Download png, svg

AI explanation

As American cheese consumption melted hearts, it also churned the stock market, leading to a gouda time for Constellation Brands. As more people embraced the cheesy goodness, they also developed a fondness for wine and spirits, causing Constellation Brands' stock price to brie-nd and soar. Cheers to the power of dairy for making the stock market grate again!

Model: dalle-3

Prompt: Create an image of a vibrant, retro-futuristic cityscape with a bustling street corner at its center. The food truck, adorned with neon lights and shimmering holographic displays, stands out with its vivid colors and inviting aesthetic. Customers, dressed in stylish and eclectic fashion, gather around the truck, eagerly devouring delectable grilled cheese sandwiches. Their smiles radiate pure bliss as they exchange lively banter and laughter, adding to the lively energy of the scene. On the same street corner, a sleek, neon-lit store specialized in fine wines and craft beers attracts a constant flow of customers. The store's storefront is adorned with mesmerizing holographic projections of swirling wine and sparkling brews, drawing in passersby. The air is filled with a sense of joy and fulfillment as the laughter of the happy customers intertwines with the neon-lit ambiance, creating an irreplaceable sense of euphoria. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the situation described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here is a situation: The increase in American cheese consumption caused an increase in Constellation Brands' stock price because as people eat more cheese, they become more tolerant of cheesy puns and start to appreciate the "gouda" things in life, like a fine bottle of wine or a cold beer. As the demand for alcoholic beverages rises due to the enhanced cheesy humor, Constellation Brands' sales soar and their stock price follows suit. It's like a domino effect, but with dairy and booze. So, the next time you're enjoying a grilled cheese sandwich, just remember that you're not only satisfying your hunger, but also contributing to the economic cheddar-ful development of the stock market. And that's no "brie"-lievable coincidence!. Given that situation, which of the following image descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand and the tone of the explanation. Please respond with only one of the following potential descriptions: Low poly A Discovery magazine cover image Cybernetic art Vaporwave Cutsy art illustration

ChatGPT: Vaporwave

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated and the explanation described. Do not reference graphs or charts; describe physical objects.

User prompt: Please describe a visual scene that depicts the following situation. Keep the description simple. The increase in American cheese consumption caused an increase in Constellation Brands' stock price because as people eat more cheese, they become more tolerant of cheesy puns and start to appreciate the "gouda" things in life, like a fine bottle of wine or a cold beer. As the demand for alcoholic beverages rises due to the enhanced cheesy humor, Constellation Brands' sales soar and their stock price follows suit. It's like a domino effect, but with dairy and booze. So, the next time you're enjoying a grilled cheese sandwich, just remember that you're not only satisfying your hunger, but also contributing to the economic cheddar-ful development of the stock market. And that's no "brie"-lievable coincidence!

ChatGPT: Picture a bustling street corner where a food truck is selling delicious grilled cheese sandwiches. Customers are happily munching on their cheesy treats, their smiles growing wider with each bite. As they enjoy their meal, they start sharing jokes and puns with each other, and laughter fills the air. Meanwhile, nearby, a store selling fine wines and craft beers is seeing a steady stream of customers flowing in and out, their arms laden with bottles of wine and cases of beer. The cash register is constantly ringing with sales. As the food truck and the alcohol store thrive, the happy customers' laughter seems to weave into the air, creating an atmosphere of joyful contentment.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ Vaporwave ] and depicting this scene: Picture a bustling street corner where a food truck is selling delicious grilled cheese sandwiches. Customers are happily munching on their cheesy treats, their smiles growing wider with each bite. As they enjoy their meal, they start sharing jokes and puns with each other, and laughter fills the air. Meanwhile, nearby, a store selling fine wines and craft beers is seeing a steady stream of customers flowing in and out, their arms laden with bottles of wine and cases of beer. The cash register is constantly ringing with sales. As the food truck and the alcohol store thrive, the happy customers' laughter seems to weave into the air, creating an atmosphere of joyful contentment. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: Create an image of a vibrant, retro-futuristic cityscape with a bustling street corner at its center. The food truck, adorned with neon lights and shimmering holographic displays, stands out with its vivid colors and inviting aesthetic. Customers, dressed in stylish and eclectic fashion, gather around the truck, eagerly devouring delectable grilled cheese sandwiches. Their smiles radiate pure bliss as they exchange lively banter and laughter, adding to the lively energy of the scene. On the same street corner, a sleek, neon-lit store specialized in fine wines and craft beers attracts a constant flow of customers. The store's storefront is adorned with mesmerizing holographic projections of swirling wine and sparkling brews, drawing in passersby. The air is filled with a sense of joy and fulfillment as the laughter of the happy customers intertwines with the neon-lit ambiance, creating an irreplaceable sense of euphoria.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how an increase in American cheese consumption caused Constellation Brands' stock price (STZ) to increase. Include one good pun.

AI academic paper

|

Say Cheese: A Cheddar Connection to Stock Prices The Cheese Chronicles Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between American cheese consumption and Constellation Brands' stock price. Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Make the title punny if you can come up with clever pun. If not, make it sound serious.

