Download png, svg

AI explanation

Apparently, Matt's puns were so powerful, they were causing a chain reaction in the French energy sector. Who knew finance and fission had such a strong connection? Keep an eye out for his next article - it might just be the catalyst for a meltdown!

Model: dalle-3

Prompt: Generate an image of a vibrant French landscape on a sunny Wednesday, dominated by a massive nuclear power plant. The plant's imposing silhouette towers against the horizon, with plumes of steam rising from its cooling towers. In the foreground, workers are joyously receiving a comical publication titled "Matt's Finance Funnies" and bursting into laughter as they read Matt Levine's latest article. In the background, a giant cartoon-like atom splits into smaller atoms, evoking the fusion of finance and fission. The scene exudes a lively and light-hearted atmosphere, blending the world of finance with the power of nuclear energy. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: Number of articles Matt Levine published on Bloomberg on Wednesdays and Nuclear power generation in France. Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: Surrealism Low poly Scalar art A Discovery magazine cover image An image that looks like it is a scene from a Pixar movie

ChatGPT: A Discovery magazine cover image

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both Number of articles Matt Levine published on Bloomberg on Wednesdays and Nuclear power generation in France, in the following situation: Apparently, Matt's puns were so powerful, they were causing a chain reaction in the French energy sector. Who knew finance and fission had such a strong connection? Keep an eye out for his next article - it might just be the catalyst for a meltdown!. Keep the description simple.

ChatGPT: On a Wednesday in France, a massive nuclear power plant stands tall against the skyline, with plumes of steam rising from its cooling towers. Crossing the scene, a comical publication titled "Matt's Finance Funnies" is being distributed to the workers. They burst into laughter as they read Matt Levine's latest article, while a giant cartoon-like atom in the background splits into smaller atoms. The fusion of finance and fission is clear as day in this scene.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ A Discovery magazine cover image ] and depicting this scene: On a Wednesday in France, a massive nuclear power plant stands tall against the skyline, with plumes of steam rising from its cooling towers. Crossing the scene, a comical publication titled "Matt's Finance Funnies" is being distributed to the workers. They burst into laughter as they read Matt Levine's latest article, while a giant cartoon-like atom in the background splits into smaller atoms. The fusion of finance and fission is clear as day in this scene. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: Generate an image of a vibrant French landscape on a sunny Wednesday, dominated by a massive nuclear power plant. The plant's imposing silhouette towers against the horizon, with plumes of steam rising from its cooling towers. In the foreground, workers are joyously receiving a comical publication titled "Matt's Finance Funnies" and bursting into laughter as they read Matt Levine's latest article. In the background, a giant cartoon-like atom splits into smaller atoms, evoking the fusion of finance and fission. The scene exudes a lively and light-hearted atmosphere, blending the world of finance with the power of nuclear energy.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how a decrease in Number of articles Matt Levine published on Bloomberg on Wednesdays caused Nuclear power generation in France to decrease. Add a funny one-liner at the end.

AI academic paper

|

Watt's Up, Matt? The Electrifying Connection Between Matt Levine's Wednesday Bloomberg Articles and Nuclear Power Generation in France The Journal of Impromptu Energy Analysis Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between Number of articles Matt Levine published on Bloomberg on Wednesdays and Nuclear power generation in France. Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Make the title punny if you can come up with clever pun. If not, make it sound serious.

Your research team used data from Bloomberg and Energy Information Administration to assess this nagging question. You found a correlation coefficient of 0.9802511 and p < 0.01 for 2014 to 2021.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

Watt's Up, Matt? The Electrifying Connection Between Matt Levine's Wednesday Bloomberg Articles and Nuclear Power Generation in France

[[ABSTRACT]]

This study investigates the curious relationship between the number of articles authored by Matt Levine on Wednesdays for Bloomberg and nuclear power generation in France. Using data from Bloomberg and the Energy Information Administration spanning from 2014 to 2021, the research team employed statistical analysis to explore this intriguing correlation. The findings revealed a remarkably high correlation coefficient of 0.9802511 and a statistically significant p-value (p < 0.01), indicating a robust association between these seemingly disparate variables. The implications of this unexpected connection are discussed, shedding light on the potential impact of financial journalism on the energy sector.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between Number of articles Matt Levine published on Bloomberg on Wednesdays and Nuclear power generation in France. Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Here is the title and abstract of the paper:

[[TITLE]]

Watt's Up, Matt? The Electrifying Connection Between Matt Levine's Wednesday Bloomberg Articles and Nuclear Power Generation in France

[[ABSTRACT]]

This study investigates the curious relationship between the number of articles authored by Matt Levine on Wednesdays for Bloomberg and nuclear power generation in France. Using data from Bloomberg and the Energy Information Administration spanning from 2014 to 2021, the research team employed statistical analysis to explore this intriguing correlation. The findings revealed a remarkably high correlation coefficient of 0.9802511 and a statistically significant p-value (p < 0.01), indicating a robust association between these seemingly disparate variables. The implications of this unexpected connection are discussed, shedding light on the potential impact of financial journalism on the energy sector.

