Download png, svg

AI explanation

As the saying goes, "special education teachers are experts in finding unique solutions to unexpected problems." In this case, their expertise inadvertently led to a breakthrough in the notoriously volatile copper market. It turns out, their creative teaching methods inspired a new approach to assessing copper reserves, leading to the discovery of an unprecedentedly bountiful ore deposit right under Wisconsin. As the unexpected boom in local copper production sent shockwaves through the stock market, Freeport-McMoRan's stock price surged, proving that when it comes to making connections, even the most seemingly unrelated factors can have a hand in shaping our economic landscape.

Model: dalle-3

Prompt: [ Symbolism ] Prompt: Create an image of a lively classroom filled with special education teachers providing personalized instruction to students with diverse learning needs. Show the teachers using customized materials and resources to support the students' education. Outside the window, depict a soaring stock price chart of a mining company, symbolizing the surging demand for copper. Capture the students with magnetic personalities creatively engaging with magnetic objects, showcasing their unique interests and abilities and representing the increasing demand for copper among students. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the situation described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here is a situation: "Rise in Special Education Teachers Leads to Surge in Freeport-McMoRan Stock Price as Demand for Copper Soars Among Students With Magnetic Personalities". Given that situation, which of the following image descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand and the tone of the explanation. Please respond with only one of the following potential descriptions: Sci-fi fantacy Hyper-realistic Data cyber art Symbolism An image that looks like it is a scene from a Pixar movie

ChatGPT: Symbolism

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated and the explanation described. Do not reference graphs or charts; describe physical objects.

User prompt: Please describe a visual scene that depicts the following situation. Keep the description simple. "Rise in Special Education Teachers Leads to Surge in Freeport-McMoRan Stock Price as Demand for Copper Soars Among Students With Magnetic Personalities"

ChatGPT: In a bustling classroom, a group of special education teachers are teaching students with various learning needs. The teachers are engaged in inclusive and personalized instruction, utilizing specialized materials and resources to support the students. Meanwhile, outside the window, a mining company's stock price soars as demand for copper surges. The students with magnetic personalities are creatively engaged, attracting and interacting with magnetic objects to enhance their learning experience, demonstrating the increasing demand for copper among students with unique interests and abilities.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ Symbolism ] and depicting this scene: In a bustling classroom, a group of special education teachers are teaching students with various learning needs. The teachers are engaged in inclusive and personalized instruction, utilizing specialized materials and resources to support the students. Meanwhile, outside the window, a mining company's stock price soars as demand for copper surges. The students with magnetic personalities are creatively engaged, attracting and interacting with magnetic objects to enhance their learning experience, demonstrating the increasing demand for copper among students with unique interests and abilities. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: [ Symbolism ] Prompt: Create an image of a lively classroom filled with special education teachers providing personalized instruction to students with diverse learning needs. Show the teachers using customized materials and resources to support the students' education. Outside the window, depict a soaring stock price chart of a mining company, symbolizing the surging demand for copper. Capture the students with magnetic personalities creatively engaging with magnetic objects, showcasing their unique interests and abilities and representing the increasing demand for copper among students.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how an increase in The number of special education teachers in Wisconsin caused Freeport-McMoRan's stock price (FCX) to increase.

AI academic paper

|

Special Education Stocks: Analyzing the Correlation Between Wisconsin's Special Education Teachers and Freeport-McMoRan's Stock Price The Journal of Humorous Economics Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between The number of special education teachers in Wisconsin and Freeport-McMoRan's stock price (FCX). Make lots of jokes, goofy observations, and puns.

Make the title punny if you can come up with clever pun. If not, just make it sound clever.

Your research team used data from Bureau of Larbor Statistics and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.9214753 and p < 0.01 for 2012 to 2022.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

"Special Education Stocks: Analyzing the Correlation Between Wisconsin's Special Education Teachers and Freeport-McMoRan's Stock Price"

[[ABSTRACT]]

This paper delves into the unexpected and often overlooked relationship between the number of special education teachers in Wisconsin and the stock price of Freeport-McMoRan (FCX). Utilizing data from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv) spanning from 2012 to 2022, our research team discovered a remarkably high correlation coefficient of 0.9214753 and a p-value of less than 0.01. The results highlight the quirky and peculiar connections that can be uncovered when seemingly unrelated variables are analyzed. Our findings contribute to the growing body of literature on unorthodox financial indicators and add a touch of whimsy to the world of economic research.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between The number of special education teachers in Wisconsin and Freeport-McMoRan's stock price (FCX). Make lots of jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Here is the title and abstract of the paper:

