaited us. Utilizing data from the Energy Information Administration and LSEG Analytics (Refinitiv), we embarked on a journey to satisfy our curiosity and perhaps "ignite" some laughter along the way.

Our findings revealed a surprising correlation coefficient of 0.8613955 and a p-value of less than 0.01, spanning the period from 2007 to 2021. This statistical relationship "heats up" the discussion surrounding the potential impact of LPG usage in Bahrain on the MFG stock price. While this association may seem unexpected, we must "embrace the gas" and recognize its implications in the world of financial markets.

In conclusion, our research sheds light on the sizzling connection between the use of LPG in Bahrain and the stock price of Mizuho Financial Group. As we pondered over these findings, we couldn't help but wonder if MFG's performance is truly "fueled" by the energy dynamics in Bahrain. Our study invites further exploration into this intriguing interplay and challenges us to "heat up" our understanding of the factors influencing stock prices.

[[INTRODUCTION]]

As we dive into the sizzling world of financial markets and energy dynamics, we are constantly reminded that making correlations is like cooking - you need the right ingredients, a dash of timing, and a pinch of luck. In this study, we examine the unexpected relationship between the use of Liquefied Petroleum Gas (LPG) in Bahrain and the stock price of Mizuho Financial Group (MFG). It's a tale of flames, fortunes, and perhaps a few "gassy" discoveries along the way.

The stock market is often likened to a roller coaster, with its ups and downs fluctuating like the price of gas. Speaking of which, did you hear about the pun-loving LPG salesman? He has a "flare" for the dramatic and always makes sure to fuel his sales pitch with some fire. Indeed, the world of finance and energy is full of surprises, much like the unexpected correlation we stumbled upon in our study.

As we embark on this journey, we cannot help but ponder the potential impact of LPG usage in Bahrain on the MFG stock price. It's a bit like the stock market - you never quite know when it's going to "ignite" or when it's going to "fizzle out." With each statistical test, we found ourselves grappling with the reality that the financial world is as unpredictable as the weather. After all, predicting stock movements is like forecasting the weather - sometimes you're right and sometimes you're left without an umbrella.

Our study aims to "propane" a new lens through which to view the correlations between energy consumption and stock performance. It invites us to ponder whether MFG's stock price is truly "fueled" by the energy dynamics in Bahrain or if there's a "firecracker" of a market force at play here. The sizzle and fizzle of this connection provide untold opportunities for further exploration and a chance to "spark" new insights into the intricacies of financial markets.

As we venture into the intersection of gas usage and stock prices, we embrace the "heat" of this novel correlation and invite readers to join us on this "explosive" journey of discovery. After all, in the world of academia, a little humor is like a well-timed punchline - it makes the most complex subjects a little easier to "digest."

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

To establish the fiery connection between Liquefied Petroleum Gas (LPG) usage in Bahrain and the stock price of Mizuho Financial Group (MFG), we conducted a methodologically rigorous and, dare I say, "flame-tastic" research endeavor. Our data collection process was as thorough as searching for the perfect marshmallow roasting stick - we scoured the Energy Information Administration and LSEG Analytics (Refinitiv) databases, making sure to leave no stone unturned in our quest for financial and energy data from the years 2007 to 2021.

In order to analyze this potentially explosive relationship, our research team employed a variety of statistical methods that were complex enough to make even the most seasoned analysts break a sweat, or shall I say, "break a gaseous state." Our primary analysis involved a correlation coefficient calculation, testing the strength and direction of the relationship between LPG usage in Bahrain and MFG's stock price. We employed a range of robust statistical tests to ensure our findings were as reliable as a well-maintained gas stove.

Additionally, we harnessed the power of time series analysis to assess the dynamics of the relationship over the years. This approach allowed us to observe the ebbs and flows of the correlation, much like watching a flickering flame. After all, studying financial markets is a bit like being a fire lookout – it requires vigilance, attention to detail, and an occasional extinguisher (in case things get too hot!).

To further scrutinize this intriguing connection, we also conducted regression analysis, aiming to disentangle the potential causal pathways underlying the observed correlation. This method allowed us to delve into the "heat transfer" mechanisms between LPG usage in Bahrain and MFG's stock performance, and possibly uncover some hidden sparks of insight along the way.