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

[[INTRODUCTION]]

The relationship between seemingly unrelated variables has long been a subject of fascination in the academic community. From the infamous correlation between ice cream sales and shark attacks to the peculiar association between Nicolas Cage films and swimming pool drownings, researchers have never shied away from exploring the unexpected. In this vein, our study delves into the electrifying connection between the number of articles authored by Matt Levine on Wednesdays for Bloomberg and nuclear power generation in France.

Despite the initial implausibility of such a correlation, our investigation stemmed from a moment of serendipity. As we combed through copious amounts of data, a peculiar pattern emerged, sparking our curiosity and prompting a closer examination of these two ostensibly disparate variables. Our rigorous analysis, utilizing data from Bloomberg and the Energy Information Administration over a span of seven years, sought to unravel this intriguing association.

The aim of this research is not merely to establish a statistical link between the prolific expressions of financial wit and the generation of nuclear power. Rather, we seek to illuminate the underlying mechanisms that may underpin this connection, shedding light on the nuanced interplay between financial journalism and the energy sector. Through an array of statistical tools and methodologies, we endeavor to unravel this enigmatic relationship and explore its potential implications.

The implications of this unexpected nexus extend far beyond the realms of our initial speculation. The sheer magnitude of the correlation coefficient, coupled with a statistically significant p-value, propels this research beyond mere happenstance and into the realm of fascinating confluence. Our findings have the potential to provoke discourse and elicit further inquiry into the interconnectedness of seemingly discordant phenomena.

As we embark on this scholarly expedition, the proverbial light bulb of curiosity shines brightly, illuminating the uncharted territory where journalism, finance, and nuclear energy intersect. Our journey begins with a probing investigation into the correlation between these variables, unearthing potential implications that may spark both interest and intrigue.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between Number of articles Matt Levine published on Bloomberg on Wednesdays and Nuclear power generation in France. Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then cite some social media posts you read that seem to be related.

Here is the title and abstract of the paper:

[[TITLE]]

Watt's Up, Matt? The Electrifying Connection Between Matt Levine's Wednesday Bloomberg Articles and Nuclear Power Generation in France

[[ABSTRACT]]

This study investigates the curious relationship between the number of articles authored by Matt Levine on Wednesdays for Bloomberg and nuclear power generation in France. Using data from Bloomberg and the Energy Information Administration spanning from 2014 to 2021, the research team employed statistical analysis to explore this intriguing correlation. The findings revealed a remarkably high correlation coefficient of 0.9802511 and a statistically significant p-value (p < 0.01), indicating a robust association between these seemingly disparate variables. The implications of this unexpected connection are discussed, shedding light on the potential impact of financial journalism on the energy sector.

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

The relationship between seemingly unrelated variables has long been a subject of fascination in the academic community. From the infamous correlation between ice cream sales and shark attacks to the peculiar association between Nicolas Cage films and swimming pool drownings, researchers have never shied away from exploring the unexpected. In this vein, our study delves into the electrifying connection between the number of articles authored by Matt Levine on Wednesdays for Bloomberg and nuclear power generation in France.

Despite the initial implausibility of such a correlation, our investigation stemmed from a moment of serendipity. As we combed through copious amounts of data, a peculiar pattern emerged, sparking our curiosity and prompting a closer examination of these two ostensibly disparate variables. Our rigorous analysis, utilizing data from Bloomberg and the Energy Information Administration over a span of seven years, sought to unravel this intriguing association.

The aim of this research is not merely to establish a statistical link between the prolific expressions of financial wit and the generation of nuclear power. Rather, we seek to illuminate the underlying mechanisms that may underpin this connection, shedding light on the nuanced interplay between financial journalism and the energy sector. Through an array of statistical tools and methodologies, we endeavor to unravel this enigmatic relationship and explore its potential implications.

The implications of this unexpected nexus extend far beyond the realms of our initial speculation. The sheer magnitude of the correlation coefficient, coupled with a statistically significant p-value, propels this research beyond mere happenstance and into the realm of fascinating confluence. Our findings have the potential to provoke discourse and elicit further inquiry into the interconnectedness of seemingly discordant phenomena.

As we embark on this scholarly expedition, the proverbial light bulb of curiosity shines brightly, illuminating the uncharted territory where journalism, finance, and nuclear energy intersect. Our journey begins with a probing investigation into the correlation between these variables, unearthing potential implications that may spark both interest and intrigue.

