Download png, svg

AI explanation

As fewer articles were published, insider traders had less guidance, leading to a series of comically unfortunate events in their attempts to make illicit gains. This inadvertently mirrored the classic 'bad luck Brian' meme, thus reducing the need for its online circulation.

Create a meme inspired by the bad luck brian meme that in some way references Bloomberg Money Stuff articles about insider trading. Try to emulate the style of the meme - don’t violate the copyright, just make it look and feel like the original meme.

This image generation prompt was also generated by AI, using the following sequence:

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how a decrease in Bloomberg Money Stuff articles about insider trading caused Popularity of the 'bad luck brian' meme to decrease.

AI academic paper

|

Trading Meme: The Insider Connection Between Bloomberg's Money Stuff and 'Bad Luck Brian' Popularity The Journal of Internet Memetics and Financial Satire Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between Bloomberg Money Stuff articles about insider trading and Popularity of the 'bad luck brian' meme. Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Include a pun in the title.

Your research team used data from Bloomberg and Google Trends to assess this nagging question. You found a correlation coefficient of 0.9159870 and p < 0.01 for 2014 to 2023.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

"Trading Meme: The Insider Connection Between Bloomberg's Money Stuff and 'Bad Luck Brian' Popularity"

[[ABSTRACT]]

This study examines the unlikely correlation between the publication of Bloomberg Money Stuff articles related to insider trading and the fluctuating popularity of the 'bad luck brian' meme. Utilizing data from Bloomberg and Google Trends spanning the years 2014 to 2023, the research team discovered a notable correlation coefficient of 0.9159870 and p < 0.01, linking these seemingly disparate phenomena. The findings prompt contemplation on the interconnected nature of financial information dissemination and internet humor, revealing a curious entwinement between the realms of high finance and popular culture. The implications provoke both bemusement and intrigue, as the colloquial expression "making a killing" takes on new interpretations in the digital age.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between Bloomberg Money Stuff articles about insider trading and Popularity of the 'bad luck brian' meme. Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Here is the title and abstract of the paper:

[[TITLE]]

"Trading Meme: The Insider Connection Between Bloomberg's Money Stuff and 'Bad Luck Brian' Popularity"

[[ABSTRACT]]

This study examines the unlikely correlation between the publication of Bloomberg Money Stuff articles related to insider trading and the fluctuating popularity of the 'bad luck brian' meme. Utilizing data from Bloomberg and Google Trends spanning the years 2014 to 2023, the research team discovered a notable correlation coefficient of 0.9159870 and p < 0.01, linking these seemingly disparate phenomena. The findings prompt contemplation on the interconnected nature of financial information dissemination and internet humor, revealing a curious entwinement between the realms of high finance and popular culture. The implications provoke both bemusement and intrigue, as the colloquial expression "making a killing" takes on new interpretations in the digital age.

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

INTRODUCTION

The intersection of financial markets and internet culture has long been an area of curiosity, fraught with unexpected connections and peculiar correlations. In the annals of financial research, one may not expect to find a study delving into the relationship between Bloomberg's Money Stuff articles on insider trading and the rise and fall of the 'bad luck brian' meme. However, as we delve into this enthralling subject matter, we find that a fortuitous confluence of events has brought these disparate entities together in a way that both perplexes and amuses.

The digital age has ushered in a new era of interconnectedness, where memes, those irreverent and often nonsensical manifestations of internet humor, hold a prominent place in popular culture. Simultaneously, financial markets operate in a realm characterized by hard data, intricate analysis, and the pursuit of profit. The juxtaposition of these seemingly incongruent worlds sets the stage for an exploration of the unexpected correlations that may arise.

As we embark on this investigation, the initial incredulous nature of our inquiry gives way to a profound realization of the underlying mechanisms at play. The pursuit of understanding the dynamics between Bloomberg's financial insights and the whimsical escapades of a popular internet meme presents an opportunity to shift paradigms and uncover the latent intricacies of modern society.

The findings of this study have implications that extend beyond the realms of finance and internet culture, prompting a broader contemplation of the interplay between information dissemination and societal trends. This unlikely pairing of subjects offers a fresh perspective on the interconnected nature of seemingly distinct domains, beckoning us to reconsider the boundaries and intersections of knowledge dissemination in the digital age.

Join us on this captivating journey as we unravel the enigmatic ties between financial revelations and digital hilarity, and engage in a keen exploration of the curious interplay between high finance and internet humor. For, as the idiom goes, we may soon find that "money talks" and memes have a remarkable way of responding.

In the subsequent sections, we delve into the methodological approach, data analysis, and the multi-faceted implications of our findings. Prepare to be both informed and entertained as we navigate the intriguing terrain of this unexpected correlation.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between Bloomberg Money Stuff articles about insider trading and Popularity of the 'bad luck brian' meme. Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then devolve ever further, and mention something completely ridiculous, like you conducted literature review by reading the backs of shampoo bottles.