[[TITLE]]

"Special Education Stocks: Analyzing the Correlation Between Wisconsin's Special Education Teachers and Freeport-McMoRan's Stock Price"

[[ABSTRACT]]

This paper delves into the unexpected and often overlooked relationship between the number of special education teachers in Wisconsin and the stock price of Freeport-McMoRan (FCX). Utilizing data from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv) spanning from 2012 to 2022, our research team discovered a remarkably high correlation coefficient of 0.9214753 and a p-value of less than 0.01. The results highlight the quirky and peculiar connections that can be uncovered when seemingly unrelated variables are analyzed. Our findings contribute to the growing body of literature on unorthodox financial indicators and add a touch of whimsy to the world of economic research.

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

[[INTRODUCTION]]

As the old adage goes, "Truth is stranger than fiction." And in the realm of economic research, this saying couldn't be more apt, particularly when venturing into the uncharted territory of the correlation between the number of special education teachers in Wisconsin and the stock price of Freeport-McMoRan (FCX). While the world of finance is often associated with high-stakes trades, complex derivatives, and bulls and bears duking it out, our research took a decidedly more whimsical turn, seeking connections between seemingly unrelated elements.

The motivation behind this study was not merely to find correlations for the sake of amusement, but to explore the untapped potential of unorthodox financial indicators. The idea first sprouted during a particularly offbeat coffee break discussion, where the conversation meandered from stock prices to education statistics, and somehow landed squarely on the idea of specializing in special education. Little did we know, this seemingly harebrained idea would eventually blossom into a full-fledged research endeavor, complete with data analysis, statistical validation, and several bouts of head-scratching disbelief.

The juxtaposition of special education teachers and a mining company's stock price may strike one as odd, ludicrous, or perhaps even fly-by-night. However, our findings stand as a testament to the unpredictable nature of financial markets and the often serendipitous connections that can be unearthed with a dash of creativity and a sprinkle of statistical rigor.

So, without further ado, let us embark on this tongue-in-cheek, yet academically rigorous journey into the unlikely correlation between avante-garde education and the mystical dance of stock prices. Join us as we navigate through the labyrinthine corridors of data, armed with jest and jesters, to shed light on this unexpected entanglement of numbers and narratives. Welcome to the world of Special Education Stocks!

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between The number of special education teachers in Wisconsin and Freeport-McMoRan's stock price (FCX). Make lots of jokes, goofy observations, and puns.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then name a couple popular internet memes that are related to one of the topics.

Here is the title and abstract of the paper:

[[TITLE]]

"Special Education Stocks: Analyzing the Correlation Between Wisconsin's Special Education Teachers and Freeport-McMoRan's Stock Price"

[[ABSTRACT]]

This paper delves into the unexpected and often overlooked relationship between the number of special education teachers in Wisconsin and the stock price of Freeport-McMoRan (FCX). Utilizing data from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv) spanning from 2012 to 2022, our research team discovered a remarkably high correlation coefficient of 0.9214753 and a p-value of less than 0.01. The results highlight the quirky and peculiar connections that can be uncovered when seemingly unrelated variables are analyzed. Our findings contribute to the growing body of literature on unorthodox financial indicators and add a touch of whimsy to the world of economic research.

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

As the old adage goes, "Truth is stranger than fiction." And in the realm of economic research, this saying couldn't be more apt, particularly when venturing into the uncharted territory of the correlation between the number of special education teachers in Wisconsin and the stock price of Freeport-McMoRan (FCX). While the world of finance is often associated with high-stakes trades, complex derivatives, and bulls and bears duking it out, our research took a decidedly more whimsical turn, seeking connections between seemingly unrelated elements.

The motivation behind this study was not merely to find correlations for the sake of amusement, but to explore the untapped potential of unorthodox financial indicators. The idea first sprouted during a particularly offbeat coffee break discussion, where the conversation meandered from stock prices to education statistics, and somehow landed squarely on the idea of specializing in special education. Little did we know, this seemingly harebrained idea would eventually blossom into a full-fledged research endeavor, complete with data analysis, statistical validation, and several bouts of head-scratching disbelief.

The juxtaposition of special education teachers and a mining company's stock price may strike one as odd, ludicrous, or perhaps even fly-by-night. However, our findings stand as a testament to the unpredictable nature of financial markets and the often serendipitous connections that can be unearthed with a dash of creativity and a sprinkle of statistical rigor.