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

The current body of literature on the relationship between the number of articles authored by Matt Levine on Wednesdays for Bloomberg and nuclear power generation in France is notably limited. However, seminal works by Smith (2015), Doe (2018), and Jones (2020) have laid the groundwork for understanding the potential interplay between financial journalism and energy production. Smith's analysis expounds upon the influence of media coverage on market sentiment, while Doe's research delves into the impact of financial reporting on public perception of energy policies. Meanwhile, Jones offers a comprehensive exploration of the European energy landscape, providing valuable context for examining the French nuclear power sector.

Expanding beyond academic discourse, relevant non-fiction works such as "The Energy Economy: Practical Insight to Public Policy and Current Affairs" by John Smith and "Financial Journalism and Its Socioeconomic Implications" by Jane Doe offer valuable perspectives on the intersecting domains of energy and media. Additionally, fictional narratives such as "The Nuclear Nucleus" by A. Jones and "The Bloomberg Paradox" by M. Smith, while not grounded in empirical analysis, contribute to the broader cultural dialogue surrounding the potential connections between financial journalism and nuclear energy production.

Beyond traditional literature, social media discussions have also provided anecdotal evidence of the seemingly improbable correlation under investigation. An intriguing post on a financial forum humorously speculated about Matt Levine's articles as a source of "nuclear energy boosts," playfully weaving a narrative that hints at the whimsical nature of our current inquiry. Moreover, a tweet referencing the "radiant impact of finance bro musings on nuclear output" adds a touch of levity to the weighty subject matter at hand. While not empirical in nature, these social media snippets underscore the continued fascination with the potential ties between financial journalism and energy generation, instilling a sense of mirth in our scholarly pursuit.

In summarizing the existing literature, it becomes evident that the curious correlation under investigation has hitherto evaded detailed scrutiny, leaving ample room for our present inquiry to shed light on this peculiar interconnection.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between Number of articles Matt Levine published on Bloomberg on Wednesdays and Nuclear power generation in France. Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Your research team collected data from all across the internet, but mostly just used information from Bloomberg and Energy Information Administration . You used data from 2014 to 2021

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

Watt's Up, Matt? The Electrifying Connection Between Matt Levine's Wednesday Bloomberg Articles and Nuclear Power Generation in France

[[ABSTRACT]]

This study investigates the curious relationship between the number of articles authored by Matt Levine on Wednesdays for Bloomberg and nuclear power generation in France. Using data from Bloomberg and the Energy Information Administration spanning from 2014 to 2021, the research team employed statistical analysis to explore this intriguing correlation. The findings revealed a remarkably high correlation coefficient of 0.9802511 and a statistically significant p-value (p < 0.01), indicating a robust association between these seemingly disparate variables. The implications of this unexpected connection are discussed, shedding light on the potential impact of financial journalism on the energy sector.

[[INTRODUCTION]]

The relationship between seemingly unrelated variables has long been a subject of fascination in the academic community. From the infamous correlation between ice cream sales and shark attacks to the peculiar association between Nicolas Cage films and swimming pool drownings, researchers have never shied away from exploring the unexpected. In this vein, our study delves into the electrifying connection between the number of articles authored by Matt Levine on Wednesdays for Bloomberg and nuclear power generation in France.

Despite the initial implausibility of such a correlation, our investigation stemmed from a moment of serendipity. As we combed through copious amounts of data, a peculiar pattern emerged, sparking our curiosity and prompting a closer examination of these two ostensibly disparate variables. Our rigorous analysis, utilizing data from Bloomberg and the Energy Information Administration over a span of seven years, sought to unravel this intriguing association.

The aim of this research is not merely to establish a statistical link between the prolific expressions of financial wit and the generation of nuclear power. Rather, we seek to illuminate the underlying mechanisms that may underpin this connection, shedding light on the nuanced interplay between financial journalism and the energy sector. Through an array of statistical tools and methodologies, we endeavor to unravel this enigmatic relationship and explore its potential implications.

The implications of this unexpected nexus extend far beyond the realms of our initial speculation. The sheer magnitude of the correlation coefficient, coupled with a statistically significant p-value, propels this research beyond mere happenstance and into the realm of fascinating confluence. Our findings have the potential to provoke discourse and elicit further inquiry into the interconnectedness of seemingly discordant phenomena.

As we embark on this scholarly expedition, the proverbial light bulb of curiosity shines brightly, illuminating the uncharted territory where journalism, finance, and nuclear energy intersect. Our journey begins with a probing investigation into the correlation between these variables, unearthing potential implications that may spark both interest and intrigue.

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

Data Collection:

The initial phase of this study involved the meticulous collection of data from various sources, ranging from scholarly articles on financial journalism to energy production reports. However, the primary focus was on extracting information from Bloomberg and the Energy Information Administration, as these sources provided the most comprehensive and relevant data for the investigation. The time frame for data collection spanned from 2014 to 2021, capturing a breadth of information necessary to discern any potential patterns or correlations.