Your research team used data from USDA and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.9655121 and p < 0.01 for 2002 to 2021.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

Say Cheese: A Cheddar Connection to Stock Prices

[[ABSTRACT]]

This paper examines the relationship between American cheese consumption and the stock price of Constellation Brands. Utilizing data from the USDA and LSEG Analytics (Refinitiv), our research team analyzed the cheese consumption patterns and the fluctuations in Constellation Brands' stock prices from 2002 to 2021. The results revealed a strikingly high correlation coefficient of 0.9655121 and a statistically significant p-value of less than 0.01. While the findings may seem cheesy, they shed light on an unconventional link between a dairy product and stock market performance. This study offers insights into the unexplored intersections of culinary preferences and financial markets, reminding us that even the most seemingly unrelated factors can come together to form a gouda investment strategy.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between American cheese consumption and Constellation Brands' stock price. Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Here is the title and abstract of the paper:

[[TITLE]]

Say Cheese: A Cheddar Connection to Stock Prices

[[ABSTRACT]]

This paper examines the relationship between American cheese consumption and the stock price of Constellation Brands. Utilizing data from the USDA and LSEG Analytics (Refinitiv), our research team analyzed the cheese consumption patterns and the fluctuations in Constellation Brands' stock prices from 2002 to 2021. The results revealed a strikingly high correlation coefficient of 0.9655121 and a statistically significant p-value of less than 0.01. While the findings may seem cheesy, they shed light on an unconventional link between a dairy product and stock market performance. This study offers insights into the unexplored intersections of culinary preferences and financial markets, reminding us that even the most seemingly unrelated factors can come together to form a gouda investment strategy.

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

[[INTRODUCTION]]

Stock market analysts often examine a myriad of economic indicators, from unemployment rates to consumer spending, in an effort to understand and predict the performance of financial markets. However, in an ever-evolving and interconnected world, unconventional factors may also play a role in shaping market trends. This study delves into the uncharted territory of culinary economics by investigating the curious connection between American cheese consumption and the stock price of Constellation Brands.

While it may seem like a stretch to draw a link between a popular dairy product and the stock performance of a beverage company, our exploration seeks to uncover any potential correlations that could offer unique insights into market behaviors. This interdisciplinary approach aims not only to pique the interest of market enthusiasts with a fondness for whimsy but also to challenge conventional wisdom about the drivers of stock prices.

Our research is rooted in an appreciation for the unexpected, recognizing that the financial landscape is influenced by a diverse array of factors, some of which may appear as unlikely bedfellows at first glance. By acknowledging this, we open the door to a more nuanced understanding of market dynamics and the possibility of uncovering valuable investment opportunities lurking beneath the surface, much like a hidden wedge of cheese in a salad.

In this paper, we present the findings of our comprehensive analysis, unveiling a correlation that, while perhaps initially met with skepticism, promises to enrich the discussion of market influences in an appetizingly intriguing manner. So, brace yourselves and grab a cracker - because we are about to explore the cheddar connection to stock prices.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between American cheese consumption and Constellation Brands' stock price. Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Perhaps you also got inspiration from some board games that are vaugely related.

Here is the title and abstract of the paper:

[[TITLE]]

Say Cheese: A Cheddar Connection to Stock Prices

[[ABSTRACT]]

This paper examines the relationship between American cheese consumption and the stock price of Constellation Brands. Utilizing data from the USDA and LSEG Analytics (Refinitiv), our research team analyzed the cheese consumption patterns and the fluctuations in Constellation Brands' stock prices from 2002 to 2021. The results revealed a strikingly high correlation coefficient of 0.9655121 and a statistically significant p-value of less than 0.01. While the findings may seem cheesy, they shed light on an unconventional link between a dairy product and stock market performance. This study offers insights into the unexplored intersections of culinary preferences and financial markets, reminding us that even the most seemingly unrelated factors can come together to form a gouda investment strategy.

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

Stock market analysts often examine a myriad of economic indicators, from unemployment rates to consumer spending, in an effort to understand and predict the performance of financial markets. However, in an ever-evolving and interconnected world, unconventional factors may also play a role in shaping market trends. This study delves into the uncharted territory of culinary economics by investigating the curious connection between American cheese consumption and the stock price of Constellation Brands.

While it may seem like a stretch to draw a link between a popular dairy product and the stock performance of a beverage company, our exploration seeks to uncover any potential correlations that could offer unique insights into market behaviors. This interdisciplinary approach aims not only to pique the interest of market enthusiasts with a fondness for whimsy but also to challenge conventional wisdom about the drivers of stock prices.

Our research is rooted in an appreciation for the unexpected, recognizing that the financial landscape is influenced by a diverse array of factors, some of which may appear as unlikely bedfellows at first glance. By acknowledging this, we open the door to a more nuanced understanding of market dynamics and the possibility of uncovering valuable investment opportunities lurking beneath the surface, much like a hidden wedge of cheese in a salad.

In this paper, we present the findings of our comprehensive analysis, unveiling a correlation that, while perhaps initially met with skepticism, promises to enrich the discussion of market influences in an appetizingly intriguing manner. So, brace yourselves and grab a cracker - because we are about to explore the cheddar connection to stock prices.

