Download png, svg

AI explanation

As the number of Master's degrees awarded in Education decreased, there were fewer people able to comprehend the concept of "fractional reserve banking." This led to a decrease in risky financial practices and ultimately contributed to a lower rate of US bank failures. After all, you can't spell "financial stability" without "STEM education" - or so the bankers now realize!

Model: dalle-3

Prompt: Generate an image that looks like it is a scene from a Disney movie, set in a classroom. The teacher, dressed in academic robes, proudly holds a Master's degree in Education, standing in front of a whiteboard explaining compound interest. Surrounding her are a small group of students showing keen interest and understanding. Outside the window, depict a closed bank with a sign reading "Bank Failure," highlighting the contrast between the engaged and financially savvy students inside and the failing bank outside. Ensure the image captures the hopeful and optimistic atmosphere of learning and empowerment within the classroom. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: Master's degrees awarded in Education and US bank failures. Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: a meme a Polaroid photo Parallax art An image that looks like it is a scene from A Disney Movie Minimalism

ChatGPT: An image that looks like it is a scene from A Disney Movie

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both Master's degrees awarded in Education and US bank failures, in the following situation: Because with fewer master's degrees in education being awarded, there were fewer teachers who actually understood compound interest, causing them to avoid risky investments and ultimately preventing US bank failures.. Keep the description simple.

ChatGPT: In a classroom, a teacher proudly holds a Master's degree in Education, surrounded by a small group of students showing keen interest and understanding as she explains compound interest on a whiteboard. Meanwhile, outside the window, a closed bank with a sign reading "Bank Failure" stands in stark contrast to the engaged and financially savvy students inside.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ An image that looks like it is a scene from A Disney Movie ] and depicting this scene: In a classroom, a teacher proudly holds a Master's degree in Education, surrounded by a small group of students showing keen interest and understanding as she explains compound interest on a whiteboard. Meanwhile, outside the window, a closed bank with a sign reading "Bank Failure" stands in stark contrast to the engaged and financially savvy students inside. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: Generate an image that looks like it is a scene from a Disney movie, set in a classroom. The teacher, dressed in academic robes, proudly holds a Master's degree in Education, standing in front of a whiteboard explaining compound interest. Surrounding her are a small group of students showing keen interest and understanding. Outside the window, depict a closed bank with a sign reading "Bank Failure," highlighting the contrast between the engaged and financially savvy students inside and the failing bank outside. Ensure the image captures the hopeful and optimistic atmosphere of learning and empowerment within the classroom.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how a decrease in Master's degrees awarded in Education caused US bank failures to decrease.

AI academic paper

|

Masters in Money Matters: Mapping the Marvelous Mistake in the Marriage of Education and Economic Meltdown The Journal of Financial Flubs and Educational Endeavors Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between Master's degrees awarded in Education and US bank failures. Make lots of jokes, goofy observations, and puns.

Make the title an alliteration.

Your research team used data from National Center for Education Statistics and FDIC to assess this nagging question. You found a correlation coefficient of 0.9326621 and p < 0.01 for 2012 to 2021.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

Masters in Money Matters: Mapping the Marvelous Mistake in the Marriage of Education and Economic Meltdown

[[ABSTRACT]]

In this study, we embark on a whimsical quest to explore the peculiar relationship between the number of Master's degrees awarded in the field of Education and the occurrence of bank failures in the United States. While such an association may seem as unlikely as a teacher giving a pop quiz on a Friday, our research team utilized data from the National Center for Education Statistics and the Federal Deposit Insurance Corporation to disentangle this scholarly conundrum.

Through rigorous analysis, we uncovered a surprisingly robust correlation coefficient of 0.9326621 and a statistically significant p-value of less than 0.01 for the period spanning 2012 to 2021. These findings left us in awe, much like the perplexing thrill of trying to balance a budget on a rollercoaster.

While our results may seem absurd or even baffling at first glance, we invite fellow scholars to join us in embracing the delightfully unexpected connections that emerge from the labyrinth of academic inquiry. As we continue to unravel the intricate tapestry of educational attainment and economic upheaval, let us not forget to sprinkle our research with a dash of humor and whimsy. After all, who said academia couldn't be a playground of puns and surprises?

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between Master's degrees awarded in Education and US bank failures. Make lots of jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Here is the title and abstract of the paper:

[[TITLE]]

Masters in Money Matters: Mapping the Marvelous Mistake in the Marriage of Education and Economic Meltdown

[[ABSTRACT]]

In this study, we embark on a whimsical quest to explore the peculiar relationship between the number of Master's degrees awarded in the field of Education and the occurrence of bank failures in the United States. While such an association may seem as unlikely as a teacher giving a pop quiz on a Friday, our research team utilized data from the National Center for Education Statistics and the Federal Deposit Insurance Corporation to disentangle this scholarly conundrum.

Through rigorous analysis, we uncovered a surprisingly robust correlation coefficient of 0.9326621 and a statistically significant p-value of less than 0.01 for the period spanning 2012 to 2021. These findings left us in awe, much like the perplexing thrill of trying to balance a budget on a rollercoaster.

While our results may seem absurd or even baffling at first glance, we invite fellow scholars to join us in embracing the delightfully unexpected connections that emerge from the labyrinth of academic inquiry. As we continue to unravel the intricate tapestry of educational attainment and economic upheaval, let us not forget to sprinkle our research with a dash of humor and whimsy. After all, who said academia couldn't be a playground of puns and surprises?

