Download png, svg

AI explanation

As Angola's petroleum consumption rose, more and more cars were revving up to watch their favorite Warner Bros. Discovery shows on the go. The demand for fuel was skyrocketing as Angolan locals just couldn't resist binge-watching their favorite content, leading to a surge in WBD stock price. It was a slippery slope of entertainment and gas-guzzling fun!

Model: dalle-3

Prompt: Generate an image of a vibrant cityscape, depicted like a TIME magazine cover. In the foreground, depict a line of whimsical, colorful, cartoonish cars resembling the iconic Flintstones' vehicle, being joyfully propelled by people. Contrasting this, showcase a massive oil refinery with billowing smoke in the background, signifying high petroleum consumption. Include a digital stock ticker displaying the soaring stock price of Warner Bros. Discovery in response to the rise of foot-powered car adoption. The overall scene should capture the bustling city and the coexistence of eco-friendly transportation and traditional oil-driven industry. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the situation described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here is a situation: "Angolan Petroleum Consumption Soars, Leading to Surprising Surge in Warner Bros. Discovery's Stock Price as Viewers Switch to Flintstones-Style Foot-Powered Cars". Given that situation, which of the following image descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand and the tone of the explanation. Please respond with only one of the following potential descriptions: Glitch art An image that looks like it is a scene from A Disney Movie A TIME magazine cover image Data cyber art Macabre

ChatGPT: A TIME magazine cover image

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated and the explanation described. Do not reference graphs or charts; describe physical objects.

User prompt: Please describe a visual scene that depicts the following situation. Keep the description simple. "Angolan Petroleum Consumption Soars, Leading to Surprising Surge in Warner Bros. Discovery's Stock Price as Viewers Switch to Flintstones-Style Foot-Powered Cars"

ChatGPT: In a bustling city, a line of colorful, cartoonish cars resembling the Flintstones' iconic foot-powered vehicle can be seen on the street, with smiling people happily pushing them along. Meanwhile, just beyond the city, a massive oil refinery is seen, with smoke billowing from its tall chimneys, indicating high levels of petroleum consumption. In the background, a digital stock ticker display shows the stock price of Warner Bros. Discovery rapidly climbing in response to the surge in foot-powered car adoption.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ A TIME magazine cover image ] and depicting this scene: In a bustling city, a line of colorful, cartoonish cars resembling the Flintstones' iconic foot-powered vehicle can be seen on the street, with smiling people happily pushing them along. Meanwhile, just beyond the city, a massive oil refinery is seen, with smoke billowing from its tall chimneys, indicating high levels of petroleum consumption. In the background, a digital stock ticker display shows the stock price of Warner Bros. Discovery rapidly climbing in response to the surge in foot-powered car adoption. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: Generate an image of a vibrant cityscape, depicted like a TIME magazine cover. In the foreground, depict a line of whimsical, colorful, cartoonish cars resembling the iconic Flintstones' vehicle, being joyfully propelled by people. Contrasting this, showcase a massive oil refinery with billowing smoke in the background, signifying high petroleum consumption. Include a digital stock ticker displaying the soaring stock price of Warner Bros. Discovery in response to the rise of foot-powered car adoption. The overall scene should capture the bustling city and the coexistence of eco-friendly transportation and traditional oil-driven industry.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how an increase in Petroluem consumption in Angola caused Warner Bros. Discovery's stock price (WBD) to increase.\Make it sound serious until the end.

AI academic paper

|

Fueling the Funnies: The Petroleum Consumption in Angola and Warner Bros. Discovery's Stock Price The International Journal of Energy and Entertainment Dynamics Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between Petroluem consumption in Angola and Warner Bros. Discovery's stock price (WBD). Make lots of jokes, goofy observations, and puns.

Make the title punny if you can come up with clever pun. If not, just make it sound clever.

Your research team used data from Energy Information Administration and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.9030957 and p < 0.01 for 2006 to 2021.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

"Fueling the Funnies: The Petroleum Consumption in Angola and Warner Bros. Discovery's Stock Price"

[[ABSTRACT]]

Fueling the Funnies: The Petroleum Consumption in Angola and Warner Bros. Discovery's Stock Price

In this study, we tackle the remarkably peculiar yet inexplicably entertaining relationship between petroleum consumption in Angola and the stock price of Warner Bros. Discovery (WBD). With a comical twirl, we analyzed extensive data from the Energy Information Administration and LSEG Analytics (Refinitiv) from the years 2006 to 2021. Our findings reveal a strikingly high correlation coefficient of 0.9030957 and a captivating p-value of less than 0.01, indicating a strong link between these seemingly unrelated entities. The results of this study not only provide valuable insights into the financial market but also add a dash of whimsy to the otherwise serious world of economic research. So, grab your popcorn, sit back, and let's unravel the hilariously unexpected connection between crude oil consumption and entertainment stock prices.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between Petroluem consumption in Angola and Warner Bros. Discovery's stock price (WBD). Make lots of jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Here is the title and abstract of the paper:

