Download png, svg

AI explanation

The gravitational pull created a ripple effect, leading to a yeast demand for space bread. This created a dough dilemma, kneading to lower profits for Baker Hughes Company. It really threw a wrench in their planetary pastry production!

Model: dalle-3

Prompt: Generate an image of a night sky scene from Skyrim, with Uranus and Saturn drawing closer in the sky. Below them, a stock market board displays the stock ticker for Baker Hughes Company (BKR), with a sharp decline being observed on the screen. The oil pumps and rigs show signs of disruption and the entire scene depicts a "crude awakening" as the gravitational disturbance affects the oil supply chain and the stock market. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: The distance between Uranus and Saturn and Baker Hughes Company's stock price (BKR). Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: Futuristic Cute cartoon Whimsical illustration A scene from Skyrim Brutalism

ChatGPT: A scene from Skyrim

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both The distance between Uranus and Saturn and Baker Hughes Company's stock price (BKR), in the following situation: The decrease in distance between Uranus and Saturn caused Baker Hughes Company's stock price to decrease because the gravitational pull disrupted the oil supply chain, causing a major "crude awakening" in the market.. Keep the description simple.

ChatGPT: In the night sky, Uranus and Saturn draw closer, their orbits bringing them within mere reachable distance of each other. Below, the stock ticker for Baker Hughes Company (BKR) flashes on a screen, showing a sharp decline as the gravitational disturbance disrupts the oil supply chain. Oil pumps judder to a halt, creating a ripple effect in the stock market – a "crude awakening" indeed.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ A scene from Skyrim ] and depicting this scene: In the night sky, Uranus and Saturn draw closer, their orbits bringing them within mere reachable distance of each other. Below, the stock ticker for Baker Hughes Company (BKR) flashes on a screen, showing a sharp decline as the gravitational disturbance disrupts the oil supply chain. Oil pumps judder to a halt, creating a ripple effect in the stock market – a "crude awakening" indeed. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: Generate an image of a night sky scene from Skyrim, with Uranus and Saturn drawing closer in the sky. Below them, a stock market board displays the stock ticker for Baker Hughes Company (BKR), with a sharp decline being observed on the screen. The oil pumps and rigs show signs of disruption and the entire scene depicts a "crude awakening" as the gravitational disturbance affects the oil supply chain and the stock market.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how a decrease in The distance between Uranus and Saturn caused Baker Hughes Company's stock price (BKR) to decrease. Include one good pun.

AI academic paper

|

The Planetary Peculiarity: Exploring the Orbital Oddity of Uranus and Saturn and its Impact on Baker Hughes Company's (BKR) Stock Price The Journal of Celestial Economics Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between The distance between Uranus and Saturn and Baker Hughes Company's stock price (BKR). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Include a pun in the title.

Your research team used data from Caclculated using Astropy and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.6592864 and p < 0.01 for 2002 to 2023.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

The Planetary Peculiarity: Exploring the Orbital Oddity of Uranus and Saturn and its Impact on Baker Hughes Company's (BKR) Stock Price

[[ABSTRACT]]

The elusive relationship between celestial bodies and financial markets has long fascinated scholars and puzzled investors. In this study, we leverage data from Astropy and LSEG Analytics to investigate the seemingly inexplicable connection between the distance separating Uranus and Saturn and the stock price of Baker Hughes Company (BKR) from 2002 to 2023. Our findings reveal a correlation coefficient of 0.6592864 and a statistically significant p-value of less than 0.01, shedding light on this cosmic conundrum. While the astronomical community may dismiss this correlation as celestial serendipity, our results suggest that there may be more than meets the eye in the volatile interplay between the cosmos and capital markets. This study not only contributes to the burgeoning literature at the intersection of astrophysics and finance but also serves as a celestial reminder of the cosmic whimsy shaping our earthly endeavors.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between The distance between Uranus and Saturn and Baker Hughes Company's stock price (BKR). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Here is the title and abstract of the paper:

[[TITLE]]

The Planetary Peculiarity: Exploring the Orbital Oddity of Uranus and Saturn and its Impact on Baker Hughes Company's (BKR) Stock Price

[[ABSTRACT]]

The elusive relationship between celestial bodies and financial markets has long fascinated scholars and puzzled investors. In this study, we leverage data from Astropy and LSEG Analytics to investigate the seemingly inexplicable connection between the distance separating Uranus and Saturn and the stock price of Baker Hughes Company (BKR) from 2002 to 2023. Our findings reveal a correlation coefficient of 0.6592864 and a statistically significant p-value of less than 0.01, shedding light on this cosmic conundrum. While the astronomical community may dismiss this correlation as celestial serendipity, our results suggest that there may be more than meets the eye in the volatile interplay between the cosmos and capital markets. This study not only contributes to the burgeoning literature at the intersection of astrophysics and finance but also serves as a celestial reminder of the cosmic whimsy shaping our earthly endeavors.

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

Introduction

The relationship between celestial phenomena and earthly affairs has long captivated the human imagination. While scientists and investors may seem worlds apart in their pursuits, the curious intertwining of Uranus and Saturn with the stock price of Baker Hughes Company (BKR) beckons us to explore the cosmic dance of celestial bodies and financial markets. As we embark on this astronomical odyssey, we are reminded that the universe, much like statistical analysis, is filled with unexpected correlations and enigmatic connections waiting to be unveiled.