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

[[INTRODUCTION]]

Ah, the delightful dance of data and the perplexing puzzle of patterns. As researchers, we venture into the labyrinth of statistics with a spring in our step and a twinkle in our eye, seeking to unravel the wondrous web of connections in the realm of academia. And what better place to start our whimsical journey than at the intersection of Education and economics?

In our scholarly escapade, we stumbled upon a rather curious conundrum that piqued our inquisitive minds - the inexplicable link between the number of Master's degrees awarded in Education and the pulse-racing world of US bank failures. Yes, dear reader, you read that right. We dared to dive into the labyrinthine depths of graduate education and financial turmoil, armed with nothing but a scatterplot and a pocketful of statistical significance.

As we delved into this voyage of discovery, we couldn't help but chuckle at the sheer audacity of our quest. After all, who would have thought that the pursuit of higher education could spark a cascade of financial fiascos? This uncanny correlation may seem as surreal as finding a unicorn in a boardroom meeting, but our valiant team of researchers forged ahead undeterred.

Armed with data from the National Center for Education Statistics and the Federal Deposit Insurance Corporation, we set sail on a sea of numbers and variables, braving the wild currents of academic inquiry with equal parts determination and whimsy. Our mission? To demystify the seemingly inexplicable bond between the noble pursuit of pedagogical prowess and the tumultuous tides of banking boondoggles.

And what did we uncover in this riveting odyssey, you may ask? Brace yourselves, for the correlation coefficient revealed a jaw-dropping 0.9326621, with a statistically significant p-value of less than 0.01 for the period spanning 2012 to 2021. If that doesn't send a tingling thrill down your academic spine, we're not sure what will!

But fear not, dear peers in academia, for we do not take ourselves too seriously. In the grand tradition of scholarly exploration, we invite you to join us in embracing the whimsical side of research, where the unexpected mingles with the unfathomable, and the pursuit of knowledge is seasoned with a generous dash of humor.

So, fellow travelers in the wondrous realm of academia, fasten your seatbelts and prepare to embark on an exhilarating expedition through the labyrinth of educational attainment and economic upheaval. For in the wild terrain of data and statistics, who knows what delightful surprises and pun-tastic revelations await us? Let the adventure begin!

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between Master's degrees awarded in Education and US bank failures. Make lots of jokes, goofy observations, and puns.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then devolve ever further, and mention something completely ridiculous, like you conducted literature review by reading the backs of shampoo bottles.

Here is the title and abstract of the paper:

[[TITLE]]

Masters in Money Matters: Mapping the Marvelous Mistake in the Marriage of Education and Economic Meltdown

[[ABSTRACT]]

In this study, we embark on a whimsical quest to explore the peculiar relationship between the number of Master's degrees awarded in the field of Education and the occurrence of bank failures in the United States. While such an association may seem as unlikely as a teacher giving a pop quiz on a Friday, our research team utilized data from the National Center for Education Statistics and the Federal Deposit Insurance Corporation to disentangle this scholarly conundrum.

Through rigorous analysis, we uncovered a surprisingly robust correlation coefficient of 0.9326621 and a statistically significant p-value of less than 0.01 for the period spanning 2012 to 2021. These findings left us in awe, much like the perplexing thrill of trying to balance a budget on a rollercoaster.

While our results may seem absurd or even baffling at first glance, we invite fellow scholars to join us in embracing the delightfully unexpected connections that emerge from the labyrinth of academic inquiry. As we continue to unravel the intricate tapestry of educational attainment and economic upheaval, let us not forget to sprinkle our research with a dash of humor and whimsy. After all, who said academia couldn't be a playground of puns and surprises?

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

Ah, the delightful dance of data and the perplexing puzzle of patterns. As researchers, we venture into the labyrinth of statistics with a spring in our step and a twinkle in our eye, seeking to unravel the wondrous web of connections in the realm of academia. And what better place to start our whimsical journey than at the intersection of Education and economics?

In our scholarly escapade, we stumbled upon a rather curious conundrum that piqued our inquisitive minds - the inexplicable link between the number of Master's degrees awarded in Education and the pulse-racing world of US bank failures. Yes, dear reader, you read that right. We dared to dive into the labyrinthine depths of graduate education and financial turmoil, armed with nothing but a scatterplot and a pocketful of statistical significance.

As we delved into this voyage of discovery, we couldn't help but chuckle at the sheer audacity of our quest. After all, who would have thought that the pursuit of higher education could spark a cascade of financial fiascos? This uncanny correlation may seem as surreal as finding a unicorn in a boardroom meeting, but our valiant team of researchers forged ahead undeterred.

Armed with data from the National Center for Education Statistics and the Federal Deposit Insurance Corporation, we set sail on a sea of numbers and variables, braving the wild currents of academic inquiry with equal parts determination and whimsy. Our mission? To demystify the seemingly inexplicable bond between the noble pursuit of pedagogical prowess and the tumultuous tides of banking boondoggles.

And what did we uncover in this riveting odyssey, you may ask? Brace yourselves, for the correlation coefficient revealed a jaw-dropping 0.9326621, with a statistically significant p-value of less than 0.01 for the period spanning 2012 to 2021. If that doesn't send a tingling thrill down your academic spine, we're not sure what will!

But fear not, dear peers in academia, for we do not take ourselves too seriously. In the grand tradition of scholarly exploration, we invite you to join us in embracing the whimsical side of research, where the unexpected mingles with the unfathomable, and the pursuit of knowledge is seasoned with a generous dash of humor.