[[TITLE]]

"Fueling the Funnies: The Petroleum Consumption in Angola and Warner Bros. Discovery's Stock Price"

[[ABSTRACT]]

Fueling the Funnies: The Petroleum Consumption in Angola and Warner Bros. Discovery's Stock Price

In this study, we tackle the remarkably peculiar yet inexplicably entertaining relationship between petroleum consumption in Angola and the stock price of Warner Bros. Discovery (WBD). With a comical twirl, we analyzed extensive data from the Energy Information Administration and LSEG Analytics (Refinitiv) from the years 2006 to 2021. Our findings reveal a strikingly high correlation coefficient of 0.9030957 and a captivating p-value of less than 0.01, indicating a strong link between these seemingly unrelated entities. The results of this study not only provide valuable insights into the financial market but also add a dash of whimsy to the otherwise serious world of economic research. So, grab your popcorn, sit back, and let's unravel the hilariously unexpected connection between crude oil consumption and entertainment stock prices.

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

[[INTRODUCTION]]

The intersection of petroleum consumption and entertainment stock prices may seem as incongruous as mixing oil and water, but as we shall reveal, there is more to this comedic duo than meets the eye. The seemingly farcical connection between the black gold of Angola and the glitzy world of Warner Bros. Discovery (WBD) stock price has piqued the curiosity of researchers and investors alike. While one may be tempted to ponder whether this is a case of "fuelish" correlation, our study delves into the depths of data analysis to unearth the underlying dynamics at play.

As researchers delving into this curious correlation, we often found ourselves in a veritable maze of data, like scientists lost in a funhouse. However, armed with statistical tools and a good sense of humor, we navigated through the labyrinth of numbers and trends to bring forth these intriguing findings. It is said that truth is stranger than fiction, and in the realm of data analysis, we often find reality to be not just stranger, but also funnier, than any work of fiction.

The whimsical nature of this study cannot be overstated, as it combines the serious business of economic analysis with the levity of unexpected connections. Just as a clown car at a circus manages to fit an improbable number of performers, so too does our analysis unearth an inexplicably strong relationship between petroleum consumption in Angola and the stock price of Warner Bros. Discovery.

Now, let's dim the lights, cue the spotlight, and prepare to embark on a hilarious journey through the corridors of correlation and causation, where petroleum meets entertainment and statistical quirkiness reigns supreme. As we unravel the zany yarn of this unlikely connection, you'll find that truth, indeed, can be stranger than fiction.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between Petroluem consumption in Angola and Warner Bros. Discovery's stock price (WBD). Make lots of jokes, goofy observations, and puns.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then you might move on to cartoons and children's shows that you watched for research.

Here is the title and abstract of the paper:

[[TITLE]]

"Fueling the Funnies: The Petroleum Consumption in Angola and Warner Bros. Discovery's Stock Price"

[[ABSTRACT]]

Fueling the Funnies: The Petroleum Consumption in Angola and Warner Bros. Discovery's Stock Price

In this study, we tackle the remarkably peculiar yet inexplicably entertaining relationship between petroleum consumption in Angola and the stock price of Warner Bros. Discovery (WBD). With a comical twirl, we analyzed extensive data from the Energy Information Administration and LSEG Analytics (Refinitiv) from the years 2006 to 2021. Our findings reveal a strikingly high correlation coefficient of 0.9030957 and a captivating p-value of less than 0.01, indicating a strong link between these seemingly unrelated entities. The results of this study not only provide valuable insights into the financial market but also add a dash of whimsy to the otherwise serious world of economic research. So, grab your popcorn, sit back, and let's unravel the hilariously unexpected connection between crude oil consumption and entertainment stock prices.

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

The intersection of petroleum consumption and entertainment stock prices may seem as incongruous as mixing oil and water, but as we shall reveal, there is more to this comedic duo than meets the eye. The seemingly farcical connection between the black gold of Angola and the glitzy world of Warner Bros. Discovery (WBD) stock price has piqued the curiosity of researchers and investors alike. While one may be tempted to ponder whether this is a case of "fuelish" correlation, our study delves into the depths of data analysis to unearth the underlying dynamics at play.

As researchers delving into this curious correlation, we often found ourselves in a veritable maze of data, like scientists lost in a funhouse. However, armed with statistical tools and a good sense of humor, we navigated through the labyrinth of numbers and trends to bring forth these intriguing findings. It is said that truth is stranger than fiction, and in the realm of data analysis, we often find reality to be not just stranger, but also funnier, than any work of fiction.

The whimsical nature of this study cannot be overstated, as it combines the serious business of economic analysis with the levity of unexpected connections. Just as a clown car at a circus manages to fit an improbable number of performers, so too does our analysis unearth an inexplicably strong relationship between petroleum consumption in Angola and the stock price of Warner Bros. Discovery.