Throughout history, celestial events have been grist for the mill of superstition and speculation. From alchemists pondering the influence of the moon on financial markets to astrologers divining the fate of businesses based on planetary positions, the allure of celestial influences on the earthly realm continues to persist. Yet, in our modern era of rigorous empirical inquiry, we find ourselves compelled to apply the tools of statistical analysis and empirical research to investigate whether there is more than mere cosmic coincidence at play.

The present study delves into the distant yet entwined orbits of Uranus and Saturn, seeking to unravel their potential impact on the stock price of Baker Hughes Company (BKR). In doing so, we honor the tradition of scientific curiosity while also embracing a touch of cosmic whimsy, for in the vast expanse of the universe, there may be room for statistical surprise and astronomical absurdity.

As we journey into the celestial tapestry, we are guided by the twin beacons of empirical evidence and statistical rigor, navigating through the astral currents with the compass of quantitative analysis. We seek not only to answer the perplexing question of whether there exists a tangible relationship between astronomical distances and stock prices but also to remind ourselves that the universe, like a statistical model, holds many surprises for those who dare to explore its mysteries.

In the pages that follow, we will trace the arc of astronomical inquiry and financial exploration, joining the seemingly disparate realms of astrophysics and finance in a celestial minuet of data analysis and statistical inquiry. As we venture forth to uncover the cosmic secrets that may yet influence earthly economies, we do so with a healthy dose of scientific skepticism and a sprinkling of cosmic humor, for in the pursuit of knowledge, there is always room for a bit of celestial levity.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between The distance between Uranus and Saturn and Baker Hughes Company's stock price (BKR). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then devolve ever further, and mention something completely ridiculous, like you conducted literature review by reading the backs of shampoo bottles.

Here is the title and abstract of the paper:

[[TITLE]]

The Planetary Peculiarity: Exploring the Orbital Oddity of Uranus and Saturn and its Impact on Baker Hughes Company's (BKR) Stock Price

[[ABSTRACT]]

The elusive relationship between celestial bodies and financial markets has long fascinated scholars and puzzled investors. In this study, we leverage data from Astropy and LSEG Analytics to investigate the seemingly inexplicable connection between the distance separating Uranus and Saturn and the stock price of Baker Hughes Company (BKR) from 2002 to 2023. Our findings reveal a correlation coefficient of 0.6592864 and a statistically significant p-value of less than 0.01, shedding light on this cosmic conundrum. While the astronomical community may dismiss this correlation as celestial serendipity, our results suggest that there may be more than meets the eye in the volatile interplay between the cosmos and capital markets. This study not only contributes to the burgeoning literature at the intersection of astrophysics and finance but also serves as a celestial reminder of the cosmic whimsy shaping our earthly endeavors.

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

Introduction

The relationship between celestial phenomena and earthly affairs has long captivated the human imagination. While scientists and investors may seem worlds apart in their pursuits, the curious intertwining of Uranus and Saturn with the stock price of Baker Hughes Company (BKR) beckons us to explore the cosmic dance of celestial bodies and financial markets. As we embark on this astronomical odyssey, we are reminded that the universe, much like statistical analysis, is filled with unexpected correlations and enigmatic connections waiting to be unveiled.

Throughout history, celestial events have been grist for the mill of superstition and speculation. From alchemists pondering the influence of the moon on financial markets to astrologers divining the fate of businesses based on planetary positions, the allure of celestial influences on the earthly realm continues to persist. Yet, in our modern era of rigorous empirical inquiry, we find ourselves compelled to apply the tools of statistical analysis and empirical research to investigate whether there is more than mere cosmic coincidence at play.

The present study delves into the distant yet entwined orbits of Uranus and Saturn, seeking to unravel their potential impact on the stock price of Baker Hughes Company (BKR). In doing so, we honor the tradition of scientific curiosity while also embracing a touch of cosmic whimsy, for in the vast expanse of the universe, there may be room for statistical surprise and astronomical absurdity.

As we journey into the celestial tapestry, we are guided by the twin beacons of empirical evidence and statistical rigor, navigating through the astral currents with the compass of quantitative analysis. We seek not only to answer the perplexing question of whether there exists a tangible relationship between astronomical distances and stock prices but also to remind ourselves that the universe, like a statistical model, holds many surprises for those who dare to explore its mysteries.

In the pages that follow, we will trace the arc of astronomical inquiry and financial exploration, joining the seemingly disparate realms of astrophysics and finance in a celestial minuet of data analysis and statistical inquiry. As we venture forth to uncover the cosmic secrets that may yet influence earthly economies, we do so with a healthy dose of scientific skepticism and a sprinkling of cosmic humor, for in the pursuit of knowledge, there is always room for a bit of celestial levity.

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

The connection between celestial phenomena and financial markets has garnered interest from both scholars and investors alike. As we delve into the literature, we encounter diverse perspectives on the potential interplay between the distance separating Uranus and Saturn and the stock price of Baker Hughes Company (BKR).

Smith et al. (2015) conducted a comprehensive study examining planetary positions and stock market trends, albeit focusing on more traditional astronomical bodies. Their findings suggested that the alignment of Jupiter and Mars may influence market volatility, leading to what they termed "astro-financial fluctuations." However, the dearth of research specifically on the peculiar pairing of Uranus and Saturn leaves much to be explored in this unique cosmic dance and its potential impact on financial markets.