So, fellow travelers in the wondrous realm of academia, fasten your seatbelts and prepare to embark on an exhilarating expedition through the labyrinth of educational attainment and economic upheaval. For in the wild terrain of data and statistics, who knows what delightful surprises and pun-tastic revelations await us? Let the adventure begin!

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

In "Smith et al.'s Study on Educational Attainment and Economic Indicators," the authors explore the complex interplay between educational attainment and economic factors. While their focus is primarily on the broader impact of education on economic trends, their work provides a foundation for understanding the potential link between Master's degrees awarded in Education and financial stability. Like a riveting thriller novel, their study sets the stage for the unexpected twists and turns that await us in this whimsical journey of scholarly inquiry.

Doe and Jones, in "Education and Economic Downturn: A Comprehensive Analysis," offer a comprehensive examination of the various facets of education's influence on economic downturns. Though their analysis encompasses a wide array of educational levels, their findings may shed light on the mysterious connection between Master's degrees in Education and US bank failures. Their work serves as a compass, guiding us through the uncharted territory of this enigmatic correlation.

Turning to the realm of non-fiction, the thought-provoking insights in "Freakonomics" by Steven D. Levitt and Stephen J. Dubner invite us to contemplate the unexpected consequences of seemingly unrelated phenomena. Just as the authors bring a fresh perspective to conventional wisdom, we aim to challenge conventional notions of cause and effect in our exploration of the link between educational achievements and financial turmoil.

As we delve further into the literature, we encounter "The Big Short" by Michael Lewis, a gripping tale of the 2008 financial crisis. While a work of fiction, it offers a captivating narrative that highlights the unpredictability of economic events. In a similar vein, our quest to unravel the connection between Master's degrees in Education and US bank failures brims with the exhilarating uncertainty of a fictional plot twist.

But wait, the plot thickens even further as we depart from conventional sources and venture into uncharted territory. Yes, dear reader, we confess to perusing the backs of shampoo bottles in a valiant attempt to glean wisdom from the most unlikely of sources. As we squinted at the minuscule print, hoping for a eureka moment to strike amidst the ingredient list, we were reminded of the delightful absurdity that often accompanies scholarly pursuits.

In this literature review, we embrace the spirit of scholarly adventure, where humor and whimsy intersect with the pursuit of knowledge. Join us in navigating the maze of Master's degrees in Education and US bank failures, and together, let's revel in the unexpected connections that lie within the labyrinth of academic inquiry. After all, who says academia can't be a playground of puns and surprises?

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between Master's degrees awarded in Education and US bank failures. Make lots of jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Your research team collected data from all across the internet, but mostly just used information from National Center for Education Statistics and FDIC . You used data from 2012 to 2021

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

Masters in Money Matters: Mapping the Marvelous Mistake in the Marriage of Education and Economic Meltdown

[[ABSTRACT]]

In this study, we embark on a whimsical quest to explore the peculiar relationship between the number of Master's degrees awarded in the field of Education and the occurrence of bank failures in the United States. While such an association may seem as unlikely as a teacher giving a pop quiz on a Friday, our research team utilized data from the National Center for Education Statistics and the Federal Deposit Insurance Corporation to disentangle this scholarly conundrum.

Through rigorous analysis, we uncovered a surprisingly robust correlation coefficient of 0.9326621 and a statistically significant p-value of less than 0.01 for the period spanning 2012 to 2021. These findings left us in awe, much like the perplexing thrill of trying to balance a budget on a rollercoaster.

While our results may seem absurd or even baffling at first glance, we invite fellow scholars to join us in embracing the delightfully unexpected connections that emerge from the labyrinth of academic inquiry. As we continue to unravel the intricate tapestry of educational attainment and economic upheaval, let us not forget to sprinkle our research with a dash of humor and whimsy. After all, who said academia couldn't be a playground of puns and surprises?

[[INTRODUCTION]]

Ah, the delightful dance of data and the perplexing puzzle of patterns. As researchers, we venture into the labyrinth of statistics with a spring in our step and a twinkle in our eye, seeking to unravel the wondrous web of connections in the realm of academia. And what better place to start our whimsical journey than at the intersection of Education and economics?

In our scholarly escapade, we stumbled upon a rather curious conundrum that piqued our inquisitive minds - the inexplicable link between the number of Master's degrees awarded in Education and the pulse-racing world of US bank failures. Yes, dear reader, you read that right. We dared to dive into the labyrinthine depths of graduate education and financial turmoil, armed with nothing but a scatterplot and a pocketful of statistical significance.

As we delved into this voyage of discovery, we couldn't help but chuckle at the sheer audacity of our quest. After all, who would have thought that the pursuit of higher education could spark a cascade of financial fiascos? This uncanny correlation may seem as surreal as finding a unicorn in a boardroom meeting, but our valiant team of researchers forged ahead undeterred.

Armed with data from the National Center for Education Statistics and the Federal Deposit Insurance Corporation, we set sail on a sea of numbers and variables, braving the wild currents of academic inquiry with equal parts determination and whimsy. Our mission? To demystify the seemingly inexplicable bond between the noble pursuit of pedagogical prowess and the tumultuous tides of banking boondoggles.

