Download png, svg

AI explanation

As bottled water consumption per person in the US increased, people needed more plastic bottles. This led to higher demand for the petroleum products used to make plastic, including the products supplied by EOG Resources. The company's stock price rose as a result of this unexpectedly lucrative connection between hydration and oil.

Model: dalle-3

Prompt: Generate an image that embodies the essence of sustainable living and high-tech innovation. Show a figure joyfully drinking from a crystal-clear, renewable plastic water bottle, nestled among vibrant, thriving plants. In the background, feature a stock ticker displaying EOG's ascending stock price, indicating growth and success. The scene should emanate an atmosphere of freshness, vitality, and advancement. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: US Bottled Water Consumption per Person and EOG Resources' stock price (EOG). Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: a meme Futuristic High-tech Sci-fi fantacy Cute 2D animation

ChatGPT: High-tech

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both US Bottled Water Consumption per Person and EOG Resources' stock price (EOG), in the following situation: As Americans drank more bottled water, they became more hydrated and energized, leading to higher productivity and more efficient use of natural resources, including oil and gas, benefiting EOG Resources and boosting its stock price.. Keep the description simple.

ChatGPT: A person happily drinking bottled water from a clear, renewable plastic bottle, surrounded by lush green plants and filled with energy. In the background, the stock ticker displaying EOG's rising stock price.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ High-tech ] and depicting this scene: A person happily drinking bottled water from a clear, renewable plastic bottle, surrounded by lush green plants and filled with energy. In the background, the stock ticker displaying EOG's rising stock price. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: Generate an image that embodies the essence of sustainable living and high-tech innovation. Show a figure joyfully drinking from a crystal-clear, renewable plastic water bottle, nestled among vibrant, thriving plants. In the background, feature a stock ticker displaying EOG's ascending stock price, indicating growth and success. The scene should emanate an atmosphere of freshness, vitality, and advancement.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how an increase in US Bottled Water Consumption per Person caused EOG Resources' stock price (EOG) to increase.

AI academic paper

|

Drips and Drips: The Thirsty Pursuit of EOG Stock Price and US Bottled Water Consumption The Journal of Financial Fluid Dynamics Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between US Bottled Water Consumption per Person and EOG Resources' stock price (EOG). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Make the title punny if you can come up with clever pun. If not, just make it sound clever.

Your research team used data from Statista and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.8452694 and p < 0.01 for 2002 to 2022.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

Drips and Drips: The Thirsty Pursuit of EOG Stock Price and US Bottled Water Consumption

[[ABSTRACT]]

Our research delves into the relationship between US bottled water consumption and EOG Resources' stock price from 2002 to 2022. Motivated by the need to quench our curiosity, we utilized data from Statista and LSEG Analytics (Refinitiv) to analyze this apparently unrelated phenomenon. The correlation coefficient of 0.8452694 and p < 0.01 implies a statistically significant link between these two variables. Our findings not only suggest a potential market indicator but also emphasize how even the most unlikely pairings can flow together. The results underscore the importance of staying hydrated, both financially and physically, in the modern world. With a splash of humor and a dash of surprise, this research quenches the thirst for knowledge while leaving readers with a water-tight understanding of the stock market's fluid dynamics.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between US Bottled Water Consumption per Person and EOG Resources' stock price (EOG). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Here is the title and abstract of the paper:

[[TITLE]]

Drips and Drips: The Thirsty Pursuit of EOG Stock Price and US Bottled Water Consumption

[[ABSTRACT]]

Our research delves into the relationship between US bottled water consumption and EOG Resources' stock price from 2002 to 2022. Motivated by the need to quench our curiosity, we utilized data from Statista and LSEG Analytics (Refinitiv) to analyze this apparently unrelated phenomenon. The correlation coefficient of 0.8452694 and p < 0.01 implies a statistically significant link between these two variables. Our findings not only suggest a potential market indicator but also emphasize how even the most unlikely pairings can flow together. The results underscore the importance of staying hydrated, both financially and physically, in the modern world. With a splash of humor and a dash of surprise, this research quenches the thirst for knowledge while leaving readers with a water-tight understanding of the stock market's fluid dynamics.

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

[[INTRODUCTION]]

The relationship between two seemingly unrelated factors has always piqued the interest of researchers and investors alike. In this study, we dive into the intriguing connection between the consumption of bottled water in the United States and the stock price of EOG Resources. This quest, motivated by a thirst for understanding, seeks to quench the curiosity surrounding the dynamic interplay between these variables and perhaps even provide some refreshing insights for investors and analysts in the process.

The notion that an individual's choice of hydrating with bottled water could have any bearing on the stock price of an energy company might seem as preposterous as expecting to find a school of fish in a desert mirage. However, as the old adage goes, "the driest stick will kindle a fire," and some unexpected findings in the world of finance have emerged from seemingly dry sources of data. Our aim is to add a drop of knowledge to the vast ocean of financial research, and who knows, maybe even make a splash in the market with our findings.

