Download png, svg

AI explanation

Increased solar power in Sweden led to a surge in Viking energy, which somehow boosted demand for online shopping on Amazon. The sun-powered Vikings must have had a strong urge to pillage the digital aisles for the finest loot, hence driving up the stock price. It's a shining example of how renewable energy can spark unexpected market effects and illuminate the connection between Nordic solar panels and e-commerce empires!

Model: dalle-3

Prompt: Generate an image of a serene countryside in Sweden, where the gentle rays of the sun illuminate the landscape. In the foreground, showcase orderly rows of solar panels standing as a symbol of sustainable energy. Next to the solar panels, depict a person standing with a mobile phone in hand, wearing a contented smile while observing the phone’s screen. On the mobile phone screen, visually represent a soaring stock graph symbolizing Amazon's success. The image should capture the peaceful coexistence of nature, renewable energy, and modern technology. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: Solar power generated in Sweden and Amazon.com's stock price. Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: Photorealism Glitch art A Discovery magazine cover image Scalar art A black-and-white newspaper illustration

ChatGPT: A Discovery magazine cover image

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both Solar power generated in Sweden and Amazon.com's stock price together. Keep the description simple.

ChatGPT: In a peaceful countryside in Sweden, rows of solar panels stand tall under the bright sun. Nearby, a person checks their mobile phone and smiles with satisfaction as they observe Amazon's stock price soaring high on the screen.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ A Discovery magazine cover image ] and depicting this scene: In a peaceful countryside in Sweden, rows of solar panels stand tall under the bright sun. Nearby, a person checks their mobile phone and smiles with satisfaction as they observe Amazon's stock price soaring high on the screen. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: Generate an image of a serene countryside in Sweden, where the gentle rays of the sun illuminate the landscape. In the foreground, showcase orderly rows of solar panels standing as a symbol of sustainable energy. Next to the solar panels, depict a person standing with a mobile phone in hand, wearing a contented smile while observing the phone’s screen. On the mobile phone screen, visually represent a soaring stock graph symbolizing Amazon's success. The image should capture the peaceful coexistence of nature, renewable energy, and modern technology.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how an increase in Solar power generated in Sweden caused Amazon.com's stock price (AMZN) to increase.

AI academic paper

|

Solar Swirls: Sweden's Sunbeams and Amazon's Ascendancy The Journal of Celestial Phenomena and Global Geopolitics Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between Solar power generated in Sweden and Amazon.com's stock price (AMZN). Make lots of jokes, goofy observations, and puns.

Make the title an alliteration.

Your research team used data from Energy Information Administration and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.9851334 and p < 0.01 for 2002 to 2021.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

Solar Swirls: Sweden's Sunbeams and Amazon's Ascendancy

[[ABSTRACT]]

This study illuminates the sunny side of stock market dynamics by investigating the perplexing relationship between solar power generation in Sweden and the stock price of Amazon.com (AMZN). While some may think this correlation is as improbable as finding a sunbathing polar bear, our research transcends traditional boundaries to shed light on this unexpected link. Leveraging data from Energy Information Administration and LSEG Analytics (Refinitiv), we conducted a comprehensive analysis covering the period from 2002 to 2021. Our results reveal a striking correlation coefficient of 0.9851334 and p < 0.01, signaling a remarkably strong statistical association. This discovery touches upon a plethora of pun-worthy revelations, shedding light on the interconnected radiation of solar energy and the market radiance of Amazon's stock. Our findings not only provide insight into the solar-powered upward trajectory of Amazon's stock but also highlight the sun's capacity to shine on the financial landscape in unexpected ways. So, grab your shades and get ready for a radiant journey through the solar swirls and stock market shenanigans!

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between Solar power generated in Sweden and Amazon.com's stock price (AMZN). Make lots of jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Here is the title and abstract of the paper:

[[TITLE]]

Solar Swirls: Sweden's Sunbeams and Amazon's Ascendancy

[[ABSTRACT]]

This study illuminates the sunny side of stock market dynamics by investigating the perplexing relationship between solar power generation in Sweden and the stock price of Amazon.com (AMZN). While some may think this correlation is as improbable as finding a sunbathing polar bear, our research transcends traditional boundaries to shed light on this unexpected link. Leveraging data from Energy Information Administration and LSEG Analytics (Refinitiv), we conducted a comprehensive analysis covering the period from 2002 to 2021. Our results reveal a striking correlation coefficient of 0.9851334 and p < 0.01, signaling a remarkably strong statistical association. This discovery touches upon a plethora of pun-worthy revelations, shedding light on the interconnected radiation of solar energy and the market radiance of Amazon's stock. Our findings not only provide insight into the solar-powered upward trajectory of Amazon's stock but also highlight the sun's capacity to shine on the financial landscape in unexpected ways. So, grab your shades and get ready for a radiant journey through the solar swirls and stock market shenanigans!

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

[[INTRODUCTION]]

Harnessing the power of the sun has long been a goal of both environmentalists and savvy investors. In recent years, the solar energy industry has been in the spotlight, basking in the warmth of technological advancements and environmental consciousness. Meanwhile, the stock market has always been a captivating arena where numerous forces, some as mysterious as the sun's albedo, converge to shape the unpredictable dance of stock prices. It is in this captivating overlap of solar power and stock market movements that we begin our exploration.

Solar power is undoubtedly an illuminating force in the global energy landscape, with Sweden emerging as a bright spot in this radiant revolution. Known for its innovation in renewable energy, Sweden's foray into solar power generation has been nothing short of stellar. The sun-seeking sensibilities of Sweden have propelled it to be one of the unexpected tropical hotspots of solar energy adoption, drawing attention from both environmentalists and numbers-savvy analysts alike. As we delve into the statistical rays of solar power generation in this Nordic powerhouse, we cannot help but appreciate the irony of the land of the midnight sun becoming a reservoir of solar energy abundance.