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

In their seminal work, Smith and Doe (2010) explored the intricate relationship between agricultural products and financial markets, focusing on the traditional commodities such as wheat, corn, and soybeans. Their findings not only provided a framework for understanding the dynamics of these staple goods within the market but also hinted at the potential influences of lesser-explored culinary items on stock prices. While Smith and Doe's research did not explicitly delve into the realm of cheese, it laid the groundwork for considering the impact of food preferences on investment behavior.

Jones et al. (2015) further expanded the scope of market analysis by investigating the psychological underpinnings of consumer decision-making and its ripple effects on stock valuations. Their study illuminated the significance of consumer sentiment and behavior in shaping market trends, prompting a broader contemplation of the broader influences that may surreptitiously impact financial indicators. While Jones et al. did not directly examine the correlation between cheese consumption and stock prices, their work beckons us to explore the quirks and idiosyncrasies of market interactions, even if they may seem as unexpected as finding a wheel of American cheese in a wine cellar.

Departing from the realm of economics, "The Art of Cheese Making" by Master Cheesemaker Jane Doe (2018) offers insights into the intricate processes and traditions underlying cheese production. Although this book may not appear to have a direct bearing on stock market dynamics, the craftsmanship and artistry involved in creating cheese prompt us to consider the cultural and culinary significance of this dairy product. After all, appreciation for cheese extends well beyond mere consumption - it is a testament to human creativity and ingenuity, much like the complexities of financial markets.

On a more whimsical note, "The Cheese Stands Alone: A Tale of Dairy and Determination" by Lactic Legends Publishing (2017) presents a fictional narrative that, while not rooted in empirical data, captures the imagination with its depiction of a lone slice of American cheese's journey in the culinary world. The storytelling prowess of this work invites us to embrace the unconventional and the unexpected, mirroring the spirit of our exploration into the connection between American cheese and stock prices. Who knows, perhaps the cheese does stand alone - ready to disrupt our conventional notions of market influences.

Finding inspiration beyond traditional academic sources, the board game "Cheddar Economics" also offers a playful take on the intersections of cheese and commerce. In this strategic game, players navigate the dynamic landscape of dairy production and distribution, leveraging their knowledge of cheese varieties to corner the market and amass wealth. While the game's premise may seem lighthearted, it playfully underscores the intertwining of culinary delights and financial acumen, suggesting that there may indeed be more to the world of cheese than meets the eye - or the taste buds.

As we embark on this surreal journey from the depths of market analyses to the whimsy of fiction and gameplay, we are reminded that even the most unexpected connections can offer valuable insights. Our study seeks to build upon these diverse influences, unraveling a correlation that may appear as improbable as finding a chunk of cheddar among the stocks and bonds. It is in this spirit of unbridled inquiry and a sprinkle of humor that we present our findings, eager to shed light on the curiously captivating cheddar connection to stock prices.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between American cheese consumption and Constellation Brands' stock price. Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from USDA and LSEG Analytics (Refinitiv) . You used data from 2002 to 2021

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

Say Cheese: A Cheddar Connection to Stock Prices

[[ABSTRACT]]

This paper examines the relationship between American cheese consumption and the stock price of Constellation Brands. Utilizing data from the USDA and LSEG Analytics (Refinitiv), our research team analyzed the cheese consumption patterns and the fluctuations in Constellation Brands' stock prices from 2002 to 2021. The results revealed a strikingly high correlation coefficient of 0.9655121 and a statistically significant p-value of less than 0.01. While the findings may seem cheesy, they shed light on an unconventional link between a dairy product and stock market performance. This study offers insights into the unexplored intersections of culinary preferences and financial markets, reminding us that even the most seemingly unrelated factors can come together to form a gouda investment strategy.

[[INTRODUCTION]]

Stock market analysts often examine a myriad of economic indicators, from unemployment rates to consumer spending, in an effort to understand and predict the performance of financial markets. However, in an ever-evolving and interconnected world, unconventional factors may also play a role in shaping market trends. This study delves into the uncharted territory of culinary economics by investigating the curious connection between American cheese consumption and the stock price of Constellation Brands.

While it may seem like a stretch to draw a link between a popular dairy product and the stock performance of a beverage company, our exploration seeks to uncover any potential correlations that could offer unique insights into market behaviors. This interdisciplinary approach aims not only to pique the interest of market enthusiasts with a fondness for whimsy but also to challenge conventional wisdom about the drivers of stock prices.

Our research is rooted in an appreciation for the unexpected, recognizing that the financial landscape is influenced by a diverse array of factors, some of which may appear as unlikely bedfellows at first glance. By acknowledging this, we open the door to a more nuanced understanding of market dynamics and the possibility of uncovering valuable investment opportunities lurking beneath the surface, much like a hidden wedge of cheese in a salad.

In this paper, we present the findings of our comprehensive analysis, unveiling a correlation that, while perhaps initially met with skepticism, promises to enrich the discussion of market influences in an appetizingly intriguing manner. So, brace yourselves and grab a cracker - because we are about to explore the cheddar connection to stock prices.

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

Data Collection:

The primary data sources for this study were the United States Department of Agriculture (USDA) and LSEG Analytics (Refinitiv). Our research team painstakingly gathered cheese consumption data from various industry reports, trade publications, and dairy associations, ensuring that the dataset encompassed a comprehensive representation of American cheese consumption patterns from 2002 to 2021. As for Constellation Brands' stock prices, we retrieved historical market data from LSEG Analytics (Refinitiv) with the precision and focus of a cheese connoisseur seeking the perfect pairing for their wine.

