AI explanation

This increase could be because anyone named Harrison is actually a secret genius at biopharmaceutical investing, leading to a surge of Harrison-named individuals investing heavily in Bristol-Myers Squibb. Or possibly, there's a Harrison out there who accidentally discovered the elixir of stock price growth, and as more and more kids were named after him, the effect compounded, much like the interest on a savvy investment.

Model: dalle-3

Prompt: Generate an image of a bustling cityscape with tall skyscrapers and busy sidewalks. In the foreground, showcase parents walking along the sidewalks, pushing strollers and admiring the latest trend in baby names. A father holds his son, Harrison, with a proud smile, depicting the influence of Harrison Ford on the child's name. A line forms outside a hat shop, with fedoras flying off the shelves, capturing the trending fashion item. In the distance, include a stock ticker displaying a sharp rise in Bristol-Myers Squibb's stock price, symbolizing the increased demand for snake bite antivenom. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: Popularity of the first name Harrison and Bristol-Myers Squibb's stock price (BMY). Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: Symbolism Parallax art Charcoal a meme Macabre

ChatGPT: Parallax art

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both Popularity of the first name Harrison and Bristol-Myers Squibb's stock price (BMY), in the following situation: Because as the popularity of the name Harrison increased, more parents started naming their kids after Harrison Ford. This created a spike in demand for fedoras and bullwhips, leading to a surge in Bristol-Myers Squibb stock as they are the leading supplier of snake bite antivenom.. Keep the description simple.

ChatGPT: In a bustling city, parents walk along the sidewalks, pushing strollers and admiring the latest trend in baby names. A father smiles proudly as he holds his son, Harrison, named after the famous actor Harrison Ford. Nearby, a line forms outside a hat shop, where fedoras are flying off the shelves. Meanwhile, in the distance, the stock ticker displays a sharp rise in Bristol-Myers Squibb's stock price, reflecting the increased demand for snake bite antivenom, as the company is the leading supplier.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ Parallax art ] and depicting this scene: In a bustling city, parents walk along the sidewalks, pushing strollers and admiring the latest trend in baby names. A father smiles proudly as he holds his son, Harrison, named after the famous actor Harrison Ford. Nearby, a line forms outside a hat shop, where fedoras are flying off the shelves. Meanwhile, in the distance, the stock ticker displays a sharp rise in Bristol-Myers Squibb's stock price, reflecting the increased demand for snake bite antivenom, as the company is the leading supplier. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: Generate an image of a bustling cityscape with tall skyscrapers and busy sidewalks. In the foreground, showcase parents walking along the sidewalks, pushing strollers and admiring the latest trend in baby names. A father holds his son, Harrison, with a proud smile, depicting the influence of Harrison Ford on the child's name. A line forms outside a hat shop, with fedoras flying off the shelves, capturing the trending fashion item. In the distance, include a stock ticker displaying a sharp rise in Bristol-Myers Squibb's stock price, symbolizing the increased demand for snake bite antivenom.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how an increase in Popularity of the first name Harrison caused Bristol-Myers Squibb's stock price (BMY) to increase.

AI academic paper

|

Harrison's Handle: How a Name Nudges the Nasdaq Journal of Behavioral Finance and Quirky Names Jan 2024 |

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between Popularity of the first name Harrison and Bristol-Myers Squibb's stock price (BMY). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Make the title an alliteration.

Your research team used data from US Social Security Administration and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.9188120 and p < 0.01 for 2002 to 2022.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

Harrison's Handle: How a Name Nudges the Nasdaq

[[ABSTRACT]]

This research investigates the correlation between the popularity of the first name "Harrison" and the stock price of Bristol-Myers Squibb (BMY) on the Nasdaq. Utilizing an extensive dataset from the US Social Security Administration and LSEG Analytics (Refinitiv), our study spans the years 2002 to 2022. A striking correlation coefficient of 0.9188120 and a statistically significant p-value of less than 0.01 emerged, revealing potential implications for investors and perhaps even the naming of future generations. This study sheds light on the subtle yet surprisingly tangible influence of first names on stock market dynamics, offering a playful foray into the intersection of nomenclature and finance.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between Popularity of the first name Harrison and Bristol-Myers Squibb's stock price (BMY). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Here is the title and abstract of the paper:

[[TITLE]]

Harrison's Handle: How a Name Nudges the Nasdaq

[[ABSTRACT]]

This research investigates the correlation between the popularity of the first name "Harrison" and the stock price of Bristol-Myers Squibb (BMY) on the Nasdaq. Utilizing an extensive dataset from the US Social Security Administration and LSEG Analytics (Refinitiv), our study spans the years 2002 to 2022. A striking correlation coefficient of 0.9188120 and a statistically significant p-value of less than 0.01 emerged, revealing potential implications for investors and perhaps even the naming of future generations. This study sheds light on the subtle yet surprisingly tangible influence of first names on stock market dynamics, offering a playful foray into the intersection of nomenclature and finance.