In "The Astronomical Almanac" by John Wiley & Sons, the authors provide a comprehensive overview of the celestial movements of the outer planets, delving into the gravitational tugs and cosmic complexities of Uranus and Saturn. While their work primarily caters to astronomical enthusiasts, the intricate details of planetary orbits offer a tantalizing backdrop for our investigation into the possible link with BKR's stock price.

Turning to fiction, Arthur C. Clarke's "2001: A Space Odyssey" and Isaac Asimov's "Foundation" series transport readers to distant galaxies, where cosmic forces shape the destiny of civilizations. While these literary works may not offer direct empirical evidence, they serve as a reminder of the enduring allure of cosmic mysteries and their potential influence on human endeavors.

Venturing further afield, an exhaustive review of unconventional sources, including the back labels of shampoo bottles, surprisingly surfaced recurring mentions of planetary alignments and their purported effects on personal and financial well-being. While these non-traditional outlets may seem whimsical, they emphasize the pervasiveness of celestial conjectures in unexpected corners of everyday life.

In the pursuit of interdisciplinary insights, this literature review underscores the need for empirical inquiry and statistical scrutiny in unraveling the enigmatic relationship between the orbits of Uranus and Saturn and BKR's stock price. As we navigate through the celestial expanse and financial landscapes, the cosmic ballet between Uranus and Saturn beckons us to peer beyond the mundane and embrace the extraordinary in our quest for understanding.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between The distance between Uranus and Saturn and Baker Hughes Company's stock price (BKR). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Your research team collected data from all across the internet, but mostly just used information from Caclculated using Astropy and LSEG Analytics (Refinitiv) . You used data from 2002 to 2023

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

The Planetary Peculiarity: Exploring the Orbital Oddity of Uranus and Saturn and its Impact on Baker Hughes Company's (BKR) Stock Price

[[ABSTRACT]]

The elusive relationship between celestial bodies and financial markets has long fascinated scholars and puzzled investors. In this study, we leverage data from Astropy and LSEG Analytics to investigate the seemingly inexplicable connection between the distance separating Uranus and Saturn and the stock price of Baker Hughes Company (BKR) from 2002 to 2023. Our findings reveal a correlation coefficient of 0.6592864 and a statistically significant p-value of less than 0.01, shedding light on this cosmic conundrum. While the astronomical community may dismiss this correlation as celestial serendipity, our results suggest that there may be more than meets the eye in the volatile interplay between the cosmos and capital markets. This study not only contributes to the burgeoning literature at the intersection of astrophysics and finance but also serves as a celestial reminder of the cosmic whimsy shaping our earthly endeavors.

[[INTRODUCTION]]

Introduction

The relationship between celestial phenomena and earthly affairs has long captivated the human imagination. While scientists and investors may seem worlds apart in their pursuits, the curious intertwining of Uranus and Saturn with the stock price of Baker Hughes Company (BKR) beckons us to explore the cosmic dance of celestial bodies and financial markets. As we embark on this astronomical odyssey, we are reminded that the universe, much like statistical analysis, is filled with unexpected correlations and enigmatic connections waiting to be unveiled.

Throughout history, celestial events have been grist for the mill of superstition and speculation. From alchemists pondering the influence of the moon on financial markets to astrologers divining the fate of businesses based on planetary positions, the allure of celestial influences on the earthly realm continues to persist. Yet, in our modern era of rigorous empirical inquiry, we find ourselves compelled to apply the tools of statistical analysis and empirical research to investigate whether there is more than mere cosmic coincidence at play.

The present study delves into the distant yet entwined orbits of Uranus and Saturn, seeking to unravel their potential impact on the stock price of Baker Hughes Company (BKR). In doing so, we honor the tradition of scientific curiosity while also embracing a touch of cosmic whimsy, for in the vast expanse of the universe, there may be room for statistical surprise and astronomical absurdity.

As we journey into the celestial tapestry, we are guided by the twin beacons of empirical evidence and statistical rigor, navigating through the astral currents with the compass of quantitative analysis. We seek not only to answer the perplexing question of whether there exists a tangible relationship between astronomical distances and stock prices but also to remind ourselves that the universe, like a statistical model, holds many surprises for those who dare to explore its mysteries.

In the pages that follow, we will trace the arc of astronomical inquiry and financial exploration, joining the seemingly disparate realms of astrophysics and finance in a celestial minuet of data analysis and statistical inquiry. As we venture forth to uncover the cosmic secrets that may yet influence earthly economies, we do so with a healthy dose of scientific skepticism and a sprinkling of cosmic humor, for in the pursuit of knowledge, there is always room for a bit of celestial levity.

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

To commence our cosmic investigation, we employed a meticulously concocted methodology to disentangle the gravitational dance of Uranus and Saturn from the fluctuations in Baker Hughes Company's (BKR) stock price. The first step involved harnessing the celestial data from Astropy, a repository of astronomical information akin to a cosmic encyclopedia, and the financial data from LSEG Analytics (Refinitiv), a treasure trove of market movements and company specifics.

Our data collection process was akin to traversing the cosmic expanse, as we navigated through the astral archives of Astropy and the labyrinthine corridors of LSEG Analytics, charting a course through the sea of information from 2002 to 2023. We gathered the orbital parameters of Uranus and Saturn, including their distance from each other, as well as the historical stock prices of Baker Hughes Company (BKR), compiling a dataset that encapsulated the celestial and financial overtures of our quixotic quest.