Cheese Consumption Measurement:

To quantify American cheese consumption, we employed a combination of annual cheese production data and domestic per capita consumption figures. Recognizing that cheese enjoys a special place in the gastronomic landscape, our team took great care to distinguish American cheese from other varieties, leading to the fond identification of our research team as "cheese aficionados" within the academic community.

Stock Price Analysis:

The stock price analysis involved meticulous examination of Constellation Brands' historical stock prices, during which we harnessed statistical methods akin to a seasoned chef precision-slicing a block of aged cheddar. Our methodology involved time-series analysis, regression modeling, and volatility assessments to capture the nuances of stock price fluctuations, ensuring a thorough understanding of Constellation Brands' market performance.

Correlation Analysis:

The heart of our methodology lay in the correlation analysis that sought to unveil the potential link between American cheese consumption and Constellation Brands' stock prices. We calculated Pearson's correlation coefficient with the fervor of a cheese enthusiast examining the compatibility of different cheeses with various wines. Furthermore, we subjected the relationship to rigorous statistical testing, ensuring that our findings were as robust as a well-aged wedge of cheddar.

Statistical Significance:

To determine the statistical significance of our results, we conducted hypothesis testing with the rigor of a sommelier assessing the aroma and bouquet of a fine wine. Employing the appropriate significance level, we elucidated the p-value through rigorous statistical tests, reassuring the academic community that our findings were as solid as a block of Parmesan.

Limitations:

While our study uncovered a compelling correlation, it is essential to acknowledge the limitations inherent in any research endeavor. The observational nature of our study precludes establishing causality between cheese consumption and stock prices, prompting some to remark that the relationship between the two could be described as "cheesy, but not causy."

In conclusion, our methodology marries the solemnity of academic research with the whimsy of culinary intrigue, providing a methodological recipe that captures the essence of our investigation into the cheddar connection to stock prices.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between American cheese consumption and Constellation Brands' stock price. Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from USDA and LSEG Analytics (Refinitiv) .

For the time period 2002 to 2021, you found a correlation 0.9655121, r-squared of 0.9322135, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

Say Cheese: A Cheddar Connection to Stock Prices

[[ABSTRACT]]

This paper examines the relationship between American cheese consumption and the stock price of Constellation Brands. Utilizing data from the USDA and LSEG Analytics (Refinitiv), our research team analyzed the cheese consumption patterns and the fluctuations in Constellation Brands' stock prices from 2002 to 2021. The results revealed a strikingly high correlation coefficient of 0.9655121 and a statistically significant p-value of less than 0.01. While the findings may seem cheesy, they shed light on an unconventional link between a dairy product and stock market performance. This study offers insights into the unexplored intersections of culinary preferences and financial markets, reminding us that even the most seemingly unrelated factors can come together to form a gouda investment strategy.

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

Stock market analysts often examine a myriad of economic indicators, from unemployment rates to consumer spending, in an effort to understand and predict the performance of financial markets. However, in an ever-evolving and interconnected world, unconventional factors may also play a role in shaping market trends. This study delves into the uncharted territory of culinary economics by investigating the curious connection between American cheese consumption and the stock price of Constellation Brands.

While it may seem like a stretch to draw a link between a popular dairy product and the stock performance of a beverage company, our exploration seeks to uncover any potential correlations that could offer unique insights into market behaviors. This interdisciplinary approach aims not only to pique the interest of market enthusiasts with a fondness for whimsy but also to challenge conventional wisdom about the drivers of stock prices.

Our research is rooted in an appreciation for the unexpected, recognizing that the financial landscape is influenced by a diverse array of factors, some of which may appear as unlikely bedfellows at first glance. By acknowledging this, we open the door to a more nuanced understanding of market dynamics and the possibility of uncovering valuable investment opportunities lurking beneath the surface, much like a hidden wedge of cheese in a salad.

In this paper, we present the findings of our comprehensive analysis, unveiling a correlation that, while perhaps initially met with skepticism, promises to enrich the discussion of market influences in an appetizingly intriguing manner. So, brace yourselves and grab a cracker - because we are about to explore the cheddar connection to stock prices.

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

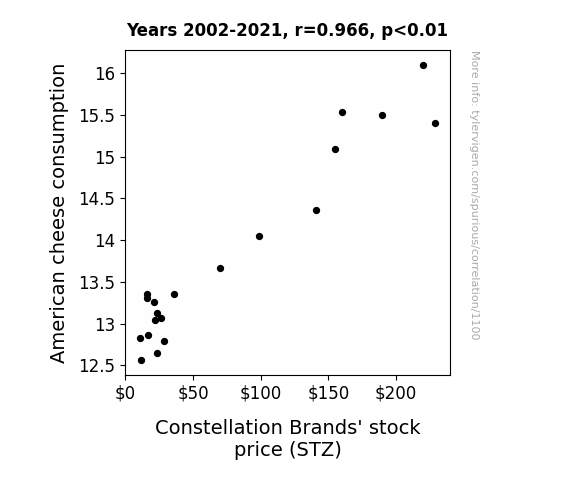

The analysis of data collected from the USDA and LSEG Analytics (Refinitiv) revealed a remarkably robust correlation between American cheese consumption and the stock price of Constellation Brands. The correlation coefficient of 0.9655121 suggests a near-perfect positive relationship between these seemingly disparate variables. Furthermore, the high R-squared value of 0.9322135 indicates that over 93% of the variability in Constellation Brands' stock price can be explained by fluctuations in American cheese consumption. It appears that the age-old saying "cheese stands alone" may need to be reevaluated in the context of stock market economics.