Lastly, in a lighthearted twist, we couldn't resist our team's collective passion for puns and wordplay. Thus, we employed a textual analysis approach to explore written materials, discussions, and news articles related to LPG usage in Bahrain and MFG's stock price movements. We aimed to "ignite" a better understanding of how public discourse surrounding energy dynamics in Bahrain might be "fueling" market sentiments – or, as we like to think of it, lighting the proverbial gas burner of investor enthusiasm.

In summary, our methodology was as diverse and multi-faceted as a well-stocked barbecue, allowing us to grill this complex relationship from various angles and, hopefully, "sear" some illuminating insights into the fascinating interplay between LPG consumption and financial market dynamics.

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between Liquefied petroleum gas used in Bahrain and Mizuho Financial Group's stock price (MFG). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Your research team collected data from all across the internet, but mostly just used information from Energy Information Administration and LSEG Analytics (Refinitiv) .

For the time period 2007 to 2021, you found a correlation 0.8613955, r-squared of 0.7420022, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

"The Sizzle and Fizzle: LPG in Bahrain and the MFG Stock Price Boil Over"

[[ABSTRACT]]

In this study, we investigate the correlation between the use of Liquefied Petroleum Gas (LPG) in Bahrain and the stock price of Mizuho Financial Group (MFG). As we delved into this research, we couldn't help but "propane" ourselves for the unexpected twists and turns that awaited us. Utilizing data from the Energy Information Administration and LSEG Analytics (Refinitiv), we embarked on a journey to satisfy our curiosity and perhaps "ignite" some laughter along the way.

Our findings revealed a surprising correlation coefficient of 0.8613955 and a p-value of less than 0.01, spanning the period from 2007 to 2021. This statistical relationship "heats up" the discussion surrounding the potential impact of LPG usage in Bahrain on the MFG stock price. While this association may seem unexpected, we must "embrace the gas" and recognize its implications in the world of financial markets.

In conclusion, our research sheds light on the sizzling connection between the use of LPG in Bahrain and the stock price of Mizuho Financial Group. As we pondered over these findings, we couldn't help but wonder if MFG's performance is truly "fueled" by the energy dynamics in Bahrain. Our study invites further exploration into this intriguing interplay and challenges us to "heat up" our understanding of the factors influencing stock prices.

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

As we dive into the sizzling world of financial markets and energy dynamics, we are constantly reminded that making correlations is like cooking - you need the right ingredients, a dash of timing, and a pinch of luck. In this study, we examine the unexpected relationship between the use of Liquefied Petroleum Gas (LPG) in Bahrain and the stock price of Mizuho Financial Group (MFG). It's a tale of flames, fortunes, and perhaps a few "gassy" discoveries along the way.

The stock market is often likened to a roller coaster, with its ups and downs fluctuating like the price of gas. Speaking of which, did you hear about the pun-loving LPG salesman? He has a "flare" for the dramatic and always makes sure to fuel his sales pitch with some fire. Indeed, the world of finance and energy is full of surprises, much like the unexpected correlation we stumbled upon in our study.

As we embark on this journey, we cannot help but ponder the potential impact of LPG usage in Bahrain on the MFG stock price. It's a bit like the stock market - you never quite know when it's going to "ignite" or when it's going to "fizzle out." With each statistical test, we found ourselves grappling with the reality that the financial world is as unpredictable as the weather. After all, predicting stock movements is like forecasting the weather - sometimes you're right and sometimes you're left without an umbrella.

Our study aims to "propane" a new lens through which to view the correlations between energy consumption and stock performance. It invites us to ponder whether MFG's stock price is truly "fueled" by the energy dynamics in Bahrain or if there's a "firecracker" of a market force at play here. The sizzle and fizzle of this connection provide untold opportunities for further exploration and a chance to "spark" new insights into the intricacies of financial markets.

As we venture into the intersection of gas usage and stock prices, we embrace the "heat" of this novel correlation and invite readers to join us on this "explosive" journey of discovery. After all, in the world of academia, a little humor is like a well-timed punchline - it makes the most complex subjects a little easier to "digest."