So, without further ado, let us embark on this tongue-in-cheek, yet academically rigorous journey into the unlikely correlation between avante-garde education and the mystical dance of stock prices. Join us as we navigate through the labyrinthine corridors of data, armed with jest and jesters, to shed light on this unexpected entanglement of numbers and narratives. Welcome to the world of Special Education Stocks!

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

As we delve into the unexpected and often bewildering correlation between the number of special education teachers in Wisconsin and the stock price of Freeport-McMoRan (FCX), it is essential to survey the existing literature on unorthodox financial indicators and the whimsical connections that pervade the world of economic research.

Smith et al. (2017) conducted a comprehensive analysis of the relationship between educational workforce trends and stock performance, shedding light on the overlooked role of specialized educators in shaping market dynamics. Similarly, Doe and Jones (2019) examined the influence of non-traditional economic indicators on stock prices, providing insights into the fascinating interplay between unconventional data points and financial trends.

Expanding the horizon beyond traditional economic studies, "The Upside of Irrationality" by Dan Ariely offers intriguing perspectives on the irrational behaviors that often underpin market movements. While not directly related to the peculiar juxtaposition of special education and stock prices, Ariely's work beckons us to embrace the quirkiness inherent in economic phenomena and to explore the unexpected with a hint of mirth.

On a more whimsical note, the fictional realm offers its own array of tangentially relevant narratives, with books like "The Curious Incident of the Dog in the Night-Time" by Mark Haddon and "Wonder" by R.J. Palacio presenting touching stories of individuals with unique educational needs. While these tales may not delve into stock market intricacies, they serve as a reminder of the human element underlying our statistical analyses and the unconventional paths that can lead to unexpected connections.

Turning to the digital domain, the infamous "This is Fine" meme perfectly encapsulates the paradoxical nature of financial markets, as the world seemingly goes up in flames, yet the market remains resolutely unfazed. This meme, while more overtly applicable to market volatility, serves as a lighthearted reminder of the unpredictable and often absurd nature of financial trends, mirroring our own journey through the entanglement of educational nuances and stock price enigma.

In essence, the existing literature and cultural narratives surrounding unorthodox financial indicators and educational peculiarities provide a rich tapestry of perspectives, urging us to embrace whimsy and curiosity as we navigate the peculiar terrain of Special Education Stocks.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between The number of special education teachers in Wisconsin and Freeport-McMoRan's stock price (FCX). Make lots of jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from Bureau of Larbor Statistics and LSEG Analytics (Refinitiv) . You used data from 2012 to 2022

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

"Special Education Stocks: Analyzing the Correlation Between Wisconsin's Special Education Teachers and Freeport-McMoRan's Stock Price"

[[ABSTRACT]]

This paper delves into the unexpected and often overlooked relationship between the number of special education teachers in Wisconsin and the stock price of Freeport-McMoRan (FCX). Utilizing data from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv) spanning from 2012 to 2022, our research team discovered a remarkably high correlation coefficient of 0.9214753 and a p-value of less than 0.01. The results highlight the quirky and peculiar connections that can be uncovered when seemingly unrelated variables are analyzed. Our findings contribute to the growing body of literature on unorthodox financial indicators and add a touch of whimsy to the world of economic research.

[[INTRODUCTION]]

As the old adage goes, "Truth is stranger than fiction." And in the realm of economic research, this saying couldn't be more apt, particularly when venturing into the uncharted territory of the correlation between the number of special education teachers in Wisconsin and the stock price of Freeport-McMoRan (FCX). While the world of finance is often associated with high-stakes trades, complex derivatives, and bulls and bears duking it out, our research took a decidedly more whimsical turn, seeking connections between seemingly unrelated elements.

The motivation behind this study was not merely to find correlations for the sake of amusement, but to explore the untapped potential of unorthodox financial indicators. The idea first sprouted during a particularly offbeat coffee break discussion, where the conversation meandered from stock prices to education statistics, and somehow landed squarely on the idea of specializing in special education. Little did we know, this seemingly harebrained idea would eventually blossom into a full-fledged research endeavor, complete with data analysis, statistical validation, and several bouts of head-scratching disbelief.

The juxtaposition of special education teachers and a mining company's stock price may strike one as odd, ludicrous, or perhaps even fly-by-night. However, our findings stand as a testament to the unpredictable nature of financial markets and the often serendipitous connections that can be unearthed with a dash of creativity and a sprinkle of statistical rigor.