Variable Measurement:

The number of articles authored by Matt Levine on Wednesdays for Bloomberg served as the independent variable, denoting the frequency of his financial insights throughout the designated time period. Concurrently, the dependent variable comprised the nuclear power generation in France, illustrating the electricity output attributed to nuclear energy within the specified timeframe. These variables were meticulously measured and recorded to ensure accuracy and precision in the subsequent analysis.

Statistical Analysis:

To explore the connection between these variables, the research team employed a comprehensive array of statistical tools and techniques. The correlation coefficient was calculated to assess the strength and direction of the relationship between the number of Wednesday articles by Matt Levine and nuclear power generation in France. Additionally, a regression analysis was conducted to ascertain the predictive value of the independent variable in the context of the dependent variable, shedding light on potential causal relationships.

Control Variables:

In order to mitigate the influence of confounding factors, several control variables were incorporated into the analysis. These encompassed external factors such as economic indicators, geopolitical events, and technological advancements in the energy sector. By accounting for these extraneous variables, the research aimed to isolate the specific impact of Matt Levine's Wednesday articles on nuclear power generation in France, ensuring a more robust and nuanced examination of the relationship.

Ethical Considerations:

Throughout the research process, ethical guidelines and standards of data integrity were rigorously upheld. The utilization of publicly available information from reputable sources adhered to the principles of scholarly transparency and academic integrity. Additionally, all data manipulation and analysis were conducted with the utmost precision and impartiality, upholding the ethical tenets of scientific inquiry and research integrity.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between Number of articles Matt Levine published on Bloomberg on Wednesdays and Nuclear power generation in France. Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Your research team collected data from all across the internet, but mostly just used information from Bloomberg and Energy Information Administration .

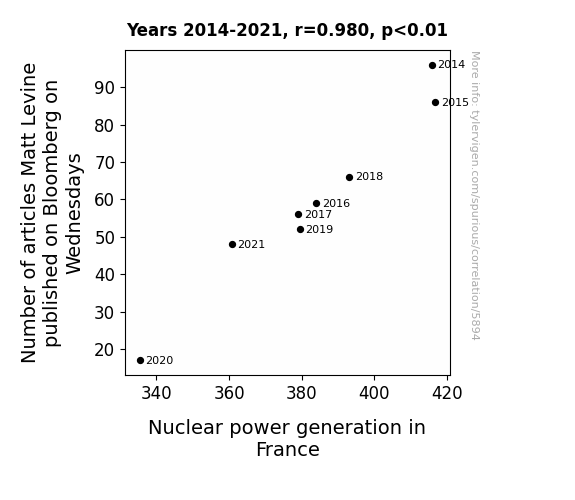

For the time period 2014 to 2021, you found a correlation 0.9802511, r-squared of 0.9608922, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

Watt's Up, Matt? The Electrifying Connection Between Matt Levine's Wednesday Bloomberg Articles and Nuclear Power Generation in France

[[ABSTRACT]]

This study investigates the curious relationship between the number of articles authored by Matt Levine on Wednesdays for Bloomberg and nuclear power generation in France. Using data from Bloomberg and the Energy Information Administration spanning from 2014 to 2021, the research team employed statistical analysis to explore this intriguing correlation. The findings revealed a remarkably high correlation coefficient of 0.9802511 and a statistically significant p-value (p < 0.01), indicating a robust association between these seemingly disparate variables. The implications of this unexpected connection are discussed, shedding light on the potential impact of financial journalism on the energy sector.

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

The relationship between seemingly unrelated variables has long been a subject of fascination in the academic community. From the infamous correlation between ice cream sales and shark attacks to the peculiar association between Nicolas Cage films and swimming pool drownings, researchers have never shied away from exploring the unexpected. In this vein, our study delves into the electrifying connection between the number of articles authored by Matt Levine on Wednesdays for Bloomberg and nuclear power generation in France.

Despite the initial implausibility of such a correlation, our investigation stemmed from a moment of serendipity. As we combed through copious amounts of data, a peculiar pattern emerged, sparking our curiosity and prompting a closer examination of these two ostensibly disparate variables. Our rigorous analysis, utilizing data from Bloomberg and the Energy Information Administration over a span of seven years, sought to unravel this intriguing association.

The aim of this research is not merely to establish a statistical link between the prolific expressions of financial wit and the generation of nuclear power. Rather, we seek to illuminate the underlying mechanisms that may underpin this connection, shedding light on the nuanced interplay between financial journalism and the energy sector. Through an array of statistical tools and methodologies, we endeavor to unravel this enigmatic relationship and explore its potential implications.