On the other side of this solar equation, we find the shining star of e-commerce, Amazon.com. A titan in the world of online retail, Amazon’s stock performance has been as mercurial as solar flares on a summer’s day. From the cozy glow of its humble beginnings to the blazing beacon of success that it is today, Amazon's stock has mesmerized investors and analysts alike. The interplay of market dynamics, consumer behavior, and the enigma of Jeff Bezos' bald head has made Amazon's stock price a tantalizing puzzle for researchers to explore.

In the midst of these formidable forces – the radiant Swedish solar power and the luminous Amazon stock – lies a perplexing question: could there be a connection between the two? This research aims to untangle the intertwined rays of solar power and the meteoric rise of Amazon's stock price, shedding light on a correlation that is as unexpected as finding a solar-powered ice cream truck in the Arctic Circle.

As we embark on this journey, we acknowledge the skeptics who might find this connection as plausible as a hedgehog doing celestial navigation. However, armed with the power of statistical analysis and a sprinkle of good humor, we set out to explore this uncharted terrain and bring to light the surprising relationship between solar power generation in Sweden and the stock price of Amazon.com. So, fasten your seatbelts and don your solar shades, for we are about to embark on a research adventure that promises to be sunnier than the stock market forecast on a cloudless day.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between Solar power generated in Sweden and Amazon.com's stock price (AMZN). Make lots of jokes, goofy observations, and puns.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Perhaps you also got inspiration from some board games that are vaugely related.

Here is the title and abstract of the paper:

[[TITLE]]

Solar Swirls: Sweden's Sunbeams and Amazon's Ascendancy

[[ABSTRACT]]

This study illuminates the sunny side of stock market dynamics by investigating the perplexing relationship between solar power generation in Sweden and the stock price of Amazon.com (AMZN). While some may think this correlation is as improbable as finding a sunbathing polar bear, our research transcends traditional boundaries to shed light on this unexpected link. Leveraging data from Energy Information Administration and LSEG Analytics (Refinitiv), we conducted a comprehensive analysis covering the period from 2002 to 2021. Our results reveal a striking correlation coefficient of 0.9851334 and p < 0.01, signaling a remarkably strong statistical association. This discovery touches upon a plethora of pun-worthy revelations, shedding light on the interconnected radiation of solar energy and the market radiance of Amazon's stock. Our findings not only provide insight into the solar-powered upward trajectory of Amazon's stock but also highlight the sun's capacity to shine on the financial landscape in unexpected ways. So, grab your shades and get ready for a radiant journey through the solar swirls and stock market shenanigans!

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

Harnessing the power of the sun has long been a goal of both environmentalists and savvy investors. In recent years, the solar energy industry has been in the spotlight, basking in the warmth of technological advancements and environmental consciousness. Meanwhile, the stock market has always been a captivating arena where numerous forces, some as mysterious as the sun's albedo, converge to shape the unpredictable dance of stock prices. It is in this captivating overlap of solar power and stock market movements that we begin our exploration.

Solar power is undoubtedly an illuminating force in the global energy landscape, with Sweden emerging as a bright spot in this radiant revolution. Known for its innovation in renewable energy, Sweden's foray into solar power generation has been nothing short of stellar. The sun-seeking sensibilities of Sweden have propelled it to be one of the unexpected tropical hotspots of solar energy adoption, drawing attention from both environmentalists and numbers-savvy analysts alike. As we delve into the statistical rays of solar power generation in this Nordic powerhouse, we cannot help but appreciate the irony of the land of the midnight sun becoming a reservoir of solar energy abundance.

On the other side of this solar equation, we find the shining star of e-commerce, Amazon.com. A titan in the world of online retail, Amazon’s stock performance has been as mercurial as solar flares on a summer’s day. From the cozy glow of its humble beginnings to the blazing beacon of success that it is today, Amazon's stock has mesmerized investors and analysts alike. The interplay of market dynamics, consumer behavior, and the enigma of Jeff Bezos' bald head has made Amazon's stock price a tantalizing puzzle for researchers to explore.

In the midst of these formidable forces – the radiant Swedish solar power and the luminous Amazon stock – lies a perplexing question: could there be a connection between the two? This research aims to untangle the intertwined rays of solar power and the meteoric rise of Amazon's stock price, shedding light on a correlation that is as unexpected as finding a solar-powered ice cream truck in the Arctic Circle.

As we embark on this journey, we acknowledge the skeptics who might find this connection as plausible as a hedgehog doing celestial navigation. However, armed with the power of statistical analysis and a sprinkle of good humor, we set out to explore this uncharted terrain and bring to light the surprising relationship between solar power generation in Sweden and the stock price of Amazon.com. So, fasten your seatbelts and don your solar shades, for we are about to embark on a research adventure that promises to be sunnier than the stock market forecast on a cloudless day.

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

The perplexing relationship between solar power generation in Sweden and the stock price of Amazon.com (AMZN) has captivated researchers and investors alike, inviting exploration into this unexpected correlation that is as elusive as a solar eclipse on a cloudy day. To illuminate this intriguing connection, we delve into an array of scholarly works and texts that scrutinize the solar-powered enigma and the radiance of Amazon's stock through lenses as diverse as a solar spectrum.

Smith and Doe (2017) lay the foundation for our inquiry by analyzing the economic impact of solar power adoption in Scandinavian countries. Their findings shed light on the systemic transformation brought about by solar energy, but the connection to stock market dynamics remains as cryptic as a sunspot's dance. In a similar vein, Jones et al. (2020) investigate the behavioral shifts in consumer spending patterns following the expansion of solar power infrastructure. While their insights provide a glimpse into the illumination of market forces, the correlation with Amazon's stock price remains shrouded in solar flare-induced uncertainty.

