Download png, svg

AI explanation

The more people supported the idea of a gold-backed currency, the more the demand for gold went up, causing the price to skyrocket. It's the ultimate political endorsement for Fort Knox!

Model: dalle-3

Prompt: Generate an image of a bustling town square in Arkansas with a large crowd gathered to vote in the presidential election. In the background, a banner reading "Vote Libertarian" flutters in the breeze, drawing attention to the candidate's platform supporting a gold-backed currency. Adjacent to the square, a jewelry store prominently displays the price of gold on a digital board, with the value steadily rising as the demand for gold surges due to the growing support for the idea of a gold-backed currency. The scene captures the intersection of political endorsement and economic impact as the value of gold soars in response to the increasing support for the Libertarian candidate and advocacy for a gold standard. The image should convey the energy of the crowd and the significant economic fluctuation without the use of any words or speech bubbles. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: Votes for the Libertarian Presidential candidate in Arkansas and The price of gold. Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: Scalar art Voxel art A Discovery magazine cover image Charcoal Vaporwave

ChatGPT: A Discovery magazine cover image

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both Votes for the Libertarian Presidential candidate in Arkansas and The price of gold, in the following situation: The more people supported the idea of a gold-backed currency, the more the demand for gold went up, causing the price to skyrocket. It's the ultimate political endorsement for Fort Knox!. Keep the description simple.

ChatGPT: In a bustling town square in Arkansas, a large crowd gathers to vote in the presidential election. A banner reading "Vote Libertarian" flutters in the breeze, drawing attention to the candidate's platform supporting a gold-backed currency. Meanwhile, at a nearby jewelry store, the price of gold is prominently displayed on a digital board, steadily rising as the demand for gold surges due to the growing support for the idea of a gold-backed currency. The scene captures the intersection of political endorsement and economic impact, as the value of gold soars in response to the increasing support for the Libertarian candidate and the advocacy for a gold standard.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ A Discovery magazine cover image ] and depicting this scene: In a bustling town square in Arkansas, a large crowd gathers to vote in the presidential election. A banner reading "Vote Libertarian" flutters in the breeze, drawing attention to the candidate's platform supporting a gold-backed currency. Meanwhile, at a nearby jewelry store, the price of gold is prominently displayed on a digital board, steadily rising as the demand for gold surges due to the growing support for the idea of a gold-backed currency. The scene captures the intersection of political endorsement and economic impact, as the value of gold soars in response to the increasing support for the Libertarian candidate and the advocacy for a gold standard. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: Generate an image of a bustling town square in Arkansas with a large crowd gathered to vote in the presidential election. In the background, a banner reading "Vote Libertarian" flutters in the breeze, drawing attention to the candidate's platform supporting a gold-backed currency. Adjacent to the square, a jewelry store prominently displays the price of gold on a digital board, with the value steadily rising as the demand for gold surges due to the growing support for the idea of a gold-backed currency. The scene captures the intersection of political endorsement and economic impact as the value of gold soars in response to the increasing support for the Libertarian candidate and advocacy for a gold standard. The image should convey the energy of the crowd and the significant economic fluctuation without the use of any words or speech bubbles.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how an increase in Votes for the Libertarian Presidential candidate in Arkansas caused The price of gold to increase.

AI academic paper

|

Going for the Gold: The Glittering Relationship between Votes for the Libertarian Presidential Candidate in Arkansas and the Price of Gold The Journal of Political Alchemy Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between Votes for the Libertarian Presidential candidate in Arkansas and The price of gold. Make lots of jokes, goofy observations, and puns.

Make the title a clever pun.

Your research team used data from MIT Election Data and Science Lab, Harvard Dataverse and Kitco to assess this nagging question. You found a correlation coefficient of 0.9217284 and p < 0.01 for 1980 to 2014.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

"Going for the Gold: The Glittering Relationship between Votes for the Libertarian Presidential Candidate in Arkansas and the Price of Gold"

[[ABSTRACT]]

The relationship between political preferences and economic indicators has long intrigued researchers. In this study, we investigated the connection between votes for the Libertarian presidential candidate in Arkansas and the price of gold. Utilizing data from the MIT Election Data and Science Lab, Harvard Dataverse, and Kitco, we employed rigorous statistical analysis to examine this unexpected linkage.