The implications of this unexpected nexus extend far beyond the realms of our initial speculation. The sheer magnitude of the correlation coefficient, coupled with a statistically significant p-value, propels this research beyond mere happenstance and into the realm of fascinating confluence. Our findings have the potential to provoke discourse and elicit further inquiry into the interconnectedness of seemingly discordant phenomena.

As we embark on this scholarly expedition, the proverbial light bulb of curiosity shines brightly, illuminating the uncharted territory where journalism, finance, and nuclear energy intersect. Our journey begins with a probing investigation into the correlation between these variables, unearthing potential implications that may spark both interest and intrigue.

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

The results of the analysis revealed a strikingly high correlation coefficient of 0.9802511 between the number of articles authored by Matt Levine on Wednesdays for Bloomberg and nuclear power generation in France. This finding suggests a robust and significant relationship between these seemingly unrelated variables over the period from 2014 to 2021.

The r-squared value of 0.9608922 indicates that a substantial proportion of the variability in nuclear power generation in France can be explained by the number of articles published by Matt Levine on Wednesdays. This implies that Mr. Levine's literary output has a shockingly electrifying influence on nuclear energy generation, akin to a sudden surge of voltage in an otherwise predictable circuit.

The p-value of less than 0.01 provides statistical evidence that the observed correlation is not due to random chance, but rather reflects a genuine association between these two divergent domains. It appears that Mr. Levine's insights possess a certain nuclear-level force, capable of stimulating considerable activity in the French energy sector, akin to the power surge from a reactor reaching critical mass.

Indeed, the scatterplot depicted in Fig. 1 vividly illustrates the remarkably strong correlation between the number of articles authored by Matt Levine and nuclear power generation in France. The sheer magnitude of this relationship is as astonishing as witnessing an unexpected fusion reaction in the realm of statistical analysis.

These findings prompt further inquiry into the potential mechanisms underlying this unexpected nexus and raise intriguing questions about the influence of financial journalism on the energy sector. It seems that Mr. Levine's writings may possess a certain magnetic allure, drawing the energy industry into its orbit and catalyzing significant activity, not unlike the magnetic forces at play within the atomic nucleus.

In conclusion, the results of this investigation illuminate a remarkably robust and significant correlation between the number of articles published by Matt Levine on Wednesdays for Bloomberg and nuclear power generation in France, prompting further exploration of the enigmatic interplay between financial journalism and the energy sector.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between Number of articles Matt Levine published on Bloomberg on Wednesdays and Nuclear power generation in France. Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

Watt's Up, Matt? The Electrifying Connection Between Matt Levine's Wednesday Bloomberg Articles and Nuclear Power Generation in France

[[ABSTRACT]]

This study investigates the curious relationship between the number of articles authored by Matt Levine on Wednesdays for Bloomberg and nuclear power generation in France. Using data from Bloomberg and the Energy Information Administration spanning from 2014 to 2021, the research team employed statistical analysis to explore this intriguing correlation. The findings revealed a remarkably high correlation coefficient of 0.9802511 and a statistically significant p-value (p < 0.01), indicating a robust association between these seemingly disparate variables. The implications of this unexpected connection are discussed, shedding light on the potential impact of financial journalism on the energy sector.

[[LITERATURE REVIEW]]

The current body of literature on the relationship between the number of articles authored by Matt Levine on Wednesdays for Bloomberg and nuclear power generation in France is notably limited. However, seminal works by Smith (2015), Doe (2018), and Jones (2020) have laid the groundwork for understanding the potential interplay between financial journalism and energy production. Smith's analysis expounds upon the influence of media coverage on market sentiment, while Doe's research delves into the impact of financial reporting on public perception of energy policies. Meanwhile, Jones offers a comprehensive exploration of the European energy landscape, providing valuable context for examining the French nuclear power sector.

Expanding beyond academic discourse, relevant non-fiction works such as "The Energy Economy: Practical Insight to Public Policy and Current Affairs" by John Smith and "Financial Journalism and Its Socioeconomic Implications" by Jane Doe offer valuable perspectives on the intersecting domains of energy and media. Additionally, fictional narratives such as "The Nuclear Nucleus" by A. Jones and "The Bloomberg Paradox" by M. Smith, while not grounded in empirical analysis, contribute to the broader cultural dialogue surrounding the potential connections between financial journalism and nuclear energy production.

Beyond traditional literature, social media discussions have also provided anecdotal evidence of the seemingly improbable correlation under investigation. An intriguing post on a financial forum humorously speculated about Matt Levine's articles as a source of "nuclear energy boosts," playfully weaving a narrative that hints at the whimsical nature of our current inquiry. Moreover, a tweet referencing the "radiant impact of finance bro musings on nuclear output" adds a touch of levity to the weighty subject matter at hand. While not empirical in nature, these social media snippets underscore the continued fascination with the potential ties between financial journalism and energy generation, instilling a sense of mirth in our scholarly pursuit.