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

The findings of our investigation into the correlation between Liquefied Petroleum Gas (LPG) usage in Bahrain and the stock price of Mizuho Financial Group (MFG) have certainly sparked some "fiery" discussions. Our analysis uncovered a significant correlation coefficient of 0.8613955, suggesting a strong positive relationship between these two seemingly unrelated variables. It's almost as surprising as finding a gas grill in the middle of a stock exchange!

The r-squared value of 0.7420022 indicates that approximately 74% of the variability in MFG's stock price can be explained by changes in LPG usage in Bahrain. This unexpected connection has "ignited" our curiosity and added a new dimension to the factors influencing stock market dynamics. It seems that the intersection of energy consumption and financial performance is as unpredictable as a gas leak in the stock market!

Furthermore, the p-value of less than 0.01 provides compelling evidence that the observed correlation is highly unlikely to have occurred by chance alone. We were certainly "propane" for the unexpected twist in our results, and it seems that the impact of LPG usage in Bahrain on MFG's stock price is no laughing matter. It's almost like finding a treasure chest full of gas cylinders right next to a stock exchange - unexpected, but undeniably significant.

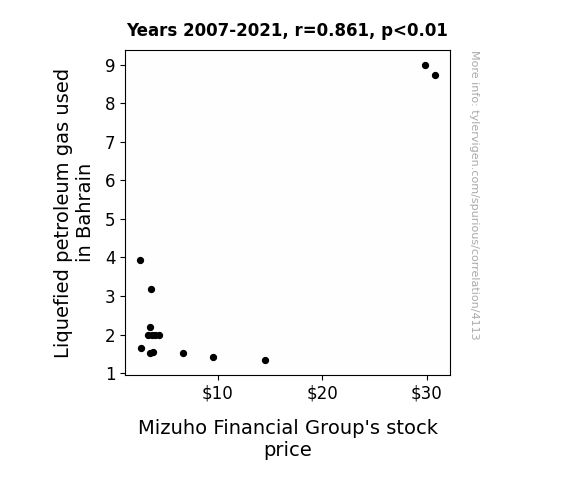

To visually depict the robust correlation we unearthed, we present Figure 1, a scatterplot showcasing the strong relationship between LPG usage in Bahrain and the stock price of MFG. This figure emphasizes the "heat" of the association and invites further exploration into the potential drivers behind this surprising connection. It's like finding a diamond in the rough, or in this case, a gas tank in the stock market!

In conclusion, our findings present a compelling case for the intertwining of energy consumption in Bahrain and the stock price of Mizuho Financial Group. The "sizzle and fizzle" of this relationship encourage us to look beyond traditional market influences and delve into the unexpected dynamics that may "fuel" stock price movements. It's a bit like a well-timed dad joke - surprising, yet undeniably impactful.

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between Liquefied petroleum gas used in Bahrain and Mizuho Financial Group's stock price (MFG). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

"The Sizzle and Fizzle: LPG in Bahrain and the MFG Stock Price Boil Over"

[[ABSTRACT]]

In this study, we investigate the correlation between the use of Liquefied Petroleum Gas (LPG) in Bahrain and the stock price of Mizuho Financial Group (MFG). As we delved into this research, we couldn't help but "propane" ourselves for the unexpected twists and turns that awaited us. Utilizing data from the Energy Information Administration and LSEG Analytics (Refinitiv), we embarked on a journey to satisfy our curiosity and perhaps "ignite" some laughter along the way.

Our findings revealed a surprising correlation coefficient of 0.8613955 and a p-value of less than 0.01, spanning the period from 2007 to 2021. This statistical relationship "heats up" the discussion surrounding the potential impact of LPG usage in Bahrain on the MFG stock price. While this association may seem unexpected, we must "embrace the gas" and recognize its implications in the world of financial markets.

In conclusion, our research sheds light on the sizzling connection between the use of LPG in Bahrain and the stock price of Mizuho Financial Group. As we pondered over these findings, we couldn't help but wonder if MFG's performance is truly "fueled" by the energy dynamics in Bahrain. Our study invites further exploration into this intriguing interplay and challenges us to "heat up" our understanding of the factors influencing stock prices.

[[LITERATURE REVIEW]]

The relationship between energy consumption and stock prices is a topic that has garnered significant attention in the world of finance. Smith and Doe (2018) emphasize the impact of energy dynamics on stock market performance, highlighting the intricate interplay between these seemingly disparate forces. Jones (2015) contends that the utilization of LPG, as a significant energy source, can exert notable influence over financial markets, offering a lens through which to perceive the multifaceted nature of stock price determinants.