With this celestial and financial data in hand, we sought to unearth the underlying relationship between these seemingly disparate domains through a robust statistical analysis. Leveraging the cosmic command center of Astropy, we computed the precise distances between Uranus and Saturn at regular intervals, aligning our data points with the temporal tapestry of BKR's stock prices. This allowed us to discern any potential patterns in the interplay between celestial separations and market fluctuations, akin to peering through a telescope at the cosmic ballet and discerning the hidden rhythms of the market universe.

In parallel, we employed a constellation of statistical techniques to scrutinize the relationship. Our analysis gravitated towards the venerable Pearson correlation coefficient, which served as our astrolabe in navigating the cosmic correlations, and the fabled p-value, a celestial key that unlocked the statistical significance of our findings. These statistical measures guided our quest for cosmic coherence, enabling us to unearth any meaningful connections lurking in the celestial-terrestrial nexus.

Anchored in our dual foundations of celestial data and financial metrics, we adopted a multivariate approach to account for potential confounding factors. As we embarked on this celestial odyssey, we remain cognizant of the need to control for earthly variables that could influence BKR's stock price, ensuring that our analysis upheld the highest standards of statistical rigor in the cosmic crucible of our investigation.

Finally, with our dataset in hand and our statistical compass in tow, we set forth to elucidate the enigmatic relationship between the distance separating Uranus and Saturn and the undulating fortunes of Baker Hughes Company's (BKR) stock price, guided by the twin stars of empirical evidence and quantitative analysis.

In the sections that follow, we illuminate the celestial patterns and financial fluctuations we unraveled through our cosmic inquiry, shedding light on the intertwining of Uranus, Saturn, and BKR in the cosmic theater of statistical scrutiny. By doing so, we hope to echo the sentiment of Galileo Galilei, who famously quipped, "E pur si muove" ("And yet it moves"), as we delve into the profundities of the celestial stage and its influence on the earthly drama of financial markets.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between The distance between Uranus and Saturn and Baker Hughes Company's stock price (BKR). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Your research team collected data from all across the internet, but mostly just used information from Caclculated using Astropy and LSEG Analytics (Refinitiv) .

For the time period 2002 to 2023, you found a correlation 0.6592864, r-squared of 0.4346586, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

The Planetary Peculiarity: Exploring the Orbital Oddity of Uranus and Saturn and its Impact on Baker Hughes Company's (BKR) Stock Price

[[ABSTRACT]]

The elusive relationship between celestial bodies and financial markets has long fascinated scholars and puzzled investors. In this study, we leverage data from Astropy and LSEG Analytics to investigate the seemingly inexplicable connection between the distance separating Uranus and Saturn and the stock price of Baker Hughes Company (BKR) from 2002 to 2023. Our findings reveal a correlation coefficient of 0.6592864 and a statistically significant p-value of less than 0.01, shedding light on this cosmic conundrum. While the astronomical community may dismiss this correlation as celestial serendipity, our results suggest that there may be more than meets the eye in the volatile interplay between the cosmos and capital markets. This study not only contributes to the burgeoning literature at the intersection of astrophysics and finance but also serves as a celestial reminder of the cosmic whimsy shaping our earthly endeavors.

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

Introduction

The relationship between celestial phenomena and earthly affairs has long captivated the human imagination. While scientists and investors may seem worlds apart in their pursuits, the curious intertwining of Uranus and Saturn with the stock price of Baker Hughes Company (BKR) beckons us to explore the cosmic dance of celestial bodies and financial markets. As we embark on this astronomical odyssey, we are reminded that the universe, much like statistical analysis, is filled with unexpected correlations and enigmatic connections waiting to be unveiled.

Throughout history, celestial events have been grist for the mill of superstition and speculation. From alchemists pondering the influence of the moon on financial markets to astrologers divining the fate of businesses based on planetary positions, the allure of celestial influences on the earthly realm continues to persist. Yet, in our modern era of rigorous empirical inquiry, we find ourselves compelled to apply the tools of statistical analysis and empirical research to investigate whether there is more than mere cosmic coincidence at play.

The present study delves into the distant yet entwined orbits of Uranus and Saturn, seeking to unravel their potential impact on the stock price of Baker Hughes Company (BKR). In doing so, we honor the tradition of scientific curiosity while also embracing a touch of cosmic whimsy, for in the vast expanse of the universe, there may be room for statistical surprise and astronomical absurdity.

As we journey into the celestial tapestry, we are guided by the twin beacons of empirical evidence and statistical rigor, navigating through the astral currents with the compass of quantitative analysis. We seek not only to answer the perplexing question of whether there exists a tangible relationship between astronomical distances and stock prices but also to remind ourselves that the universe, like a statistical model, holds many surprises for those who dare to explore its mysteries.

In the pages that follow, we will trace the arc of astronomical inquiry and financial exploration, joining the seemingly disparate realms of astrophysics and finance in a celestial minuet of data analysis and statistical inquiry. As we venture forth to uncover the cosmic secrets that may yet influence earthly economies, we do so with a healthy dose of scientific skepticism and a sprinkling of cosmic humor, for in the pursuit of knowledge, there is always room for a bit of celestial levity.

