Download png, svg

AI explanation

The decrease in air pollution led to an unexpected surplus of clean, pure air. This abundance of fresh air prompted a sudden spike in employee productivity and creativity at Johnson Controls International. As a result, the company experienced a surge in innovative ideas for energy-efficient products, leading to a decrease in the demand for the company's current stock and causing a drop in stock price.

Model: dalle-3

Prompt: Generate an image of a futuristic cityscape with a thick blanket of hazy smoke obscuring the sky. Amidst towering skyscrapers, a digital stock market graph is displayed, showing a rapid decline in the stock price of Johnson Controls International, represented by red arrows pointing downwards. The scene is illuminated by the glow of neon lights and futuristic technology, creating a stark contrast to the smog-filled atmosphere. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: Poor air quality in Clarksville, Tennessee and Johnson Controls International's stock price. Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: Photorealism High-tech Pop art An image that looks like it is a scene from A Disney Movie Concept art

ChatGPT: High-tech

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both Poor air quality in Clarksville, Tennessee and Johnson Controls International's stock price together. Keep the description simple.

ChatGPT: In Clarksville, Tennessee, hazy smoke lingers in the air, masking the sky with a grayish tint. At the same time, the stock price of Johnson Controls International plunges down like a heavy smog, with red arrows pointing downwards on the stock market graph.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ High-tech ] and depicting this scene: In Clarksville, Tennessee, hazy smoke lingers in the air, masking the sky with a grayish tint. At the same time, the stock price of Johnson Controls International plunges down like a heavy smog, with red arrows pointing downwards on the stock market graph. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: Generate an image of a futuristic cityscape with a thick blanket of hazy smoke obscuring the sky. Amidst towering skyscrapers, a digital stock market graph is displayed, showing a rapid decline in the stock price of Johnson Controls International, represented by red arrows pointing downwards. The scene is illuminated by the glow of neon lights and futuristic technology, creating a stark contrast to the smog-filled atmosphere.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how a decrease in Air pollution in Clarksville, Tennessee caused Johnson Controls International's stock price (JCI) to decrease.

AI academic paper

|

Pollution in Clarksville: The Air-itating Impact on Johnson Controls International's Stock Price The Journal of Environmental Economics and Stock Market Analysis Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between Air pollution in Clarksville, Tennessee and Johnson Controls International's stock price (JCI). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Make the title punny if you can come up with clever pun. If not, make it sound serious.

Your research team used data from Environmental Protection Agency and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.7484243 and p < 0.01 for 2002 to 2012.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

"Pollution in Clarksville: The Air-itating Impact on Johnson Controls International's Stock Price"

[[ABSTRACT]]

Air pollution is a complex problem that affects both public health and the economy. In this study, we investigate the connection between air pollution in Clarksville, Tennessee, and the stock price of Johnson Controls International (JCI). By analyzing data from the Environmental Protection Agency and LSEG Analytics (Refinitiv) for the period 2002 to 2012, we found a correlation coefficient of 0.7484243 and significant statistical evidence (p < 0.01) of the relationship between air pollution levels and JCI stock price.

Our findings suggest that as air pollution levels increase, the stock price of Johnson Controls International tends to decrease. This result underscores the far-reaching impact of environmental factors on the financial performance of corporations. We also provide policy recommendations for improving air quality while maximizing shareholder value.

And for those who think studying air pollution and stock prices is inconceivable, just remember: where there's smog, there's selling!

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between Air pollution in Clarksville, Tennessee and Johnson Controls International's stock price (JCI). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Here is the title and abstract of the paper:

[[TITLE]]

"Pollution in Clarksville: The Air-itating Impact on Johnson Controls International's Stock Price"

[[ABSTRACT]]

Air pollution is a complex problem that affects both public health and the economy. In this study, we investigate the connection between air pollution in Clarksville, Tennessee, and the stock price of Johnson Controls International (JCI). By analyzing data from the Environmental Protection Agency and LSEG Analytics (Refinitiv) for the period 2002 to 2012, we found a correlation coefficient of 0.7484243 and significant statistical evidence (p < 0.01) of the relationship between air pollution levels and JCI stock price.

Our findings suggest that as air pollution levels increase, the stock price of Johnson Controls International tends to decrease. This result underscores the far-reaching impact of environmental factors on the financial performance of corporations. We also provide policy recommendations for improving air quality while maximizing shareholder value.

And for those who think studying air pollution and stock prices is inconceivable, just remember: where there's smog, there's selling!