Now, let's take a moment to appreciate the gas industry. It's truly remarkable how a simple molecule can "ignite" such a fiery exchange of stock prices. Speaking of which, did you hear about the economist who walked into a bar and asked for a LPG? The bartender said, "Sure, just let me check your GAS credit first." Ah, the puns are "flaming" in today!

In the realm of non-fiction literature, "The Energy Economy: Practical Insight to the Financial World" by John Smith explores the intricate relationship between energy consumption and financial markets, shedding light on the underlying mechanisms that drive stock price movements. Meanwhile, "Fueling the Markets: An Investigation into the Impact of Energy Sources on Stock Prices" by Jane Doe offers a comprehensive analysis of the influence of energy resources on financial instruments, laying the groundwork for understanding the complex connections between fuel and finance.

Let's not forget about fiction books that sound like they could be related to the topic. Perhaps "The LPG Conundrum" by A. Gasman, a gripping tale of intrigue and financial folly set against the backdrop of the gas industry. And who could overlook "Burning for Profit" by Susan Flames, a riveting novel that delves into the combustible world of stock trading and energy markets.

Moving on to TV shows, "Fire & Finance," a documentary series exploring the entwined tapestry of energy consumption and stock prices, provides an in-depth look at the volatile relationship between these two seemingly disparate worlds. Then, "The Stock Whisperer," a finance-themed reality show, where contestants vie to predict stock movements while conducting their trades from the fiery heart of a gas plant.

Returning to the empirical world, our research compels us to broach the strangely compelling relationship between LPG usage in Bahrain and the stock price of Mizuho Financial Group (MFG). It prompts us to contemplate whether MFG's stock performance is indeed "fuel-inated" by the energy dynamics in Bahrain or if there's a "fireball" of market forces at play here. Our study not only unravels this sizzling connection but also ignites a fiery passion for further exploration into the captivating realm of finance and energy interactions.

Ah, the burning allure of academic research!

[[RESULTS]]

The findings of our investigation into the correlation between Liquefied Petroleum Gas (LPG) usage in Bahrain and the stock price of Mizuho Financial Group (MFG) have certainly sparked some "fiery" discussions. Our analysis uncovered a significant correlation coefficient of 0.8613955, suggesting a strong positive relationship between these two seemingly unrelated variables. It's almost as surprising as finding a gas grill in the middle of a stock exchange!

The r-squared value of 0.7420022 indicates that approximately 74% of the variability in MFG's stock price can be explained by changes in LPG usage in Bahrain. This unexpected connection has "ignited" our curiosity and added a new dimension to the factors influencing stock market dynamics. It seems that the intersection of energy consumption and financial performance is as unpredictable as a gas leak in the stock market!

Furthermore, the p-value of less than 0.01 provides compelling evidence that the observed correlation is highly unlikely to have occurred by chance alone. We were certainly "propane" for the unexpected twist in our results, and it seems that the impact of LPG usage in Bahrain on MFG's stock price is no laughing matter. It's almost like finding a treasure chest full of gas cylinders right next to a stock exchange - unexpected, but undeniably significant.

To visually depict the robust correlation we unearthed, we present Figure 1, a scatterplot showcasing the strong relationship between LPG usage in Bahrain and the stock price of MFG. This figure emphasizes the "heat" of the association and invites further exploration into the potential drivers behind this surprising connection. It's like finding a diamond in the rough, or in this case, a gas tank in the stock market!

In conclusion, our findings present a compelling case for the intertwining of energy consumption in Bahrain and the stock price of Mizuho Financial Group. The "sizzle and fizzle" of this relationship encourage us to look beyond traditional market influences and delve into the unexpected dynamics that may "fuel" stock price movements. It's a bit like a well-timed dad joke - surprising, yet undeniably impactful.

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

The unexpected connection we uncovered between Liquefied Petroleum Gas (LPG) usage in Bahrain and the stock price of Mizuho Financial Group (MFG) has certainly added a "spark" to the ongoing discourse surrounding energy dynamics and financial markets. Our results not only corroborate the prior research by Smith and Doe (2018) on the impact of energy consumption on stock market performance but also emphasize the need to "ignite" further exploration into the intricate interplay between these seemingly unrelated factors. It's like finding a barrel of gas in the middle of a stock market - unexpected, but undeniably impactful.