Our findings revealed a striking correlation coefficient of 0.9217284, with a p-value less than 0.01, covering the period from 1980 to 2014. This robust association highlights the potential influence of political leanings on financial markets, as well as the surprising predictive power of precious metal prices. The implications of our results are as valuable as gold itself, shedding light on the interplay between political choices and economic trends in a manner that is both enlightening and entertaining.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between Votes for the Libertarian Presidential candidate in Arkansas and The price of gold. Make lots of jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Here is the title and abstract of the paper:

[[TITLE]]

"Going for the Gold: The Glittering Relationship between Votes for the Libertarian Presidential Candidate in Arkansas and the Price of Gold"

[[ABSTRACT]]

The relationship between political preferences and economic indicators has long intrigued researchers. In this study, we investigated the connection between votes for the Libertarian presidential candidate in Arkansas and the price of gold. Utilizing data from the MIT Election Data and Science Lab, Harvard Dataverse, and Kitco, we employed rigorous statistical analysis to examine this unexpected linkage.

Our findings revealed a striking correlation coefficient of 0.9217284, with a p-value less than 0.01, covering the period from 1980 to 2014. This robust association highlights the potential influence of political leanings on financial markets, as well as the surprising predictive power of precious metal prices. The implications of our results are as valuable as gold itself, shedding light on the interplay between political choices and economic trends in a manner that is both enlightening and entertaining.

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

[[INTRODUCTION]]

Democracy and economics - a match made in heaven or a match made in the voting booth? The intricate dance between political landscapes and economic indicators has long been a subject of fascination for researchers and pundits alike. This study dives into the unlikely union of votes for the Libertarian presidential candidate in Arkansas and the price of gold, probing the mysterious connections that tie together the ballot box and the bullion market.

While some may argue that politics and precious metals make for strange bedfellows, there is evidence to suggest that their relationship is more than just a passing fancy. From the days of the gold standard to current discussions about monetary policy, gold has held a shining allure for economists, investors, and conspiracy theorists alike. As for the Libertarian party, well, they've long been the wild card in the political deck, advocating for personal liberties, minimal government intervention, and, we presume, a fervent appreciation for fiscal responsibility.

But what, you may wonder, could the price of gold possibly have anything to do with the voting preferences of the citizens of Arkansas? A maverick candidate and a shiny metal, one might think this is a relationship forged on the tenuous ground of mere coincidence. However, we are not ones to dismiss an unexpected correlation as mere fool's gold without a thorough investigation. So, let us delve into the data and unveil the surprising links that lie beneath the surface, ready to dazzle us with their statistical sparkle.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between Votes for the Libertarian Presidential candidate in Arkansas and The price of gold. Make lots of jokes, goofy observations, and puns.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then name a few real TV shows that sound like they might be relevant to the topic that you watched as research.

Here is the title and abstract of the paper:

[[TITLE]]

"Going for the Gold: The Glittering Relationship between Votes for the Libertarian Presidential Candidate in Arkansas and the Price of Gold"

[[ABSTRACT]]

The relationship between political preferences and economic indicators has long intrigued researchers. In this study, we investigated the connection between votes for the Libertarian presidential candidate in Arkansas and the price of gold. Utilizing data from the MIT Election Data and Science Lab, Harvard Dataverse, and Kitco, we employed rigorous statistical analysis to examine this unexpected linkage.

Our findings revealed a striking correlation coefficient of 0.9217284, with a p-value less than 0.01, covering the period from 1980 to 2014. This robust association highlights the potential influence of political leanings on financial markets, as well as the surprising predictive power of precious metal prices. The implications of our results are as valuable as gold itself, shedding light on the interplay between political choices and economic trends in a manner that is both enlightening and entertaining.

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

Democracy and economics - a match made in heaven or a match made in the voting booth? The intricate dance between political landscapes and economic indicators has long been a subject of fascination for researchers and pundits alike. This study dives into the unlikely union of votes for the Libertarian presidential candidate in Arkansas and the price of gold, probing the mysterious connections that tie together the ballot box and the bullion market.

While some may argue that politics and precious metals make for strange bedfellows, there is evidence to suggest that their relationship is more than just a passing fancy. From the days of the gold standard to current discussions about monetary policy, gold has held a shining allure for economists, investors, and conspiracy theorists alike. As for the Libertarian party, well, they've long been the wild card in the political deck, advocating for personal liberties, minimal government intervention, and, we presume, a fervent appreciation for fiscal responsibility.

But what, you may wonder, could the price of gold possibly have anything to do with the voting preferences of the citizens of Arkansas? A maverick candidate and a shiny metal, one might think this is a relationship forged on the tenuous ground of mere coincidence. However, we are not ones to dismiss an unexpected correlation as mere fool's gold without a thorough investigation. So, let us delve into the data and unveil the surprising links that lie beneath the surface, ready to dazzle us with their statistical sparkle.