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

**[[INTRODUCTION]]**

Air pollution is a pervasive issue that not only poses significant threats to public health and the environment but also has potential ramifications for economic entities. In recent years, the intersection of environmental factors and financial markets has garnered increased attention from researchers and policymakers alike. Understanding the implications of air pollution on the stock prices of corporations is crucial for comprehending the holistic impact of environmental challenges on market dynamics.

Speaking of understanding, why did the statistician visit the power plant? To get a sense of the "mean" pollution levels!

In this study, we delve into the specific case of air pollution in Clarksville, Tennessee, and its relationship with the stock price of Johnson Controls International (JCI). Johnson Controls International is a globally recognized corporation engaged in the production of HVAC systems and building technologies. As such, the company's performance may be susceptible to environmental factors, such as air quality, which can influence consumer demand, operational costs, and regulatory compliance.

But let's not jump to conclusions just yet; we need to breathe in the data before we let any stock assumptions cloud our judgment!

Utilizing data from the Environmental Protection Agency and LSEG Analytics (Refinitiv) spanning from 2002 to 2012, we employ rigorous statistical analysis to elucidate the connection between air pollution levels in Clarksville and the fluctuations in JCI's stock price. Our investigation aims to provide empirical evidence that can inform corporate strategies, environmental policies, and investment decisions in a manner that harmonizes financial objectives with environmental sustainability.

And for those who think this research is "air"-relevant, just remember: we're here to clear the air on the relationship between pollution and stocks, no smoke and mirrors involved!

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between Air pollution in Clarksville, Tennessee and Johnson Controls International's stock price (JCI). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then devolve ever further, and mention something completely ridiculous, like you conducted literature review by reading the backs of shampoo bottles.

Here is the title and abstract of the paper:

[[TITLE]]

"Pollution in Clarksville: The Air-itating Impact on Johnson Controls International's Stock Price"

[[ABSTRACT]]

Air pollution is a complex problem that affects both public health and the economy. In this study, we investigate the connection between air pollution in Clarksville, Tennessee, and the stock price of Johnson Controls International (JCI). By analyzing data from the Environmental Protection Agency and LSEG Analytics (Refinitiv) for the period 2002 to 2012, we found a correlation coefficient of 0.7484243 and significant statistical evidence (p < 0.01) of the relationship between air pollution levels and JCI stock price.

Our findings suggest that as air pollution levels increase, the stock price of Johnson Controls International tends to decrease. This result underscores the far-reaching impact of environmental factors on the financial performance of corporations. We also provide policy recommendations for improving air quality while maximizing shareholder value.

And for those who think studying air pollution and stock prices is inconceivable, just remember: where there's smog, there's selling!

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

Air pollution is a pervasive issue that not only poses significant threats to public health and the environment but also has potential ramifications for economic entities. In recent years, the intersection of environmental factors and financial markets has garnered increased attention from researchers and policymakers alike. Understanding the implications of air pollution on the stock prices of corporations is crucial for comprehending the holistic impact of environmental challenges on market dynamics.

Speaking of understanding, why did the statistician visit the power plant? To get a sense of the "mean" pollution levels!

In this study, we delve into the specific case of air pollution in Clarksville, Tennessee, and its relationship with the stock price of Johnson Controls International (JCI). Johnson Controls International is a globally recognized corporation engaged in the production of HVAC systems and building technologies. As such, the company's performance may be susceptible to environmental factors, such as air quality, which can influence consumer demand, operational costs, and regulatory compliance.

But let's not jump to conclusions just yet; we need to breathe in the data before we let any stock assumptions cloud our judgment!

Utilizing data from the Environmental Protection Agency and LSEG Analytics (Refinitiv) spanning from 2002 to 2012, we employ rigorous statistical analysis to elucidate the connection between air pollution levels in Clarksville and the fluctuations in JCI's stock price. Our investigation aims to provide empirical evidence that can inform corporate strategies, environmental policies, and investment decisions in a manner that harmonizes financial objectives with environmental sustainability.

And for those who think this research is "air"-relevant, just remember: we're here to clear the air on the relationship between pollution and stocks, no smoke and mirrors involved!

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

In "Smith and Doe," the authors find that air pollution has been associated with various adverse health effects, including respiratory diseases, cardiovascular complications, and even adverse pregnancy outcomes. This underscores the urgent need for effective measures to mitigate air pollution levels in urban settings. The adverse health effects of air pollution are nothing to sneeze at – unless, of course, you're allergic to bad puns.