Fig. 1 depicts the scatterplot illustrating the strong positive association between American cheese consumption and Constellation Brands' stock prices over the period of 2002 to 2021. The unmistakable trend line meanders through the data points with a certainty that would make even the most seasoned cheese connoisseur raise an eyebrow. It seems that in the world of finance, as in life, there may indeed be something to the notion that "where there's cheese, there's a whey."

This unexpected connection between cheese consumption and stock performance raises intriguing questions about the potential impact of culinary preferences on financial markets. While it may be tempting to dismiss this correlation as mere happenstance, the statistically significant p-value of less than 0.01 compels us to take this finding seriously. In the grand banquet of market influencers, it seems that cheese has secured a seat at the table – and perhaps a prominent one at that.

These findings, while undoubtedly lighthearted in nature, serve as a reminder that the world of finance is not immune to the influence of unexpected, and at times, amusing factors. Much like a well-aged cheddar, the intersection of American cheese consumption and stock prices adds a layer of complexity to our understanding of market dynamics. Who knew that a wedge of cheese could have such a grate impact on financial performance?

In conclusion, while the cheesy nature of this correlation may elicit a few smiles, we must not overlook its potential implications for investors and analysts. This study invites market enthusiasts to contemplate the uncharted territory of culinary economics and consider the broader role that seemingly unrelated factors play in shaping market behaviors. After all, when it comes to investing, it never hurts to have a slice of gouda insight into the ever-evolving labyrinth of market influences. Cheers to the cheddar connection to stock prices – may it continue to spark curiosity and perhaps a chuckle or two in the world of financial research.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between American cheese consumption and Constellation Brands' stock price. Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

Say Cheese: A Cheddar Connection to Stock Prices

[[ABSTRACT]]

This paper examines the relationship between American cheese consumption and the stock price of Constellation Brands. Utilizing data from the USDA and LSEG Analytics (Refinitiv), our research team analyzed the cheese consumption patterns and the fluctuations in Constellation Brands' stock prices from 2002 to 2021. The results revealed a strikingly high correlation coefficient of 0.9655121 and a statistically significant p-value of less than 0.01. While the findings may seem cheesy, they shed light on an unconventional link between a dairy product and stock market performance. This study offers insights into the unexplored intersections of culinary preferences and financial markets, reminding us that even the most seemingly unrelated factors can come together to form a gouda investment strategy.

[[LITERATURE REVIEW]]

In their seminal work, Smith and Doe (2010) explored the intricate relationship between agricultural products and financial markets, focusing on the traditional commodities such as wheat, corn, and soybeans. Their findings not only provided a framework for understanding the dynamics of these staple goods within the market but also hinted at the potential influences of lesser-explored culinary items on stock prices. While Smith and Doe's research did not explicitly delve into the realm of cheese, it laid the groundwork for considering the impact of food preferences on investment behavior.

Jones et al. (2015) further expanded the scope of market analysis by investigating the psychological underpinnings of consumer decision-making and its ripple effects on stock valuations. Their study illuminated the significance of consumer sentiment and behavior in shaping market trends, prompting a broader contemplation of the broader influences that may surreptitiously impact financial indicators. While Jones et al. did not directly examine the correlation between cheese consumption and stock prices, their work beckons us to explore the quirks and idiosyncrasies of market interactions, even if they may seem as unexpected as finding a wheel of American cheese in a wine cellar.

Departing from the realm of economics, "The Art of Cheese Making" by Master Cheesemaker Jane Doe (2018) offers insights into the intricate processes and traditions underlying cheese production. Although this book may not appear to have a direct bearing on stock market dynamics, the craftsmanship and artistry involved in creating cheese prompt us to consider the cultural and culinary significance of this dairy product. After all, appreciation for cheese extends well beyond mere consumption - it is a testament to human creativity and ingenuity, much like the complexities of financial markets.

On a more whimsical note, "The Cheese Stands Alone: A Tale of Dairy and Determination" by Lactic Legends Publishing (2017) presents a fictional narrative that, while not rooted in empirical data, captures the imagination with its depiction of a lone slice of American cheese's journey in the culinary world. The storytelling prowess of this work invites us to embrace the unconventional and the unexpected, mirroring the spirit of our exploration into the connection between American cheese and stock prices. Who knows, perhaps the cheese does stand alone - ready to disrupt our conventional notions of market influences.

Finding inspiration beyond traditional academic sources, the board game "Cheddar Economics" also offers a playful take on the intersections of cheese and commerce. In this strategic game, players navigate the dynamic landscape of dairy production and distribution, leveraging their knowledge of cheese varieties to corner the market and amass wealth. While the game's premise may seem lighthearted, it playfully underscores the intertwining of culinary delights and financial acumen, suggesting that there may indeed be more to the world of cheese than meets the eye - or the taste buds.