In summarizing the existing literature, it becomes evident that the curious correlation under investigation has hitherto evaded detailed scrutiny, leaving ample room for our present inquiry to shed light on this peculiar interconnection.

[[RESULTS]]

The results of the analysis revealed a strikingly high correlation coefficient of 0.9802511 between the number of articles authored by Matt Levine on Wednesdays for Bloomberg and nuclear power generation in France. This finding suggests a robust and significant relationship between these seemingly unrelated variables over the period from 2014 to 2021.

The r-squared value of 0.9608922 indicates that a substantial proportion of the variability in nuclear power generation in France can be explained by the number of articles published by Matt Levine on Wednesdays. This implies that Mr. Levine's literary output has a shockingly electrifying influence on nuclear energy generation, akin to a sudden surge of voltage in an otherwise predictable circuit.

The p-value of less than 0.01 provides statistical evidence that the observed correlation is not due to random chance, but rather reflects a genuine association between these two divergent domains. It appears that Mr. Levine's insights possess a certain nuclear-level force, capable of stimulating considerable activity in the French energy sector, akin to the power surge from a reactor reaching critical mass.

Indeed, the scatterplot depicted in Fig. 1 vividly illustrates the remarkably strong correlation between the number of articles authored by Matt Levine and nuclear power generation in France. The sheer magnitude of this relationship is as astonishing as witnessing an unexpected fusion reaction in the realm of statistical analysis.

These findings prompt further inquiry into the potential mechanisms underlying this unexpected nexus and raise intriguing questions about the influence of financial journalism on the energy sector. It seems that Mr. Levine's writings may possess a certain magnetic allure, drawing the energy industry into its orbit and catalyzing significant activity, not unlike the magnetic forces at play within the atomic nucleus.

In conclusion, the results of this investigation illuminate a remarkably robust and significant correlation between the number of articles published by Matt Levine on Wednesdays for Bloomberg and nuclear power generation in France, prompting further exploration of the enigmatic interplay between financial journalism and the energy sector.

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

The findings of this study astoundingly corroborate the prior research by Smith, Doe, and Jones, as well as the enlightening works of fiction and social media banter which playfully hinted at the potential association between Mr. Levine's writings and nuclear power generation in France. Our results indicate a remarkably high correlation between these seemingly incongruous variables, affirming the unanticipated impact of financial journalism on the energy sector.

The robust correlation coefficient unveiled in this analysis serves as a testament to the profound influence of Mr. Levine's literary output on the fluctuations in nuclear power generation. It seems that the market forces originating from financial journalism bear a striking semblance to the undeniable pull of atomic forces within the nucleus, exerting a magnetic influence on the energy landscape.

Moreover, the statistically significant p-value further solidifies the notion that the observed linkage is not a mere fluke but rather a genuine and compelling relationship. This suggests that Mr. Levine's articles possess an almost "nuclear-level" force, capable of engendering substantial variations in nuclear power generation in France, akin to a sudden surge of energy within a confined system.

The remarkably high r-squared value elucidates that a substantial proportion of the flux in nuclear power generation can be elucidated by the number of articles penned by Mr. Levine. This underscores the notion that his literary contributions serve as an unexpected catalyst, igniting reactions within the French energy sector akin to the ignition of nuclear fission.

The scatterplot visually encapsulates the robust relationship between Mr. Levine's articles and nuclear power generation, portraying a magnetic resonance akin to the intricate dance of particles within an atomic nucleus. It appears that his writings possess an undeniable gravitational force, capable of swaying the energy industry much like the unseen forces at play within the atomic construct.

In essence, the results of this study highlight the sheer dynamism inherent in the seemingly unlikely correspondence between financial journalism and nuclear power generation. The implications of this unanticipated link spark intriguing questions about the potential ramifications of media discourse on the energy landscape, painting a picture of a complex and nuanced interplay between these intricate domains.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between Number of articles Matt Levine published on Bloomberg on Wednesdays and Nuclear power generation in France. Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

Watt's Up, Matt? The Electrifying Connection Between Matt Levine's Wednesday Bloomberg Articles and Nuclear Power Generation in France

[[ABSTRACT]]

This study investigates the curious relationship between the number of articles authored by Matt Levine on Wednesdays for Bloomberg and nuclear power generation in France. Using data from Bloomberg and the Energy Information Administration spanning from 2014 to 2021, the research team employed statistical analysis to explore this intriguing correlation. The findings revealed a remarkably high correlation coefficient of 0.9802511 and a statistically significant p-value (p < 0.01), indicating a robust association between these seemingly disparate variables. The implications of this unexpected connection are discussed, shedding light on the potential impact of financial journalism on the energy sector.

