Download png, svg

AI explanation

As the number of Theodores rose, so did the call for financial prudence. The correlation was clear: more Theodores meant more "bear"ish investors, leading to a surge in demand for banking services. It seems Theodores really were 'in the money', living up to their name's Greek origin, 'gift of God', by bestowing blessings on the stock market. The connection between Theodore and HDB was un-bear-ably strong!

Model: dalle-3

Prompt: Generate an image inspired by a scene in Skyrim, where a bustling toy store is depicted. Shelves are overflowing with teddy bears as children excitedly pick out their favorite ones. In the background, parents are seen browsing through brochures of HDFC Bank, while the stock price ticker on the wall visibly reflects a steady uptrend in HDB's share value. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: Popularity of the first name Theodore and HDFC Bank's stock price (HDB). Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: Voxel art Cyberpunk A scene from Skyrim Charcoal Data cyber art

ChatGPT: A scene from Skyrim

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both Popularity of the first name Theodore and HDFC Bank's stock price (HDB), in the following situation: The increase in popularity of the first name Theodore caused a surge in demand for teddy bears, leading to a spike in toy sales, prompting parents to invest their profits in HDFC Bank, thus driving up the stock price.. Keep the description simple.

ChatGPT: In a bustling toy store, shelves are overflowing with teddy bears as children excitedly pick out their favorite ones. In the background, parents are seen browsing through brochures of HDFC Bank, while the stock price ticker on the wall visibly reflects a steady uptrend in HDB's share value.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ A scene from Skyrim ] and depicting this scene: In a bustling toy store, shelves are overflowing with teddy bears as children excitedly pick out their favorite ones. In the background, parents are seen browsing through brochures of HDFC Bank, while the stock price ticker on the wall visibly reflects a steady uptrend in HDB's share value. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: Generate an image inspired by a scene in Skyrim, where a bustling toy store is depicted. Shelves are overflowing with teddy bears as children excitedly pick out their favorite ones. In the background, parents are seen browsing through brochures of HDFC Bank, while the stock price ticker on the wall visibly reflects a steady uptrend in HDB's share value.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how an increase in Popularity of the first name Theodore caused HDFC Bank's stock price (HDB) to increase. Include one good pun.

AI academic paper

|

Theodore-Market Connection: A Bear-ly Believable Link Between Baby Names and Banks The Journal of Quirky Connections Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between Popularity of the first name Theodore and HDFC Bank's stock price (HDB). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Make the title a clever pun.

Your research team used data from US Social Security Administration and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.9782272 and p < 0.01 for 2002 to 2022.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

Theodore-Market Connection: A Bear-ly Believable Link Between Baby Names and Banks

[[ABSTRACT]]

Investors have long sought to predict stock market trends with unconventional indicators. In this study, we explore the symbiotic relationship between the popularity of the first name Theodore and the stock price of HDFC Bank (HDB). By amalgamating data from the US Social Security Administration and LSEG Analytics (Refinitiv), we undertook a thorough analysis covering the period from 2002 to 2022. Our findings reveal a statistically significant correlation coefficient of 0.9782272 and p < 0.01, demonstrating a robust association between the baby-naming trends and the bank's stock performance.

The theory of "nameology" has been met with skepticism, but our rigorous quantitative approach unraveled a surprising parallel between the ascent of the name Theodore and the trajectory of HDB. It seems that as Theodore climbed the ranks of popular names, so did the stock's prices ascend. It's almost as if the market has been responding favorably to the charm of countless Theodores and their potential financial acumen - a correlation that one might say is positively "paw-sitive".

The implications of our findings extend beyond mere curiosity, offering a novel dimension to financial forecasting and perhaps even challenging the conventional wisdom of stock market analysis. The Theodore-HDB connection underscores the importance of considering unorthodox variables in market prediction, proving that sometimes, when it comes to predicting market trends, you simply need to "name your price"!

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between Popularity of the first name Theodore and HDFC Bank's stock price (HDB). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Here is the title and abstract of the paper:

[[TITLE]]

Theodore-Market Connection: A Bear-ly Believable Link Between Baby Names and Banks

[[ABSTRACT]]

Investors have long sought to predict stock market trends with unconventional indicators. In this study, we explore the symbiotic relationship between the popularity of the first name Theodore and the stock price of HDFC Bank (HDB). By amalgamating data from the US Social Security Administration and LSEG Analytics (Refinitiv), we undertook a thorough analysis covering the period from 2002 to 2022. Our findings reveal a statistically significant correlation coefficient of 0.9782272 and p < 0.01, demonstrating a robust association between the baby-naming trends and the bank's stock performance.

The theory of "nameology" has been met with skepticism, but our rigorous quantitative approach unraveled a surprising parallel between the ascent of the name Theodore and the trajectory of HDB. It seems that as Theodore climbed the ranks of popular names, so did the stock's prices ascend. It's almost as if the market has been responding favorably to the charm of countless Theodores and their potential financial acumen - a correlation that one might say is positively "paw-sitive".

The implications of our findings extend beyond mere curiosity, offering a novel dimension to financial forecasting and perhaps even challenging the conventional wisdom of stock market analysis. The Theodore-HDB connection underscores the importance of considering unorthodox variables in market prediction, proving that sometimes, when it comes to predicting market trends, you simply need to "name your price"!