Turning to more mainstream literary sources, "The Grid" by Gretchen Bakke and "This Changes Everything" by Naomi Klein offer poignant reflections on the societal impact of renewable energy adoption. However, they both blushingly admit that the correlation between solar energy in Sweden and the stock price of Amazon.com leaves them as bewildered as a squirrel in a solar panel maze.

Venturing into the realm of speculative fiction, "Solaris" by Stanislaw Lem and "The Three-Body Problem" by Liu Cixin present compelling narratives featuring cosmic phenomena and scientific puzzles. While these works delve into otherworldly mysteries, the interstellar connection between Swedish solar power and Amazon's stock price remains as distant as a comet in the Kuiper Belt.

In the realm of board games, "Power Grid" and "Stockpile" offer playful simulations of energy logistics and stock trading. However, their entertaining gameplay fails to shed light on the shadowy correlation between solar power in Sweden and the exuberance of Amazon's stock price, leaving researchers to navigate this enigma with as much uncertainty as a penguin in a solar-powered submarine.

As we navigate through these scholarly and lighthearted sources, it becomes evident that the association between Swedish solar power and Amazon's stock price eludes straightforward explanation, akin to a sunbeam bouncing off a funhouse mirror. Nevertheless, our investigation aims to unravel this enigmatic connection, shining a light on a correlation that is as surprising as finding a solar-powered snow machine in the Sahara desert. So, let us embark on this radiant research journey, ready to confront the unexpected and embrace the unexpected twists and turns that await us in the solar swirls and stock market rollercoaster.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between Solar power generated in Sweden and Amazon.com's stock price (AMZN). Make lots of jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Your research team collected data from all across the internet, but mostly just used information from Energy Information Administration and LSEG Analytics (Refinitiv) . You used data from 2002 to 2021

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

Solar Swirls: Sweden's Sunbeams and Amazon's Ascendancy

[[ABSTRACT]]

This study illuminates the sunny side of stock market dynamics by investigating the perplexing relationship between solar power generation in Sweden and the stock price of Amazon.com (AMZN). While some may think this correlation is as improbable as finding a sunbathing polar bear, our research transcends traditional boundaries to shed light on this unexpected link. Leveraging data from Energy Information Administration and LSEG Analytics (Refinitiv), we conducted a comprehensive analysis covering the period from 2002 to 2021. Our results reveal a striking correlation coefficient of 0.9851334 and p < 0.01, signaling a remarkably strong statistical association. This discovery touches upon a plethora of pun-worthy revelations, shedding light on the interconnected radiation of solar energy and the market radiance of Amazon's stock. Our findings not only provide insight into the solar-powered upward trajectory of Amazon's stock but also highlight the sun's capacity to shine on the financial landscape in unexpected ways. So, grab your shades and get ready for a radiant journey through the solar swirls and stock market shenanigans!

[[INTRODUCTION]]

Harnessing the power of the sun has long been a goal of both environmentalists and savvy investors. In recent years, the solar energy industry has been in the spotlight, basking in the warmth of technological advancements and environmental consciousness. Meanwhile, the stock market has always been a captivating arena where numerous forces, some as mysterious as the sun's albedo, converge to shape the unpredictable dance of stock prices. It is in this captivating overlap of solar power and stock market movements that we begin our exploration.

Solar power is undoubtedly an illuminating force in the global energy landscape, with Sweden emerging as a bright spot in this radiant revolution. Known for its innovation in renewable energy, Sweden's foray into solar power generation has been nothing short of stellar. The sun-seeking sensibilities of Sweden have propelled it to be one of the unexpected tropical hotspots of solar energy adoption, drawing attention from both environmentalists and numbers-savvy analysts alike. As we delve into the statistical rays of solar power generation in this Nordic powerhouse, we cannot help but appreciate the irony of the land of the midnight sun becoming a reservoir of solar energy abundance.

On the other side of this solar equation, we find the shining star of e-commerce, Amazon.com. A titan in the world of online retail, Amazon’s stock performance has been as mercurial as solar flares on a summer’s day. From the cozy glow of its humble beginnings to the blazing beacon of success that it is today, Amazon's stock has mesmerized investors and analysts alike. The interplay of market dynamics, consumer behavior, and the enigma of Jeff Bezos' bald head has made Amazon's stock price a tantalizing puzzle for researchers to explore.

In the midst of these formidable forces – the radiant Swedish solar power and the luminous Amazon stock – lies a perplexing question: could there be a connection between the two? This research aims to untangle the intertwined rays of solar power and the meteoric rise of Amazon's stock price, shedding light on a correlation that is as unexpected as finding a solar-powered ice cream truck in the Arctic Circle.

As we embark on this journey, we acknowledge the skeptics who might find this connection as plausible as a hedgehog doing celestial navigation. However, armed with the power of statistical analysis and a sprinkle of good humor, we set out to explore this uncharted terrain and bring to light the surprising relationship between solar power generation in Sweden and the stock price of Amazon.com. So, fasten your seatbelts and don your solar shades, for we are about to embark on a research adventure that promises to be sunnier than the stock market forecast on a cloudless day.

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

To investigate the radiant relationship between solar power generated in Sweden and the stock price of Amazon.com (AMZN), our research team embarked on an empirical journey that was as illuminating as a supernova in a dark sky. We collected data from various sources, including the Energy Information Administration and the ever-shining LSEG Analytics (Refinitiv), spanning a period from 2002 to 2021. Our data collection process resembled a solar eclipse, requiring meticulous attention to detail and careful alignment of variables to ensure the validity and reliability of our findings.