In "Jones," the authors elucidate the potential economic consequences of air pollution, highlighting its impact on labor productivity, healthcare costs, and overall economic development. The economic ramifications of air pollution are not just academic – they have real-world implications that can weigh heavily on the financial performance of corporations. It's enough to make you wheeze and please for cleaner air, isn't it?

Turning to non-fiction literature related to environmental and economic factors, "The Sixth Extinction" by Elizabeth Kolbert provides a sobering account of human-induced environmental changes that have led to mass extinctions. While we're not suggesting air pollution will lead to the next extinction event, it's a gentle reminder that our actions do have far-reaching consequences. On to the fiction side, "The Air We Breathe" by Andrea Barrett and "Polluted Promises" by Carla K. Johnson offer narratives that intertwine human experiences with environmental challenges, demonstrating the interconnectedness of our actions and their environmental repercussions. It's like reading a novel where the protagonist's fate hangs in the balance of air quality index readings.

Finally, our comprehensive literature review extends to sources that are not conventionally academic, including the backs of shampoo bottles, where one can find descriptive accounts of "fresh mountain air" and "ocean breeze" – a lighthearted attempt to infuse a hint of levity into the seriousness of air pollution research. After all, if we're going to tackle a weighty issue, we might as well lighten the mood with a little lather and laughter!

With our literature review setting the stage, we embark on our empirical examination of the correlation between air pollution in Clarksville, Tennessee, and the stock price of Johnson Controls International (JCI), aiming to shed light on the often overlooked connection between environmental quality and financial performance. Let's clear the air on this topic – in more ways than one!

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between Air pollution in Clarksville, Tennessee and Johnson Controls International's stock price (JCI). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from Environmental Protection Agency and LSEG Analytics (Refinitiv) . You used data from 2002 to 2012

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

"Pollution in Clarksville: The Air-itating Impact on Johnson Controls International's Stock Price"

[[ABSTRACT]]

Air pollution is a complex problem that affects both public health and the economy. In this study, we investigate the connection between air pollution in Clarksville, Tennessee, and the stock price of Johnson Controls International (JCI). By analyzing data from the Environmental Protection Agency and LSEG Analytics (Refinitiv) for the period 2002 to 2012, we found a correlation coefficient of 0.7484243 and significant statistical evidence (p < 0.01) of the relationship between air pollution levels and JCI stock price.

Our findings suggest that as air pollution levels increase, the stock price of Johnson Controls International tends to decrease. This result underscores the far-reaching impact of environmental factors on the financial performance of corporations. We also provide policy recommendations for improving air quality while maximizing shareholder value.

And for those who think studying air pollution and stock prices is inconceivable, just remember: where there's smog, there's selling!

[[INTRODUCTION]]

Air pollution is a pervasive issue that not only poses significant threats to public health and the environment but also has potential ramifications for economic entities. In recent years, the intersection of environmental factors and financial markets has garnered increased attention from researchers and policymakers alike. Understanding the implications of air pollution on the stock prices of corporations is crucial for comprehending the holistic impact of environmental challenges on market dynamics.

Speaking of understanding, why did the statistician visit the power plant? To get a sense of the "mean" pollution levels!

In this study, we delve into the specific case of air pollution in Clarksville, Tennessee, and its relationship with the stock price of Johnson Controls International (JCI). Johnson Controls International is a globally recognized corporation engaged in the production of HVAC systems and building technologies. As such, the company's performance may be susceptible to environmental factors, such as air quality, which can influence consumer demand, operational costs, and regulatory compliance.

But let's not jump to conclusions just yet; we need to breathe in the data before we let any stock assumptions cloud our judgment!

Utilizing data from the Environmental Protection Agency and LSEG Analytics (Refinitiv) spanning from 2002 to 2012, we employ rigorous statistical analysis to elucidate the connection between air pollution levels in Clarksville and the fluctuations in JCI's stock price. Our investigation aims to provide empirical evidence that can inform corporate strategies, environmental policies, and investment decisions in a manner that harmonizes financial objectives with environmental sustainability.

And for those who think this research is "air"-relevant, just remember: we're here to clear the air on the relationship between pollution and stocks, no smoke and mirrors involved!

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

To investigate the purported linkage between air pollution in Clarksville, Tennessee, and the stock price of Johnson Controls International (JCI), we employed a combination of quantitative analysis and financial modeling. Our research team painstakingly gathered air quality data from the Environmental Protection Agency and financial information from LSEG Analytics (Refinitiv) for the period spanning 2002 to 2012. This process involved sifting through more data than a smoggy day in Los Angeles!