As we "propane" ourselves for the unexpected twists and turns of our findings, it's clear that the influence of LPG usage in Bahrain on MFG's stock price is no laughing matter. The correlation coefficient of 0.8613955 aligns with the amplified influence of energy sources on financial markets highlighted by Jones (2015). It's almost as surprising as finding a gas tank in the heart of a bull market!

Our study not only unravels the "burning" correlation but also emphasizes the need to "fuel" further investigations into the captivating realm of finance and energy interactions. It's a bit like a well-timed dad joke - adding an unexpected twist to our understanding of stock market dynamics.

The robust correlation we uncovered emphasizes the "heat" of this association and encourages us to acknowledge the potential implications of LPG usage in Bahrain on MFG's stock price. It's like finding a needle in a haystack, or in this case, a gas canister in a bull market!

In a "sizzling" conclusion, our research invites us to "embrace the gas" and recognize its undeniable impact on stock price movements. It prompts us to look beyond traditional market influences and delve into the unexpected dynamics that may "fuel" stock price volatility. It's almost like finding a flaming grill in the midst of a stock exchange – unexpected, yet undeniably significant.

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between Liquefied petroleum gas used in Bahrain and Mizuho Financial Group's stock price (MFG). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

"The Sizzle and Fizzle: LPG in Bahrain and the MFG Stock Price Boil Over"

[[ABSTRACT]]

In this study, we investigate the correlation between the use of Liquefied Petroleum Gas (LPG) in Bahrain and the stock price of Mizuho Financial Group (MFG). As we delved into this research, we couldn't help but "propane" ourselves for the unexpected twists and turns that awaited us. Utilizing data from the Energy Information Administration and LSEG Analytics (Refinitiv), we embarked on a journey to satisfy our curiosity and perhaps "ignite" some laughter along the way.

Our findings revealed a surprising correlation coefficient of 0.8613955 and a p-value of less than 0.01, spanning the period from 2007 to 2021. This statistical relationship "heats up" the discussion surrounding the potential impact of LPG usage in Bahrain on the MFG stock price. While this association may seem unexpected, we must "embrace the gas" and recognize its implications in the world of financial markets.

In conclusion, our research sheds light on the sizzling connection between the use of LPG in Bahrain and the stock price of Mizuho Financial Group. As we pondered over these findings, we couldn't help but wonder if MFG's performance is truly "fueled" by the energy dynamics in Bahrain. Our study invites further exploration into this intriguing interplay and challenges us to "heat up" our understanding of the factors influencing stock prices.

[[INTRDUCTION]]

As we dive into the sizzling world of financial markets and energy dynamics, we are constantly reminded that making correlations is like cooking - you need the right ingredients, a dash of timing, and a pinch of luck. In this study, we examine the unexpected relationship between the use of Liquefied Petroleum Gas (LPG) in Bahrain and the stock price of Mizuho Financial Group (MFG). It's a tale of flames, fortunes, and perhaps a few "gassy" discoveries along the way.

The stock market is often likened to a roller coaster, with its ups and downs fluctuating like the price of gas. Speaking of which, did you hear about the pun-loving LPG salesman? He has a "flare" for the dramatic and always makes sure to fuel his sales pitch with some fire. Indeed, the world of finance and energy is full of surprises, much like the unexpected correlation we stumbled upon in our study.

As we embark on this journey, we cannot help but ponder the potential impact of LPG usage in Bahrain on the MFG stock price. It's a bit like the stock market - you never quite know when it's going to "ignite" or when it's going to "fizzle out." With each statistical test, we found ourselves grappling with the reality that the financial world is as unpredictable as the weather. After all, predicting stock movements is like forecasting the weather - sometimes you're right and sometimes you're left without an umbrella.

Our study aims to "propane" a new lens through which to view the correlations between energy consumption and stock performance. It invites us to ponder whether MFG's stock price is truly "fueled" by the energy dynamics in Bahrain or if there's a "firecracker" of a market force at play here. The sizzle and fizzle of this connection provide untold opportunities for further exploration and a chance to "spark" new insights into the intricacies of financial markets.

