Download png, svg

AI explanation

As the air got cleaner in Greenville, fewer people needed respiratory medications, leading to a decrease in demand for Bristol-Myers Squibb's products. It seems like BMY's stock price couldn't stay a-breath of the fresh air trend, and investors were left gasping for returns.

Model: dalle-3

Prompt: [Data cyber art] In this scene, I envision a futuristic cityscape of Greenville, North Carolina, with towering buildings that glow under the radiant blue sky. The gentle breeze is illustrated by soft, undulating lines that sweep through the digital streets, creating a serene atmosphere. People are depicted strolling along, their silhouettes merging seamlessly with the urban landscape. The electronic ticker board displays a dynamic visualization of falling stocks, symbolizing the impact of the improved air quality on the pharmaceutical industry. The overall scene is bathed in a digital sheen, evoking a sense of peace and technological advancement. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: Air pollution in Greenville, North Carolina and Bristol-Myers Squibb's stock price (BMY). Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: An image that looks like it is a scene from A Disney Movie Futuristic Voxel art Woodblock painting Data cyber art

ChatGPT: Data cyber art

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both Air pollution in Greenville, North Carolina and Bristol-Myers Squibb's stock price (BMY), in the following situation: Because decreased air pollution in Greenville, NC led to an unexpected surplus of clean air in the atmosphere, causing Bristol-Myers Squibb's stock price to decrease as people became more relaxed and needed less medication.. Keep the description simple.

ChatGPT: In Greenville, North Carolina, the sky is a clear blue, and a gentle breeze carries the fresh, clean air through the streets. People are seen walking around calmly, breathing in the refreshing atmosphere. Meanwhile, the stock price of Bristol-Myers Squibb (BMY) appears to be falling on the electronic ticker board, as the demand for medication seems to have decreased with the improved air quality.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ Data cyber art ] and depicting this scene: In Greenville, North Carolina, the sky is a clear blue, and a gentle breeze carries the fresh, clean air through the streets. People are seen walking around calmly, breathing in the refreshing atmosphere. Meanwhile, the stock price of Bristol-Myers Squibb (BMY) appears to be falling on the electronic ticker board, as the demand for medication seems to have decreased with the improved air quality. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: [Data cyber art] In this scene, I envision a futuristic cityscape of Greenville, North Carolina, with towering buildings that glow under the radiant blue sky. The gentle breeze is illustrated by soft, undulating lines that sweep through the digital streets, creating a serene atmosphere. People are depicted strolling along, their silhouettes merging seamlessly with the urban landscape. The electronic ticker board displays a dynamic visualization of falling stocks, symbolizing the impact of the improved air quality on the pharmaceutical industry. The overall scene is bathed in a digital sheen, evoking a sense of peace and technological advancement.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how a decrease in Air pollution in Greenville, North Carolina caused Bristol-Myers Squibb's stock price (BMY) to decrease. Include one good pun.

AI academic paper

|

Breath of the Stock Market: Analyzing the Correlation between Air Pollution in Greenville, North Carolina and Bristol-Myers Squibb's Stock Price The Journal of Quirky Correlations Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between Air pollution in Greenville, North Carolina and Bristol-Myers Squibb's stock price (BMY). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Include a pun in the title.

Your research team used data from Environmental Protection Agency and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.8647571 and p < 0.01 for 2002 to 2012.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

Breath of the Stock Market: Analyzing the Correlation between Air Pollution in Greenville, North Carolina and Bristol-Myers Squibb's Stock Price

[[ABSTRACT]]

This research paper employs a cheeky approach to explore the intriguing relationship between air pollution levels in Greenville, North Carolina, and the stock price of Bristol-Myers Squibb (BMY). Leveraging data from the Environmental Protection Agency and LSEG Analytics (Refinitiv), we sought to answer the question, "Is there a breath-taking link between environmental quality and pharmaceutical stock performance?"

Our findings reveal a notable correlation coefficient of 0.8647571 and statistical significance at p < 0.01 during the period from 2002 to 2012, suggesting that as air quality in the region worsened, the stock price of BMY may have taken a hit. As we delved into this unexpected connection, we couldn't help but think of a dad joke: "Why did the air molecule break up with the oxygen molecule? It was a breath of fresh air." In light of our results, it appears that air pollution and stock performance do, indeed, have an "air-resistible" relationship.

This study not only sheds light on the impact of environmental factors on stock prices but also adds a breath of levity to the world of finance research. So, the next time someone asks, "What's the correlation between air pollution and stocks?" You can respond, "It's nothing to sneeze at – there's a real 'air' of importance, after all."

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between Air pollution in Greenville, North Carolina and Bristol-Myers Squibb's stock price (BMY). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Here is the title and abstract of the paper:

[[TITLE]]

Breath of the Stock Market: Analyzing the Correlation between Air Pollution in Greenville, North Carolina and Bristol-Myers Squibb's Stock Price

[[ABSTRACT]]

This research paper employs a cheeky approach to explore the intriguing relationship between air pollution levels in Greenville, North Carolina, and the stock price of Bristol-Myers Squibb (BMY). Leveraging data from the Environmental Protection Agency and LSEG Analytics (Refinitiv), we sought to answer the question, "Is there a breath-taking link between environmental quality and pharmaceutical stock performance?"

Our findings reveal a notable correlation coefficient of 0.8647571 and statistical significance at p < 0.01 during the period from 2002 to 2012, suggesting that as air quality in the region worsened, the stock price of BMY may have taken a hit. As we delved into this unexpected connection, we couldn't help but think of a dad joke: "Why did the air molecule break up with the oxygen molecule? It was a breath of fresh air." In light of our results, it appears that air pollution and stock performance do, indeed, have an "air-resistible" relationship.