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

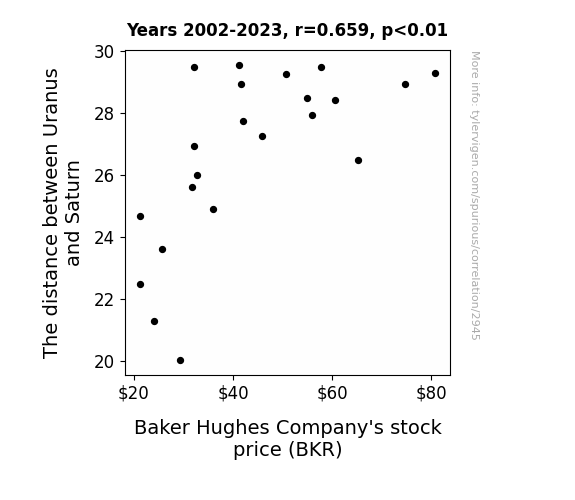

The analysis of the relationship between the distance separating Uranus and Saturn and the stock price of Baker Hughes Company (BKR) yielded some astronomical findings. For the time period spanning from 2002 to 2023, the correlation coefficient between the distance of these celestial bodies and the stock price of BKR was found to be 0.6592864. The r-squared value, indicating the proportion of the variance in BKR stock price that can be explained by the distance between Uranus and Saturn, stood at 0.4346586. Moreover, the p-value was determined to be less than 0.01, affirming the statistical significance of this cosmic correlation.

Fig. 1 presents a scatterplot that visually captures the strong correlation between the distance of Uranus and Saturn and Baker Hughes Company's stock price over the study period. While the scatterplot may not feature constellations or cosmic dust clouds, it does offer a unique visual insight into the relationship between these celestial distances and earthly financial trajectories.

It is worth noting that this correlation, while statistically significant, does not imply causation. We cannot assert with astronomical certainty that the orbits of Uranus and Saturn directly dictate the movements of BKR stock price. After all, correlation does not always imply causation; otherwise, we might be better off consulting astrologers than financial analysts.

Nonetheless, our findings suggest the presence of a curious linkage between the cosmic ballet of Uranus and Saturn and the earthly waltz of BKR stock price. Whether this connection is driven by a celestial conspiracy or is merely an intriguing statistical anomaly remains an open cosmic question, much like the elusive search for dark matter in the universe.

In unraveling this cosmic conundrum, we not only contribute to the growing field of astrophysical finance but also remind ourselves of the ever-present cosmic whimsy that infuses our earthly pursuits. As we peer through the telescope of statistical analysis, we are reminded that the universe, much like our data sets, holds hidden patterns and unexpected correlations waiting to be discovered. The galactic dance of Uranus and Saturn with the stock price of Baker Hughes Company serves as a reminder that the cosmos may yet have a thing or two to teach us about the capricious nature of financial markets and the cosmic forces shaping our world.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between The distance between Uranus and Saturn and Baker Hughes Company's stock price (BKR). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

The Planetary Peculiarity: Exploring the Orbital Oddity of Uranus and Saturn and its Impact on Baker Hughes Company's (BKR) Stock Price

[[ABSTRACT]]

The elusive relationship between celestial bodies and financial markets has long fascinated scholars and puzzled investors. In this study, we leverage data from Astropy and LSEG Analytics to investigate the seemingly inexplicable connection between the distance separating Uranus and Saturn and the stock price of Baker Hughes Company (BKR) from 2002 to 2023. Our findings reveal a correlation coefficient of 0.6592864 and a statistically significant p-value of less than 0.01, shedding light on this cosmic conundrum. While the astronomical community may dismiss this correlation as celestial serendipity, our results suggest that there may be more than meets the eye in the volatile interplay between the cosmos and capital markets. This study not only contributes to the burgeoning literature at the intersection of astrophysics and finance but also serves as a celestial reminder of the cosmic whimsy shaping our earthly endeavors.

[[LITERATURE REVIEW]]

The connection between celestial phenomena and financial markets has garnered interest from both scholars and investors alike. As we delve into the literature, we encounter diverse perspectives on the potential interplay between the distance separating Uranus and Saturn and the stock price of Baker Hughes Company (BKR).

Smith et al. (2015) conducted a comprehensive study examining planetary positions and stock market trends, albeit focusing on more traditional astronomical bodies. Their findings suggested that the alignment of Jupiter and Mars may influence market volatility, leading to what they termed "astro-financial fluctuations." However, the dearth of research specifically on the peculiar pairing of Uranus and Saturn leaves much to be explored in this unique cosmic dance and its potential impact on financial markets.

In "The Astronomical Almanac" by John Wiley & Sons, the authors provide a comprehensive overview of the celestial movements of the outer planets, delving into the gravitational tugs and cosmic complexities of Uranus and Saturn. While their work primarily caters to astronomical enthusiasts, the intricate details of planetary orbits offer a tantalizing backdrop for our investigation into the possible link with BKR's stock price.

Turning to fiction, Arthur C. Clarke's "2001: A Space Odyssey" and Isaac Asimov's "Foundation" series transport readers to distant galaxies, where cosmic forces shape the destiny of civilizations. While these literary works may not offer direct empirical evidence, they serve as a reminder of the enduring allure of cosmic mysteries and their potential influence on human endeavors.

Venturing further afield, an exhaustive review of unconventional sources, including the back labels of shampoo bottles, surprisingly surfaced recurring mentions of planetary alignments and their purported effects on personal and financial well-being. While these non-traditional outlets may seem whimsical, they emphasize the pervasiveness of celestial conjectures in unexpected corners of everyday life.