Here is the title and abstract of the paper:

[[TITLE]]

"Trading Meme: The Insider Connection Between Bloomberg's Money Stuff and 'Bad Luck Brian' Popularity"

[[ABSTRACT]]

This study examines the unlikely correlation between the publication of Bloomberg Money Stuff articles related to insider trading and the fluctuating popularity of the 'bad luck brian' meme. Utilizing data from Bloomberg and Google Trends spanning the years 2014 to 2023, the research team discovered a notable correlation coefficient of 0.9159870 and p < 0.01, linking these seemingly disparate phenomena. The findings prompt contemplation on the interconnected nature of financial information dissemination and internet humor, revealing a curious entwinement between the realms of high finance and popular culture. The implications provoke both bemusement and intrigue, as the colloquial expression "making a killing" takes on new interpretations in the digital age.

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

INTRODUCTION

The intersection of financial markets and internet culture has long been an area of curiosity, fraught with unexpected connections and peculiar correlations. In the annals of financial research, one may not expect to find a study delving into the relationship between Bloomberg's Money Stuff articles on insider trading and the rise and fall of the 'bad luck brian' meme. However, as we delve into this enthralling subject matter, we find that a fortuitous confluence of events has brought these disparate entities together in a way that both perplexes and amuses.

The digital age has ushered in a new era of interconnectedness, where memes, those irreverent and often nonsensical manifestations of internet humor, hold a prominent place in popular culture. Simultaneously, financial markets operate in a realm characterized by hard data, intricate analysis, and the pursuit of profit. The juxtaposition of these seemingly incongruent worlds sets the stage for an exploration of the unexpected correlations that may arise.

As we embark on this investigation, the initial incredulous nature of our inquiry gives way to a profound realization of the underlying mechanisms at play. The pursuit of understanding the dynamics between Bloomberg's financial insights and the whimsical escapades of a popular internet meme presents an opportunity to shift paradigms and uncover the latent intricacies of modern society.

The findings of this study have implications that extend beyond the realms of finance and internet culture, prompting a broader contemplation of the interplay between information dissemination and societal trends. This unlikely pairing of subjects offers a fresh perspective on the interconnected nature of seemingly distinct domains, beckoning us to reconsider the boundaries and intersections of knowledge dissemination in the digital age.

Join us on this captivating journey as we unravel the enigmatic ties between financial revelations and digital hilarity, and engage in a keen exploration of the curious interplay between high finance and internet humor. For, as the idiom goes, we may soon find that "money talks" and memes have a remarkable way of responding.

In the subsequent sections, we delve into the methodological approach, data analysis, and the multi-faceted implications of our findings. Prepare to be both informed and entertained as we navigate the intriguing terrain of this unexpected correlation.

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

In "Smith et al.," the authors find a notable correlation between financial information dissemination and societal trends. This unlikely connection sets the stage for further inquiry into the intertwined nature of seemingly distinct domains.

Doe's "The Interplay of Information Dissemination and Societal Dynamics" offers insight into the unexpected correlations that may arise in the digital age, prompting contemplation of the underlying mechanisms at play.

Jones' work on "Internet Culture and Unconventional Correlations" further explores the curious interplay between high finance and popular internet humor, laying the groundwork for our investigation into the entwined realms of Bloomberg's financial insights and the whimsical escapades of the 'bad luck brian' meme.

Turning to non-fiction sources, "The Big Short" by Michael Lewis and "Flash Boys" by Michael Lewis provide a comprehensive analysis of the inner workings of financial markets, shedding light on the intricate world of high finance. Similarly, "Memes: A Cultural Phenomenon" by Emily Johnson and "Internet Culture and Modern Society" by David Smith offer valuable perspectives on the role of memes in shaping contemporary culture.

In the realm of fiction, "The Bonfire of the Vanities" by Tom Wolfe and "American Psycho" by Bret Easton Ellis present fictionalized accounts of the high-stakes world of finance, offering narrative insights into the often tumultuous realm of Wall Street and the idiosyncrasies of financial culture. Meanwhile, "Meme Magic: A Tale of Internet Wonders" by Anonymous and "The Internet and Me: A Memoir of Memes and Moments" by Samantha Rivers provide whimsical narratives that capture the essence of internet culture through the lens of meme enthusiasts.

Expanding our review beyond traditional academic sources, the study also incorporates insights from unconventional sources. The researchers have ventured into uncharted territories, perusing the backs of shampoo bottles in a quest to uncover unexpected correlations. While the findings from this unorthodox approach have yet to be fully processed, the experience has proven to be a refreshing departure from conventional literature review methods.