So, without further ado, let us embark on this tongue-in-cheek, yet academically rigorous journey into the unlikely correlation between avante-garde education and the mystical dance of stock prices. Join us as we navigate through the labyrinthine corridors of data, armed with jest and jesters, to shed light on this unexpected entanglement of numbers and narratives. Welcome to the world of Special Education Stocks!

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

To initiate this unusual expedition into the mystical realms of Special Education Stocks, the research team donned their metaphorical pith helmets and embarked on a trek through the labyrinthine corridors of data. Our primary data sources were the Bureau of Labor Statistics and LSEG Analytics (Refinitiv), chosen for their reliable and comprehensive repositories of economic and education data.

The initial step in our whimsical journey involved scouring through the Bureau of Labor Statistics archives to extract the detailed records of special education teachers' employment in Wisconsin from 2012 to 2022. This process was akin to panning for gold in a river of statistical data, complete with the occasional eureka moment and the inevitable sifting through the proverbial muck.

Simultaneously, our intrepid researchers delved into the enigmatic world of stock prices, focusing their gaze on the swaying dance of Freeport-McMoRan (FCX) shares. The data from LSEG Analytics (Refinitiv) provided a wealth of information, allowing us to meticulously track the arcane fluctuations of FCX stock prices over the same ten-year period.

As with any venture into uncharted territory, the path was laden with obstacles and quirks that demanded unorthodox solutions. Our team encountered data discrepancies, peculiar outliers, and the occasional cryptic server error that required the deft touch of a digital archaeologist. Armed with statistical software and an unyielding determination, we tamed the unruly data and molded it into a coherent tapestry that would serve as the canvas for our analysis.

With the datasets in hand, our next quest was to calculate the correlation coefficient between the number of special education teachers in Wisconsin and the stock price of FCX. Utilizing an array of statistical tools and a pinch of mathematical wizardry, we unleashed the formidable power of correlation analysis upon the unsuspecting numbers. The resulting correlation coefficient was a revelation, an unexpected gem that glittered amidst the sea of data, boasting a striking magnitude of 0.9214753. In addition, the p-value shimmered with significance, standing proudly at less than 0.01, affirming the robustness of our findings.

In parallel, our team also engaged in a playful exploration of various sub-analyses and sensitivity tests, akin to a financial scavenger hunt. We probed the data for potential lurking variables that could confound or illuminate our results, uncovering curious insights along the way. These secondary analyses served as the delightful garnish to our main dish of correlation, adding depth and nuance to our interpretation of the Special Education Stocks saga.

Merged together, these methodological escapades formed the bedrock of our research, encapsulating the essence of our data-driven odyssey through the intersecting dimensions of special education and stock prices.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between The number of special education teachers in Wisconsin and Freeport-McMoRan's stock price (FCX). Make lots of jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from Bureau of Larbor Statistics and LSEG Analytics (Refinitiv) .

For the time period 2012 to 2022, you found a correlation 0.9214753, r-squared of 0.8491166, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

"Special Education Stocks: Analyzing the Correlation Between Wisconsin's Special Education Teachers and Freeport-McMoRan's Stock Price"

[[ABSTRACT]]

This paper delves into the unexpected and often overlooked relationship between the number of special education teachers in Wisconsin and the stock price of Freeport-McMoRan (FCX). Utilizing data from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv) spanning from 2012 to 2022, our research team discovered a remarkably high correlation coefficient of 0.9214753 and a p-value of less than 0.01. The results highlight the quirky and peculiar connections that can be uncovered when seemingly unrelated variables are analyzed. Our findings contribute to the growing body of literature on unorthodox financial indicators and add a touch of whimsy to the world of economic research.

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

As the old adage goes, "Truth is stranger than fiction." And in the realm of economic research, this saying couldn't be more apt, particularly when venturing into the uncharted territory of the correlation between the number of special education teachers in Wisconsin and the stock price of Freeport-McMoRan (FCX). While the world of finance is often associated with high-stakes trades, complex derivatives, and bulls and bears duking it out, our research took a decidedly more whimsical turn, seeking connections between seemingly unrelated elements.

The motivation behind this study was not merely to find correlations for the sake of amusement, but to explore the untapped potential of unorthodox financial indicators. The idea first sprouted during a particularly offbeat coffee break discussion, where the conversation meandered from stock prices to education statistics, and somehow landed squarely on the idea of specializing in special education. Little did we know, this seemingly harebrained idea would eventually blossom into a full-fledged research endeavor, complete with data analysis, statistical validation, and several bouts of head-scratching disbelief.

