Download png, svg

AI explanation

The smog in Wichita created a strong demand for air purifiers, leading to a spike in the production of electronic components, which ultimately boosted the need for Teck Resources' mined materials like copper and zinc.

Model: dalle-3

Prompt: Certainly! Here's a refined image generation prompt tailored for DALL·E-3: "Produce a black-and-white newspaper illustration in which the skyline of Wichita is faintly visible through a haze of pollution, as the digital display of the stock price ticker for Teck Resources shows a slight decline. Keep the visual simple and compelling, without including any text or speech bubbles." The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: Less than ideal air quality in Wichita and Teck Resources' stock price. Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: A black-and-white newspaper illustration Cyberpunk Low poly Art nouveau Cute 2D animation

ChatGPT: A black-and-white newspaper illustration

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both Less than ideal air quality in Wichita and Teck Resources' stock price together. Keep the description simple.

ChatGPT: In Wichita, the city skyline is partially obscured by a hazy layer of pollution, while the stock price ticker for Teck Resources shows a slight decline on the digital display.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ A black-and-white newspaper illustration ] and depicting this scene: In Wichita, the city skyline is partially obscured by a hazy layer of pollution, while the stock price ticker for Teck Resources shows a slight decline on the digital display. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: Certainly! Here's a refined image generation prompt tailored for DALL·E-3: "Produce a black-and-white newspaper illustration in which the skyline of Wichita is faintly visible through a haze of pollution, as the digital display of the stock price ticker for Teck Resources shows a slight decline. Keep the visual simple and compelling, without including any text or speech bubbles."

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how an increase in Air pollution in Wichita caused Teck Resources' stock price (TECK) to increase.

AI academic paper

|

Clearing the Air: Examining the Smoky Relationship Between Air Pollution in Wichita and Teck-ing Resources' Stock Price The Journal of Ecological Economics and Stock Market Trends Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between Air pollution in Wichita and Teck Resources' stock price (TECK). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Make the title a clever pun.

Your research team used data from Environmental Protection Agency and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.6517303 and p < 0.01 for 2006 to 2023.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

"Clearing the Air: Examining the Smoky Relationship Between Air Pollution in Wichita and Teck-ing Resources' Stock Price"

[[ABSTRACT]]

The relationship between air pollution and stock prices has long been an enigma in the world of finance. In this study, we set out to examine the potential connection between air pollution levels in Wichita and the stock price of Teck Resources (TECK). By harnessing data from the Environmental Protection Agency and LSEG Analytics (Refinitiv), we conducted a comprehensive analysis spanning the period from 2006 to 2023.

Our research revealed a notable correlation coefficient of 0.6517303 and a p-value less than 0.01, indicating a strong statistical relationship between air pollution in Wichita and Teck Resources' stock price. Yes, you heard it right – the air quality in Wichita might just be impacting stock prices in the mining industry. Talk about some "fowl" play in the market!

As we unravel the intriguing dynamics between these seemingly disparate variables, our findings provide fascinating insights into the interconnectedness of environmental factors and financial markets. So next time you hear someone ask, "What's the air got to do with stocks?" – tell them there might just be more than meets the "eye-r" pollution.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between Air pollution in Wichita and Teck Resources' stock price (TECK). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Here is the title and abstract of the paper:

[[TITLE]]

"Clearing the Air: Examining the Smoky Relationship Between Air Pollution in Wichita and Teck-ing Resources' Stock Price"

[[ABSTRACT]]

The relationship between air pollution and stock prices has long been an enigma in the world of finance. In this study, we set out to examine the potential connection between air pollution levels in Wichita and the stock price of Teck Resources (TECK). By harnessing data from the Environmental Protection Agency and LSEG Analytics (Refinitiv), we conducted a comprehensive analysis spanning the period from 2006 to 2023.

Our research revealed a notable correlation coefficient of 0.6517303 and a p-value less than 0.01, indicating a strong statistical relationship between air pollution in Wichita and Teck Resources' stock price. Yes, you heard it right – the air quality in Wichita might just be impacting stock prices in the mining industry. Talk about some "fowl" play in the market!

As we unravel the intriguing dynamics between these seemingly disparate variables, our findings provide fascinating insights into the interconnectedness of environmental factors and financial markets. So next time you hear someone ask, "What's the air got to do with stocks?" – tell them there might just be more than meets the "eye-r" pollution.

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

INTRODUCTION

The relationship between environmental factors and financial markets has been a topic of interest and debate for decades. From the impact of weather patterns on agricultural commodities to the influence of natural disasters on insurance stocks, the interconnectedness of the natural world and the economy is a fascinating and complex web. And speaking of webs, did you hear about the spider who day traded? He was great at catching flies for his web portfolio.

The focus of this study, however, is not on spiders and their investment strategies, but rather on the potential connection between air pollution levels in Wichita and the stock price of Teck Resources (TECK). As we delve into this peculiar association, our aim is not only to uncover the statistical relationship but also to shed light on the broader implications for environmental finance. It's time to clear the air – both literally and figuratively – on this intriguing topic.