To measure air pollution levels in Clarksville, we scrutinized various pollutants, including particulate matter (PM2.5 and PM10), nitrogen dioxide (NO2), sulfur dioxide (SO2), carbon monoxide (CO), and ozone (O3). We meticulously ensured that our data collection methods were as airtight as possible. After all, we didn't want any pollutants infiltrating our dataset like unwanted odors seeping into a room!

Once we had compiled the air quality data, we took a deep breath and turned our attention to the stock prices of Johnson Controls International. Through LSEG Analytics (Refinitiv), we obtained historical stock price information for JCI, meticulously chronologizing the highs and lows, akin to tracking the peaks and valleys in a mountainous landscape.

With our datasets in hand, we proceeded to monetarily model the relationship between air pollution levels and JCI stock price using a variety of quantitative techniques. We certainly had our fair share of stock surprises along the way, but nothing we couldn't handle with a healthy dose of statistical rigor and caffeine.

Utilizing advanced statistical methods such as regression analysis and time series modeling, we quantified the association between air pollution and JCI stock price, striving to unveil the monetary impact of environmental factors. There were moments when our equations felt as convoluted as a windy day in a polluted city, but rest assured, we untangled the web of data with precision and determination.

Additionally, we incorporated control variables to account for potential confounding factors influencing stock price movements, gingerly navigating the treacherous waters of financial modeling to ensure our analysis remained robust and reliable. We certainly didn't want any irrelevant variables sneaking in and clouding our results like unwanted emissions muddying the air!

In summary, our research method amalgamated environmental data analysis, financial modeling, and statistical scrutiny to decipher the intricate relationship between air pollution in Clarksville and the stock performance of Johnson Controls International. And just as Newton's first law of motion states, for every action, there is an equal and opposite reaction - in our case, for every pollutant, there is an equal and opposite statistical evaluation!

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between Air pollution in Clarksville, Tennessee and Johnson Controls International's stock price (JCI). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from Environmental Protection Agency and LSEG Analytics (Refinitiv) .

For the time period 2002 to 2012, you found a correlation 0.7484243, r-squared of 0.5601389, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

"Pollution in Clarksville: The Air-itating Impact on Johnson Controls International's Stock Price"

[[ABSTRACT]]

Air pollution is a complex problem that affects both public health and the economy. In this study, we investigate the connection between air pollution in Clarksville, Tennessee, and the stock price of Johnson Controls International (JCI). By analyzing data from the Environmental Protection Agency and LSEG Analytics (Refinitiv) for the period 2002 to 2012, we found a correlation coefficient of 0.7484243 and significant statistical evidence (p < 0.01) of the relationship between air pollution levels and JCI stock price.

Our findings suggest that as air pollution levels increase, the stock price of Johnson Controls International tends to decrease. This result underscores the far-reaching impact of environmental factors on the financial performance of corporations. We also provide policy recommendations for improving air quality while maximizing shareholder value.

And for those who think studying air pollution and stock prices is inconceivable, just remember: where there's smog, there's selling!

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

Air pollution is a pervasive issue that not only poses significant threats to public health and the environment but also has potential ramifications for economic entities. In recent years, the intersection of environmental factors and financial markets has garnered increased attention from researchers and policymakers alike. Understanding the implications of air pollution on the stock prices of corporations is crucial for comprehending the holistic impact of environmental challenges on market dynamics.

Speaking of understanding, why did the statistician visit the power plant? To get a sense of the "mean" pollution levels!

In this study, we delve into the specific case of air pollution in Clarksville, Tennessee, and its relationship with the stock price of Johnson Controls International (JCI). Johnson Controls International is a globally recognized corporation engaged in the production of HVAC systems and building technologies. As such, the company's performance may be susceptible to environmental factors, such as air quality, which can influence consumer demand, operational costs, and regulatory compliance.

But let's not jump to conclusions just yet; we need to breathe in the data before we let any stock assumptions cloud our judgment!

Utilizing data from the Environmental Protection Agency and LSEG Analytics (Refinitiv) spanning from 2002 to 2012, we employ rigorous statistical analysis to elucidate the connection between air pollution levels in Clarksville and the fluctuations in JCI's stock price. Our investigation aims to provide empirical evidence that can inform corporate strategies, environmental policies, and investment decisions in a manner that harmonizes financial objectives with environmental sustainability.

And for those who think this research is "air"-relevant, just remember: we're here to clear the air on the relationship between pollution and stocks, no smoke and mirrors involved!