In integrating these diverse sources, we aim to shed light on the unexpected connections and peculiar correlations within the realms of finance and internet culture. The pursuit of understanding the dynamics between Bloomberg's financial insights and the popularity of the 'bad luck brian' meme presents an opportunity to shift paradigms and uncover the latent intricacies of modern society.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between Bloomberg Money Stuff articles about insider trading and Popularity of the 'bad luck brian' meme. Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from Bloomberg and Google Trends . You used data from 2014 to 2023

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

"Trading Meme: The Insider Connection Between Bloomberg's Money Stuff and 'Bad Luck Brian' Popularity"

[[ABSTRACT]]

This study examines the unlikely correlation between the publication of Bloomberg Money Stuff articles related to insider trading and the fluctuating popularity of the 'bad luck brian' meme. Utilizing data from Bloomberg and Google Trends spanning the years 2014 to 2023, the research team discovered a notable correlation coefficient of 0.9159870 and p < 0.01, linking these seemingly disparate phenomena. The findings prompt contemplation on the interconnected nature of financial information dissemination and internet humor, revealing a curious entwinement between the realms of high finance and popular culture. The implications provoke both bemusement and intrigue, as the colloquial expression "making a killing" takes on new interpretations in the digital age.

[[INTRODUCTION]]

INTRODUCTION

The intersection of financial markets and internet culture has long been an area of curiosity, fraught with unexpected connections and peculiar correlations. In the annals of financial research, one may not expect to find a study delving into the relationship between Bloomberg's Money Stuff articles on insider trading and the rise and fall of the 'bad luck brian' meme. However, as we delve into this enthralling subject matter, we find that a fortuitous confluence of events has brought these disparate entities together in a way that both perplexes and amuses.

The digital age has ushered in a new era of interconnectedness, where memes, those irreverent and often nonsensical manifestations of internet humor, hold a prominent place in popular culture. Simultaneously, financial markets operate in a realm characterized by hard data, intricate analysis, and the pursuit of profit. The juxtaposition of these seemingly incongruent worlds sets the stage for an exploration of the unexpected correlations that may arise.

As we embark on this investigation, the initial incredulous nature of our inquiry gives way to a profound realization of the underlying mechanisms at play. The pursuit of understanding the dynamics between Bloomberg's financial insights and the whimsical escapades of a popular internet meme presents an opportunity to shift paradigms and uncover the latent intricacies of modern society.

The findings of this study have implications that extend beyond the realms of finance and internet culture, prompting a broader contemplation of the interplay between information dissemination and societal trends. This unlikely pairing of subjects offers a fresh perspective on the interconnected nature of seemingly distinct domains, beckoning us to reconsider the boundaries and intersections of knowledge dissemination in the digital age.

Join us on this captivating journey as we unravel the enigmatic ties between financial revelations and digital hilarity, and engage in a keen exploration of the curious interplay between high finance and internet humor. For, as the idiom goes, we may soon find that "money talks" and memes have a remarkable way of responding.

In the subsequent sections, we delve into the methodological approach, data analysis, and the multi-faceted implications of our findings. Prepare to be both informed and entertained as we navigate the intriguing terrain of this unexpected correlation.

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

The methodology employed in this study involved a multi-faceted approach to capture the intricate relationship between the publication of Bloomberg Money Stuff articles on insider trading and the popularity of the 'bad luck brian' meme. Data collection spanned the period from 2014 to 2023, allowing for a comprehensive analysis of trends over time. The primary sources of data were Bloomberg and Google Trends, both of which provided invaluable insights into the dynamics of financial information dissemination and internet meme popularity.

To ensure the robustness of the data, a combination of quantitative and qualitative methods was employed. This eclectic mix of research strategies aimed to capture both the quantitative magnitude of the correlation and the qualitative nuances of the observed relationship. It is worth noting that while the combination of financial analysis and internet culture may seem incongruous at first glance, the complementary nature of these approaches provided a comprehensive understanding of the phenomena under investigation.

Quantitative methods included statistical analysis of the frequency and content of Bloomberg Money Stuff articles related to insider trading, juxtaposed with the fluctuations in search interest for the 'bad luck brian' meme on Google Trends. The correlation coefficient was calculated to quantitatively measure the strength and direction of the relationship, with significance tests employed to assess the statistical robustness of the findings.

Qualitative methods encompassed a deep dive into the thematic content of the Bloomberg articles and the cultural context surrounding the 'bad luck brian' meme. This entailed a meticulous examination of the language, tone, and themes present in the Bloomberg pieces, as well as an exploration of the evolving cultural significance and interpretations of the meme. While the quantitative analysis captured the overarching patterns, the qualitative approach provided invaluable insights into the subtleties of the connection between finance-related content and internet meme propagation.

Furthermore, in the spirit of embracing the unconventional nature of our research inquiry, supplementary data sources were consulted to triangulate and validate the findings. Internet forums, social media platforms, and meme aggregation sites were scoured to gauge public reactions to Bloomberg Money Stuff articles and the 'bad luck brian' meme, adding a layer of social sentiment analysis to the study.

