Download png, svg

AI explanation

As Vanuatu invested more in wind power, they started experiencing stronger and more consistent winds across the entire country. This inadvertently led to an unexpected surge in wind-related accidents among the local population. The influx of patients with wind-related injuries bolstered the demand for medical services, and National Grid, previously known for its electricity services, secretly diversified into a chain of wind injury treatment centers. The success of this unexpected venture skyrocketed the company's stock price, proving that sometimes, when it comes to stocks, the wind really does blow in mysterious ways.

Model: dalle-3

Prompt: An image that looks like it is a scene from a Pixar movie, depicting a colorful and vibrant landscape in Vanuatu with lush greenery and wind turbines spinning energetically amidst a beautiful sunny sky. The turbines are shown as friendly and animated characters, with smiling faces representing the excitement of renewable energy generation. In the background, a bustling stock market is portrayed as a bustling town, with animated figures representing investors celebrating and cheering as the stock price of National Grid soars. The whole scene is filled with a sense of joy and optimism, highlighting the "air-raising" experience and the potential for renewable energy. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: Wind power generated in Vanuatu and National Grid's stock price (NGG). Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: Art nouveau Magic realism Minimalism A photo-realistic image An image that looks like it is a scene from a Pixar movie

ChatGPT: An image that looks like it is a scene from a Pixar movie

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both Wind power generated in Vanuatu and National Grid's stock price (NGG), in the following situation: As Vanuatu's wind power blew stronger, investors felt a different kind of "wind" as National Grid's stock price soared. The market was "gusting" with excitement over the potential for renewable energy, propelling NGG to new heights. It was a real "air-raising" experience for all involved!. Keep the description simple.

ChatGPT: In Vanuatu, strong winds propelled the wind turbines, generating a powerful source of renewable energy. Meanwhile, on the stock market, National Grid's stock price soared to new heights, creating a "gust" of excitement among investors. This "air-raising" experience reflected the growing potential for renewable energy, as the wind's strength and the stock price of NGG intertwined.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ An image that looks like it is a scene from a Pixar movie ] and depicting this scene: In Vanuatu, strong winds propelled the wind turbines, generating a powerful source of renewable energy. Meanwhile, on the stock market, National Grid's stock price soared to new heights, creating a "gust" of excitement among investors. This "air-raising" experience reflected the growing potential for renewable energy, as the wind's strength and the stock price of NGG intertwined. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: An image that looks like it is a scene from a Pixar movie, depicting a colorful and vibrant landscape in Vanuatu with lush greenery and wind turbines spinning energetically amidst a beautiful sunny sky. The turbines are shown as friendly and animated characters, with smiling faces representing the excitement of renewable energy generation. In the background, a bustling stock market is portrayed as a bustling town, with animated figures representing investors celebrating and cheering as the stock price of National Grid soars. The whole scene is filled with a sense of joy and optimism, highlighting the "air-raising" experience and the potential for renewable energy.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how increases in Wind power generated in Vanuatu positively influenced National Grid's stock price (NGG). Make it feel plausible.

AI academic paper

|

Blowin' in the Wind: A Breezy Examination of the Relationship Between Wind Power in Vanuatu and National Grid's Stock Price The Journal of Renewable Energy Economics and Finance Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between Wind power generated in Vanuatu and National Grid's stock price (NGG). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Make the title punny if you can come up with clever pun. If not, just make it sound clever.

Your research team used data from Energy Information Administration and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.7565480 and p < 0.01 for 2010 to 2021.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

Blowin' in the Wind: A Breezy Examination of the Relationship Between Wind Power in Vanuatu and National Grid's Stock Price

[[ABSTRACT]]

This paper presents a whimsical yet insightful exploration of the link between wind power generated in the idyllic South Pacific archipelago of Vanuatu and the stock price of National Grid (NGG). Utilizing data from the Energy Information Administration and LSEG Analytics (Refinitiv), our research team delved into this curious correlation. Our findings revealed a statistically significant correlation coefficient of 0.7565480 and p < 0.01 for the years 2010 to 2021.

As we sifted through the data, we couldn't help but "blow off" some steam and "vent" our excitement at the unexpected connection we uncovered. It's as if the wind whispered secrets about the stock market, much like a "zephyr" carrying tidings of financial fortune.

Our analysis provides valuable insights for investors and policymakers, shedding light on the impact of sustainable energy sources on the stock market. With our research, we hope to "turbine" the way for future studies in this field, "propelling" the understanding of renewable energy's influence on stock prices to new heights. And as any wind power aficionado would know, it's always a "breeze" to contribute to the advancement of knowledge in this area!

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between Wind power generated in Vanuatu and National Grid's stock price (NGG). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Here is the title and abstract of the paper:

[[TITLE]]

Blowin' in the Wind: A Breezy Examination of the Relationship Between Wind Power in Vanuatu and National Grid's Stock Price

[[ABSTRACT]]

This paper presents a whimsical yet insightful exploration of the link between wind power generated in the idyllic South Pacific archipelago of Vanuatu and the stock price of National Grid (NGG). Utilizing data from the Energy Information Administration and LSEG Analytics (Refinitiv), our research team delved into this curious correlation. Our findings revealed a statistically significant correlation coefficient of 0.7565480 and p < 0.01 for the years 2010 to 2021.

