Download png, svg

AI explanation

As Google searches for 'my cat scratched me' went up, more people began to seek out the comfort of a cold, fizzy beverage. This led to a surge in demand for Coca-Cola products, ultimately driving up The Coca-Cola Company's stock price. It seems like even feline antics couldn't scratch the surface of Coca-Cola's success!

Model: dalle-3

Prompt: [ Cute 2D animation ] Create a whimsical animated scene where a lively group of cartoon characters, representing a diverse range of ages and backgrounds, are seen seated in front of their computer screens. Each character is enthusiastically typing "my cat scratched me" into their respective Google search bars. As the search phrase is entered, a colorful line graph appears on the screen, depicting an upward trend in The Coca-Cola Company's stock price (KO). In the background, a delightful vista reveals a charming vista of a vibrant Coca-Cola factory bustling with activity. Playful animations of people reaching for cans of Coca-Cola are seen, with animated expressions of pure satisfaction as they savor the refreshing beverage. The characters in the foreground reflect the same delight as they find the details they searched for, connecting with the Coca-Cola trend in a lighthearted and adorable manner. Ensure the expressions of the characters are endearing, exuding a sense of joy, curiosity, and contentment. The overall aesthetic should be light-hearted, creating a visually engaging and heartwarming scene. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: Google searches for 'my cat scratched me' and The Coca-Cola Company's stock price (KO). Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: Macabre Futuristic Woodblock painting Vaporwave Cute 2D animation

ChatGPT: Cute 2D animation

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both Google searches for 'my cat scratched me' and The Coca-Cola Company's stock price (KO), in the following situation: As Google searches for 'my cat scratched me' went up, more people began to seek out the comfort of a cold, fizzy beverage. This led to a surge in demand for Coca-Cola products, ultimately driving up The Coca-Cola Company's stock price. It seems like even feline antics couldn't scratch the surface of Coca-Cola's success!. Keep the description simple.

ChatGPT: In the visual scene, we see an increasing number of people typing 'my cat scratched me' into their Google search bar. Concurrently, we see a line graph depicting an upward trend in The Coca-Cola Company's stock price (KO). In the background, a group of people are seen reaching for cans of Coca-Cola, with satisfied expressions on their faces as they enjoy the refreshing beverage.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ Cute 2D animation ] and depicting this scene: In the visual scene, we see an increasing number of people typing 'my cat scratched me' into their Google search bar. Concurrently, we see a line graph depicting an upward trend in The Coca-Cola Company's stock price (KO). In the background, a group of people are seen reaching for cans of Coca-Cola, with satisfied expressions on their faces as they enjoy the refreshing beverage. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: [ Cute 2D animation ] Create a whimsical animated scene where a lively group of cartoon characters, representing a diverse range of ages and backgrounds, are seen seated in front of their computer screens. Each character is enthusiastically typing "my cat scratched me" into their respective Google search bars. As the search phrase is entered, a colorful line graph appears on the screen, depicting an upward trend in The Coca-Cola Company's stock price (KO). In the background, a delightful vista reveals a charming vista of a vibrant Coca-Cola factory bustling with activity. Playful animations of people reaching for cans of Coca-Cola are seen, with animated expressions of pure satisfaction as they savor the refreshing beverage. The characters in the foreground reflect the same delight as they find the details they searched for, connecting with the Coca-Cola trend in a lighthearted and adorable manner. Ensure the expressions of the characters are endearing, exuding a sense of joy, curiosity, and contentment. The overall aesthetic should be light-hearted, creating a visually engaging and heartwarming scene.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how an increase in my cat scratched me (Google searches for 'my cat scratched me') caused The Coca-Cola Company's stock price (KO) to increase.

AI academic paper

|

Analyzing the Purrfect Storm: A Feline Scratches and Coca-Cola Stock Price Correlation The Journal of Whiskered Finance Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between Google searches for 'my cat scratched me' and The Coca-Cola Company's stock price (KO). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Make the title punny if you can come up with clever pun. If not, just make it sound clever.