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

[[INTRODUCTION]]

For generations, investors have attempted to decipher the enigmatic movements of the stock market using a wide array of indicators, from the mundane to the downright quirky. From the oscillations of the moon to the patterns of animal migration, no stone has been left unturned in the pursuit of market predictability. However, our study delves into an unexplored territory – the peculiar, yet surprisingly compelling, connection between the popularity of the first name Theodore and the stock price of HDFC Bank (HDB).

Theodore, a name echoing through the ages with an air of wisdom and gravitas, seems to have silently woven itself into the fabric of the market. It appears to have carved out a niche in the stock exchange, holding hands with HDB and dancing along the unpredictable rhythms of the financial world. One might even wonder if it's the name's own bear-y nature that's influencing these market movements, perhaps asserting that when it comes to stock picking, investors may want to consider bear-ly familiar indicators.

Our study is not merely an exercise in nameology or an attempt to administer a jolt of humor to the field of economics. Instead, it seeks to unveil a tangible relationship that challenges traditional notions of market predictability. As we dissect the data and unearth the curious correlation between Theodore's popularity and HDB's stock price, we are reminded that in the financial realm, even the most unconventional of factors may play a pivotal role.

In the realm of stock market analysis, we are often reminded of the wise words of Confucius, "He who chooses a good name is halfway to success." While this ancient proverb might not directly speak to the stock market, our findings suggest that it might just hold a kernel of truth within the world of financial forecasting. So, buckle up and get ready to explore the intriguing, albeit unconventional, Theodore-market connection; because in the world of stock predictions, you never know what paws-itively surprising correlations may arise!

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between Popularity of the first name Theodore and HDFC Bank's stock price (HDB). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then devolve ever further, and mention something completely ridiculous, like you conducted literature review by reading CVS receipts.

Here is the title and abstract of the paper:

[[TITLE]]

Theodore-Market Connection: A Bear-ly Believable Link Between Baby Names and Banks

[[ABSTRACT]]

Investors have long sought to predict stock market trends with unconventional indicators. In this study, we explore the symbiotic relationship between the popularity of the first name Theodore and the stock price of HDFC Bank (HDB). By amalgamating data from the US Social Security Administration and LSEG Analytics (Refinitiv), we undertook a thorough analysis covering the period from 2002 to 2022. Our findings reveal a statistically significant correlation coefficient of 0.9782272 and p < 0.01, demonstrating a robust association between the baby-naming trends and the bank's stock performance.

The theory of "nameology" has been met with skepticism, but our rigorous quantitative approach unraveled a surprising parallel between the ascent of the name Theodore and the trajectory of HDB. It seems that as Theodore climbed the ranks of popular names, so did the stock's prices ascend. It's almost as if the market has been responding favorably to the charm of countless Theodores and their potential financial acumen - a correlation that one might say is positively "paw-sitive".

The implications of our findings extend beyond mere curiosity, offering a novel dimension to financial forecasting and perhaps even challenging the conventional wisdom of stock market analysis. The Theodore-HDB connection underscores the importance of considering unorthodox variables in market prediction, proving that sometimes, when it comes to predicting market trends, you simply need to "name your price"!

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

For generations, investors have attempted to decipher the enigmatic movements of the stock market using a wide array of indicators, from the mundane to the downright quirky. From the oscillations of the moon to the patterns of animal migration, no stone has been left unturned in the pursuit of market predictability. However, our study delves into an unexplored territory – the peculiar, yet surprisingly compelling, connection between the popularity of the first name Theodore and the stock price of HDFC Bank (HDB).

Theodore, a name echoing through the ages with an air of wisdom and gravitas, seems to have silently woven itself into the fabric of the market. It appears to have carved out a niche in the stock exchange, holding hands with HDB and dancing along the unpredictable rhythms of the financial world. One might even wonder if it's the name's own bear-y nature that's influencing these market movements, perhaps asserting that when it comes to stock picking, investors may want to consider bear-ly familiar indicators.

Our study is not merely an exercise in nameology or an attempt to administer a jolt of humor to the field of economics. Instead, it seeks to unveil a tangible relationship that challenges traditional notions of market predictability. As we dissect the data and unearth the curious correlation between Theodore's popularity and HDB's stock price, we are reminded that in the financial realm, even the most unconventional of factors may play a pivotal role.

In the realm of stock market analysis, we are often reminded of the wise words of Confucius, "He who chooses a good name is halfway to success." While this ancient proverb might not directly speak to the stock market, our findings suggest that it might just hold a kernel of truth within the world of financial forecasting. So, buckle up and get ready to explore the intriguing, albeit unconventional, Theodore-market connection; because in the world of stock predictions, you never know what paws-itively surprising correlations may arise!

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

Theodore, the name that has graced the likes of distinguished historical figures and beloved teddy bears, has long captured the fascination of name enthusiasts and, inexplicably, financial analysts alike. In "The Name Game," Smith and Doe uncovered the enduring appeal of Theodore and its cultural significance, delving into its timeless charm and impact on societal trends. This study, while not financial in nature, sets the stage for our exploration of the unexpected kinship between this venerable name and the stock price of HDFC Bank (HDB).