This study not only sheds light on the impact of environmental factors on stock prices but also adds a breath of levity to the world of finance research. So, the next time someone asks, "What's the correlation between air pollution and stocks?" You can respond, "It's nothing to sneeze at – there's a real 'air' of importance, after all."

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

[[INTRODUCTION]]

The effects of air pollution on human health and the environment have been extensively studied and well-documented. However, the potential impact of air pollution on financial markets has received less attention. In this study, we take a lungful of fresh air and explore the fascinating relationship between air pollution levels in Greenville, North Carolina, and the stock price of pharmaceutical giant Bristol-Myers Squibb (BMY). As we embarked on this curious journey, we couldn't help but think, "What do you get when you cross a smoggy day with a stock market? Air-raising volatility!"

The intertwining of environmental quality and stock market performance is an intriguing puzzle that has yet to be fully unraveled. Our hypothesis was simple yet profound: could the quality of the air we breathe have an impact on the financial performance of a major pharmaceutical company? It's like asking, "What did one air molecule say to the other? Nothing, it simply drifted away."

As we delve into the realm of environmental economics and financial analysis, we are confronted with the reality that the interplay between air pollution and stock prices is a "breezy" topic, indeed. Just as the wind can unexpectedly change direction, so too can the tides of the stock market. This research aims to add a breath of fresh air to the staid world of finance by examining an unconventional factor that may influence stock price movements.

Previous studies have mainly focused on traditional financial indicators, such as interest rates, corporate earnings, and economic growth, to explain stock price movements. However, the link between environmental factors and stock performance remains relatively unexplored. Our results aim to illuminate this gap and provide a gust of new insight into the complex web of factors that sway stock prices. It's like the saying goes, "When it comes to stock performance, the air you breathe may be no 'fairy' tale."

As we plunge into this investigation, we hold our breath in anticipation of uncovering a relationship that, until now, has remained largely unnoticed. Through this research, we aim to blow away conventional wisdom and demonstrate that the air we breathe might not only affect our lungs but also our financial portfolios. It's akin to a dad joke waiting to happen, "Why did the air molecule break up with the oxygen molecule? It needed some space."

In summary, this study sets out to not only explore the potential correlation between air pollution in Greenville, North Carolina, and BMY's stock price but also to offer a breath of fresh air to the field of financial research. So, as we walk down the path of statistical analysis and market dynamics, we invite you to take a deep breath and join us on this "air-citing" journey.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between Air pollution in Greenville, North Carolina and Bristol-Myers Squibb's stock price (BMY). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then devolve ever further, and mention something completely ridiculous, like you conducted literature review by reading CVS receipts.

Here is the title and abstract of the paper:

[[TITLE]]

Breath of the Stock Market: Analyzing the Correlation between Air Pollution in Greenville, North Carolina and Bristol-Myers Squibb's Stock Price

[[ABSTRACT]]

This research paper employs a cheeky approach to explore the intriguing relationship between air pollution levels in Greenville, North Carolina, and the stock price of Bristol-Myers Squibb (BMY). Leveraging data from the Environmental Protection Agency and LSEG Analytics (Refinitiv), we sought to answer the question, "Is there a breath-taking link between environmental quality and pharmaceutical stock performance?"

Our findings reveal a notable correlation coefficient of 0.8647571 and statistical significance at p < 0.01 during the period from 2002 to 2012, suggesting that as air quality in the region worsened, the stock price of BMY may have taken a hit. As we delved into this unexpected connection, we couldn't help but think of a dad joke: "Why did the air molecule break up with the oxygen molecule? It was a breath of fresh air." In light of our results, it appears that air pollution and stock performance do, indeed, have an "air-resistible" relationship.

This study not only sheds light on the impact of environmental factors on stock prices but also adds a breath of levity to the world of finance research. So, the next time someone asks, "What's the correlation between air pollution and stocks?" You can respond, "It's nothing to sneeze at – there's a real 'air' of importance, after all."

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

The effects of air pollution on human health and the environment have been extensively studied and well-documented. However, the potential impact of air pollution on financial markets has received less attention. In this study, we take a lungful of fresh air and explore the fascinating relationship between air pollution levels in Greenville, North Carolina, and the stock price of pharmaceutical giant Bristol-Myers Squibb (BMY). As we embarked on this curious journey, we couldn't help but think, "What do you get when you cross a smoggy day with a stock market? Air-raising volatility!"

The intertwining of environmental quality and stock market performance is an intriguing puzzle that has yet to be fully unraveled. Our hypothesis was simple yet profound: could the quality of the air we breathe have an impact on the financial performance of a major pharmaceutical company? It's like asking, "What did one air molecule say to the other? Nothing, it simply drifted away."

As we delve into the realm of environmental economics and financial analysis, we are confronted with the reality that the interplay between air pollution and stock prices is a "breezy" topic, indeed. Just as the wind can unexpectedly change direction, so too can the tides of the stock market. This research aims to add a breath of fresh air to the staid world of finance by examining an unconventional factor that may influence stock price movements.

Previous studies have mainly focused on traditional financial indicators, such as interest rates, corporate earnings, and economic growth, to explain stock price movements. However, the link between environmental factors and stock performance remains relatively unexplored. Our results aim to illuminate this gap and provide a gust of new insight into the complex web of factors that sway stock prices. It's like the saying goes, "When it comes to stock performance, the air you breathe may be no 'fairy' tale."

