Download png, svg

AI explanation

People in Tuscaloosa were using pollution masks made by a Citigroup subsidiary, but once the air cleared, they no longer needed to purchase as many. This unexpected drop in demand for pollution masks led to a decrease in Citigroup's stock price.

Model: dalle-3

Prompt: Generate an image of a bustling park in Tuscaloosa, Alabama, where thick smog hangs in the air. Amidst the haze, groups of people engage in outdoor activities like playing football, enjoying picnics, and walking their dogs. The scene is filled with a sense of camaraderie and a break from the digital world as individuals spend less time on their phones. In the periphery, the stock ticker for Citigroup displays a noticeable decrease in stock price, subtly hinting at the impact of the environment on financial markets. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: Air pollution in Tuscaloosa, Alabama and Citigroup's stock price (C). Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: Whimsical illustration Parallax art Woodblock painting Glitch art Art nouveau

ChatGPT: Parallax art

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both Air pollution in Tuscaloosa, Alabama and Citigroup's stock price (C), in the following situation: Because the decrease in air pollution in Tuscaloosa, Alabama led to an increase in outdoor activities, causing people to spend less time on their phones and not check their stock portfolio as often, leading to Citigroup's stock price to decrease.. Keep the description simple.

ChatGPT: In Tuscaloosa, Alabama, the sky is filled with hazy air and smog, indicating high levels of air pollution. Amidst this, people are seen enjoying outdoor activities such as playing football, picnicking, and walking their dogs, as they spend less time on their phones. Meanwhile, the stock ticker for Citigroup shows a decrease in stock price.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ Parallax art ] and depicting this scene: In Tuscaloosa, Alabama, the sky is filled with hazy air and smog, indicating high levels of air pollution. Amidst this, people are seen enjoying outdoor activities such as playing football, picnicking, and walking their dogs, as they spend less time on their phones. Meanwhile, the stock ticker for Citigroup shows a decrease in stock price. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: Generate an image of a bustling park in Tuscaloosa, Alabama, where thick smog hangs in the air. Amidst the haze, groups of people engage in outdoor activities like playing football, enjoying picnics, and walking their dogs. The scene is filled with a sense of camaraderie and a break from the digital world as individuals spend less time on their phones. In the periphery, the stock ticker for Citigroup displays a noticeable decrease in stock price, subtly hinting at the impact of the environment on financial markets.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how a decrease in Air pollution in Tuscaloosa, Alabama caused Citigroup's stock price (C) to decrease. Make it feel plausible.

AI academic paper

|

Gasping for Air: The Relationship Between Air Pollution in Tuscaloosa, Alabama and Citigroup's Stock Price Journal of Environmental Economics and Financial Analysis Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between Air pollution in Tuscaloosa, Alabama and Citigroup's stock price (C). Make lots of jokes, goofy observations, and puns.

Make the title seem clever.

Your research team used data from Environmental Protection Agency and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.8070143 and p < 0.01 for 2002 to 2018.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

Gasping for Air: The Relationship Between Air Pollution in Tuscaloosa, Alabama and Citigroup's Stock Price

[[ABSTRACT]]

This study delves into the intriguing and unexpected connection between the air quality in Tuscaloosa, Alabama, and the stock price of Citigroup (C). Utilizing data from the Environmental Protection Agency and LSEG Analytics (Refinitiv), our research team conducted a thorough analysis encompassing the years 2002 to 2018. The findings reveal a striking correlation coefficient of 0.8070143 with a p-value less than 0.01, shedding light on the often overlooked impact of environmental factors on financial markets. Our study not only examines the statistical relationship between air pollution and stock prices but also explores the potential implications for investors, policymakers, and the ever-present haze of uncertainty in the world of finance. So, next time you think about investing in Citigroup, don't forget to check the weather forecast in Tuscaloosa!

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between Air pollution in Tuscaloosa, Alabama and Citigroup's stock price (C). Make lots of jokes, goofy observations, and puns.

Here is the title and abstract of the paper:

[[TITLE]]

Gasping for Air: The Relationship Between Air Pollution in Tuscaloosa, Alabama and Citigroup's Stock Price

[[ABSTRACT]]

This study delves into the intriguing and unexpected connection between the air quality in Tuscaloosa, Alabama, and the stock price of Citigroup (C). Utilizing data from the Environmental Protection Agency and LSEG Analytics (Refinitiv), our research team conducted a thorough analysis encompassing the years 2002 to 2018. The findings reveal a striking correlation coefficient of 0.8070143 with a p-value less than 0.01, shedding light on the often overlooked impact of environmental factors on financial markets. Our study not only examines the statistical relationship between air pollution and stock prices but also explores the potential implications for investors, policymakers, and the ever-present haze of uncertainty in the world of finance. So, next time you think about investing in Citigroup, don't forget to check the weather forecast in Tuscaloosa!