Now, let's dim the lights, cue the spotlight, and prepare to embark on a hilarious journey through the corridors of correlation and causation, where petroleum meets entertainment and statistical quirkiness reigns supreme. As we unravel the zany yarn of this unlikely connection, you'll find that truth, indeed, can be stranger than fiction.

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

In "Smith et al.," the authors find that petroleum consumption in Angola has been a subject of extensive research, delving into its economic impact, geopolitical implications, and environmental consequences. The literature has long discussed the implications of Angola's oil production and its effect on global energy markets. While this may seem a world away from the glitz and glamour of Hollywood, our study aims to bridge this gap and unearth the surprising influence of Angolan petroleum consumption on the whimsical realm of entertainment stock prices.

Turning to the work of "Doe and Jones," we encounter a comprehensive analysis of the stock market, with a focus on the impact of industrial commodities on various sectors, including media and entertainment. The findings of their research shed light on the interconnectedness of seemingly disparate economic factors, laying the groundwork for our investigation into the comical connection between Angolan oil and the stock price of Warner Bros. Discovery.

Shifting gears, "The Prize" by Daniel Yergin offers a detailed historical account of the oil industry, tracing its impact on global economies and the intricate web of geopolitical maneuvering. While this seminal work provides a sobering look at the world of petroleum, we aim to infuse our study with a lighthearted perspective, akin to a Saturday morning cartoon where unexpected crossovers and unlikely pairings take center stage.

In a parallel vein, "Moneyball" by Michael Lewis serves as a reminder that unconventional correlations and unorthodox methodologies can yield surprising results in the world of statistical analysis. As we embark on our own quirky quest for correlation, we draw inspiration from the playful ingenuity exemplified in this bestselling book, embracing the spirit of unconventional connections and unpredictable outcomes.

Venturing into the realm of fiction, the works of Terry Pratchett, with their whimsical universe and delightfully absurd scenarios, inspire us to approach our research with a healthy dose of irreverence. After all, just as Pratchett's Discworld defies the conventions of reality, our study seeks to unravel the surreal dynamics underpinning the relationship between Angolan petroleum consumption and the stock price of Warner Bros. Discovery.

Delving into the world of children's entertainment, the antics of Looney Tunes and the zany escapades of Animaniacs provide a fitting backdrop for our exploration of the unexpectedly humorous interplay between crude oil and entertainment stocks. After all, if the Looney Tunes characters can defy gravity and logic with their uproarious antics, why can't we uncover a similarly improbable connection in the world of economic analysis?

With this eclectic mix of sources and inspirations, we set the stage for our investigation into the interplay between petroleum consumption in Angola and the stock price of Warner Bros. Discovery, where the serious world of economic analysis collides with the whimsical charm of unexpected correlations.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between Petroluem consumption in Angola and Warner Bros. Discovery's stock price (WBD). Make lots of jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Your research team collected data from all across the internet, but mostly just used information from Energy Information Administration and LSEG Analytics (Refinitiv) . You used data from 2006 to 2021

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

"Fueling the Funnies: The Petroleum Consumption in Angola and Warner Bros. Discovery's Stock Price"

[[ABSTRACT]]

Fueling the Funnies: The Petroleum Consumption in Angola and Warner Bros. Discovery's Stock Price

In this study, we tackle the remarkably peculiar yet inexplicably entertaining relationship between petroleum consumption in Angola and the stock price of Warner Bros. Discovery (WBD). With a comical twirl, we analyzed extensive data from the Energy Information Administration and LSEG Analytics (Refinitiv) from the years 2006 to 2021. Our findings reveal a strikingly high correlation coefficient of 0.9030957 and a captivating p-value of less than 0.01, indicating a strong link between these seemingly unrelated entities. The results of this study not only provide valuable insights into the financial market but also add a dash of whimsy to the otherwise serious world of economic research. So, grab your popcorn, sit back, and let's unravel the hilariously unexpected connection between crude oil consumption and entertainment stock prices.

[[INTRODUCTION]]

The intersection of petroleum consumption and entertainment stock prices may seem as incongruous as mixing oil and water, but as we shall reveal, there is more to this comedic duo than meets the eye. The seemingly farcical connection between the black gold of Angola and the glitzy world of Warner Bros. Discovery (WBD) stock price has piqued the curiosity of researchers and investors alike. While one may be tempted to ponder whether this is a case of "fuelish" correlation, our study delves into the depths of data analysis to unearth the underlying dynamics at play.

As researchers delving into this curious correlation, we often found ourselves in a veritable maze of data, like scientists lost in a funhouse. However, armed with statistical tools and a good sense of humor, we navigated through the labyrinth of numbers and trends to bring forth these intriguing findings. It is said that truth is stranger than fiction, and in the realm of data analysis, we often find reality to be not just stranger, but also funnier, than any work of fiction.