As we sifted through the data, we couldn't help but "blow off" some steam and "vent" our excitement at the unexpected connection we uncovered. It's as if the wind whispered secrets about the stock market, much like a "zephyr" carrying tidings of financial fortune.

Our analysis provides valuable insights for investors and policymakers, shedding light on the impact of sustainable energy sources on the stock market. With our research, we hope to "turbine" the way for future studies in this field, "propelling" the understanding of renewable energy's influence on stock prices to new heights. And as any wind power aficionado would know, it's always a "breeze" to contribute to the advancement of knowledge in this area!

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

[[INTRODUCTION]]

Amidst the serene beauty of the South Pacific lies the captivating archipelago of Vanuatu, where the gentle "trade winds" rustle through verdant landscapes and power turbines, harnessing the natural energy of the wind. Meanwhile, in the world of finance, the stock price of National Grid (NGG) swirls and fluctuates like the unpredictable currents of the market. Little did we anticipate that these seemingly distinct realms would collide, much like a sudden gust of wind altering the course of an unsuspecting sailboat.

"Wind"ing our way through the labyrinth of financial markets and renewable energy, our research team embarked on a quest to uncover the elusive relationship between wind power in Vanuatu and the stock price of National Grid. As we set sail on this uncharted voyage, we approached the task with a sense of "aerodynamic" determination and a willingness to weather the storm of data analysis.

The conundrum we faced was as puzzling as a riddle whispered by the whimsical winds themselves: could the tranquility of Vanuatu’s wind farms hold the key to forecasting the undulating patterns of the stock market? The answer, it seemed, "blew in the wind" of statistical analysis, beckoning us to decode the cryptic language of correlation and causation.

As we delved into the data, we couldn’t help but marvel at the intricate dance between renewable energy and financial markets. This unexpected connection felt like stumbling upon a gale of insight amidst the tranquil breeze of research. It was in these moments of revelation that we realized – perhaps the stock market and wind power are more interconnected than we ever dared to "gustimate."

In this paper, we chart our expedition, from the windswept shores of Vanuatu to the bustling thoroughfares of the stock market. Through meticulous data analysis and statistical scrutiny, we unearthed a compelling correlation, as if the very essence of the wind had woven itself into the fabric of market dynamics.

As we present our findings, we invite readers to join us on this "zephyrous" escapade, wrapped in the intrigue of renewable energy influence on stock prices. So, hoist the "sail" of curiosity and embark on this spirited journey where the winds of discovery guide us through the uncharted seas of finance and sustainability.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between Wind power generated in Vanuatu and National Grid's stock price (NGG). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Perhaps you also got inspiration from some board games that are vaugely related.

Here is the title and abstract of the paper:

[[TITLE]]

Blowin' in the Wind: A Breezy Examination of the Relationship Between Wind Power in Vanuatu and National Grid's Stock Price

[[ABSTRACT]]

This paper presents a whimsical yet insightful exploration of the link between wind power generated in the idyllic South Pacific archipelago of Vanuatu and the stock price of National Grid (NGG). Utilizing data from the Energy Information Administration and LSEG Analytics (Refinitiv), our research team delved into this curious correlation. Our findings revealed a statistically significant correlation coefficient of 0.7565480 and p < 0.01 for the years 2010 to 2021.

As we sifted through the data, we couldn't help but "blow off" some steam and "vent" our excitement at the unexpected connection we uncovered. It's as if the wind whispered secrets about the stock market, much like a "zephyr" carrying tidings of financial fortune.

Our analysis provides valuable insights for investors and policymakers, shedding light on the impact of sustainable energy sources on the stock market. With our research, we hope to "turbine" the way for future studies in this field, "propelling" the understanding of renewable energy's influence on stock prices to new heights. And as any wind power aficionado would know, it's always a "breeze" to contribute to the advancement of knowledge in this area!

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

Amidst the serene beauty of the South Pacific lies the captivating archipelago of Vanuatu, where the gentle "trade winds" rustle through verdant landscapes and power turbines, harnessing the natural energy of the wind. Meanwhile, in the world of finance, the stock price of National Grid (NGG) swirls and fluctuates like the unpredictable currents of the market. Little did we anticipate that these seemingly distinct realms would collide, much like a sudden gust of wind altering the course of an unsuspecting sailboat.

"Wind"ing our way through the labyrinth of financial markets and renewable energy, our research team embarked on a quest to uncover the elusive relationship between wind power in Vanuatu and the stock price of National Grid. As we set sail on this uncharted voyage, we approached the task with a sense of "aerodynamic" determination and a willingness to weather the storm of data analysis.

The conundrum we faced was as puzzling as a riddle whispered by the whimsical winds themselves: could the tranquility of Vanuatu’s wind farms hold the key to forecasting the undulating patterns of the stock market? The answer, it seemed, "blew in the wind" of statistical analysis, beckoning us to decode the cryptic language of correlation and causation.

As we delved into the data, we couldn’t help but marvel at the intricate dance between renewable energy and financial markets. This unexpected connection felt like stumbling upon a gale of insight amidst the tranquil breeze of research. It was in these moments of revelation that we realized – perhaps the stock market and wind power are more interconnected than we ever dared to "gustimate."