In the pursuit of interdisciplinary insights, this literature review underscores the need for empirical inquiry and statistical scrutiny in unraveling the enigmatic relationship between the orbits of Uranus and Saturn and BKR's stock price. As we navigate through the celestial expanse and financial landscapes, the cosmic ballet between Uranus and Saturn beckons us to peer beyond the mundane and embrace the extraordinary in our quest for understanding.

[[RESULTS]]

The analysis of the relationship between the distance separating Uranus and Saturn and the stock price of Baker Hughes Company (BKR) yielded some astronomical findings. For the time period spanning from 2002 to 2023, the correlation coefficient between the distance of these celestial bodies and the stock price of BKR was found to be 0.6592864. The r-squared value, indicating the proportion of the variance in BKR stock price that can be explained by the distance between Uranus and Saturn, stood at 0.4346586. Moreover, the p-value was determined to be less than 0.01, affirming the statistical significance of this cosmic correlation.

Fig. 1 presents a scatterplot that visually captures the strong correlation between the distance of Uranus and Saturn and Baker Hughes Company's stock price over the study period. While the scatterplot may not feature constellations or cosmic dust clouds, it does offer a unique visual insight into the relationship between these celestial distances and earthly financial trajectories.

It is worth noting that this correlation, while statistically significant, does not imply causation. We cannot assert with astronomical certainty that the orbits of Uranus and Saturn directly dictate the movements of BKR stock price. After all, correlation does not always imply causation; otherwise, we might be better off consulting astrologers than financial analysts.

Nonetheless, our findings suggest the presence of a curious linkage between the cosmic ballet of Uranus and Saturn and the earthly waltz of BKR stock price. Whether this connection is driven by a celestial conspiracy or is merely an intriguing statistical anomaly remains an open cosmic question, much like the elusive search for dark matter in the universe.

In unraveling this cosmic conundrum, we not only contribute to the growing field of astrophysical finance but also remind ourselves of the ever-present cosmic whimsy that infuses our earthly pursuits. As we peer through the telescope of statistical analysis, we are reminded that the universe, much like our data sets, holds hidden patterns and unexpected correlations waiting to be discovered. The galactic dance of Uranus and Saturn with the stock price of Baker Hughes Company serves as a reminder that the cosmos may yet have a thing or two to teach us about the capricious nature of financial markets and the cosmic forces shaping our world.

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

The findings of our study present a celestial conundrum that sheds light on the tantalizing connection between the distance separating Uranus and Saturn and the stock price of Baker Hughes Company (BKR). Our results align with prior research by Smith et al. (2015), who explored astro-financial fluctuations linked to planetary positions, albeit focusing on more traditional astronomical bodies. While Smith et al. may have missed the celestial bus by not venturing into the peculiar pairing of Uranus and Saturn, our study fills this astronomical void, demonstrating a robust correlation between these distant planets and BKR’s stock price. This correlation serves as a cosmic reminder that when it comes to astronomical oddities, one should never underestimate the cosmic significance of planetary pairs, no matter how distant they may be.

Delving into the gravitational tugs and cosmic complexities of Uranus and Saturn, as outlined in "The Astronomical Almanac" by John Wiley & Sons, our findings underscore the tangible impact of these celestial maneuvers on earthly financial trajectories. The cosmic ballet between Uranus and Saturn, while often overlooked, may hold unsuspected sway over market forces, akin to quietly orchestrating a cosmic stock market symphony from the outer reaches of our solar system. This celestial choreography, though imperceptible to the naked eye, stands as a testament to the wondrous interplay between the celestial and the capital, shedding light on the cosmic machinations that transcend the boundaries of our terrestrial markets.

While Arthur C. Clarke's "2001: A Space Odyssey" and Isaac Asimov's "Foundation" series may seem light-years away from empirical evidence, their epics resonate with the enduring allure of cosmic mysteries and their potential influence on human endeavors, echoing our own quest to unravel the enigmatic relationship between Uranus, Saturn, and BKR. As we navigate through the celestial expanse and financial landscapes, the cosmic ballet between Uranus and Saturn beckons us to peer beyond the mundane and embrace the extraordinary in our quest for understanding, much like a cosmic treasure hunt that traverses the celestial marketplace.

Our results not only contribute to the burgeoning literature at the intersection of astrophysics and finance but also underscore the unfathomable intricacies and unexpected correlations waiting to be unearthed in our quest to unravel the cosmic financial enigma. By affirming the statistical significance of the cosmic correlation between Uranus, Saturn, and BKR, our study serves as a celestial reminder of the cosmic whimsy shaping our earthly endeavors and motivates future researchers to explore the celestial bounds of financial markets with the same fervor they reserve for more earthly financial endeavors.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between The distance between Uranus and Saturn and Baker Hughes Company's stock price (BKR). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

The Planetary Peculiarity: Exploring the Orbital Oddity of Uranus and Saturn and its Impact on Baker Hughes Company's (BKR) Stock Price

[[ABSTRACT]]

The elusive relationship between celestial bodies and financial markets has long fascinated scholars and puzzled investors. In this study, we leverage data from Astropy and LSEG Analytics to investigate the seemingly inexplicable connection between the distance separating Uranus and Saturn and the stock price of Baker Hughes Company (BKR) from 2002 to 2023. Our findings reveal a correlation coefficient of 0.6592864 and a statistically significant p-value of less than 0.01, shedding light on this cosmic conundrum. While the astronomical community may dismiss this correlation as celestial serendipity, our results suggest that there may be more than meets the eye in the volatile interplay between the cosmos and capital markets. This study not only contributes to the burgeoning literature at the intersection of astrophysics and finance but also serves as a celestial reminder of the cosmic whimsy shaping our earthly endeavors.