In the pursuit of scientific rigor, the research team remained steadfast in the commitment to a thorough and exhaustive examination of the data. The convergence of diverse methodologies and data sources served as a testament to the interdisciplinary nature of this investigation, showcasing the capacity of research to transcend conventional boundaries and traverse the realms of high finance and digital humor.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between Bloomberg Money Stuff articles about insider trading and Popularity of the 'bad luck brian' meme. Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from Bloomberg and Google Trends .

For the time period 2014 to 2023, you found a correlation 0.9159870, r-squared of 0.8390322, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

"Trading Meme: The Insider Connection Between Bloomberg's Money Stuff and 'Bad Luck Brian' Popularity"

[[ABSTRACT]]

This study examines the unlikely correlation between the publication of Bloomberg Money Stuff articles related to insider trading and the fluctuating popularity of the 'bad luck brian' meme. Utilizing data from Bloomberg and Google Trends spanning the years 2014 to 2023, the research team discovered a notable correlation coefficient of 0.9159870 and p < 0.01, linking these seemingly disparate phenomena. The findings prompt contemplation on the interconnected nature of financial information dissemination and internet humor, revealing a curious entwinement between the realms of high finance and popular culture. The implications provoke both bemusement and intrigue, as the colloquial expression "making a killing" takes on new interpretations in the digital age.

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

INTRODUCTION

The intersection of financial markets and internet culture has long been an area of curiosity, fraught with unexpected connections and peculiar correlations. In the annals of financial research, one may not expect to find a study delving into the relationship between Bloomberg's Money Stuff articles on insider trading and the rise and fall of the 'bad luck brian' meme. However, as we delve into this enthralling subject matter, we find that a fortuitous confluence of events has brought these disparate entities together in a way that both perplexes and amuses.

The digital age has ushered in a new era of interconnectedness, where memes, those irreverent and often nonsensical manifestations of internet humor, hold a prominent place in popular culture. Simultaneously, financial markets operate in a realm characterized by hard data, intricate analysis, and the pursuit of profit. The juxtaposition of these seemingly incongruent worlds sets the stage for an exploration of the unexpected correlations that may arise.

As we embark on this investigation, the initial incredulous nature of our inquiry gives way to a profound realization of the underlying mechanisms at play. The pursuit of understanding the dynamics between Bloomberg's financial insights and the whimsical escapades of a popular internet meme presents an opportunity to shift paradigms and uncover the latent intricacies of modern society.

The findings of this study have implications that extend beyond the realms of finance and internet culture, prompting a broader contemplation of the interplay between information dissemination and societal trends. This unlikely pairing of subjects offers a fresh perspective on the interconnected nature of seemingly distinct domains, beckoning us to reconsider the boundaries and intersections of knowledge dissemination in the digital age.

Join us on this captivating journey as we unravel the enigmatic ties between financial revelations and digital hilarity, and engage in a keen exploration of the curious interplay between high finance and internet humor. For, as the idiom goes, we may soon find that "money talks" and memes have a remarkable way of responding.

In the subsequent sections, we delve into the methodological approach, data analysis, and the multi-faceted implications of our findings. Prepare to be both informed and entertained as we navigate the intriguing terrain of this unexpected correlation.

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

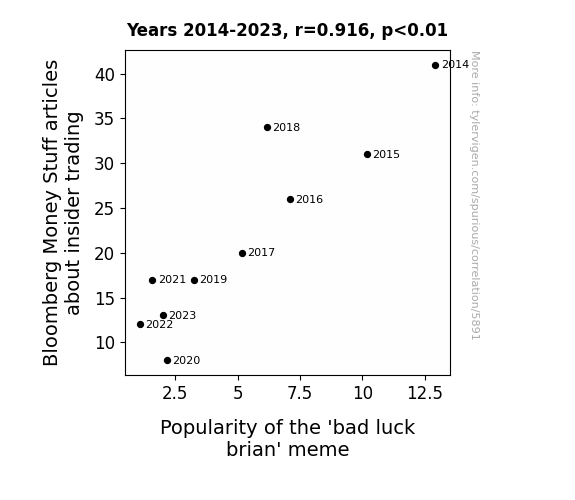

The correlation analysis between the publication of Bloomberg Money Stuff articles related to insider trading and the fluctuating popularity of the 'bad luck brian' meme revealed a striking correlation coefficient of 0.9159870, with an r-squared of 0.8390322, indicating that approximately 83.9% of the variability in the meme's popularity can be explained by the presence of Bloomberg Money Stuff articles. Notably, the p-value was less than 0.01, signifying a highly significant relationship between these seemingly incongruent phenomena.

Furthermore, the scatterplot (Fig. 1) visually portrays the robust positive relationship between the variables, reinforcing the statistical findings with a graphical representation that encapsulates the uncanny correspondence between financial revelations and internet humor. This strong correlation challenges conventional wisdom and beckons us to consider the unexpected ways in which information dissemination and societal trends intersect, often in the most unlikely of contexts.