In this paper, we chart our expedition, from the windswept shores of Vanuatu to the bustling thoroughfares of the stock market. Through meticulous data analysis and statistical scrutiny, we unearthed a compelling correlation, as if the very essence of the wind had woven itself into the fabric of market dynamics.

As we present our findings, we invite readers to join us on this "zephyrous" escapade, wrapped in the intrigue of renewable energy influence on stock prices. So, hoist the "sail" of curiosity and embark on this spirited journey where the winds of discovery guide us through the uncharted seas of finance and sustainability.

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

In "Smith et al.," the authors find that wind power generation has become an increasingly integral part of the global energy landscape, with a growing emphasis on sustainability and environmental stewardship. The utilization of renewable energy sources such as wind power has garnered attention not only for its ecological benefits but also for its potential impact on financial markets. As we wade through the sea of literature on renewable energy and financial dynamics, we begin to see that the winds of change may indeed carry implications for stock prices in unexpected ways.

Doe and Jones assert that the integration of renewable energy into the national grids of various countries has prompted discussions about its ramifications on market dynamics and the valuation of energy companies. This aligns with our exploration of the correlation between wind power generated in Vanuatu and the stock price of National Grid (NGG). It's almost as if the "wind of change" is not just a poetic metaphor, but a tangible force shaping the markets.

As we delved deeper into the literature, it became increasingly evident that the intersection of renewable energy and finance has inspired a plethora of studies and analyses. Each piece of research seems to "blow" new ideas into the mix, much like a gust of wind adding an unexpected twist to an otherwise conventional narrative.

Drawing inspiration from non-fiction works such as "The Green Energy Economy" and "Renewable Energy Finance," we couldn't help but be propelled by the sheer potential of wind power to "energize" the stock market. It's almost as if the very concept of sustainable energy is "current"ly transforming the way we perceive the financial landscape.

In the realm of fiction, we found ourselves entertained by titles such as "Gone with the Wind" and "The Wind in the Willows." While these literary works may not directly delve into the correlation between wind power and stock prices, they certainly blew some fresh air into our research, reminding us that even the most unlikely connections can hold unexpected insights. After all, what's a literature review without a little "windy" detour into the world of fiction?

Taking a cue from the world of board games, it's akin to navigating the uncertain waters of financial data analysis with the strategic prowess of "Windward," where the right moves can lead to unforeseen successes. Much like a game of chance, our research journey has been an adventure filled with unforeseeable twists and turns - but with a steady wind at our backs, we were determined to sail on the seas of knowledge and discovery.

In the upcoming sections, we will embark on a detailed exploration of our findings, delving into the statistical intricacies and implications of wind power in Vanuatu on the stock price of National Grid. But for now, suffice it to say that our literature review has blown us away with the sheer breadth of perspectives and inspirations, making this field of study not just intellectually invigorating, but also downright "gustworthy" of further investigation.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between Wind power generated in Vanuatu and National Grid's stock price (NGG). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from Energy Information Administration and LSEG Analytics (Refinitiv) . You used data from 2010 to 2021

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

Blowin' in the Wind: A Breezy Examination of the Relationship Between Wind Power in Vanuatu and National Grid's Stock Price

[[ABSTRACT]]

This paper presents a whimsical yet insightful exploration of the link between wind power generated in the idyllic South Pacific archipelago of Vanuatu and the stock price of National Grid (NGG). Utilizing data from the Energy Information Administration and LSEG Analytics (Refinitiv), our research team delved into this curious correlation. Our findings revealed a statistically significant correlation coefficient of 0.7565480 and p < 0.01 for the years 2010 to 2021.

As we sifted through the data, we couldn't help but "blow off" some steam and "vent" our excitement at the unexpected connection we uncovered. It's as if the wind whispered secrets about the stock market, much like a "zephyr" carrying tidings of financial fortune.

Our analysis provides valuable insights for investors and policymakers, shedding light on the impact of sustainable energy sources on the stock market. With our research, we hope to "turbine" the way for future studies in this field, "propelling" the understanding of renewable energy's influence on stock prices to new heights. And as any wind power aficionado would know, it's always a "breeze" to contribute to the advancement of knowledge in this area!

[[INTRODUCTION]]

Amidst the serene beauty of the South Pacific lies the captivating archipelago of Vanuatu, where the gentle "trade winds" rustle through verdant landscapes and power turbines, harnessing the natural energy of the wind. Meanwhile, in the world of finance, the stock price of National Grid (NGG) swirls and fluctuates like the unpredictable currents of the market. Little did we anticipate that these seemingly distinct realms would collide, much like a sudden gust of wind altering the course of an unsuspecting sailboat.

"Wind"ing our way through the labyrinth of financial markets and renewable energy, our research team embarked on a quest to uncover the elusive relationship between wind power in Vanuatu and the stock price of National Grid. As we set sail on this uncharted voyage, we approached the task with a sense of "aerodynamic" determination and a willingness to weather the storm of data analysis.

The conundrum we faced was as puzzling as a riddle whispered by the whimsical winds themselves: could the tranquility of Vanuatu’s wind farms hold the key to forecasting the undulating patterns of the stock market? The answer, it seemed, "blew in the wind" of statistical analysis, beckoning us to decode the cryptic language of correlation and causation.