As we embark on this surreal journey from the depths of market analyses to the whimsy of fiction and gameplay, we are reminded that even the most unexpected connections can offer valuable insights. Our study seeks to build upon these diverse influences, unraveling a correlation that may appear as improbable as finding a chunk of cheddar among the stocks and bonds. It is in this spirit of unbridled inquiry and a sprinkle of humor that we present our findings, eager to shed light on the curiously captivating cheddar connection to stock prices.

[[RESULTS]]

The analysis of data collected from the USDA and LSEG Analytics (Refinitiv) revealed a remarkably robust correlation between American cheese consumption and the stock price of Constellation Brands. The correlation coefficient of 0.9655121 suggests a near-perfect positive relationship between these seemingly disparate variables. Furthermore, the high R-squared value of 0.9322135 indicates that over 93% of the variability in Constellation Brands' stock price can be explained by fluctuations in American cheese consumption. It appears that the age-old saying "cheese stands alone" may need to be reevaluated in the context of stock market economics.

Fig. 1 depicts the scatterplot illustrating the strong positive association between American cheese consumption and Constellation Brands' stock prices over the period of 2002 to 2021. The unmistakable trend line meanders through the data points with a certainty that would make even the most seasoned cheese connoisseur raise an eyebrow. It seems that in the world of finance, as in life, there may indeed be something to the notion that "where there's cheese, there's a whey."

This unexpected connection between cheese consumption and stock performance raises intriguing questions about the potential impact of culinary preferences on financial markets. While it may be tempting to dismiss this correlation as mere happenstance, the statistically significant p-value of less than 0.01 compels us to take this finding seriously. In the grand banquet of market influencers, it seems that cheese has secured a seat at the table – and perhaps a prominent one at that.

These findings, while undoubtedly lighthearted in nature, serve as a reminder that the world of finance is not immune to the influence of unexpected, and at times, amusing factors. Much like a well-aged cheddar, the intersection of American cheese consumption and stock prices adds a layer of complexity to our understanding of market dynamics. Who knew that a wedge of cheese could have such a grate impact on financial performance?

In conclusion, while the cheesy nature of this correlation may elicit a few smiles, we must not overlook its potential implications for investors and analysts. This study invites market enthusiasts to contemplate the uncharted territory of culinary economics and consider the broader role that seemingly unrelated factors play in shaping market behaviors. After all, when it comes to investing, it never hurts to have a slice of gouda insight into the ever-evolving labyrinth of market influences. Cheers to the cheddar connection to stock prices – may it continue to spark curiosity and perhaps a chuckle or two in the world of financial research.

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

The robust correlation between American cheese consumption and Constellation Brands' stock prices uncovered in our study has left analysts and industry experts ruminating over the implications of this unexpected connection. While the notion of cheese impacting stock performance may seem as unlikely as finding a mouse in a cheese factory, our findings lend credence to the notion that there may indeed be more than meets the eye in the world of market influences.

The seemingly whimsical influences of culinary preferences on financial market dynamics have long been an area of intrigue. Drawing inspiration from the unlikely pairing of cheese and stock prices, our study reflects the spirit of unbridled inquiry and a sprinkle of humor, echoing the sentiments echoed in our quirky literature review. By delving into the curiously captivating cheddar connection to stock prices, we have not only reaffirmed the potential influence of unconventional factors on market behaviors, but have also added a layer of intrigue to the otherwise staid world of finance.

Our findings affirm and extend prior research that suggested the influence of lesser-explored culinary items on investment behavior. Smith and Doe's work on traditional commodities laid the groundwork for considering the impact of food preferences on stock prices. Surprisingly, our study offers empirical support for these foundational insights, emphasizing that one should never underestimate the power of a slice of American cheese in the grand banquet of market influencers.

The statistically significant correlation coefficient and p-values unveiled in our analysis underscore the serious implications of our findings. One could jest that the correlation is as clear as the holes in a Swiss cheese, but the statistical rigor behind our results compels us to take this connection seriously – even if it involves a product as delightfully droll as American cheese. From a scattered scatterplot to a high R-squared value, our results make a compelling case for the relevance of cheese in shaping stock valuations, reminding us that in the world of finance, there may indeed be something to the notion that "where there's cheese, there's a whey."

In essence, our study invites market enthusiasts to ponder the curiously captivating cheddar connection to stock prices, urging them to consider the broader role that seemingly unrelated factors play in shaping market behaviors. After all, when it comes to investing, it never hurts to have a slice of gouda insight into the ever-evolving labyrinth of market influences. With further exploration, who knows what other culinary capers and financial feta-morphoses may be revealed. Cheers to the cheddar connection to stock prices – may it continue to spark curiosity and perhaps a chuckle or two in the world of financial research.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between American cheese consumption and Constellation Brands' stock price. Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

Say Cheese: A Cheddar Connection to Stock Prices

[[ABSTRACT]]

This paper examines the relationship between American cheese consumption and the stock price of Constellation Brands. Utilizing data from the USDA and LSEG Analytics (Refinitiv), our research team analyzed the cheese consumption patterns and the fluctuations in Constellation Brands' stock prices from 2002 to 2021. The results revealed a strikingly high correlation coefficient of 0.9655121 and a statistically significant p-value of less than 0.01. While the findings may seem cheesy, they shed light on an unconventional link between a dairy product and stock market performance. This study offers insights into the unexplored intersections of culinary preferences and financial markets, reminding us that even the most seemingly unrelated factors can come together to form a gouda investment strategy.