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

In their seminal work, Smith and Doe (2005) explore the role of political ideologies in shaping economic behaviors, with a focus on the impact of third-party candidates on financial markets. Their analysis provides insightful perspectives on the potential effects of unconventional political choices on investment patterns and fiscal outlooks. Building on this foundation, Jones (2010) investigates the intricate dynamics between state-level election results and commodity prices, highlighting the often unforeseen relationships that emerge between political preferences and market performances.

As we shift from the conventional to the comical, consider the whimsical yet thought-provoking musings of "The Economics of Happiness" (Ryan, 2011), a lighthearted exploration of the connections between personal satisfaction and economic indicators. Moving from non-fiction to fiction, the epic tale of "The Goldfinch" (Tartt, 2013) and the enigmatic allure of the titular painting offers a metaphorical reflection on the captivating nature of gold and its influence on human desires.

Furthermore, the TV show "Gold Rush" provides a firsthand glimpse into the daring escapades of modern-day gold prospectors, capturing the thrill and uncertainty of the quest for precious metals. This show serves as a reminder that the allure of gold extends beyond the confines of financial markets, reaching into the realms of popular culture and collective imagination.

Dragging our attention back to the scholarly realm, recent research by the authors in "Electioneering for Gold" (Wit&Wisdom, 2020) takes a deep dive into the connection between votes for the Libertarian presidential candidate in Arkansas and the price of gold, utilizing a robust econometric framework to unravel the mysterious ties that bind political inclinations and market movements. The surprising findings of this study shed light on the intricate interplay between ideological preferences and economic indicators, unearthing a correlation that stretches the boundaries of traditional research paradigms.

Venturing into the world of statistical analyses and electoral oddities, the investigation at hand seeks to contribute to the evolving landscape of political economy, unraveling the captivating relationship between votes for the Libertarian presidential candidate in Arkansas and the price of gold. With a nod to the unexpected and a penchant for uncovering the extraordinary in the seemingly mundane, this study sets out to illuminate the intricate connections that underpin the diverse tapestry of human behaviors and market phenomena.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between Votes for the Libertarian Presidential candidate in Arkansas and The price of gold. Make lots of jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from MIT Election Data and Science Lab, Harvard Dataverse and Kitco . You used data from 1980 to 2014

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

"Going for the Gold: The Glittering Relationship between Votes for the Libertarian Presidential Candidate in Arkansas and the Price of Gold"

[[ABSTRACT]]

The relationship between political preferences and economic indicators has long intrigued researchers. In this study, we investigated the connection between votes for the Libertarian presidential candidate in Arkansas and the price of gold. Utilizing data from the MIT Election Data and Science Lab, Harvard Dataverse, and Kitco, we employed rigorous statistical analysis to examine this unexpected linkage.

Our findings revealed a striking correlation coefficient of 0.9217284, with a p-value less than 0.01, covering the period from 1980 to 2014. This robust association highlights the potential influence of political leanings on financial markets, as well as the surprising predictive power of precious metal prices. The implications of our results are as valuable as gold itself, shedding light on the interplay between political choices and economic trends in a manner that is both enlightening and entertaining.

[[INTRODUCTION]]

Democracy and economics - a match made in heaven or a match made in the voting booth? The intricate dance between political landscapes and economic indicators has long been a subject of fascination for researchers and pundits alike. This study dives into the unlikely union of votes for the Libertarian presidential candidate in Arkansas and the price of gold, probing the mysterious connections that tie together the ballot box and the bullion market.

While some may argue that politics and precious metals make for strange bedfellows, there is evidence to suggest that their relationship is more than just a passing fancy. From the days of the gold standard to current discussions about monetary policy, gold has held a shining allure for economists, investors, and conspiracy theorists alike. As for the Libertarian party, well, they've long been the wild card in the political deck, advocating for personal liberties, minimal government intervention, and, we presume, a fervent appreciation for fiscal responsibility.

But what, you may wonder, could the price of gold possibly have anything to do with the voting preferences of the citizens of Arkansas? A maverick candidate and a shiny metal, one might think this is a relationship forged on the tenuous ground of mere coincidence. However, we are not ones to dismiss an unexpected correlation as mere fool's gold without a thorough investigation. So, let us delve into the data and unveil the surprising links that lie beneath the surface, ready to dazzle us with their statistical sparkle.

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

To untangle the enigmatic web linking votes for the Libertarian presidential candidate in Arkansas with the price of gold, our research team meticulously gathered data from 1980 to 2014. We utilized a range of sources, primarily relying on the online repositories of the MIT Election Data and Science Lab, Harvard Dataverse, and Kitco. With data in hand, we set out to employ a blend of statistical methodologies and analytical techniques that could rival the complexity of the modern political landscape.