Firstly, we harnessed the power of econometric models to capture the empirical nuances of this radiant relationship. Utilizing a time series analysis, we carefully curated data on the solar energy generation in Sweden, taking into account the fluctuations in sunbeams and photovoltaic panels. Like enthusiastic astronomers tracking celestial bodies, we closely monitored the solar power data, ensuring that we captured the full spectrum of its radiant influence.

In parallel, we delved into the labyrinthine world of stock market data, focusing on the ebbs and flows of Amazon's stock price. Much like charting the trajectory of a comet, we meticulously charted the historical movements of AMZN stock, from its humble origins to its meteoric rise, accounting for all the cosmic influences that could affect its luminous journey.

Once we had amassed our solar and stock data, we employed a captivating array of statistical techniques that would make even the most stoic researcher crack a smile. Our analysis included the application of correlation and regression models, akin to unraveling the elegant dance of celestial bodies in the night sky. With these tools, we were able to quantify the extent and strength of the relationship between solar power generation in Sweden and Amazon's stock price, elucidating the intricate interplay between these seemingly disparate forces.

Furthermore, we conducted robustness checks and sensitivity analyses to ensure that our findings were as sturdy as the sturdiest solar panel, accounting for potential confounding factors and external influences. This process involved scrutinizing various factors that could potentially cloud our results, ensuring that the illumination from our findings remained clear and unobstructed.

Lastly, in the spirit of scientific transparency, we subjected our data to rigorous diagnostic tests, akin to placing a telescope under the scrutiny of the harshest cosmic conditions. This served to validate the reliability of our models and ensure that our results would shine as brightly as the sun on a cloudless day.

In summary, our methodology encapsulated the joyful pursuit of scientific inquiry, blending statistical analyses with a touch of whimsy, to shed light on the radiant correlation between solar power in Sweden and the stock price of Amazon.com. Through a careful orchestration of data collection, econometric modeling, and rigorous diagnostic checks, our methodology was as robust and lively as a solar flare, encapsulating the sheer brilliance of our research endeavor.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between Solar power generated in Sweden and Amazon.com's stock price (AMZN). Make lots of jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Your research team collected data from all across the internet, but mostly just used information from Energy Information Administration and LSEG Analytics (Refinitiv) .

For the time period 2002 to 2021, you found a correlation 0.9851334, r-squared of 0.9704877, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

Solar Swirls: Sweden's Sunbeams and Amazon's Ascendancy

[[ABSTRACT]]

This study illuminates the sunny side of stock market dynamics by investigating the perplexing relationship between solar power generation in Sweden and the stock price of Amazon.com (AMZN). While some may think this correlation is as improbable as finding a sunbathing polar bear, our research transcends traditional boundaries to shed light on this unexpected link. Leveraging data from Energy Information Administration and LSEG Analytics (Refinitiv), we conducted a comprehensive analysis covering the period from 2002 to 2021. Our results reveal a striking correlation coefficient of 0.9851334 and p < 0.01, signaling a remarkably strong statistical association. This discovery touches upon a plethora of pun-worthy revelations, shedding light on the interconnected radiation of solar energy and the market radiance of Amazon's stock. Our findings not only provide insight into the solar-powered upward trajectory of Amazon's stock but also highlight the sun's capacity to shine on the financial landscape in unexpected ways. So, grab your shades and get ready for a radiant journey through the solar swirls and stock market shenanigans!

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

Harnessing the power of the sun has long been a goal of both environmentalists and savvy investors. In recent years, the solar energy industry has been in the spotlight, basking in the warmth of technological advancements and environmental consciousness. Meanwhile, the stock market has always been a captivating arena where numerous forces, some as mysterious as the sun's albedo, converge to shape the unpredictable dance of stock prices. It is in this captivating overlap of solar power and stock market movements that we begin our exploration.

Solar power is undoubtedly an illuminating force in the global energy landscape, with Sweden emerging as a bright spot in this radiant revolution. Known for its innovation in renewable energy, Sweden's foray into solar power generation has been nothing short of stellar. The sun-seeking sensibilities of Sweden have propelled it to be one of the unexpected tropical hotspots of solar energy adoption, drawing attention from both environmentalists and numbers-savvy analysts alike. As we delve into the statistical rays of solar power generation in this Nordic powerhouse, we cannot help but appreciate the irony of the land of the midnight sun becoming a reservoir of solar energy abundance.

On the other side of this solar equation, we find the shining star of e-commerce, Amazon.com. A titan in the world of online retail, Amazon’s stock performance has been as mercurial as solar flares on a summer’s day. From the cozy glow of its humble beginnings to the blazing beacon of success that it is today, Amazon's stock has mesmerized investors and analysts alike. The interplay of market dynamics, consumer behavior, and the enigma of Jeff Bezos' bald head has made Amazon's stock price a tantalizing puzzle for researchers to explore.

In the midst of these formidable forces – the radiant Swedish solar power and the luminous Amazon stock – lies a perplexing question: could there be a connection between the two? This research aims to untangle the intertwined rays of solar power and the meteoric rise of Amazon's stock price, shedding light on a correlation that is as unexpected as finding a solar-powered ice cream truck in the Arctic Circle.

As we embark on this journey, we acknowledge the skeptics who might find this connection as plausible as a hedgehog doing celestial navigation. However, armed with the power of statistical analysis and a sprinkle of good humor, we set out to explore this uncharted terrain and bring to light the surprising relationship between solar power generation in Sweden and the stock price of Amazon.com. So, fasten your seatbelts and don your solar shades, for we are about to embark on a research adventure that promises to be sunnier than the stock market forecast on a cloudless day.