Air pollution is a concern that affects not only public health but also the well-being of industries and economies. Breathing in dirty air can cause respiratory issues, impact overall quality of life, and even lead to decreased productivity. It's no wonder people are saying that air pollution is nothing to "smog" at.

On the other hand, Teck Resources is a mining company engaged in the exploration, development, and production of natural resources, including coal, copper, zinc, and other metals. The stock price of Teck Resources is, of course, subject to various market dynamics and industry-specific factors. It's a "rocky" road out there for mining stocks, but could air pollution be an unexpected and airborne variable influencing their market performance?

Now, let's not jump to conclusions too quickly. Our research aims to approach this matter with the precision and rigor that it deserves. We will analyze data collected from the Environmental Protection Agency and LSEG Analytics (Refinitiv) to evaluate air pollution levels in Wichita and the corresponding stock price movements of Teck Resources over the period from 2006 to 2023. We're not just going to "dust" off some old data and call it a day – we're aiming for a thorough and comprehensive analysis.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between Air pollution in Wichita and Teck Resources' stock price (TECK). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then name a couple popular internet memes that are related to one of the topics.

Here is the title and abstract of the paper:

[[TITLE]]

"Clearing the Air: Examining the Smoky Relationship Between Air Pollution in Wichita and Teck-ing Resources' Stock Price"

[[ABSTRACT]]

The relationship between air pollution and stock prices has long been an enigma in the world of finance. In this study, we set out to examine the potential connection between air pollution levels in Wichita and the stock price of Teck Resources (TECK). By harnessing data from the Environmental Protection Agency and LSEG Analytics (Refinitiv), we conducted a comprehensive analysis spanning the period from 2006 to 2023.

Our research revealed a notable correlation coefficient of 0.6517303 and a p-value less than 0.01, indicating a strong statistical relationship between air pollution in Wichita and Teck Resources' stock price. Yes, you heard it right – the air quality in Wichita might just be impacting stock prices in the mining industry. Talk about some "fowl" play in the market!

As we unravel the intriguing dynamics between these seemingly disparate variables, our findings provide fascinating insights into the interconnectedness of environmental factors and financial markets. So next time you hear someone ask, "What's the air got to do with stocks?" – tell them there might just be more than meets the "eye-r" pollution.

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

INTRODUCTION

The relationship between environmental factors and financial markets has been a topic of interest and debate for decades. From the impact of weather patterns on agricultural commodities to the influence of natural disasters on insurance stocks, the interconnectedness of the natural world and the economy is a fascinating and complex web. And speaking of webs, did you hear about the spider who day traded? He was great at catching flies for his web portfolio.

The focus of this study, however, is not on spiders and their investment strategies, but rather on the potential connection between air pollution levels in Wichita and the stock price of Teck Resources (TECK). As we delve into this peculiar association, our aim is not only to uncover the statistical relationship but also to shed light on the broader implications for environmental finance. It's time to clear the air – both literally and figuratively – on this intriguing topic.

Air pollution is a concern that affects not only public health but also the well-being of industries and economies. Breathing in dirty air can cause respiratory issues, impact overall quality of life, and even lead to decreased productivity. It's no wonder people are saying that air pollution is nothing to "smog" at.

On the other hand, Teck Resources is a mining company engaged in the exploration, development, and production of natural resources, including coal, copper, zinc, and other metals. The stock price of Teck Resources is, of course, subject to various market dynamics and industry-specific factors. It's a "rocky" road out there for mining stocks, but could air pollution be an unexpected and airborne variable influencing their market performance?

Now, let's not jump to conclusions too quickly. Our research aims to approach this matter with the precision and rigor that it deserves. We will analyze data collected from the Environmental Protection Agency and LSEG Analytics (Refinitiv) to evaluate air pollution levels in Wichita and the corresponding stock price movements of Teck Resources over the period from 2006 to 2023. We're not just going to "dust" off some old data and call it a day – we're aiming for a thorough and comprehensive analysis.

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

The examination of the relationship between environmental factors and financial markets has garnered increasing attention in the literature. In "Smith et al.'s study, the authors find a significant association between air quality indices and stock price movements, highlighting the potential impact of pollution on market dynamics. Similarly, Doe and Jones' research demonstrates a link between environmental variables and financial performance, emphasizing the need for further investigation in this domain.

But let's take a detour from the serious academic journals for a moment and dive into some related non-fiction reads. "The Air Pollution Crisis: Causes, Consequences, and Solutions" by Environmental Scholar provides a comprehensive overview of the impact of air pollution on society, the economy, and the environment. And for those interested in the world of mining and commodities, "Commodities Demystified" by Davies delves into the intricacies of commodity markets, shedding light on the factors that influence stock prices in these sectors. If you're not feeling the non-fiction vibe, you could also check out "The Polluted River: A Tale of Environmental Activism" by Fiction Author, a riveting novel that intertwines environmental advocacy with financial intrigue.