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

[[INTRODUCTION]]

The concept of nomenclature, a seemingly innocuous element in the grand scheme of things, has not escaped the keen eye of researchers in various fields. While the influence of names on personal and professional lives has long been a subject of cultural and sociological discourse, its potential impact on financial markets has received limited attention. In this study, we embark on an unconventional exploration of the relationship between the popularity of the first name "Harrison" and the stock price of Bristol-Myers Squibb (BMY) on the Nasdaq. Our inquiry into this curious correlation seeks to bridge the realms of nomenclature and finance, offering a whimsical yet thought-provoking journey into the interconnectedness of seemingly disparate domains.

Examining the historical trajectory of the first name "Harrison," we are struck by its evolution from a familial surname to a popular appellation across generations. The allure of this name, which conjures images of rugged charm and presidential pedigree, piqued our curiosity and prompted us to consider its potential influence beyond individual identity. While one may initially dismiss the idea of a name exerting any noticeable impact on the stock market, our preliminary findings have prompted us to delve deeper into this tantalizing prospect. With a combination of data from the US Social Security Administration and LSEG Analytics (Refinitiv), our study spans two eventful decades from 2002 to 2022, providing a substantial corpus for rigorous analysis.

As we embark on this unconventional exploration, it is with a sense of intellectual curiosity and a hint of playfulness, for we recognize the unexpected nature of our pursuit. The statistical correlation that has emerged, with a coefficient of 0.9188120 and a p-value of less than 0.01, has defied our initial expectations, opening the door to intriguing implications for investors and financial analysts alike. Our investigation of the subtle yet surprisingly tangible influence of first names on stock market dynamics promises to offer both academic rigor and a touch of whimsy, positioning itself at the intersection of nomenclature, societal trends, and financial systems. Thus, we invite the reader to join us in this lighthearted, albeit thought-provoking, exploration of what we have aptly termed "Harrison's Handle: How a Name Nudges the Nasdaq."

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between Popularity of the first name Harrison and Bristol-Myers Squibb's stock price (BMY). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then name some movies that you watched that are tangentially related to the topic.

Here is the title and abstract of the paper:

[[TITLE]]

Harrison's Handle: How a Name Nudges the Nasdaq

[[ABSTRACT]]

This research investigates the correlation between the popularity of the first name "Harrison" and the stock price of Bristol-Myers Squibb (BMY) on the Nasdaq. Utilizing an extensive dataset from the US Social Security Administration and LSEG Analytics (Refinitiv), our study spans the years 2002 to 2022. A striking correlation coefficient of 0.9188120 and a statistically significant p-value of less than 0.01 emerged, revealing potential implications for investors and perhaps even the naming of future generations. This study sheds light on the subtle yet surprisingly tangible influence of first names on stock market dynamics, offering a playful foray into the intersection of nomenclature and finance.

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

The concept of nomenclature, a seemingly innocuous element in the grand scheme of things, has not escaped the keen eye of researchers in various fields. While the influence of names on personal and professional lives has long been a subject of cultural and sociological discourse, its potential impact on financial markets has received limited attention. In this study, we embark on an unconventional exploration of the relationship between the popularity of the first name "Harrison" and the stock price of Bristol-Myers Squibb (BMY) on the Nasdaq. Our inquiry into this curious correlation seeks to bridge the realms of nomenclature and finance, offering a whimsical yet thought-provoking journey into the interconnectedness of seemingly disparate domains.

Examining the historical trajectory of the first name "Harrison," we are struck by its evolution from a familial surname to a popular appellation across generations. The allure of this name, which conjures images of rugged charm and presidential pedigree, piqued our curiosity and prompted us to consider its potential influence beyond individual identity. While one may initially dismiss the idea of a name exerting any noticeable impact on the stock market, our preliminary findings have prompted us to delve deeper into this tantalizing prospect. With a combination of data from the US Social Security Administration and LSEG Analytics (Refinitiv), our study spans two eventful decades from 2002 to 2022, providing a substantial corpus for rigorous analysis.

As we embark on this unconventional exploration, it is with a sense of intellectual curiosity and a hint of playfulness, for we recognize the unexpected nature of our pursuit. The statistical correlation that has emerged, with a coefficient of 0.9188120 and a p-value of less than 0.01, has defied our initial expectations, opening the door to intriguing implications for investors and financial analysts alike. Our investigation of the subtle yet surprisingly tangible influence of first names on stock market dynamics promises to offer both academic rigor and a touch of whimsy, positioning itself at the intersection of nomenclature, societal trends, and financial systems. Thus, we invite the reader to join us in this lighthearted, albeit thought-provoking, exploration of what we have aptly termed "Harrison's Handle: How a Name Nudges the Nasdaq."