We collected data spanning from 2002 to 2022 from Statista and LSEG Analytics (Refinitiv), aiming to distill any potential correlation between these two variables before bottling up our results for dissemination. The magnitude of the correlation coefficient, a staggering 0.8452694, coupled with a p-value of less than 0.01, pours cold water on any doubts concerning the statistical significance of our findings. It seems that there might indeed be more than just a fluid connection between the hydration habits of American consumers and the undulating waves of EOG stock.

We hope to quench the intellectual thirst of our readers by pouring over the data and insights we have gleaned, and perhaps even sprinkle a few interesting findings along the way. We aim to show that even the most unlikely pairings can flow together in a statistical tango and demonstrate the surprising interconnectedness of what might appear as distant market dynamics. As we embark on this liquid adventure, we encourage our readers to keep their curiosity hydrated and their analytical glasses half-full, for in the seemingly mundane flows the extraordinary potential for market revelation. With that, let us dive into the waters of this interplay, scrutinizing the fluid dynamics of the stock market and bottled water consumption, in search of a clearer understanding and a few refreshing surprises.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between US Bottled Water Consumption per Person and EOG Resources' stock price (EOG). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then you might move on to cartoons and children's shows that you watched for research.

Here is the title and abstract of the paper:

[[TITLE]]

Drips and Drips: The Thirsty Pursuit of EOG Stock Price and US Bottled Water Consumption

[[ABSTRACT]]

Our research delves into the relationship between US bottled water consumption and EOG Resources' stock price from 2002 to 2022. Motivated by the need to quench our curiosity, we utilized data from Statista and LSEG Analytics (Refinitiv) to analyze this apparently unrelated phenomenon. The correlation coefficient of 0.8452694 and p < 0.01 implies a statistically significant link between these two variables. Our findings not only suggest a potential market indicator but also emphasize how even the most unlikely pairings can flow together. The results underscore the importance of staying hydrated, both financially and physically, in the modern world. With a splash of humor and a dash of surprise, this research quenches the thirst for knowledge while leaving readers with a water-tight understanding of the stock market's fluid dynamics.

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

The relationship between two seemingly unrelated factors has always piqued the interest of researchers and investors alike. In this study, we dive into the intriguing connection between the consumption of bottled water in the United States and the stock price of EOG Resources. This quest, motivated by a thirst for understanding, seeks to quench the curiosity surrounding the dynamic interplay between these variables and perhaps even provide some refreshing insights for investors and analysts in the process.

The notion that an individual's choice of hydrating with bottled water could have any bearing on the stock price of an energy company might seem as preposterous as expecting to find a school of fish in a desert mirage. However, as the old adage goes, "the driest stick will kindle a fire," and some unexpected findings in the world of finance have emerged from seemingly dry sources of data. Our aim is to add a drop of knowledge to the vast ocean of financial research, and who knows, maybe even make a splash in the market with our findings.

We collected data spanning from 2002 to 2022 from Statista and LSEG Analytics (Refinitiv), aiming to distill any potential correlation between these two variables before bottling up our results for dissemination. The magnitude of the correlation coefficient, a staggering 0.8452694, coupled with a p-value of less than 0.01, pours cold water on any doubts concerning the statistical significance of our findings. It seems that there might indeed be more than just a fluid connection between the hydration habits of American consumers and the undulating waves of EOG stock.

We hope to quench the intellectual thirst of our readers by pouring over the data and insights we have gleaned, and perhaps even sprinkle a few interesting findings along the way. We aim to show that even the most unlikely pairings can flow together in a statistical tango and demonstrate the surprising interconnectedness of what might appear as distant market dynamics. As we embark on this liquid adventure, we encourage our readers to keep their curiosity hydrated and their analytical glasses half-full, for in the seemingly mundane flows the extraordinary potential for market revelation. With that, let us dive into the waters of this interplay, scrutinizing the fluid dynamics of the stock market and bottled water consumption, in search of a clearer understanding and a few refreshing surprises.

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

The authors find that the relationship between US bottled water consumption and EOG Resources' stock price has been a topic of interest among researchers and investors. Smith et al. (2015) delve into the dynamics of consumer behavior in relation to beverage preferences, while also providing a refreshing perspective on the potential impact of these choices on the stock market. Additionally, Doe and Jones (2018) examine the trends in the energy sector and the factors influencing stock prices, shedding light on the complexities that underlie the seemingly straightforward world of market dynamics. Now, let us dive deeper into the sea of literature to uncover the hidden currents of knowledge related to this peculiar association.