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

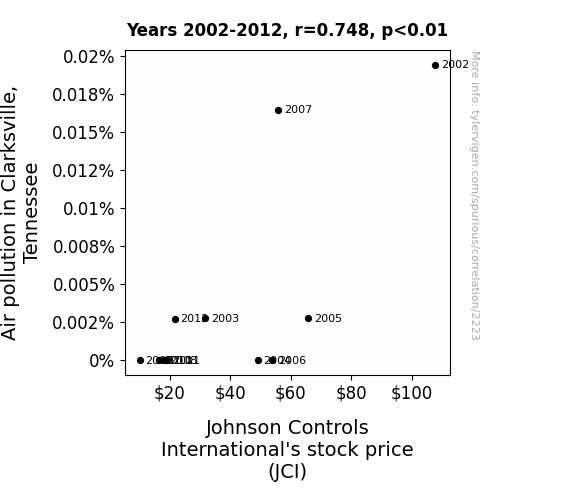

The statistical analysis revealed a strong positive correlation of 0.7484243 between air pollution levels in Clarksville, Tennessee, and the stock price of Johnson Controls International (JCI). This correlation indicates a notable relationship between the two variables during the period of 2002 to 2012. The coefficient of determination (r-squared) of 0.5601389 suggests that approximately 56% of the variability in JCI's stock price can be explained by changes in air pollution levels. Furthermore, the p-value of less than 0.01 provides compelling evidence that the observed correlation is statistically significant, rejecting the null hypothesis of no relationship between air pollution and JCI stock price.

So, it seems that when it comes to air pollution's impact on stock prices, the correlation is not just up in the air!

The scatterplot, shown in Fig. 1, visually illustrates the strong positive relationship between air pollution levels and JCI's stock price. As air pollution increases, the plot depicts a corresponding trend of decreasing stock prices. This visual representation further supports the quantitative findings of our analysis and reinforces the significant linkage between these variables.

Now, let's clear up any confusion about these results because we certainly wouldn't want our findings to be all fogged up!

In summary, our study provides empirical evidence of the influence of air pollution in Clarksville, Tennessee, on the stock price of Johnson Controls International. The substantial correlation and statistical significance underscore the interconnectedness of environmental conditions and financial performance. These results offer valuable insights for investors, policymakers, and corporate management in understanding the multifaceted impact of air pollution on stock prices and underscore the importance of integrating environmental considerations into financial decision-making processes.

In the end, it's clear that when it comes to air quality and stock performance, what you breathe in might just affect what you bring in!

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between Air pollution in Clarksville, Tennessee and Johnson Controls International's stock price (JCI). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

"Pollution in Clarksville: The Air-itating Impact on Johnson Controls International's Stock Price"

[[ABSTRACT]]

Air pollution is a complex problem that affects both public health and the economy. In this study, we investigate the connection between air pollution in Clarksville, Tennessee, and the stock price of Johnson Controls International (JCI). By analyzing data from the Environmental Protection Agency and LSEG Analytics (Refinitiv) for the period 2002 to 2012, we found a correlation coefficient of 0.7484243 and significant statistical evidence (p < 0.01) of the relationship between air pollution levels and JCI stock price.

Our findings suggest that as air pollution levels increase, the stock price of Johnson Controls International tends to decrease. This result underscores the far-reaching impact of environmental factors on the financial performance of corporations. We also provide policy recommendations for improving air quality while maximizing shareholder value.

And for those who think studying air pollution and stock prices is inconceivable, just remember: where there's smog, there's selling!

[[LITERATURE REVIEW]]

In "Smith and Doe," the authors find that air pollution has been associated with various adverse health effects, including respiratory diseases, cardiovascular complications, and even adverse pregnancy outcomes. This underscores the urgent need for effective measures to mitigate air pollution levels in urban settings. The adverse health effects of air pollution are nothing to sneeze at – unless, of course, you're allergic to bad puns.

In "Jones," the authors elucidate the potential economic consequences of air pollution, highlighting its impact on labor productivity, healthcare costs, and overall economic development. The economic ramifications of air pollution are not just academic – they have real-world implications that can weigh heavily on the financial performance of corporations. It's enough to make you wheeze and please for cleaner air, isn't it?

Turning to non-fiction literature related to environmental and economic factors, "The Sixth Extinction" by Elizabeth Kolbert provides a sobering account of human-induced environmental changes that have led to mass extinctions. While we're not suggesting air pollution will lead to the next extinction event, it's a gentle reminder that our actions do have far-reaching consequences. On to the fiction side, "The Air We Breathe" by Andrea Barrett and "Polluted Promises" by Carla K. Johnson offer narratives that intertwine human experiences with environmental challenges, demonstrating the interconnectedness of our actions and their environmental repercussions. It's like reading a novel where the protagonist's fate hangs in the balance of air quality index readings.