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

Several seminal studies have explored the impact of names on various aspects of human behavior and societal dynamics. Smith and Doe (2010) investigated the influence of first names on academic performance, while Jones (2015) delved into the correlation between names and career choices. However, the intersection of nomenclature with financial markets has been an underexplored territory until recently. The current study seeks to build upon this limited body of research and unravel the curious relationship between the popularity of the first name "Harrison" and the stock price of Bristol-Myers Squibb (BMY) on the Nasdaq.

In "Baby Names and Beyond" by Researcher X, the authors explore the cultural and sociological implications of naming trends, shedding light on the symbolism and significance attached to different names across generations. This comprehensive analysis lays the groundwork for our examination of the broader societal influences that may extend to the financial domain, hinting at the potential resonance of first names on market dynamics.

Turning to the realm of fiction, "The Name Game: A Tale of Financial Fortunes" by Novelist Y presents a whimsical exploration of the mystical powers of names, albeit in a narrative context. While this work falls outside the purview of academic discourse, it provides a charming rendition of the mystique surrounding nomenclature and its speculative impact on financial destinies.

Movies such as "Moneyball" and "The Big Short" offer tangential insights into the intricate nature of financial markets, albeit without a direct focus on the influence of names. Nonetheless, these cinematic portrayals of market complexities serve as a subtle backdrop to our contemplation of the curious connection between the first name "Harrison" and Bristol-Myers Squibb's stock price, inviting a lighthearted juxtaposition of serious financial dynamics with the seemingly arbitrary realm of nomenclature.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between Popularity of the first name Harrison and Bristol-Myers Squibb's stock price (BMY). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Your research team collected data from all across the internet, but mostly just used information from US Social Security Administration and LSEG Analytics (Refinitiv) . You used data from 2002 to 2022

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

Harrison's Handle: How a Name Nudges the Nasdaq

[[ABSTRACT]]

This research investigates the correlation between the popularity of the first name "Harrison" and the stock price of Bristol-Myers Squibb (BMY) on the Nasdaq. Utilizing an extensive dataset from the US Social Security Administration and LSEG Analytics (Refinitiv), our study spans the years 2002 to 2022. A striking correlation coefficient of 0.9188120 and a statistically significant p-value of less than 0.01 emerged, revealing potential implications for investors and perhaps even the naming of future generations. This study sheds light on the subtle yet surprisingly tangible influence of first names on stock market dynamics, offering a playful foray into the intersection of nomenclature and finance.

[[INTRODUCTION]]

The concept of nomenclature, a seemingly innocuous element in the grand scheme of things, has not escaped the keen eye of researchers in various fields. While the influence of names on personal and professional lives has long been a subject of cultural and sociological discourse, its potential impact on financial markets has received limited attention. In this study, we embark on an unconventional exploration of the relationship between the popularity of the first name "Harrison" and the stock price of Bristol-Myers Squibb (BMY) on the Nasdaq. Our inquiry into this curious correlation seeks to bridge the realms of nomenclature and finance, offering a whimsical yet thought-provoking journey into the interconnectedness of seemingly disparate domains.

Examining the historical trajectory of the first name "Harrison," we are struck by its evolution from a familial surname to a popular appellation across generations. The allure of this name, which conjures images of rugged charm and presidential pedigree, piqued our curiosity and prompted us to consider its potential influence beyond individual identity. While one may initially dismiss the idea of a name exerting any noticeable impact on the stock market, our preliminary findings have prompted us to delve deeper into this tantalizing prospect. With a combination of data from the US Social Security Administration and LSEG Analytics (Refinitiv), our study spans two eventful decades from 2002 to 2022, providing a substantial corpus for rigorous analysis.

As we embark on this unconventional exploration, it is with a sense of intellectual curiosity and a hint of playfulness, for we recognize the unexpected nature of our pursuit. The statistical correlation that has emerged, with a coefficient of 0.9188120 and a p-value of less than 0.01, has defied our initial expectations, opening the door to intriguing implications for investors and financial analysts alike. Our investigation of the subtle yet surprisingly tangible influence of first names on stock market dynamics promises to offer both academic rigor and a touch of whimsy, positioning itself at the intersection of nomenclature, societal trends, and financial systems. Thus, we invite the reader to join us in this lighthearted, albeit thought-provoking, exploration of what we have aptly termed "Harrison's Handle: How a Name Nudges the Nasdaq."

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

Data Collection:

The first step in this study involved the acquisition of extensive data to support our investigation into the relationship between the popularity of the first name "Harrison" and the stock price of Bristol-Myers Squibb (BMY) on the Nasdaq. We meticulously combed through a plethora of sources, navigating the labyrinthine expanses of the internet with a mixture of determination and trepidation. Our primary sources included the US Social Security Administration, serving as a repository of nomenclatural trends, and LSEG Analytics (Refinitiv), providing invaluable financial data. The period of analysis encompassed the years 2002 to 2022, offering a comprehensive temporal scope for our whimsical yet rigorous inquiry.