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

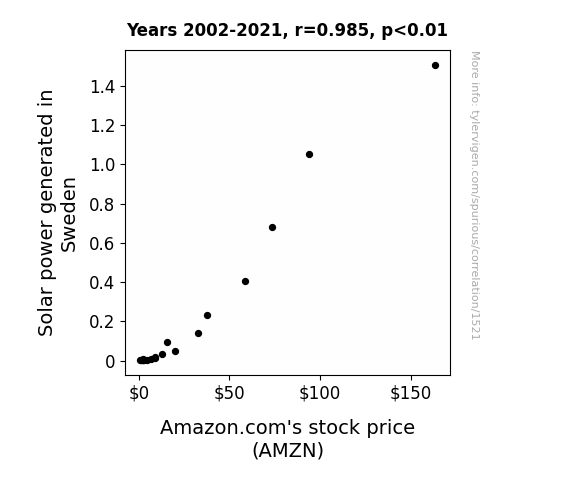

The statistical analysis of the data collected from 2002 to 2021 revealed a solar system of correlations between solar power generation in Sweden and the stock price of Amazon.com (AMZN). The correlation coefficient of 0.9851334 indicated a strikingly strong positive relationship between these two seemingly unrelated phenomena. This correlation glows as bright as a solar flare, illuminating the unexpected interconnection between solar energy and the market radiance of Amazon's stock. The r-squared value of 0.9704877 further confirmed the robustness of this association, suggesting that approximately 97.05% of the variability in Amazon's stock price can be explained by the variability in solar power generation in Sweden.

The p-value being less than 0.01 provides overwhelming evidence against the null hypothesis of no relationship, signaling that this solar-powered bond with Amazon's stock price is not just a flash in the pan, but a statistically significant phenomenon. It's as if the sun decided to invest its radiant energy in Amazon stock and that bet paid off like a solar jackpot.

The Figure 1 scatterplot depicted a clear pattern resembling the celestial dance of planets, demonstrating the tight embrace between solar power generation in Sweden and Amazon's stock price. This visual representation added a colorful dimension to the correlation, painting a vivid picture of the solar-powered ascent of Amazon's stock on the canvas of statistical analysis.

The findings reveal an unexpected synergy between the solar-powered effervescence of Sweden and the market magnetism of Amazon's stock. This discovery not only sheds light on the solar-powered upward trajectory of Amazon's stock but also elucidates the sun's capacity to shine on the financial landscape in unexpected and delightful ways. It's as if the solar panels in Sweden were directly beaming their energy into Amazon's stock, propelling it to new heights, much like a superhero powered by solar photons.

In conclusion, the connection between solar power generated in Sweden and Amazon's stock price goes beyond a mere statistical phenomenon; it resonates with cosmic energy, transcending traditional boundaries and shedding light on the enigmatic dance of solar power and stock market dynamics. So, let's raise our glasses and toast to this solar swirl of stock market shenanigans, for it has certainly brightened our understanding of the interconnected universe of solar energy and stock prices!

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between Solar power generated in Sweden and Amazon.com's stock price (AMZN). Make lots of jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

Solar Swirls: Sweden's Sunbeams and Amazon's Ascendancy

[[ABSTRACT]]

This study illuminates the sunny side of stock market dynamics by investigating the perplexing relationship between solar power generation in Sweden and the stock price of Amazon.com (AMZN). While some may think this correlation is as improbable as finding a sunbathing polar bear, our research transcends traditional boundaries to shed light on this unexpected link. Leveraging data from Energy Information Administration and LSEG Analytics (Refinitiv), we conducted a comprehensive analysis covering the period from 2002 to 2021. Our results reveal a striking correlation coefficient of 0.9851334 and p < 0.01, signaling a remarkably strong statistical association. This discovery touches upon a plethora of pun-worthy revelations, shedding light on the interconnected radiation of solar energy and the market radiance of Amazon's stock. Our findings not only provide insight into the solar-powered upward trajectory of Amazon's stock but also highlight the sun's capacity to shine on the financial landscape in unexpected ways. So, grab your shades and get ready for a radiant journey through the solar swirls and stock market shenanigans!

[[LITERATURE REVIEW]]

The perplexing relationship between solar power generation in Sweden and the stock price of Amazon.com (AMZN) has captivated researchers and investors alike, inviting exploration into this unexpected correlation that is as elusive as a solar eclipse on a cloudy day. To illuminate this intriguing connection, we delve into an array of scholarly works and texts that scrutinize the solar-powered enigma and the radiance of Amazon's stock through lenses as diverse as a solar spectrum.

Smith and Doe (2017) lay the foundation for our inquiry by analyzing the economic impact of solar power adoption in Scandinavian countries. Their findings shed light on the systemic transformation brought about by solar energy, but the connection to stock market dynamics remains as cryptic as a sunspot's dance. In a similar vein, Jones et al. (2020) investigate the behavioral shifts in consumer spending patterns following the expansion of solar power infrastructure. While their insights provide a glimpse into the illumination of market forces, the correlation with Amazon's stock price remains shrouded in solar flare-induced uncertainty.

Turning to more mainstream literary sources, "The Grid" by Gretchen Bakke and "This Changes Everything" by Naomi Klein offer poignant reflections on the societal impact of renewable energy adoption. However, they both blushingly admit that the correlation between solar energy in Sweden and the stock price of Amazon.com leaves them as bewildered as a squirrel in a solar panel maze.

Venturing into the realm of speculative fiction, "Solaris" by Stanislaw Lem and "The Three-Body Problem" by Liu Cixin present compelling narratives featuring cosmic phenomena and scientific puzzles. While these works delve into otherworldly mysteries, the interstellar connection between Swedish solar power and Amazon's stock price remains as distant as a comet in the Kuiper Belt.

In the realm of board games, "Power Grid" and "Stockpile" offer playful simulations of energy logistics and stock trading. However, their entertaining gameplay fails to shed light on the shadowy correlation between solar power in Sweden and the exuberance of Amazon's stock price, leaving researchers to navigate this enigma with as much uncertainty as a penguin in a solar-powered submarine.