The implications of this convergence prompt contemplation on the interconnected nature of knowledge dissemination in the digital age. The fortuitous pairing of Bloomberg's financial insights and the whimsical escapades of a popular internet meme invites us to reflect on the intricate dynamics that underpin the evolution of popular culture and financial discourse. Indeed, as we navigate this uncharted terrain of correlation, we are reminded that relationships, no matter how obscure they may appear at first glance, can reveal profound insights into the multifaceted facets of society's interconnected web.

In light of these unexpected findings, it becomes apparent that the colloquial expression "making a killing" extends beyond its traditional financial connotations, immersing itself in the digital realm in ways previously unimagined. The enigmatic ties between financial revelations and digital hilarity, while initially puzzling, offer a compelling avenue for a paradigm shift in our understanding of the intricate interplay between high finance and internet humor. The idiom "money talks" gains a new resonance in this context, as the fervent buzz of financial information finds an unlikely symphony in the echoes of internet viral memes.

In summary, the correlation between Bloomberg Money Stuff articles about insider trading and the popularity of the 'bad luck brian' meme is a captivating testament to the interconnectedness of seemingly disparate realms. This unexpected relationship prompts introspection on the interplay between high finance and internet humor, challenging us to reconsider the boundaries and intersections of knowledge dissemination in the digital age.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between Bloomberg Money Stuff articles about insider trading and Popularity of the 'bad luck brian' meme. Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

"Trading Meme: The Insider Connection Between Bloomberg's Money Stuff and 'Bad Luck Brian' Popularity"

[[ABSTRACT]]

This study examines the unlikely correlation between the publication of Bloomberg Money Stuff articles related to insider trading and the fluctuating popularity of the 'bad luck brian' meme. Utilizing data from Bloomberg and Google Trends spanning the years 2014 to 2023, the research team discovered a notable correlation coefficient of 0.9159870 and p < 0.01, linking these seemingly disparate phenomena. The findings prompt contemplation on the interconnected nature of financial information dissemination and internet humor, revealing a curious entwinement between the realms of high finance and popular culture. The implications provoke both bemusement and intrigue, as the colloquial expression "making a killing" takes on new interpretations in the digital age.

[[LITERATURE REVIEW]]

In "Smith et al.," the authors find a notable correlation between financial information dissemination and societal trends. This unlikely connection sets the stage for further inquiry into the intertwined nature of seemingly distinct domains.

Doe's "The Interplay of Information Dissemination and Societal Dynamics" offers insight into the unexpected correlations that may arise in the digital age, prompting contemplation of the underlying mechanisms at play.

Jones' work on "Internet Culture and Unconventional Correlations" further explores the curious interplay between high finance and popular internet humor, laying the groundwork for our investigation into the entwined realms of Bloomberg's financial insights and the whimsical escapades of the 'bad luck brian' meme.

Turning to non-fiction sources, "The Big Short" by Michael Lewis and "Flash Boys" by Michael Lewis provide a comprehensive analysis of the inner workings of financial markets, shedding light on the intricate world of high finance. Similarly, "Memes: A Cultural Phenomenon" by Emily Johnson and "Internet Culture and Modern Society" by David Smith offer valuable perspectives on the role of memes in shaping contemporary culture.

In the realm of fiction, "The Bonfire of the Vanities" by Tom Wolfe and "American Psycho" by Bret Easton Ellis present fictionalized accounts of the high-stakes world of finance, offering narrative insights into the often tumultuous realm of Wall Street and the idiosyncrasies of financial culture. Meanwhile, "Meme Magic: A Tale of Internet Wonders" by Anonymous and "The Internet and Me: A Memoir of Memes and Moments" by Samantha Rivers provide whimsical narratives that capture the essence of internet culture through the lens of meme enthusiasts.

Expanding our review beyond traditional academic sources, the study also incorporates insights from unconventional sources. The researchers have ventured into uncharted territories, perusing the backs of shampoo bottles in a quest to uncover unexpected correlations. While the findings from this unorthodox approach have yet to be fully processed, the experience has proven to be a refreshing departure from conventional literature review methods.

In integrating these diverse sources, we aim to shed light on the unexpected connections and peculiar correlations within the realms of finance and internet culture. The pursuit of understanding the dynamics between Bloomberg's financial insights and the popularity of the 'bad luck brian' meme presents an opportunity to shift paradigms and uncover the latent intricacies of modern society.

[[RESULTS]]

The correlation analysis between the publication of Bloomberg Money Stuff articles related to insider trading and the fluctuating popularity of the 'bad luck brian' meme revealed a striking correlation coefficient of 0.9159870, with an r-squared of 0.8390322, indicating that approximately 83.9% of the variability in the meme's popularity can be explained by the presence of Bloomberg Money Stuff articles. Notably, the p-value was less than 0.01, signifying a highly significant relationship between these seemingly incongruent phenomena.