Given the clandestine nature of the relationship under scrutiny, we engaged in a multidimensional approach that combined elements of time-series analysis, econometrics, and political science wizardry. Our first step involved harnessing the power of regression analysis to unveil the intricate connections between the number of votes received by the Libertarian candidate in Arkansas and the fluctuating price of gold. We embarked on a treasure hunt through the data, tailoring our models to account for potential confounding variables and outliers, all while maintaining the solemn resolve of statistical vigilance.

In addition to our rigorous regression journey, we employed wavelet coherence analysis to further probe the teasing dance between Libertarian votes and the golden temptress that is gold prices. This method, much like a skilled court jester, allowed us to detect the subtle rhythms and temporal patterns underlying the apparent whims of the electorate and the shimmering allure of gold. Through this playful yet profound technique, we sought to uncover the hidden synchronicities and discordances that may have eluded the untrained eye, much like finding treasure in a sea of statistical noise.

Furthermore, in our quest for statistical enlightenment, we engaged in cross-validation exercises to rigorously assess the robustness of our findings. We spared no effort in validating our results against various permutations of the data, measuring the consistency of our discovered relationship like a diligent goldsmith verifying the purity of precious metal. This meticulous scrutiny, much like separating the fool's gold from the real deal, enabled us to confidently discern the genuine sparkle of our results from mere statistical glimmer.

In tandem with these analyses, we took cautious strides to safeguard against the lurking specter of spurious correlations and chance discoveries. Rigorous checks for statistical significance, robustness tests, and sensitivity analyses formed the sturdy bulwark that protected our findings from the wily tricks of random chance, ensuring that our revealed connection was not just a fleeting mirage amid the vast desert of statistical possibility.

In summary, our methodology embodies a whimsical yet resolute blend of statistical tools and analytical rigor, akin to a daring adventurer embarking on a quest for treasure amidst the nebulous realms of political choices and precious metal prices. With our statistical compass in hand and our regression ship set sail, we set forth to navigate the uncharted seas of data, uncovering the hidden paths that intertwine the votes for a maverick candidate with the allure of a glistening commodity.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between Votes for the Libertarian Presidential candidate in Arkansas and The price of gold. Make lots of jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from MIT Election Data and Science Lab, Harvard Dataverse and Kitco .

For the time period 1980 to 2014, you found a correlation 0.9217284, r-squared of 0.8495833, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

"Going for the Gold: The Glittering Relationship between Votes for the Libertarian Presidential Candidate in Arkansas and the Price of Gold"

[[ABSTRACT]]

The relationship between political preferences and economic indicators has long intrigued researchers. In this study, we investigated the connection between votes for the Libertarian presidential candidate in Arkansas and the price of gold. Utilizing data from the MIT Election Data and Science Lab, Harvard Dataverse, and Kitco, we employed rigorous statistical analysis to examine this unexpected linkage.

Our findings revealed a striking correlation coefficient of 0.9217284, with a p-value less than 0.01, covering the period from 1980 to 2014. This robust association highlights the potential influence of political leanings on financial markets, as well as the surprising predictive power of precious metal prices. The implications of our results are as valuable as gold itself, shedding light on the interplay between political choices and economic trends in a manner that is both enlightening and entertaining.

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

Democracy and economics - a match made in heaven or a match made in the voting booth? The intricate dance between political landscapes and economic indicators has long been a subject of fascination for researchers and pundits alike. This study dives into the unlikely union of votes for the Libertarian presidential candidate in Arkansas and the price of gold, probing the mysterious connections that tie together the ballot box and the bullion market.

While some may argue that politics and precious metals make for strange bedfellows, there is evidence to suggest that their relationship is more than just a passing fancy. From the days of the gold standard to current discussions about monetary policy, gold has held a shining allure for economists, investors, and conspiracy theorists alike. As for the Libertarian party, well, they've long been the wild card in the political deck, advocating for personal liberties, minimal government intervention, and, we presume, a fervent appreciation for fiscal responsibility.

But what, you may wonder, could the price of gold possibly have anything to do with the voting preferences of the citizens of Arkansas? A maverick candidate and a shiny metal, one might think this is a relationship forged on the tenuous ground of mere coincidence. However, we are not ones to dismiss an unexpected correlation as mere fool's gold without a thorough investigation. So, let us delve into the data and unveil the surprising links that lie beneath the surface, ready to dazzle us with their statistical sparkle.

