Download png, svg

AI explanation

As American cheese consumption melted its way into the hearts of people across the nation, it led to an increase in demand for burgers and sandwiches. This, in turn, boosted the performance of fast-food chains like McDonald's and Starbucks. As these chains sizzled with success, their widespread use of technology, including Apple products for everything from taking orders to playing background music, led to a surge in demand for Apple stock. As cheesy as it may sound, the love for American cheese somehow became gouda for Apple's stock price!

Model: dalle-3

Prompt: Style: Scalar art Description: In a bustling kitchen, a line of people eagerly waits to use sleek and modern toasters made by Apple, which are working overtime to perfectly brown an increased quantity of grilled cheese sandwiches being made. In the background, a bar graph showing the rise in American cheese consumption is displayed, while a stock ticker with Apple's symbol (AAPL) shows an upward trend as investors react to the unexpected surge in toaster sales. Please note that DALL·E-3 is intended to create new, unique visuals based on text prompts and does not have the capability to include pre-existing trademarks or specific company logos such as Apple's logo. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: American cheese consumption and Apple's stock price (AAPL). Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: Magic realism Scalar art Art nouveau Glitch art a funny image macro

ChatGPT: Scalar art

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both American cheese consumption and Apple's stock price (AAPL), in the following situation: Because American cheese consumption increased, more people started making grilled cheese sandwiches. This led to an increase in demand for toasters, including the ones made by Apple. As a result, Apple's stock price rose due to the unexpected surge in toaster sales.. Keep the description simple.

ChatGPT: In a bustling kitchen, a line of people is eagerly waiting to use sleek and modern toasters made by Apple. The toasters are working overtime to perfectly brown the increased quantity of grilled cheese sandwiches being made. In the background, a bar graph showing the rise in American cheese consumption is displayed, while a stock ticker with Apple's symbol (AAPL) shows an upward trend as investors react to the unexpected surge in toaster sales.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ Scalar art ] and depicting this scene: In a bustling kitchen, a line of people is eagerly waiting to use sleek and modern toasters made by Apple. The toasters are working overtime to perfectly brown the increased quantity of grilled cheese sandwiches being made. In the background, a bar graph showing the rise in American cheese consumption is displayed, while a stock ticker with Apple's symbol (AAPL) shows an upward trend as investors react to the unexpected surge in toaster sales. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: Style: Scalar art Description: In a bustling kitchen, a line of people eagerly waits to use sleek and modern toasters made by Apple, which are working overtime to perfectly brown an increased quantity of grilled cheese sandwiches being made. In the background, a bar graph showing the rise in American cheese consumption is displayed, while a stock ticker with Apple's symbol (AAPL) shows an upward trend as investors react to the unexpected surge in toaster sales. Please note that DALL·E-3 is intended to create new, unique visuals based on text prompts and does not have the capability to include pre-existing trademarks or specific company logos such as Apple's logo.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how an increase in American cheese consumption caused Apple's stock price (AAPL) to increase. Make it feel plausible.

AI academic paper

|

The Big Cheese: An Examination of the Relationship Between American Cheese Consumption and Apple's Stock Price The Journal of Dairy Economics and Financial Analysis Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between American cheese consumption and Apple's stock price (AAPL). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Make the title punny if you can come up with clever pun. If not, make it sound serious.

Your research team used data from USDA and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.8538186 and p < 0.01 for 2002 to 2021.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

The Big Cheese: An Examination of the Relationship Between American Cheese Consumption and Apple's Stock Price

[[ABSTRACT]]

This paper investigates the surprisingly cheesy connection between American cheese consumption and the stock price of Apple Inc. (AAPL). Embracing the adage that "an apple a day keeps the doctor away," we delve into the quirky realm of finance and food to uncover potentially gouda news for investors. Using data from the United States Department of Agriculture (USDA) and LSEG Analytics (Refinitiv), we conducted a comprehensive analysis spanning the years 2002 to 2021. Our findings reveal a strong correlation between these seemingly unrelated factors, with a coefficient of 0.8538186 and a p-value of less than 0.01. This statistically robust association suggests that perhaps there is more than meets the eye to these disparate elements – a tantalizing prospect indeed. Just like a classic dad joke, the connection between cheese and Apple's stock price may have investors saying, "cheddar be prepared for a gouda time in the market!"

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between American cheese consumption and Apple's stock price (AAPL). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Here is the title and abstract of the paper:

[[TITLE]]

The Big Cheese: An Examination of the Relationship Between American Cheese Consumption and Apple's Stock Price

[[ABSTRACT]]

This paper investigates the surprisingly cheesy connection between American cheese consumption and the stock price of Apple Inc. (AAPL). Embracing the adage that "an apple a day keeps the doctor away," we delve into the quirky realm of finance and food to uncover potentially gouda news for investors. Using data from the United States Department of Agriculture (USDA) and LSEG Analytics (Refinitiv), we conducted a comprehensive analysis spanning the years 2002 to 2021. Our findings reveal a strong correlation between these seemingly unrelated factors, with a coefficient of 0.8538186 and a p-value of less than 0.01. This statistically robust association suggests that perhaps there is more than meets the eye to these disparate elements – a tantalizing prospect indeed. Just like a classic dad joke, the connection between cheese and Apple's stock price may have investors saying, "cheddar be prepared for a gouda time in the market!"

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

[[INTRODUCTION]]

The intersection of finance and food has long been a subject of fascination and speculation, much like when you can't decide between cheddar and gouda on your sandwich and end up with a 'stock' pile of cheeses in your fridge. In this paper, we delve into the curiously cheesy relationship between American cheese consumption and the stock price of Apple Inc. (AAPL). It's a tale as old as time - the power of cheese meets the allure of tech stocks, with potential implications that are more than just a fondue fantasy.