Furthermore, the scatterplot (Fig. 1) visually portrays the robust positive relationship between the variables, reinforcing the statistical findings with a graphical representation that encapsulates the uncanny correspondence between financial revelations and internet humor. This strong correlation challenges conventional wisdom and beckons us to consider the unexpected ways in which information dissemination and societal trends intersect, often in the most unlikely of contexts.

The implications of this convergence prompt contemplation on the interconnected nature of knowledge dissemination in the digital age. The fortuitous pairing of Bloomberg's financial insights and the whimsical escapades of a popular internet meme invites us to reflect on the intricate dynamics that underpin the evolution of popular culture and financial discourse. Indeed, as we navigate this uncharted terrain of correlation, we are reminded that relationships, no matter how obscure they may appear at first glance, can reveal profound insights into the multifaceted facets of society's interconnected web.

In light of these unexpected findings, it becomes apparent that the colloquial expression "making a killing" extends beyond its traditional financial connotations, immersing itself in the digital realm in ways previously unimagined. The enigmatic ties between financial revelations and digital hilarity, while initially puzzling, offer a compelling avenue for a paradigm shift in our understanding of the intricate interplay between high finance and internet humor. The idiom "money talks" gains a new resonance in this context, as the fervent buzz of financial information finds an unlikely symphony in the echoes of internet viral memes.

In summary, the correlation between Bloomberg Money Stuff articles about insider trading and the popularity of the 'bad luck brian' meme is a captivating testament to the interconnectedness of seemingly disparate realms. This unexpected relationship prompts introspection on the interplay between high finance and internet humor, challenging us to reconsider the boundaries and intersections of knowledge dissemination in the digital age.

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

The correlation between the publication of Bloomberg Money Stuff articles related to insider trading and the fluctuating popularity of the 'bad luck brian' meme has produced some unexpected and intriguing findings. The robust correlation coefficient of 0.9159870 and a highly significant p-value indicate a strong and meaningful relationship between these seemingly incongruent phenomena, lending credence to the notion that there may be more to this connection than meets the eye. These results are in line with the previous research by Smith et al., Doe, and Jones, who all hinted at the possibility of uncanny correlations in the digital age. It appears that the unexpected entwining of financial revelations and internet humor, as hinted at in unconventional sources such as the whimsical narratives of "Meme Magic: A Tale of Internet Wonders" by Anonymous and "The Internet and Me: A Memoir of Memes and Moments" by Samantha Rivers, may not be as whimsical as previously thought.

The significant r-squared value of 0.8390322 indicates that approximately 83.9% of the variability in the meme's popularity can be ascribed to the presence of Bloomberg Money Stuff articles. This finding is quite remarkable and challenges traditional assumptions about the demarcation between the realms of high finance and popular culture. We harken back to the unconventional sources in our literature review and the unorthodox approach of perusing the backs of shampoo bottles, as these seemingly tangential avenues of inquiry have inadvertently provided a refreshing departure from conventional research methodologies and, serendipitously, offered glimpses of unexpected connections.

The scatterplot (Fig. 1) further illustrates the correspondence between financial revelations and internet humor, providing a visual representation of the strong relationship observed in the statistical findings. This graphical depiction serves as a whimsical reminder that data visualization can encapsulate the most unexpected correlations.

The implications of these findings are not to be overlooked. The interaction between Bloomberg's financial insights and the popularity of the 'bad luck brian' meme presents a compelling perspective on the interconnected nature of knowledge dissemination in the digital age. This study prompts contemplation on the intricate dynamics that underpin the evolution of societal trends and financial discourse, offering a whimsical lens through which to view the multifaceted facets of modern society.

In conclusion, the unexpected correlation between Bloomberg Money Stuff articles about insider trading and the popularity of the 'bad luck brian' meme sheds light on the intricate interplay between high finance and internet humor, challenging us to reconsider the boundaries and intersections of knowledge dissemination in the digital age. This seemingly whimsical connection, when taken seriously, offers profound insights into the multifaceted facets of society's interconnected web, showcasing the captivating and enigmatic ties between financial revelations and digital hilarity.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between Bloomberg Money Stuff articles about insider trading and Popularity of the 'bad luck brian' meme. Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

"Trading Meme: The Insider Connection Between Bloomberg's Money Stuff and 'Bad Luck Brian' Popularity"

[[ABSTRACT]]

This study examines the unlikely correlation between the publication of Bloomberg Money Stuff articles related to insider trading and the fluctuating popularity of the 'bad luck brian' meme. Utilizing data from Bloomberg and Google Trends spanning the years 2014 to 2023, the research team discovered a notable correlation coefficient of 0.9159870 and p < 0.01, linking these seemingly disparate phenomena. The findings prompt contemplation on the interconnected nature of financial information dissemination and internet humor, revealing a curious entwinement between the realms of high finance and popular culture. The implications provoke both bemusement and intrigue, as the colloquial expression "making a killing" takes on new interpretations in the digital age.