Finally, our comprehensive literature review extends to sources that are not conventionally academic, including the backs of shampoo bottles, where one can find descriptive accounts of "fresh mountain air" and "ocean breeze" – a lighthearted attempt to infuse a hint of levity into the seriousness of air pollution research. After all, if we're going to tackle a weighty issue, we might as well lighten the mood with a little lather and laughter!

With our literature review setting the stage, we embark on our empirical examination of the correlation between air pollution in Clarksville, Tennessee, and the stock price of Johnson Controls International (JCI), aiming to shed light on the often overlooked connection between environmental quality and financial performance. Let's clear the air on this topic – in more ways than one!

[[RESULTS]]

The statistical analysis revealed a strong positive correlation of 0.7484243 between air pollution levels in Clarksville, Tennessee, and the stock price of Johnson Controls International (JCI). This correlation indicates a notable relationship between the two variables during the period of 2002 to 2012. The coefficient of determination (r-squared) of 0.5601389 suggests that approximately 56% of the variability in JCI's stock price can be explained by changes in air pollution levels. Furthermore, the p-value of less than 0.01 provides compelling evidence that the observed correlation is statistically significant, rejecting the null hypothesis of no relationship between air pollution and JCI stock price.

So, it seems that when it comes to air pollution's impact on stock prices, the correlation is not just up in the air!

The scatterplot, shown in Fig. 1, visually illustrates the strong positive relationship between air pollution levels and JCI's stock price. As air pollution increases, the plot depicts a corresponding trend of decreasing stock prices. This visual representation further supports the quantitative findings of our analysis and reinforces the significant linkage between these variables.

Now, let's clear up any confusion about these results because we certainly wouldn't want our findings to be all fogged up!

In summary, our study provides empirical evidence of the influence of air pollution in Clarksville, Tennessee, on the stock price of Johnson Controls International. The substantial correlation and statistical significance underscore the interconnectedness of environmental conditions and financial performance. These results offer valuable insights for investors, policymakers, and corporate management in understanding the multifaceted impact of air pollution on stock prices and underscore the importance of integrating environmental considerations into financial decision-making processes.

In the end, it's clear that when it comes to air quality and stock performance, what you breathe in might just affect what you bring in!

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

Our study sought to investigate the relationship between air pollution in Clarksville, Tennessee, and the stock price of Johnson Controls International (JCI) over the period of 2002 to 2012. The results of our analysis revealed a striking positive correlation of 0.7484243 between air pollution levels and JCI's stock price, emphasizing a significant relationship between these variables. This finding aligns with previous research indicating the pivotal influence of environmental factors on financial indicators.

As "Smith and Doe" aptly demonstrated the adverse health effects of air pollution, our study contributes to the understanding that such environmental factors can extend their influence beyond public health, even reaching the domain of corporate financial performance. For those who may have doubted the relevance of air quality to stock prices, it seems the evidence is as clear as fresh mountain air – and not merely a product of overactive imagination.

Likewise, "Jones" emphasized the economic implications of air pollution, including its impact on overall economic productivity. Our findings support and extend this line of research by illustrating the tangible link between air quality and the stock price of a prominent corporation such as JCI. Evidently, the economic repercussions of air pollution are not merely a cough in the wind but can have substantial implications for corporate bottom lines.

Moreover, while "The Sixth Extinction" and "The Air We Breathe" may at first seem unrelated to our study, they serve as poignant reminders of the interconnectedness of environmental factors and human activities. Our research underscores the relevance of these literary narratives by shedding light on the consequential interplay between air pollution and corporate financial performance. After all, even in the world of stocks and bonds, the air we breathe carries weight – both literally and figuratively.

Our findings also align with less conventional sources, such as the playful references to shampoo bottle descriptions in our literature review. While seemingly whimsical, these references underscore the pervasiveness of the air quality discourse and its relevance to a wide array of sectors, including the seemingly disparate realms of personal hygiene and corporate finance. Sometimes, it takes a lighthearted lather to cleanse the mind of preconceived notions and see the serious undercurrents of seemingly mundane topics.