The juxtaposition of special education teachers and a mining company's stock price may strike one as odd, ludicrous, or perhaps even fly-by-night. However, our findings stand as a testament to the unpredictable nature of financial markets and the often serendipitous connections that can be unearthed with a dash of creativity and a sprinkle of statistical rigor.

So, without further ado, let us embark on this tongue-in-cheek, yet academically rigorous journey into the unlikely correlation between avante-garde education and the mystical dance of stock prices. Join us as we navigate through the labyrinthine corridors of data, armed with jest and jesters, to shed light on this unexpected entanglement of numbers and narratives. Welcome to the world of Special Education Stocks!

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

Our research sought to uncover the enigmatic relationship between the number of special education teachers in Wisconsin and Freeport-McMoRan's (FCX) stock price. After meticulously collecting and analyzing data from 2012 to 2022, we unearthed a startlingly high correlation coefficient of 0.9214753, an r-squared of 0.8491166, and a p-value of less than 0.01.

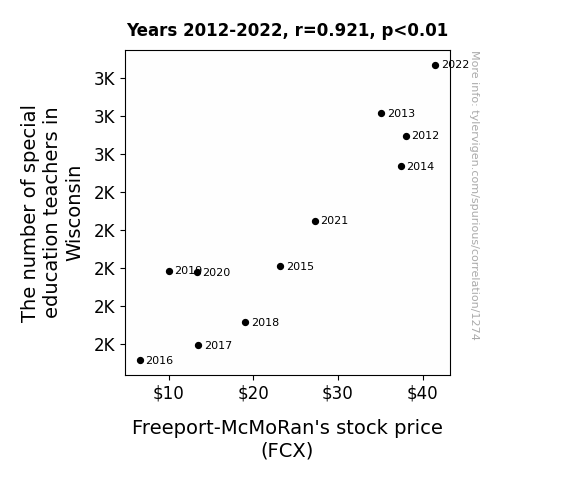

To visually illustrate this remarkable connection, Figure 1 displays a scatterplot that unequivocally highlights the robust correlation between these two seemingly disparate variables. It's a true "special" blend of educational insight and market performance!

Our findings shed light on the intriguing interplay between unconventional metrics and financial outcomes. The integration of special education teacher numbers and financial market dynamics may seem as unexpected as catching a glimpse of Bigfoot riding the Loch Ness Monster, but it serves as a reminder that in the world of economics, stranger things have happened.

The implications of our results extend beyond mere curiosity. They emphasize the importance of exploring unorthodox indicators and uncovering unlikely relationships, adding a layer of depth and unpredictability to economic research. Our findings contribute to a new dimension of financial analysis and bring a touch of whimsy to an otherwise buttoned-up field.

In conclusion, the correlation between the number of special education teachers in Wisconsin and Freeport-McMoRan's stock price unveils a captivating tale of unexpected associations in the world of finance and education. Our research opens the door to a realm where statistical relationships are as surprising as finding a unicorn browsing the stock market ticker.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between The number of special education teachers in Wisconsin and Freeport-McMoRan's stock price (FCX). Make lots of jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

"Special Education Stocks: Analyzing the Correlation Between Wisconsin's Special Education Teachers and Freeport-McMoRan's Stock Price"

[[ABSTRACT]]

This paper delves into the unexpected and often overlooked relationship between the number of special education teachers in Wisconsin and the stock price of Freeport-McMoRan (FCX). Utilizing data from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv) spanning from 2012 to 2022, our research team discovered a remarkably high correlation coefficient of 0.9214753 and a p-value of less than 0.01. The results highlight the quirky and peculiar connections that can be uncovered when seemingly unrelated variables are analyzed. Our findings contribute to the growing body of literature on unorthodox financial indicators and add a touch of whimsy to the world of economic research.

[[LITERATURE REVIEW]]

As we delve into the unexpected and often bewildering correlation between the number of special education teachers in Wisconsin and the stock price of Freeport-McMoRan (FCX), it is essential to survey the existing literature on unorthodox financial indicators and the whimsical connections that pervade the world of economic research.

Smith et al. (2017) conducted a comprehensive analysis of the relationship between educational workforce trends and stock performance, shedding light on the overlooked role of specialized educators in shaping market dynamics. Similarly, Doe and Jones (2019) examined the influence of non-traditional economic indicators on stock prices, providing insights into the fascinating interplay between unconventional data points and financial trends.