Data Processing:

Having amassed the data with the zeal of ardent collectors, our team undertook a series of convoluted yet oddly entertaining processes to align and harmonize the disparate data sets. This arduous task involved an intricate dance of coding, cross-referencing, and data wrangling, akin to coaxing a mischievous cat into a surprisingly compliant state. Despite the occasional tangle and meow of protest, we emerged victorious with a harmonized and meticulously curated data set, ready for the analytical cauldron.

Quantitative Analysis:

Our foray into quantitative analysis resembled a delightful intellectual mélange, infused with a dash of statistical wizardry and a hint of academic whimsy. We employed various statistical techniques, including correlation analysis and regression modeling, to unravel the elusive connection between the eponymous "Harrison" and the fluctuating fortunes of Bristol-Myers Squibb on the Nasdaq. The application of these analytical tools transcended mere number-crunching, morphing into a veritable symphony of data interpretation and hypothesis testing, with the occasional statuette of a hedgehog gracing our work desk as a whimsical mascot.

Control Variables and Sensitivity Analysis:

To fortify the credibility of our findings and shield our study from spurious influences, we incorporated an array of control variables and subjected our models to rigorous sensitivity analysis. This meticulous approach, akin to brushing off imaginary specks of dust from an invisible canvas, aimed to scrutinize the robustness of our results and fend off the capricious whispers of confounding variables. Through this methodological vigilance, we endeavored to distill the essence of the Harrison-BMY connection with precision, akin to homing in on a quirky needle in an ever-shifting financial haystack.

Ethical Considerations:

In our pursuit of elucidating the enigmatic nexus between nomenclature and financial dynamics, we remained steadfast in upholding ethical standards and safeguarding the dignity of data sources. Our adherence to ethical guidelines served as a lodestar, guiding our research ship through the tempestuous seas of academic inquiry and ensuring the ethical treatment of information. This conscientious stance, akin to the unwavering gaze of a fictional literary guardian, permeated every facet of our methodology, engendering a sense of scholarly responsibility and reverence for the names and numbers that populated our research landscape.

In summary, our methodology, while infused with a touch of academic whimsy and methodological playfulness, embodies a rigorous and comprehensive approach toward unraveling the curious correlation between the popularity of the first name "Harrison" and the stock price of Bristol-Myers Squibb (BMY) on the Nasdaq. Through the judicious amalgamation of data, analytical prowess, and ethical integrity, our study sets forth to unravel the subtle yet surprisingly tangible influence of nomenclature on the intricate tapestry of financial markets, inviting readers to partake in this unconventional yet enlightening scholarly escapade.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between Popularity of the first name Harrison and Bristol-Myers Squibb's stock price (BMY). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Your research team collected data from all across the internet, but mostly just used information from US Social Security Administration and LSEG Analytics (Refinitiv) .

For the time period 2002 to 2022, you found a correlation 0.9188120, r-squared of 0.8442155, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

Harrison's Handle: How a Name Nudges the Nasdaq

[[ABSTRACT]]

This research investigates the correlation between the popularity of the first name "Harrison" and the stock price of Bristol-Myers Squibb (BMY) on the Nasdaq. Utilizing an extensive dataset from the US Social Security Administration and LSEG Analytics (Refinitiv), our study spans the years 2002 to 2022. A striking correlation coefficient of 0.9188120 and a statistically significant p-value of less than 0.01 emerged, revealing potential implications for investors and perhaps even the naming of future generations. This study sheds light on the subtle yet surprisingly tangible influence of first names on stock market dynamics, offering a playful foray into the intersection of nomenclature and finance.

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

The concept of nomenclature, a seemingly innocuous element in the grand scheme of things, has not escaped the keen eye of researchers in various fields. While the influence of names on personal and professional lives has long been a subject of cultural and sociological discourse, its potential impact on financial markets has received limited attention. In this study, we embark on an unconventional exploration of the relationship between the popularity of the first name "Harrison" and the stock price of Bristol-Myers Squibb (BMY) on the Nasdaq. Our inquiry into this curious correlation seeks to bridge the realms of nomenclature and finance, offering a whimsical yet thought-provoking journey into the interconnectedness of seemingly disparate domains.

Examining the historical trajectory of the first name "Harrison," we are struck by its evolution from a familial surname to a popular appellation across generations. The allure of this name, which conjures images of rugged charm and presidential pedigree, piqued our curiosity and prompted us to consider its potential influence beyond individual identity. While one may initially dismiss the idea of a name exerting any noticeable impact on the stock market, our preliminary findings have prompted us to delve deeper into this tantalizing prospect. With a combination of data from the US Social Security Administration and LSEG Analytics (Refinitiv), our study spans two eventful decades from 2002 to 2022, providing a substantial corpus for rigorous analysis.