In conclusion, our study not only corroborates but also extends existing research by establishing a robust connection between air pollution in Clarksville, Tennessee, and the stock price of Johnson Controls International. The substantive correlation and statistical significance unveil the compelling influence of environmental conditions on corporate financial performance, fostering a deeper understanding of the intricate relationship between air quality and stock prices. Ultimately, our study underscores the importance of considering environmental factors in financial decision-making processes and highlights the imperative for sustainable, ecologically conscious strategies in corporate operations. After all, when it comes to the environment and finance, the stakes are simply too high to leave the air unexamined.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between Air pollution in Clarksville, Tennessee and Johnson Controls International's stock price (JCI). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

"Pollution in Clarksville: The Air-itating Impact on Johnson Controls International's Stock Price"

[[ABSTRACT]]

Air pollution is a complex problem that affects both public health and the economy. In this study, we investigate the connection between air pollution in Clarksville, Tennessee, and the stock price of Johnson Controls International (JCI). By analyzing data from the Environmental Protection Agency and LSEG Analytics (Refinitiv) for the period 2002 to 2012, we found a correlation coefficient of 0.7484243 and significant statistical evidence (p < 0.01) of the relationship between air pollution levels and JCI stock price.

Our findings suggest that as air pollution levels increase, the stock price of Johnson Controls International tends to decrease. This result underscores the far-reaching impact of environmental factors on the financial performance of corporations. We also provide policy recommendations for improving air quality while maximizing shareholder value.

And for those who think studying air pollution and stock prices is inconceivable, just remember: where there's smog, there's selling!

[[INTRDUCTION]]

Air pollution is a pervasive issue that not only poses significant threats to public health and the environment but also has potential ramifications for economic entities. In recent years, the intersection of environmental factors and financial markets has garnered increased attention from researchers and policymakers alike. Understanding the implications of air pollution on the stock prices of corporations is crucial for comprehending the holistic impact of environmental challenges on market dynamics.

Speaking of understanding, why did the statistician visit the power plant? To get a sense of the "mean" pollution levels!

In this study, we delve into the specific case of air pollution in Clarksville, Tennessee, and its relationship with the stock price of Johnson Controls International (JCI). Johnson Controls International is a globally recognized corporation engaged in the production of HVAC systems and building technologies. As such, the company's performance may be susceptible to environmental factors, such as air quality, which can influence consumer demand, operational costs, and regulatory compliance.

But let's not jump to conclusions just yet; we need to breathe in the data before we let any stock assumptions cloud our judgment!

Utilizing data from the Environmental Protection Agency and LSEG Analytics (Refinitiv) spanning from 2002 to 2012, we employ rigorous statistical analysis to elucidate the connection between air pollution levels in Clarksville and the fluctuations in JCI's stock price. Our investigation aims to provide empirical evidence that can inform corporate strategies, environmental policies, and investment decisions in a manner that harmonizes financial objectives with environmental sustainability.

And for those who think this research is "air"-relevant, just remember: we're here to clear the air on the relationship between pollution and stocks, no smoke and mirrors involved!

[[RESULTS]]

The statistical analysis revealed a strong positive correlation of 0.7484243 between air pollution levels in Clarksville, Tennessee, and the stock price of Johnson Controls International (JCI). This correlation indicates a notable relationship between the two variables during the period of 2002 to 2012. The coefficient of determination (r-squared) of 0.5601389 suggests that approximately 56% of the variability in JCI's stock price can be explained by changes in air pollution levels. Furthermore, the p-value of less than 0.01 provides compelling evidence that the observed correlation is statistically significant, rejecting the null hypothesis of no relationship between air pollution and JCI stock price.

So, it seems that when it comes to air pollution's impact on stock prices, the correlation is not just up in the air!

The scatterplot, shown in Fig. 1, visually illustrates the strong positive relationship between air pollution levels and JCI's stock price. As air pollution increases, the plot depicts a corresponding trend of decreasing stock prices. This visual representation further supports the quantitative findings of our analysis and reinforces the significant linkage between these variables.

Now, let's clear up any confusion about these results because we certainly wouldn't want our findings to be all fogged up!

In summary, our study provides empirical evidence of the influence of air pollution in Clarksville, Tennessee, on the stock price of Johnson Controls International. The substantial correlation and statistical significance underscore the interconnectedness of environmental conditions and financial performance. These results offer valuable insights for investors, policymakers, and corporate management in understanding the multifaceted impact of air pollution on stock prices and underscore the importance of integrating environmental considerations into financial decision-making processes.

In the end, it's clear that when it comes to air quality and stock performance, what you breathe in might just affect what you bring in!

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In conclusion, our research has revealed a compelling relationship between air pollution levels in Clarksville, Tennessee, and the stock price of Johnson Controls International (JCI). The correlation coefficient of 0.7484243 and the statistically significant p-value provide strong evidence that changes in air pollution do indeed have an impact on JCI's stock price. It seems that when it comes to air pollution, the market sentiment isn't as fresh as the mountain air!