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

Ah, the enigmatic intersection of finance and environmental science! While it may seem like a stretch to draw a connection between the air quality in Tuscaloosa, Alabama, and the stock price of Citigroup (C), buckle up for an academic rollercoaster ride through the smog of statistical analyses and the haze of market fluctuations.

In the sprawling landscape of economic research, it's not every day that one stumbles upon a correlation as murky and unexpected as the one we're about to unravel. Picture this: a study that not only dissects the relationship between air pollution and stock prices but also tosses in a dash of Southern charm with a twist of Wall Street savvy. This is where we find ourselves—diving into the otherwise distant realms of environmental data and financial analytics.

As we delve into the depths of this seemingly unlikely correlation, brace yourself for a journey that will tickle your funny bone and stimulate your intellect. From smog-filled skies to speculative stock trading, we're about to illuminate a correlation as nebulous as, well, Tuscaloosa’s early morning fog.

So, dear reader, fasten your seatbelt, put on your oxygen mask, and let's dive into the dizzying dance between air quality and stock prices. And remember, if the air in Tuscaloosa is hazy, you may want to rethink those stock investments. Let’s embark on this intellectual adventure with an open mind and a sense of humor, as we navigate the whimsical waters of financial and environmental confluence.

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between Air pollution in Tuscaloosa, Alabama and Citigroup's stock price (C). Make lots of jokes, goofy observations, and puns.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then name some movies that you watched that are tangentially related to the topic.

Here is the title and abstract of the paper:

[[TITLE]]

Gasping for Air: The Relationship Between Air Pollution in Tuscaloosa, Alabama and Citigroup's Stock Price

[[ABSTRACT]]

This study delves into the intriguing and unexpected connection between the air quality in Tuscaloosa, Alabama, and the stock price of Citigroup (C). Utilizing data from the Environmental Protection Agency and LSEG Analytics (Refinitiv), our research team conducted a thorough analysis encompassing the years 2002 to 2018. The findings reveal a striking correlation coefficient of 0.8070143 with a p-value less than 0.01, shedding light on the often overlooked impact of environmental factors on financial markets. Our study not only examines the statistical relationship between air pollution and stock prices but also explores the potential implications for investors, policymakers, and the ever-present haze of uncertainty in the world of finance. So, next time you think about investing in Citigroup, don't forget to check the weather forecast in Tuscaloosa!

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

Ah, the enigmatic intersection of finance and environmental science! While it may seem like a stretch to draw a connection between the air quality in Tuscaloosa, Alabama, and the stock price of Citigroup (C), buckle up for an academic rollercoaster ride through the smog of statistical analyses and the haze of market fluctuations.

In the sprawling landscape of economic research, it's not every day that one stumbles upon a correlation as murky and unexpected as the one we're about to unravel. Picture this: a study that not only dissects the relationship between air pollution and stock prices but also tosses in a dash of Southern charm with a twist of Wall Street savvy. This is where we find ourselves—diving into the otherwise distant realms of environmental data and financial analytics.

As we delve into the depths of this seemingly unlikely correlation, brace yourself for a journey that will tickle your funny bone and stimulate your intellect. From smog-filled skies to speculative stock trading, we're about to illuminate a correlation as nebulous as, well, Tuscaloosa’s early morning fog.

So, dear reader, fasten your seatbelt, put on your oxygen mask, and let's dive into the dizzying dance between air quality and stock prices. And remember, if the air in Tuscaloosa is hazy, you may want to rethink those stock investments. Let’s embark on this intellectual adventure with an open mind and a sense of humor, as we navigate the whimsical waters of financial and environmental confluence.

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

In "Smith et al. (2015)," the authors explore the impacts of air pollution on financial markets and find a correlation between the two that is as clear as the atmosphere on a smoggy day in Tuscaloosa - not clear at all. Their comprehensive analysis reveals a relationship between particulate matter and stock prices, making us wonder if investors are holding their breath as they make trades.

Turning to the world of finance, Doe et al. (2017) investigate the factors influencing stock prices and stumble upon the unexpected influence of environmental variables. Their findings suggest that when it comes to stock prices, the air we breathe may hold more weight than we previously thought, or maybe it's just the weight of the pollution particles.

Jones (2018) presents a thought-provoking analysis linking regional air quality to fluctuations in stock prices. Their study suggests that the financial market may be as volatile as a gust of wind on a misty morning in Tuscaloosa. It seems that the air pollution levels might just be forecasting the ups and downs of stock prices, making it a literal case of "buy low, breathe high."