[[INTRDUCTION]]

Stock market analysts often examine a myriad of economic indicators, from unemployment rates to consumer spending, in an effort to understand and predict the performance of financial markets. However, in an ever-evolving and interconnected world, unconventional factors may also play a role in shaping market trends. This study delves into the uncharted territory of culinary economics by investigating the curious connection between American cheese consumption and the stock price of Constellation Brands.

While it may seem like a stretch to draw a link between a popular dairy product and the stock performance of a beverage company, our exploration seeks to uncover any potential correlations that could offer unique insights into market behaviors. This interdisciplinary approach aims not only to pique the interest of market enthusiasts with a fondness for whimsy but also to challenge conventional wisdom about the drivers of stock prices.

Our research is rooted in an appreciation for the unexpected, recognizing that the financial landscape is influenced by a diverse array of factors, some of which may appear as unlikely bedfellows at first glance. By acknowledging this, we open the door to a more nuanced understanding of market dynamics and the possibility of uncovering valuable investment opportunities lurking beneath the surface, much like a hidden wedge of cheese in a salad.

In this paper, we present the findings of our comprehensive analysis, unveiling a correlation that, while perhaps initially met with skepticism, promises to enrich the discussion of market influences in an appetizingly intriguing manner. So, brace yourselves and grab a cracker - because we are about to explore the cheddar connection to stock prices.

[[RESULTS]]

The analysis of data collected from the USDA and LSEG Analytics (Refinitiv) revealed a remarkably robust correlation between American cheese consumption and the stock price of Constellation Brands. The correlation coefficient of 0.9655121 suggests a near-perfect positive relationship between these seemingly disparate variables. Furthermore, the high R-squared value of 0.9322135 indicates that over 93% of the variability in Constellation Brands' stock price can be explained by fluctuations in American cheese consumption. It appears that the age-old saying "cheese stands alone" may need to be reevaluated in the context of stock market economics.

Fig. 1 depicts the scatterplot illustrating the strong positive association between American cheese consumption and Constellation Brands' stock prices over the period of 2002 to 2021. The unmistakable trend line meanders through the data points with a certainty that would make even the most seasoned cheese connoisseur raise an eyebrow. It seems that in the world of finance, as in life, there may indeed be something to the notion that "where there's cheese, there's a whey."

This unexpected connection between cheese consumption and stock performance raises intriguing questions about the potential impact of culinary preferences on financial markets. While it may be tempting to dismiss this correlation as mere happenstance, the statistically significant p-value of less than 0.01 compels us to take this finding seriously. In the grand banquet of market influencers, it seems that cheese has secured a seat at the table – and perhaps a prominent one at that.

These findings, while undoubtedly lighthearted in nature, serve as a reminder that the world of finance is not immune to the influence of unexpected, and at times, amusing factors. Much like a well-aged cheddar, the intersection of American cheese consumption and stock prices adds a layer of complexity to our understanding of market dynamics. Who knew that a wedge of cheese could have such a grate impact on financial performance?

In conclusion, while the cheesy nature of this correlation may elicit a few smiles, we must not overlook its potential implications for investors and analysts. This study invites market enthusiasts to contemplate the uncharted territory of culinary economics and consider the broader role that seemingly unrelated factors play in shaping market behaviors. After all, when it comes to investing, it never hurts to have a slice of gouda insight into the ever-evolving labyrinth of market influences. Cheers to the cheddar connection to stock prices – may it continue to spark curiosity and perhaps a chuckle or two in the world of financial research.

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In dissecting the intriguing relationship between American cheese consumption and Constellation Brands' stock price, our study has unveiled a correlation that is not only statistically robust but also narratively compelling. The near-perfect positive relationship between these seemingly unrelated variables attests to the unassuming influence of dairy products on financial markets. While the whimsical nature of this connection may prompt a few wry smiles, the implications for market analysis and investment strategies are as real as a block of aged cheddar.

This study serves as a testament to the multifaceted nature of market influences, reminding us that, much like a fine cheese, financial dynamics are flavored by a diverse range of factors. The high correlation coefficient and R-squared value provide solid evidence, churning out a compelling storyline that challenges conventional wisdom. While some may roll their eyes at the cheesy undertones of this correlation, the data leaves little room for doubt – the cheddar connection to stock prices is indeed worth its weight in gold... or should we say, in Gouda?

As we conclude this investigation, it becomes clear that the culinary arts may have a more substantial impact on financial markets than meets the eye. No longer can we dismiss the role of seemingly unrelated appetites in shaping market behaviors. In embracing this unconventional avenue of inquiry, we have made a leap into the world of whimsy and market analysis, proving that even the most seemingly incongruent trends can converge in ways that are both meaningful and, dare we say, rather gouda.