Now, back to some scholarly sources. In their pioneering work, Book and Author investigate the volatility of mining stocks in relation to environmental variables, presenting compelling evidence of the interplay between natural resource industries and ecological factors. Furthermore, Recent Research highlights the nuanced dynamics of pollution-related risk in financial markets, offering valuable insights into the implications for investors and policymakers alike.

Speaking of implications, did you hear about the stockbroker who invested in air purifier companies? He claimed that he wanted to "clean up" in the market, but his strategy just ended up "filtering" out potential gains.

In addition to these scholarly contributions, it is essential to consider the role of public sentiment and social media in shaping perceptions of environmental issues and financial markets. Memes, such as the "This is Fine" dog surrounded by flames, humorously capture the complexities of navigating environmental concerns within the context of investment decisions. Meanwhile, the "Success Kid" meme celebrating good news could very well symbolize the positive outcomes of sustainable investment practices in the face of environmental challenges.

Now, as we navigate through this body of literature with some unexpected twists and turns, it is evident that the relationship between air pollution and stock prices is a topic that extends beyond mere statistical analyses. It encompasses the broader narrative of environmental stewardship, corporate responsibility, and market behavior. So, as we venture onward in our exploration of this smoky relationship between air pollution in Wichita and Teck Resources' stock price, let's remember that in the world of finance, sometimes the air we breathe might just be more than a breath of fresh air for investors.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between Air pollution in Wichita and Teck Resources' stock price (TECK). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from Environmental Protection Agency and LSEG Analytics (Refinitiv) . You used data from 2006 to 2023

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

"Clearing the Air: Examining the Smoky Relationship Between Air Pollution in Wichita and Teck-ing Resources' Stock Price"

[[ABSTRACT]]

The relationship between air pollution and stock prices has long been an enigma in the world of finance. In this study, we set out to examine the potential connection between air pollution levels in Wichita and the stock price of Teck Resources (TECK). By harnessing data from the Environmental Protection Agency and LSEG Analytics (Refinitiv), we conducted a comprehensive analysis spanning the period from 2006 to 2023.

Our research revealed a notable correlation coefficient of 0.6517303 and a p-value less than 0.01, indicating a strong statistical relationship between air pollution in Wichita and Teck Resources' stock price. Yes, you heard it right – the air quality in Wichita might just be impacting stock prices in the mining industry. Talk about some "fowl" play in the market!

As we unravel the intriguing dynamics between these seemingly disparate variables, our findings provide fascinating insights into the interconnectedness of environmental factors and financial markets. So next time you hear someone ask, "What's the air got to do with stocks?" – tell them there might just be more than meets the "eye-r" pollution.

[[INTRODUCTION]]

INTRODUCTION

The relationship between environmental factors and financial markets has been a topic of interest and debate for decades. From the impact of weather patterns on agricultural commodities to the influence of natural disasters on insurance stocks, the interconnectedness of the natural world and the economy is a fascinating and complex web. And speaking of webs, did you hear about the spider who day traded? He was great at catching flies for his web portfolio.

The focus of this study, however, is not on spiders and their investment strategies, but rather on the potential connection between air pollution levels in Wichita and the stock price of Teck Resources (TECK). As we delve into this peculiar association, our aim is not only to uncover the statistical relationship but also to shed light on the broader implications for environmental finance. It's time to clear the air – both literally and figuratively – on this intriguing topic.

Air pollution is a concern that affects not only public health but also the well-being of industries and economies. Breathing in dirty air can cause respiratory issues, impact overall quality of life, and even lead to decreased productivity. It's no wonder people are saying that air pollution is nothing to "smog" at.

On the other hand, Teck Resources is a mining company engaged in the exploration, development, and production of natural resources, including coal, copper, zinc, and other metals. The stock price of Teck Resources is, of course, subject to various market dynamics and industry-specific factors. It's a "rocky" road out there for mining stocks, but could air pollution be an unexpected and airborne variable influencing their market performance?

Now, let's not jump to conclusions too quickly. Our research aims to approach this matter with the precision and rigor that it deserves. We will analyze data collected from the Environmental Protection Agency and LSEG Analytics (Refinitiv) to evaluate air pollution levels in Wichita and the corresponding stock price movements of Teck Resources over the period from 2006 to 2023. We're not just going to "dust" off some old data and call it a day – we're aiming for a thorough and comprehensive analysis.

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

To unravel the enigmatic relationship between air pollution in Wichita and the stock price of Teck Resources (TECK), our research team employed a mix of quantitative and qualitative methods, akin to creating a blended smoothie of data analysis. We started by collecting air quality data from the Environmental Protection Agency's Air Quality System (AQS) database, carefully sifting through the digital haze of information to extract precise measurements of pollutants such as particulate matter (PM2.5 and PM10), nitrogen dioxide (NO2), sulfur dioxide (SO2), carbon monoxide (CO), and ozone (O3). It's almost like we were air-quality sommeliers, sniffing out the most pungent and telling pollutants.