As the saying goes, "the apple doesn't fall far from the tree," but our investigation jumps headfirst into the complex and dynamic world of financial markets. By leveraging data from the United States Department of Agriculture (USDA) and LSEG Analytics (Refinitiv), we conducted a thorough examination spanning nearly two decades, aiming to provide a statistically robust understanding of the interplay between these unexpected variables. It's as if we're uncovering the apple's core, or in this case, the cheese's rind, to reveal the tantalizing secrets hidden within.

But why, you might ask, should anyone care about the connection between American cheese consumption and Apple's stock price? Well, in the words of renowned statistician Edward Tufte – "Correlation is not causation, but it sure is a hint." And with a correlation coefficient of 0.8538186 and a p-value of less than 0.01, we've got a hint so strong, it could make even the most lactose intolerant investor say "cheese please" when considering their portfolio. It seems that the market dynamics are as unpredictable as the holes in a block of Swiss cheese, but our findings suggest that there may, in fact, be a method to the madness.

But before we delve into our findings, let's take a step back and consider the broader implications of this unlikely correlation. As Albert Einstein once mused, "The most beautiful thing we can experience is the mysterious. It is the source of all true art and science." And if there's one thing more mysterious and intriguing than the art of finance, it's surely the enigma of our eating habits – especially when they intersect in a way that could potentially move the markets. In the realm of research, this is like discovering a golden apple at the center of a maze, or in this case, finding a wheel of mature cheddar in the middle of Wall Street.

So, hold onto your hats, because we're about to embark on a journey that's as unexpected as a cow doing calculus – to explore the fascinating relationship between American cheese consumption and Apple's stock price. It's a tale of numbers, markets, and dairy delights, where the punchlines are as cheesy as the data is compelling.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between American cheese consumption and Apple's stock price (AAPL). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Perhaps you also got inspiration from some board games that are vaugely related.

Here is the title and abstract of the paper:

[[TITLE]]

The Big Cheese: An Examination of the Relationship Between American Cheese Consumption and Apple's Stock Price

[[ABSTRACT]]

This paper investigates the surprisingly cheesy connection between American cheese consumption and the stock price of Apple Inc. (AAPL). Embracing the adage that "an apple a day keeps the doctor away," we delve into the quirky realm of finance and food to uncover potentially gouda news for investors. Using data from the United States Department of Agriculture (USDA) and LSEG Analytics (Refinitiv), we conducted a comprehensive analysis spanning the years 2002 to 2021. Our findings reveal a strong correlation between these seemingly unrelated factors, with a coefficient of 0.8538186 and a p-value of less than 0.01. This statistically robust association suggests that perhaps there is more than meets the eye to these disparate elements – a tantalizing prospect indeed. Just like a classic dad joke, the connection between cheese and Apple's stock price may have investors saying, "cheddar be prepared for a gouda time in the market!"

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

The intersection of finance and food has long been a subject of fascination and speculation, much like when you can't decide between cheddar and gouda on your sandwich and end up with a 'stock' pile of cheeses in your fridge. In this paper, we delve into the curiously cheesy relationship between American cheese consumption and the stock price of Apple Inc. (AAPL). It's a tale as old as time - the power of cheese meets the allure of tech stocks, with potential implications that are more than just a fondue fantasy.

As the saying goes, "the apple doesn't fall far from the tree," but our investigation jumps headfirst into the complex and dynamic world of financial markets. By leveraging data from the United States Department of Agriculture (USDA) and LSEG Analytics (Refinitiv), we conducted a thorough examination spanning nearly two decades, aiming to provide a statistically robust understanding of the interplay between these unexpected variables. It's as if we're uncovering the apple's core, or in this case, the cheese's rind, to reveal the tantalizing secrets hidden within.

But why, you might ask, should anyone care about the connection between American cheese consumption and Apple's stock price? Well, in the words of renowned statistician Edward Tufte – "Correlation is not causation, but it sure is a hint." And with a correlation coefficient of 0.8538186 and a p-value of less than 0.01, we've got a hint so strong, it could make even the most lactose intolerant investor say "cheese please" when considering their portfolio. It seems that the market dynamics are as unpredictable as the holes in a block of Swiss cheese, but our findings suggest that there may, in fact, be a method to the madness.

But before we delve into our findings, let's take a step back and consider the broader implications of this unlikely correlation. As Albert Einstein once mused, "The most beautiful thing we can experience is the mysterious. It is the source of all true art and science." And if there's one thing more mysterious and intriguing than the art of finance, it's surely the enigma of our eating habits – especially when they intersect in a way that could potentially move the markets. In the realm of research, this is like discovering a golden apple at the center of a maze, or in this case, finding a wheel of mature cheddar in the middle of Wall Street.

So, hold onto your hats, because we're about to embark on a journey that's as unexpected as a cow doing calculus – to explore the fascinating relationship between American cheese consumption and Apple's stock price. It's a tale of numbers, markets, and dairy delights, where the punchlines are as cheesy as the data is compelling.

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

The curious connection between American cheese consumption and the stock price of Apple Inc. (AAPL) has intrigued researchers and investors alike. Smith et al. (2015) were among the pioneers in exploring the potential links between food consumption and financial markets, laying the groundwork for our own investigation. Their study, "The Dairy Dilemma: Unraveling the Mysteries of Cheese and Capital Markets," hinted at the possibility of an underlying relationship between cheese consumption and stock prices, akin to the way cheddar and gouda complement each other on a cheeseboard.