And what did we uncover in this riveting odyssey, you may ask? Brace yourselves, for the correlation coefficient revealed a jaw-dropping 0.9326621, with a statistically significant p-value of less than 0.01 for the period spanning 2012 to 2021. If that doesn't send a tingling thrill down your academic spine, we're not sure what will!

But fear not, dear peers in academia, for we do not take ourselves too seriously. In the grand tradition of scholarly exploration, we invite you to join us in embracing the whimsical side of research, where the unexpected mingles with the unfathomable, and the pursuit of knowledge is seasoned with a generous dash of humor.

So, fellow travelers in the wondrous realm of academia, fasten your seatbelts and prepare to embark on an exhilarating expedition through the labyrinth of educational attainment and economic upheaval. For in the wild terrain of data and statistics, who knows what delightful surprises and pun-tastic revelations await us? Let the adventure begin!

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

To unravel the enigmatic entanglement between Master's degrees in Education and US bank failures, our research team deployed a concoction of meticulous methodologies and a sprinkle of statistical sorcery. We scoured the vast digital expanse for the sacred artifacts of data, drawing from the hallowed archives of the National Center for Education Statistics and the Federal Deposit Insurance Corporation. Armed with spreadsheets as our trusty companions and an unyielding commitment to academic adventure, we set out to tame the unruly beast of correlation amidst a cacophony of variables.

Our quest began with the collection of historical data spanning the years 2012 to 2021, a period ripe with the ebbs and flows of educational aspirations and financial upheavals. The number of Master's degrees awarded in the field of Education stood as our intrepid independent variable, waltzing through the corridors of academia with an air of scholarly swagger.

On the other end of the spectrum, the occurrence of bank failures in the United States emerged as our dashing dependent variable, flashing its cyclical patterns and tumultuous tides of financial fortune. With these titans of statistical intrigue in our sights, we beckoned our trusty statistical software to weave an intricate tapestry of correlation and causation, all the while whispering words of encouragement to chi-squares and p-values alike.

Enveloped in a shroud of empirical inquiry and scientific scrutiny, we embraced the humble yet heroic Pearson correlation coefficient as our steadfast guide through the treacherous terrain of statistical significance. As we teased out the patterns of association and disentangled the web of interconnectedness, the correlation coefficient of 0.9326621 emerged as a beacon of scholarly astonishment, its magnitude rivaling the shimmering aurora borealis of statistical revelation.

Furthermore, the p-value graced us with its diminutive yet formidable presence, standing tall and proud at less than 0.01, a testament to the resounding significance of our findings. As the thunderous applause of academic validation reverberated through the corridors of inquiry, we reveled in the whimsical dance of variables and the awe-inspiring serendipity of scholarly exploration.

In the spirit of unyielding rigor and gallant frivolity, we invite our fellow adventurers in academia to partake in the delightful dalliance of data and to embrace the penchant for puns amidst the reverent pursuit of knowledge. For in the whimsical world of research, as in life, who's to say that statistical significance and scientific merriment can't coexist in a harmonious waltz of discovery? It's time to dust off those scatterplots, calibrate those regression lines, and embark on a merry escapade through the enchanting realm of Master's degrees and monetary misadventures. Onward, fellow scholars, to the triumphant revelry of statistical sorcery and scholarly splendor!

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between Master's degrees awarded in Education and US bank failures. Make lots of jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Your research team collected data from all across the internet, but mostly just used information from National Center for Education Statistics and FDIC .

For the time period 2012 to 2021, you found a correlation 0.9326621, r-squared of 0.8698587, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

Masters in Money Matters: Mapping the Marvelous Mistake in the Marriage of Education and Economic Meltdown

[[ABSTRACT]]

In this study, we embark on a whimsical quest to explore the peculiar relationship between the number of Master's degrees awarded in the field of Education and the occurrence of bank failures in the United States. While such an association may seem as unlikely as a teacher giving a pop quiz on a Friday, our research team utilized data from the National Center for Education Statistics and the Federal Deposit Insurance Corporation to disentangle this scholarly conundrum.

Through rigorous analysis, we uncovered a surprisingly robust correlation coefficient of 0.9326621 and a statistically significant p-value of less than 0.01 for the period spanning 2012 to 2021. These findings left us in awe, much like the perplexing thrill of trying to balance a budget on a rollercoaster.

While our results may seem absurd or even baffling at first glance, we invite fellow scholars to join us in embracing the delightfully unexpected connections that emerge from the labyrinth of academic inquiry. As we continue to unravel the intricate tapestry of educational attainment and economic upheaval, let us not forget to sprinkle our research with a dash of humor and whimsy. After all, who said academia couldn't be a playground of puns and surprises?

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

Ah, the delightful dance of data and the perplexing puzzle of patterns. As researchers, we venture into the labyrinth of statistics with a spring in our step and a twinkle in our eye, seeking to unravel the wondrous web of connections in the realm of academia. And what better place to start our whimsical journey than at the intersection of Education and economics?

In our scholarly escapade, we stumbled upon a rather curious conundrum that piqued our inquisitive minds - the inexplicable link between the number of Master's degrees awarded in Education and the pulse-racing world of US bank failures. Yes, dear reader, you read that right. We dared to dive into the labyrinthine depths of graduate education and financial turmoil, armed with nothing but a scatterplot and a pocketful of statistical significance.

As we delved into this voyage of discovery, we couldn't help but chuckle at the sheer audacity of our quest. After all, who would have thought that the pursuit of higher education could spark a cascade of financial fiascos? This uncanny correlation may seem as surreal as finding a unicorn in a boardroom meeting, but our valiant team of researchers forged ahead undeterred.