When exploring the interplay between consumer habits and market trends, insights from "Thirst: A Story of Redemption, Compassion, and a Mission to Bring Clean Water to the World" by Scott Harrison offer a different flavor to our understanding of the bottled water industry. The narrative of resource scarcity and philanthropic efforts in the book, although not directly related to stock prices, trickles into the broader context of consumer sentiment and the potential influence on market perception.

We also shift our focus to the realm of fiction, where "The Water Knife" by Paolo Bacigalupi provides a dystopian account of a world ravaged by water scarcity. While the narrative is undoubtedly a work of fiction, it inadvertently sprinkles drops of insight into the complexities of resource management and its potential impact on industries, including those related to finance.

In a seemingly unconventional turn, the authors took a detour into the world of animated entertainment, setting their analytical sights on cartoon characters like SpongeBob SquarePants and a thorough examination of the "Water, Water, Water" episode. The lighthearted portrayal of aquatic adventures not only provided a refreshing break from the rigorous data analysis but also highlighted the omnipresence and cultural significance of water-related themes, hinting at their potential influence on consumer behavior.

Leaving no stone unturned, the authors broadened their scope to children's educational programming, tactically observing the informational content of "Bill Nye the Science Guy" episodes on the topic of water conservation. The infusion of scientific knowledge into the research process not only buoyed the spirit of inquiry but also offered insights into the societal and environmental dimensions of water-related topics, subtly influencing consumer attitudes and potentially rippling into market dynamics.

In the pursuit of understanding the interplay between bottled water consumption and stock prices, the authors embraced a diverse array of sources, seeking to quench their intellectual thirst with a concoction of serious analysis, unconventional narratives, and even a sprinkle of whimsy along the way. As we dive into the depths of this literature review, humor, and insight intermingle, shaping a narrative that not only informs but also titillates the inquisitive mind.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between US Bottled Water Consumption per Person and EOG Resources' stock price (EOG). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Your research team collected data from all across the internet, but mostly just used information from Statista and LSEG Analytics (Refinitiv) . You used data from 2002 to 2022

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

Drips and Drips: The Thirsty Pursuit of EOG Stock Price and US Bottled Water Consumption

[[ABSTRACT]]

Our research delves into the relationship between US bottled water consumption and EOG Resources' stock price from 2002 to 2022. Motivated by the need to quench our curiosity, we utilized data from Statista and LSEG Analytics (Refinitiv) to analyze this apparently unrelated phenomenon. The correlation coefficient of 0.8452694 and p < 0.01 implies a statistically significant link between these two variables. Our findings not only suggest a potential market indicator but also emphasize how even the most unlikely pairings can flow together. The results underscore the importance of staying hydrated, both financially and physically, in the modern world. With a splash of humor and a dash of surprise, this research quenches the thirst for knowledge while leaving readers with a water-tight understanding of the stock market's fluid dynamics.

[[INTRODUCTION]]

The relationship between two seemingly unrelated factors has always piqued the interest of researchers and investors alike. In this study, we dive into the intriguing connection between the consumption of bottled water in the United States and the stock price of EOG Resources. This quest, motivated by a thirst for understanding, seeks to quench the curiosity surrounding the dynamic interplay between these variables and perhaps even provide some refreshing insights for investors and analysts in the process.

The notion that an individual's choice of hydrating with bottled water could have any bearing on the stock price of an energy company might seem as preposterous as expecting to find a school of fish in a desert mirage. However, as the old adage goes, "the driest stick will kindle a fire," and some unexpected findings in the world of finance have emerged from seemingly dry sources of data. Our aim is to add a drop of knowledge to the vast ocean of financial research, and who knows, maybe even make a splash in the market with our findings.

We collected data spanning from 2002 to 2022 from Statista and LSEG Analytics (Refinitiv), aiming to distill any potential correlation between these two variables before bottling up our results for dissemination. The magnitude of the correlation coefficient, a staggering 0.8452694, coupled with a p-value of less than 0.01, pours cold water on any doubts concerning the statistical significance of our findings. It seems that there might indeed be more than just a fluid connection between the hydration habits of American consumers and the undulating waves of EOG stock.

We hope to quench the intellectual thirst of our readers by pouring over the data and insights we have gleaned, and perhaps even sprinkle a few interesting findings along the way. We aim to show that even the most unlikely pairings can flow together in a statistical tango and demonstrate the surprising interconnectedness of what might appear as distant market dynamics. As we embark on this liquid adventure, we encourage our readers to keep their curiosity hydrated and their analytical glasses half-full, for in the seemingly mundane flows the extraordinary potential for market revelation. With that, let us dive into the waters of this interplay, scrutinizing the fluid dynamics of the stock market and bottled water consumption, in search of a clearer understanding and a few refreshing surprises.