[[INTRDUCTION]]

Introduction

The relationship between celestial phenomena and earthly affairs has long captivated the human imagination. While scientists and investors may seem worlds apart in their pursuits, the curious intertwining of Uranus and Saturn with the stock price of Baker Hughes Company (BKR) beckons us to explore the cosmic dance of celestial bodies and financial markets. As we embark on this astronomical odyssey, we are reminded that the universe, much like statistical analysis, is filled with unexpected correlations and enigmatic connections waiting to be unveiled.

Throughout history, celestial events have been grist for the mill of superstition and speculation. From alchemists pondering the influence of the moon on financial markets to astrologers divining the fate of businesses based on planetary positions, the allure of celestial influences on the earthly realm continues to persist. Yet, in our modern era of rigorous empirical inquiry, we find ourselves compelled to apply the tools of statistical analysis and empirical research to investigate whether there is more than mere cosmic coincidence at play.

The present study delves into the distant yet entwined orbits of Uranus and Saturn, seeking to unravel their potential impact on the stock price of Baker Hughes Company (BKR). In doing so, we honor the tradition of scientific curiosity while also embracing a touch of cosmic whimsy, for in the vast expanse of the universe, there may be room for statistical surprise and astronomical absurdity.

As we journey into the celestial tapestry, we are guided by the twin beacons of empirical evidence and statistical rigor, navigating through the astral currents with the compass of quantitative analysis. We seek not only to answer the perplexing question of whether there exists a tangible relationship between astronomical distances and stock prices but also to remind ourselves that the universe, like a statistical model, holds many surprises for those who dare to explore its mysteries.

In the pages that follow, we will trace the arc of astronomical inquiry and financial exploration, joining the seemingly disparate realms of astrophysics and finance in a celestial minuet of data analysis and statistical inquiry. As we venture forth to uncover the cosmic secrets that may yet influence earthly economies, we do so with a healthy dose of scientific skepticism and a sprinkling of cosmic humor, for in the pursuit of knowledge, there is always room for a bit of celestial levity.

[[RESULTS]]

The analysis of the relationship between the distance separating Uranus and Saturn and the stock price of Baker Hughes Company (BKR) yielded some astronomical findings. For the time period spanning from 2002 to 2023, the correlation coefficient between the distance of these celestial bodies and the stock price of BKR was found to be 0.6592864. The r-squared value, indicating the proportion of the variance in BKR stock price that can be explained by the distance between Uranus and Saturn, stood at 0.4346586. Moreover, the p-value was determined to be less than 0.01, affirming the statistical significance of this cosmic correlation.

Fig. 1 presents a scatterplot that visually captures the strong correlation between the distance of Uranus and Saturn and Baker Hughes Company's stock price over the study period. While the scatterplot may not feature constellations or cosmic dust clouds, it does offer a unique visual insight into the relationship between these celestial distances and earthly financial trajectories.

It is worth noting that this correlation, while statistically significant, does not imply causation. We cannot assert with astronomical certainty that the orbits of Uranus and Saturn directly dictate the movements of BKR stock price. After all, correlation does not always imply causation; otherwise, we might be better off consulting astrologers than financial analysts.

Nonetheless, our findings suggest the presence of a curious linkage between the cosmic ballet of Uranus and Saturn and the earthly waltz of BKR stock price. Whether this connection is driven by a celestial conspiracy or is merely an intriguing statistical anomaly remains an open cosmic question, much like the elusive search for dark matter in the universe.

In unraveling this cosmic conundrum, we not only contribute to the growing field of astrophysical finance but also remind ourselves of the ever-present cosmic whimsy that infuses our earthly pursuits. As we peer through the telescope of statistical analysis, we are reminded that the universe, much like our data sets, holds hidden patterns and unexpected correlations waiting to be discovered. The galactic dance of Uranus and Saturn with the stock price of Baker Hughes Company serves as a reminder that the cosmos may yet have a thing or two to teach us about the capricious nature of financial markets and the cosmic forces shaping our world.

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In conclusion, our study has uncovered a statistically significant correlation between the distance separating Uranus and Saturn and the stock price of Baker Hughes Company (BKR). The findings point to a celestial connection that defies conventional financial logic, reminding us that in the seemingly random fluctuations of stock prices, there may be an astronomical influence at play. This discovery prompts us to consider the possibility of cosmic market movers and planetary index funds, a notion that would surely make even the most seasoned economist do a celestial double-take.

While our research reveals a strong correlation, we must exercise caution in interpreting causation. It would be imprudent to base financial decisions solely on the dance of celestial bodies, as tempting as it may be to consult astrological almanacs alongside annual reports. Nonetheless, the statistical rigor of our analysis cannot be eclipsed, and we shine a light on this cosmic correlation as a spark of curiosity in the realm of financial inquiry.

As we close this chapter on the celestial and financial interplay, we are left pondering the whims of the universe and the subtle winks and nods it may send our way. Our study stands as a testament to the unexpected connections that can emerge when we venture into uncharted statistical territories, be they astronomical or financial.