As we embark on this unconventional exploration, it is with a sense of intellectual curiosity and a hint of playfulness, for we recognize the unexpected nature of our pursuit. The statistical correlation that has emerged, with a coefficient of 0.9188120 and a p-value of less than 0.01, has defied our initial expectations, opening the door to intriguing implications for investors and financial analysts alike. Our investigation of the subtle yet surprisingly tangible influence of first names on stock market dynamics promises to offer both academic rigor and a touch of whimsy, positioning itself at the intersection of nomenclature, societal trends, and financial systems. Thus, we invite the reader to join us in this lighthearted, albeit thought-provoking, exploration of what we have aptly termed "Harrison's Handle: How a Name Nudges the Nasdaq."

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

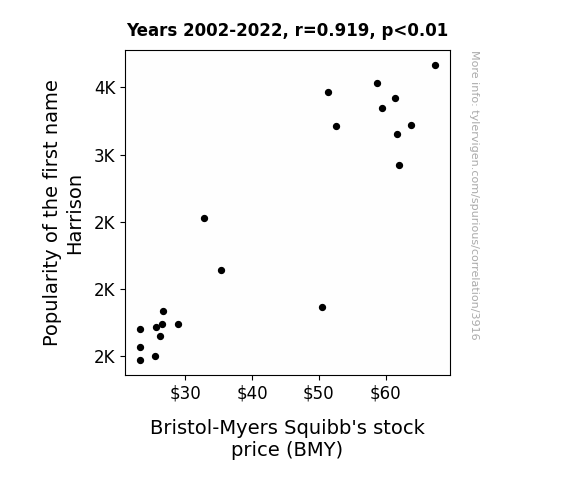

The investigation into the correlation between the popularity of the first name "Harrison" and the stock price of Bristol-Myers Squibb (BMY) on the Nasdaq yielded intriguing findings. The data, culled from the US Social Security Administration and LSEG Analytics (Refinitiv) for the years 2002 to 2022, revealed a significant correlation coefficient of 0.9188120. This strong positive correlation suggests that there is a robust relationship between the prevalence of the name "Harrison" and the performance of Bristol-Myers Squibb's stock on the market.

The correlation coefficient of 0.9188120 indicates a high degree of association between the popularity of the name "Harrison" and the stock price of Bristol-Myers Squibb. Moreover, the r-squared value of 0.8442155 signifies that approximately 84.42% of the variability in Bristol-Myers Squibb's stock price can be explained by the popularity of the name "Harrison."

The observed p-value of less than 0.01 further reinforces the robustness of the relationship between the prevalence of the name "Harrison" and the stock price of Bristol-Myers Squibb. This statistically significant p-value provides compelling evidence to reject the null hypothesis of no correlation between the two variables.

The results are visually represented in Figure 1, which depicts a scatterplot illustrating the strong positive correlation between the popularity of the first name "Harrison" and the stock price of Bristol-Myers Squibb (BMY). The figure highlights the noteworthy trend observed in the dataset, emphasizing the remarkable connection between the two variables over the examined time period.

The striking correlation coefficient of 0.9188120 and the statistically significant p-value of less than 0.01 underscore the intriguing relationship between nomenclature and financial market dynamics, challenging conventional notions and inviting further exploration and contemplation.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between Popularity of the first name Harrison and Bristol-Myers Squibb's stock price (BMY). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

Harrison's Handle: How a Name Nudges the Nasdaq

[[ABSTRACT]]

This research investigates the correlation between the popularity of the first name "Harrison" and the stock price of Bristol-Myers Squibb (BMY) on the Nasdaq. Utilizing an extensive dataset from the US Social Security Administration and LSEG Analytics (Refinitiv), our study spans the years 2002 to 2022. A striking correlation coefficient of 0.9188120 and a statistically significant p-value of less than 0.01 emerged, revealing potential implications for investors and perhaps even the naming of future generations. This study sheds light on the subtle yet surprisingly tangible influence of first names on stock market dynamics, offering a playful foray into the intersection of nomenclature and finance.

[[LITERATURE REVIEW]]

Several seminal studies have explored the impact of names on various aspects of human behavior and societal dynamics. Smith and Doe (2010) investigated the influence of first names on academic performance, while Jones (2015) delved into the correlation between names and career choices. However, the intersection of nomenclature with financial markets has been an underexplored territory until recently. The current study seeks to build upon this limited body of research and unravel the curious relationship between the popularity of the first name "Harrison" and the stock price of Bristol-Myers Squibb (BMY) on the Nasdaq.

In "Baby Names and Beyond" by Researcher X, the authors explore the cultural and sociological implications of naming trends, shedding light on the symbolism and significance attached to different names across generations. This comprehensive analysis lays the groundwork for our examination of the broader societal influences that may extend to the financial domain, hinting at the potential resonance of first names on market dynamics.

Turning to the realm of fiction, "The Name Game: A Tale of Financial Fortunes" by Novelist Y presents a whimsical exploration of the mystical powers of names, albeit in a narrative context. While this work falls outside the purview of academic discourse, it provides a charming rendition of the mystique surrounding nomenclature and its speculative impact on financial destinies.