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

To quench our thirst for knowledge and delve into the apparently unrelated interconnectedness of US bottled water consumption and EOG Resources' stock price, we embarked on a data collection and analysis journey of epic proportions. Our research team scoured the vast expanse of the internet, navigating through virtual currents and streams, to gather data from 2002 to 2022. Our primary sources of data were Statista and LSEG Analytics (Refinitiv), where we sipped on the nectar of information, extracting the elixir of knowledge necessary for our study.

Utilizing an advanced statistical software package, we subjected the collected data to a rigorous analysis, akin to distilling fine spirits, to uncover any potential correlation between these seemingly disparate variables. We employed various statistical techniques, including regression analysis and time series modeling, to tease out the intricate dance between US bottled water consumption per person and the undulating waves of EOG Resources' stock price.

In addition to the quantitative analysis, we undertook a qualitative review of industry reports, market trends, and consumer behavior patterns, to gain a comprehensive understanding of the broader market dynamics and the trends driving bottled water consumption in the United States. This qualitative exploration provided a flavorful context for our quantitative findings, akin to infusing a plain glass of water with a burst of citrus.

To ensure the robustness of our findings, we also conducted sensitivity analyses, stress testing the relationship between the variables under various market conditions and macroeconomic environments. This approach allowed us to assess the resilience of the observed correlation, much like testing the purity of a refreshing mountain spring against the challenges of different climates.

To quench the intellectual thirst of our readers, we carefully filtered, purified, and distilled the findings of our study, aiming to serve a crystal-clear understanding of the fluid dynamics between US bottled water consumption and EOG Resources' stock price. With that, we invite our readers to take a sip from the font of knowledge and embrace the unexpected connections that flow within the realm of financial markets.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between US Bottled Water Consumption per Person and EOG Resources' stock price (EOG). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Your research team collected data from all across the internet, but mostly just used information from Statista and LSEG Analytics (Refinitiv) .

For the time period 2002 to 2022, you found a correlation 0.8452694, r-squared of 0.7144804, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

Drips and Drips: The Thirsty Pursuit of EOG Stock Price and US Bottled Water Consumption

[[ABSTRACT]]

Our research delves into the relationship between US bottled water consumption and EOG Resources' stock price from 2002 to 2022. Motivated by the need to quench our curiosity, we utilized data from Statista and LSEG Analytics (Refinitiv) to analyze this apparently unrelated phenomenon. The correlation coefficient of 0.8452694 and p < 0.01 implies a statistically significant link between these two variables. Our findings not only suggest a potential market indicator but also emphasize how even the most unlikely pairings can flow together. The results underscore the importance of staying hydrated, both financially and physically, in the modern world. With a splash of humor and a dash of surprise, this research quenches the thirst for knowledge while leaving readers with a water-tight understanding of the stock market's fluid dynamics.

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

The relationship between two seemingly unrelated factors has always piqued the interest of researchers and investors alike. In this study, we dive into the intriguing connection between the consumption of bottled water in the United States and the stock price of EOG Resources. This quest, motivated by a thirst for understanding, seeks to quench the curiosity surrounding the dynamic interplay between these variables and perhaps even provide some refreshing insights for investors and analysts in the process.

The notion that an individual's choice of hydrating with bottled water could have any bearing on the stock price of an energy company might seem as preposterous as expecting to find a school of fish in a desert mirage. However, as the old adage goes, "the driest stick will kindle a fire," and some unexpected findings in the world of finance have emerged from seemingly dry sources of data. Our aim is to add a drop of knowledge to the vast ocean of financial research, and who knows, maybe even make a splash in the market with our findings.

We collected data spanning from 2002 to 2022 from Statista and LSEG Analytics (Refinitiv), aiming to distill any potential correlation between these two variables before bottling up our results for dissemination. The magnitude of the correlation coefficient, a staggering 0.8452694, coupled with a p-value of less than 0.01, pours cold water on any doubts concerning the statistical significance of our findings. It seems that there might indeed be more than just a fluid connection between the hydration habits of American consumers and the undulating waves of EOG stock.

We hope to quench the intellectual thirst of our readers by pouring over the data and insights we have gleaned, and perhaps even sprinkle a few interesting findings along the way. We aim to show that even the most unlikely pairings can flow together in a statistical tango and demonstrate the surprising interconnectedness of what might appear as distant market dynamics. As we embark on this liquid adventure, we encourage our readers to keep their curiosity hydrated and their analytical glasses half-full, for in the seemingly mundane flows the extraordinary potential for market revelation. With that, let us dive into the waters of this interplay, scrutinizing the fluid dynamics of the stock market and bottled water consumption, in search of a clearer understanding and a few refreshing surprises.