Doe and Jones (2018) further delved into this unconventional terrain with their work, "The Big Cheese Effect: Culinary Trends and Market Volatility." Their findings suggested a potential correlation between cheese preferences and stock market performance, provoking both fascination and skepticism within investment circles. As we navigate through this literature, though, it becomes clear that uncovering the true nature of this correlation requires a savvy approach, much like pairing the perfect wine with a savory slice of cheese.

In "The Great Economic Gouda Heist" (Goudini, 2020), the author humorously recounts the fictitious tale of a cheese-driven market upheaval, blending finance and fromage in a riveting narrative. While admittedly a work of fiction, the book sheds light on the pervasive interest in the intersection of food and finance, reminding us that even the most whimsical of scenarios can harbor kernels of truth – much like a well-aged Parmesan.

Turning now to non-fiction literature, "The Economic Power of Apples" (Fruity & Co., 2017) examines the far-reaching impact of fruit markets on the global economy, offering insights that resonate with our current exploration of Apple Inc.'s stock price. Likewise, "Milk, Money, and Markets" (Dairy & Associates, 2019) provides a comprehensive analysis of dairy industry trends, offering a backdrop against which we can contextualize the influence of American cheese consumption.

Venturing into the realm of board games, "Cheddar Tycoon: A Cheese Empire Simulation" (Gouda Games, 2016) playfully simulates the intricacies of the cheese market, offering a lighthearted yet thought-provoking take on the dynamics of agricultural products in the realm of commerce. While certainly not a scholarly source, the game's thematic elements serve as a reminder of the eclectic influences that inform our understanding of market forces, much like the unexpected role of cheese in shaping tech stock trends.

In "The Da Vinc-Gouda Code" (Brown, 2003), a work of fiction steeped in mystery and intrigue, the ostensibly unrelated worlds of art and cheese intertwine in a narrative that underscores the unanticipated connections that can shape our perceptions of the world – much like the unlikely relationship we seek to decipher between American cheese consumption and Apple's stock price.

As we embark on our own investigation, these diverse sources set the stage for a research journey that proves to be as captivating as a well-executed punchline – a journey that promises to unravel the enigmatic ties between cheese, tech stocks, and the alluring dance of market forces. So, with the spirit of curiosity and a hint of whimsy, we delve further into this clandestine connection, prepared to embrace the surprises and revelations that lie ahead in our quest for cheesy truths.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between American cheese consumption and Apple's stock price (AAPL). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Your research team collected data from all across the internet, but mostly just used information from USDA and LSEG Analytics (Refinitiv) . You used data from 2002 to 2021

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

The Big Cheese: An Examination of the Relationship Between American Cheese Consumption and Apple's Stock Price

[[ABSTRACT]]

This paper investigates the surprisingly cheesy connection between American cheese consumption and the stock price of Apple Inc. (AAPL). Embracing the adage that "an apple a day keeps the doctor away," we delve into the quirky realm of finance and food to uncover potentially gouda news for investors. Using data from the United States Department of Agriculture (USDA) and LSEG Analytics (Refinitiv), we conducted a comprehensive analysis spanning the years 2002 to 2021. Our findings reveal a strong correlation between these seemingly unrelated factors, with a coefficient of 0.8538186 and a p-value of less than 0.01. This statistically robust association suggests that perhaps there is more than meets the eye to these disparate elements – a tantalizing prospect indeed. Just like a classic dad joke, the connection between cheese and Apple's stock price may have investors saying, "cheddar be prepared for a gouda time in the market!"

[[INTRODUCTION]]

The intersection of finance and food has long been a subject of fascination and speculation, much like when you can't decide between cheddar and gouda on your sandwich and end up with a 'stock' pile of cheeses in your fridge. In this paper, we delve into the curiously cheesy relationship between American cheese consumption and the stock price of Apple Inc. (AAPL). It's a tale as old as time - the power of cheese meets the allure of tech stocks, with potential implications that are more than just a fondue fantasy.

As the saying goes, "the apple doesn't fall far from the tree," but our investigation jumps headfirst into the complex and dynamic world of financial markets. By leveraging data from the United States Department of Agriculture (USDA) and LSEG Analytics (Refinitiv), we conducted a thorough examination spanning nearly two decades, aiming to provide a statistically robust understanding of the interplay between these unexpected variables. It's as if we're uncovering the apple's core, or in this case, the cheese's rind, to reveal the tantalizing secrets hidden within.

But why, you might ask, should anyone care about the connection between American cheese consumption and Apple's stock price? Well, in the words of renowned statistician Edward Tufte – "Correlation is not causation, but it sure is a hint." And with a correlation coefficient of 0.8538186 and a p-value of less than 0.01, we've got a hint so strong, it could make even the most lactose intolerant investor say "cheese please" when considering their portfolio. It seems that the market dynamics are as unpredictable as the holes in a block of Swiss cheese, but our findings suggest that there may, in fact, be a method to the madness.

But before we delve into our findings, let's take a step back and consider the broader implications of this unlikely correlation. As Albert Einstein once mused, "The most beautiful thing we can experience is the mysterious. It is the source of all true art and science." And if there's one thing more mysterious and intriguing than the art of finance, it's surely the enigma of our eating habits – especially when they intersect in a way that could potentially move the markets. In the realm of research, this is like discovering a golden apple at the center of a maze, or in this case, finding a wheel of mature cheddar in the middle of Wall Street.

So, hold onto your hats, because we're about to embark on a journey that's as unexpected as a cow doing calculus – to explore the fascinating relationship between American cheese consumption and Apple's stock price. It's a tale of numbers, markets, and dairy delights, where the punchlines are as cheesy as the data is compelling.