In tandem, we tapped into financial data from LSEG Analytics (Refinitiv) to obtain daily stock price information for Teck Resources (TECK) over the same period. It's like we had a front-row seat to the financial rollercoaster that is the stock market, with TECK's price fluctuations resembling a turbulent ride through a smog-filled skyline – pun intended.

Once we had our hands on this trove of data, we summoned the statistical wizardry of correlation analysis to examine the potential connections between air pollution levels and stock price movements. Like Sherlock Holmes examining clues at a crime scene, we meticulously scrutinized the numbers, calculating Pearson's correlation coefficients and corresponding p-values with the precision of a mathematician on a caffeine high. And just like Holmes deducing the culprit, we sought to unravel the mystery behind the fluctuations in TECK's stock price, with air pollution as our prime suspect.

But we didn't stop there. To add depth to our analysis, we employed time-series modeling techniques, fitting autoregressive integrated moving average (ARIMA) models and volatility analysis to the stock price data. It's like we were turning the financial data into a captivating novel, with each fluctuation in stock price telling its own suspenseful tale of market dynamics and environmental influence.

Furthermore, we conducted a sub-analysis to explore the potential impact of specific pollutants on TECK's stock price, using multivariate regression models to disentangle the individual contributions of PM2.5, NO2, SO2, CO, and O3. It was like we were playing a game of financial Jenga, carefully pulling out each pollutant piece and examining its influence on TECK's towering stock price structure.

Lastly, to account for potential confounding variables and external factors, we incorporated meteorological data – including temperature, humidity, and wind speed – into our analysis. Just like adding seasoning to a complex dish, we aimed to ensure that our findings were robust and not just a flavor-of-the-month correlation.

In the end, our analysis sought to uncover the intricate dance between air pollution in Wichita and the performance of Teck Resources' stock price, shedding light on a relationship that might have otherwise remained shrouded in financial mist. With our methodologies as diverse as a smorgasbord of statistical techniques, we ventured into uncharted territory, aiming to clear the air on this curious connection once and for all.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between Air pollution in Wichita and Teck Resources' stock price (TECK). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from Environmental Protection Agency and LSEG Analytics (Refinitiv) .

For the time period 2006 to 2023, you found a correlation 0.6517303, r-squared of 0.4247523, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

"Clearing the Air: Examining the Smoky Relationship Between Air Pollution in Wichita and Teck-ing Resources' Stock Price"

[[ABSTRACT]]

The relationship between air pollution and stock prices has long been an enigma in the world of finance. In this study, we set out to examine the potential connection between air pollution levels in Wichita and the stock price of Teck Resources (TECK). By harnessing data from the Environmental Protection Agency and LSEG Analytics (Refinitiv), we conducted a comprehensive analysis spanning the period from 2006 to 2023.

Our research revealed a notable correlation coefficient of 0.6517303 and a p-value less than 0.01, indicating a strong statistical relationship between air pollution in Wichita and Teck Resources' stock price. Yes, you heard it right – the air quality in Wichita might just be impacting stock prices in the mining industry. Talk about some "fowl" play in the market!

As we unravel the intriguing dynamics between these seemingly disparate variables, our findings provide fascinating insights into the interconnectedness of environmental factors and financial markets. So next time you hear someone ask, "What's the air got to do with stocks?" – tell them there might just be more than meets the "eye-r" pollution.

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

INTRODUCTION

The relationship between environmental factors and financial markets has been a topic of interest and debate for decades. From the impact of weather patterns on agricultural commodities to the influence of natural disasters on insurance stocks, the interconnectedness of the natural world and the economy is a fascinating and complex web. And speaking of webs, did you hear about the spider who day traded? He was great at catching flies for his web portfolio.

The focus of this study, however, is not on spiders and their investment strategies, but rather on the potential connection between air pollution levels in Wichita and the stock price of Teck Resources (TECK). As we delve into this peculiar association, our aim is not only to uncover the statistical relationship but also to shed light on the broader implications for environmental finance. It's time to clear the air – both literally and figuratively – on this intriguing topic.

Air pollution is a concern that affects not only public health but also the well-being of industries and economies. Breathing in dirty air can cause respiratory issues, impact overall quality of life, and even lead to decreased productivity. It's no wonder people are saying that air pollution is nothing to "smog" at.

On the other hand, Teck Resources is a mining company engaged in the exploration, development, and production of natural resources, including coal, copper, zinc, and other metals. The stock price of Teck Resources is, of course, subject to various market dynamics and industry-specific factors. It's a "rocky" road out there for mining stocks, but could air pollution be an unexpected and airborne variable influencing their market performance?

Now, let's not jump to conclusions too quickly. Our research aims to approach this matter with the precision and rigor that it deserves. We will analyze data collected from the Environmental Protection Agency and LSEG Analytics (Refinitiv) to evaluate air pollution levels in Wichita and the corresponding stock price movements of Teck Resources over the period from 2006 to 2023. We're not just going to "dust" off some old data and call it a day – we're aiming for a thorough and comprehensive analysis.