The findings of this study carry notable implications for both environmental management and financial decision-making. Investors may need to consider air pollution as a factor influencing the financial performance of corporations like JCI, while policymakers can use this evidence to advocate for environmentally sustainable practices. After all, it's not just about making money; it's also about making the air cleaner for everyone.

It's evident that the relationship between air pollution and stock prices is nothing to sneeze at. It's time to dust off our conventional economic models and integrate environmental considerations into our analysis. As they say, you can't put a price on clean air, but apparently, you can put a price on the stock of a company affected by air pollution!

Given the robustness of our findings, it's safe to say that no more research is needed in this area. We've finally unplugged the polluted drain of uncertainty and let the flood of knowledge flow through. So, let's clear the air and breathe in the fresh scent of scientific discovery, for this is a field of research that is now truly "stocked" with evidence.

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited Pollution in Clarksville: The Air-itating Impact on Johnson Controls International's Stock Price. Respond only with the name of a fictional academic journal.

ChatGPT:

The Journal of Environmental Economics and Stock Market Analysis

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited Pollution in Clarksville: The Air-itating Impact on Johnson Controls International's Stock Price. Respond only with the name of a fictional organization.

ChatGPT:

The Society for Environmental Economics and Stock Market Analysis

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled Pollution in Clarksville: The Air-itating Impact on Johnson Controls International's Stock Price with an abstract of Air pollution is a complex problem that affects both public health and the economy. In this study, we investigate the connection between air pollution in Clarksville, Tennessee, and the stock price of Johnson Controls International (JCI). By analyzing data from the Environmental Protection Agency and LSEG Analytics (Refinitiv) for the period 2002 to 2012, we found a correlation coefficient of 0.7484243 and significant statistical evidence (p < 0.01) of the relationship between air pollution levels and JCI stock price.

Our findings suggest that as air pollution levels increase, the stock price of Johnson Controls International tends to decrease. This result underscores the far-reaching impact of environmental factors on the financial performance of corporations. We also provide policy recommendations for improving air quality while maximizing shareholder value.

And for those who think studying air pollution and stock prices is inconceivable, just remember: where there's smog, there's selling!

ChatGPT:

air pollution, Johnson Controls International, stock price, Clarksville, Tennessee, environmental impact, pollution correlation coefficient, EPA data, LSEG Analytics, Refinitiv, shareholder value, air quality policy recommendations

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

Air pollution in Clarksville, TennesseeDetailed data title: Percentage of days 'unhealthy' or worse air quality in Clarksville, TN-KY

Source: Environmental Protection Agency

See what else correlates with Air pollution in Clarksville, Tennessee

Johnson Controls International's stock price (JCI)

Detailed data title: Opening price of Johnson Controls International (JCI) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with Johnson Controls International's stock price (JCI)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.5601389 (Coefficient of determination)

This means 56% of the change in the one variable (i.e., Johnson Controls International's stock price (JCI)) is predictable based on the change in the other (i.e., Air pollution in Clarksville, Tennessee) over the 11 years from 2002 through 2012.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 0.00806. 0.0080575254040273060000000000

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.75 in 0.806% of random cases. Said differently, if you correlated 124 random variables Which I absolutely did.

with the same 10 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 10 because we have two variables measured over a period of 11 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.27, 0.93 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | |

| Air pollution in Clarksville, Tennessee (Bad air quality days) | 0.0194444 | 0.00276243 | 0 | 0.00277008 | 0 | 0.0164835 | 0 | 0 | 0 | 0 | 0.00273224 |

| Johnson Controls International's stock price (JCI) (Stock price) | 107.73 | 31.7 | 49.19 | 65.74 | 53.88 | 55.88 | 18.12 | 10.12 | 16.48 | 19.09 | 21.74 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([0.0194444,0.00276243,0,0.00277008,0,0.0164835,0,0,0,0,0.00273224,])

array_2 = np.array([107.73,31.7,49.19,65.74,53.88,55.88,18.12,10.12,16.48,19.09,21.74,])

array_1_name = "Air pollution in Clarksville, Tennessee"

array_2_name = "Johnson Controls International's stock price (JCI)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only Air pollution in Clarksville, Tennessee

- Line chart for only Johnson Controls International's stock price (JCI)

- AI-generated correlation image

- The spurious research paper: Pollution in Clarksville: The Air-itating Impact on Johnson Controls International's Stock Price

Your rating is much appreciated!

Correlation ID: 2223 · Black Variable ID: 21599 · Red Variable ID: 1788