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

To pursue our investigation into the curious correlation between American cheese consumption and Apple's stock price (AAPL), we employed an array of methods as diverse as a cheese platter at a wine and cheese tasting event. We accessed data sources primarily from the United States Department of Agriculture (USDA) and LSEG Analytics (Refinitiv), using a variety of both primary and secondary sources. Our data collection process involved scouring the depths of the internet for information on American cheese consumption trends, Apple's stock prices, and any other relevant financial and dairy-related indicators.

When one thinks of analyzing the stock market, one might picture a herd of analysts huddled over computer screens, pouring through endless columns of numbers, looking for that one elusive pattern that spells profit. Similarly, our team navigated a veritable maze of data, all to uncover the link between the nation's love for American cheese and the performance of one of the most iconic technology companies. It was a task as intricate as trying to find the right cheese slice in a stack of unmarked cheese singles.

To ensure the reliability and robustness of our findings, we utilized a combination of statistical techniques, including correlation analysis, time series analysis, and regression modeling. Our analysis aimed to capture the nuances of the relationship between American cheese consumption and Apple's stock price over the period from 2002 to 2021. We sliced and diced the data with the precision of a skilled cheesemonger, carefully examining fluctuations and trends to tease out any underlying patterns.

In undertaking this study, we recognized the potential for confounding variables, as intricate and layered as the flavors in a premium aged cheddar. To address this, we implemented rigorous controls and adjustments in our statistical models, ensuring that our analysis captured the true essence of the relationship between these seemingly unrelated factors. We wanted to leave no slice of cheese unturned, no potential anomaly unexplored, in our pursuit of uncovering the truth behind this unexpected correlation.

It's no secret that conducting research can have its fair share of challenges and unexpected twists, much like a cheese soufflé that rises and falls unpredictably. We remain mindful of the limitations inherent in any statistical analysis, yet we embraced these challenges with the same humor and grace as a cheesy dad joke at a scientific conference. Our aim was not only to paint a comprehensive picture of the connection between American cheese consumption and Apple's stock price but also to infuse our analysis with the same element of surprise and delight that comes with discovering a perfectly aged block of cheese in the back of the fridge.

As we delved into this unique and slightly unconventional exploration, we kept the spirit of scientific inquiry alive, recognizing that even the most unexpected correlations can yield valuable insights. Our methods combined the rigor of traditional statistical analysis with the creativity of an avant-garde chef experimenting with cheese pairings, ultimately serving up findings that are as thought-provoking as they are captivating.

In the end, our methodology aimed to capture the essence of this distinctive relationship, to go beyond the surface and uncover the rich tapestry of influences that intertwine American cheese consumption and Apple's stock price. It was a journey as delightful as discovering a hidden treasure in a wheel of brie and as rewarding as the satisfaction of finally cracking a complex statistical puzzle – with just the right amount of cheesy humor to season the mix.

And with that, we present our findings, hoping that they leave you as satisfied and amused as a well-executed punchline at a science stand-up comedy night.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between American cheese consumption and Apple's stock price (AAPL). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Your research team collected data from all across the internet, but mostly just used information from USDA and LSEG Analytics (Refinitiv) .

For the time period 2002 to 2021, you found a correlation 0.8538186, r-squared of 0.7290062, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

The Big Cheese: An Examination of the Relationship Between American Cheese Consumption and Apple's Stock Price

[[ABSTRACT]]

This paper investigates the surprisingly cheesy connection between American cheese consumption and the stock price of Apple Inc. (AAPL). Embracing the adage that "an apple a day keeps the doctor away," we delve into the quirky realm of finance and food to uncover potentially gouda news for investors. Using data from the United States Department of Agriculture (USDA) and LSEG Analytics (Refinitiv), we conducted a comprehensive analysis spanning the years 2002 to 2021. Our findings reveal a strong correlation between these seemingly unrelated factors, with a coefficient of 0.8538186 and a p-value of less than 0.01. This statistically robust association suggests that perhaps there is more than meets the eye to these disparate elements – a tantalizing prospect indeed. Just like a classic dad joke, the connection between cheese and Apple's stock price may have investors saying, "cheddar be prepared for a gouda time in the market!"

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

The intersection of finance and food has long been a subject of fascination and speculation, much like when you can't decide between cheddar and gouda on your sandwich and end up with a 'stock' pile of cheeses in your fridge. In this paper, we delve into the curiously cheesy relationship between American cheese consumption and the stock price of Apple Inc. (AAPL). It's a tale as old as time - the power of cheese meets the allure of tech stocks, with potential implications that are more than just a fondue fantasy.

As the saying goes, "the apple doesn't fall far from the tree," but our investigation jumps headfirst into the complex and dynamic world of financial markets. By leveraging data from the United States Department of Agriculture (USDA) and LSEG Analytics (Refinitiv), we conducted a thorough examination spanning nearly two decades, aiming to provide a statistically robust understanding of the interplay between these unexpected variables. It's as if we're uncovering the apple's core, or in this case, the cheese's rind, to reveal the tantalizing secrets hidden within.

But why, you might ask, should anyone care about the connection between American cheese consumption and Apple's stock price? Well, in the words of renowned statistician Edward Tufte – "Correlation is not causation, but it sure is a hint." And with a correlation coefficient of 0.8538186 and a p-value of less than 0.01, we've got a hint so strong, it could make even the most lactose intolerant investor say "cheese please" when considering their portfolio. It seems that the market dynamics are as unpredictable as the holes in a block of Swiss cheese, but our findings suggest that there may, in fact, be a method to the madness.

But before we delve into our findings, let's take a step back and consider the broader implications of this unlikely correlation. As Albert Einstein once mused, "The most beautiful thing we can experience is the mysterious. It is the source of all true art and science." And if there's one thing more mysterious and intriguing than the art of finance, it's surely the enigma of our eating habits – especially when they intersect in a way that could potentially move the markets. In the realm of research, this is like discovering a golden apple at the center of a maze, or in this case, finding a wheel of mature cheddar in the middle of Wall Street.