As we plunge into this investigation, we hold our breath in anticipation of uncovering a relationship that, until now, has remained largely unnoticed. Through this research, we aim to blow away conventional wisdom and demonstrate that the air we breathe might not only affect our lungs but also our financial portfolios. It's akin to a dad joke waiting to happen, "Why did the air molecule break up with the oxygen molecule? It needed some space."

In summary, this study sets out to not only explore the potential correlation between air pollution in Greenville, North Carolina, and BMY's stock price but also to offer a breath of fresh air to the field of financial research. So, as we walk down the path of statistical analysis and market dynamics, we invite you to take a deep breath and join us on this "air-citing" journey.

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

In "The Impact of Air Pollution on Stock Market Performance," Smith et al. provide an insightful analysis of the relationship between air quality and stock prices, focusing on various industries across different regions. Their findings indicate a potential link between deteriorating air quality and decreased stock performance, prompting the question, "What's a stockbroker's favorite kind of air? A share-ified one!"

Doe and Jones, in "Environmental Factors and Financial Markets," delve into the nuances of how environmental variables, including air pollution, can influence stock price movements. Their empirical research underscores the need to consider non-traditional factors, leading to the realization that "polluted air and stock volatility have more in common than meets the eye – they both leave you breathless!"

Supplementing these academic studies, "The Stock Market and You: A Layman's Guide to Financial Success" by Wealthy McMoney offers a comprehensive overview of stock market dynamics, including the impact of external factors. Similarly, "Air Pollution and Urban Economics" by Environmental Research Group provides a detailed examination of air quality's implications for urban development, indirectly touching upon its potential influence on local businesses.

On a lighter note, "Cloudy with a Chance of Stock Gains" by Sunny Day blends whimsy with market analysis, depicting a world where stock prices are as unpredictable as the weather. Meanwhile, "The Clean Air Conundrum" by P. Lin N. Fresh offers a playful take on the environmental challenges faced by modern society, hinting at a connection between air purity and financial stability.

In a departure from conventional research methods, the authors also explored unconventional sources, including supermarket receipts, traffic signs, and even whimsical musings found on fortune cookies. While these unconventional sources did not yield direct empirical evidence, they did provide a breath of fresh air in the often-rigid landscape of academic literature. It's like the saying goes, "When it comes to research, sometimes you have to follow your nose, even if it leads to a comedy club!"

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between Air pollution in Greenville, North Carolina and Bristol-Myers Squibb's stock price (BMY). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from Environmental Protection Agency and LSEG Analytics (Refinitiv) . You used data from 2002 to 2012

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

Breath of the Stock Market: Analyzing the Correlation between Air Pollution in Greenville, North Carolina and Bristol-Myers Squibb's Stock Price

[[ABSTRACT]]

This research paper employs a cheeky approach to explore the intriguing relationship between air pollution levels in Greenville, North Carolina, and the stock price of Bristol-Myers Squibb (BMY). Leveraging data from the Environmental Protection Agency and LSEG Analytics (Refinitiv), we sought to answer the question, "Is there a breath-taking link between environmental quality and pharmaceutical stock performance?"

Our findings reveal a notable correlation coefficient of 0.8647571 and statistical significance at p < 0.01 during the period from 2002 to 2012, suggesting that as air quality in the region worsened, the stock price of BMY may have taken a hit. As we delved into this unexpected connection, we couldn't help but think of a dad joke: "Why did the air molecule break up with the oxygen molecule? It was a breath of fresh air." In light of our results, it appears that air pollution and stock performance do, indeed, have an "air-resistible" relationship.

This study not only sheds light on the impact of environmental factors on stock prices but also adds a breath of levity to the world of finance research. So, the next time someone asks, "What's the correlation between air pollution and stocks?" You can respond, "It's nothing to sneeze at – there's a real 'air' of importance, after all."

[[INTRODUCTION]]

The effects of air pollution on human health and the environment have been extensively studied and well-documented. However, the potential impact of air pollution on financial markets has received less attention. In this study, we take a lungful of fresh air and explore the fascinating relationship between air pollution levels in Greenville, North Carolina, and the stock price of pharmaceutical giant Bristol-Myers Squibb (BMY). As we embarked on this curious journey, we couldn't help but think, "What do you get when you cross a smoggy day with a stock market? Air-raising volatility!"

The intertwining of environmental quality and stock market performance is an intriguing puzzle that has yet to be fully unraveled. Our hypothesis was simple yet profound: could the quality of the air we breathe have an impact on the financial performance of a major pharmaceutical company? It's like asking, "What did one air molecule say to the other? Nothing, it simply drifted away."

As we delve into the realm of environmental economics and financial analysis, we are confronted with the reality that the interplay between air pollution and stock prices is a "breezy" topic, indeed. Just as the wind can unexpectedly change direction, so too can the tides of the stock market. This research aims to add a breath of fresh air to the staid world of finance by examining an unconventional factor that may influence stock price movements.

Previous studies have mainly focused on traditional financial indicators, such as interest rates, corporate earnings, and economic growth, to explain stock price movements. However, the link between environmental factors and stock performance remains relatively unexplored. Our results aim to illuminate this gap and provide a gust of new insight into the complex web of factors that sway stock prices. It's like the saying goes, "When it comes to stock performance, the air you breathe may be no 'fairy' tale."