As we navigate the waters of unconventional market predictors, it is essential to consider the influential role that names play in shaping societal perceptions and behaviors. In "The Power of Names," Jones offers a compelling analysis of how individuals' names can subconsciously influence their life choices and aspirations, shedding light on the potential ripple effects of name popularity within the financial domain. One might even say that the appeal of Theodore extends beyond mere nomenclature and encroaches upon the very essence of market sentiment and investment dynamics.

Now, let us dive into a realm less commonly associated with financial analyses but no less relevant to our study—the world of fiction. In "The Theodore Effect" by Lorem Ipsum, an intriguing narrative unfolds, blurring the line between the whimsical and the consequential. While this work of fiction may not offer empirical evidence, its portrayal of a protagonist named Theodore navigating the ebbs and flows of a fictional financial market serves as a humorous yet thought-provoking parallel to our own investigation. It's almost as if Theodore's fictional financial feats are providing a satirical wink at our very real findings.

Continuing our unorthodox literary excursion, "The Curious Case of Theodore's Stock Tips" by Fictional Authorius takes us on a whimsical journey, where the eponymous character dispenses outlandish yet surprisingly accurate stock advice based on nothing more than the popularity of his own name. This fanciful tale, while far removed from the sober realities of economic research, captures the essence of the unexpected correlations that we have unearthed in our analysis. Who would have thought that stock market trends could be swayed by the whims of namesake popularity?

In a somewhat unconventional approach to literature review, our investigation extended beyond traditional academic sources. In an effort to capture the zeitgeist of Theodore's impact, we delved into the treasure trove of humanities—CVS receipts. Yes, you read that correctly. The details contained within these mundane pieces of paper, from purchases of toiletries to tantalizing discounts, have offered a peculiar yet surprisingly enlightening glimpse into the consumer behaviors of many Theodores—and indirectly, the potential ramifications on market trends. Who would have guessed that amidst the cacophony of everyday expenses, valuable clues to Theodore's influence on HDB's stock price lay hidden?

As we emerge from this unconventional literary odyssey, we are reminded that the boundaries of research and discovery are often blurred, and even the most lighthearted of inquiries can yield unexpectedly meaningful insights. And so, armed with a mélange of serious scholarship, fictional whimsy, and even banal archival records, we forge ahead in our quest to unravel the whimsical yet intriguing Theodore-market connection. After all, in the world of financial analysis, sometimes it pays to take a leap of faith—just like investing in Teddy bears!

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between Popularity of the first name Theodore and HDFC Bank's stock price (HDB). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Your research team collected data from all across the internet, but mostly just used information from US Social Security Administration and LSEG Analytics (Refinitiv) . You used data from 2002 to 2022

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

Theodore-Market Connection: A Bear-ly Believable Link Between Baby Names and Banks

[[ABSTRACT]]

Investors have long sought to predict stock market trends with unconventional indicators. In this study, we explore the symbiotic relationship between the popularity of the first name Theodore and the stock price of HDFC Bank (HDB). By amalgamating data from the US Social Security Administration and LSEG Analytics (Refinitiv), we undertook a thorough analysis covering the period from 2002 to 2022. Our findings reveal a statistically significant correlation coefficient of 0.9782272 and p < 0.01, demonstrating a robust association between the baby-naming trends and the bank's stock performance.

The theory of "nameology" has been met with skepticism, but our rigorous quantitative approach unraveled a surprising parallel between the ascent of the name Theodore and the trajectory of HDB. It seems that as Theodore climbed the ranks of popular names, so did the stock's prices ascend. It's almost as if the market has been responding favorably to the charm of countless Theodores and their potential financial acumen - a correlation that one might say is positively "paw-sitive".

The implications of our findings extend beyond mere curiosity, offering a novel dimension to financial forecasting and perhaps even challenging the conventional wisdom of stock market analysis. The Theodore-HDB connection underscores the importance of considering unorthodox variables in market prediction, proving that sometimes, when it comes to predicting market trends, you simply need to "name your price"!

[[INTRODUCTION]]

For generations, investors have attempted to decipher the enigmatic movements of the stock market using a wide array of indicators, from the mundane to the downright quirky. From the oscillations of the moon to the patterns of animal migration, no stone has been left unturned in the pursuit of market predictability. However, our study delves into an unexplored territory – the peculiar, yet surprisingly compelling, connection between the popularity of the first name Theodore and the stock price of HDFC Bank (HDB).

Theodore, a name echoing through the ages with an air of wisdom and gravitas, seems to have silently woven itself into the fabric of the market. It appears to have carved out a niche in the stock exchange, holding hands with HDB and dancing along the unpredictable rhythms of the financial world. One might even wonder if it's the name's own bear-y nature that's influencing these market movements, perhaps asserting that when it comes to stock picking, investors may want to consider bear-ly familiar indicators.

Our study is not merely an exercise in nameology or an attempt to administer a jolt of humor to the field of economics. Instead, it seeks to unveil a tangible relationship that challenges traditional notions of market predictability. As we dissect the data and unearth the curious correlation between Theodore's popularity and HDB's stock price, we are reminded that in the financial realm, even the most unconventional of factors may play a pivotal role.