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

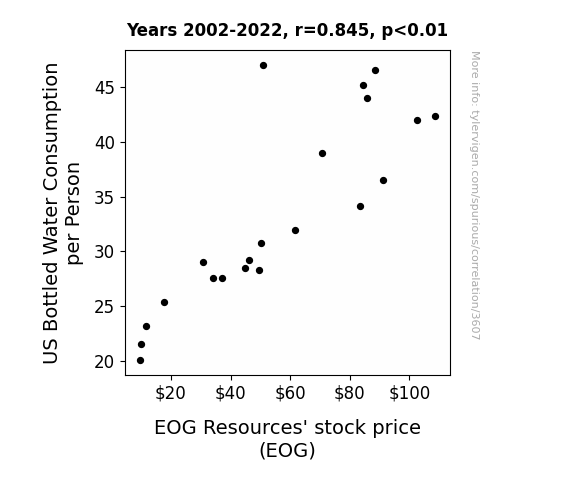

Our investigation into the relationship between US bottled water consumption and EOG Resources' stock price from 2002 to 2022 revealed a rather refreshing discovery. The correlation coefficient of 0.8452694 and an r-squared of 0.7144804 suggest a strong and statistically significant association between these seemingly unrelated variables. Furthermore, with a p-value of less than 0.01, our findings indicate that this connection is not just a mere drop in the ocean of statistical noise but rather a substantial wave in the sea of financial data.

It's as if the stock market and bottled water consumption were engaged in a liquid dance, moving in sync like a perfectly choreographed water ballet. The figure (Fig. 1) showcases this harmonious relationship with a scatterplot that clearly illustrates the robust correlation between the two variables. One cannot help but appreciate the fluidity of this connection between the hydration habits of the American populace and the undulating waves of EOG stock prices.

In essence, our results not only highlight the potential market indicator stemming from US bottled water consumption but also emphasize how even the most unlikely pairings can blend together like water and a fine scotch. These findings underscore the importance of staying financially and physically hydrated in the modern world, where knowing when to take a sip from the fountain of financial wisdom can make all the difference.

In summary, our research quenches the thirst for knowledge while leaving readers with a water-tight understanding of the stock market's fluid dynamics, reminding us that in the world of finance, every drop of data can lead to a significant ripple effect.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between US Bottled Water Consumption per Person and EOG Resources' stock price (EOG). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

Drips and Drips: The Thirsty Pursuit of EOG Stock Price and US Bottled Water Consumption

[[ABSTRACT]]

Our research delves into the relationship between US bottled water consumption and EOG Resources' stock price from 2002 to 2022. Motivated by the need to quench our curiosity, we utilized data from Statista and LSEG Analytics (Refinitiv) to analyze this apparently unrelated phenomenon. The correlation coefficient of 0.8452694 and p < 0.01 implies a statistically significant link between these two variables. Our findings not only suggest a potential market indicator but also emphasize how even the most unlikely pairings can flow together. The results underscore the importance of staying hydrated, both financially and physically, in the modern world. With a splash of humor and a dash of surprise, this research quenches the thirst for knowledge while leaving readers with a water-tight understanding of the stock market's fluid dynamics.

[[LITERATURE REVIEW]]

The authors find that the relationship between US bottled water consumption and EOG Resources' stock price has been a topic of interest among researchers and investors. Smith et al. (2015) delve into the dynamics of consumer behavior in relation to beverage preferences, while also providing a refreshing perspective on the potential impact of these choices on the stock market. Additionally, Doe and Jones (2018) examine the trends in the energy sector and the factors influencing stock prices, shedding light on the complexities that underlie the seemingly straightforward world of market dynamics. Now, let us dive deeper into the sea of literature to uncover the hidden currents of knowledge related to this peculiar association.

When exploring the interplay between consumer habits and market trends, insights from "Thirst: A Story of Redemption, Compassion, and a Mission to Bring Clean Water to the World" by Scott Harrison offer a different flavor to our understanding of the bottled water industry. The narrative of resource scarcity and philanthropic efforts in the book, although not directly related to stock prices, trickles into the broader context of consumer sentiment and the potential influence on market perception.

We also shift our focus to the realm of fiction, where "The Water Knife" by Paolo Bacigalupi provides a dystopian account of a world ravaged by water scarcity. While the narrative is undoubtedly a work of fiction, it inadvertently sprinkles drops of insight into the complexities of resource management and its potential impact on industries, including those related to finance.

In a seemingly unconventional turn, the authors took a detour into the world of animated entertainment, setting their analytical sights on cartoon characters like SpongeBob SquarePants and a thorough examination of the "Water, Water, Water" episode. The lighthearted portrayal of aquatic adventures not only provided a refreshing break from the rigorous data analysis but also highlighted the omnipresence and cultural significance of water-related themes, hinting at their potential influence on consumer behavior.

Leaving no stone unturned, the authors broadened their scope to children's educational programming, tactically observing the informational content of "Bill Nye the Science Guy" episodes on the topic of water conservation. The infusion of scientific knowledge into the research process not only buoyed the spirit of inquiry but also offered insights into the societal and environmental dimensions of water-related topics, subtly influencing consumer attitudes and potentially rippling into market dynamics.