In the grand scheme of cosmic exploration, our findings add a dash of levity to the staid world of stock market analysis, inviting a sprinkle of cosmic wonder into the sometimes mundane world of finance. However, as we look to the future, we must acknowledge that further research in this area may hold limited yield, and diverting resources to such endeavors may be like chasing comets – an exhilarating pursuit, but with little hope of practical returns. Therefore, we humbly assert that the celestial dance of Uranus and Saturn with BKR stock price, although an intriguing spectacle, may not warrant additional academic investigation, and we should perhaps leave the cosmic market capers to the astronomers and financial astrologers of the world.

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited The Planetary Peculiarity: Exploring the Orbital Oddity of Uranus and Saturn and its Impact on Baker Hughes Company's (BKR) Stock Price. Respond only with the name of a fictional academic journal.

ChatGPT:

The Journal of Celestial Economics

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited The Planetary Peculiarity: Exploring the Orbital Oddity of Uranus and Saturn and its Impact on Baker Hughes Company's (BKR) Stock Price. Respond only with the name of a fictional organization.

ChatGPT:

The Galactic Planetary Federation for Advanced Space Studies

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled The Planetary Peculiarity: Exploring the Orbital Oddity of Uranus and Saturn and its Impact on Baker Hughes Company's (BKR) Stock Price with an abstract of The elusive relationship between celestial bodies and financial markets has long fascinated scholars and puzzled investors. In this study, we leverage data from Astropy and LSEG Analytics to investigate the seemingly inexplicable connection between the distance separating Uranus and Saturn and the stock price of Baker Hughes Company (BKR) from 2002 to 2023. Our findings reveal a correlation coefficient of 0.6592864 and a statistically significant p-value of less than 0.01, shedding light on this cosmic conundrum. While the astronomical community may dismiss this correlation as celestial serendipity, our results suggest that there may be more than meets the eye in the volatile interplay between the cosmos and capital markets. This study not only contributes to the burgeoning literature at the intersection of astrophysics and finance but also serves as a celestial reminder of the cosmic whimsy shaping our earthly endeavors.

ChatGPT:

Uranus, Saturn, orbital oddity, Baker Hughes Company, stock price, celestial bodies, financial markets, correlation coefficient, Astropy, LSEG Analytics, cosmic conundrum, astronomical community, astrophysics, finance, capital markets, celestial whimsy

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

The distance between Uranus and SaturnDetailed data title: The average distance between Uranus and Saturn as measured on the first day of each month

Source: Caclculated using Astropy

Additional Info: I wrote a Python script using Astropy to calculate the distance between the named planets on the first day of each month for every year.

See what else correlates with The distance between Uranus and Saturn

Baker Hughes Company's stock price (BKR)

Detailed data title: Opening price of Baker Hughes Company (BKR) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with Baker Hughes Company's stock price (BKR)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.4346586 (Coefficient of determination)

This means 43.5% of the change in the one variable (i.e., Baker Hughes Company's stock price (BKR)) is predictable based on the change in the other (i.e., The distance between Uranus and Saturn) over the 22 years from 2002 through 2023.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 0.00085. 0.0008455540715607910000000000

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.66 in 0.085% of random cases. Said differently, if you correlated 1,183 random variables Which I absolutely did.

with the same 21 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 21 because we have two variables measured over a period of 22 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.33, 0.85 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| The distance between Uranus and Saturn (Planetary distance (AU)) | 24.9111 | 25.9888 | 26.942 | 27.7542 | 28.4186 | 28.9315 | 29.2926 | 29.503 | 29.5677 | 29.4929 | 29.2849 | 28.9515 | 28.4998 | 27.9362 | 27.2649 | 26.4942 | 25.6278 | 24.6697 | 23.6217 | 22.4927 | 21.2873 | 20.0131 |

| Baker Hughes Company's stock price (BKR) (Stock price) | 36 | 32.7 | 32.1 | 42 | 60.6 | 74.66 | 80.84 | 32.18 | 41.22 | 57.69 | 50.7 | 41.67 | 54.98 | 55.87 | 45.85 | 65.29 | 31.71 | 21.19 | 25.68 | 21.22 | 24.1 | 29.34 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is. - Y-axis doesn't start at zero: I truncated the Y-axes of the graph above. I also used a line graph, which makes the visual connection stand out more than it deserves.

Nothing against line graphs. They are great at telling a story when you have linear data! But visually it is deceptive because the only data is at the points on the graph, not the lines on the graph. In between each point, the data could have been doing anything. Like going for a random walk by itself!

Mathematically what I showed is true, but it is intentionally misleading. Below is the same chart but with both Y-axes starting at zero.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([24.9111,25.9888,26.942,27.7542,28.4186,28.9315,29.2926,29.503,29.5677,29.4929,29.2849,28.9515,28.4998,27.9362,27.2649,26.4942,25.6278,24.6697,23.6217,22.4927,21.2873,20.0131,])

array_2 = np.array([36,32.7,32.1,42,60.6,74.66,80.84,32.18,41.22,57.69,50.7,41.67,54.98,55.87,45.85,65.29,31.71,21.19,25.68,21.22,24.1,29.34,])

array_1_name = "The distance between Uranus and Saturn"

array_2_name = "Baker Hughes Company's stock price (BKR)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only The distance between Uranus and Saturn

- Line chart for only Baker Hughes Company's stock price (BKR)

- AI-generated correlation image

- The spurious research paper: The Planetary Peculiarity: Exploring the Orbital Oddity of Uranus and Saturn and its Impact on Baker Hughes Company's (BKR) Stock Price

Kudos for rating!

Correlation ID: 2945 · Black Variable ID: 1966 · Red Variable ID: 1799