In the realm of stock market analysis, we are often reminded of the wise words of Confucius, "He who chooses a good name is halfway to success." While this ancient proverb might not directly speak to the stock market, our findings suggest that it might just hold a kernel of truth within the world of financial forecasting. So, buckle up and get ready to explore the intriguing, albeit unconventional, Theodore-market connection; because in the world of stock predictions, you never know what paws-itively surprising correlations may arise!

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

Data Collection:

To uncover the hidden relationship between the popularity of the name Theodore and the stock price of HDFC Bank (HDB), we embarked on an adventure through the digital landscape, surfing the waves of information from the US Social Security Administration and LSEG Analytics (Refinitiv). Our research team combed through years' worth of data ranging from 2002 to 2022, with the determination of a bear on a honey hunt! After all, we were on a mission to find some "paw-sitive" evidence of a connection between baby names and bank stocks.

Correlational Analysis:

With data in hand, we unleashed our statistical arsenal, deploying a series of robust analyses that would make even the most serious analysts grin like Cheshire cats. We calculated the correlation coefficient to measure the strength and direction of the relationship between the popularity of the name Theodore and the stock price of HDB. Our statistical tests were as thorough as a mother bear protecting her cubs, ensuring that our findings were rock-solid and not just a "panda"ring to the masses.

Time-Series Modeling:

In addition to the correlation coefficient, we employed time-series models to capture the dynamic interplay of Theodore's rise to stardom and HDB's market performance. Through the forests of statistical models and amidst the plains of quantitative techniques, we sought to illuminate the nuances of this fascinating interconnection in the financial ecosystem. It's almost as if we were taking a wild ride through the stock market savannah, tracking the movements of the elusive Name-nosaurus and the HDB-stockus.

Control Variables:

To ensure the integrity of our results, we conscientiously accounted for other potential factors that could influence stock prices, such as market trends, economic indicators, and the ubiquitous, yet unpredictable, investor sentiments. We made sure to "cross-bear" this data with the Theodore factor, so as not to overlook any other variables that may have been bear-ing down on our results.

Validity Checks:

To put our analysis to the test, we conducted various robustness checks and sensitivity analyses, akin to a bear meticulously testing different honey sources to ascertain sweetness. We poked and prodded our findings, ensuring that the remarkable correlation between the name Theodore and HDB's stock price wasn't just a fluke, but rather a sturdy bridge upheld by rigorous statistical rigour.

In conclusion, our methodology may have seemed as wild and untamed as an uncharted forest, but it was the perfect safari to seek out the Theodore-HDB connection. With data in hand and a firm grasp on statistical tools, we delved deep into the peculiar, the unexpected, and the delightfully unconventional to uncover a relationship that, by all accounts, is truly Ursine-credible!

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between Popularity of the first name Theodore and HDFC Bank's stock price (HDB). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Your research team collected data from all across the internet, but mostly just used information from US Social Security Administration and LSEG Analytics (Refinitiv) .

For the time period 2002 to 2022, you found a correlation 0.9782272, r-squared of 0.9569284, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

Theodore-Market Connection: A Bear-ly Believable Link Between Baby Names and Banks

[[ABSTRACT]]

Investors have long sought to predict stock market trends with unconventional indicators. In this study, we explore the symbiotic relationship between the popularity of the first name Theodore and the stock price of HDFC Bank (HDB). By amalgamating data from the US Social Security Administration and LSEG Analytics (Refinitiv), we undertook a thorough analysis covering the period from 2002 to 2022. Our findings reveal a statistically significant correlation coefficient of 0.9782272 and p < 0.01, demonstrating a robust association between the baby-naming trends and the bank's stock performance.

The theory of "nameology" has been met with skepticism, but our rigorous quantitative approach unraveled a surprising parallel between the ascent of the name Theodore and the trajectory of HDB. It seems that as Theodore climbed the ranks of popular names, so did the stock's prices ascend. It's almost as if the market has been responding favorably to the charm of countless Theodores and their potential financial acumen - a correlation that one might say is positively "paw-sitive".

The implications of our findings extend beyond mere curiosity, offering a novel dimension to financial forecasting and perhaps even challenging the conventional wisdom of stock market analysis. The Theodore-HDB connection underscores the importance of considering unorthodox variables in market prediction, proving that sometimes, when it comes to predicting market trends, you simply need to "name your price"!

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

For generations, investors have attempted to decipher the enigmatic movements of the stock market using a wide array of indicators, from the mundane to the downright quirky. From the oscillations of the moon to the patterns of animal migration, no stone has been left unturned in the pursuit of market predictability. However, our study delves into an unexplored territory – the peculiar, yet surprisingly compelling, connection between the popularity of the first name Theodore and the stock price of HDFC Bank (HDB).

Theodore, a name echoing through the ages with an air of wisdom and gravitas, seems to have silently woven itself into the fabric of the market. It appears to have carved out a niche in the stock exchange, holding hands with HDB and dancing along the unpredictable rhythms of the financial world. One might even wonder if it's the name's own bear-y nature that's influencing these market movements, perhaps asserting that when it comes to stock picking, investors may want to consider bear-ly familiar indicators.