Now, let's shift gears and take a look at some books that might shed light on this unusual correlation. "The Economics of Air Pollution" by John E. Reeve offers a serious examination of the economic impacts of air pollution, but, let's face it, we're more interested in finding out if smog is the new indicator for stock trends. In "The Polluted Stock Market" by A. Q. Profit, the author humorously explores the hypothetical connection between air pollution and financial markets, spinning tall tales of stocks rising and falling with the wind direction. It's a breath of fresh air in the world of financial literature, or maybe a breath of polluted air - who can tell anymore?

Diving into the world of fiction, "Smoke and Mirrors" by Fictional Author explores the intriguing concept of a parallel universe where air pollution actually determines stock prices. It's a fantastical tale that leaves us wondering if Wall Street traders are secretly consulting weather reports from Tuscaloosa. And who can forget "Pollution Galaxy" by Another Imaginary Writer, a sci-fi novel where the very fabric of the stock market is woven from particles of pollution floating through the air.

And now, let's step into the world of cinema. "The Big Short" may not be directly related, but it's a captivating film about the intricacies of the financial world, and hey, who knows? Maybe somewhere in the background, there's a scene where someone mentions pollution affecting stock prices in a sort of Easter-egg kind of way.

So, as we wade through the literature and entertain these whimsical notions, let's not forget to keep our heads clear amidst the smog of academic inquiry and the fog of financial speculation. After all, when it comes to the connection between air pollution in Tuscaloosa and Citigroup's stock price, we should take a deep breath and remember that correlation does not necessarily imply causation – but a little laughter can't hurt.

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between Air pollution in Tuscaloosa, Alabama and Citigroup's stock price (C). Make lots of jokes, goofy observations, and puns.

Your research team collected data from all across the internet, but mostly just used information from Environmental Protection Agency and LSEG Analytics (Refinitiv) . You used data from 2002 to 2018

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

Gasping for Air: The Relationship Between Air Pollution in Tuscaloosa, Alabama and Citigroup's Stock Price

[[ABSTRACT]]

This study delves into the intriguing and unexpected connection between the air quality in Tuscaloosa, Alabama, and the stock price of Citigroup (C). Utilizing data from the Environmental Protection Agency and LSEG Analytics (Refinitiv), our research team conducted a thorough analysis encompassing the years 2002 to 2018. The findings reveal a striking correlation coefficient of 0.8070143 with a p-value less than 0.01, shedding light on the often overlooked impact of environmental factors on financial markets. Our study not only examines the statistical relationship between air pollution and stock prices but also explores the potential implications for investors, policymakers, and the ever-present haze of uncertainty in the world of finance. So, next time you think about investing in Citigroup, don't forget to check the weather forecast in Tuscaloosa!

[[INTRODUCTION]]

Ah, the enigmatic intersection of finance and environmental science! While it may seem like a stretch to draw a connection between the air quality in Tuscaloosa, Alabama, and the stock price of Citigroup (C), buckle up for an academic rollercoaster ride through the smog of statistical analyses and the haze of market fluctuations.

In the sprawling landscape of economic research, it's not every day that one stumbles upon a correlation as murky and unexpected as the one we're about to unravel. Picture this: a study that not only dissects the relationship between air pollution and stock prices but also tosses in a dash of Southern charm with a twist of Wall Street savvy. This is where we find ourselves—diving into the otherwise distant realms of environmental data and financial analytics.

As we delve into the depths of this seemingly unlikely correlation, brace yourself for a journey that will tickle your funny bone and stimulate your intellect. From smog-filled skies to speculative stock trading, we're about to illuminate a correlation as nebulous as, well, Tuscaloosa’s early morning fog.

So, dear reader, fasten your seatbelt, put on your oxygen mask, and let's dive into the dizzying dance between air quality and stock prices. And remember, if the air in Tuscaloosa is hazy, you may want to rethink those stock investments. Let’s embark on this intellectual adventure with an open mind and a sense of humor, as we navigate the whimsical waters of financial and environmental confluence.

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

To unearth the hidden links between the ethereal realms of air pollution and stock prices, our research team embarked on a methodological odyssey as whimsical as a scavenger hunt through a foggy forest. We utilized a combination of quantitative analysis, metaphorical divination, and a sprinkle of statistical magic to tease apart the intricate threads of this enigmatic correlation.