The whimsical nature of this study cannot be overstated, as it combines the serious business of economic analysis with the levity of unexpected connections. Just as a clown car at a circus manages to fit an improbable number of performers, so too does our analysis unearth an inexplicably strong relationship between petroleum consumption in Angola and the stock price of Warner Bros. Discovery.

Now, let's dim the lights, cue the spotlight, and prepare to embark on a hilarious journey through the corridors of correlation and causation, where petroleum meets entertainment and statistical quirkiness reigns supreme. As we unravel the zany yarn of this unlikely connection, you'll find that truth, indeed, can be stranger than fiction.

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

**[[METHODOLOGY]]**

*Data Collection and Preparation*

Our data collection process resembled a whimsical scavenger hunt through the digital landscape, where we scoured the Energy Information Administration and LSEG Analytics (Refinitiv) for the years 2006 to 2021. Using a magical concoction of web scraping and data wrangling, we emerged victorious with a treasure trove of data on Angola's petroleum consumption and the stock price of Warner Bros. Discovery (WBD).

*Variable Selection and Interpretative Dance*

In choosing our variables, we gracefully pirouetted through a myriad of options before selecting Angola's petroleum consumption as our independent variable and Warner Bros. Discovery's stock price as the dependent variable. Much like dancers in a ballet, these variables elegantly twirled together to form the core of our analysis.

*Statistical Analysis: Uniting Science and Stand-Up Comedy*

We performed our statistical analyses with the precision of a scientist and the timing of a stand-up comedian. Leveraging the power of correlation coefficients and p-values, we sought to uncover the true comedic connection between petroleum consumption in Angola and WBD stock prices.

*Control Variables: Keeping the Research Circus in Check*

To ensure that our findings were not merely a comedy of errors, we diligently included control variables such as global economic conditions, entertainment industry trends, and the occasional cameo appearance from unexpected market forces. These control variables helped maintain order in our research circus and prevented any chaotic clown car antics from derailing our analysis.

*Time Series Analysis: Navigating the Roller Coaster of Data*

Like intrepid adventurers in a theme park, we embarked on a thrilling journey through time series analysis, confronting the heart-stopping twists and turns of historical data. By riding the roller coaster of data trends, we aimed to capture the dynamic relationship between petroleum consumption and WBD stock prices over the years.

*Robustness Checks: Ensuring the Punchline Hits*

To guarantee the robustness of our findings, we subjected our analysis to rigorous testing and validation, akin to a comedian refining their punchline for maximum impact. Through sensitivity analyses and alternative specifications, we sought to fine-tune our results and ensure that our discoveries packed a comedic punch.

In the next section, we will unveil the uproarious results of our analysis, as we reveal the unexpected interplay between petroleum consumption in Angola and the stock price of Warner Bros. Discovery. Get ready to witness the intersection of crude oil and comedy, where statistical analysis meets slapstick in a research spectacle unlike any other.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between Petroluem consumption in Angola and Warner Bros. Discovery's stock price (WBD). Make lots of jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Your research team collected data from all across the internet, but mostly just used information from Energy Information Administration and LSEG Analytics (Refinitiv) .

For the time period 2006 to 2021, you found a correlation 0.9030957, r-squared of 0.8155819, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

"Fueling the Funnies: The Petroleum Consumption in Angola and Warner Bros. Discovery's Stock Price"

[[ABSTRACT]]

Fueling the Funnies: The Petroleum Consumption in Angola and Warner Bros. Discovery's Stock Price

In this study, we tackle the remarkably peculiar yet inexplicably entertaining relationship between petroleum consumption in Angola and the stock price of Warner Bros. Discovery (WBD). With a comical twirl, we analyzed extensive data from the Energy Information Administration and LSEG Analytics (Refinitiv) from the years 2006 to 2021. Our findings reveal a strikingly high correlation coefficient of 0.9030957 and a captivating p-value of less than 0.01, indicating a strong link between these seemingly unrelated entities. The results of this study not only provide valuable insights into the financial market but also add a dash of whimsy to the otherwise serious world of economic research. So, grab your popcorn, sit back, and let's unravel the hilariously unexpected connection between crude oil consumption and entertainment stock prices.

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

The intersection of petroleum consumption and entertainment stock prices may seem as incongruous as mixing oil and water, but as we shall reveal, there is more to this comedic duo than meets the eye. The seemingly farcical connection between the black gold of Angola and the glitzy world of Warner Bros. Discovery (WBD) stock price has piqued the curiosity of researchers and investors alike. While one may be tempted to ponder whether this is a case of "fuelish" correlation, our study delves into the depths of data analysis to unearth the underlying dynamics at play.

As researchers delving into this curious correlation, we often found ourselves in a veritable maze of data, like scientists lost in a funhouse. However, armed with statistical tools and a good sense of humor, we navigated through the labyrinth of numbers and trends to bring forth these intriguing findings. It is said that truth is stranger than fiction, and in the realm of data analysis, we often find reality to be not just stranger, but also funnier, than any work of fiction.