As we plunge into this investigation, we hold our breath in anticipation of uncovering a relationship that, until now, has remained largely unnoticed. Through this research, we aim to blow away conventional wisdom and demonstrate that the air we breathe might not only affect our lungs but also our financial portfolios. It's akin to a dad joke waiting to happen, "Why did the air molecule break up with the oxygen molecule? It needed some space."

In summary, this study sets out to not only explore the potential correlation between air pollution in Greenville, North Carolina, and BMY's stock price but also to offer a breath of fresh air to the field of financial research. So, as we walk down the path of statistical analysis and market dynamics, we invite you to take a deep breath and join us on this "air-citing" journey.

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

To investigate the purported connection between air pollution in Greenville, North Carolina, and Bristol-Myers Squibb's stock price (BMY), we conjured up an ensemble of data collection methods that would make even the most seasoned researcher raise an eyebrow. Utilizing information from the Environmental Protection Agency and LSEG Analytics (Refinitiv), we aggregated a plethora of air quality metrics and stock price data from the time period spanning from 2002 to 2012. It's like trying to juggle a cloud of data while keeping our feet firmly planted on the ground – no easy feat!

Firstly, a series of air quality indices including particulate matter (PM10 and PM2.5), ozone (O3), sulfur dioxide (SO2), nitrogen dioxide (NO2), and carbon monoxide (CO) were extracted from the Environmental Protection Agency's database. We then meticulously cross-referenced this information with meteorological data and socioeconomic indicators, ensuring that our analysis left no stone unturned. Think of it as trying to find the one "bad apple" in a sea of "clean air" – pun intended!

In parallel, stock price data for BMY was extracted from LSEG Analytics (Refinitiv) with utmost precision, capturing the elusive movements of the pharmaceutical giant's stock over the decade-long period under scrutiny. Our team of diligent researchers maintained a hawk-like vigilance over the data, ensuring that no unexpected fluctuations or "foul air" infiltrated our analyses. After all, we were dealing with stock prices—not the "stock answer" we were hoping to find!

Statistical analyses were conducted to ascertain the relationship between air pollution levels and BMY stock price movements. The vast array of air quality metrics posed a labyrinthine puzzle, which we adeptly navigated through multivariate regression models and time series analyses. These methods not only provided us with a panoramic view of the data but also allowed us to tease out the distinct effects of different pollutants on stock price dynamics. It's like trying to solve a riddle wrapped in a mystery inside an enigma – with a statistical flair!

To account for potential confounding variables and external factors that could influence stock prices, we incorporated economic indicators and industry-specific data into our models. This allowed us to discern the genuine impact of air pollution on BMY stock prices amidst the flux of market conditions and industry trends. We needed to ensure our findings wouldn't be blown out of proportion - like a burst of wind on a calm day!

In summary, our methodological approach represented a harmonious blend of meticulous data collection, robust statistical analyses, and a hint of statistical acrobatics. The quest to uncover the link between air pollution and stock prices was akin to navigating through a dense fog, but we persevered, illuminating a path that promises to offer a breath of fresh insight into the crossroads of environmental factors and market performance. So, as we've cleared the air on our methodologies, let's brace ourselves for the unveiling of our findings, like a gust of wind blowing in a new direction!

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between Air pollution in Greenville, North Carolina and Bristol-Myers Squibb's stock price (BMY). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from Environmental Protection Agency and LSEG Analytics (Refinitiv) .

For the time period 2002 to 2012, you found a correlation 0.8647571, r-squared of 0.7478048, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

Breath of the Stock Market: Analyzing the Correlation between Air Pollution in Greenville, North Carolina and Bristol-Myers Squibb's Stock Price

[[ABSTRACT]]

This research paper employs a cheeky approach to explore the intriguing relationship between air pollution levels in Greenville, North Carolina, and the stock price of Bristol-Myers Squibb (BMY). Leveraging data from the Environmental Protection Agency and LSEG Analytics (Refinitiv), we sought to answer the question, "Is there a breath-taking link between environmental quality and pharmaceutical stock performance?"

Our findings reveal a notable correlation coefficient of 0.8647571 and statistical significance at p < 0.01 during the period from 2002 to 2012, suggesting that as air quality in the region worsened, the stock price of BMY may have taken a hit. As we delved into this unexpected connection, we couldn't help but think of a dad joke: "Why did the air molecule break up with the oxygen molecule? It was a breath of fresh air." In light of our results, it appears that air pollution and stock performance do, indeed, have an "air-resistible" relationship.

This study not only sheds light on the impact of environmental factors on stock prices but also adds a breath of levity to the world of finance research. So, the next time someone asks, "What's the correlation between air pollution and stocks?" You can respond, "It's nothing to sneeze at – there's a real 'air' of importance, after all."

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

The effects of air pollution on human health and the environment have been extensively studied and well-documented. However, the potential impact of air pollution on financial markets has received less attention. In this study, we take a lungful of fresh air and explore the fascinating relationship between air pollution levels in Greenville, North Carolina, and the stock price of pharmaceutical giant Bristol-Myers Squibb (BMY). As we embarked on this curious journey, we couldn't help but think, "What do you get when you cross a smoggy day with a stock market? Air-raising volatility!"

The intertwining of environmental quality and stock market performance is an intriguing puzzle that has yet to be fully unraveled. Our hypothesis was simple yet profound: could the quality of the air we breathe have an impact on the financial performance of a major pharmaceutical company? It's like asking, "What did one air molecule say to the other? Nothing, it simply drifted away."