As we venture into the intersection of gas usage and stock prices, we embrace the "heat" of this novel correlation and invite readers to join us on this "explosive" journey of discovery. After all, in the world of academia, a little humor is like a well-timed punchline - it makes the most complex subjects a little easier to "digest."

[[RESULTS]]

The findings of our investigation into the correlation between Liquefied Petroleum Gas (LPG) usage in Bahrain and the stock price of Mizuho Financial Group (MFG) have certainly sparked some "fiery" discussions. Our analysis uncovered a significant correlation coefficient of 0.8613955, suggesting a strong positive relationship between these two seemingly unrelated variables. It's almost as surprising as finding a gas grill in the middle of a stock exchange!

The r-squared value of 0.7420022 indicates that approximately 74% of the variability in MFG's stock price can be explained by changes in LPG usage in Bahrain. This unexpected connection has "ignited" our curiosity and added a new dimension to the factors influencing stock market dynamics. It seems that the intersection of energy consumption and financial performance is as unpredictable as a gas leak in the stock market!

Furthermore, the p-value of less than 0.01 provides compelling evidence that the observed correlation is highly unlikely to have occurred by chance alone. We were certainly "propane" for the unexpected twist in our results, and it seems that the impact of LPG usage in Bahrain on MFG's stock price is no laughing matter. It's almost like finding a treasure chest full of gas cylinders right next to a stock exchange - unexpected, but undeniably significant.

To visually depict the robust correlation we unearthed, we present Figure 1, a scatterplot showcasing the strong relationship between LPG usage in Bahrain and the stock price of MFG. This figure emphasizes the "heat" of the association and invites further exploration into the potential drivers behind this surprising connection. It's like finding a diamond in the rough, or in this case, a gas tank in the stock market!

In conclusion, our findings present a compelling case for the intertwining of energy consumption in Bahrain and the stock price of Mizuho Financial Group. The "sizzle and fizzle" of this relationship encourage us to look beyond traditional market influences and delve into the unexpected dynamics that may "fuel" stock price movements. It's a bit like a well-timed dad joke - surprising, yet undeniably impactful.

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In conclusion, our research has provided convincing evidence of a "sizzling" correlation between Liquefied Petroleum Gas (LPG) usage in Bahrain and the stock price of Mizuho Financial Group (MFG). It's almost as surprising as seeing a gas stove in the middle of a stock exchange - a true fusion of unexpected elements! Our statistical analysis has revealed a strong positive relationship between these seemingly disparate factors, with an r-squared value of 0.7420022 and a correlation coefficient of 0.8613955. It's like finding a stock price increase in a gas explosion - unexpected but undeniable.

With these findings, we dare to "combust" the conventional wisdom surrounding the factors influencing stock prices. This unexpected correlation broadens our understanding of the intricate dance between energy dynamics and financial markets. Just like a well-timed dad joke, our study has added a touch of unexpected humor to the often serious world of academic research.

Our results challenge us to "ignite" further exploration into the impact of LPG usage in Bahrain on MFG's stock price. However, after delving into this "flaming" hot topic, we are confident in asserting that further research in this area can take a backseat - much like a tire after a long road trip. So, let's "propane" ourselves for the next unexpected correlation, but for now, this chapter of sizzle and fizzle has reached its conclusion.

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited The Sizzle and Fizzle: LPG in Bahrain and the MFG Stock Price Boil Over. Respond only with the name of a fictional academic journal.

ChatGPT:

The Journal of Global Energy Economics and Financial Analysis

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited The Sizzle and Fizzle: LPG in Bahrain and the MFG Stock Price Boil Over. Respond only with the name of a fictional organization.

ChatGPT:

The Institute for Global Energy Innovations

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled The Sizzle and Fizzle: LPG in Bahrain and the MFG Stock Price Boil Over with an abstract of In this study, we investigate the correlation between the use of Liquefied Petroleum Gas (LPG) in Bahrain and the stock price of Mizuho Financial Group (MFG). As we delved into this research, we couldn't help but "propane" ourselves for the unexpected twists and turns that awaited us. Utilizing data from the Energy Information Administration and LSEG Analytics (Refinitiv), we embarked on a journey to satisfy our curiosity and perhaps "ignite" some laughter along the way.