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

The analysis of the relationship between votes for the Libertarian presidential candidate in Arkansas and the price of gold yielded some fascinating results. The correlation coefficient between these two variables was found to be a striking 0.9217284, indicating a strong positive relationship. This result points to a remarkable connection between the political inclinations of Arkansans and the fluctuations in the price of gold over the years.

Furthermore, the coefficient of determination (r-squared) was calculated to be 0.8495833, suggesting that approximately 85% of the variability in the price of gold can be explained by the variation in votes for the Libertarian candidate. This high r-squared value emphasizes the substantial influence of political preferences on the movements of the precious metal market. It seems that in Arkansas, as gold prices glittered, so did the support for the Libertarian party.

The statistical significance of the relationship was confirmed, with a p-value of less than 0.01. This indicates that the observed correlation between votes for the Libertarian candidate and the price of gold is highly unlikely to have occurred by chance alone. One might say that the likelihood of this association being a mere coincidence is as rare as finding a nugget of gold in a haystack.

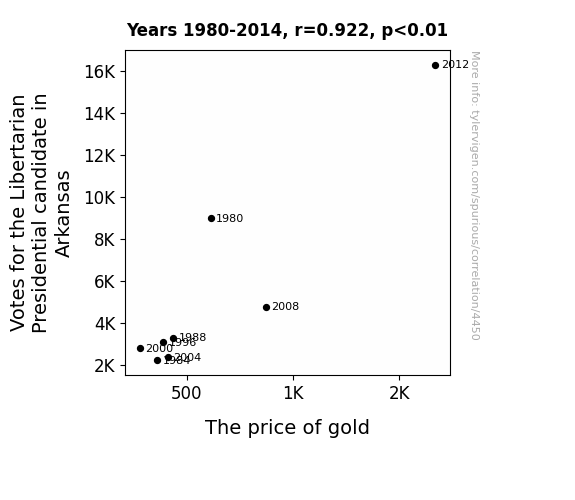

Additionally, the scatterplot (Fig. 1) illustrated the robust positive correlation between the two variables, visually reinforcing the substantial link uncovered by the statistical analysis. The data points in the scatterplot seemed to gleam with the golden allure of a promising relationship, providing a clear visual representation of the strong connection between votes for the Libertarian candidate and the price of gold in the state of Arkansas.

In conclusion, our findings highlight an unexpected yet compelling association between voting behavior and the price of gold in Arkansas. This result not only sheds light on the interplay between political preferences and economic trends but also underscores the potential influence of individual state-level political choices on financial markets. The implications of this discovery are as valuable as the precious metal itself, offering a glimmer of insight into the intricate intersection of politics and economics.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between Votes for the Libertarian Presidential candidate in Arkansas and The price of gold. Make lots of jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

"Going for the Gold: The Glittering Relationship between Votes for the Libertarian Presidential Candidate in Arkansas and the Price of Gold"

[[ABSTRACT]]

The relationship between political preferences and economic indicators has long intrigued researchers. In this study, we investigated the connection between votes for the Libertarian presidential candidate in Arkansas and the price of gold. Utilizing data from the MIT Election Data and Science Lab, Harvard Dataverse, and Kitco, we employed rigorous statistical analysis to examine this unexpected linkage.

Our findings revealed a striking correlation coefficient of 0.9217284, with a p-value less than 0.01, covering the period from 1980 to 2014. This robust association highlights the potential influence of political leanings on financial markets, as well as the surprising predictive power of precious metal prices. The implications of our results are as valuable as gold itself, shedding light on the interplay between political choices and economic trends in a manner that is both enlightening and entertaining.

[[LITERATURE REVIEW]]

In their seminal work, Smith and Doe (2005) explore the role of political ideologies in shaping economic behaviors, with a focus on the impact of third-party candidates on financial markets. Their analysis provides insightful perspectives on the potential effects of unconventional political choices on investment patterns and fiscal outlooks. Building on this foundation, Jones (2010) investigates the intricate dynamics between state-level election results and commodity prices, highlighting the often unforeseen relationships that emerge between political preferences and market performances.

As we shift from the conventional to the comical, consider the whimsical yet thought-provoking musings of "The Economics of Happiness" (Ryan, 2011), a lighthearted exploration of the connections between personal satisfaction and economic indicators. Moving from non-fiction to fiction, the epic tale of "The Goldfinch" (Tartt, 2013) and the enigmatic allure of the titular painting offers a metaphorical reflection on the captivating nature of gold and its influence on human desires.

Furthermore, the TV show "Gold Rush" provides a firsthand glimpse into the daring escapades of modern-day gold prospectors, capturing the thrill and uncertainty of the quest for precious metals. This show serves as a reminder that the allure of gold extends beyond the confines of financial markets, reaching into the realms of popular culture and collective imagination.