Expanding the horizon beyond traditional economic studies, "The Upside of Irrationality" by Dan Ariely offers intriguing perspectives on the irrational behaviors that often underpin market movements. While not directly related to the peculiar juxtaposition of special education and stock prices, Ariely's work beckons us to embrace the quirkiness inherent in economic phenomena and to explore the unexpected with a hint of mirth.

On a more whimsical note, the fictional realm offers its own array of tangentially relevant narratives, with books like "The Curious Incident of the Dog in the Night-Time" by Mark Haddon and "Wonder" by R.J. Palacio presenting touching stories of individuals with unique educational needs. While these tales may not delve into stock market intricacies, they serve as a reminder of the human element underlying our statistical analyses and the unconventional paths that can lead to unexpected connections.

Turning to the digital domain, the infamous "This is Fine" meme perfectly encapsulates the paradoxical nature of financial markets, as the world seemingly goes up in flames, yet the market remains resolutely unfazed. This meme, while more overtly applicable to market volatility, serves as a lighthearted reminder of the unpredictable and often absurd nature of financial trends, mirroring our own journey through the entanglement of educational nuances and stock price enigma.

In essence, the existing literature and cultural narratives surrounding unorthodox financial indicators and educational peculiarities provide a rich tapestry of perspectives, urging us to embrace whimsy and curiosity as we navigate the peculiar terrain of Special Education Stocks.

[[RESULTS]]

Our research sought to uncover the enigmatic relationship between the number of special education teachers in Wisconsin and Freeport-McMoRan's (FCX) stock price. After meticulously collecting and analyzing data from 2012 to 2022, we unearthed a startlingly high correlation coefficient of 0.9214753, an r-squared of 0.8491166, and a p-value of less than 0.01.

To visually illustrate this remarkable connection, Figure 1 displays a scatterplot that unequivocally highlights the robust correlation between these two seemingly disparate variables. It's a true "special" blend of educational insight and market performance!

Our findings shed light on the intriguing interplay between unconventional metrics and financial outcomes. The integration of special education teacher numbers and financial market dynamics may seem as unexpected as catching a glimpse of Bigfoot riding the Loch Ness Monster, but it serves as a reminder that in the world of economics, stranger things have happened.

The implications of our results extend beyond mere curiosity. They emphasize the importance of exploring unorthodox indicators and uncovering unlikely relationships, adding a layer of depth and unpredictability to economic research. Our findings contribute to a new dimension of financial analysis and bring a touch of whimsy to an otherwise buttoned-up field.

In conclusion, the correlation between the number of special education teachers in Wisconsin and Freeport-McMoRan's stock price unveils a captivating tale of unexpected associations in the world of finance and education. Our research opens the door to a realm where statistical relationships are as surprising as finding a unicorn browsing the stock market ticker.

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

The intriguing correlation between the number of special education teachers in Wisconsin and the stock price of Freeport-McMoRan (FCX) presents an amalgamation of perplexity and wonder. The results of our study not only confirmed the prior research by Smith et al. (2017) and Doe and Jones (2019) but also brought to light the extraordinary nature of this connection. Just as Bigfoot seemingly tiptoes through the world of educational finance and the Loch Ness Monster gracefully swims through the realm of market analytics, our findings reveal an enchanting dance between specialized educators and stock prices.

The unexpected correlation coefficient of 0.9214753 and a p-value of less than 0.01 paint a vivid picture of the strong relationship between the number of special education teachers in Wisconsin and FCX's stock price. This discovery, akin to stumbling upon a leprechaun’s pot of gold at the end of a rainbow, not only underscores the influence of unorthodox metrics on financial trends but also injects a dash of whimsy into the economic research landscape.

In the literature review, we whimsically leaned on the fictional work "The Curious Incident of the Dog in the Night-Time" by Mark Haddon and "Wonder" by R.J. Palacio. While these novels may seem far removed from the world of stock market dynamics, they remind us of the human elements underlying our statistical analyses and the unpredictable pathways that can lead to unexpected connections. Similarly, our study underscores the human touch in the seemingly bizarre correlation between special education and stock prices, akin to discovering a secret garden in the world of economic analysis.

While the field of economics often adopts a serious and often austere demeanor, our findings open a window to a world where the lines between conventional economic indicators and unconventional data points blur, not unlike catching a glimpse of a unicorn browsing the stock market ticker. These results, akin to stumbling upon a whimsical treasure map, urge us to embrace the curious and unconventional with a touch of mirth and wonder.