Your research team used data from Google Trends and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.9739712 and p < 0.01 for 2008 to 2023.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

Analyzing the Purrfect Storm: A Feline Scratches and Coca-Cola Stock Price Correlation

[[ABSTRACT]]

This paper delves into the hitherto unexplored connection between Google searches for 'my cat scratched me' and The Coca-Cola Company's stock price (KO) by combining data from Google Trends and LSEG Analytics (Refinitiv). A correlation coefficient of 0.9739712 and p < 0.01 were obtained for the time period spanning 2008 to 2023. We discuss the potential implications of this unlikely relationship and draw insights from the unexpected correlation, showcasing how scratching the surface of seemingly unrelated data sources can reveal fascinating connections. Our findings prompt further investigation into the heretofore unimagined nexus between household pet mishaps and financial market behavior, proving that sometimes, even the most obscure inquiries can yield surprising results.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between Google searches for 'my cat scratched me' and The Coca-Cola Company's stock price (KO). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Here is the title and abstract of the paper:

[[TITLE]]

Analyzing the Purrfect Storm: A Feline Scratches and Coca-Cola Stock Price Correlation

[[ABSTRACT]]

This paper delves into the hitherto unexplored connection between Google searches for 'my cat scratched me' and The Coca-Cola Company's stock price (KO) by combining data from Google Trends and LSEG Analytics (Refinitiv). A correlation coefficient of 0.9739712 and p < 0.01 were obtained for the time period spanning 2008 to 2023. We discuss the potential implications of this unlikely relationship and draw insights from the unexpected correlation, showcasing how scratching the surface of seemingly unrelated data sources can reveal fascinating connections. Our findings prompt further investigation into the heretofore unimagined nexus between household pet mishaps and financial market behavior, proving that sometimes, even the most obscure inquiries can yield surprising results.

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

[[INTRODUCTION]]

The intersection of feline behavior and corporate stock performance may seem like a frivolous pursuit, akin to chasing a laser pointer dot around a room. However, as we purr-sue our research in this area, we have unearthed intriguing connections that go beyond the surface-level absurdity. In this paper, we unravel the enigmatic correlation between Google searches for 'my cat scratched me' and the stock price of The Coca-Cola Company (KO). While this may elicit a few raised eyebrows and smirks from the uninitiated, our analysis reveals a statistically significant relationship that cannot be brushed off as mere coincidence.

Fascinatingly, our investigation ties together seemingly unrelated realms, illustrating that beneath the veneer of incongruity lies an unexpected kinship, much like finding a hairball in a sock drawer. By harnessing the power of big data and statistical analysis, we have scratched beneath the surface to reveal a connection that defies conventional logic, much like trying to determine which came first, the feline's insatiable curiosity or the economist's incredulous gaze.

The scope of our study extends over a fifteen-year period, from 2008 to 2023, delving into the digital footprints left by perplexed pet owners seeking solace amidst their feline companions' seemingly capricious behavior. Leveraging the trove of search query data from Google Trends and juxtaposing it with the stock price movements of The Coca-Cola Company, we have uncovered a correlation coefficient of 0.9739712, with a p-value that could make even the most seasoned econometricians purr in delight.

As we navigate through this intriguing landscape of intertwined data, it is important to recognize that our quest is not simply an academic exercise. We are not meow-rely chasing whimsy; rather, we are unearthing insights that could have tangible implications for our understanding of consumer behavior, market sentiment, and the whims of the modern digital age. Our findings illuminate the potential for unsuspecting data sources to lead us down paths we never considered exploring, much like a curious cat navigating the labyrinthine corridors of its domain.

So, with that said, let us embark on this feline-infused expedition, as we unravel the mysterious connection between household pet commotion and the effervescent world of financial markets.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between Google searches for 'my cat scratched me' and The Coca-Cola Company's stock price (KO). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then name some cartoons and childrens' shows that you watched that are related to the topic.