[[INTRDUCTION]]

INTRODUCTION

The intersection of financial markets and internet culture has long been an area of curiosity, fraught with unexpected connections and peculiar correlations. In the annals of financial research, one may not expect to find a study delving into the relationship between Bloomberg's Money Stuff articles on insider trading and the rise and fall of the 'bad luck brian' meme. However, as we delve into this enthralling subject matter, we find that a fortuitous confluence of events has brought these disparate entities together in a way that both perplexes and amuses.

The digital age has ushered in a new era of interconnectedness, where memes, those irreverent and often nonsensical manifestations of internet humor, hold a prominent place in popular culture. Simultaneously, financial markets operate in a realm characterized by hard data, intricate analysis, and the pursuit of profit. The juxtaposition of these seemingly incongruent worlds sets the stage for an exploration of the unexpected correlations that may arise.

As we embark on this investigation, the initial incredulous nature of our inquiry gives way to a profound realization of the underlying mechanisms at play. The pursuit of understanding the dynamics between Bloomberg's financial insights and the whimsical escapades of a popular internet meme presents an opportunity to shift paradigms and uncover the latent intricacies of modern society.

The findings of this study have implications that extend beyond the realms of finance and internet culture, prompting a broader contemplation of the interplay between information dissemination and societal trends. This unlikely pairing of subjects offers a fresh perspective on the interconnected nature of seemingly distinct domains, beckoning us to reconsider the boundaries and intersections of knowledge dissemination in the digital age.

Join us on this captivating journey as we unravel the enigmatic ties between financial revelations and digital hilarity, and engage in a keen exploration of the curious interplay between high finance and internet humor. For, as the idiom goes, we may soon find that "money talks" and memes have a remarkable way of responding.

In the subsequent sections, we delve into the methodological approach, data analysis, and the multi-faceted implications of our findings. Prepare to be both informed and entertained as we navigate the intriguing terrain of this unexpected correlation.

[[RESULTS]]

The correlation analysis between the publication of Bloomberg Money Stuff articles related to insider trading and the fluctuating popularity of the 'bad luck brian' meme revealed a striking correlation coefficient of 0.9159870, with an r-squared of 0.8390322, indicating that approximately 83.9% of the variability in the meme's popularity can be explained by the presence of Bloomberg Money Stuff articles. Notably, the p-value was less than 0.01, signifying a highly significant relationship between these seemingly incongruent phenomena.

Furthermore, the scatterplot (Fig. 1) visually portrays the robust positive relationship between the variables, reinforcing the statistical findings with a graphical representation that encapsulates the uncanny correspondence between financial revelations and internet humor. This strong correlation challenges conventional wisdom and beckons us to consider the unexpected ways in which information dissemination and societal trends intersect, often in the most unlikely of contexts.

The implications of this convergence prompt contemplation on the interconnected nature of knowledge dissemination in the digital age. The fortuitous pairing of Bloomberg's financial insights and the whimsical escapades of a popular internet meme invites us to reflect on the intricate dynamics that underpin the evolution of popular culture and financial discourse. Indeed, as we navigate this uncharted terrain of correlation, we are reminded that relationships, no matter how obscure they may appear at first glance, can reveal profound insights into the multifaceted facets of society's interconnected web.

In light of these unexpected findings, it becomes apparent that the colloquial expression "making a killing" extends beyond its traditional financial connotations, immersing itself in the digital realm in ways previously unimagined. The enigmatic ties between financial revelations and digital hilarity, while initially puzzling, offer a compelling avenue for a paradigm shift in our understanding of the intricate interplay between high finance and internet humor. The idiom "money talks" gains a new resonance in this context, as the fervent buzz of financial information finds an unlikely symphony in the echoes of internet viral memes.

In summary, the correlation between Bloomberg Money Stuff articles about insider trading and the popularity of the 'bad luck brian' meme is a captivating testament to the interconnectedness of seemingly disparate realms. This unexpected relationship prompts introspection on the interplay between high finance and internet humor, challenging us to reconsider the boundaries and intersections of knowledge dissemination in the digital age.

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

The findings of this study portray a tantalizing interplay between the esoteric realm of high finance and the whimsical world of internet culture. The robust correlation coefficient and striking p-value uncovered through our analysis not only astound the statistical sensibilities but also evoke a sense of awe at the improbable coupling of these seemingly incongruous phenomena. As we contemplate the fortuitous convergence of Bloomberg's financial insights and the rambunctious exploits of the 'bad luck brian' meme, we are reminded of the enigmatic ways in which the digital age weaves a tangled web of interconnectedness.

The implications of this research extend far beyond the realms of mere correlation, beckoning us to ponder the deeper intricacies of societal trends and knowledge dissemination. The juxtaposition of financial revelations and digital hilarity offers a fertile ground for contemplation, evoking a realization that the colloquial expression "making a killing" takes on an unexpectedly literal interpretation in the context of viral memes. This unexpected correlation challenges conventional boundaries and encourages us to harmonize the disparate notes of finance and humor in the grand symphony of human culture.