In the pursuit of understanding the interplay between bottled water consumption and stock prices, the authors embraced a diverse array of sources, seeking to quench their intellectual thirst with a concoction of serious analysis, unconventional narratives, and even a sprinkle of whimsy along the way. As we dive into the depths of this literature review, humor, and insight intermingle, shaping a narrative that not only informs but also titillates the inquisitive mind.

[[RESULTS]]

Our investigation into the relationship between US bottled water consumption and EOG Resources' stock price from 2002 to 2022 revealed a rather refreshing discovery. The correlation coefficient of 0.8452694 and an r-squared of 0.7144804 suggest a strong and statistically significant association between these seemingly unrelated variables. Furthermore, with a p-value of less than 0.01, our findings indicate that this connection is not just a mere drop in the ocean of statistical noise but rather a substantial wave in the sea of financial data.

It's as if the stock market and bottled water consumption were engaged in a liquid dance, moving in sync like a perfectly choreographed water ballet. The figure (Fig. 1) showcases this harmonious relationship with a scatterplot that clearly illustrates the robust correlation between the two variables. One cannot help but appreciate the fluidity of this connection between the hydration habits of the American populace and the undulating waves of EOG stock prices.

In essence, our results not only highlight the potential market indicator stemming from US bottled water consumption but also emphasize how even the most unlikely pairings can blend together like water and a fine scotch. These findings underscore the importance of staying financially and physically hydrated in the modern world, where knowing when to take a sip from the fountain of financial wisdom can make all the difference.

In summary, our research quenches the thirst for knowledge while leaving readers with a water-tight understanding of the stock market's fluid dynamics, reminding us that in the world of finance, every drop of data can lead to a significant ripple effect.

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

The findings of our study provide compelling evidence in support of the previously highlighted literature on the relationship between US bottled water consumption and EOG Resources' stock price. Our results align closely with the work of Smith et al. (2015), who emphasized the potential impact of consumer behavior on market dynamics. It appears that the ebb and flow of bottled water consumption indeed has a buoyant effect on the undulating waves of stock prices, much like a refreshing wave of inspiration in the parched landscape of financial analysis.

Interestingly, the whimsical detours we took in our literature review also seem to hold a kernel of truth. The dystopian narrative of water scarcity in "The Water Knife" by Paolo Bacigalupi, while a work of fiction, serves as a metaphorical reminder of the delicate balance between resource management and market influence. Similarly, the lighthearted portrayal of aquatic adventures in the "Water, Water, Water" episode of SpongeBob SquarePants may have inadvertently splashed some insight on the pervasive influence of water-related themes on consumer sentiment and market perception.

Our results echo the sentiment that even the most unlikely pairings can flow together harmoniously, much like water and a fine scotch, illustrating the potential for unconventional variables to create a symphony of statistical significance. The robust correlation coefficient and p-value less than 0.01 highlight the significant association between these seemingly disparate variables, underscoring the depth of the connection between hydration habits and stock market undulations. It seems that in the vast ocean of financial data, every drop of insight counts and has the potential to create substantial ripples.

In essence, our research quenches the thirst for knowledge while leaving readers with a water-tight understanding of the market's fluid dynamics, demonstrating that seminal discoveries can sometimes arise from the most unexpected sources, much like stumbling upon an oasis in a desert of statistical predictability. As we gaze into the crystal-clear waters of statistical significance, we are reminded that in the realm of finance, even the most unconventional variables can offer a refreshing perspective, and that a splash of humor and surprise can turn even the driest topics into a liquid delight.

Model: gpt-3.5-turbo-1106

System prompt: You are a witty academic researcher. Your writing sounds like it belongs in a statistics journal.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between US Bottled Water Consumption per Person and EOG Resources' stock price (EOG). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

Drips and Drips: The Thirsty Pursuit of EOG Stock Price and US Bottled Water Consumption

[[ABSTRACT]]

Our research delves into the relationship between US bottled water consumption and EOG Resources' stock price from 2002 to 2022. Motivated by the need to quench our curiosity, we utilized data from Statista and LSEG Analytics (Refinitiv) to analyze this apparently unrelated phenomenon. The correlation coefficient of 0.8452694 and p < 0.01 implies a statistically significant link between these two variables. Our findings not only suggest a potential market indicator but also emphasize how even the most unlikely pairings can flow together. The results underscore the importance of staying hydrated, both financially and physically, in the modern world. With a splash of humor and a dash of surprise, this research quenches the thirst for knowledge while leaving readers with a water-tight understanding of the stock market's fluid dynamics.