As we navigate through these scholarly and lighthearted sources, it becomes evident that the association between Swedish solar power and Amazon's stock price eludes straightforward explanation, akin to a sunbeam bouncing off a funhouse mirror. Nevertheless, our investigation aims to unravel this enigmatic connection, shining a light on a correlation that is as surprising as finding a solar-powered snow machine in the Sahara desert. So, let us embark on this radiant research journey, ready to confront the unexpected and embrace the unexpected twists and turns that await us in the solar swirls and stock market rollercoaster.

[[RESULTS]]

The statistical analysis of the data collected from 2002 to 2021 revealed a solar system of correlations between solar power generation in Sweden and the stock price of Amazon.com (AMZN). The correlation coefficient of 0.9851334 indicated a strikingly strong positive relationship between these two seemingly unrelated phenomena. This correlation glows as bright as a solar flare, illuminating the unexpected interconnection between solar energy and the market radiance of Amazon's stock. The r-squared value of 0.9704877 further confirmed the robustness of this association, suggesting that approximately 97.05% of the variability in Amazon's stock price can be explained by the variability in solar power generation in Sweden.

The p-value being less than 0.01 provides overwhelming evidence against the null hypothesis of no relationship, signaling that this solar-powered bond with Amazon's stock price is not just a flash in the pan, but a statistically significant phenomenon. It's as if the sun decided to invest its radiant energy in Amazon stock and that bet paid off like a solar jackpot.

The Figure 1 scatterplot depicted a clear pattern resembling the celestial dance of planets, demonstrating the tight embrace between solar power generation in Sweden and Amazon's stock price. This visual representation added a colorful dimension to the correlation, painting a vivid picture of the solar-powered ascent of Amazon's stock on the canvas of statistical analysis.

The findings reveal an unexpected synergy between the solar-powered effervescence of Sweden and the market magnetism of Amazon's stock. This discovery not only sheds light on the solar-powered upward trajectory of Amazon's stock but also elucidates the sun's capacity to shine on the financial landscape in unexpected and delightful ways. It's as if the solar panels in Sweden were directly beaming their energy into Amazon's stock, propelling it to new heights, much like a superhero powered by solar photons.

In conclusion, the connection between solar power generated in Sweden and Amazon's stock price goes beyond a mere statistical phenomenon; it resonates with cosmic energy, transcending traditional boundaries and shedding light on the enigmatic dance of solar power and stock market dynamics. So, let's raise our glasses and toast to this solar swirl of stock market shenanigans, for it has certainly brightened our understanding of the interconnected universe of solar energy and stock prices!

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

Our findings have uncovered an unexpected solar synergy between the luminous power generated in Sweden and the financial radiance of Amazon.com's stock, illustrating a correlation as conspicuous as a supernova in the night sky. The statistical rigidity of our results aligns with previous research in unexpected ways, as if we stumbled upon a solar-powered trail leading to the Amazonian stock market bonanza.

The insights offered by Smith and Doe (2017) on the economic ramifications of solar adoption in Scandinavia find resonance in our study, akin to parallel paths of solar irradiance and stock market brilliance. It's as though the sun's energy, harnessed in Sweden, has cascaded onto the global financial terrain, illuminating Amazon's stock in an undeniably positive manner. It's like watching a solar eclipse over Wall Street, where the shadow of the moon transforms into a radiant uptick in stock prices.

Similarly, the behavioral shifts in consumer spending patterns investigated by Jones et al. (2020) offer a metaphorical solar sail for Amazon's stock, catching the solar wind emanating from Sweden's energy infrastructure and propelling the company's market ascension. One could picture Jeff Bezos riding a solar-powered surfboard, riding the waves of financial success with Sweden's solar energy as his invisible guiding force.

Inspired by the anthropological and societal reflections presented in "The Grid" by Gretchen Bakke and "This Changes Everything" by Naomi Klein, our study's unexpected correlation shines as bright as a solar-powered skyscraper, reaching unprecedented heights and casting a shadow on traditional market dynamics. The solar radiance from Sweden seems to have seeped into Amazon's stock market performance like sunlight through a window, invigorating the company's financial growth in a manner reminiscent of a plant basking in the sun's nurturing glow.

If we were to compare our findings to a speculative fiction narrative, it would be as if we stumbled upon a cosmic nexus between solar energy and stock market success, much like stumbling upon an alien artifact in a sci-fi adventure. The interstellar connection discovered in our study displays an intergalactic magnitude of statistical significance, defying conventional explanations and spiraling into the starlit abyss of financial analytics.

In the realm of board games, "Power Grid" and "Stockpile" might whimsically represent the solar-powered energy logistics of Sweden's solar panels, transferring their chi into the game pieces that depict Amazon's stock. As the solar-powered pawns move across the board, they carry the underlying force of the sun's energy, subtly driving the stock price to uncharted territories like a solar-powered locomotive on a stock market track.

In summary, our investigation has shed light on a connection that, much like the unpredictable flight path of a solar-powered airplane, defies conventional wisdom and takes us on an unexpected journey through the solar swirls and stock market rollercoaster. The solar beams from Sweden have cast their warming glow on Amazon's stock, creating an unforeseen alliance between celestial energy and financial market dynamics, akin to the alignment of planets in a cosmic ballet.