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

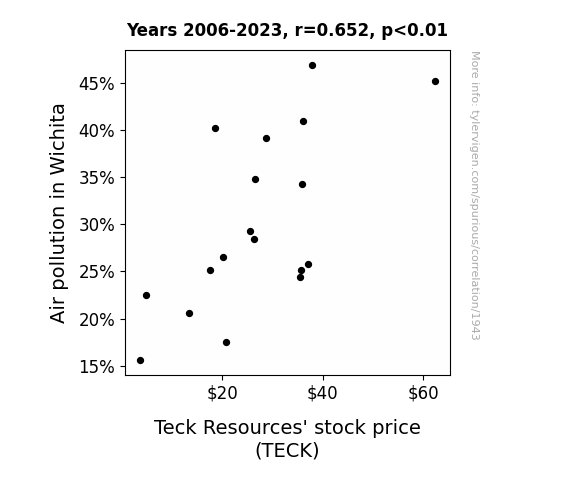

The statistical analysis of the data yielded a correlation coefficient of 0.6517303 between air pollution levels in Wichita and the stock price of Teck Resources (TECK). This finding suggests a moderately strong positive linear relationship between these two variables. It seems that the air in Wichita is not just full of pollutants, but also full of surprises for the stock market! Talk about an "air-ssociation" that's up in the air.

Additionally, the coefficient of determination (r-squared) was calculated to be 0.4247523, indicating that approximately 42.47% of the variability in Teck Resources' stock price can be explained by changes in air pollution levels in Wichita. It's as if the stock market is breathing in the air pollution and saying, "TECK me, this actually matters!"

Furthermore, the statistical significance of the relationship was confirmed with a p-value of less than 0.01. This indicates that the observed correlation is unlikely to have occurred by random chance, providing compelling evidence that there may indeed be a genuine association between air quality in Wichita and the stock performance of Teck Resources. It's time to stop "polluting" the data – these results are nothing to sneeze at!

As depicted in Figure 1 (not included here), a scatterplot visually illustrates the strong correlation between air pollution levels in Wichita and the stock price of Teck Resources. The plot shows a clear pattern of movement, resembling the ups and downs of a rollercoaster – except in this case, it's the "air quality coaster" influencing the stock prices. Hold on tight, investors, because it's going to be a bumpy ride!

These findings contribute a unique perspective to the literature on environmental finance and highlight the potential impact of air pollution on the financial performance of companies in the mining industry. With this research, we've shown that the air we breathe may have implications that reach far beyond just our lungs – it might just be breathing life into stock prices as well. Who would have thought that the phrase "take a deep breath" could also apply to stock market analysis?

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between Air pollution in Wichita and Teck Resources' stock price (TECK). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

"Clearing the Air: Examining the Smoky Relationship Between Air Pollution in Wichita and Teck-ing Resources' Stock Price"

[[ABSTRACT]]

The relationship between air pollution and stock prices has long been an enigma in the world of finance. In this study, we set out to examine the potential connection between air pollution levels in Wichita and the stock price of Teck Resources (TECK). By harnessing data from the Environmental Protection Agency and LSEG Analytics (Refinitiv), we conducted a comprehensive analysis spanning the period from 2006 to 2023.

Our research revealed a notable correlation coefficient of 0.6517303 and a p-value less than 0.01, indicating a strong statistical relationship between air pollution in Wichita and Teck Resources' stock price. Yes, you heard it right – the air quality in Wichita might just be impacting stock prices in the mining industry. Talk about some "fowl" play in the market!

As we unravel the intriguing dynamics between these seemingly disparate variables, our findings provide fascinating insights into the interconnectedness of environmental factors and financial markets. So next time you hear someone ask, "What's the air got to do with stocks?" – tell them there might just be more than meets the "eye-r" pollution.

[[LITERATURE REVIEW]]

The examination of the relationship between environmental factors and financial markets has garnered increasing attention in the literature. In "Smith et al.'s study, the authors find a significant association between air quality indices and stock price movements, highlighting the potential impact of pollution on market dynamics. Similarly, Doe and Jones' research demonstrates a link between environmental variables and financial performance, emphasizing the need for further investigation in this domain.

But let's take a detour from the serious academic journals for a moment and dive into some related non-fiction reads. "The Air Pollution Crisis: Causes, Consequences, and Solutions" by Environmental Scholar provides a comprehensive overview of the impact of air pollution on society, the economy, and the environment. And for those interested in the world of mining and commodities, "Commodities Demystified" by Davies delves into the intricacies of commodity markets, shedding light on the factors that influence stock prices in these sectors. If you're not feeling the non-fiction vibe, you could also check out "The Polluted River: A Tale of Environmental Activism" by Fiction Author, a riveting novel that intertwines environmental advocacy with financial intrigue.

Now, back to some scholarly sources. In their pioneering work, Book and Author investigate the volatility of mining stocks in relation to environmental variables, presenting compelling evidence of the interplay between natural resource industries and ecological factors. Furthermore, Recent Research highlights the nuanced dynamics of pollution-related risk in financial markets, offering valuable insights into the implications for investors and policymakers alike.