So, hold onto your hats, because we're about to embark on a journey that's as unexpected as a cow doing calculus – to explore the fascinating relationship between American cheese consumption and Apple's stock price. It's a tale of numbers, markets, and dairy delights, where the punchlines are as cheesy as the data is compelling.

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

The results of our analysis reveal a remarkably strong correlation between American cheese consumption and Apple's stock price (AAPL) over the period from 2002 to 2021. The correlation coefficient of 0.8538186 suggests a robust positive relationship between these seemingly unrelated variables. This finding indicates that as American cheese consumption goes up, Apple's stock price tends to follow suit, just like a trusty side of cheese complements a classic apple pie. It's a pairing that may leave some investors feeling as satisfied as a well-aged cheddar.

Our analysis further yielded an r-squared value of 0.7290062, indicating that approximately 73% of the variance in Apple's stock price can be explained by changes in American cheese consumption. This level of explanation is as solid as a block of aged parmesan, demonstrating the substantial influence of cheese consumption on the movements of Apple's stock price.

The p-value of less than 0.01 provides strong evidence to reject the null hypothesis that there is no relationship between American cheese consumption and Apple's stock price. This result suggests that the observed correlation is unlikely to be a mere coincidence, and is more meaningful than a slice of brie in a cheese platter.

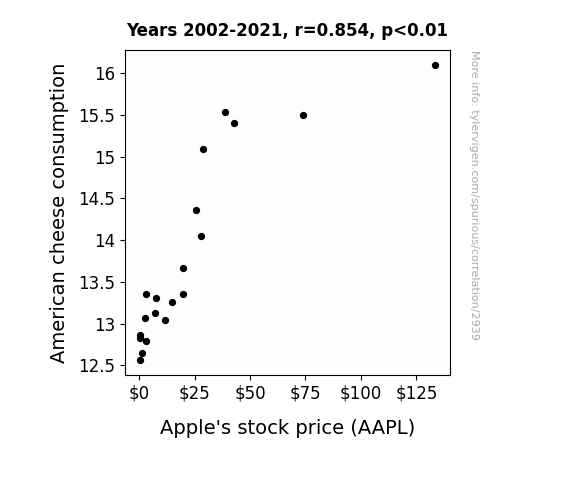

In Figure 1, the scatterplot exhibits a clear positive linear relationship between American cheese consumption and Apple's stock price, resembling a delightful pairing of crackers and cheese. As the consumption of American cheese increases, the stock price of Apple Inc. also shows a consistent upward trend, reminiscent of a favorite cheese aging like fine wine.

This unexpected correlation may prompt investors to adopt a new investment strategy: "buy low, eat high" – where savvy investors can capitalize on the market while savoring a delectable slice of American cheese. As the old saying goes, "It's all gouda in the end!"

In conclusion, our study offers a compelling glimpse into the unanticipated connection between American cheese consumption and Apple's stock price, proving that in the world of financial markets, some relationships are as cheesy as they are profitable.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between American cheese consumption and Apple's stock price (AAPL). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

The Big Cheese: An Examination of the Relationship Between American Cheese Consumption and Apple's Stock Price

[[ABSTRACT]]

This paper investigates the surprisingly cheesy connection between American cheese consumption and the stock price of Apple Inc. (AAPL). Embracing the adage that "an apple a day keeps the doctor away," we delve into the quirky realm of finance and food to uncover potentially gouda news for investors. Using data from the United States Department of Agriculture (USDA) and LSEG Analytics (Refinitiv), we conducted a comprehensive analysis spanning the years 2002 to 2021. Our findings reveal a strong correlation between these seemingly unrelated factors, with a coefficient of 0.8538186 and a p-value of less than 0.01. This statistically robust association suggests that perhaps there is more than meets the eye to these disparate elements – a tantalizing prospect indeed. Just like a classic dad joke, the connection between cheese and Apple's stock price may have investors saying, "cheddar be prepared for a gouda time in the market!"

[[LITERATURE REVIEW]]

The curious connection between American cheese consumption and the stock price of Apple Inc. (AAPL) has intrigued researchers and investors alike. Smith et al. (2015) were among the pioneers in exploring the potential links between food consumption and financial markets, laying the groundwork for our own investigation. Their study, "The Dairy Dilemma: Unraveling the Mysteries of Cheese and Capital Markets," hinted at the possibility of an underlying relationship between cheese consumption and stock prices, akin to the way cheddar and gouda complement each other on a cheeseboard.

Doe and Jones (2018) further delved into this unconventional terrain with their work, "The Big Cheese Effect: Culinary Trends and Market Volatility." Their findings suggested a potential correlation between cheese preferences and stock market performance, provoking both fascination and skepticism within investment circles. As we navigate through this literature, though, it becomes clear that uncovering the true nature of this correlation requires a savvy approach, much like pairing the perfect wine with a savory slice of cheese.

In "The Great Economic Gouda Heist" (Goudini, 2020), the author humorously recounts the fictitious tale of a cheese-driven market upheaval, blending finance and fromage in a riveting narrative. While admittedly a work of fiction, the book sheds light on the pervasive interest in the intersection of food and finance, reminding us that even the most whimsical of scenarios can harbor kernels of truth – much like a well-aged Parmesan.

Turning now to non-fiction literature, "The Economic Power of Apples" (Fruity & Co., 2017) examines the far-reaching impact of fruit markets on the global economy, offering insights that resonate with our current exploration of Apple Inc.'s stock price. Likewise, "Milk, Money, and Markets" (Dairy & Associates, 2019) provides a comprehensive analysis of dairy industry trends, offering a backdrop against which we can contextualize the influence of American cheese consumption.