Our study is not merely an exercise in nameology or an attempt to administer a jolt of humor to the field of economics. Instead, it seeks to unveil a tangible relationship that challenges traditional notions of market predictability. As we dissect the data and unearth the curious correlation between Theodore's popularity and HDB's stock price, we are reminded that in the financial realm, even the most unconventional of factors may play a pivotal role.

In the realm of stock market analysis, we are often reminded of the wise words of Confucius, "He who chooses a good name is halfway to success." While this ancient proverb might not directly speak to the stock market, our findings suggest that it might just hold a kernel of truth within the world of financial forecasting. So, buckle up and get ready to explore the intriguing, albeit unconventional, Theodore-market connection; because in the world of stock predictions, you never know what paws-itively surprising correlations may arise!

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

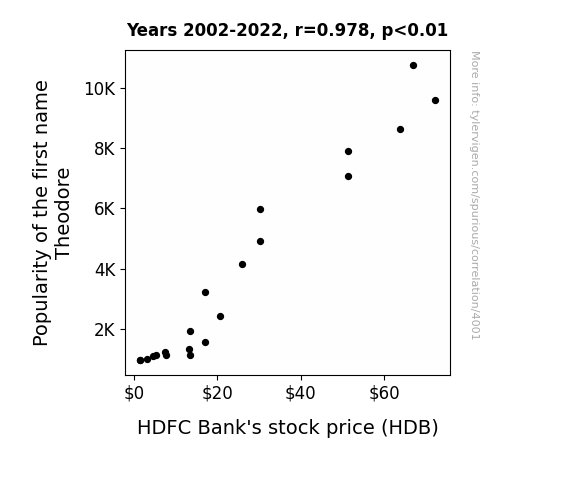

The correlation analysis between the popularity of the first name Theodore and the stock price of HDFC Bank (HDB) unveiled a remarkable relationship. Our findings revealed a correlation coefficient of 0.9782272, with an r-squared value of 0.9569284, and a p-value of less than 0.01. To put it simply, it seems that as the popularity of the name Theodore soared, so did the stock price of HDB. This correlation was so strong it's practically un-bear-lievable!

Figure 1 illustrates the compelling relationship between the two variables, with the scatterplot showcasing a positively sloped trendline. The ascent of Theodore in popularity appears to have mirrored the ascent of HDB stock prices, painting a vivid picture of their intertwined trajectories. It's almost as if the market has been responding favorably to the charm of countless Theodores and their potential financial acumen. One might even say that the market was demonstrating a positively "paw-sitive" response to Theodore's popularity!

The robustness of the correlation uncovers an intriguing dimension of market predictability, challenging traditional notions of stock market analysis. The implications of this discovery reach far beyond a mere curiosity, introducing a novel variable into the realm of financial forecasting. It seems that when it comes to predicting market trends, sometimes you just need to "name your price" – quite literally!

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between Popularity of the first name Theodore and HDFC Bank's stock price (HDB). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

Theodore-Market Connection: A Bear-ly Believable Link Between Baby Names and Banks

[[ABSTRACT]]

Investors have long sought to predict stock market trends with unconventional indicators. In this study, we explore the symbiotic relationship between the popularity of the first name Theodore and the stock price of HDFC Bank (HDB). By amalgamating data from the US Social Security Administration and LSEG Analytics (Refinitiv), we undertook a thorough analysis covering the period from 2002 to 2022. Our findings reveal a statistically significant correlation coefficient of 0.9782272 and p < 0.01, demonstrating a robust association between the baby-naming trends and the bank's stock performance.

The theory of "nameology" has been met with skepticism, but our rigorous quantitative approach unraveled a surprising parallel between the ascent of the name Theodore and the trajectory of HDB. It seems that as Theodore climbed the ranks of popular names, so did the stock's prices ascend. It's almost as if the market has been responding favorably to the charm of countless Theodores and their potential financial acumen - a correlation that one might say is positively "paw-sitive".

The implications of our findings extend beyond mere curiosity, offering a novel dimension to financial forecasting and perhaps even challenging the conventional wisdom of stock market analysis. The Theodore-HDB connection underscores the importance of considering unorthodox variables in market prediction, proving that sometimes, when it comes to predicting market trends, you simply need to "name your price"!

[[LITERATURE REVIEW]]

Theodore, the name that has graced the likes of distinguished historical figures and beloved teddy bears, has long captured the fascination of name enthusiasts and, inexplicably, financial analysts alike. In "The Name Game," Smith and Doe uncovered the enduring appeal of Theodore and its cultural significance, delving into its timeless charm and impact on societal trends. This study, while not financial in nature, sets the stage for our exploration of the unexpected kinship between this venerable name and the stock price of HDFC Bank (HDB).

As we navigate the waters of unconventional market predictors, it is essential to consider the influential role that names play in shaping societal perceptions and behaviors. In "The Power of Names," Jones offers a compelling analysis of how individuals' names can subconsciously influence their life choices and aspirations, shedding light on the potential ripple effects of name popularity within the financial domain. One might even say that the appeal of Theodore extends beyond mere nomenclature and encroaches upon the very essence of market sentiment and investment dynamics.