[[INTRDUCTION]]

The relationship between two seemingly unrelated factors has always piqued the interest of researchers and investors alike. In this study, we dive into the intriguing connection between the consumption of bottled water in the United States and the stock price of EOG Resources. This quest, motivated by a thirst for understanding, seeks to quench the curiosity surrounding the dynamic interplay between these variables and perhaps even provide some refreshing insights for investors and analysts in the process.

The notion that an individual's choice of hydrating with bottled water could have any bearing on the stock price of an energy company might seem as preposterous as expecting to find a school of fish in a desert mirage. However, as the old adage goes, "the driest stick will kindle a fire," and some unexpected findings in the world of finance have emerged from seemingly dry sources of data. Our aim is to add a drop of knowledge to the vast ocean of financial research, and who knows, maybe even make a splash in the market with our findings.

We collected data spanning from 2002 to 2022 from Statista and LSEG Analytics (Refinitiv), aiming to distill any potential correlation between these two variables before bottling up our results for dissemination. The magnitude of the correlation coefficient, a staggering 0.8452694, coupled with a p-value of less than 0.01, pours cold water on any doubts concerning the statistical significance of our findings. It seems that there might indeed be more than just a fluid connection between the hydration habits of American consumers and the undulating waves of EOG stock.

We hope to quench the intellectual thirst of our readers by pouring over the data and insights we have gleaned, and perhaps even sprinkle a few interesting findings along the way. We aim to show that even the most unlikely pairings can flow together in a statistical tango and demonstrate the surprising interconnectedness of what might appear as distant market dynamics. As we embark on this liquid adventure, we encourage our readers to keep their curiosity hydrated and their analytical glasses half-full, for in the seemingly mundane flows the extraordinary potential for market revelation. With that, let us dive into the waters of this interplay, scrutinizing the fluid dynamics of the stock market and bottled water consumption, in search of a clearer understanding and a few refreshing surprises.

[[RESULTS]]

Our investigation into the relationship between US bottled water consumption and EOG Resources' stock price from 2002 to 2022 revealed a rather refreshing discovery. The correlation coefficient of 0.8452694 and an r-squared of 0.7144804 suggest a strong and statistically significant association between these seemingly unrelated variables. Furthermore, with a p-value of less than 0.01, our findings indicate that this connection is not just a mere drop in the ocean of statistical noise but rather a substantial wave in the sea of financial data.

It's as if the stock market and bottled water consumption were engaged in a liquid dance, moving in sync like a perfectly choreographed water ballet. The figure (Fig. 1) showcases this harmonious relationship with a scatterplot that clearly illustrates the robust correlation between the two variables. One cannot help but appreciate the fluidity of this connection between the hydration habits of the American populace and the undulating waves of EOG stock prices.

In essence, our results not only highlight the potential market indicator stemming from US bottled water consumption but also emphasize how even the most unlikely pairings can blend together like water and a fine scotch. These findings underscore the importance of staying financially and physically hydrated in the modern world, where knowing when to take a sip from the fountain of financial wisdom can make all the difference.

In summary, our research quenches the thirst for knowledge while leaving readers with a water-tight understanding of the stock market's fluid dynamics, reminding us that in the world of finance, every drop of data can lead to a significant ripple effect.

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In conclusion, our findings have served to pour cold water on any doubts regarding the potential relationship between US bottled water consumption and EOG Resources' stock price. The statistical correlation coefficient of 0.8452694, coupled with a r-squared of 0.7144804, flows in the direction of a strong and robust association between these seemingly unrelated variables. The p-value of less than 0.01 underscores the statistical significance of this connection, affirming that it's not just a mere drop in the ocean of data but rather a substantial wave in the sea of financial information.

Through our study, we have uncovered a surprising synchrony between the hydration habits of the American populace and the undulating waves of EOG stock prices. It's almost as if the market and bottled water consumption were performing a liquid ballet, moving in delightful sync like a well-rehearsed water-themed Broadway show. Our scatterplot (see Fig. 1) beautifully illustrates this harmonious relationship, akin to a refreshing sip on a scorching summer day.

This research not only quenches the thirst for knowledge but also underscores the importance of staying financially and physically hydrated in the modern world, where knowing when to take a sip from the fountain of financial wisdom can make all the difference. The unexpected dance between these variables highlights the need for investors and analysts to keep their glasses half-full and their reflexes quick, ready to catch the next wave in the market.

In closing, our study has left readers with a water-tight understanding of the stock market's fluid dynamics, demonstrating the inherent potential for surprise in seemingly unrelated market dynamics. With this, we confidently assert that no further research is needed in this area, as we have already made quite the splash in this domain.

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited Drips and Drips: The Thirsty Pursuit of EOG Stock Price and US Bottled Water Consumption. Respond only with the name of a fictional academic journal.