Now, let's raise our telescopes and toast to this solar-powered revelation, for it has illuminated the interconnected universe of solar energy and stock prices with a brilliance as resplendent as a solar-powered firework on a starry night.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between Solar power generated in Sweden and Amazon.com's stock price (AMZN). Make lots of jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

Solar Swirls: Sweden's Sunbeams and Amazon's Ascendancy

[[ABSTRACT]]

This study illuminates the sunny side of stock market dynamics by investigating the perplexing relationship between solar power generation in Sweden and the stock price of Amazon.com (AMZN). While some may think this correlation is as improbable as finding a sunbathing polar bear, our research transcends traditional boundaries to shed light on this unexpected link. Leveraging data from Energy Information Administration and LSEG Analytics (Refinitiv), we conducted a comprehensive analysis covering the period from 2002 to 2021. Our results reveal a striking correlation coefficient of 0.9851334 and p < 0.01, signaling a remarkably strong statistical association. This discovery touches upon a plethora of pun-worthy revelations, shedding light on the interconnected radiation of solar energy and the market radiance of Amazon's stock. Our findings not only provide insight into the solar-powered upward trajectory of Amazon's stock but also highlight the sun's capacity to shine on the financial landscape in unexpected ways. So, grab your shades and get ready for a radiant journey through the solar swirls and stock market shenanigans!

[[INTRDUCTION]]

Harnessing the power of the sun has long been a goal of both environmentalists and savvy investors. In recent years, the solar energy industry has been in the spotlight, basking in the warmth of technological advancements and environmental consciousness. Meanwhile, the stock market has always been a captivating arena where numerous forces, some as mysterious as the sun's albedo, converge to shape the unpredictable dance of stock prices. It is in this captivating overlap of solar power and stock market movements that we begin our exploration.

Solar power is undoubtedly an illuminating force in the global energy landscape, with Sweden emerging as a bright spot in this radiant revolution. Known for its innovation in renewable energy, Sweden's foray into solar power generation has been nothing short of stellar. The sun-seeking sensibilities of Sweden have propelled it to be one of the unexpected tropical hotspots of solar energy adoption, drawing attention from both environmentalists and numbers-savvy analysts alike. As we delve into the statistical rays of solar power generation in this Nordic powerhouse, we cannot help but appreciate the irony of the land of the midnight sun becoming a reservoir of solar energy abundance.

On the other side of this solar equation, we find the shining star of e-commerce, Amazon.com. A titan in the world of online retail, Amazon’s stock performance has been as mercurial as solar flares on a summer’s day. From the cozy glow of its humble beginnings to the blazing beacon of success that it is today, Amazon's stock has mesmerized investors and analysts alike. The interplay of market dynamics, consumer behavior, and the enigma of Jeff Bezos' bald head has made Amazon's stock price a tantalizing puzzle for researchers to explore.

In the midst of these formidable forces – the radiant Swedish solar power and the luminous Amazon stock – lies a perplexing question: could there be a connection between the two? This research aims to untangle the intertwined rays of solar power and the meteoric rise of Amazon's stock price, shedding light on a correlation that is as unexpected as finding a solar-powered ice cream truck in the Arctic Circle.

As we embark on this journey, we acknowledge the skeptics who might find this connection as plausible as a hedgehog doing celestial navigation. However, armed with the power of statistical analysis and a sprinkle of good humor, we set out to explore this uncharted terrain and bring to light the surprising relationship between solar power generation in Sweden and the stock price of Amazon.com. So, fasten your seatbelts and don your solar shades, for we are about to embark on a research adventure that promises to be sunnier than the stock market forecast on a cloudless day.

[[RESULTS]]

The statistical analysis of the data collected from 2002 to 2021 revealed a solar system of correlations between solar power generation in Sweden and the stock price of Amazon.com (AMZN). The correlation coefficient of 0.9851334 indicated a strikingly strong positive relationship between these two seemingly unrelated phenomena. This correlation glows as bright as a solar flare, illuminating the unexpected interconnection between solar energy and the market radiance of Amazon's stock. The r-squared value of 0.9704877 further confirmed the robustness of this association, suggesting that approximately 97.05% of the variability in Amazon's stock price can be explained by the variability in solar power generation in Sweden.

The p-value being less than 0.01 provides overwhelming evidence against the null hypothesis of no relationship, signaling that this solar-powered bond with Amazon's stock price is not just a flash in the pan, but a statistically significant phenomenon. It's as if the sun decided to invest its radiant energy in Amazon stock and that bet paid off like a solar jackpot.

The Figure 1 scatterplot depicted a clear pattern resembling the celestial dance of planets, demonstrating the tight embrace between solar power generation in Sweden and Amazon's stock price. This visual representation added a colorful dimension to the correlation, painting a vivid picture of the solar-powered ascent of Amazon's stock on the canvas of statistical analysis.

The findings reveal an unexpected synergy between the solar-powered effervescence of Sweden and the market magnetism of Amazon's stock. This discovery not only sheds light on the solar-powered upward trajectory of Amazon's stock but also elucidates the sun's capacity to shine on the financial landscape in unexpected and delightful ways. It's as if the solar panels in Sweden were directly beaming their energy into Amazon's stock, propelling it to new heights, much like a superhero powered by solar photons.

In conclusion, the connection between solar power generated in Sweden and Amazon's stock price goes beyond a mere statistical phenomenon; it resonates with cosmic energy, transcending traditional boundaries and shedding light on the enigmatic dance of solar power and stock market dynamics. So, let's raise our glasses and toast to this solar swirl of stock market shenanigans, for it has certainly brightened our understanding of the interconnected universe of solar energy and stock prices!

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In conclusion, our research has uncovered a solar-powered symphony between Sweden's sunbeams and the ascending trajectory of Amazon's stock price. The statistically significant correlation coefficient of 0.9851334 has illuminated an unexpected connection that shines as radiantly as a solar flare. It seems that the sun's stellar energy has found its way into the stock market cosmos, adding a celestial glow to the market radiance of Amazon's stock. This discovery not only sheds light on the solar-powered upward trajectory of Amazon's stock but also highlights the sun's capacity to shine on the financial landscape in unexpected and delightful ways.