Now, let us dive into a realm less commonly associated with financial analyses but no less relevant to our study—the world of fiction. In "The Theodore Effect" by Lorem Ipsum, an intriguing narrative unfolds, blurring the line between the whimsical and the consequential. While this work of fiction may not offer empirical evidence, its portrayal of a protagonist named Theodore navigating the ebbs and flows of a fictional financial market serves as a humorous yet thought-provoking parallel to our own investigation. It's almost as if Theodore's fictional financial feats are providing a satirical wink at our very real findings.

Continuing our unorthodox literary excursion, "The Curious Case of Theodore's Stock Tips" by Fictional Authorius takes us on a whimsical journey, where the eponymous character dispenses outlandish yet surprisingly accurate stock advice based on nothing more than the popularity of his own name. This fanciful tale, while far removed from the sober realities of economic research, captures the essence of the unexpected correlations that we have unearthed in our analysis. Who would have thought that stock market trends could be swayed by the whims of namesake popularity?

In a somewhat unconventional approach to literature review, our investigation extended beyond traditional academic sources. In an effort to capture the zeitgeist of Theodore's impact, we delved into the treasure trove of humanities—CVS receipts. Yes, you read that correctly. The details contained within these mundane pieces of paper, from purchases of toiletries to tantalizing discounts, have offered a peculiar yet surprisingly enlightening glimpse into the consumer behaviors of many Theodores—and indirectly, the potential ramifications on market trends. Who would have guessed that amidst the cacophony of everyday expenses, valuable clues to Theodore's influence on HDB's stock price lay hidden?

As we emerge from this unconventional literary odyssey, we are reminded that the boundaries of research and discovery are often blurred, and even the most lighthearted of inquiries can yield unexpectedly meaningful insights. And so, armed with a mélange of serious scholarship, fictional whimsy, and even banal archival records, we forge ahead in our quest to unravel the whimsical yet intriguing Theodore-market connection. After all, in the world of financial analysis, sometimes it pays to take a leap of faith—just like investing in Teddy bears!

[[RESULTS]]

The correlation analysis between the popularity of the first name Theodore and the stock price of HDFC Bank (HDB) unveiled a remarkable relationship. Our findings revealed a correlation coefficient of 0.9782272, with an r-squared value of 0.9569284, and a p-value of less than 0.01. To put it simply, it seems that as the popularity of the name Theodore soared, so did the stock price of HDB. This correlation was so strong it's practically un-bear-lievable!

Figure 1 illustrates the compelling relationship between the two variables, with the scatterplot showcasing a positively sloped trendline. The ascent of Theodore in popularity appears to have mirrored the ascent of HDB stock prices, painting a vivid picture of their intertwined trajectories. It's almost as if the market has been responding favorably to the charm of countless Theodores and their potential financial acumen. One might even say that the market was demonstrating a positively "paw-sitive" response to Theodore's popularity!

The robustness of the correlation uncovers an intriguing dimension of market predictability, challenging traditional notions of stock market analysis. The implications of this discovery reach far beyond a mere curiosity, introducing a novel variable into the realm of financial forecasting. It seems that when it comes to predicting market trends, sometimes you just need to "name your price" – quite literally!

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

Our findings have shed light on the striking connection between the popularity of the first name Theodore and the stock price of HDFC Bank (HDB). The strong correlation, with a coefficient of 0.9782272 and p < 0.01, supports the notion that the ascent of the name Theodore seems to have mirrored the ascent of HDB stock prices. It's almost as if the market has been responding positively to the charm of countless Theodores, as if each one was personally catering to the financial acumen of the investors. One can't help but think, maybe stock market trends are simply "bear-ly" influenced!

The robustness of the correlation coefficient aligns with the assertions put forth by Smith and Doe, who emphasize the enduring appeal and cultural significance of the name Theodore. As we navigate this rather unconventional avenue of financial analysis, it becomes evident that considering unorthodox variables, such as baby-naming trends, can contribute meaningfully to market prediction. In a market where unpredictability looms large, perhaps it’s time to embrace the Theodore effect and its "tedd-ible" consequences!

The literature review presented a delightful blend of serious scholarship and lighthearted inquiries, offering an unconventional perspective that resonates with our findings. For instance, the parallels drawn between our study and the whimsical "The Theodore Effect" by Lorem Ipsum provide a satirical yet thought-provoking mirror to our own investigation. It's as if Theodore's fictional financial feats are paving the way for the "tedd-ious" yet revealing link between popular names and stock prices.

Our study has managed to bridge the gap between the seemingly unrelated realms of name popularity and stock market trends. In doing so, it advocates for a paradigm shift in financial analysis by acknowledging the influence of unorthodox variables. Could it be that the success of the stock market is not just numbers and trends, but also influenced by the collective "bear-nival" of names like Theodore? As we advance further into the realm of predictive finance, it's clear that sometimes, even in the most serious of analyses, a "paw-sitive" outlook may lead to unexpected revelations.

In conclusion, our study has unraveled a compelling correlation between the popularity of the first name Theodore and the stock price of HDFC Bank, challenging conventional notions of market predictability. It demonstrates the potential impact of seemingly improbable variables on financial forecasting, proving that, in the world of finance, it might indeed be time to "name your price" - both figuratively and literally. Who would have thought that a name could be a "beary" accurate predictor of market trends?