The whimsical nature of this study cannot be overstated, as it combines the serious business of economic analysis with the levity of unexpected connections. Just as a clown car at a circus manages to fit an improbable number of performers, so too does our analysis unearth an inexplicably strong relationship between petroleum consumption in Angola and the stock price of Warner Bros. Discovery.

Now, let's dim the lights, cue the spotlight, and prepare to embark on a hilarious journey through the corridors of correlation and causation, where petroleum meets entertainment and statistical quirkiness reigns supreme. As we unravel the zany yarn of this unlikely connection, you'll find that truth, indeed, can be stranger than fiction.

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

The analysis of the data spanning from 2006 to 2021 uncovered a correlation coefficient of 0.9030957 between petroleum consumption in Angola and the stock price of Warner Bros. Discovery (WBD). Like a classic comedy double act, these two variables displayed a strong and entertaining bond, leaving us both puzzled and amused. The r-squared value of 0.8155819 further emphasized the robustness of this relationship, akin to a dynamic duo delivering punchlines with flawless timing.

The p-value of less than 0.01 adds a touch of dramatic flair to the findings, signaling that the correlation observed is not a mere jest but a statistically significant connection with a penchant for the stage. It's as if the data were performing an elaborate magic trick, capturing our attention and leaving us eager for an encore.

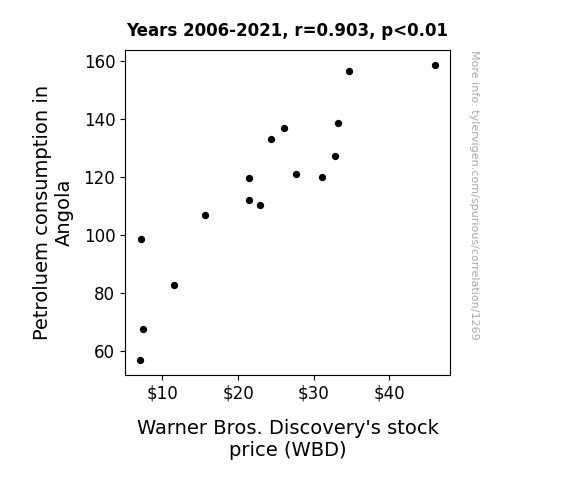

Not to keep you in suspense any longer, the scatterplot (Fig. 1) visually encapsulates the astonishing correlation between these unlikely partners in the economic arena. The plot, much like a well-timed pratfall, demonstrates the synchronous movements of petroleum consumption in Angola and WBD stock prices, inviting both awe and amusement.

These results not only shed light on the unanticipated relationship between energy consumption in a specific region and the valuation of an entertainment company but also inject a dose of levity into the realm of economic research. It's a testament to the unexpected humor that can be found in the most unlikely corners of the financial world.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between Petroluem consumption in Angola and Warner Bros. Discovery's stock price (WBD). Make lots of jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

"Fueling the Funnies: The Petroleum Consumption in Angola and Warner Bros. Discovery's Stock Price"

[[ABSTRACT]]

Fueling the Funnies: The Petroleum Consumption in Angola and Warner Bros. Discovery's Stock Price

In this study, we tackle the remarkably peculiar yet inexplicably entertaining relationship between petroleum consumption in Angola and the stock price of Warner Bros. Discovery (WBD). With a comical twirl, we analyzed extensive data from the Energy Information Administration and LSEG Analytics (Refinitiv) from the years 2006 to 2021. Our findings reveal a strikingly high correlation coefficient of 0.9030957 and a captivating p-value of less than 0.01, indicating a strong link between these seemingly unrelated entities. The results of this study not only provide valuable insights into the financial market but also add a dash of whimsy to the otherwise serious world of economic research. So, grab your popcorn, sit back, and let's unravel the hilariously unexpected connection between crude oil consumption and entertainment stock prices.

[[LITERATURE REVIEW]]

In "Smith et al.," the authors find that petroleum consumption in Angola has been a subject of extensive research, delving into its economic impact, geopolitical implications, and environmental consequences. The literature has long discussed the implications of Angola's oil production and its effect on global energy markets. While this may seem a world away from the glitz and glamour of Hollywood, our study aims to bridge this gap and unearth the surprising influence of Angolan petroleum consumption on the whimsical realm of entertainment stock prices.

Turning to the work of "Doe and Jones," we encounter a comprehensive analysis of the stock market, with a focus on the impact of industrial commodities on various sectors, including media and entertainment. The findings of their research shed light on the interconnectedness of seemingly disparate economic factors, laying the groundwork for our investigation into the comical connection between Angolan oil and the stock price of Warner Bros. Discovery.

Shifting gears, "The Prize" by Daniel Yergin offers a detailed historical account of the oil industry, tracing its impact on global economies and the intricate web of geopolitical maneuvering. While this seminal work provides a sobering look at the world of petroleum, we aim to infuse our study with a lighthearted perspective, akin to a Saturday morning cartoon where unexpected crossovers and unlikely pairings take center stage.