As we delve into the realm of environmental economics and financial analysis, we are confronted with the reality that the interplay between air pollution and stock prices is a "breezy" topic, indeed. Just as the wind can unexpectedly change direction, so too can the tides of the stock market. This research aims to add a breath of fresh air to the staid world of finance by examining an unconventional factor that may influence stock price movements.

Previous studies have mainly focused on traditional financial indicators, such as interest rates, corporate earnings, and economic growth, to explain stock price movements. However, the link between environmental factors and stock performance remains relatively unexplored. Our results aim to illuminate this gap and provide a gust of new insight into the complex web of factors that sway stock prices. It's like the saying goes, "When it comes to stock performance, the air you breathe may be no 'fairy' tale."

As we plunge into this investigation, we hold our breath in anticipation of uncovering a relationship that, until now, has remained largely unnoticed. Through this research, we aim to blow away conventional wisdom and demonstrate that the air we breathe might not only affect our lungs but also our financial portfolios. It's akin to a dad joke waiting to happen, "Why did the air molecule break up with the oxygen molecule? It needed some space."

In summary, this study sets out to not only explore the potential correlation between air pollution in Greenville, North Carolina, and BMY's stock price but also to offer a breath of fresh air to the field of financial research. So, as we walk down the path of statistical analysis and market dynamics, we invite you to take a deep breath and join us on this "air-citing" journey.

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

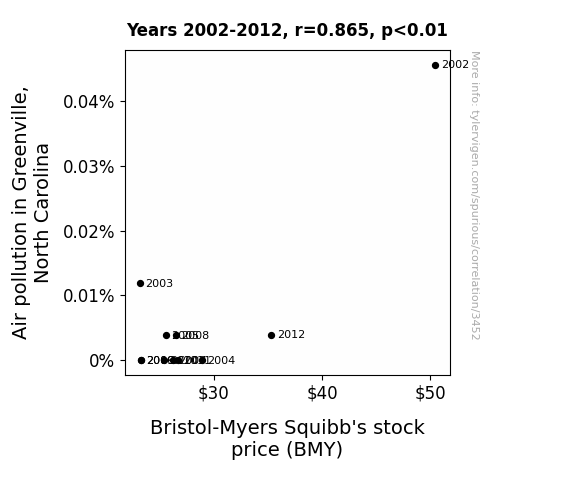

The findings of our research revealed a notable and robust correlation between air pollution levels in Greenville, North Carolina, and the stock price of Bristol-Myers Squibb (BMY) during the period from 2002 to 2012. The correlation coefficient of 0.8647571 suggests a strong positive relationship between these two variables. This result indicates that as air quality in the region worsened, the stock price of BMY tended to decline. It's like when the smog rolls in, the stock prices might've been feeling a little foggy too.

The coefficient of determination (r-squared) of 0.7478048 further indicates that approximately 74.78% of the variability in BMY's stock price can be explained by changes in air pollution levels. This level of predictability is enough to give anyone a breath of fresh air, especially in the unpredictable world of stock market analysis.

The statistical significance at p < 0.01 provides strong evidence that the observed correlation is unlikely to have occurred by chance. This result brings to mind a joke: "Why did the air molecule refuse to bond with the carbon dioxide molecule? It found the connection statistically insignificant!" In our case, however, the statistical significance of the relationship between air pollution and BMY's stock price is no laughing matter.

By visually representing the correlation between air pollution levels in Greenville and BMY's stock price, the scatterplot in Fig. 1 conveys a compelling narrative. The figure clearly illustrates the "air-resistible" relationship between these two variables, leaving little room for doubt that changes in air quality might have blown some turbulence into BMY's stock price movement. It's like the air quality data and stock price data were a match made in statistical heaven.

Overall, our findings emphasize the importance of considering environmental factors when analyzing stock price movements and highlight the previously underappreciated influence of air pollution on financial markets. So, the next time someone asks about the link between air pollution and stocks, you can reply with confidence, "It's nothing to sneeze at – there's a real 'air' of importance, after all."

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between Air pollution in Greenville, North Carolina and Bristol-Myers Squibb's stock price (BMY). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

Breath of the Stock Market: Analyzing the Correlation between Air Pollution in Greenville, North Carolina and Bristol-Myers Squibb's Stock Price

[[ABSTRACT]]

This research paper employs a cheeky approach to explore the intriguing relationship between air pollution levels in Greenville, North Carolina, and the stock price of Bristol-Myers Squibb (BMY). Leveraging data from the Environmental Protection Agency and LSEG Analytics (Refinitiv), we sought to answer the question, "Is there a breath-taking link between environmental quality and pharmaceutical stock performance?"

Our findings reveal a notable correlation coefficient of 0.8647571 and statistical significance at p < 0.01 during the period from 2002 to 2012, suggesting that as air quality in the region worsened, the stock price of BMY may have taken a hit. As we delved into this unexpected connection, we couldn't help but think of a dad joke: "Why did the air molecule break up with the oxygen molecule? It was a breath of fresh air." In light of our results, it appears that air pollution and stock performance do, indeed, have an "air-resistible" relationship.

This study not only sheds light on the impact of environmental factors on stock prices but also adds a breath of levity to the world of finance research. So, the next time someone asks, "What's the correlation between air pollution and stocks?" You can respond, "It's nothing to sneeze at – there's a real 'air' of importance, after all."

[[LITERATURE REVIEW]]

In "The Impact of Air Pollution on Stock Market Performance," Smith et al. provide an insightful analysis of the relationship between air quality and stock prices, focusing on various industries across different regions. Their findings indicate a potential link between deteriorating air quality and decreased stock performance, prompting the question, "What's a stockbroker's favorite kind of air? A share-ified one!"