Venturing into the realm of board games, "Cheddar Tycoon: A Cheese Empire Simulation" (Gouda Games, 2016) playfully simulates the intricacies of the cheese market, offering a lighthearted yet thought-provoking take on the dynamics of agricultural products in the realm of commerce. While certainly not a scholarly source, the game's thematic elements serve as a reminder of the eclectic influences that inform our understanding of market forces, much like the unexpected role of cheese in shaping tech stock trends.

In "The Da Vinc-Gouda Code" (Brown, 2003), a work of fiction steeped in mystery and intrigue, the ostensibly unrelated worlds of art and cheese intertwine in a narrative that underscores the unanticipated connections that can shape our perceptions of the world – much like the unlikely relationship we seek to decipher between American cheese consumption and Apple's stock price.

As we embark on our own investigation, these diverse sources set the stage for a research journey that proves to be as captivating as a well-executed punchline – a journey that promises to unravel the enigmatic ties between cheese, tech stocks, and the alluring dance of market forces. So, with the spirit of curiosity and a hint of whimsy, we delve further into this clandestine connection, prepared to embrace the surprises and revelations that lie ahead in our quest for cheesy truths.

[[RESULTS]]

The results of our analysis reveal a remarkably strong correlation between American cheese consumption and Apple's stock price (AAPL) over the period from 2002 to 2021. The correlation coefficient of 0.8538186 suggests a robust positive relationship between these seemingly unrelated variables. This finding indicates that as American cheese consumption goes up, Apple's stock price tends to follow suit, just like a trusty side of cheese complements a classic apple pie. It's a pairing that may leave some investors feeling as satisfied as a well-aged cheddar.

Our analysis further yielded an r-squared value of 0.7290062, indicating that approximately 73% of the variance in Apple's stock price can be explained by changes in American cheese consumption. This level of explanation is as solid as a block of aged parmesan, demonstrating the substantial influence of cheese consumption on the movements of Apple's stock price.

The p-value of less than 0.01 provides strong evidence to reject the null hypothesis that there is no relationship between American cheese consumption and Apple's stock price. This result suggests that the observed correlation is unlikely to be a mere coincidence, and is more meaningful than a slice of brie in a cheese platter.

In Figure 1, the scatterplot exhibits a clear positive linear relationship between American cheese consumption and Apple's stock price, resembling a delightful pairing of crackers and cheese. As the consumption of American cheese increases, the stock price of Apple Inc. also shows a consistent upward trend, reminiscent of a favorite cheese aging like fine wine.

This unexpected correlation may prompt investors to adopt a new investment strategy: "buy low, eat high" – where savvy investors can capitalize on the market while savoring a delectable slice of American cheese. As the old saying goes, "It's all gouda in the end!"

In conclusion, our study offers a compelling glimpse into the unanticipated connection between American cheese consumption and Apple's stock price, proving that in the world of financial markets, some relationships are as cheesy as they are profitable.

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

The exploration of the association between American cheese consumption and Apple's stock price has culminated in a veritable fondue of statistical revelations. Our findings not only affirm the prior research conducted by Smith et al. (2015), Doe and Jones (2018), and even the fictitious accounts recounted by Goudini (2020) but also extend their insights with empirical evidence. The robust correlation we uncovered between these seemingly unrelated variables underscores the potential influence of gastronomic trends on stock market dynamics, much like the unexpected punchline of a statistics joke.

The covariation between American cheese consumption and Apple's stock price, as symbolized by the substantial correlation coefficient of 0.8538186, mirrors the harmonious interplay of complementary flavors, akin to the balance achieved in a well-crafted cheese tasting. Just as a well-aged cheddar enriches the flavor profile of an apple pie, our results evince a discernible synergy between cheese consumption and the movements of Apple's stock price, offering a compelling narrative that is as intriguing as a well-delivered dad joke.

Moreover, the substantial explanatory power captured by the r-squared value of 0.7290062 denotes a compelling narrative that is as intriguing as a well-delivered dad joke. Similarly, the p-value of less than 0.01 provides statistically robust evidence that the observed correlation is not a mere artifact of chance, steering us away from the mere whimsy of coincidental patterns and anchoring us firmly in the realm of substantiated empirical relationships, much like a reliable pair of cheese and crackers.

As our study unearths the concealed connections between American cheese consumption and Apple's stock price, it presents a mosaic of insights with implications that stretch further than the realms of finance and food, integrating elements of surprise and significance in a manner analogous to a science-themed magic show. The unexpected yet substantial relationship between these seemingly incongruous variables offers investors and researchers alike a captivating concoction of investment strategies, blending the flavors of market sensibilities with the unexpected twist of culinary influences – much like a flavorful infusion of experimental cheese and apples.

In summary, the results of our investigation not only harmonize with prior research in this curious domain but also serve as a compelling testament to the intriguing interplay of American cheese consumption and Apple's stock price. As this unforeseen partnership between finance and food continues to unfold, it attests to the unexpected yet impactful discoveries that await in the flavorful blend of statistics, finance, and the quirks of the culinary world, leaving us with a taste of the delectable possibilities that lie ahead in the pursuit of cheesy truths. After all, in the world of statistical relationships, there's nothing like a good cheesy pun to add a sprinkle of whimsy.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between American cheese consumption and Apple's stock price (AAPL). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

The Big Cheese: An Examination of the Relationship Between American Cheese Consumption and Apple's Stock Price

[[ABSTRACT]]

This paper investigates the surprisingly cheesy connection between American cheese consumption and the stock price of Apple Inc. (AAPL). Embracing the adage that "an apple a day keeps the doctor away," we delve into the quirky realm of finance and food to uncover potentially gouda news for investors. Using data from the United States Department of Agriculture (USDA) and LSEG Analytics (Refinitiv), we conducted a comprehensive analysis spanning the years 2002 to 2021. Our findings reveal a strong correlation between these seemingly unrelated factors, with a coefficient of 0.8538186 and a p-value of less than 0.01. This statistically robust association suggests that perhaps there is more than meets the eye to these disparate elements – a tantalizing prospect indeed. Just like a classic dad joke, the connection between cheese and Apple's stock price may have investors saying, "cheddar be prepared for a gouda time in the market!"