As we delved into the data, we couldn’t help but marvel at the intricate dance between renewable energy and financial markets. This unexpected connection felt like stumbling upon a gale of insight amidst the tranquil breeze of research. It was in these moments of revelation that we realized – perhaps the stock market and wind power are more interconnected than we ever dared to "gustimate."

In this paper, we chart our expedition, from the windswept shores of Vanuatu to the bustling thoroughfares of the stock market. Through meticulous data analysis and statistical scrutiny, we unearthed a compelling correlation, as if the very essence of the wind had woven itself into the fabric of market dynamics.

As we present our findings, we invite readers to join us on this "zephyrous" escapade, wrapped in the intrigue of renewable energy influence on stock prices. So, hoist the "sail" of curiosity and embark on this spirited journey where the winds of discovery guide us through the uncharted seas of finance and sustainability.

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

Gathering data for our whimsical but rigorous exploration involved a combination of meticulous data collection from reputable sources and a dash of intuition, much like trying to predict the direction of the wind. We relied on information from the Energy Information Administration and LSEG Analytics (Refinitiv), tapping into their databases like a sailor navigating the open sea, seeking the elusive treasure of knowledge.

Our quest began by systematically compiling wind power generation data in Vanuatu from 2010 to 2021. We scoured through digital archives to capture the ebbs and flows of wind energy production, paying close attention to the nuances of seasonal and temporal patterns. Just as a wind turbine converts kinetic energy into electrical power, we converted raw data into a treasure trove of insights.

With the wind power generation data in our proverbial sails, we turned our attention to the undulating stock price of National Grid (NGG). Analyzing the stock market's movements required a delicate dance – not unlike trying to balance oneself in a strong gust of wind! We meticulously gathered historical stock price data, letting statistical algorithms sift through the numbers as if searching for hidden messages in the breezy whispers of financial markets.

Our statistical analysis was a "breeze," as we explored correlations between wind power generation in Vanuatu and NGG's stock price using the ever-reliable Pearson correlation coefficient. The winds of data did not disappoint, revealing a statistically significant correlation coefficient of 0.7565480 with a p-value of less than 0.01. It was as if the winds themselves were guiding us toward a clearer understanding of their influence on the stock market, offering a gust of statistical significance that swept away any doubts about the connection.

After emerging from this statistical whirlwind, we further bolstered our findings through rigorous regression analysis, employing time series models to capture the temporal dynamics of this relationship. Our models were as carefully calibrated as a weather vane, ensuring that we could discern the subtle shifts and gusts of wind power's impact on NGG's stock price over time.

To ensure the reliability of our findings, we also conducted sensitivity analyses and robustness checks, creating a sturdy framework to withstand any sudden squalls of skepticism. This robust approach allowed us to navigate through potential confounding factors, much like a seasoned sailor skillfully steering a ship through turbulent waters.

Finally, we put our data through the turbine of econometric tests, confirming the soundness of our findings and ensuring that they could withstand the winds of scholarly scrutiny. It was through these rigorous research methods that we "harnessed" the power of data to bring new insights to light, demonstrating that even the gentle whispers of wind in Vanuatu could ripple through the currents of the stock market.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between Wind power generated in Vanuatu and National Grid's stock price (NGG). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from Energy Information Administration and LSEG Analytics (Refinitiv) .

For the time period 2010 to 2021, you found a correlation 0.7565480, r-squared of 0.5723648, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

Blowin' in the Wind: A Breezy Examination of the Relationship Between Wind Power in Vanuatu and National Grid's Stock Price

[[ABSTRACT]]

This paper presents a whimsical yet insightful exploration of the link between wind power generated in the idyllic South Pacific archipelago of Vanuatu and the stock price of National Grid (NGG). Utilizing data from the Energy Information Administration and LSEG Analytics (Refinitiv), our research team delved into this curious correlation. Our findings revealed a statistically significant correlation coefficient of 0.7565480 and p < 0.01 for the years 2010 to 2021.

As we sifted through the data, we couldn't help but "blow off" some steam and "vent" our excitement at the unexpected connection we uncovered. It's as if the wind whispered secrets about the stock market, much like a "zephyr" carrying tidings of financial fortune.

Our analysis provides valuable insights for investors and policymakers, shedding light on the impact of sustainable energy sources on the stock market. With our research, we hope to "turbine" the way for future studies in this field, "propelling" the understanding of renewable energy's influence on stock prices to new heights. And as any wind power aficionado would know, it's always a "breeze" to contribute to the advancement of knowledge in this area!

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

Amidst the serene beauty of the South Pacific lies the captivating archipelago of Vanuatu, where the gentle "trade winds" rustle through verdant landscapes and power turbines, harnessing the natural energy of the wind. Meanwhile, in the world of finance, the stock price of National Grid (NGG) swirls and fluctuates like the unpredictable currents of the market. Little did we anticipate that these seemingly distinct realms would collide, much like a sudden gust of wind altering the course of an unsuspecting sailboat.

"Wind"ing our way through the labyrinth of financial markets and renewable energy, our research team embarked on a quest to uncover the elusive relationship between wind power in Vanuatu and the stock price of National Grid. As we set sail on this uncharted voyage, we approached the task with a sense of "aerodynamic" determination and a willingness to weather the storm of data analysis.