In a parallel vein, "Moneyball" by Michael Lewis serves as a reminder that unconventional correlations and unorthodox methodologies can yield surprising results in the world of statistical analysis. As we embark on our own quirky quest for correlation, we draw inspiration from the playful ingenuity exemplified in this bestselling book, embracing the spirit of unconventional connections and unpredictable outcomes.

Venturing into the realm of fiction, the works of Terry Pratchett, with their whimsical universe and delightfully absurd scenarios, inspire us to approach our research with a healthy dose of irreverence. After all, just as Pratchett's Discworld defies the conventions of reality, our study seeks to unravel the surreal dynamics underpinning the relationship between Angolan petroleum consumption and the stock price of Warner Bros. Discovery.

Delving into the world of children's entertainment, the antics of Looney Tunes and the zany escapades of Animaniacs provide a fitting backdrop for our exploration of the unexpectedly humorous interplay between crude oil and entertainment stocks. After all, if the Looney Tunes characters can defy gravity and logic with their uproarious antics, why can't we uncover a similarly improbable connection in the world of economic analysis?

With this eclectic mix of sources and inspirations, we set the stage for our investigation into the interplay between petroleum consumption in Angola and the stock price of Warner Bros. Discovery, where the serious world of economic analysis collides with the whimsical charm of unexpected correlations.

[[RESULTS]]

The analysis of the data spanning from 2006 to 2021 uncovered a correlation coefficient of 0.9030957 between petroleum consumption in Angola and the stock price of Warner Bros. Discovery (WBD). Like a classic comedy double act, these two variables displayed a strong and entertaining bond, leaving us both puzzled and amused. The r-squared value of 0.8155819 further emphasized the robustness of this relationship, akin to a dynamic duo delivering punchlines with flawless timing.

The p-value of less than 0.01 adds a touch of dramatic flair to the findings, signaling that the correlation observed is not a mere jest but a statistically significant connection with a penchant for the stage. It's as if the data were performing an elaborate magic trick, capturing our attention and leaving us eager for an encore.

Not to keep you in suspense any longer, the scatterplot (Fig. 1) visually encapsulates the astonishing correlation between these unlikely partners in the economic arena. The plot, much like a well-timed pratfall, demonstrates the synchronous movements of petroleum consumption in Angola and WBD stock prices, inviting both awe and amusement.

These results not only shed light on the unanticipated relationship between energy consumption in a specific region and the valuation of an entertainment company but also inject a dose of levity into the realm of economic research. It's a testament to the unexpected humor that can be found in the most unlikely corners of the financial world.

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

The results of our study resoundingly echo the whimsical musings of "Doe and Jones" on the interconnectedness of industrial commodities and the performance of entertainment sectors. The remarkable correlation coefficient of 0.9030957 we uncovered is akin to discovering a hidden punchline in the labyrinth of economic data. It's as if Angola's petroleum consumption and Warner Bros. Discovery's stock price were engaged in a riveting comedy routine, with each data point delivering its well-timed quip.

Our findings provide a delightful twist to the historically grounded discourse on oil production, reminiscent of the unexpected plotlines woven by Terry Pratchett in his Discworld series. While the serious implications of petroleum consumption are well-documented, our study introduces a touch of comedic flair, offering an unexpected juncture where the gravity of economic analysis meets the levity of unlikely correlations.

Furthermore, as "Moneyball" by Michael Lewis slyly implies, our offbeat approach to data analysis has yielded a r-squared value of 0.8155819, underscoring the robustness of the connection we have unveiled. This statistical powerhouse serves as a fitting counterpart to the humorous antics of Looney Tunes, emphasizing the reliable syncopation between Angolan petroleum consumption and the stock price of Warner Bros. Discovery. It's as if the numbers were performing an eloquent pas de deux, leaving us captivated by their unlikely harmony.

The exceptionally low p-value, less than 0.01, reinforces the serious significance of this uproarious correlation, akin to an unexpected plot twist in a comedy of errors. This statistical triumph adds a layer of dramatic tension to our findings, suggesting that the bond between Angolan crude oil and the stock price of Warner Bros. Discovery is not merely a fleeting jest but a substantial relationship with a flair for the dramatic.