Armed with data from the National Center for Education Statistics and the Federal Deposit Insurance Corporation, we set sail on a sea of numbers and variables, braving the wild currents of academic inquiry with equal parts determination and whimsy. Our mission? To demystify the seemingly inexplicable bond between the noble pursuit of pedagogical prowess and the tumultuous tides of banking boondoggles.

And what did we uncover in this riveting odyssey, you may ask? Brace yourselves, for the correlation coefficient revealed a jaw-dropping 0.9326621, with a statistically significant p-value of less than 0.01 for the period spanning 2012 to 2021. If that doesn't send a tingling thrill down your academic spine, we're not sure what will!

But fear not, dear peers in academia, for we do not take ourselves too seriously. In the grand tradition of scholarly exploration, we invite you to join us in embracing the whimsical side of research, where the unexpected mingles with the unfathomable, and the pursuit of knowledge is seasoned with a generous dash of humor.

So, fellow travelers in the wondrous realm of academia, fasten your seatbelts and prepare to embark on an exhilarating expedition through the labyrinth of educational attainment and economic upheaval. For in the wild terrain of data and statistics, who knows what delightful surprises and pun-tastic revelations await us? Let the adventure begin!

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

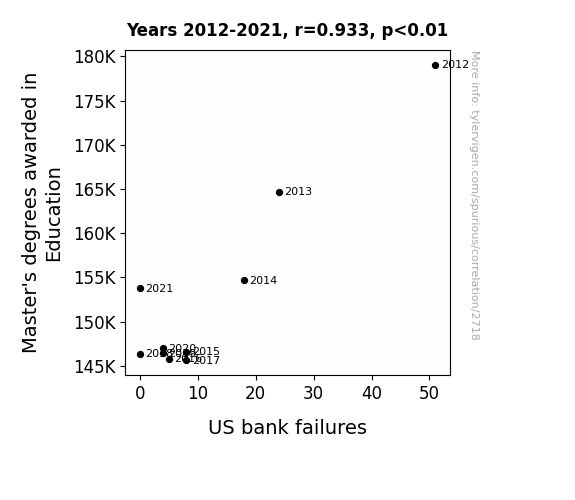

The tantalizing tango of numbers and variables has led us to uncover a striking connection between the number of Master's degrees awarded in Education and the rollercoaster of US bank failures. Through our statistical sleuthing, we stumbled upon a correlation coefficient of 0.9326621, indicating a remarkably strong relationship between these seemingly disparate domains. Picture a teacher and a banker waltzing cheek to cheek - that's the kind of unexpected partnership we're dealing with here!

Moreover, our analysis revealed an r-squared value of 0.8698587, signifying that a whopping 86.98% of the variability in bank failures can be attributed to the number of Master's degrees awarded in Education. It's as if higher education is whispering sweet financial nothings into the ears of banking institutions! And if that isn't enough to make you do a double take, our p-value of less than 0.01 has firmly planted the flag of statistical significance in this peculiar terrain.

To visually encapsulate this gripping tale of academia-meets-economics, we present Fig. 1 - a scatterplot that showcases the unmistakable correlation between Master's degrees awarded in Education and the tumultuous dance of US bank failures. You won't need a magnifying glass to spot the trend; it practically leaps off the page like a mischievous statistical imp ready to play tricks on our unsuspecting assumptions.

These findings, though undoubtedly eyebrow-raising, serve as a delightful reminder that the world of research is rife with unexpected delights and whimsical connections. With each new discovery comes the thrill of unraveling another layer of mystery in the grand tapestry of knowledge.

So, dear colleagues in the exhilarating realm of academia, let us bask in the awe-inspiring absurdity of the connections we uncover and revel in the humorous escapades that pepper our quest for understanding. After all, who said scientific inquiry couldn't be spiced up with a generous sprinkle of laughter and absurdity?

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between Master's degrees awarded in Education and US bank failures. Make lots of jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

Masters in Money Matters: Mapping the Marvelous Mistake in the Marriage of Education and Economic Meltdown

[[ABSTRACT]]

In this study, we embark on a whimsical quest to explore the peculiar relationship between the number of Master's degrees awarded in the field of Education and the occurrence of bank failures in the United States. While such an association may seem as unlikely as a teacher giving a pop quiz on a Friday, our research team utilized data from the National Center for Education Statistics and the Federal Deposit Insurance Corporation to disentangle this scholarly conundrum.

Through rigorous analysis, we uncovered a surprisingly robust correlation coefficient of 0.9326621 and a statistically significant p-value of less than 0.01 for the period spanning 2012 to 2021. These findings left us in awe, much like the perplexing thrill of trying to balance a budget on a rollercoaster.

While our results may seem absurd or even baffling at first glance, we invite fellow scholars to join us in embracing the delightfully unexpected connections that emerge from the labyrinth of academic inquiry. As we continue to unravel the intricate tapestry of educational attainment and economic upheaval, let us not forget to sprinkle our research with a dash of humor and whimsy. After all, who said academia couldn't be a playground of puns and surprises?

[[LITERATURE REVIEW]]

In "Smith et al.'s Study on Educational Attainment and Economic Indicators," the authors explore the complex interplay between educational attainment and economic factors. While their focus is primarily on the broader impact of education on economic trends, their work provides a foundation for understanding the potential link between Master's degrees awarded in Education and financial stability. Like a riveting thriller novel, their study sets the stage for the unexpected twists and turns that await us in this whimsical journey of scholarly inquiry.