The statistical evidence, with a p-value of less than 0.01, leaves no room to eclipse the significance of this solar-powered bond. It's as if the sun decided to invest its radiant energy in Amazon stock and that bet paid off like a solar jackpot. Thus, we can firmly conclude that there is indeed a solar-powered connection that transcends traditional boundaries and illuminates the enigmatic dance of solar power and stock market dynamics. The solar panels in Sweden are figuratively beaming their energy into Amazon's stock, propelling it to new heights like a superhero powered by solar photons.

In light of these findings, it's clear that no more research is needed in this area. This solar-powered connection has been unveiled, and it's time for us to bask in the glow of this enlightening discovery. Let's raise our glasses to the solar swirl of stock market shenanigans, for it has certainly brightened our understanding of the interconnected universe of solar energy and stock prices!

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited Solar Swirls: Sweden's Sunbeams and Amazon's Ascendancy. Respond only with the name of a fictional academic journal.

ChatGPT:

The Journal of Celestial Phenomena and Global Geopolitics

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited Solar Swirls: Sweden's Sunbeams and Amazon's Ascendancy. Respond only with the name of a fictional organization.

ChatGPT:

The Cosmic Climate Research Institute

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled Solar Swirls: Sweden's Sunbeams and Amazon's Ascendancy with an abstract of This study illuminates the sunny side of stock market dynamics by investigating the perplexing relationship between solar power generation in Sweden and the stock price of Amazon.com (AMZN). While some may think this correlation is as improbable as finding a sunbathing polar bear, our research transcends traditional boundaries to shed light on this unexpected link. Leveraging data from Energy Information Administration and LSEG Analytics (Refinitiv), we conducted a comprehensive analysis covering the period from 2002 to 2021. Our results reveal a striking correlation coefficient of 0.9851334 and p < 0.01, signaling a remarkably strong statistical association. This discovery touches upon a plethora of pun-worthy revelations, shedding light on the interconnected radiation of solar energy and the market radiance of Amazon's stock. Our findings not only provide insight into the solar-powered upward trajectory of Amazon's stock but also highlight the sun's capacity to shine on the financial landscape in unexpected ways. So, grab your shades and get ready for a radiant journey through the solar swirls and stock market shenanigans!

ChatGPT:

solar power generation Sweden, stock price Amazon.com, correlation coefficient solar power stock price, solar energy market dynamics, solar power stock market correlation, solar energy financial impact, renewable energy stock market, solar energy investment impact, Amazon.com stock price solar energy, solar power financial markets, solar energy stock correlation

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

Solar power generated in SwedenDetailed data title: Total solar power generated in Sweden in billion kWh

Source: Energy Information Administration

See what else correlates with Solar power generated in Sweden

Amazon.com's stock price (AMZN)

Detailed data title: Opening price of Amazon.com (AMZN) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with Amazon.com's stock price (AMZN)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.9704877 (Coefficient of determination)

This means 97% of the change in the one variable (i.e., Amazon.com's stock price (AMZN)) is predictable based on the change in the other (i.e., Solar power generated in Sweden) over the 20 years from 2002 through 2021.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 3.2E-15. 0.0000000000000031926081184018

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.99 in 3.2E-13% of random cases. Said differently, if you correlated 313,223,534,775,885 random variables You don't actually need 313 trillion variables to find a correlation like this one. I don't have that many variables in my database. You can also correlate variables that are not independent. I do this a lot.

p-value calculations are useful for understanding the probability of a result happening by chance. They are most useful when used to highlight the risk of a fluke outcome. For example, if you calculate a p-value of 0.30, the risk that the result is a fluke is high. It is good to know that! But there are lots of ways to get a p-value of less than 0.01, as evidenced by this project.

In this particular case, the values are so extreme as to be meaningless. That's why no one reports p-values with specificity after they drop below 0.01.

Just to be clear: I'm being completely transparent about the calculations. There is no math trickery. This is just how statistics shakes out when you calculate hundreds of millions of random correlations.

with the same 19 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 19 because we have two variables measured over a period of 20 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.96, 0.99 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

| Solar power generated in Sweden (Billion kWh) | 0.002 | 0.002 | 0.002 | 0.002 | 0.002 | 0.003 | 0.004 | 0.007 | 0.0086 | 0.010999 | 0.019001 | 0.035 | 0.047001 | 0.097 | 0.143002 | 0.229999 | 0.407 | 0.679 | 1.051 | 1.507 |

| Amazon.com's stock price (AMZN) (Stock price) | 0.55 | 0.96 | 2.64 | 2.25 | 2.37 | 1.93 | 4.77 | 2.57 | 6.81 | 9.07 | 8.79 | 12.8 | 19.94 | 15.63 | 32.81 | 37.9 | 58.6 | 73.26 | 93.75 | 163.5 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([0.002,0.002,0.002,0.002,0.002,0.003,0.004,0.007,0.0086,0.010999,0.019001,0.035,0.047001,0.097,0.143002,0.229999,0.407,0.679,1.051,1.507,])

array_2 = np.array([0.55,0.96,2.64,2.25,2.37,1.93,4.77,2.57,6.81,9.07,8.79,12.8,19.94,15.63,32.81,37.9,58.6,73.26,93.75,163.5,])

array_1_name = "Solar power generated in Sweden"

array_2_name = "Amazon.com's stock price (AMZN)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only Solar power generated in Sweden

- Line chart for only Amazon.com's stock price (AMZN)

- AI-generated correlation image

- The spurious research paper: Solar Swirls: Sweden's Sunbeams and Amazon's Ascendancy

Your correlation inspection deserves a standing ovation!

Correlation ID: 1521 · Black Variable ID: 24010 · Red Variable ID: 1543