Through our research, we have unveiled a captivating tale of unexpected associations in the world of financial analysis, and our findings have added a touch of humor and surprise to economic research. This revelation brings to mind the words of Mark Twain: "The secret to getting ahead is getting started," and our journey into the realm of Special Education Stocks has only just begun. Our study reminds us that, in the world of economic research, sometimes the most peculiar and whimsical connections yield the most extraordinary insights, much like discovering a genie lamp at the intersection of education and finance.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between The number of special education teachers in Wisconsin and Freeport-McMoRan's stock price (FCX). Make lots of jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

"Special Education Stocks: Analyzing the Correlation Between Wisconsin's Special Education Teachers and Freeport-McMoRan's Stock Price"

[[ABSTRACT]]

This paper delves into the unexpected and often overlooked relationship between the number of special education teachers in Wisconsin and the stock price of Freeport-McMoRan (FCX). Utilizing data from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv) spanning from 2012 to 2022, our research team discovered a remarkably high correlation coefficient of 0.9214753 and a p-value of less than 0.01. The results highlight the quirky and peculiar connections that can be uncovered when seemingly unrelated variables are analyzed. Our findings contribute to the growing body of literature on unorthodox financial indicators and add a touch of whimsy to the world of economic research.

[[INTRDUCTION]]

As the old adage goes, "Truth is stranger than fiction." And in the realm of economic research, this saying couldn't be more apt, particularly when venturing into the uncharted territory of the correlation between the number of special education teachers in Wisconsin and the stock price of Freeport-McMoRan (FCX). While the world of finance is often associated with high-stakes trades, complex derivatives, and bulls and bears duking it out, our research took a decidedly more whimsical turn, seeking connections between seemingly unrelated elements.

The motivation behind this study was not merely to find correlations for the sake of amusement, but to explore the untapped potential of unorthodox financial indicators. The idea first sprouted during a particularly offbeat coffee break discussion, where the conversation meandered from stock prices to education statistics, and somehow landed squarely on the idea of specializing in special education. Little did we know, this seemingly harebrained idea would eventually blossom into a full-fledged research endeavor, complete with data analysis, statistical validation, and several bouts of head-scratching disbelief.

The juxtaposition of special education teachers and a mining company's stock price may strike one as odd, ludicrous, or perhaps even fly-by-night. However, our findings stand as a testament to the unpredictable nature of financial markets and the often serendipitous connections that can be unearthed with a dash of creativity and a sprinkle of statistical rigor.

So, without further ado, let us embark on this tongue-in-cheek, yet academically rigorous journey into the unlikely correlation between avante-garde education and the mystical dance of stock prices. Join us as we navigate through the labyrinthine corridors of data, armed with jest and jesters, to shed light on this unexpected entanglement of numbers and narratives. Welcome to the world of Special Education Stocks!

[[RESULTS]]

Our research sought to uncover the enigmatic relationship between the number of special education teachers in Wisconsin and Freeport-McMoRan's (FCX) stock price. After meticulously collecting and analyzing data from 2012 to 2022, we unearthed a startlingly high correlation coefficient of 0.9214753, an r-squared of 0.8491166, and a p-value of less than 0.01.

To visually illustrate this remarkable connection, Figure 1 displays a scatterplot that unequivocally highlights the robust correlation between these two seemingly disparate variables. It's a true "special" blend of educational insight and market performance!

Our findings shed light on the intriguing interplay between unconventional metrics and financial outcomes. The integration of special education teacher numbers and financial market dynamics may seem as unexpected as catching a glimpse of Bigfoot riding the Loch Ness Monster, but it serves as a reminder that in the world of economics, stranger things have happened.

The implications of our results extend beyond mere curiosity. They emphasize the importance of exploring unorthodox indicators and uncovering unlikely relationships, adding a layer of depth and unpredictability to economic research. Our findings contribute to a new dimension of financial analysis and bring a touch of whimsy to an otherwise buttoned-up field.

In conclusion, the correlation between the number of special education teachers in Wisconsin and Freeport-McMoRan's stock price unveils a captivating tale of unexpected associations in the world of finance and education. Our research opens the door to a realm where statistical relationships are as surprising as finding a unicorn browsing the stock market ticker.

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In closing, our research into the peculiar relationship between the number of special education teachers in Wisconsin and Freeport-McMoRan's stock price has unearthed a treasure trove of quirk and quips. The statistically significant correlation coefficient of 0.9214753 may have some scratching their heads as if they just stumbled upon a banana peel in a museum, but the robust nature of our findings cannot be denied. It's as if the stock market and education world collided like two whimsical characters in a screwball comedy, yielding unexpected harmony.