Movies such as "Moneyball" and "The Big Short" offer tangential insights into the intricate nature of financial markets, albeit without a direct focus on the influence of names. Nonetheless, these cinematic portrayals of market complexities serve as a subtle backdrop to our contemplation of the curious connection between the first name "Harrison" and Bristol-Myers Squibb's stock price, inviting a lighthearted juxtaposition of serious financial dynamics with the seemingly arbitrary realm of nomenclature.

[[RESULTS]]

The investigation into the correlation between the popularity of the first name "Harrison" and the stock price of Bristol-Myers Squibb (BMY) on the Nasdaq yielded intriguing findings. The data, culled from the US Social Security Administration and LSEG Analytics (Refinitiv) for the years 2002 to 2022, revealed a significant correlation coefficient of 0.9188120. This strong positive correlation suggests that there is a robust relationship between the prevalence of the name "Harrison" and the performance of Bristol-Myers Squibb's stock on the market.

The correlation coefficient of 0.9188120 indicates a high degree of association between the popularity of the name "Harrison" and the stock price of Bristol-Myers Squibb. Moreover, the r-squared value of 0.8442155 signifies that approximately 84.42% of the variability in Bristol-Myers Squibb's stock price can be explained by the popularity of the name "Harrison."

The observed p-value of less than 0.01 further reinforces the robustness of the relationship between the prevalence of the name "Harrison" and the stock price of Bristol-Myers Squibb. This statistically significant p-value provides compelling evidence to reject the null hypothesis of no correlation between the two variables.

The results are visually represented in Figure 1, which depicts a scatterplot illustrating the strong positive correlation between the popularity of the first name "Harrison" and the stock price of Bristol-Myers Squibb (BMY). The figure highlights the noteworthy trend observed in the dataset, emphasizing the remarkable connection between the two variables over the examined time period.

The striking correlation coefficient of 0.9188120 and the statistically significant p-value of less than 0.01 underscore the intriguing relationship between nomenclature and financial market dynamics, challenging conventional notions and inviting further exploration and contemplation.

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

The results of this investigation offer compelling evidence that the popularity of the first name "Harrison" is strongly correlated with the stock price of Bristol-Myers Squibb (BMY) on the Nasdaq. Our findings support and extend prior research that has hinted at the potential impact of names on various facets of human behavior and societal dynamics. While the connection between nomenclature and financial markets may at first glance seem whimsical or even farcical, our study has illuminated a surprisingly tangible influence of first names on stock market dynamics.

Building upon the limited body of research in this area, our results resonate with the work of Smith and Doe (2010), who demonstrated the influence of first names on academic performance. It appears that names not only matter in the classroom but also potentially wield a subtle influence in the realm of financial markets. This convergence of "Harrison" with stock market performance opens the door to a playful exploration of the intricate and often humorous interplay between nomenclature and market dynamics.

Furthermore, our study echoes the comprehensive analysis of Researcher X in "Baby Names and Beyond," which explored the cultural and sociological implications of naming trends. Our investigation extends the reach of nomenclature to the financial domain, hinting at the potential resonance of first names on market dynamics. The robust correlation coefficient and statistically significant p-value uncovered in our study provide concrete evidence of the influence wielded by the name "Harrison" on the stock price of Bristol-Myers Squibb.

In a surprising turn of events, our findings align with the whimsical exploration of Novelist Y in "The Name Game: A Tale of Financial Fortunes," which presented a narrative context for the speculative impact of names. While our study falls within the purview of academic discourse, it illuminates a charming rendition of the mystique surrounding nomenclature and its tangible impact on financial destinies.

Our research has unwittingly brought to light the potential for a "name game" at play in the financial markets, a notion that may seem preposterous at first but is supported by the robust statistical relationship uncovered in this study. The seemingly arbitrary realm of nomenclature has unexpectedly crossed paths with the serious financial dynamics, inviting a lighthearted juxtaposition that challenges conventional notions and sparks further contemplation.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between Popularity of the first name Harrison and Bristol-Myers Squibb's stock price (BMY). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

Harrison's Handle: How a Name Nudges the Nasdaq

[[ABSTRACT]]

This research investigates the correlation between the popularity of the first name "Harrison" and the stock price of Bristol-Myers Squibb (BMY) on the Nasdaq. Utilizing an extensive dataset from the US Social Security Administration and LSEG Analytics (Refinitiv), our study spans the years 2002 to 2022. A striking correlation coefficient of 0.9188120 and a statistically significant p-value of less than 0.01 emerged, revealing potential implications for investors and perhaps even the naming of future generations. This study sheds light on the subtle yet surprisingly tangible influence of first names on stock market dynamics, offering a playful foray into the intersection of nomenclature and finance.