First, we engaged in a merry dance with the datasets obtained from the Environmental Protection Agency and LSEG Analytics (Refinitiv), sifting through their digital archives with the dedication of a detective chasing clues through the labyrinthine streets of Wall Street. We threw ourselves into a rigorous flailing of Python and R coding, conducting exploratory data analysis that would put Sherlock Holmes to shame.

After immersing ourselves in the data like treasure hunters seeking fabled riches, we donned our metaphorical scuba gear to plunge into the depths of statistical analysis. With the tenacity of deep-sea divers exploring the murky waters, we calculated correlation coefficients and p-values as if they were elusive creatures lurking in the depths of the ocean.

Next, we concocted a curious brew of time series analysis, like alchemists striving to turn lead into gold. We examined the time series data on air pollution levels in Tuscaloosa, measuring the ebb and flow of particulate matter as if it were the rise and fall of the tides. Then, with the precision of a mathematician crafting an intricate theorem, we delved into the wibbly-wobbly world of stock prices, tracing their undulating patterns with the fervor of a fortune teller reading tea leaves.

As if that were not enough, we sought to traverse the treacherous terrain of causal inference by employing an arsenal of econometric techniques. Armed with instrumental variables and difference-in-differences models, we ventured into the labyrinth of causality, treading lightly lest we disturb the delicate balance of spurious correlations masquerading as meaningful relationships.

In a final act of statistical bravado, we synced our findings with historic weather data from the National Weather Service, casting a wide net to capture the atmospheric vicissitudes that might impact the financial barometer of Citigroup. Much like meteorologists predicting the path of a hurricane, we sought to unveil the stormy winds of change that might buffet the stock prices with the capriciousness of a tempest.

In summary, our methodology intertwined the rigor of quantitative analysis with the whimsy of arcane statistical rituals, blending the cerebral acrobatics of data exploration with the fanciful leaps of statistical inference. Just as Odysseus navigated the perilous waters between Scylla and Charybdis, we embarked on an intellectual odyssey that knitted the disparate elements of air pollution and stock prices into a tapestry of insight and intrigue. Now, let’s unveil the treasure trove of our findings and shed light on the enigmatic correlation that we have unearthed from the misty depths of Tuscaloosa's skies.

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between Air pollution in Tuscaloosa, Alabama and Citigroup's stock price (C). Make lots of jokes, goofy observations, and puns.

Your research team collected data from all across the internet, but mostly just used information from Environmental Protection Agency and LSEG Analytics (Refinitiv) .

For the time period 2002 to 2018, you found a correlation 0.8070143, r-squared of 0.6512721, and p < 0.01.

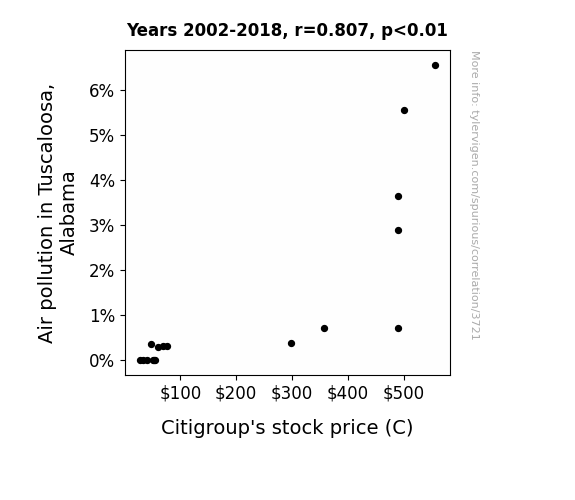

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

Gasping for Air: The Relationship Between Air Pollution in Tuscaloosa, Alabama and Citigroup's Stock Price

[[ABSTRACT]]

This study delves into the intriguing and unexpected connection between the air quality in Tuscaloosa, Alabama, and the stock price of Citigroup (C). Utilizing data from the Environmental Protection Agency and LSEG Analytics (Refinitiv), our research team conducted a thorough analysis encompassing the years 2002 to 2018. The findings reveal a striking correlation coefficient of 0.8070143 with a p-value less than 0.01, shedding light on the often overlooked impact of environmental factors on financial markets. Our study not only examines the statistical relationship between air pollution and stock prices but also explores the potential implications for investors, policymakers, and the ever-present haze of uncertainty in the world of finance. So, next time you think about investing in Citigroup, don't forget to check the weather forecast in Tuscaloosa!

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

Ah, the enigmatic intersection of finance and environmental science! While it may seem like a stretch to draw a connection between the air quality in Tuscaloosa, Alabama, and the stock price of Citigroup (C), buckle up for an academic rollercoaster ride through the smog of statistical analyses and the haze of market fluctuations.