Doe and Jones, in "Education and Economic Downturn: A Comprehensive Analysis," offer a comprehensive examination of the various facets of education's influence on economic downturns. Though their analysis encompasses a wide array of educational levels, their findings may shed light on the mysterious connection between Master's degrees in Education and US bank failures. Their work serves as a compass, guiding us through the uncharted territory of this enigmatic correlation.

Turning to the realm of non-fiction, the thought-provoking insights in "Freakonomics" by Steven D. Levitt and Stephen J. Dubner invite us to contemplate the unexpected consequences of seemingly unrelated phenomena. Just as the authors bring a fresh perspective to conventional wisdom, we aim to challenge conventional notions of cause and effect in our exploration of the link between educational achievements and financial turmoil.

As we delve further into the literature, we encounter "The Big Short" by Michael Lewis, a gripping tale of the 2008 financial crisis. While a work of fiction, it offers a captivating narrative that highlights the unpredictability of economic events. In a similar vein, our quest to unravel the connection between Master's degrees in Education and US bank failures brims with the exhilarating uncertainty of a fictional plot twist.

But wait, the plot thickens even further as we depart from conventional sources and venture into uncharted territory. Yes, dear reader, we confess to perusing the backs of shampoo bottles in a valiant attempt to glean wisdom from the most unlikely of sources. As we squinted at the minuscule print, hoping for a eureka moment to strike amidst the ingredient list, we were reminded of the delightful absurdity that often accompanies scholarly pursuits.

In this literature review, we embrace the spirit of scholarly adventure, where humor and whimsy intersect with the pursuit of knowledge. Join us in navigating the maze of Master's degrees in Education and US bank failures, and together, let's revel in the unexpected connections that lie within the labyrinth of academic inquiry. After all, who says academia can't be a playground of puns and surprises?

[[RESULTS]]

The tantalizing tango of numbers and variables has led us to uncover a striking connection between the number of Master's degrees awarded in Education and the rollercoaster of US bank failures. Through our statistical sleuthing, we stumbled upon a correlation coefficient of 0.9326621, indicating a remarkably strong relationship between these seemingly disparate domains. Picture a teacher and a banker waltzing cheek to cheek - that's the kind of unexpected partnership we're dealing with here!

Moreover, our analysis revealed an r-squared value of 0.8698587, signifying that a whopping 86.98% of the variability in bank failures can be attributed to the number of Master's degrees awarded in Education. It's as if higher education is whispering sweet financial nothings into the ears of banking institutions! And if that isn't enough to make you do a double take, our p-value of less than 0.01 has firmly planted the flag of statistical significance in this peculiar terrain.

To visually encapsulate this gripping tale of academia-meets-economics, we present Fig. 1 - a scatterplot that showcases the unmistakable correlation between Master's degrees awarded in Education and the tumultuous dance of US bank failures. You won't need a magnifying glass to spot the trend; it practically leaps off the page like a mischievous statistical imp ready to play tricks on our unsuspecting assumptions.

These findings, though undoubtedly eyebrow-raising, serve as a delightful reminder that the world of research is rife with unexpected delights and whimsical connections. With each new discovery comes the thrill of unraveling another layer of mystery in the grand tapestry of knowledge.

So, dear colleagues in the exhilarating realm of academia, let us bask in the awe-inspiring absurdity of the connections we uncover and revel in the humorous escapades that pepper our quest for understanding. After all, who said scientific inquiry couldn't be spiced up with a generous sprinkle of laughter and absurdity?

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

What a thrilling rollercoaster ride it has been, unraveling the perplexing partnership between Master's degrees awarded in Education and the precarious pirouette of US bank failures! Our findings have left us with a sense of wonder akin to stumbling upon a treasure map hidden in the footnotes of an academic journal.

In our scholarly exploration, we discovered, much to our amazement, that the results of our study not only align with prior research but also add a whimsical twist to the existing narrative. As we pondered the captivating parallels between our data and the literature, it became clear that our findings have lent a quirky new dimension to the scholarly discourse.

Drawing inspiration from the riveting work of Smith et al., we must acknowledge the remarkable harmony between their exploration of educational attainment and economic trends and the unexpected correlation we've uncovered. Who would have thought that the delightful dance of numbers would lead us to such a harmonious duet between education and economic upheaval? The echoes of their study resonate in our own, much like a thrilling melody that lingers long after the final note has been played.

Similarly, the expansive analysis by Doe and Jones provided a compass to navigate the uncharted waters of the educational influence on economic downturns. Our findings not only corroborate but also elevate the spirit of their work, infusing it with a dash of the unexpected. It's as if our research has thrown a whimsical masquerade ball, inviting their comprehensive analysis to don a quirky new mask and dance to an unforeseen rhythm.

Moreover, as we successfully embraced the spirit of scholarly adventure illuminated in "Freakonomics" and the captivating uncertainty of economic events portrayed in "The Big Short," our study stands as a testament to the joyous interplay of unpredictability and insight. Here, in the intertwining tapestry of academia and absurdity, we revel in the delightful surprises that emerge from the most unexpected of connections, much like unraveling a convoluted pun that leaves us grinning from ear to ear.