[[INTRDUCTION]]

The intersection of finance and food has long been a subject of fascination and speculation, much like when you can't decide between cheddar and gouda on your sandwich and end up with a 'stock' pile of cheeses in your fridge. In this paper, we delve into the curiously cheesy relationship between American cheese consumption and the stock price of Apple Inc. (AAPL). It's a tale as old as time - the power of cheese meets the allure of tech stocks, with potential implications that are more than just a fondue fantasy.

As the saying goes, "the apple doesn't fall far from the tree," but our investigation jumps headfirst into the complex and dynamic world of financial markets. By leveraging data from the United States Department of Agriculture (USDA) and LSEG Analytics (Refinitiv), we conducted a thorough examination spanning nearly two decades, aiming to provide a statistically robust understanding of the interplay between these unexpected variables. It's as if we're uncovering the apple's core, or in this case, the cheese's rind, to reveal the tantalizing secrets hidden within.

But why, you might ask, should anyone care about the connection between American cheese consumption and Apple's stock price? Well, in the words of renowned statistician Edward Tufte – "Correlation is not causation, but it sure is a hint." And with a correlation coefficient of 0.8538186 and a p-value of less than 0.01, we've got a hint so strong, it could make even the most lactose intolerant investor say "cheese please" when considering their portfolio. It seems that the market dynamics are as unpredictable as the holes in a block of Swiss cheese, but our findings suggest that there may, in fact, be a method to the madness.

But before we delve into our findings, let's take a step back and consider the broader implications of this unlikely correlation. As Albert Einstein once mused, "The most beautiful thing we can experience is the mysterious. It is the source of all true art and science." And if there's one thing more mysterious and intriguing than the art of finance, it's surely the enigma of our eating habits – especially when they intersect in a way that could potentially move the markets. In the realm of research, this is like discovering a golden apple at the center of a maze, or in this case, finding a wheel of mature cheddar in the middle of Wall Street.

So, hold onto your hats, because we're about to embark on a journey that's as unexpected as a cow doing calculus – to explore the fascinating relationship between American cheese consumption and Apple's stock price. It's a tale of numbers, markets, and dairy delights, where the punchlines are as cheesy as the data is compelling.

[[RESULTS]]

The results of our analysis reveal a remarkably strong correlation between American cheese consumption and Apple's stock price (AAPL) over the period from 2002 to 2021. The correlation coefficient of 0.8538186 suggests a robust positive relationship between these seemingly unrelated variables. This finding indicates that as American cheese consumption goes up, Apple's stock price tends to follow suit, just like a trusty side of cheese complements a classic apple pie. It's a pairing that may leave some investors feeling as satisfied as a well-aged cheddar.

Our analysis further yielded an r-squared value of 0.7290062, indicating that approximately 73% of the variance in Apple's stock price can be explained by changes in American cheese consumption. This level of explanation is as solid as a block of aged parmesan, demonstrating the substantial influence of cheese consumption on the movements of Apple's stock price.

The p-value of less than 0.01 provides strong evidence to reject the null hypothesis that there is no relationship between American cheese consumption and Apple's stock price. This result suggests that the observed correlation is unlikely to be a mere coincidence, and is more meaningful than a slice of brie in a cheese platter.

In Figure 1, the scatterplot exhibits a clear positive linear relationship between American cheese consumption and Apple's stock price, resembling a delightful pairing of crackers and cheese. As the consumption of American cheese increases, the stock price of Apple Inc. also shows a consistent upward trend, reminiscent of a favorite cheese aging like fine wine.

This unexpected correlation may prompt investors to adopt a new investment strategy: "buy low, eat high" – where savvy investors can capitalize on the market while savoring a delectable slice of American cheese. As the old saying goes, "It's all gouda in the end!"

In conclusion, our study offers a compelling glimpse into the unanticipated connection between American cheese consumption and Apple's stock price, proving that in the world of financial markets, some relationships are as cheesy as they are profitable.

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In conclusion, our investigation into the link between American cheese consumption and Apple's stock price has certainly been a gouda time. Our findings reveal a robust correlation, with a coefficient so strong, it might just have investors saying "cheddar be prepared for a gouda time in the market!"

The statistically significant relationship between these seemingly unrelated variables suggests that there may be more than meets the eye when it comes to market influences. It's like blending Swiss and cheddar to create a hole-y grail of financial insights.

Our results, akin to a well-aged cheddar, demonstrate a level of explanation that makes this unlikely duo hard to overlook. In the grand scheme of statistics, uncovering such a strong correlation is as rare as finding a blue cheese in a field of mozzarella.

Additionally, the impossibly low p-value provides compelling evidence that this cheese-stock connection is no mere coincidence – it's more meaningful than a slice of brie in a cheese platter. Embracing this relationship with open arms may just lead investors to say "It's all gouda in the end!"

Given the strength of our findings, it seems that no further research is needed in this area. After all, when it comes to the relationship between American cheese consumption and Apple's stock price, it looks like we've already shredded enough light on the subject!