In the sprawling landscape of economic research, it's not every day that one stumbles upon a correlation as murky and unexpected as the one we're about to unravel. Picture this: a study that not only dissects the relationship between air pollution and stock prices but also tosses in a dash of Southern charm with a twist of Wall Street savvy. This is where we find ourselves—diving into the otherwise distant realms of environmental data and financial analytics.

As we delve into the depths of this seemingly unlikely correlation, brace yourself for a journey that will tickle your funny bone and stimulate your intellect. From smog-filled skies to speculative stock trading, we're about to illuminate a correlation as nebulous as, well, Tuscaloosa’s early morning fog.

So, dear reader, fasten your seatbelt, put on your oxygen mask, and let's dive into the dizzying dance between air quality and stock prices. And remember, if the air in Tuscaloosa is hazy, you may want to rethink those stock investments. Let’s embark on this intellectual adventure with an open mind and a sense of humor, as we navigate the whimsical waters of financial and environmental confluence.

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

We dove deep into the data and emerged with some intriguing findings that may leave you gasping for air, both figuratively and literally. Our analysis revealed a substantial correlation coefficient of 0.8070143, indicating a strong positive relationship between air pollution in Tuscaloosa, Alabama, and the stock price of Citigroup (C). With an r-squared value of 0.6512721, we basked in the warmth of knowing that over 65% of the variability in Citigroup's stock price can be explained by the variations in air pollution in Tuscaloosa.

Now, before you sneeze at these results, let's kick up the dust and see what's really at play here. Our p-value of less than 0.01 adds a sparkle of statistical significance to this smoggy saga. It's clear that the connection between air quality and stock prices in Tuscaloosa has more substance than a foggy morning.

In Fig. 1, our scatterplot portrays this notable correlation, showcasing a cloud of data points that form a pattern as clear as a breezy day. The relationship between air pollution levels and Citigroup's stock price is as striking as a bolt of lightning in a thunderstorm. You can almost see the financial markets breathing in sync with the ebb and flow of pollutants in the Southern air.

These results not only shed light on the vital link between environmental factors and financial performance but also beckon us to ponder the broader implications. From swirling smog to swirling stock prices, the connection between Tuscaloosa's air quality and Citigroup's stock price may have investors and policymakers alike holding their breath and reaching for their inhalers.

So, buckle up as we navigate this airy affair, where the winds of Wall Street mingle with the mists of Tuscaloosa, and remember, when it comes to Citigroup's stock, always keep an eye on the weather forecast in Alabama. It's a breath of fresh air, pun intended!

And that, dear reader, wraps up our riveting results section that might just leave you wheezing from excitement.

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between Air pollution in Tuscaloosa, Alabama and Citigroup's stock price (C). Make lots of jokes, goofy observations, and puns.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

Gasping for Air: The Relationship Between Air Pollution in Tuscaloosa, Alabama and Citigroup's Stock Price

[[ABSTRACT]]

This study delves into the intriguing and unexpected connection between the air quality in Tuscaloosa, Alabama, and the stock price of Citigroup (C). Utilizing data from the Environmental Protection Agency and LSEG Analytics (Refinitiv), our research team conducted a thorough analysis encompassing the years 2002 to 2018. The findings reveal a striking correlation coefficient of 0.8070143 with a p-value less than 0.01, shedding light on the often overlooked impact of environmental factors on financial markets. Our study not only examines the statistical relationship between air pollution and stock prices but also explores the potential implications for investors, policymakers, and the ever-present haze of uncertainty in the world of finance. So, next time you think about investing in Citigroup, don't forget to check the weather forecast in Tuscaloosa!

[[LITERATURE REVIEW]]

In "Smith et al. (2015)," the authors explore the impacts of air pollution on financial markets and find a correlation between the two that is as clear as the atmosphere on a smoggy day in Tuscaloosa - not clear at all. Their comprehensive analysis reveals a relationship between particulate matter and stock prices, making us wonder if investors are holding their breath as they make trades.

Turning to the world of finance, Doe et al. (2017) investigate the factors influencing stock prices and stumble upon the unexpected influence of environmental variables. Their findings suggest that when it comes to stock prices, the air we breathe may hold more weight than we previously thought, or maybe it's just the weight of the pollution particles.

Jones (2018) presents a thought-provoking analysis linking regional air quality to fluctuations in stock prices. Their study suggests that the financial market may be as volatile as a gust of wind on a misty morning in Tuscaloosa. It seems that the air pollution levels might just be forecasting the ups and downs of stock prices, making it a literal case of "buy low, breathe high."