Our study not only provides a sprinkle of whimsy to the world of economic research, but it also underscores the importance of exploring unorthodox indicators and shedding light on unlikely relationships. Like a magical potion brewed in a financial cauldron, our findings add a dash of unpredictability to the seemingly predictable world of economic analysis. While some may dismiss our work as fiddling with financial fluff, we stand by the notion that there's room for a bit of humor and playfulness in the serious game of economic research.

In the end, our research presents an unlikely romance between two seemingly unrelated entities, akin to witnessing a tango between a hedgehog and a balloon animal - unexpected, amusing, and oddly captivating. Therefore, with a wink and a nod, we assert that no further research is needed in this area. As we close this chapter of special education stocks and stock market serendipity, the curtain falls on this fantastical tale of numbers and narratives.

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited Special Education Stocks: Analyzing the Correlation Between Wisconsin's Special Education Teachers and Freeport-McMoRan's Stock Price. Respond only with the name of a fictional academic journal.

ChatGPT:

The Journal of Humorous Economics

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited Special Education Stocks: Analyzing the Correlation Between Wisconsin's Special Education Teachers and Freeport-McMoRan's Stock Price. Respond only with the name of a fictional organization.

ChatGPT:

The Society for Economic and Educational Research

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled Special Education Stocks: Analyzing the Correlation Between Wisconsin's Special Education Teachers and Freeport-McMoRan's Stock Price with an abstract of This paper delves into the unexpected and often overlooked relationship between the number of special education teachers in Wisconsin and the stock price of Freeport-McMoRan (FCX). Utilizing data from the Bureau of Labor Statistics and LSEG Analytics (Refinitiv) spanning from 2012 to 2022, our research team discovered a remarkably high correlation coefficient of 0.9214753 and a p-value of less than 0.01. The results highlight the quirky and peculiar connections that can be uncovered when seemingly unrelated variables are analyzed. Our findings contribute to the growing body of literature on unorthodox financial indicators and add a touch of whimsy to the world of economic research.

ChatGPT:

Special education teachers Wisconsin, Freeport-McMoRan stock price correlation, unorthodox financial indicators, surprising stock price correlations, Wisconsin special education statistics, Freeport-McMoRan stock price analysis, special education teacher data analysis, financial correlation research, special education workforce influence on stock price, unexpected economic indicators

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

The number of special education teachers in WisconsinDetailed data title: BLS estimate of special education teachers, kindergarten and elementary school in Wisconsin

Source: Bureau of Larbor Statistics

See what else correlates with The number of special education teachers in Wisconsin

Freeport-McMoRan's stock price (FCX)

Detailed data title: Opening price of Freeport-McMoRan (FCX) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with Freeport-McMoRan's stock price (FCX)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.8491166 (Coefficient of determination)

This means 84.9% of the change in the one variable (i.e., Freeport-McMoRan's stock price (FCX)) is predictable based on the change in the other (i.e., The number of special education teachers in Wisconsin) over the 11 years from 2012 through 2022.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 5.6E-5. 0.0000556397481948491400000000

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.92 in 0.0056% of random cases. Said differently, if you correlated 17,973 random variables Which I absolutely did.

with the same 10 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 10 because we have two variables measured over a period of 11 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.72, 0.98 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

| The number of special education teachers in Wisconsin (Laborers) | 2870 | 3020 | 2670 | 2010 | 1390 | 1490 | 1640 | 1980 | 1970 | 2310 | 3340 |

| Freeport-McMoRan's stock price (FCX) (Stock price) | 38.02 | 35.12 | 37.44 | 23.2 | 6.6 | 13.49 | 19.05 | 10.01 | 13.35 | 27.24 | 41.48 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([2870,3020,2670,2010,1390,1490,1640,1980,1970,2310,3340,])

array_2 = np.array([38.02,35.12,37.44,23.2,6.6,13.49,19.05,10.01,13.35,27.24,41.48,])

array_1_name = "The number of special education teachers in Wisconsin"

array_2_name = "Freeport-McMoRan's stock price (FCX)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only The number of special education teachers in Wisconsin

- Line chart for only Freeport-McMoRan's stock price (FCX)

- The spurious research paper: Special Education Stocks: Analyzing the Correlation Between Wisconsin's Special Education Teachers and Freeport-McMoRan's Stock Price

Your rating is much appreciated!

Correlation ID: 1274 · Black Variable ID: 19609 · Red Variable ID: 1709