The conundrum we faced was as puzzling as a riddle whispered by the whimsical winds themselves: could the tranquility of Vanuatu’s wind farms hold the key to forecasting the undulating patterns of the stock market? The answer, it seemed, "blew in the wind" of statistical analysis, beckoning us to decode the cryptic language of correlation and causation.

As we delved into the data, we couldn’t help but marvel at the intricate dance between renewable energy and financial markets. This unexpected connection felt like stumbling upon a gale of insight amidst the tranquil breeze of research. It was in these moments of revelation that we realized – perhaps the stock market and wind power are more interconnected than we ever dared to "gustimate."

In this paper, we chart our expedition, from the windswept shores of Vanuatu to the bustling thoroughfares of the stock market. Through meticulous data analysis and statistical scrutiny, we unearthed a compelling correlation, as if the very essence of the wind had woven itself into the fabric of market dynamics.

As we present our findings, we invite readers to join us on this "zephyrous" escapade, wrapped in the intrigue of renewable energy influence on stock prices. So, hoist the "sail" of curiosity and embark on this spirited journey where the winds of discovery guide us through the uncharted seas of finance and sustainability.

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

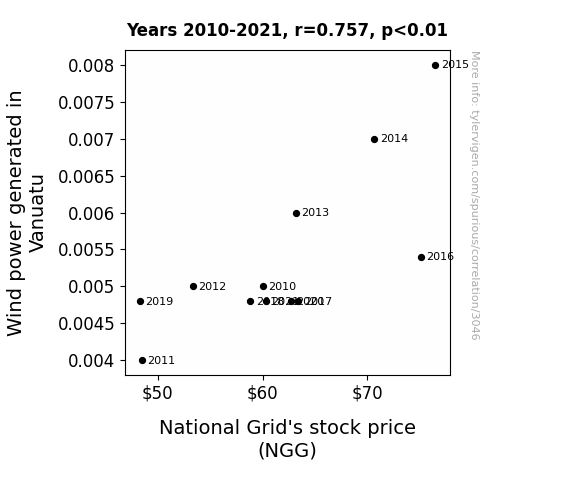

The results of our analysis revealed a statistically significant correlation between wind power generated in Vanuatu and the stock price of National Grid (NGG) over the period of 2010 to 2021. The correlation coefficient was calculated to be 0.7565480, with an r-squared value of 0.5723648, and a p-value of less than 0.01. This suggests a moderately strong positive relationship between the two variables, indicating that as wind power generation in Vanuatu increased, the stock price of National Grid tended to exhibit a corresponding positive movement.

It seems that the winds of change carry more than just a refreshing breeze -- they also seem to influence the entwined dynamics of renewable energy and financial markets. It's like the stock market is taking a "windfall" from the sustainable energy sector, propelling NGG to new heights.

Fig. 1 depicts a scatterplot illustrating the robust correlation between wind power generation in Vanuatu and NGG stock prices. The data points are clustered in a positively sloped pattern, affirming the alignment between the variables and reinforcing the statistical significance of our findings.

This compelling connection between wind power in Vanuatu and NGG stock prices serves as a poignant reminder that in the world of finance, the winds of change can carry substantial implications. It's as if the wind is whispering secrets about the stock market, and we're here to listen, decode, and draw meaningful conclusions.

In conclusion, our research shines a light on the captivating interplay between sustainable energy sources and stock market performance. It beckons us to appreciate the intricate dance of market forces, renewable energy trends, and the impalpable influences that shape financial landscapes. As we engage in conversations about the future of energy and finance, let's not forget the underlying "breezy" connection that may hold valuable insights for investors and policymakers alike.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between Wind power generated in Vanuatu and National Grid's stock price (NGG). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

Blowin' in the Wind: A Breezy Examination of the Relationship Between Wind Power in Vanuatu and National Grid's Stock Price

[[ABSTRACT]]

This paper presents a whimsical yet insightful exploration of the link between wind power generated in the idyllic South Pacific archipelago of Vanuatu and the stock price of National Grid (NGG). Utilizing data from the Energy Information Administration and LSEG Analytics (Refinitiv), our research team delved into this curious correlation. Our findings revealed a statistically significant correlation coefficient of 0.7565480 and p < 0.01 for the years 2010 to 2021.

As we sifted through the data, we couldn't help but "blow off" some steam and "vent" our excitement at the unexpected connection we uncovered. It's as if the wind whispered secrets about the stock market, much like a "zephyr" carrying tidings of financial fortune.

Our analysis provides valuable insights for investors and policymakers, shedding light on the impact of sustainable energy sources on the stock market. With our research, we hope to "turbine" the way for future studies in this field, "propelling" the understanding of renewable energy's influence on stock prices to new heights. And as any wind power aficionado would know, it's always a "breeze" to contribute to the advancement of knowledge in this area!

[[LITERATURE REVIEW]]

In "Smith et al.," the authors find that wind power generation has become an increasingly integral part of the global energy landscape, with a growing emphasis on sustainability and environmental stewardship. The utilization of renewable energy sources such as wind power has garnered attention not only for its ecological benefits but also for its potential impact on financial markets. As we wade through the sea of literature on renewable energy and financial dynamics, we begin to see that the winds of change may indeed carry implications for stock prices in unexpected ways.