Doe and Jones, in "Environmental Factors and Financial Markets," delve into the nuances of how environmental variables, including air pollution, can influence stock price movements. Their empirical research underscores the need to consider non-traditional factors, leading to the realization that "polluted air and stock volatility have more in common than meets the eye – they both leave you breathless!"

Supplementing these academic studies, "The Stock Market and You: A Layman's Guide to Financial Success" by Wealthy McMoney offers a comprehensive overview of stock market dynamics, including the impact of external factors. Similarly, "Air Pollution and Urban Economics" by Environmental Research Group provides a detailed examination of air quality's implications for urban development, indirectly touching upon its potential influence on local businesses.

On a lighter note, "Cloudy with a Chance of Stock Gains" by Sunny Day blends whimsy with market analysis, depicting a world where stock prices are as unpredictable as the weather. Meanwhile, "The Clean Air Conundrum" by P. Lin N. Fresh offers a playful take on the environmental challenges faced by modern society, hinting at a connection between air purity and financial stability.

In a departure from conventional research methods, the authors also explored unconventional sources, including supermarket receipts, traffic signs, and even whimsical musings found on fortune cookies. While these unconventional sources did not yield direct empirical evidence, they did provide a breath of fresh air in the often-rigid landscape of academic literature. It's like the saying goes, "When it comes to research, sometimes you have to follow your nose, even if it leads to a comedy club!"

[[RESULTS]]

The findings of our research revealed a notable and robust correlation between air pollution levels in Greenville, North Carolina, and the stock price of Bristol-Myers Squibb (BMY) during the period from 2002 to 2012. The correlation coefficient of 0.8647571 suggests a strong positive relationship between these two variables. This result indicates that as air quality in the region worsened, the stock price of BMY tended to decline. It's like when the smog rolls in, the stock prices might've been feeling a little foggy too.

The coefficient of determination (r-squared) of 0.7478048 further indicates that approximately 74.78% of the variability in BMY's stock price can be explained by changes in air pollution levels. This level of predictability is enough to give anyone a breath of fresh air, especially in the unpredictable world of stock market analysis.

The statistical significance at p < 0.01 provides strong evidence that the observed correlation is unlikely to have occurred by chance. This result brings to mind a joke: "Why did the air molecule refuse to bond with the carbon dioxide molecule? It found the connection statistically insignificant!" In our case, however, the statistical significance of the relationship between air pollution and BMY's stock price is no laughing matter.

By visually representing the correlation between air pollution levels in Greenville and BMY's stock price, the scatterplot in Fig. 1 conveys a compelling narrative. The figure clearly illustrates the "air-resistible" relationship between these two variables, leaving little room for doubt that changes in air quality might have blown some turbulence into BMY's stock price movement. It's like the air quality data and stock price data were a match made in statistical heaven.

Overall, our findings emphasize the importance of considering environmental factors when analyzing stock price movements and highlight the previously underappreciated influence of air pollution on financial markets. So, the next time someone asks about the link between air pollution and stocks, you can reply with confidence, "It's nothing to sneeze at – there's a real 'air' of importance, after all."

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

Our study has shed light on the intriguing and unexpected relationship between air pollution in Greenville, North Carolina, and the stock price of Bristol-Myers Squibb (BMY). The substantial correlation coefficient of 0.8647571 strongly supports prior research by Smith et al. and Doe and Jones, who have also hinted at the potential link between air quality and stock performance. It seems that the tie between environmental quality and stock prices is not just an airy-fairy notion after all. In fact, it's as substantial as the fog on a misty morning.

The humorous musings found in unconventional sources, such as in sunny Day's "Cloudy with a Chance of Stock Gains" and P. Lin N. Fresh's "The Clean Air Conundrum," seem to have a ring of truth to them. While these sources did not provide empirical evidence themselves, they did give us a breath of fresh air, as they indirectly predicted the significant impact of air quality on stock prices. It's as if the wit and humor led to some air-ssured findings.

Moreover, the coefficient of determination (r-squared) of 0.7478048 demonstrates that a substantial 74.78% of the variability in BMY's stock price can be explained by changes in air pollution levels. This level of predictability is more reliable than a weather forecast in April, which says a lot in the volatile world of stock market analysis. One might say that our findings have blown away any previous doubts about the importance of environmental factors in stock price movements.

The statistical significance at p < 0.01 further adds weight to our results, making the relationship between air pollution and BMY's stock price as solid as a rock. This isn't a case where we can simply brush the findings under the rug; the statistical significance demands attention. It's like the statistical significance of the relationship is the wind beneath our research wings – propelling us to new heights in understanding the complexities of stock market dynamics.

Overall, our research provides substantial evidence supporting the notion that air pollution in Greenville, North Carolina, has indeed had a tangible impact on the stock price of Bristol-Myers Squibb. This connection may leave us all a bit breathless, but it's important to take it seriously, much like a sudden change in stock prices. As we continue to delve deeper into this unexplored territory, one thing is for sure – we've uncovered an "air-resistible" relationship between environmental quality and stock market performance.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between Air pollution in Greenville, North Carolina and Bristol-Myers Squibb's stock price (BMY). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

Breath of the Stock Market: Analyzing the Correlation between Air Pollution in Greenville, North Carolina and Bristol-Myers Squibb's Stock Price

[[ABSTRACT]]

This research paper employs a cheeky approach to explore the intriguing relationship between air pollution levels in Greenville, North Carolina, and the stock price of Bristol-Myers Squibb (BMY). Leveraging data from the Environmental Protection Agency and LSEG Analytics (Refinitiv), we sought to answer the question, "Is there a breath-taking link between environmental quality and pharmaceutical stock performance?"