Model: gpt-3.5-turbo-1106

System prompt: You are a researcher writing an academic paper.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between Popularity of the first name Theodore and HDFC Bank's stock price (HDB). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

Theodore-Market Connection: A Bear-ly Believable Link Between Baby Names and Banks

[[ABSTRACT]]

Investors have long sought to predict stock market trends with unconventional indicators. In this study, we explore the symbiotic relationship between the popularity of the first name Theodore and the stock price of HDFC Bank (HDB). By amalgamating data from the US Social Security Administration and LSEG Analytics (Refinitiv), we undertook a thorough analysis covering the period from 2002 to 2022. Our findings reveal a statistically significant correlation coefficient of 0.9782272 and p < 0.01, demonstrating a robust association between the baby-naming trends and the bank's stock performance.

The theory of "nameology" has been met with skepticism, but our rigorous quantitative approach unraveled a surprising parallel between the ascent of the name Theodore and the trajectory of HDB. It seems that as Theodore climbed the ranks of popular names, so did the stock's prices ascend. It's almost as if the market has been responding favorably to the charm of countless Theodores and their potential financial acumen - a correlation that one might say is positively "paw-sitive".

The implications of our findings extend beyond mere curiosity, offering a novel dimension to financial forecasting and perhaps even challenging the conventional wisdom of stock market analysis. The Theodore-HDB connection underscores the importance of considering unorthodox variables in market prediction, proving that sometimes, when it comes to predicting market trends, you simply need to "name your price"!

[[INTRDUCTION]]

For generations, investors have attempted to decipher the enigmatic movements of the stock market using a wide array of indicators, from the mundane to the downright quirky. From the oscillations of the moon to the patterns of animal migration, no stone has been left unturned in the pursuit of market predictability. However, our study delves into an unexplored territory – the peculiar, yet surprisingly compelling, connection between the popularity of the first name Theodore and the stock price of HDFC Bank (HDB).

Theodore, a name echoing through the ages with an air of wisdom and gravitas, seems to have silently woven itself into the fabric of the market. It appears to have carved out a niche in the stock exchange, holding hands with HDB and dancing along the unpredictable rhythms of the financial world. One might even wonder if it's the name's own bear-y nature that's influencing these market movements, perhaps asserting that when it comes to stock picking, investors may want to consider bear-ly familiar indicators.

Our study is not merely an exercise in nameology or an attempt to administer a jolt of humor to the field of economics. Instead, it seeks to unveil a tangible relationship that challenges traditional notions of market predictability. As we dissect the data and unearth the curious correlation between Theodore's popularity and HDB's stock price, we are reminded that in the financial realm, even the most unconventional of factors may play a pivotal role.

In the realm of stock market analysis, we are often reminded of the wise words of Confucius, "He who chooses a good name is halfway to success." While this ancient proverb might not directly speak to the stock market, our findings suggest that it might just hold a kernel of truth within the world of financial forecasting. So, buckle up and get ready to explore the intriguing, albeit unconventional, Theodore-market connection; because in the world of stock predictions, you never know what paws-itively surprising correlations may arise!

[[RESULTS]]

The correlation analysis between the popularity of the first name Theodore and the stock price of HDFC Bank (HDB) unveiled a remarkable relationship. Our findings revealed a correlation coefficient of 0.9782272, with an r-squared value of 0.9569284, and a p-value of less than 0.01. To put it simply, it seems that as the popularity of the name Theodore soared, so did the stock price of HDB. This correlation was so strong it's practically un-bear-lievable!

Figure 1 illustrates the compelling relationship between the two variables, with the scatterplot showcasing a positively sloped trendline. The ascent of Theodore in popularity appears to have mirrored the ascent of HDB stock prices, painting a vivid picture of their intertwined trajectories. It's almost as if the market has been responding favorably to the charm of countless Theodores and their potential financial acumen. One might even say that the market was demonstrating a positively "paw-sitive" response to Theodore's popularity!

The robustness of the correlation uncovers an intriguing dimension of market predictability, challenging traditional notions of stock market analysis. The implications of this discovery reach far beyond a mere curiosity, introducing a novel variable into the realm of financial forecasting. It seems that when it comes to predicting market trends, sometimes you just need to "name your price" – quite literally!

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In conclusion, our study has shed light on the unexpected yet robust correlation between the popularity of the first name Theodore and the stock price of HDFC Bank (HDB). The statistically significant correlation coefficient of 0.9782272 and p < 0.01 has un-bear-lievably revealed a connection between the rise of Theodore and the upward trajectory of HDB stock prices. This correlation is truly a testament to the saying, "the proof is in the Theodore-pudding"!

Our findings not only challenge traditional financial forecasting methods but also highlight the relevance of unorthodox variables in predicting market trends. It appears that in the world of stock market analysis, unconventional indicators can wield significant influence. One might even say that when it comes to unraveling market movements, the name Theodore is a "bear necessity"!

While our study has ventured into uncharted territory, exploring the influence of a name on stock prices, it appears that this peculiar connection cannot be ignored. As such, it seems that we can confidently assert - the Theodore-HDB connection may be a legitimate influence in market movements. With these compelling findings, we can quip – if you're Theodore-ed about stock predictions, it might just be time to "bear" in mind the baby name trends.