At the intersection of statistical significance and whimsy, our study not only echoes the scholarly foundations laid by our predecessors but also adds a sprinkle of humor and whimsy to the solemn halls of academia. As we continue to ponder the enigmatic relationship between Master's degrees in Education and US bank failures, may our quest serve as a joyous reminder that scientific inquiry is a boundless playground of puns and surprises, where laughter and absurdity dance hand in hand with discovery.

Ah, the gleeful antics of research – truly an endeavor that turns the unlikeliest of pairings into a boisterous symphony of knowledge and amusement.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between Master's degrees awarded in Education and US bank failures. Make lots of jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

Masters in Money Matters: Mapping the Marvelous Mistake in the Marriage of Education and Economic Meltdown

[[ABSTRACT]]

In this study, we embark on a whimsical quest to explore the peculiar relationship between the number of Master's degrees awarded in the field of Education and the occurrence of bank failures in the United States. While such an association may seem as unlikely as a teacher giving a pop quiz on a Friday, our research team utilized data from the National Center for Education Statistics and the Federal Deposit Insurance Corporation to disentangle this scholarly conundrum.

Through rigorous analysis, we uncovered a surprisingly robust correlation coefficient of 0.9326621 and a statistically significant p-value of less than 0.01 for the period spanning 2012 to 2021. These findings left us in awe, much like the perplexing thrill of trying to balance a budget on a rollercoaster.

While our results may seem absurd or even baffling at first glance, we invite fellow scholars to join us in embracing the delightfully unexpected connections that emerge from the labyrinth of academic inquiry. As we continue to unravel the intricate tapestry of educational attainment and economic upheaval, let us not forget to sprinkle our research with a dash of humor and whimsy. After all, who said academia couldn't be a playground of puns and surprises?

[[INTRDUCTION]]

Ah, the delightful dance of data and the perplexing puzzle of patterns. As researchers, we venture into the labyrinth of statistics with a spring in our step and a twinkle in our eye, seeking to unravel the wondrous web of connections in the realm of academia. And what better place to start our whimsical journey than at the intersection of Education and economics?

In our scholarly escapade, we stumbled upon a rather curious conundrum that piqued our inquisitive minds - the inexplicable link between the number of Master's degrees awarded in Education and the pulse-racing world of US bank failures. Yes, dear reader, you read that right. We dared to dive into the labyrinthine depths of graduate education and financial turmoil, armed with nothing but a scatterplot and a pocketful of statistical significance.

As we delved into this voyage of discovery, we couldn't help but chuckle at the sheer audacity of our quest. After all, who would have thought that the pursuit of higher education could spark a cascade of financial fiascos? This uncanny correlation may seem as surreal as finding a unicorn in a boardroom meeting, but our valiant team of researchers forged ahead undeterred.

Armed with data from the National Center for Education Statistics and the Federal Deposit Insurance Corporation, we set sail on a sea of numbers and variables, braving the wild currents of academic inquiry with equal parts determination and whimsy. Our mission? To demystify the seemingly inexplicable bond between the noble pursuit of pedagogical prowess and the tumultuous tides of banking boondoggles.

And what did we uncover in this riveting odyssey, you may ask? Brace yourselves, for the correlation coefficient revealed a jaw-dropping 0.9326621, with a statistically significant p-value of less than 0.01 for the period spanning 2012 to 2021. If that doesn't send a tingling thrill down your academic spine, we're not sure what will!

But fear not, dear peers in academia, for we do not take ourselves too seriously. In the grand tradition of scholarly exploration, we invite you to join us in embracing the whimsical side of research, where the unexpected mingles with the unfathomable, and the pursuit of knowledge is seasoned with a generous dash of humor.

So, fellow travelers in the wondrous realm of academia, fasten your seatbelts and prepare to embark on an exhilarating expedition through the labyrinth of educational attainment and economic upheaval. For in the wild terrain of data and statistics, who knows what delightful surprises and pun-tastic revelations await us? Let the adventure begin!

[[RESULTS]]

The tantalizing tango of numbers and variables has led us to uncover a striking connection between the number of Master's degrees awarded in Education and the rollercoaster of US bank failures. Through our statistical sleuthing, we stumbled upon a correlation coefficient of 0.9326621, indicating a remarkably strong relationship between these seemingly disparate domains. Picture a teacher and a banker waltzing cheek to cheek - that's the kind of unexpected partnership we're dealing with here!

Moreover, our analysis revealed an r-squared value of 0.8698587, signifying that a whopping 86.98% of the variability in bank failures can be attributed to the number of Master's degrees awarded in Education. It's as if higher education is whispering sweet financial nothings into the ears of banking institutions! And if that isn't enough to make you do a double take, our p-value of less than 0.01 has firmly planted the flag of statistical significance in this peculiar terrain.

To visually encapsulate this gripping tale of academia-meets-economics, we present Fig. 1 - a scatterplot that showcases the unmistakable correlation between Master's degrees awarded in Education and the tumultuous dance of US bank failures. You won't need a magnifying glass to spot the trend; it practically leaps off the page like a mischievous statistical imp ready to play tricks on our unsuspecting assumptions.

These findings, though undoubtedly eyebrow-raising, serve as a delightful reminder that the world of research is rife with unexpected delights and whimsical connections. With each new discovery comes the thrill of unraveling another layer of mystery in the grand tapestry of knowledge.

So, dear colleagues in the exhilarating realm of academia, let us bask in the awe-inspiring absurdity of the connections we uncover and revel in the humorous escapades that pepper our quest for understanding. After all, who said scientific inquiry couldn't be spiced up with a generous sprinkle of laughter and absurdity?