Our findings reveal a notable correlation coefficient of 0.8647571 and statistical significance at p < 0.01 during the period from 2002 to 2012, suggesting that as air quality in the region worsened, the stock price of BMY may have taken a hit. As we delved into this unexpected connection, we couldn't help but think of a dad joke: "Why did the air molecule break up with the oxygen molecule? It was a breath of fresh air." In light of our results, it appears that air pollution and stock performance do, indeed, have an "air-resistible" relationship.

This study not only sheds light on the impact of environmental factors on stock prices but also adds a breath of levity to the world of finance research. So, the next time someone asks, "What's the correlation between air pollution and stocks?" You can respond, "It's nothing to sneeze at – there's a real 'air' of importance, after all."

[[INTRDUCTION]]

The effects of air pollution on human health and the environment have been extensively studied and well-documented. However, the potential impact of air pollution on financial markets has received less attention. In this study, we take a lungful of fresh air and explore the fascinating relationship between air pollution levels in Greenville, North Carolina, and the stock price of pharmaceutical giant Bristol-Myers Squibb (BMY). As we embarked on this curious journey, we couldn't help but think, "What do you get when you cross a smoggy day with a stock market? Air-raising volatility!"

The intertwining of environmental quality and stock market performance is an intriguing puzzle that has yet to be fully unraveled. Our hypothesis was simple yet profound: could the quality of the air we breathe have an impact on the financial performance of a major pharmaceutical company? It's like asking, "What did one air molecule say to the other? Nothing, it simply drifted away."

As we delve into the realm of environmental economics and financial analysis, we are confronted with the reality that the interplay between air pollution and stock prices is a "breezy" topic, indeed. Just as the wind can unexpectedly change direction, so too can the tides of the stock market. This research aims to add a breath of fresh air to the staid world of finance by examining an unconventional factor that may influence stock price movements.

Previous studies have mainly focused on traditional financial indicators, such as interest rates, corporate earnings, and economic growth, to explain stock price movements. However, the link between environmental factors and stock performance remains relatively unexplored. Our results aim to illuminate this gap and provide a gust of new insight into the complex web of factors that sway stock prices. It's like the saying goes, "When it comes to stock performance, the air you breathe may be no 'fairy' tale."

As we plunge into this investigation, we hold our breath in anticipation of uncovering a relationship that, until now, has remained largely unnoticed. Through this research, we aim to blow away conventional wisdom and demonstrate that the air we breathe might not only affect our lungs but also our financial portfolios. It's akin to a dad joke waiting to happen, "Why did the air molecule break up with the oxygen molecule? It needed some space."

In summary, this study sets out to not only explore the potential correlation between air pollution in Greenville, North Carolina, and BMY's stock price but also to offer a breath of fresh air to the field of financial research. So, as we walk down the path of statistical analysis and market dynamics, we invite you to take a deep breath and join us on this "air-citing" journey.

[[RESULTS]]

The findings of our research revealed a notable and robust correlation between air pollution levels in Greenville, North Carolina, and the stock price of Bristol-Myers Squibb (BMY) during the period from 2002 to 2012. The correlation coefficient of 0.8647571 suggests a strong positive relationship between these two variables. This result indicates that as air quality in the region worsened, the stock price of BMY tended to decline. It's like when the smog rolls in, the stock prices might've been feeling a little foggy too.

The coefficient of determination (r-squared) of 0.7478048 further indicates that approximately 74.78% of the variability in BMY's stock price can be explained by changes in air pollution levels. This level of predictability is enough to give anyone a breath of fresh air, especially in the unpredictable world of stock market analysis.

The statistical significance at p < 0.01 provides strong evidence that the observed correlation is unlikely to have occurred by chance. This result brings to mind a joke: "Why did the air molecule refuse to bond with the carbon dioxide molecule? It found the connection statistically insignificant!" In our case, however, the statistical significance of the relationship between air pollution and BMY's stock price is no laughing matter.

By visually representing the correlation between air pollution levels in Greenville and BMY's stock price, the scatterplot in Fig. 1 conveys a compelling narrative. The figure clearly illustrates the "air-resistible" relationship between these two variables, leaving little room for doubt that changes in air quality might have blown some turbulence into BMY's stock price movement. It's like the air quality data and stock price data were a match made in statistical heaven.

Overall, our findings emphasize the importance of considering environmental factors when analyzing stock price movements and highlight the previously underappreciated influence of air pollution on financial markets. So, the next time someone asks about the link between air pollution and stocks, you can reply with confidence, "It's nothing to sneeze at – there's a real 'air' of importance, after all."

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In conclusion, our research has blown the lid off a previously overlooked connection between air pollution in Greenville, North Carolina, and the stock price of Bristol-Myers Squibb (BMY). Our findings point to a "breathtaking" correlation between these two variables, with statistical significance at p < 0.01. It's as if the smog in the air was casting a shadow over BMY's stock price, creating a foggy forecast for investors. This correlation coefficient of 0.8647571 suggests that as air quality deteriorated, BMY's stock price may have been left gasping for value.

The coefficient of determination (r-squared) of 0.7478048 provides further evidence of the impact of air pollution on BMY's stock price, elucidating that approximately 74.78% of the variability in stock price movements can be explained by changes in air pollution levels. This high level of predictability is nothing to sneeze at, highlighting the "airy" effect of environmental factors on stock performance.