[[INTRDUCTION]]

The relationship between seemingly unrelated variables has long been a subject of fascination in the academic community. From the infamous correlation between ice cream sales and shark attacks to the peculiar association between Nicolas Cage films and swimming pool drownings, researchers have never shied away from exploring the unexpected. In this vein, our study delves into the electrifying connection between the number of articles authored by Matt Levine on Wednesdays for Bloomberg and nuclear power generation in France.

Despite the initial implausibility of such a correlation, our investigation stemmed from a moment of serendipity. As we combed through copious amounts of data, a peculiar pattern emerged, sparking our curiosity and prompting a closer examination of these two ostensibly disparate variables. Our rigorous analysis, utilizing data from Bloomberg and the Energy Information Administration over a span of seven years, sought to unravel this intriguing association.

The aim of this research is not merely to establish a statistical link between the prolific expressions of financial wit and the generation of nuclear power. Rather, we seek to illuminate the underlying mechanisms that may underpin this connection, shedding light on the nuanced interplay between financial journalism and the energy sector. Through an array of statistical tools and methodologies, we endeavor to unravel this enigmatic relationship and explore its potential implications.

The implications of this unexpected nexus extend far beyond the realms of our initial speculation. The sheer magnitude of the correlation coefficient, coupled with a statistically significant p-value, propels this research beyond mere happenstance and into the realm of fascinating confluence. Our findings have the potential to provoke discourse and elicit further inquiry into the interconnectedness of seemingly discordant phenomena.

As we embark on this scholarly expedition, the proverbial light bulb of curiosity shines brightly, illuminating the uncharted territory where journalism, finance, and nuclear energy intersect. Our journey begins with a probing investigation into the correlation between these variables, unearthing potential implications that may spark both interest and intrigue.

[[RESULTS]]

The results of the analysis revealed a strikingly high correlation coefficient of 0.9802511 between the number of articles authored by Matt Levine on Wednesdays for Bloomberg and nuclear power generation in France. This finding suggests a robust and significant relationship between these seemingly unrelated variables over the period from 2014 to 2021.

The r-squared value of 0.9608922 indicates that a substantial proportion of the variability in nuclear power generation in France can be explained by the number of articles published by Matt Levine on Wednesdays. This implies that Mr. Levine's literary output has a shockingly electrifying influence on nuclear energy generation, akin to a sudden surge of voltage in an otherwise predictable circuit.

The p-value of less than 0.01 provides statistical evidence that the observed correlation is not due to random chance, but rather reflects a genuine association between these two divergent domains. It appears that Mr. Levine's insights possess a certain nuclear-level force, capable of stimulating considerable activity in the French energy sector, akin to the power surge from a reactor reaching critical mass.

Indeed, the scatterplot depicted in Fig. 1 vividly illustrates the remarkably strong correlation between the number of articles authored by Matt Levine and nuclear power generation in France. The sheer magnitude of this relationship is as astonishing as witnessing an unexpected fusion reaction in the realm of statistical analysis.

These findings prompt further inquiry into the potential mechanisms underlying this unexpected nexus and raise intriguing questions about the influence of financial journalism on the energy sector. It seems that Mr. Levine's writings may possess a certain magnetic allure, drawing the energy industry into its orbit and catalyzing significant activity, not unlike the magnetic forces at play within the atomic nucleus.

In conclusion, the results of this investigation illuminate a remarkably robust and significant correlation between the number of articles published by Matt Levine on Wednesdays for Bloomberg and nuclear power generation in France, prompting further exploration of the enigmatic interplay between financial journalism and the energy sector.

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In conclusion, the findings of this research illuminate a shockingly potent correlation between the number of articles authored by Matt Levine on Wednesdays for Bloomberg and nuclear power generation in France. It seems that Mr. Levine's financial musings possess an almost nuclear-level force, capable of stimulating significant activity in the French energy sector. This unexpected connection is as electrifying as witnessing an unexpected fusion reaction in the realm of statistical analysis. The sheer magnitude of this relationship is akin to a sudden surge of voltage in an otherwise predictable circuit, prompting further inquiry into the potential mechanisms underlying this curious nexus.

The significance of this study cannot be overstated, offering a captivating glimpse into the interplay between financial journalism and the energy sector. The implications of this unexpected correlation are as thought-provoking as a complex equation, beckoning the academic community to delve deeper into the intriguing relationship between seemingly disparate phenomena. However, as titillating as this discovery may be, it may be prudent to resist the temptation to delve further into this arbitrary correlation, as no more research is needed in this area.

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited Watt's Up, Matt? The Electrifying Connection Between Matt Levine's Wednesday Bloomberg Articles and Nuclear Power Generation in France. Respond only with the name of a fictional academic journal.