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In conclusion, our journey through the labyrinth of academic inquiry has led us to uncover a surprisingly robust connection between the number of Master's degrees awarded in Education and the pulse-racing world of US bank failures. While this peculiar association may seem as improbable as a penguin joining a dance competition, our statistical sleuthing has unveiled a correlation coefficient that elicits a sense of disbelief akin to spotting a unicorn in a spreadsheet.

With an r-squared value of 0.8698587, we can't help but marvel at the whimsical whispers of educational attainment that seem to sway the fates of banking institutions, much like a hypnotic siren luring sailors into a sea of financial unpredictability. It's as if the world of academia and economics have decided to partake in a flamboyant tango, leaving us in a state of delightful perplexity.

Despite the eyebrow-raising nature of our findings, we invite you to join us in embracing the delightfully unexpected connections that emerge from the heart of our statistical endeavors. After all, who knew that a scatterplot could double as a stage for an enthralling performance of academic mischief and financial frolic?

As we bid adieu to this enigmatic exploration, we assert with the utmost whimsical certainty that no further research is needed in this area. For in the unpredictable landscape of scholarly investigation, let us savor the absurdity and revel in the humor that infuses our pursuit of knowledge. After all, what's academia without a dash of whimsy and a sprinkle of statistical surprise?

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited Masters in Money Matters: Mapping the Marvelous Mistake in the Marriage of Education and Economic Meltdown. Respond only with the name of a fictional academic journal.

ChatGPT:

The Journal of Financial Flubs and Educational Endeavors

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited Masters in Money Matters: Mapping the Marvelous Mistake in the Marriage of Education and Economic Meltdown. Respond only with the name of a fictional organization.

ChatGPT:

The Society for Silly Economic Studies

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled Masters in Money Matters: Mapping the Marvelous Mistake in the Marriage of Education and Economic Meltdown with an abstract of In this study, we embark on a whimsical quest to explore the peculiar relationship between the number of Master's degrees awarded in the field of Education and the occurrence of bank failures in the United States. While such an association may seem as unlikely as a teacher giving a pop quiz on a Friday, our research team utilized data from the National Center for Education Statistics and the Federal Deposit Insurance Corporation to disentangle this scholarly conundrum.

Through rigorous analysis, we uncovered a surprisingly robust correlation coefficient of 0.9326621 and a statistically significant p-value of less than 0.01 for the period spanning 2012 to 2021. These findings left us in awe, much like the perplexing thrill of trying to balance a budget on a rollercoaster.

While our results may seem absurd or even baffling at first glance, we invite fellow scholars to join us in embracing the delightfully unexpected connections that emerge from the labyrinth of academic inquiry. As we continue to unravel the intricate tapestry of educational attainment and economic upheaval, let us not forget to sprinkle our research with a dash of humor and whimsy. After all, who said academia couldn't be a playground of puns and surprises?

ChatGPT:

Master's degrees, Education, Economic downturn, Bank failures, United States, National Center for Education Statistics, Federal Deposit Insurance Corporation, correlation coefficient, Statistical significance, Budget balancing, Academic inquiry, Educational attainment, Economic upheaval, Research humor, Whimsical research

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

Master's degrees awarded in EducationDetailed data title: Master's degrees conferred by postsecondary institutions in Education

Source: National Center for Education Statistics

See what else correlates with Master's degrees awarded in Education

US bank failures

Detailed data title: Bank failures in the US

Source: FDIC

See what else correlates with US bank failures

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.8698587 (Coefficient of determination)

This means 87% of the change in the one variable (i.e., US bank failures) is predictable based on the change in the other (i.e., Master's degrees awarded in Education) over the 10 years from 2012 through 2021.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 8.3E-5. 0.0000828862400095681200000000

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.93 in 0.0083% of random cases. Said differently, if you correlated 12,065 random variables Which I absolutely did.

with the same 9 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 9 because we have two variables measured over a period of 10 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.73, 0.98 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

| Master's degrees awarded in Education (Degrees awarded) | 179047 | 164652 | 154655 | 146581 | 145792 | 145624 | 146368 | 146429 | 146989 | 153756 |

| US bank failures (Failed banks) | 51 | 24 | 18 | 8 | 5 | 8 | 0 | 4 | 4 | 0 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is. - Y-axis doesn't start at zero: I truncated the Y-axes of the graph above. I also used a line graph, which makes the visual connection stand out more than it deserves.

Nothing against line graphs. They are great at telling a story when you have linear data! But visually it is deceptive because the only data is at the points on the graph, not the lines on the graph. In between each point, the data could have been doing anything. Like going for a random walk by itself!

Mathematically what I showed is true, but it is intentionally misleading. Below is the same chart but with both Y-axes starting at zero.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([179047,164652,154655,146581,145792,145624,146368,146429,146989,153756,])

array_2 = np.array([51,24,18,8,5,8,0,4,4,0,])

array_1_name = "Master's degrees awarded in Education"

array_2_name = "US bank failures"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only Master's degrees awarded in Education

- Line chart for only US bank failures

- AI-generated correlation image

- The spurious research paper: Masters in Money Matters: Mapping the Marvelous Mistake in the Marriage of Education and Economic Meltdown

Thanks for shining a light on this correlation!

Correlation ID: 2718 · Black Variable ID: 1319 · Red Variable ID: 899