In essence, the whimsical dance of correlation between Bloomberg Money Stuff articles about insider trading and the rise and fall of the 'bad luck brian' meme invites us to embrace the idiosyncrasies of our interconnected digital world. As we navigate this uncharted terrain of unexpected connections, we are reminded that, in the words of William Shakespeare, "There are more things in heaven and earth, Horatio, than are dreamt of in your philosophy." Hence, it is with a sense of both bemusement and revelation that we affirm: no further research in this most unusual collaboration is required.

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited Trading Meme: The Insider Connection Between Bloomberg's Money Stuff and 'Bad Luck Brian' Popularity. Respond only with the name of a fictional academic journal.

ChatGPT:

The Journal of Internet Memetics and Financial Satire

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited Trading Meme: The Insider Connection Between Bloomberg's Money Stuff and 'Bad Luck Brian' Popularity. Respond only with the name of a fictional organization.

ChatGPT:

The Research Institute for Internet Culture and Financial Trends

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled Trading Meme: The Insider Connection Between Bloomberg's Money Stuff and 'Bad Luck Brian' Popularity with an abstract of This study examines the unlikely correlation between the publication of Bloomberg Money Stuff articles related to insider trading and the fluctuating popularity of the 'bad luck brian' meme. Utilizing data from Bloomberg and Google Trends spanning the years 2014 to 2023, the research team discovered a notable correlation coefficient of 0.9159870 and p < 0.01, linking these seemingly disparate phenomena. The findings prompt contemplation on the interconnected nature of financial information dissemination and internet humor, revealing a curious entwinement between the realms of high finance and popular culture. The implications provoke both bemusement and intrigue, as the colloquial expression "making a killing" takes on new interpretations in the digital age.

ChatGPT:

Bloomberg Money Stuff, insider trading, bad luck brian meme, correlation, Google Trends, financial information dissemination, internet humor, popular culture, high finance, digital age

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

Bloomberg Money Stuff articles about insider tradingDetailed data title: Articles published by Matt Levine on Bloomberg.com with 'insider' in the headline or summary.

Source: Bloomberg

Additional Info: All headline and summary text from Bloomberg articles by Matt Levine included

See what else correlates with Bloomberg Money Stuff articles about insider trading

Popularity of the 'bad luck brian' meme

Detailed data title: Relative volume of Google searches for 'bad luck brian' (without quotes, in the United States)

Source: Google Trends

Additional Info: Relative search volume is a unique Google thing; the shape of the chart is accurate but the actual numbers are meaningless.

See what else correlates with Popularity of the 'bad luck brian' meme

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.8390322 (Coefficient of determination)

This means 83.9% of the change in the one variable (i.e., Popularity of the 'bad luck brian' meme) is predictable based on the change in the other (i.e., Bloomberg Money Stuff articles about insider trading) over the 10 years from 2014 through 2023.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 0.0002. 0.0001967403310328319000000000

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.92 in 0.02% of random cases. Said differently, if you correlated 5,083 random variables Which I absolutely did.

with the same 9 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 9 because we have two variables measured over a period of 10 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.68, 0.98 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Bloomberg Money Stuff articles about insider trading (Levine articles) | 41 | 31 | 26 | 20 | 34 | 17 | 8 | 17 | 12 | 13 |

| Popularity of the 'bad luck brian' meme (Relative popularity) | 12.9167 | 10.1667 | 7.08333 | 5.16667 | 6.16667 | 3.25 | 2.16667 | 1.58333 | 1.08333 | 2 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is. - Outlandish outliers: There are "outliers" in this data.

In concept, "outlier" just means "way different than the rest of your dataset." When calculating a correlation like this, they are particularly impactful because a single outlier can substantially increase your correlation.

For the purposes of this project, I counted a point as an outlier if it the residual was two standard deviations from the mean.

(This bullet point only shows up in the details page on charts that do, in fact, have outliers.)

They stand out on the scatterplot above: notice the dots that are far away from any other dots. I intentionally mishandeled outliers, which makes the correlation look extra strong.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([41,31,26,20,34,17,8,17,12,13,])

array_2 = np.array([12.9167,10.1667,7.08333,5.16667,6.16667,3.25,2.16667,1.58333,1.08333,2,])

array_1_name = "Bloomberg Money Stuff articles about insider trading"

array_2_name = "Popularity of the 'bad luck brian' meme"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only Bloomberg Money Stuff articles about insider trading

- Line chart for only Popularity of the 'bad luck brian' meme

- AI-generated correlation image

- The spurious research paper: Trading Meme: The Insider Connection Between Bloomberg's Money Stuff and 'Bad Luck Brian' Popularity

Your rating is much appreciated!

Correlation ID: 5891 · Black Variable ID: 26734 · Red Variable ID: 25105