Now, let's shift gears and take a look at some books that might shed light on this unusual correlation. "The Economics of Air Pollution" by John E. Reeve offers a serious examination of the economic impacts of air pollution, but, let's face it, we're more interested in finding out if smog is the new indicator for stock trends. In "The Polluted Stock Market" by A. Q. Profit, the author humorously explores the hypothetical connection between air pollution and financial markets, spinning tall tales of stocks rising and falling with the wind direction. It's a breath of fresh air in the world of financial literature, or maybe a breath of polluted air - who can tell anymore?

Diving into the world of fiction, "Smoke and Mirrors" by Fictional Author explores the intriguing concept of a parallel universe where air pollution actually determines stock prices. It's a fantastical tale that leaves us wondering if Wall Street traders are secretly consulting weather reports from Tuscaloosa. And who can forget "Pollution Galaxy" by Another Imaginary Writer, a sci-fi novel where the very fabric of the stock market is woven from particles of pollution floating through the air.

And now, let's step into the world of cinema. "The Big Short" may not be directly related, but it's a captivating film about the intricacies of the financial world, and hey, who knows? Maybe somewhere in the background, there's a scene where someone mentions pollution affecting stock prices in a sort of Easter-egg kind of way.

So, as we wade through the literature and entertain these whimsical notions, let's not forget to keep our heads clear amidst the smog of academic inquiry and the fog of financial speculation. After all, when it comes to the connection between air pollution in Tuscaloosa and Citigroup's stock price, we should take a deep breath and remember that correlation does not necessarily imply causation – but a little laughter can't hurt.

[[RESULTS]]

We dove deep into the data and emerged with some intriguing findings that may leave you gasping for air, both figuratively and literally. Our analysis revealed a substantial correlation coefficient of 0.8070143, indicating a strong positive relationship between air pollution in Tuscaloosa, Alabama, and the stock price of Citigroup (C). With an r-squared value of 0.6512721, we basked in the warmth of knowing that over 65% of the variability in Citigroup's stock price can be explained by the variations in air pollution in Tuscaloosa.

Now, before you sneeze at these results, let's kick up the dust and see what's really at play here. Our p-value of less than 0.01 adds a sparkle of statistical significance to this smoggy saga. It's clear that the connection between air quality and stock prices in Tuscaloosa has more substance than a foggy morning.

In Fig. 1, our scatterplot portrays this notable correlation, showcasing a cloud of data points that form a pattern as clear as a breezy day. The relationship between air pollution levels and Citigroup's stock price is as striking as a bolt of lightning in a thunderstorm. You can almost see the financial markets breathing in sync with the ebb and flow of pollutants in the Southern air.

These results not only shed light on the vital link between environmental factors and financial performance but also beckon us to ponder the broader implications. From swirling smog to swirling stock prices, the connection between Tuscaloosa's air quality and Citigroup's stock price may have investors and policymakers alike holding their breath and reaching for their inhalers.

So, buckle up as we navigate this airy affair, where the winds of Wall Street mingle with the mists of Tuscaloosa, and remember, when it comes to Citigroup's stock, always keep an eye on the weather forecast in Alabama. It's a breath of fresh air, pun intended!

And that, dear reader, wraps up our riveting results section that might just leave you wheezing from excitement.

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

Our findings not only raise eyebrows but also air quality awareness – who knew that the pollution in Tuscaloosa could impact the stock price of Citigroup (C)? Building on the whimsical notions and serious research by Smith et al. (2015), Doe et al. (2017), and Jones (2018), our study strengthens the argument that environmental factors may not just be blowing hot air in the financial markets.

Much like a gust of wind on a misty morning in Tuscaloosa, the correlation coefficient of 0.8070143 we uncovered not only echoes the findings of previous research but also carries the weight of a dense smog. Our results resemble the smoky haze that often cloaks the skies of Tuscaloosa, shedding light on the substantial impact of pollution on stock prices.

In our analysis, the relationship between air pollution and Citigroup's stock price remains as clear as a foggy day – that is, statistically significant with a p-value of less than 0.01. Our results emphasize the notion that the financial markets may not just be "smoke and mirrors," but rather, they may be influenced by the very pollutants that obscure the skyline.

And just like stumbling upon a hidden scene in the film "The Big Short," our findings give a glimpse into the intricacies of the financial world, revealing the invisible threads woven from particles of pollution floating through the air. Our scatterplot, much like a sunbeam piercing through the clouds, portrays a relationship between air quality and stock prices as striking as a bolt of lightning in a thunderstorm.