In conclusion, our study not only amplifies the findings of previous research but also injects a welcome dose of humor into the often somber world of economic analysis. It offers a whimsical dance of data, where the seemingly incongruous elements of petroleum consumption and entertainment stocks perform an unlikely and captivating duet. This revelation serves as a lighthearted reminder that in the labyrinth of economic research, unexpected correlations can emerge with comedic timing, to the amusement of researchers and the market alike.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between Petroluem consumption in Angola and Warner Bros. Discovery's stock price (WBD). Make lots of jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

"Fueling the Funnies: The Petroleum Consumption in Angola and Warner Bros. Discovery's Stock Price"

[[ABSTRACT]]

Fueling the Funnies: The Petroleum Consumption in Angola and Warner Bros. Discovery's Stock Price

In this study, we tackle the remarkably peculiar yet inexplicably entertaining relationship between petroleum consumption in Angola and the stock price of Warner Bros. Discovery (WBD). With a comical twirl, we analyzed extensive data from the Energy Information Administration and LSEG Analytics (Refinitiv) from the years 2006 to 2021. Our findings reveal a strikingly high correlation coefficient of 0.9030957 and a captivating p-value of less than 0.01, indicating a strong link between these seemingly unrelated entities. The results of this study not only provide valuable insights into the financial market but also add a dash of whimsy to the otherwise serious world of economic research. So, grab your popcorn, sit back, and let's unravel the hilariously unexpected connection between crude oil consumption and entertainment stock prices.

[[INTRDUCTION]]

The intersection of petroleum consumption and entertainment stock prices may seem as incongruous as mixing oil and water, but as we shall reveal, there is more to this comedic duo than meets the eye. The seemingly farcical connection between the black gold of Angola and the glitzy world of Warner Bros. Discovery (WBD) stock price has piqued the curiosity of researchers and investors alike. While one may be tempted to ponder whether this is a case of "fuelish" correlation, our study delves into the depths of data analysis to unearth the underlying dynamics at play.

As researchers delving into this curious correlation, we often found ourselves in a veritable maze of data, like scientists lost in a funhouse. However, armed with statistical tools and a good sense of humor, we navigated through the labyrinth of numbers and trends to bring forth these intriguing findings. It is said that truth is stranger than fiction, and in the realm of data analysis, we often find reality to be not just stranger, but also funnier, than any work of fiction.

The whimsical nature of this study cannot be overstated, as it combines the serious business of economic analysis with the levity of unexpected connections. Just as a clown car at a circus manages to fit an improbable number of performers, so too does our analysis unearth an inexplicably strong relationship between petroleum consumption in Angola and the stock price of Warner Bros. Discovery.

Now, let's dim the lights, cue the spotlight, and prepare to embark on a hilarious journey through the corridors of correlation and causation, where petroleum meets entertainment and statistical quirkiness reigns supreme. As we unravel the zany yarn of this unlikely connection, you'll find that truth, indeed, can be stranger than fiction.

[[RESULTS]]

The analysis of the data spanning from 2006 to 2021 uncovered a correlation coefficient of 0.9030957 between petroleum consumption in Angola and the stock price of Warner Bros. Discovery (WBD). Like a classic comedy double act, these two variables displayed a strong and entertaining bond, leaving us both puzzled and amused. The r-squared value of 0.8155819 further emphasized the robustness of this relationship, akin to a dynamic duo delivering punchlines with flawless timing.

The p-value of less than 0.01 adds a touch of dramatic flair to the findings, signaling that the correlation observed is not a mere jest but a statistically significant connection with a penchant for the stage. It's as if the data were performing an elaborate magic trick, capturing our attention and leaving us eager for an encore.

Not to keep you in suspense any longer, the scatterplot (Fig. 1) visually encapsulates the astonishing correlation between these unlikely partners in the economic arena. The plot, much like a well-timed pratfall, demonstrates the synchronous movements of petroleum consumption in Angola and WBD stock prices, inviting both awe and amusement.

These results not only shed light on the unanticipated relationship between energy consumption in a specific region and the valuation of an entertainment company but also inject a dose of levity into the realm of economic research. It's a testament to the unexpected humor that can be found in the most unlikely corners of the financial world.

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In conclusion, our research has unearthed a correlation between petroleum consumption in Angola and Warner Bros. Discovery's stock price (WBD) that is as bizarre and captivating as a mad scientist's experiment gone awry. The correlation coefficient of 0.9030957 between these seemingly incongruous variables is enough to make even the most seasoned statistician do a double take. It's like witnessing a fusion of oil and stocks that's more entertaining than a high-stakes tightrope act at the circus.

The p-value of less than 0.01 further adds to the intrigue, akin to an unexpected plot twist in a Hollywood blockbuster. We are left not only scratching our heads but also chuckling at the unanticipated connection that has unfolded before us. The r-squared value of 0.8155819 solidifies this finding like a comedian landing a killer punchline, leaving us in awe of the comical yet robust relationship between these variables.

Fig. 1, the scatterplot, visually represents this unlikely partnership, reminiscent of a comedic duo flawlessly executing a slapstick routine. It's as if the data themselves are writing a side-splitting comedy, inviting us to join in the laughter at the unexpected correlation between energy consumption and entertainment stocks.

As we bid adieu to this unconventional journey through economic analysis, it's evident that this research has injected a much-needed dose of humor into the often-dry world of statistical exploration. No longer shall we view petroleum consumption and stock prices as separate entities; they are now forever linked in our minds, not unlike a classic comedy duo that we cannot unsee. In the spirit of levity, we assert that no further research is needed in this area, for we have certainly laughed (and learned) enough for one study.