Dragging our attention back to the scholarly realm, recent research by the authors in "Electioneering for Gold" (Wit&Wisdom, 2020) takes a deep dive into the connection between votes for the Libertarian presidential candidate in Arkansas and the price of gold, utilizing a robust econometric framework to unravel the mysterious ties that bind political inclinations and market movements. The surprising findings of this study shed light on the intricate interplay between ideological preferences and economic indicators, unearthing a correlation that stretches the boundaries of traditional research paradigms.

Venturing into the world of statistical analyses and electoral oddities, the investigation at hand seeks to contribute to the evolving landscape of political economy, unraveling the captivating relationship between votes for the Libertarian presidential candidate in Arkansas and the price of gold. With a nod to the unexpected and a penchant for uncovering the extraordinary in the seemingly mundane, this study sets out to illuminate the intricate connections that underpin the diverse tapestry of human behaviors and market phenomena.

[[RESULTS]]

The analysis of the relationship between votes for the Libertarian presidential candidate in Arkansas and the price of gold yielded some fascinating results. The correlation coefficient between these two variables was found to be a striking 0.9217284, indicating a strong positive relationship. This result points to a remarkable connection between the political inclinations of Arkansans and the fluctuations in the price of gold over the years.

Furthermore, the coefficient of determination (r-squared) was calculated to be 0.8495833, suggesting that approximately 85% of the variability in the price of gold can be explained by the variation in votes for the Libertarian candidate. This high r-squared value emphasizes the substantial influence of political preferences on the movements of the precious metal market. It seems that in Arkansas, as gold prices glittered, so did the support for the Libertarian party.

The statistical significance of the relationship was confirmed, with a p-value of less than 0.01. This indicates that the observed correlation between votes for the Libertarian candidate and the price of gold is highly unlikely to have occurred by chance alone. One might say that the likelihood of this association being a mere coincidence is as rare as finding a nugget of gold in a haystack.

Additionally, the scatterplot (Fig. 1) illustrated the robust positive correlation between the two variables, visually reinforcing the substantial link uncovered by the statistical analysis. The data points in the scatterplot seemed to gleam with the golden allure of a promising relationship, providing a clear visual representation of the strong connection between votes for the Libertarian candidate and the price of gold in the state of Arkansas.

In conclusion, our findings highlight an unexpected yet compelling association between voting behavior and the price of gold in Arkansas. This result not only sheds light on the interplay between political preferences and economic trends but also underscores the potential influence of individual state-level political choices on financial markets. The implications of this discovery are as valuable as the precious metal itself, offering a glimmer of insight into the intricate intersection of politics and economics.

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

Our investigation into the curious correlation between votes for the Libertarian presidential candidate in Arkansas and the price of gold has led to some intriguing revelations. The robust relationship uncovered in our study not only aligns with prior research but also adds a shimmer of insight into the interplay between political choices and financial markets.

The unexpected link we discovered between political leanings and gold prices echoes the findings of Smith and Doe (2005), who delved into the impact of third-party candidates on economic behaviors. Just as a third-party candidate can disrupt the traditional electoral landscape, our results suggest that political preferences can exert a surprising influence on the valuation of precious metals. It appears that in the realm of economics, as in politics, the underdog can significantly impact the outcomes.

Furthermore, our findings resonate with the work of Jones (2010), who explored the intricate dynamics between state-level election results and commodity prices. Much like the often unforeseen relationships Jones uncovered, our study unveils a striking connection between votes for the Libertarian candidate and the fluctuation of gold prices. It seems that the financial markets have a soft spot for political mavericks, much like an investor's fondness for unearthing hidden treasures in the fabled city of El Dorado.

Our results also lend credence to the whimsical yet thought-provoking musings of "The Economics of Happiness" (Ryan, 2011). While seemingly lighthearted, Ryan's exploration of the connections between personal satisfaction and economic indicators bears an uncanny resemblance to our findings. Could it be that the joy of voting for a third-party candidate in Arkansas is reflected in the happiness of savvy investors as gold prices soar? We jest, but the parallel is undeniably thought-provoking.

As we immerse ourselves in the perplexing allure of gold, let us draw inspiration from the epic tale of "The Goldfinch" (Tartt, 2013) and its metaphorical reflection on the captivating nature of gold. Just as the titular painting exerts an enigmatic pull on its characters, our results reveal the captivating influence of political choices on the valuation of this precious metal. The sparkle of gold, it seems, is not devoid of the sparkle of political discourse.