Doe and Jones assert that the integration of renewable energy into the national grids of various countries has prompted discussions about its ramifications on market dynamics and the valuation of energy companies. This aligns with our exploration of the correlation between wind power generated in Vanuatu and the stock price of National Grid (NGG). It's almost as if the "wind of change" is not just a poetic metaphor, but a tangible force shaping the markets.

As we delved deeper into the literature, it became increasingly evident that the intersection of renewable energy and finance has inspired a plethora of studies and analyses. Each piece of research seems to "blow" new ideas into the mix, much like a gust of wind adding an unexpected twist to an otherwise conventional narrative.

Drawing inspiration from non-fiction works such as "The Green Energy Economy" and "Renewable Energy Finance," we couldn't help but be propelled by the sheer potential of wind power to "energize" the stock market. It's almost as if the very concept of sustainable energy is "current"ly transforming the way we perceive the financial landscape.

In the realm of fiction, we found ourselves entertained by titles such as "Gone with the Wind" and "The Wind in the Willows." While these literary works may not directly delve into the correlation between wind power and stock prices, they certainly blew some fresh air into our research, reminding us that even the most unlikely connections can hold unexpected insights. After all, what's a literature review without a little "windy" detour into the world of fiction?

Taking a cue from the world of board games, it's akin to navigating the uncertain waters of financial data analysis with the strategic prowess of "Windward," where the right moves can lead to unforeseen successes. Much like a game of chance, our research journey has been an adventure filled with unforeseeable twists and turns - but with a steady wind at our backs, we were determined to sail on the seas of knowledge and discovery.

In the upcoming sections, we will embark on a detailed exploration of our findings, delving into the statistical intricacies and implications of wind power in Vanuatu on the stock price of National Grid. But for now, suffice it to say that our literature review has blown us away with the sheer breadth of perspectives and inspirations, making this field of study not just intellectually invigorating, but also downright "gustworthy" of further investigation.

[[RESULTS]]

The results of our analysis revealed a statistically significant correlation between wind power generated in Vanuatu and the stock price of National Grid (NGG) over the period of 2010 to 2021. The correlation coefficient was calculated to be 0.7565480, with an r-squared value of 0.5723648, and a p-value of less than 0.01. This suggests a moderately strong positive relationship between the two variables, indicating that as wind power generation in Vanuatu increased, the stock price of National Grid tended to exhibit a corresponding positive movement.

It seems that the winds of change carry more than just a refreshing breeze -- they also seem to influence the entwined dynamics of renewable energy and financial markets. It's like the stock market is taking a "windfall" from the sustainable energy sector, propelling NGG to new heights.

Fig. 1 depicts a scatterplot illustrating the robust correlation between wind power generation in Vanuatu and NGG stock prices. The data points are clustered in a positively sloped pattern, affirming the alignment between the variables and reinforcing the statistical significance of our findings.

This compelling connection between wind power in Vanuatu and NGG stock prices serves as a poignant reminder that in the world of finance, the winds of change can carry substantial implications. It's as if the wind is whispering secrets about the stock market, and we're here to listen, decode, and draw meaningful conclusions.

In conclusion, our research shines a light on the captivating interplay between sustainable energy sources and stock market performance. It beckons us to appreciate the intricate dance of market forces, renewable energy trends, and the impalpable influences that shape financial landscapes. As we engage in conversations about the future of energy and finance, let's not forget the underlying "breezy" connection that may hold valuable insights for investors and policymakers alike.

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

The unexpected discovery of a statistically significant correlation between wind power generation in Vanuatu and the stock price of National Grid (NGG) from 2010 to 2021 has certainly blown us away – pun intended. Our results align with previous research that has hinted at the intertwining of renewable energy dynamics and financial markets. This finding is a breath of fresh air for our understanding of the impact of sustainable energy on stock prices, and it "blows" previous misconceptions out of the window.

The positive relationship between wind power generation in Vanuatu and NGG stock prices sheds light on the potential influence of sustainable energy sources on financial dynamics. It's almost as if the winds of change are not just metaphorical, but tangible forces shaping the markets – who knew Mother Nature was also a savvy stock trader? It seems like the stock market is harnessing the power of renewable energy to fuel its own growth, reaping a "windfall" from this sustainable sector. This correlation highlights the importance of considering environmental and social factors in financial decision-making, emphasizing the need for a holistic approach to economic analysis. Our findings "blow away" any doubts about the relevance of renewable energy to market dynamics.

Our "windswept" results, illustrated in Fig. 1, depict a positively sloped scatterplot, affirming the robust correlation between wind power in Vanuatu and NGG stock prices. This visual representation provides a clear portrayal of the "breezy" connection we've uncovered, reaffirming the statistical significance of our findings. It's like the wind is guiding us toward a better understanding of the financial implications of sustainable energy – talk about a "tailwind" for sustainable investors.

In conclusion, our research contributes to the growing body of knowledge on the interaction between renewable energy and financial markets. It encourages us to set sail on the sea of renewable energy finance, harnessing the "gustworthy" potential of sustainable sources to drive not only environmental but also financial progress. As we navigate this new frontier, let's not shy away from acknowledging the influence of the wind in our economic endeavors. After all, as they say, "where there's a will, there's a wave."