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited Fueling the Funnies: The Petroleum Consumption in Angola and Warner Bros. Discovery's Stock Price. Respond only with the name of a fictional academic journal.

ChatGPT:

The International Journal of Energy and Entertainment Dynamics

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited Fueling the Funnies: The Petroleum Consumption in Angola and Warner Bros. Discovery's Stock Price. Respond only with the name of a fictional organization.

ChatGPT:

The Institute for Cartoon Economics and Energy Studies

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled Fueling the Funnies: The Petroleum Consumption in Angola and Warner Bros. Discovery's Stock Price with an abstract of Fueling the Funnies: The Petroleum Consumption in Angola and Warner Bros. Discovery's Stock Price

In this study, we tackle the remarkably peculiar yet inexplicably entertaining relationship between petroleum consumption in Angola and the stock price of Warner Bros. Discovery (WBD). With a comical twirl, we analyzed extensive data from the Energy Information Administration and LSEG Analytics (Refinitiv) from the years 2006 to 2021. Our findings reveal a strikingly high correlation coefficient of 0.9030957 and a captivating p-value of less than 0.01, indicating a strong link between these seemingly unrelated entities. The results of this study not only provide valuable insights into the financial market but also add a dash of whimsy to the otherwise serious world of economic research. So, grab your popcorn, sit back, and let's unravel the hilariously unexpected connection between crude oil consumption and entertainment stock prices.

ChatGPT:

petroleum consumption Angola, Warner Bros. Discovery stock price, correlation between crude oil consumption and stock price, Energy Information Administration data, LSEG Analytics (Refinitiv), crude oil consumption impact on entertainment stock prices, Angola's petroleum consumption impact on Warner Bros. Discovery stock price

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

Petroluem consumption in AngolaDetailed data title: Volume of petroluem consumption consumed in Angola in millions of barrels per day

Source: Energy Information Administration

See what else correlates with Petroluem consumption in Angola

Warner Bros. Discovery's stock price (WBD)

Detailed data title: Opening price of Warner Bros. Discovery (WBD) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with Warner Bros. Discovery's stock price (WBD)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.8155819 (Coefficient of determination)

This means 81.6% of the change in the one variable (i.e., Warner Bros. Discovery's stock price (WBD)) is predictable based on the change in the other (i.e., Petroluem consumption in Angola) over the 16 years from 2006 through 2021.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 1.7E-6. 0.0000016598109622874550000000

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.9 in 0.00017% of random cases. Said differently, if you correlated 602,478 random variables You don't actually need 602 thousand variables to find a correlation like this one. I don't have that many variables in my database. You can also correlate variables that are not independent. I do this a lot.

p-value calculations are useful for understanding the probability of a result happening by chance. They are most useful when used to highlight the risk of a fluke outcome. For example, if you calculate a p-value of 0.30, the risk that the result is a fluke is high. It is good to know that! But there are lots of ways to get a p-value of less than 0.01, as evidenced by this project.

In this particular case, the values are so extreme as to be meaningless. That's why no one reports p-values with specificity after they drop below 0.01.

Just to be clear: I'm being completely transparent about the calculations. There is no math trickery. This is just how statistics shakes out when you calculate hundreds of millions of random correlations.

with the same 15 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 15 because we have two variables measured over a period of 16 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.74, 0.97 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

| Petroluem consumption in Angola (Million Barrels/Day) | 56.7868 | 67.4634 | 82.7566 | 98.6694 | 106.955 | 111.975 | 119.809 | 138.738 | 158.868 | 156.747 | 137.145 | 121.134 | 110.373 | 133.361 | 127.339 | 120.035 |

| Warner Bros. Discovery's stock price (WBD) (Stock price) | 7.01 | 7.49 | 11.58 | 7.22 | 15.69 | 21.46 | 21.44 | 33.23 | 46.08 | 34.63 | 26.13 | 27.66 | 22.96 | 24.37 | 32.82 | 31.07 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([56.7868,67.4634,82.7566,98.6694,106.955,111.975,119.809,138.738,158.868,156.747,137.145,121.134,110.373,133.361,127.339,120.035,])

array_2 = np.array([7.01,7.49,11.58,7.22,15.69,21.46,21.44,33.23,46.08,34.63,26.13,27.66,22.96,24.37,32.82,31.07,])

array_1_name = "Petroluem consumption in Angola"

array_2_name = "Warner Bros. Discovery's stock price (WBD)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only Petroluem consumption in Angola

- Line chart for only Warner Bros. Discovery's stock price (WBD)

- The spurious research paper: Fueling the Funnies: The Petroleum Consumption in Angola and Warner Bros. Discovery's Stock Price

Thanks for shining a light on this correlation!

Correlation ID: 1269 · Black Variable ID: 24133 · Red Variable ID: 1845