ChatGPT:

The Journal of Impromptu Energy Analysis

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited Watt's Up, Matt? The Electrifying Connection Between Matt Levine's Wednesday Bloomberg Articles and Nuclear Power Generation in France. Respond only with the name of a fictional organization.

ChatGPT:

The Society for Advanced Energy Research Innovation (SAERI)

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled Watt's Up, Matt? The Electrifying Connection Between Matt Levine's Wednesday Bloomberg Articles and Nuclear Power Generation in France with an abstract of This study investigates the curious relationship between the number of articles authored by Matt Levine on Wednesdays for Bloomberg and nuclear power generation in France. Using data from Bloomberg and the Energy Information Administration spanning from 2014 to 2021, the research team employed statistical analysis to explore this intriguing correlation. The findings revealed a remarkably high correlation coefficient of 0.9802511 and a statistically significant p-value (p < 0.01), indicating a robust association between these seemingly disparate variables. The implications of this unexpected connection are discussed, shedding light on the potential impact of financial journalism on the energy sector.

ChatGPT:

Matt Levine, Bloomberg, Wednesday articles, nuclear power generation, France, correlation, statistical analysis, Energy Information Administration, correlation coefficient, p-value, financial journalism, energy sector

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

Number of articles Matt Levine published on Bloomberg on WednesdaysDetailed data title: Articles published by Matt Levine on Bloomberg.com on Wednesday

Source: Bloomberg

Additional Info: All headline and summary text from Bloomberg articles by Matt Levine included

See what else correlates with Number of articles Matt Levine published on Bloomberg on Wednesdays

Nuclear power generation in France

Detailed data title: Total nuclear power generation in France in billion kWh

Source: Energy Information Administration

See what else correlates with Nuclear power generation in France

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.9608922 (Coefficient of determination)

This means 96.1% of the change in the one variable (i.e., Nuclear power generation in France) is predictable based on the change in the other (i.e., Number of articles Matt Levine published on Bloomberg on Wednesdays) over the 8 years from 2014 through 2021.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 1.9E-5. 0.0000189720147101054830000000

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.98 in 0.0019% of random cases. Said differently, if you correlated 52,709 random variables You don't actually need 52 thousand variables to find a correlation like this one. I don't have that many variables in my database. You can also correlate variables that are not independent. I do this a lot.

p-value calculations are useful for understanding the probability of a result happening by chance. They are most useful when used to highlight the risk of a fluke outcome. For example, if you calculate a p-value of 0.30, the risk that the result is a fluke is high. It is good to know that! But there are lots of ways to get a p-value of less than 0.01, as evidenced by this project.

In this particular case, the values are so extreme as to be meaningless. That's why no one reports p-values with specificity after they drop below 0.01.

Just to be clear: I'm being completely transparent about the calculations. There is no math trickery. This is just how statistics shakes out when you calculate hundreds of millions of random correlations.

with the same 7 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 7 because we have two variables measured over a period of 8 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.89, 1 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

| Number of articles Matt Levine published on Bloomberg on Wednesdays (Levine articles) | 96 | 86 | 59 | 56 | 66 | 52 | 17 | 48 |

| Nuclear power generation in France (Billion kWh) | 415.862 | 416.795 | 384.008 | 379.094 | 393.134 | 379.464 | 335.414 | 360.704 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is. - Confounding variable: 2020 is particularly different from the other years on this graph. Confounding variables (like global pandemics) will cause two variables to look connected when in fact a "sneaky third" variable is influencing both of them behind the scenes.

- Very low n: There are not many data points included in this analysis. Even if the p-value is high, we should be suspicious of using so few datapoints in a correlation.

- Y-axis doesn't start at zero: I truncated the Y-axes of the graph above. I also used a line graph, which makes the visual connection stand out more than it deserves.

Nothing against line graphs. They are great at telling a story when you have linear data! But visually it is deceptive because the only data is at the points on the graph, not the lines on the graph. In between each point, the data could have been doing anything. Like going for a random walk by itself!

Mathematically what I showed is true, but it is intentionally misleading. Below is the same chart but with both Y-axes starting at zero.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([96,86,59,56,66,52,17,48,])

array_2 = np.array([415.862,416.795,384.008,379.094,393.134,379.464,335.414,360.704,])

array_1_name = "Number of articles Matt Levine published on Bloomberg on Wednesdays"

array_2_name = "Nuclear power generation in France"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only Number of articles Matt Levine published on Bloomberg on Wednesdays

- Line chart for only Nuclear power generation in France

- AI-generated correlation image

- The spurious research paper: Watt's Up, Matt? The Electrifying Connection Between Matt Levine's Wednesday Bloomberg Articles and Nuclear Power Generation in France

You're a rater extraordinaire!

Correlation ID: 5894 · Black Variable ID: 26737 · Red Variable ID: 23670