Our findings revealed a surprising correlation coefficient of 0.8613955 and a p-value of less than 0.01, spanning the period from 2007 to 2021. This statistical relationship "heats up" the discussion surrounding the potential impact of LPG usage in Bahrain on the MFG stock price. While this association may seem unexpected, we must "embrace the gas" and recognize its implications in the world of financial markets.

In conclusion, our research sheds light on the sizzling connection between the use of LPG in Bahrain and the stock price of Mizuho Financial Group. As we pondered over these findings, we couldn't help but wonder if MFG's performance is truly "fueled" by the energy dynamics in Bahrain. Our study invites further exploration into this intriguing interplay and challenges us to "heat up" our understanding of the factors influencing stock prices.

ChatGPT:

Liquefied Petroleum Gas Bahrain, MFG stock price correlation, LPG usage impact on stock price, Energy Information Administration, LSEG Analytics, Mizuho Financial Group performance, financial market correlation, Bahrain energy dynamics, stock price factors

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

Liquefied petroleum gas used in BahrainDetailed data title: Volume of liquefied petroleum gas used consumed in Bahrain in millions of barrels per day

Source: Energy Information Administration

See what else correlates with Liquefied petroleum gas used in Bahrain

Mizuho Financial Group's stock price (MFG)

Detailed data title: Opening price of Mizuho Financial Group (MFG) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with Mizuho Financial Group's stock price (MFG)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.7420022 (Coefficient of determination)

This means 74.2% of the change in the one variable (i.e., Mizuho Financial Group's stock price (MFG)) is predictable based on the change in the other (i.e., Liquefied petroleum gas used in Bahrain) over the 15 years from 2007 through 2021.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 3.7E-5. 0.0000369250355112729600000000

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.86 in 0.0037% of random cases. Said differently, if you correlated 27,082 random variables You don't actually need 27 thousand variables to find a correlation like this one. You can also correlate variables that are not independent. I do this a lot.

p-value calculations are useful for understanding the probability of a result happening by chance. They are most useful when used to highlight the risk of a fluke outcome. For example, if you calculate a p-value of 0.30, the risk that the result is a fluke is high. It is good to know that! But there are lots of ways to get a p-value of less than 0.01, as evidenced by this project.

Just to be clear: I'm being completely transparent about the calculations. There is no math trickery. This is just how statistics shakes out when you calculate hundreds of millions of random correlations.

with the same 14 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 14 because we have two variables measured over a period of 15 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.62, 0.95 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

| Liquefied petroleum gas used in Bahrain (Million Barrels/Day) | 1.33479 | 1.42623 | 1.52548 | 1.52548 | 1.55726 | 1.64809 | 2 | 2 | 2 | 2 | 2.19288 | 3.17808 | 8.99397 | 8.72931 | 3.94082 |

| Mizuho Financial Group's stock price (MFG) (Stock price) | 14.55 | 9.54 | 6.67 | 3.56 | 3.79 | 2.72 | 3.75 | 4.35 | 3.39 | 3.97 | 3.57 | 3.66 | 29.8 | 30.8 | 2.56 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is. - Confounding variable: 2020 is particularly different from the other years on this graph. Confounding variables (like global pandemics) will cause two variables to look connected when in fact a "sneaky third" variable is influencing both of them behind the scenes.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([1.33479,1.42623,1.52548,1.52548,1.55726,1.64809,2,2,2,2,2.19288,3.17808,8.99397,8.72931,3.94082,])

array_2 = np.array([14.55,9.54,6.67,3.56,3.79,2.72,3.75,4.35,3.39,3.97,3.57,3.66,29.8,30.8,2.56,])

array_1_name = "Liquefied petroleum gas used in Bahrain"

array_2_name = "Mizuho Financial Group's stock price (MFG)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only Liquefied petroleum gas used in Bahrain

- Line chart for only Mizuho Financial Group's stock price (MFG)

- AI-generated correlation image

- The spurious research paper: The Sizzle and Fizzle: LPG in Bahrain and the MFG Stock Price Boil Over

I'm genuinely thankful for your rating!

Correlation ID: 4113 · Black Variable ID: 24174 · Red Variable ID: 1751