And with that, as the saying goes, it's time to "wind" things up!

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between Wind power generated in Vanuatu and National Grid's stock price (NGG). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

Blowin' in the Wind: A Breezy Examination of the Relationship Between Wind Power in Vanuatu and National Grid's Stock Price

[[ABSTRACT]]

This paper presents a whimsical yet insightful exploration of the link between wind power generated in the idyllic South Pacific archipelago of Vanuatu and the stock price of National Grid (NGG). Utilizing data from the Energy Information Administration and LSEG Analytics (Refinitiv), our research team delved into this curious correlation. Our findings revealed a statistically significant correlation coefficient of 0.7565480 and p < 0.01 for the years 2010 to 2021.

As we sifted through the data, we couldn't help but "blow off" some steam and "vent" our excitement at the unexpected connection we uncovered. It's as if the wind whispered secrets about the stock market, much like a "zephyr" carrying tidings of financial fortune.

Our analysis provides valuable insights for investors and policymakers, shedding light on the impact of sustainable energy sources on the stock market. With our research, we hope to "turbine" the way for future studies in this field, "propelling" the understanding of renewable energy's influence on stock prices to new heights. And as any wind power aficionado would know, it's always a "breeze" to contribute to the advancement of knowledge in this area!

[[INTRDUCTION]]

Amidst the serene beauty of the South Pacific lies the captivating archipelago of Vanuatu, where the gentle "trade winds" rustle through verdant landscapes and power turbines, harnessing the natural energy of the wind. Meanwhile, in the world of finance, the stock price of National Grid (NGG) swirls and fluctuates like the unpredictable currents of the market. Little did we anticipate that these seemingly distinct realms would collide, much like a sudden gust of wind altering the course of an unsuspecting sailboat.

"Wind"ing our way through the labyrinth of financial markets and renewable energy, our research team embarked on a quest to uncover the elusive relationship between wind power in Vanuatu and the stock price of National Grid. As we set sail on this uncharted voyage, we approached the task with a sense of "aerodynamic" determination and a willingness to weather the storm of data analysis.

The conundrum we faced was as puzzling as a riddle whispered by the whimsical winds themselves: could the tranquility of Vanuatu’s wind farms hold the key to forecasting the undulating patterns of the stock market? The answer, it seemed, "blew in the wind" of statistical analysis, beckoning us to decode the cryptic language of correlation and causation.

As we delved into the data, we couldn’t help but marvel at the intricate dance between renewable energy and financial markets. This unexpected connection felt like stumbling upon a gale of insight amidst the tranquil breeze of research. It was in these moments of revelation that we realized – perhaps the stock market and wind power are more interconnected than we ever dared to "gustimate."

In this paper, we chart our expedition, from the windswept shores of Vanuatu to the bustling thoroughfares of the stock market. Through meticulous data analysis and statistical scrutiny, we unearthed a compelling correlation, as if the very essence of the wind had woven itself into the fabric of market dynamics.

As we present our findings, we invite readers to join us on this "zephyrous" escapade, wrapped in the intrigue of renewable energy influence on stock prices. So, hoist the "sail" of curiosity and embark on this spirited journey where the winds of discovery guide us through the uncharted seas of finance and sustainability.

[[RESULTS]]

The results of our analysis revealed a statistically significant correlation between wind power generated in Vanuatu and the stock price of National Grid (NGG) over the period of 2010 to 2021. The correlation coefficient was calculated to be 0.7565480, with an r-squared value of 0.5723648, and a p-value of less than 0.01. This suggests a moderately strong positive relationship between the two variables, indicating that as wind power generation in Vanuatu increased, the stock price of National Grid tended to exhibit a corresponding positive movement.

It seems that the winds of change carry more than just a refreshing breeze -- they also seem to influence the entwined dynamics of renewable energy and financial markets. It's like the stock market is taking a "windfall" from the sustainable energy sector, propelling NGG to new heights.

Fig. 1 depicts a scatterplot illustrating the robust correlation between wind power generation in Vanuatu and NGG stock prices. The data points are clustered in a positively sloped pattern, affirming the alignment between the variables and reinforcing the statistical significance of our findings.

This compelling connection between wind power in Vanuatu and NGG stock prices serves as a poignant reminder that in the world of finance, the winds of change can carry substantial implications. It's as if the wind is whispering secrets about the stock market, and we're here to listen, decode, and draw meaningful conclusions.

In conclusion, our research shines a light on the captivating interplay between sustainable energy sources and stock market performance. It beckons us to appreciate the intricate dance of market forces, renewable energy trends, and the impalpable influences that shape financial landscapes. As we engage in conversations about the future of energy and finance, let's not forget the underlying "breezy" connection that may hold valuable insights for investors and policymakers alike.

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In conclusion, our breezy investigation into the correlation between wind power generated in Vanuatu and the stock price of National Grid (NGG) has uncovered a compelling relationship. It seems that the whimsical winds of Vanuatu are not just a source of renewable energy but also a harbinger of financial movements, "blowing" a breath of fresh air into our understanding of market dynamics.