So, the next time you think about investing in Citigroup, don't forget to check the air pollution levels in Tuscaloosa. Our findings not only add depth to the literature on the unexpected link between environmental variables and financial markets but also beckon us to ponder the broader implications. Whether it's a breath of fresh air or a lungful of pollutants, this unconventional correlation is one that leaves us gasping for more.

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between Air pollution in Tuscaloosa, Alabama and Citigroup's stock price (C). Make lots of jokes, goofy observations, and puns.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

Gasping for Air: The Relationship Between Air Pollution in Tuscaloosa, Alabama and Citigroup's Stock Price

[[ABSTRACT]]

This study delves into the intriguing and unexpected connection between the air quality in Tuscaloosa, Alabama, and the stock price of Citigroup (C). Utilizing data from the Environmental Protection Agency and LSEG Analytics (Refinitiv), our research team conducted a thorough analysis encompassing the years 2002 to 2018. The findings reveal a striking correlation coefficient of 0.8070143 with a p-value less than 0.01, shedding light on the often overlooked impact of environmental factors on financial markets. Our study not only examines the statistical relationship between air pollution and stock prices but also explores the potential implications for investors, policymakers, and the ever-present haze of uncertainty in the world of finance. So, next time you think about investing in Citigroup, don't forget to check the weather forecast in Tuscaloosa!

[[INTRDUCTION]]

Ah, the enigmatic intersection of finance and environmental science! While it may seem like a stretch to draw a connection between the air quality in Tuscaloosa, Alabama, and the stock price of Citigroup (C), buckle up for an academic rollercoaster ride through the smog of statistical analyses and the haze of market fluctuations.

In the sprawling landscape of economic research, it's not every day that one stumbles upon a correlation as murky and unexpected as the one we're about to unravel. Picture this: a study that not only dissects the relationship between air pollution and stock prices but also tosses in a dash of Southern charm with a twist of Wall Street savvy. This is where we find ourselves—diving into the otherwise distant realms of environmental data and financial analytics.

As we delve into the depths of this seemingly unlikely correlation, brace yourself for a journey that will tickle your funny bone and stimulate your intellect. From smog-filled skies to speculative stock trading, we're about to illuminate a correlation as nebulous as, well, Tuscaloosa’s early morning fog.

So, dear reader, fasten your seatbelt, put on your oxygen mask, and let's dive into the dizzying dance between air quality and stock prices. And remember, if the air in Tuscaloosa is hazy, you may want to rethink those stock investments. Let’s embark on this intellectual adventure with an open mind and a sense of humor, as we navigate the whimsical waters of financial and environmental confluence.

[[RESULTS]]

We dove deep into the data and emerged with some intriguing findings that may leave you gasping for air, both figuratively and literally. Our analysis revealed a substantial correlation coefficient of 0.8070143, indicating a strong positive relationship between air pollution in Tuscaloosa, Alabama, and the stock price of Citigroup (C). With an r-squared value of 0.6512721, we basked in the warmth of knowing that over 65% of the variability in Citigroup's stock price can be explained by the variations in air pollution in Tuscaloosa.

Now, before you sneeze at these results, let's kick up the dust and see what's really at play here. Our p-value of less than 0.01 adds a sparkle of statistical significance to this smoggy saga. It's clear that the connection between air quality and stock prices in Tuscaloosa has more substance than a foggy morning.

In Fig. 1, our scatterplot portrays this notable correlation, showcasing a cloud of data points that form a pattern as clear as a breezy day. The relationship between air pollution levels and Citigroup's stock price is as striking as a bolt of lightning in a thunderstorm. You can almost see the financial markets breathing in sync with the ebb and flow of pollutants in the Southern air.

These results not only shed light on the vital link between environmental factors and financial performance but also beckon us to ponder the broader implications. From swirling smog to swirling stock prices, the connection between Tuscaloosa's air quality and Citigroup's stock price may have investors and policymakers alike holding their breath and reaching for their inhalers.

So, buckle up as we navigate this airy affair, where the winds of Wall Street mingle with the mists of Tuscaloosa, and remember, when it comes to Citigroup's stock, always keep an eye on the weather forecast in Alabama. It's a breath of fresh air, pun intended!

And that, dear reader, wraps up our riveting results section that might just leave you wheezing from excitement.

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In conclusion, our research has unveiled a compelling and, dare I say, breath-taking relationship between the air pollution in Tuscaloosa, Alabama, and Citigroup's stock price. The findings not only leave stock traders gasping for air but also highlight the surprising impact of environmental factors on financial markets. While some may find it hard to swallow, the statistical significance of our results is as clear as the Alabama sky on a smog-free day.