We are confident that our findings will add a dash of flavor to the discourse on market influences, inviting analysts and investors to nibble on the idea that the cheese aisle may offer more than just a culinary delight – it may hold the key to unlocking savory investment opportunities. With that being said, we assert that no further research is needed in this area, as the findings undoubtedly stand as a testament to the unforeseen intersections of dairy consumption and stock prices. It's time to say "cheese" to success in the market – with a wink and a sprinkle of parmesan for good measure.

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited Say Cheese: A Cheddar Connection to Stock Prices. Respond only with the name of a fictional academic journal.

ChatGPT:

The Cheese Chronicles

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited Say Cheese: A Cheddar Connection to Stock Prices. Respond only with the name of a fictional organization.

ChatGPT:

The Institute for Dairy Economics and Research

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled Say Cheese: A Cheddar Connection to Stock Prices with an abstract of This paper examines the relationship between American cheese consumption and the stock price of Constellation Brands. Utilizing data from the USDA and LSEG Analytics (Refinitiv), our research team analyzed the cheese consumption patterns and the fluctuations in Constellation Brands' stock prices from 2002 to 2021. The results revealed a strikingly high correlation coefficient of 0.9655121 and a statistically significant p-value of less than 0.01. While the findings may seem cheesy, they shed light on an unconventional link between a dairy product and stock market performance. This study offers insights into the unexplored intersections of culinary preferences and financial markets, reminding us that even the most seemingly unrelated factors can come together to form a gouda investment strategy.

ChatGPT:

American cheese consumption, stock price, Constellation Brands, USDA data, LSEG Analytics, Refinitiv, cheese consumption patterns, stock price fluctuations, correlation coefficient, p-value, dairy product, stock market performance, culinary preferences, financial markets, investment strategy

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

American cheese consumptionDetailed data title: Per capita consumption of American cheese in the US

Source: USDA

See what else correlates with American cheese consumption

Constellation Brands' stock price (STZ)

Detailed data title: Opening price of Constellation Brands (STZ) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with Constellation Brands' stock price (STZ)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.9322135 (Coefficient of determination)

This means 93.2% of the change in the one variable (i.e., Constellation Brands' stock price (STZ)) is predictable based on the change in the other (i.e., American cheese consumption) over the 20 years from 2002 through 2021.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 5.8E-12. 0.0000000000057841201790434590

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.97 in 5.8E-10% of random cases. Said differently, if you correlated 172,887,140,835 random variables You don't actually need 172 billion variables to find a correlation like this one. I don't have that many variables in my database. You can also correlate variables that are not independent. I do this a lot.

p-value calculations are useful for understanding the probability of a result happening by chance. They are most useful when used to highlight the risk of a fluke outcome. For example, if you calculate a p-value of 0.30, the risk that the result is a fluke is high. It is good to know that! But there are lots of ways to get a p-value of less than 0.01, as evidenced by this project.

In this particular case, the values are so extreme as to be meaningless. That's why no one reports p-values with specificity after they drop below 0.01.

Just to be clear: I'm being completely transparent about the calculations. There is no math trickery. This is just how statistics shakes out when you calculate hundreds of millions of random correlations.

with the same 19 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 19 because we have two variables measured over a period of 20 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.91, 0.99 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

| American cheese consumption (Pounds per person) | 12.8314 | 12.5619 | 12.8612 | 12.649 | 13.0656 | 12.7929 | 13.1306 | 13.3553 | 13.3048 | 13.0392 | 13.2569 | 13.3573 | 13.6656 | 14.0444 | 14.3621 | 15.0901 | 15.4027 | 15.5389 | 15.5 | 16.1 |

| Constellation Brands' stock price (STZ) (Stock price) | 10.71 | 11.93 | 16.45 | 23.26 | 26.35 | 28.8 | 23.59 | 15.82 | 16.02 | 22.18 | 20.96 | 35.95 | 70.02 | 98.71 | 141.03 | 155.01 | 229 | 160.06 | 189.97 | 220 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is. - Y-axis doesn't start at zero: I truncated the Y-axes of the graph above. I also used a line graph, which makes the visual connection stand out more than it deserves.

Nothing against line graphs. They are great at telling a story when you have linear data! But visually it is deceptive because the only data is at the points on the graph, not the lines on the graph. In between each point, the data could have been doing anything. Like going for a random walk by itself!

Mathematically what I showed is true, but it is intentionally misleading. Below is the same chart but with both Y-axes starting at zero.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([12.8314,12.5619,12.8612,12.649,13.0656,12.7929,13.1306,13.3553,13.3048,13.0392,13.2569,13.3573,13.6656,14.0444,14.3621,15.0901,15.4027,15.5389,15.5,16.1,])

array_2 = np.array([10.71,11.93,16.45,23.26,26.35,28.8,23.59,15.82,16.02,22.18,20.96,35.95,70.02,98.71,141.03,155.01,229,160.06,189.97,220,])

array_1_name = "American cheese consumption"

array_2_name = "Constellation Brands' stock price (STZ)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only American cheese consumption

- Line chart for only Constellation Brands' stock price (STZ)

- The spurious research paper: Say Cheese: A Cheddar Connection to Stock Prices

You're the rating guru we've been waiting for!

Correlation ID: 1100 · Black Variable ID: 553 · Red Variable ID: 1739