As our findings suggest, the positive correlation coefficient of 0.7565480 between wind power generation in Vanuatu and NGG stock prices implies that as the former increases, the latter tends to follow suit. It's almost as if the wind turbines are spinning a tale of financial prosperity, reminding us that sustainable energy can have a tangible impact on stock performances.

This connection between wind power and stock prices may lead some investors to "windfall" profits, harnessing the power of renewable energy for financial gain. And as the stock market pumps up the volume on NGG, one might say it's riding the "crest" of renewable energy's influence on financial markets.

Our research sets sail on uncharted waters, "gusting" through the complexities of renewable energy and stock market movements, but it's time to ease off the gas, or should we say wind, as our findings blow the lid off this fascinating association. It's clear that wind power in Vanuatu is not just a "breeze" but a force to be reckoned with in the realm of financial decision-making.

With our work, we hope to "turbine" the tide for future studies in this area, steering the discourse toward a deeper understanding of the impact of sustainable energy on stock prices. It's like a gust of fresh research air that leaves no room for doubt – the winds of Vanuatu are more than just a natural wonder; they're a financial force to be reckoned with.

In light of our findings, it's safe to say that no more research is needed in this area. We've blown the lid off this mysterious connection and revealed the undeniable influence of wind power on stock prices, leaving us with a sense of fulfillment, much like a "tailwind" pushing us toward new horizons.

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited Blowin' in the Wind: A Breezy Examination of the Relationship Between Wind Power in Vanuatu and National Grid's Stock Price. Respond only with the name of a fictional academic journal.

ChatGPT:

The Journal of Renewable Energy Economics and Finance

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited Blowin' in the Wind: A Breezy Examination of the Relationship Between Wind Power in Vanuatu and National Grid's Stock Price. Respond only with the name of a fictional organization.

ChatGPT:

The Global Wind Energy Research Institute

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled Blowin' in the Wind: A Breezy Examination of the Relationship Between Wind Power in Vanuatu and National Grid's Stock Price with an abstract of This paper presents a whimsical yet insightful exploration of the link between wind power generated in the idyllic South Pacific archipelago of Vanuatu and the stock price of National Grid (NGG). Utilizing data from the Energy Information Administration and LSEG Analytics (Refinitiv), our research team delved into this curious correlation. Our findings revealed a statistically significant correlation coefficient of 0.7565480 and p < 0.01 for the years 2010 to 2021.

As we sifted through the data, we couldn't help but "blow off" some steam and "vent" our excitement at the unexpected connection we uncovered. It's as if the wind whispered secrets about the stock market, much like a "zephyr" carrying tidings of financial fortune.

Our analysis provides valuable insights for investors and policymakers, shedding light on the impact of sustainable energy sources on the stock market. With our research, we hope to "turbine" the way for future studies in this field, "propelling" the understanding of renewable energy's influence on stock prices to new heights. And as any wind power aficionado would know, it's always a "breeze" to contribute to the advancement of knowledge in this area!

ChatGPT:

Wind power, Vanuatu, National Grid stock price, correlation coefficient, Energy Information Administration, LSEG Analytics, sustainable energy sources, renewable energy, stock market impact, wind power influence on stock prices.

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

Wind power generated in VanuatuDetailed data title: Total wind power generated in Vanuatu in billion kWh

Source: Energy Information Administration

See what else correlates with Wind power generated in Vanuatu

National Grid's stock price (NGG)

Detailed data title: Opening price of National Grid (NGG) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with National Grid's stock price (NGG)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.5723648 (Coefficient of determination)

This means 57.2% of the change in the one variable (i.e., National Grid's stock price (NGG)) is predictable based on the change in the other (i.e., Wind power generated in Vanuatu) over the 12 years from 2010 through 2021.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 0.0044. 0.0044001893416295010000000000

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.76 in 0.44% of random cases. Said differently, if you correlated 227 random variables Which I absolutely did.

with the same 11 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 11 because we have two variables measured over a period of 12 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.32, 0.93 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

| Wind power generated in Vanuatu (Billion kWh) | 0.005 | 0.004 | 0.005 | 0.006 | 0.007 | 0.008 | 0.0054 | 0.0048 | 0.0048 | 0.0048 | 0.0048 | 0.0048 |

| National Grid's stock price (NGG) (Stock price) | 59.99 | 48.49 | 53.35 | 63.14 | 70.65 | 76.47 | 75.08 | 63.39 | 58.81 | 48.28 | 62.7 | 60.32 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([0.005,0.004,0.005,0.006,0.007,0.008,0.0054,0.0048,0.0048,0.0048,0.0048,0.0048,])

array_2 = np.array([59.99,48.49,53.35,63.14,70.65,76.47,75.08,63.39,58.81,48.28,62.7,60.32,])

array_1_name = "Wind power generated in Vanuatu"

array_2_name = "National Grid's stock price (NGG)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only Wind power generated in Vanuatu

- Line chart for only National Grid's stock price (NGG)

- AI-generated correlation image

- The spurious research paper: Blowin' in the Wind: A Breezy Examination of the Relationship Between Wind Power in Vanuatu and National Grid's Stock Price

Your rating skills are legendary!

Correlation ID: 3046 · Black Variable ID: 24093 · Red Variable ID: 1742