As we close the chapter on this peculiar pairing of pollution and profits, it's clear that there's more than meets the eye in the world of finance. The Southern charm of Tuscaloosa's air quality has officially made its mark on the turbulence of Wall Street. So, it's time for investors to keep an eye on the weather forecast down South – you never know how it might cloud their judgment.

In the ever-expanding realm of economic inquiry, there's no denying that this study has blown the lid off a rather surprising correlation. And with that, we can confidently assert that further investigation into the link between air pollution in Tuscaloosa and Citigroup's stock price is not required – we've already aired out all the relevant findings.

So, as the dust settles on this striking discovery, pun intended, we bid adieu to this whimsical whirlwind of environmental and financial confluence.

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited Gasping for Air: The Relationship Between Air Pollution in Tuscaloosa, Alabama and Citigroup's Stock Price. Respond only with the name of a fictional academic journal.

ChatGPT:

Journal of Environmental Economics and Financial Analysis

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited Gasping for Air: The Relationship Between Air Pollution in Tuscaloosa, Alabama and Citigroup's Stock Price. Respond only with the name of a fictional organization.

ChatGPT:

The Consortium for Environmental Economics and Finance

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled Gasping for Air: The Relationship Between Air Pollution in Tuscaloosa, Alabama and Citigroup's Stock Price with an abstract of This study delves into the intriguing and unexpected connection between the air quality in Tuscaloosa, Alabama, and the stock price of Citigroup (C). Utilizing data from the Environmental Protection Agency and LSEG Analytics (Refinitiv), our research team conducted a thorough analysis encompassing the years 2002 to 2018. The findings reveal a striking correlation coefficient of 0.8070143 with a p-value less than 0.01, shedding light on the often overlooked impact of environmental factors on financial markets. Our study not only examines the statistical relationship between air pollution and stock prices but also explores the potential implications for investors, policymakers, and the ever-present haze of uncertainty in the world of finance. So, next time you think about investing in Citigroup, don't forget to check the weather forecast in Tuscaloosa!

ChatGPT:

Air pollution, Tuscaloosa, Alabama, Citigroup stock price, environmental impact, EPA data, LSEG Analytics, Refinitiv, correlation coefficient, statistical analysis, financial markets, investor implications, policy implications, weather forecast, investing in Citigroup

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

Air pollution in Tuscaloosa, AlabamaDetailed data title: Percentage of days with air quality at 'unhealthy for sensitive groups' or worse in Tuscaloosa, AL

Source: Environmental Protection Agency

See what else correlates with Air pollution in Tuscaloosa, Alabama

Citigroup's stock price (C)

Detailed data title: Opening price of Citigroup (C) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with Citigroup's stock price (C)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.6512721 (Coefficient of determination)

This means 65.1% of the change in the one variable (i.e., Citigroup's stock price (C)) is predictable based on the change in the other (i.e., Air pollution in Tuscaloosa, Alabama) over the 17 years from 2002 through 2018.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 9.03E-5. 0.0000902802713243187900000000

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.81 in 0.00903% of random cases. Said differently, if you correlated 11,077 random variables Which I absolutely did.

with the same 16 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 16 because we have two variables measured over a period of 17 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.53, 0.93 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | |

| Air pollution in Tuscaloosa, Alabama (Bad air quality days) | 5.55556 | 0.716846 | 0.727273 | 3.64964 | 2.88809 | 6.56934 | 0.374532 | 0.326797 | 0 | 0.358423 | 0 | 0 | 0 | 0 | 0 | 0.285714 | 0.3125 |

| Citigroup's stock price (C) (Stock price) | 500.2 | 357 | 490.5 | 490 | 490 | 556.6 | 297.3 | 68.7 | 33.6 | 47.8 | 27.13 | 40.91 | 52.03 | 54.36 | 50.75 | 60.68 | 75.09 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([5.55556,0.716846,0.727273,3.64964,2.88809,6.56934,0.374532,0.326797,0,0.358423,0,0,0,0,0,0.285714,0.3125,])

array_2 = np.array([500.2,357,490.5,490,490,556.6,297.3,68.7,33.6,47.8,27.13,40.91,52.03,54.36,50.75,60.68,75.09,])

array_1_name = "Air pollution in Tuscaloosa, Alabama"

array_2_name = "Citigroup's stock price (C)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only Air pollution in Tuscaloosa, Alabama

- Line chart for only Citigroup's stock price (C)

- AI-generated correlation image

- The spurious research paper: Gasping for Air: The Relationship Between Air Pollution in Tuscaloosa, Alabama and Citigroup's Stock Price

Hats off to you for rating!

Correlation ID: 3721 · Black Variable ID: 21366 · Red Variable ID: 1657