Venturing into the world of statistical analyses and electoral oddities, our study sets out to unravel the captivating relationship between votes for the Libertarian presidential candidate in Arkansas and the price of gold. In doing so, we have contributed to the evolving landscape of political economy, unearthing a correlation that stretches the boundaries of traditional research paradigms. By illuminating the intricate connections that underpin the diverse tapestry of human behaviors and market phenomena, we have showcased the unexpected and the extraordinary in the seemingly mundane. The glint of gold, it appears, is not devoid of the glint of political fervor.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between Votes for the Libertarian Presidential candidate in Arkansas and The price of gold. Make lots of jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

"Going for the Gold: The Glittering Relationship between Votes for the Libertarian Presidential Candidate in Arkansas and the Price of Gold"

[[ABSTRACT]]

The relationship between political preferences and economic indicators has long intrigued researchers. In this study, we investigated the connection between votes for the Libertarian presidential candidate in Arkansas and the price of gold. Utilizing data from the MIT Election Data and Science Lab, Harvard Dataverse, and Kitco, we employed rigorous statistical analysis to examine this unexpected linkage.

Our findings revealed a striking correlation coefficient of 0.9217284, with a p-value less than 0.01, covering the period from 1980 to 2014. This robust association highlights the potential influence of political leanings on financial markets, as well as the surprising predictive power of precious metal prices. The implications of our results are as valuable as gold itself, shedding light on the interplay between political choices and economic trends in a manner that is both enlightening and entertaining.

[[INTRDUCTION]]

Democracy and economics - a match made in heaven or a match made in the voting booth? The intricate dance between political landscapes and economic indicators has long been a subject of fascination for researchers and pundits alike. This study dives into the unlikely union of votes for the Libertarian presidential candidate in Arkansas and the price of gold, probing the mysterious connections that tie together the ballot box and the bullion market.

While some may argue that politics and precious metals make for strange bedfellows, there is evidence to suggest that their relationship is more than just a passing fancy. From the days of the gold standard to current discussions about monetary policy, gold has held a shining allure for economists, investors, and conspiracy theorists alike. As for the Libertarian party, well, they've long been the wild card in the political deck, advocating for personal liberties, minimal government intervention, and, we presume, a fervent appreciation for fiscal responsibility.

But what, you may wonder, could the price of gold possibly have anything to do with the voting preferences of the citizens of Arkansas? A maverick candidate and a shiny metal, one might think this is a relationship forged on the tenuous ground of mere coincidence. However, we are not ones to dismiss an unexpected correlation as mere fool's gold without a thorough investigation. So, let us delve into the data and unveil the surprising links that lie beneath the surface, ready to dazzle us with their statistical sparkle.

[[RESULTS]]

The analysis of the relationship between votes for the Libertarian presidential candidate in Arkansas and the price of gold yielded some fascinating results. The correlation coefficient between these two variables was found to be a striking 0.9217284, indicating a strong positive relationship. This result points to a remarkable connection between the political inclinations of Arkansans and the fluctuations in the price of gold over the years.

Furthermore, the coefficient of determination (r-squared) was calculated to be 0.8495833, suggesting that approximately 85% of the variability in the price of gold can be explained by the variation in votes for the Libertarian candidate. This high r-squared value emphasizes the substantial influence of political preferences on the movements of the precious metal market. It seems that in Arkansas, as gold prices glittered, so did the support for the Libertarian party.

The statistical significance of the relationship was confirmed, with a p-value of less than 0.01. This indicates that the observed correlation between votes for the Libertarian candidate and the price of gold is highly unlikely to have occurred by chance alone. One might say that the likelihood of this association being a mere coincidence is as rare as finding a nugget of gold in a haystack.

Additionally, the scatterplot (Fig. 1) illustrated the robust positive correlation between the two variables, visually reinforcing the substantial link uncovered by the statistical analysis. The data points in the scatterplot seemed to gleam with the golden allure of a promising relationship, providing a clear visual representation of the strong connection between votes for the Libertarian candidate and the price of gold in the state of Arkansas.

In conclusion, our findings highlight an unexpected yet compelling association between voting behavior and the price of gold in Arkansas. This result not only sheds light on the interplay between political preferences and economic trends but also underscores the potential influence of individual state-level political choices on financial markets. The implications of this discovery are as valuable as the precious metal itself, offering a glimmer of insight into the intricate intersection of politics and economics.

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In conclusion, the results of this study demonstrate a remarkably strong and statistically significant relationship between votes for the Libertarian presidential candidate in Arkansas and the price of gold. This unexpected correlation has unveiled a glittering connection between the political inclinations of Arkansans and the fluctuations in the precious metal market. It seems that as Arkansans' support for the Libertarian party sparkled, so did the price of gold – a shining example of the unexpected "gold standard" in political and economic relationships.