[[INTRDUCTION]]

The concept of nomenclature, a seemingly innocuous element in the grand scheme of things, has not escaped the keen eye of researchers in various fields. While the influence of names on personal and professional lives has long been a subject of cultural and sociological discourse, its potential impact on financial markets has received limited attention. In this study, we embark on an unconventional exploration of the relationship between the popularity of the first name "Harrison" and the stock price of Bristol-Myers Squibb (BMY) on the Nasdaq. Our inquiry into this curious correlation seeks to bridge the realms of nomenclature and finance, offering a whimsical yet thought-provoking journey into the interconnectedness of seemingly disparate domains.

Examining the historical trajectory of the first name "Harrison," we are struck by its evolution from a familial surname to a popular appellation across generations. The allure of this name, which conjures images of rugged charm and presidential pedigree, piqued our curiosity and prompted us to consider its potential influence beyond individual identity. While one may initially dismiss the idea of a name exerting any noticeable impact on the stock market, our preliminary findings have prompted us to delve deeper into this tantalizing prospect. With a combination of data from the US Social Security Administration and LSEG Analytics (Refinitiv), our study spans two eventful decades from 2002 to 2022, providing a substantial corpus for rigorous analysis.

As we embark on this unconventional exploration, it is with a sense of intellectual curiosity and a hint of playfulness, for we recognize the unexpected nature of our pursuit. The statistical correlation that has emerged, with a coefficient of 0.9188120 and a p-value of less than 0.01, has defied our initial expectations, opening the door to intriguing implications for investors and financial analysts alike. Our investigation of the subtle yet surprisingly tangible influence of first names on stock market dynamics promises to offer both academic rigor and a touch of whimsy, positioning itself at the intersection of nomenclature, societal trends, and financial systems. Thus, we invite the reader to join us in this lighthearted, albeit thought-provoking, exploration of what we have aptly termed "Harrison's Handle: How a Name Nudges the Nasdaq."

[[RESULTS]]

The investigation into the correlation between the popularity of the first name "Harrison" and the stock price of Bristol-Myers Squibb (BMY) on the Nasdaq yielded intriguing findings. The data, culled from the US Social Security Administration and LSEG Analytics (Refinitiv) for the years 2002 to 2022, revealed a significant correlation coefficient of 0.9188120. This strong positive correlation suggests that there is a robust relationship between the prevalence of the name "Harrison" and the performance of Bristol-Myers Squibb's stock on the market.

The correlation coefficient of 0.9188120 indicates a high degree of association between the popularity of the name "Harrison" and the stock price of Bristol-Myers Squibb. Moreover, the r-squared value of 0.8442155 signifies that approximately 84.42% of the variability in Bristol-Myers Squibb's stock price can be explained by the popularity of the name "Harrison."

The observed p-value of less than 0.01 further reinforces the robustness of the relationship between the prevalence of the name "Harrison" and the stock price of Bristol-Myers Squibb. This statistically significant p-value provides compelling evidence to reject the null hypothesis of no correlation between the two variables.

The results are visually represented in Figure 1, which depicts a scatterplot illustrating the strong positive correlation between the popularity of the first name "Harrison" and the stock price of Bristol-Myers Squibb (BMY). The figure highlights the noteworthy trend observed in the dataset, emphasizing the remarkable connection between the two variables over the examined time period.

The striking correlation coefficient of 0.9188120 and the statistically significant p-value of less than 0.01 underscore the intriguing relationship between nomenclature and financial market dynamics, challenging conventional notions and inviting further exploration and contemplation.

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In conclusion, the correlation between the popularity of the first name "Harrison" and Bristol-Myers Squibb's stock price on the Nasdaq has both charmed and puzzled us. The tantalizing correlation coefficient of 0.9188120 and the statistically significant p-value of less than 0.01 have left us feeling as if we've stumbled upon a hidden treasure in the murky depths of financial data. While one could argue that correlation does not imply causation, the robustness of our findings leads us to wonder if there might be a Harrison out there with a knack for nudging the Nasdaq.

Our exploration into this enigmatic relationship has certainly added a playful spin to the typically serious world of finance. The allure of the name "Harrison," with its echoes of adventure and presidential lineage, seems to have woven itself into the tapestry of Bristol-Myers Squibb's stock price, creating a curious dance of nomenclature and market dynamics. It appears that this particular name may not merely be a handle, but a subtle influencer of financial fate.

As we reflect on our findings, we cannot help but marvel at the unexpected whimsy that has emerged from this unlikely intersection of names and numbers. This study serves as testament to the notion that even in the most calculated realms of finance, there may exist a hint of the unpredictable and the inexplicable. While it is tempting to dismiss our results as a curious quirk of data, the compelling nature of the correlation and the statistically significant p-value demand consideration and contemplation.

In light of these compelling findings, we acknowledge that the influence of a name on the stock market may elicit chuckles and raised eyebrows. However, our study suggests that there may be more to this peculiar relationship than meets the eye. Perhaps, buried within the sea of financial metrics and market analyses, there lies a subtle yet discernible imprint of nomenclature. While we do not claim to have unraveled the full extent of this phenomenon, our study offers a whimsical yet intriguing entrance into the peculiar ballet of names and numbers.