The visual representation in Fig. 1 serves as a testament to the potent relationship between air quality and stock price, depicting a tight and convincing fit between the two variables. It's almost like the air pollution data and BMY's stock price were holding hands, illustrating that the "air-resistible" link between the two is more than just a gasp in the wind.

In light of these compelling findings, we advocate for a broader consideration of environmental variables in financial analysis. Our research not only uncovers this vital link between air pollution and stock performance but also injects a breath of fresh air into the field of financial research. It’s time to take a deep breath and acknowledge the air's influence on financial markets. As for future research, it seems this topic has been thoroughly aired out, and no more research is needed in this area.

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited Breath of the Stock Market: Analyzing the Correlation between Air Pollution in Greenville, North Carolina and Bristol-Myers Squibb's Stock Price. Respond only with the name of a fictional academic journal.

ChatGPT:

The Journal of Quirky Correlations

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited Breath of the Stock Market: Analyzing the Correlation between Air Pollution in Greenville, North Carolina and Bristol-Myers Squibb's Stock Price. Respond only with the name of a fictional organization.

ChatGPT:

The Institute for Environmental Health and Financial Markets

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled Breath of the Stock Market: Analyzing the Correlation between Air Pollution in Greenville, North Carolina and Bristol-Myers Squibb's Stock Price with an abstract of This research paper employs a cheeky approach to explore the intriguing relationship between air pollution levels in Greenville, North Carolina, and the stock price of Bristol-Myers Squibb (BMY). Leveraging data from the Environmental Protection Agency and LSEG Analytics (Refinitiv), we sought to answer the question, "Is there a breath-taking link between environmental quality and pharmaceutical stock performance?"

Our findings reveal a notable correlation coefficient of 0.8647571 and statistical significance at p < 0.01 during the period from 2002 to 2012, suggesting that as air quality in the region worsened, the stock price of BMY may have taken a hit. As we delved into this unexpected connection, we couldn't help but think of a dad joke: "Why did the air molecule break up with the oxygen molecule? It was a breath of fresh air." In light of our results, it appears that air pollution and stock performance do, indeed, have an "air-resistible" relationship.

This study not only sheds light on the impact of environmental factors on stock prices but also adds a breath of levity to the world of finance research. So, the next time someone asks, "What's the correlation between air pollution and stocks?" You can respond, "It's nothing to sneeze at – there's a real 'air' of importance, after all.

ChatGPT:

air pollution, stock price correlation, environmental quality, pharmaceutical stock performance, air quality, stock market, Bristol-Myers Squibb, Greenville, North Carolina, correlation coefficient, statistical significance, LSEG Analytics, Refinitiv, EPA data, finance research, environmental factors, dad joke

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

Air pollution in Greenville, North CarolinaDetailed data title: Percentage of days 'unhealthy' or worse air quality in Greenville, NC

Source: Environmental Protection Agency

See what else correlates with Air pollution in Greenville, North Carolina

Bristol-Myers Squibb's stock price (BMY)

Detailed data title: Opening price of Bristol-Myers Squibb Company (BMY) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with Bristol-Myers Squibb's stock price (BMY)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.7478048 (Coefficient of determination)

This means 74.8% of the change in the one variable (i.e., Bristol-Myers Squibb's stock price (BMY)) is predictable based on the change in the other (i.e., Air pollution in Greenville, North Carolina) over the 11 years from 2002 through 2012.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 0.00059. 0.0005903915725497487000000000

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.86 in 0.059% of random cases. Said differently, if you correlated 1,694 random variables Which I absolutely did.

with the same 10 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 10 because we have two variables measured over a period of 11 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.55, 0.96 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | |

| Air pollution in Greenville, North Carolina (Bad air quality days) | 0.0456274 | 0.0118577 | 0 | 0.003861 | 0 | 0 | 0.00384615 | 0 | 0 | 0 | 0.00393701 |

| Bristol-Myers Squibb's stock price (BMY) (Stock price) | 50.47 | 23.16 | 28.9 | 25.57 | 23.25 | 26.21 | 26.5 | 23.25 | 25.41 | 26.65 | 35.33 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is. - Y-axis doesn't start at zero: I truncated the Y-axes of the graph above. I also used a line graph, which makes the visual connection stand out more than it deserves.

Nothing against line graphs. They are great at telling a story when you have linear data! But visually it is deceptive because the only data is at the points on the graph, not the lines on the graph. In between each point, the data could have been doing anything. Like going for a random walk by itself!

Mathematically what I showed is true, but it is intentionally misleading. Below is the same chart but with both Y-axes starting at zero.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([0.0456274,0.0118577,0,0.003861,0,0,0.00384615,0,0,0,0.00393701,])

array_2 = np.array([50.47,23.16,28.9,25.57,23.25,26.21,26.5,23.25,25.41,26.65,35.33,])

array_1_name = "Air pollution in Greenville, North Carolina"

array_2_name = "Bristol-Myers Squibb's stock price (BMY)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only Air pollution in Greenville, North Carolina

- Line chart for only Bristol-Myers Squibb's stock price (BMY)

- AI-generated correlation image

- The spurious research paper: Breath of the Stock Market: Analyzing the Correlation between Air Pollution in Greenville, North Carolina and Bristol-Myers Squibb's Stock Price

Big thanks for reviewing!

Correlation ID: 3452 · Black Variable ID: 21609 · Red Variable ID: 1616