ChatGPT:

The Journal of Financial Fluid Dynamics

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited Drips and Drips: The Thirsty Pursuit of EOG Stock Price and US Bottled Water Consumption. Respond only with the name of a fictional organization.

ChatGPT:

The Society for Aquatic Economics and Financial Fluid Dynamics

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled Drips and Drips: The Thirsty Pursuit of EOG Stock Price and US Bottled Water Consumption with an abstract of Our research delves into the relationship between US bottled water consumption and EOG Resources' stock price from 2002 to 2022. Motivated by the need to quench our curiosity, we utilized data from Statista and LSEG Analytics (Refinitiv) to analyze this apparently unrelated phenomenon. The correlation coefficient of 0.8452694 and p < 0.01 implies a statistically significant link between these two variables. Our findings not only suggest a potential market indicator but also emphasize how even the most unlikely pairings can flow together. The results underscore the importance of staying hydrated, both financially and physically, in the modern world. With a splash of humor and a dash of surprise, this research quenches the thirst for knowledge while leaving readers with a water-tight understanding of the stock market's fluid dynamics.

ChatGPT:

US bottled water consumption, EOG Resources stock price, correlation coefficient, market indicator, Statista data, LSEG Analytics, Refinitiv, stock market fluid dynamics, market trends, financial implications, statistical significance, relationship analysis

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

US Bottled Water Consumption per PersonSource: Statista

See what else correlates with US Bottled Water Consumption per Person

EOG Resources' stock price (EOG)

Detailed data title: Opening price of EOG Resources (EOG) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with EOG Resources' stock price (EOG)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.7144804 (Coefficient of determination)

This means 71.4% of the change in the one variable (i.e., EOG Resources' stock price (EOG)) is predictable based on the change in the other (i.e., US Bottled Water Consumption per Person) over the 21 years from 2002 through 2022.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 1.4E-6. 0.0000014140350209285445000000

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.85 in 0.00014% of random cases. Said differently, if you correlated 707,196 random variables You don't actually need 707 thousand variables to find a correlation like this one. I don't have that many variables in my database. You can also correlate variables that are not independent. I do this a lot.

p-value calculations are useful for understanding the probability of a result happening by chance. They are most useful when used to highlight the risk of a fluke outcome. For example, if you calculate a p-value of 0.30, the risk that the result is a fluke is high. It is good to know that! But there are lots of ways to get a p-value of less than 0.01, as evidenced by this project.

In this particular case, the values are so extreme as to be meaningless. That's why no one reports p-values with specificity after they drop below 0.01.

Just to be clear: I'm being completely transparent about the calculations. There is no math trickery. This is just how statistics shakes out when you calculate hundreds of millions of random correlations.

with the same 20 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 20 because we have two variables measured over a period of 21 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.65, 0.94 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

| US Bottled Water Consumption per Person (Gallons) | 20.1 | 21.6 | 23.2 | 25.4 | 27.6 | 29 | 28.5 | 27.6 | 28.3 | 29.2 | 30.8 | 32 | 34.1 | 36.5 | 39 | 42 | 42.3 | 44 | 45.2 | 47 | 46.5 |

| EOG Resources' stock price (EOG) (Stock price) | 9.55 | 10.11 | 11.51 | 17.84 | 37 | 30.91 | 45 | 33.97 | 49.68 | 46.23 | 50.31 | 61.7 | 83.29 | 91.01 | 70.8 | 102.63 | 108.67 | 85.66 | 84.32 | 50.76 | 88.33 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is. - Y-axis doesn't start at zero: I truncated the Y-axes of the graph above. I also used a line graph, which makes the visual connection stand out more than it deserves.

Nothing against line graphs. They are great at telling a story when you have linear data! But visually it is deceptive because the only data is at the points on the graph, not the lines on the graph. In between each point, the data could have been doing anything. Like going for a random walk by itself!

Mathematically what I showed is true, but it is intentionally misleading. Below is the same chart but with both Y-axes starting at zero.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([20.1,21.6,23.2,25.4,27.6,29,28.5,27.6,28.3,29.2,30.8,32,34.1,36.5,39,42,42.3,44,45.2,47,46.5,])

array_2 = np.array([9.55,10.11,11.51,17.84,37,30.91,45,33.97,49.68,46.23,50.31,61.7,83.29,91.01,70.8,102.63,108.67,85.66,84.32,50.76,88.33,])

array_1_name = "US Bottled Water Consumption per Person"

array_2_name = "EOG Resources' stock price (EOG)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only US Bottled Water Consumption per Person

- Line chart for only EOG Resources' stock price (EOG)

- AI-generated correlation image

- The spurious research paper: Drips and Drips: The Thirsty Pursuit of EOG Stock Price and US Bottled Water Consumption

I'm genuinely thankful for your rating!

Correlation ID: 3607 · Black Variable ID: 32 · Red Variable ID: 1660