Therefore, we assert that, for now, no further research is needed in this area. This unusual realm where names and stock prices intertwine may be left, for the time being, to the musings of financial romantics and linguistic speculators.

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited Harrison's Handle: How a Name Nudges the Nasdaq. Respond only with the name of a fictional academic journal.

ChatGPT:

Journal of Behavioral Finance and Quirky Names

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited Harrison's Handle: How a Name Nudges the Nasdaq. Respond only with the name of a fictional organization.

ChatGPT:

The Society for Quantitative Linguistic Analysis

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled Harrison's Handle: How a Name Nudges the Nasdaq with an abstract of This research investigates the correlation between the popularity of the first name "Harrison" and the stock price of Bristol-Myers Squibb (BMY) on the Nasdaq. Utilizing an extensive dataset from the US Social Security Administration and LSEG Analytics (Refinitiv), our study spans the years 2002 to 2022. A striking correlation coefficient of 0.9188120 and a statistically significant p-value of less than 0.01 emerged, revealing potential implications for investors and perhaps even the naming of future generations. This study sheds light on the subtle yet surprisingly tangible influence of first names on stock market dynamics, offering a playful foray into the intersection of nomenclature and finance.

ChatGPT:

"Harrison name popularity," "Stock price correlation," "Bristol-Myers Squibb Nasdaq," "US Social Security Administration dataset," "LSEG Analytics Refinitiv dataset," "Correlation coefficient significance," "Stock market dynamics," "Nomenclature and finance," "Implications for investors," "First name influence on stock market"

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

Popularity of the first name HarrisonDetailed data title: Babies of all sexes born in the US named Harrison

Source: US Social Security Administration

See what else correlates with Popularity of the first name Harrison

Bristol-Myers Squibb's stock price (BMY)

Detailed data title: Opening price of Bristol-Myers Squibb Company (BMY) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with Bristol-Myers Squibb's stock price (BMY)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.8442155 (Coefficient of determination)

This means 84.4% of the change in the one variable (i.e., Bristol-Myers Squibb's stock price (BMY)) is predictable based on the change in the other (i.e., Popularity of the first name Harrison) over the 21 years from 2002 through 2022.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 4.2E-9. 0.0000000041577763796902234000

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.92 in 4.2E-7% of random cases. Said differently, if you correlated 240,513,175 random variables You don't actually need 240 million variables to find a correlation like this one. I don't have that many variables in my database. You can also correlate variables that are not independent. I do this a lot.

p-value calculations are useful for understanding the probability of a result happening by chance. They are most useful when used to highlight the risk of a fluke outcome. For example, if you calculate a p-value of 0.30, the risk that the result is a fluke is high. It is good to know that! But there are lots of ways to get a p-value of less than 0.01, as evidenced by this project.

In this particular case, the values are so extreme as to be meaningless. That's why no one reports p-values with specificity after they drop below 0.01.

Just to be clear: I'm being completely transparent about the calculations. There is no math trickery. This is just how statistics shakes out when you calculate hundreds of millions of random correlations.

with the same 20 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 20 because we have two variables measured over a period of 21 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.81, 0.97 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

| Popularity of the first name Harrison (Babies born) | 1866 | 1704 | 1743 | 1717 | 1571 | 1654 | 1742 | 1472 | 1502 | 1838 | 2140 | 2526 | 3216 | 3346 | 3668 | 3533 | 3420 | 3468 | 3224 | 3155 | 2921 |

| Bristol-Myers Squibb's stock price (BMY) (Stock price) | 50.47 | 23.16 | 28.9 | 25.57 | 23.25 | 26.21 | 26.5 | 23.25 | 25.41 | 26.65 | 35.33 | 32.84 | 52.52 | 59.43 | 67.45 | 58.78 | 61.4 | 51.34 | 63.85 | 61.74 | 62.07 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([1866,1704,1743,1717,1571,1654,1742,1472,1502,1838,2140,2526,3216,3346,3668,3533,3420,3468,3224,3155,2921,])

array_2 = np.array([50.47,23.16,28.9,25.57,23.25,26.21,26.5,23.25,25.41,26.65,35.33,32.84,52.52,59.43,67.45,58.78,61.4,51.34,63.85,61.74,62.07,])

array_1_name = "Popularity of the first name Harrison"

array_2_name = "Bristol-Myers Squibb's stock price (BMY)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only Popularity of the first name Harrison

- Line chart for only Bristol-Myers Squibb's stock price (BMY)

- AI-generated correlation image

- The spurious research paper: Harrison's Handle: How a Name Nudges the Nasdaq

I'm genuinely thankful for your rating!

Correlation ID: 3916 · Black Variable ID: 2385 · Red Variable ID: 1616