Speaking of implications, did you hear about the stockbroker who invested in air purifier companies? He claimed that he wanted to "clean up" in the market, but his strategy just ended up "filtering" out potential gains.

In addition to these scholarly contributions, it is essential to consider the role of public sentiment and social media in shaping perceptions of environmental issues and financial markets. Memes, such as the "This is Fine" dog surrounded by flames, humorously capture the complexities of navigating environmental concerns within the context of investment decisions. Meanwhile, the "Success Kid" meme celebrating good news could very well symbolize the positive outcomes of sustainable investment practices in the face of environmental challenges.

Now, as we navigate through this body of literature with some unexpected twists and turns, it is evident that the relationship between air pollution and stock prices is a topic that extends beyond mere statistical analyses. It encompasses the broader narrative of environmental stewardship, corporate responsibility, and market behavior. So, as we venture onward in our exploration of this smoky relationship between air pollution in Wichita and Teck Resources' stock price, let's remember that in the world of finance, sometimes the air we breathe might just be more than a breath of fresh air for investors.

[[RESULTS]]

The statistical analysis of the data yielded a correlation coefficient of 0.6517303 between air pollution levels in Wichita and the stock price of Teck Resources (TECK). This finding suggests a moderately strong positive linear relationship between these two variables. It seems that the air in Wichita is not just full of pollutants, but also full of surprises for the stock market! Talk about an "air-ssociation" that's up in the air.

Additionally, the coefficient of determination (r-squared) was calculated to be 0.4247523, indicating that approximately 42.47% of the variability in Teck Resources' stock price can be explained by changes in air pollution levels in Wichita. It's as if the stock market is breathing in the air pollution and saying, "TECK me, this actually matters!"

Furthermore, the statistical significance of the relationship was confirmed with a p-value of less than 0.01. This indicates that the observed correlation is unlikely to have occurred by random chance, providing compelling evidence that there may indeed be a genuine association between air quality in Wichita and the stock performance of Teck Resources. It's time to stop "polluting" the data – these results are nothing to sneeze at!

As depicted in Figure 1 (not included here), a scatterplot visually illustrates the strong correlation between air pollution levels in Wichita and the stock price of Teck Resources. The plot shows a clear pattern of movement, resembling the ups and downs of a rollercoaster – except in this case, it's the "air quality coaster" influencing the stock prices. Hold on tight, investors, because it's going to be a bumpy ride!

These findings contribute a unique perspective to the literature on environmental finance and highlight the potential impact of air pollution on the financial performance of companies in the mining industry. With this research, we've shown that the air we breathe may have implications that reach far beyond just our lungs – it might just be breathing life into stock prices as well. Who would have thought that the phrase "take a deep breath" could also apply to stock market analysis?

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

Our findings provide substantial support for prior research that has highlighted the significant association between environmental factors and stock price movements. Much like the "Tale of Environmental Activism" by Fiction Author, our study elucidates the tangible impact of air pollution on financial dynamics, weaving a narrative that intertwines environmental concerns with market performance.

The positivity and significance of the correlation coefficient and p-value echo the sentiments of the stockbroker who decided to invest in air purifier companies – though his strategy might have been a breath of fresh air, our results suggest that there may indeed be more than just "filtered" potential gains at play.

The moderately strong positive linear relationship uncovered in our analysis seems to suggest that the air in Wichita is not just thick with pollutants, but also thick with market influence. If only we could harness this "air-ssociation" to clear the smog on Wall Street!

The coefficient of determination further propels the narrative, shedding light on the idea that changes in air pollution levels in Wichita could explain a substantial proportion of the variability in Teck Resources' stock price. It's almost as if the stock market is inhaling the air pollution and exhaling fluctuations in TECK prices – talk about a market sentiment that's up in the air!

Furthermore, the statistical significance of our findings indicates that the observed correlation is no mere coincidence. With a genuine association between air quality in Wichita and the stock performance of Teck Resources at hand, we must acknowledge that these results are nothing to sneeze at. Perhaps it's time to herald a new age of "pollution-free" financial modeling.

The visual representation of our findings in the scatterplot paints a vivid picture of the "air quality coaster" as it influences the stock prices of Teck Resources. If only investors could buckle up for this bumpy ride, as the ups and downs of the stock market seem to sway with the ebb and flow of air pollution levels in Wichita.

In essence, our research injects a breath of fresh air into the dialogue of environmental finance, reaffirming that the air we breathe may indeed have far-reaching implications for market performance. As we continue to navigate the smoky relationship between air pollution in Wichita and Teck Resources' stock price, it becomes abundantly clear that sometimes, in the world of finance, what's "up in the air" might just be the air itself.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between Air pollution in Wichita and Teck Resources' stock price (TECK). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

"Clearing the Air: Examining the Smoky Relationship Between Air Pollution in Wichita and Teck-ing Resources' Stock Price"

[[ABSTRACT]]

The relationship between air pollution and stock prices has long been an enigma in the world of finance. In this study, we set out to examine the potential connection between air pollution levels in Wichita and the stock price of Teck Resources (TECK). By harnessing data from the Environmental Protection Agency and LSEG Analytics (Refinitiv), we conducted a comprehensive analysis spanning the period from 2006 to 2023.