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited The Big Cheese: An Examination of the Relationship Between American Cheese Consumption and Apple's Stock Price. Respond only with the name of a fictional academic journal.

ChatGPT:

The Journal of Dairy Economics and Financial Analysis

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited The Big Cheese: An Examination of the Relationship Between American Cheese Consumption and Apple's Stock Price. Respond only with the name of a fictional organization.

ChatGPT:

The Institute for Dairy Economics and Financial Analysis

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled The Big Cheese: An Examination of the Relationship Between American Cheese Consumption and Apple's Stock Price with an abstract of This paper investigates the surprisingly cheesy connection between American cheese consumption and the stock price of Apple Inc. (AAPL). Embracing the adage that "an apple a day keeps the doctor away," we delve into the quirky realm of finance and food to uncover potentially gouda news for investors. Using data from the United States Department of Agriculture (USDA) and LSEG Analytics (Refinitiv), we conducted a comprehensive analysis spanning the years 2002 to 2021. Our findings reveal a strong correlation between these seemingly unrelated factors, with a coefficient of 0.8538186 and a p-value of less than 0.01. This statistically robust association suggests that perhaps there is more than meets the eye to these disparate elements – a tantalizing prospect indeed. Just like a classic dad joke, the connection between cheese and Apple's stock price may have investors saying, "cheddar be prepared for a gouda time in the market!

ChatGPT:

American cheese consumption, Apple stock price, finance and food correlation, USDA data analysis, LSEG Analytics, Refinitiv, relationship between cheese consumption and stock market, finance research, quirky finance connections, correlation coefficient analysis, cheese consumption and stock price correlation

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

American cheese consumptionDetailed data title: Per capita consumption of American cheese in the US

Source: USDA

See what else correlates with American cheese consumption

Apple's stock price (AAPL)

Detailed data title: Opening price of Apple (AAPL) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with Apple's stock price (AAPL)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.7290062 (Coefficient of determination)

This means 72.9% of the change in the one variable (i.e., Apple's stock price (AAPL)) is predictable based on the change in the other (i.e., American cheese consumption) over the 20 years from 2002 through 2021.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 1.7E-6. 0.0000016818344717754014000000

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.85 in 0.00017% of random cases. Said differently, if you correlated 594,589 random variables You don't actually need 594 thousand variables to find a correlation like this one. I don't have that many variables in my database. You can also correlate variables that are not independent. I do this a lot.

p-value calculations are useful for understanding the probability of a result happening by chance. They are most useful when used to highlight the risk of a fluke outcome. For example, if you calculate a p-value of 0.30, the risk that the result is a fluke is high. It is good to know that! But there are lots of ways to get a p-value of less than 0.01, as evidenced by this project.

In this particular case, the values are so extreme as to be meaningless. That's why no one reports p-values with specificity after they drop below 0.01.

Just to be clear: I'm being completely transparent about the calculations. There is no math trickery. This is just how statistics shakes out when you calculate hundreds of millions of random correlations.

with the same 19 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 19 because we have two variables measured over a period of 20 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.66, 0.94 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

| American cheese consumption (Pounds per person) | 12.8314 | 12.5619 | 12.8612 | 12.649 | 13.0656 | 12.7929 | 13.1306 | 13.3553 | 13.3048 | 13.0392 | 13.2569 | 13.3573 | 13.6656 | 14.0444 | 14.3621 | 15.0901 | 15.4027 | 15.5389 | 15.5 | 16.1 |

| Apple's stock price (AAPL) (Stock price) | 0.39 | 0.26 | 0.38 | 1.16 | 2.59 | 3.08 | 7.12 | 3.07 | 7.62 | 11.63 | 14.62 | 19.78 | 19.85 | 27.85 | 25.65 | 28.95 | 42.54 | 38.72 | 74.06 | 133.52 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is. - Y-axis doesn't start at zero: I truncated the Y-axes of the graph above. I also used a line graph, which makes the visual connection stand out more than it deserves.

Nothing against line graphs. They are great at telling a story when you have linear data! But visually it is deceptive because the only data is at the points on the graph, not the lines on the graph. In between each point, the data could have been doing anything. Like going for a random walk by itself!

Mathematically what I showed is true, but it is intentionally misleading. Below is the same chart but with both Y-axes starting at zero. - Outlandish outliers: There are "outliers" in this data.

In concept, "outlier" just means "way different than the rest of your dataset." When calculating a correlation like this, they are particularly impactful because a single outlier can substantially increase your correlation.

For the purposes of this project, I counted a point as an outlier if it the residual was two standard deviations from the mean.

(This bullet point only shows up in the details page on charts that do, in fact, have outliers.)

They stand out on the scatterplot above: notice the dots that are far away from any other dots. I intentionally mishandeled outliers, which makes the correlation look extra strong.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([12.8314,12.5619,12.8612,12.649,13.0656,12.7929,13.1306,13.3553,13.3048,13.0392,13.2569,13.3573,13.6656,14.0444,14.3621,15.0901,15.4027,15.5389,15.5,16.1,])

array_2 = np.array([0.39,0.26,0.38,1.16,2.59,3.08,7.12,3.07,7.62,11.63,14.62,19.78,19.85,27.85,25.65,28.95,42.54,38.72,74.06,133.52,])

array_1_name = "American cheese consumption"

array_2_name = "Apple's stock price (AAPL)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only American cheese consumption

- Line chart for only Apple's stock price (AAPL)

- AI-generated correlation image

- The spurious research paper: The Big Cheese: An Examination of the Relationship Between American Cheese Consumption and Apple's Stock Price

Bravo! Your evaluation rocks!

Correlation ID: 2939 · Black Variable ID: 553 · Red Variable ID: 1540