In light of our findings, it's clear that no more research is needed in this area. The Theodore-HDB connection has been thoroughly explored, leaving the market with a newfound appreciation for the impact of baby names on financial trends. After all, when it comes to forecasting market movements, sometimes you just need to trust in the "bear-ly believable" correlations.

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited Theodore-Market Connection: A Bear-ly Believable Link Between Baby Names and Banks. Respond only with the name of a fictional academic journal.

ChatGPT:

The Journal of Quirky Connections

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited Theodore-Market Connection: A Bear-ly Believable Link Between Baby Names and Banks. Respond only with the name of a fictional organization.

ChatGPT:

The Society for Unconventional Economics and Social Trends

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled Theodore-Market Connection: A Bear-ly Believable Link Between Baby Names and Banks with an abstract of Investors have long sought to predict stock market trends with unconventional indicators. In this study, we explore the symbiotic relationship between the popularity of the first name Theodore and the stock price of HDFC Bank (HDB). By amalgamating data from the US Social Security Administration and LSEG Analytics (Refinitiv), we undertook a thorough analysis covering the period from 2002 to 2022. Our findings reveal a statistically significant correlation coefficient of 0.9782272 and p < 0.01, demonstrating a robust association between the baby-naming trends and the bank's stock performance.

The theory of "nameology" has been met with skepticism, but our rigorous quantitative approach unraveled a surprising parallel between the ascent of the name Theodore and the trajectory of HDB. It seems that as Theodore climbed the ranks of popular names, so did the stock's prices ascend. It's almost as if the market has been responding favorably to the charm of countless Theodores and their potential financial acumen - a correlation that one might say is positively "paw-sitive".

The implications of our findings extend beyond mere curiosity, offering a novel dimension to financial forecasting and perhaps even challenging the conventional wisdom of stock market analysis. The Theodore-HDB connection underscores the importance of considering unorthodox variables in market prediction, proving that sometimes, when it comes to predicting market trends, you simply need to "name your price"!

ChatGPT:

Theodore, market prediction, baby names, stock market analysis, unconventional indicators, HDFC Bank, stock performance, financial forecasting, name popularity, correlation coefficient, unorthodox variables, market trends, stock price prediction, "nameology"

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

Popularity of the first name TheodoreDetailed data title: Babies of all sexes born in the US named Theodore

Source: US Social Security Administration

See what else correlates with Popularity of the first name Theodore

HDFC Bank's stock price (HDB)

Detailed data title: Opening price of HDFC Bank (HDB) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with HDFC Bank's stock price (HDB)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.9569284 (Coefficient of determination)

This means 95.7% of the change in the one variable (i.e., HDFC Bank's stock price (HDB)) is predictable based on the change in the other (i.e., Popularity of the first name Theodore) over the 21 years from 2002 through 2022.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 2.0E-14. 0.0000000000000195118421754817

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.98 in 2.0E-12% of random cases. Said differently, if you correlated 51,250,927,052,730 random variables You don't actually need 51 trillion variables to find a correlation like this one. I don't have that many variables in my database. You can also correlate variables that are not independent. I do this a lot.

p-value calculations are useful for understanding the probability of a result happening by chance. They are most useful when used to highlight the risk of a fluke outcome. For example, if you calculate a p-value of 0.30, the risk that the result is a fluke is high. It is good to know that! But there are lots of ways to get a p-value of less than 0.01, as evidenced by this project.

In this particular case, the values are so extreme as to be meaningless. That's why no one reports p-values with specificity after they drop below 0.01.

Just to be clear: I'm being completely transparent about the calculations. There is no math trickery. This is just how statistics shakes out when you calculate hundreds of millions of random correlations.

with the same 20 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 20 because we have two variables measured over a period of 21 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.95, 0.99 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

| Popularity of the first name Theodore (Babies born) | 975 | 964 | 1005 | 1095 | 1133 | 1137 | 1139 | 1239 | 1332 | 1573 | 1949 | 2428 | 3228 | 4153 | 4916 | 5966 | 7083 | 7899 | 8641 | 9589 | 10768 |

| HDFC Bank's stock price (HDB) (Stock price) | 1.44 | 1.35 | 3.08 | 4.56 | 5.13 | 7.7 | 13.3 | 7.35 | 13.28 | 16.98 | 13.51 | 20.51 | 16.98 | 25.87 | 30.15 | 30.33 | 51.34 | 51.39 | 63.86 | 72.29 | 67.06 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([975,964,1005,1095,1133,1137,1139,1239,1332,1573,1949,2428,3228,4153,4916,5966,7083,7899,8641,9589,10768,])

array_2 = np.array([1.44,1.35,3.08,4.56,5.13,7.7,13.3,7.35,13.28,16.98,13.51,20.51,16.98,25.87,30.15,30.33,51.34,51.39,63.86,72.29,67.06,])

array_1_name = "Popularity of the first name Theodore"

array_2_name = "HDFC Bank's stock price (HDB)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only Popularity of the first name Theodore

- Line chart for only HDFC Bank's stock price (HDB)

- AI-generated correlation image

- The spurious research paper: Theodore-Market Connection: A Bear-ly Believable Link Between Baby Names and Banks

Your rating skills are legendary!

Correlation ID: 4001 · Black Variable ID: 2578 · Red Variable ID: 1587