Our research revealed a notable correlation coefficient of 0.6517303 and a p-value less than 0.01, indicating a strong statistical relationship between air pollution in Wichita and Teck Resources' stock price. Yes, you heard it right – the air quality in Wichita might just be impacting stock prices in the mining industry. Talk about some "fowl" play in the market!

As we unravel the intriguing dynamics between these seemingly disparate variables, our findings provide fascinating insights into the interconnectedness of environmental factors and financial markets. So next time you hear someone ask, "What's the air got to do with stocks?" – tell them there might just be more than meets the "eye-r" pollution.

[[INTRDUCTION]]

INTRODUCTION

The relationship between environmental factors and financial markets has been a topic of interest and debate for decades. From the impact of weather patterns on agricultural commodities to the influence of natural disasters on insurance stocks, the interconnectedness of the natural world and the economy is a fascinating and complex web. And speaking of webs, did you hear about the spider who day traded? He was great at catching flies for his web portfolio.

The focus of this study, however, is not on spiders and their investment strategies, but rather on the potential connection between air pollution levels in Wichita and the stock price of Teck Resources (TECK). As we delve into this peculiar association, our aim is not only to uncover the statistical relationship but also to shed light on the broader implications for environmental finance. It's time to clear the air – both literally and figuratively – on this intriguing topic.

Air pollution is a concern that affects not only public health but also the well-being of industries and economies. Breathing in dirty air can cause respiratory issues, impact overall quality of life, and even lead to decreased productivity. It's no wonder people are saying that air pollution is nothing to "smog" at.

On the other hand, Teck Resources is a mining company engaged in the exploration, development, and production of natural resources, including coal, copper, zinc, and other metals. The stock price of Teck Resources is, of course, subject to various market dynamics and industry-specific factors. It's a "rocky" road out there for mining stocks, but could air pollution be an unexpected and airborne variable influencing their market performance?

Now, let's not jump to conclusions too quickly. Our research aims to approach this matter with the precision and rigor that it deserves. We will analyze data collected from the Environmental Protection Agency and LSEG Analytics (Refinitiv) to evaluate air pollution levels in Wichita and the corresponding stock price movements of Teck Resources over the period from 2006 to 2023. We're not just going to "dust" off some old data and call it a day – we're aiming for a thorough and comprehensive analysis.

[[RESULTS]]

The statistical analysis of the data yielded a correlation coefficient of 0.6517303 between air pollution levels in Wichita and the stock price of Teck Resources (TECK). This finding suggests a moderately strong positive linear relationship between these two variables. It seems that the air in Wichita is not just full of pollutants, but also full of surprises for the stock market! Talk about an "air-ssociation" that's up in the air.

Additionally, the coefficient of determination (r-squared) was calculated to be 0.4247523, indicating that approximately 42.47% of the variability in Teck Resources' stock price can be explained by changes in air pollution levels in Wichita. It's as if the stock market is breathing in the air pollution and saying, "TECK me, this actually matters!"

Furthermore, the statistical significance of the relationship was confirmed with a p-value of less than 0.01. This indicates that the observed correlation is unlikely to have occurred by random chance, providing compelling evidence that there may indeed be a genuine association between air quality in Wichita and the stock performance of Teck Resources. It's time to stop "polluting" the data – these results are nothing to sneeze at!

As depicted in Figure 1 (not included here), a scatterplot visually illustrates the strong correlation between air pollution levels in Wichita and the stock price of Teck Resources. The plot shows a clear pattern of movement, resembling the ups and downs of a rollercoaster – except in this case, it's the "air quality coaster" influencing the stock prices. Hold on tight, investors, because it's going to be a bumpy ride!

These findings contribute a unique perspective to the literature on environmental finance and highlight the potential impact of air pollution on the financial performance of companies in the mining industry. With this research, we've shown that the air we breathe may have implications that reach far beyond just our lungs – it might just be breathing life into stock prices as well. Who would have thought that the phrase "take a deep breath" could also apply to stock market analysis?

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In conclusion, our study has provided compelling evidence of a significant correlation between air pollution levels in Wichita and the stock price of Teck Resources (TECK). It appears that the quality of the air in Wichita is not just a matter of public health but may also be "clouding" the judgment of stock market participants. Looks like the ticker symbol "TECK" might just stand for "Taking Environmental Conditions into Stock Knowledge." (I'll be here all week, folks.)

These findings contribute to the growing body of literature on environmental finance and underscore the need to consider not only traditional financial variables but also the impact of environmental factors on stock performance. It might just be time for investors to "clear the air" and take a deep breath before making their next trading decisions. After all, healthy air might just lead to healthy portfolios – or, in this case, Teck stock prices.