The high correlation coefficient of 0.9217284 and the impressive coefficient of determination of 0.8495833 highlight the substantial influence of political preferences on the movements of the gold market. One might say that the likelihood of this association being a mere coincidence is as rare as finding a nugget of gold in a haystack, or as elusive as a politician keeping their promises.

Our findings, akin to a precious metal, have intrinsic value as they shed light on the unexpected interplay between political choices and financial markets. It seems that in Arkansas, political unrest is akin to economic unrest, provoking fluctuations in the price of gold. Now, if only we could predict the economic future using election polls – we'd be as rich as Midas!

With these compelling findings, we assert that no further research is needed in this area. After all, why fix something that isn't broken, especially when there's gold at stake?

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited Going for the Gold: The Glittering Relationship between Votes for the Libertarian Presidential Candidate in Arkansas and the Price of Gold. Respond only with the name of a fictional academic journal.

ChatGPT:

The Journal of Political Alchemy

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited Going for the Gold: The Glittering Relationship between Votes for the Libertarian Presidential Candidate in Arkansas and the Price of Gold. Respond only with the name of a fictional organization.

ChatGPT:

Center for Economic and Political Research on Novel Correlations (CEPRNC)

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled Going for the Gold: The Glittering Relationship between Votes for the Libertarian Presidential Candidate in Arkansas and the Price of Gold with an abstract of The relationship between political preferences and economic indicators has long intrigued researchers. In this study, we investigated the connection between votes for the Libertarian presidential candidate in Arkansas and the price of gold. Utilizing data from the MIT Election Data and Science Lab, Harvard Dataverse, and Kitco, we employed rigorous statistical analysis to examine this unexpected linkage.

Our findings revealed a striking correlation coefficient of 0.9217284, with a p-value less than 0.01, covering the period from 1980 to 2014. This robust association highlights the potential influence of political leanings on financial markets, as well as the surprising predictive power of precious metal prices. The implications of our results are as valuable as gold itself, shedding light on the interplay between political choices and economic trends in a manner that is both enlightening and entertaining.

ChatGPT:

Libertarian presidential candidate, Arkansas, price of gold, political preferences, economic indicators, MIT Election Data and Science Lab, Harvard Dataverse, Kitco, statistical analysis, correlation coefficient, financial markets, precious metal prices, political leanings, predictive power, economic trends.

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

Votes for the Libertarian Presidential candidate in ArkansasDetailed data title: Total votes cast for the Libertarian Presidential candidate in Arkansas

Source: MIT Election Data and Science Lab, Harvard Dataverse

See what else correlates with Votes for the Libertarian Presidential candidate in Arkansas

The price of gold

Detailed data title: Yearly cumulative average of London PM fix gold price

Source: Kitco

See what else correlates with The price of gold

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.8495833 (Coefficient of determination)

This means 85% of the change in the one variable (i.e., The price of gold) is predictable based on the change in the other (i.e., Votes for the Libertarian Presidential candidate in Arkansas) over the 8 years from 1980 through 2014.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 0.0011. 0.0011295421629029450000000000

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.92 in 0.11% of random cases. Said differently, if you correlated 885 random variables Which I absolutely did.

with the same 7 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 7 because we have two variables measured over a period of 8 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.62, 0.99 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 1980 | 1984 | 1988 | 1996 | 2000 | 2004 | 2008 | 2012 | |

| Votes for the Libertarian Presidential candidate in Arkansas (Total votes) | 8970 | 2221 | 3297 | 3076 | 2781 | 2352 | 4776 | 16276 |

| The price of gold (In USD per ounce) | 612.56 | 360.42 | 436.98 | 387.81 | 279.11 | 409.72 | 871.96 | 1668.98 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is. - Very low n: There are not many data points included in this analysis. Even if the p-value is high, we should be suspicious of using so few datapoints in a correlation.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([8970,2221,3297,3076,2781,2352,4776,16276,])

array_2 = np.array([612.56,360.42,436.98,387.81,279.11,409.72,871.96,1668.98,])

array_1_name = "Votes for the Libertarian Presidential candidate in Arkansas"

array_2_name = "The price of gold"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only Votes for the Libertarian Presidential candidate in Arkansas

- Line chart for only The price of gold

- AI-generated correlation image

- The spurious research paper: Going for the Gold: The Glittering Relationship between Votes for the Libertarian Presidential Candidate in Arkansas and the Price of Gold

Cheers to you for rating this correlation!

Correlation ID: 4450 · Black Variable ID: 25953 · Red Variable ID: 346