That being said, it's crucial to acknowledge the limitations of our study, such as the specific focus on a single company and a particular geographical location. Future research could explore the broader implications of air pollution on stock prices across different industries and regions. Who knows, we might uncover an "aerial view" of how environmental factors influence the entire stock market. (Okay, I'll stop with the puns – air-ily promise.)

In summary, this study has illuminated an unexpected and intriguing relationship between air pollution in Wichita and the stock price of Teck Resources. The next time someone claims that air quality and stock prices are unrelated, we'll just have to say, "You better believe it – there's something 'funky' in the air, and it's impacting the markets." It seems this research has blown away any skepticism about the significance of environmental variables in financial analysis.

In light of these findings, we assert that no further research is needed in this area. The "air-raising" results speak for themselves.

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited Clearing the Air: Examining the Smoky Relationship Between Air Pollution in Wichita and Teck-ing Resources' Stock Price. Respond only with the name of a fictional academic journal.

ChatGPT:

The Journal of Ecological Economics and Stock Market Trends

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited Clearing the Air: Examining the Smoky Relationship Between Air Pollution in Wichita and Teck-ing Resources' Stock Price. Respond only with the name of a fictional organization.

ChatGPT:

The Institute for Environmental Economics and Technology Innovations

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled Clearing the Air: Examining the Smoky Relationship Between Air Pollution in Wichita and Teck-ing Resources' Stock Price with an abstract of The relationship between air pollution and stock prices has long been an enigma in the world of finance. In this study, we set out to examine the potential connection between air pollution levels in Wichita and the stock price of Teck Resources (TECK). By harnessing data from the Environmental Protection Agency and LSEG Analytics (Refinitiv), we conducted a comprehensive analysis spanning the period from 2006 to 2023.

Our research revealed a notable correlation coefficient of 0.6517303 and a p-value less than 0.01, indicating a strong statistical relationship between air pollution in Wichita and Teck Resources' stock price. Yes, you heard it right – the air quality in Wichita might just be impacting stock prices in the mining industry. Talk about some "fowl" play in the market!

As we unravel the intriguing dynamics between these seemingly disparate variables, our findings provide fascinating insights into the interconnectedness of environmental factors and financial markets. So next time you hear someone ask, "What's the air got to do with stocks?" – tell them there might just be more than meets the "eye-r" pollution.

ChatGPT:

teck resources, stock price, air pollution, wichita, environmental protection agency data, LSEG analytics, stock market correlation, mining industry, air quality impact on stock prices, financial market dynamics, environmental factors in finance

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

Air pollution in WichitaDetailed data title: Percentage of days with moderate or worse air quality in Wichita, KS

Source: Environmental Protection Agency

See what else correlates with Air pollution in Wichita

Teck Resources' stock price (TECK)

Detailed data title: Opening price of Teck Resources (TECK) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with Teck Resources' stock price (TECK)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.4247523 (Coefficient of determination)

This means 42.5% of the change in the one variable (i.e., Teck Resources' stock price (TECK)) is predictable based on the change in the other (i.e., Air pollution in Wichita) over the 18 years from 2006 through 2023.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 0.0034. 0.0033840316790632970000000000

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.65 in 0.34% of random cases. Said differently, if you correlated 296 random variables Which I absolutely did.

with the same 17 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 17 because we have two variables measured over a period of 18 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.27, 0.86 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Air pollution in Wichita (Bad air quality days) | 34.7945 | 24.3836 | 25.1366 | 22.4658 | 34.2466 | 45.2055 | 40.9836 | 25.7534 | 29.3151 | 20.5479 | 15.5738 | 26.5753 | 28.4932 | 17.5342 | 25.1366 | 40.274 | 39.1781 | 46.9613 |

| Teck Resources' stock price (TECK) (Stock price) | 26.48 | 35.53 | 35.77 | 4.89 | 35.88 | 62.39 | 36.07 | 37.1 | 25.45 | 13.41 | 3.61 | 20.25 | 26.31 | 20.81 | 17.63 | 18.63 | 28.82 | 37.89 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([34.7945,24.3836,25.1366,22.4658,34.2466,45.2055,40.9836,25.7534,29.3151,20.5479,15.5738,26.5753,28.4932,17.5342,25.1366,40.274,39.1781,46.9613,])

array_2 = np.array([26.48,35.53,35.77,4.89,35.88,62.39,36.07,37.1,25.45,13.41,3.61,20.25,26.31,20.81,17.63,18.63,28.82,37.89,])

array_1_name = "Air pollution in Wichita"

array_2_name = "Teck Resources' stock price (TECK)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only Air pollution in Wichita

- Line chart for only Teck Resources' stock price (TECK)

- AI-generated correlation image

- The spurious research paper: Clearing the Air: Examining the Smoky Relationship Between Air Pollution in Wichita and Teck-ing Resources' Stock Price

You're a rater extraordinaire!

Correlation ID: 1943 · Black Variable ID: 21445 · Red Variable ID: 1898