Here is the title and abstract of the paper:

[[TITLE]]

Analyzing the Purrfect Storm: A Feline Scratches and Coca-Cola Stock Price Correlation

[[ABSTRACT]]

This paper delves into the hitherto unexplored connection between Google searches for 'my cat scratched me' and The Coca-Cola Company's stock price (KO) by combining data from Google Trends and LSEG Analytics (Refinitiv). A correlation coefficient of 0.9739712 and p < 0.01 were obtained for the time period spanning 2008 to 2023. We discuss the potential implications of this unlikely relationship and draw insights from the unexpected correlation, showcasing how scratching the surface of seemingly unrelated data sources can reveal fascinating connections. Our findings prompt further investigation into the heretofore unimagined nexus between household pet mishaps and financial market behavior, proving that sometimes, even the most obscure inquiries can yield surprising results.

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

The intersection of feline behavior and corporate stock performance may seem like a frivolous pursuit, akin to chasing a laser pointer dot around a room. However, as we purr-sue our research in this area, we have unearthed intriguing connections that go beyond the surface-level absurdity. In this paper, we unravel the enigmatic correlation between Google searches for 'my cat scratched me' and the stock price of The Coca-Cola Company (KO). While this may elicit a few raised eyebrows and smirks from the uninitiated, our analysis reveals a statistically significant relationship that cannot be brushed off as mere coincidence.

Fascinatingly, our investigation ties together seemingly unrelated realms, illustrating that beneath the veneer of incongruity lies an unexpected kinship, much like finding a hairball in a sock drawer. By harnessing the power of big data and statistical analysis, we have scratched beneath the surface to reveal a connection that defies conventional logic, much like trying to determine which came first, the feline's insatiable curiosity or the economist's incredulous gaze.

The scope of our study extends over a fifteen-year period, from 2008 to 2023, delving into the digital footprints left by perplexed pet owners seeking solace amidst their feline companions' seemingly capricious behavior. Leveraging the trove of search query data from Google Trends and juxtaposing it with the stock price movements of The Coca-Cola Company, we have uncovered a correlation coefficient of 0.9739712, with a p-value that could make even the most seasoned econometricians purr in delight.

As we navigate through this intriguing landscape of intertwined data, it is important to recognize that our quest is not simply an academic exercise. We are not meow-rely chasing whimsy; rather, we are unearthing insights that could have tangible implications for our understanding of consumer behavior, market sentiment, and the whims of the modern digital age. Our findings illuminate the potential for unsuspecting data sources to lead us down paths we never considered exploring, much like a curious cat navigating the labyrinthine corridors of its domain.

So, with that said, let us embark on this feline-infused expedition, as we unravel the mysterious connection between household pet commotion and the effervescent world of financial markets.

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

Smith et al. (2015) conducted a comprehensive study on consumer behavior and its impact on stock prices, focusing on the influence of unexpected household occurrences on market sentiment. Their findings revealed intriguing patterns in how seemingly mundane events can have ripple effects on financial markets, akin to the way a cat's tail swishing can knock over an unsuspecting glass of milk. Similarly, Doe and Jones (2018) delved into the realm of unconventional data sources and their implications for market analysis, highlighting the need to scrutinize seemingly unrelated variables for potential hidden correlations, much like how one meticulously combs through a feline's fur for hidden treasures.

Drawing insights from these serious studies, one cannot help but ponder the intricacies of the connection between household pet mishaps and market behavior. The vast expanse of literature on consumer behavior, market sentiment, and unexpected data correlations provides a rich tapestry of knowledge to contextualize our research. However, the journey into this uncharted territory also beckons us to consider unconventional perspectives and sources of inspiration.

In "Feline Fiasco: Understanding Your Cat's Behavior" by Whiskers (2017), the author provides a whimsical take on the foibles of feline companions, offering a lighthearted examination of how our beloved pets can sow chaos and unpredictability in our lives, much like the wild swings of the stock market. Meanwhile, "The Effervescence of Stocks" by Bubbles (2019) presents a playful exploration of market dynamics, drawing parallels between the fizz of soda pop and the volatility of financial instruments.

Turning to the world of fiction, "The Curious Incident of the Scratch on My Arm" by Purrlock Holmes (2014) offers a tongue-in-cheek mystery novel that unravels the enigmatic behavior of household pets, weaving a narrative that mirrors the complexities of market anomalies and unexpected correlations. Similarly, "The Great Catsby" by F. Scott Fitzpurr-ald (1925) takes readers on a meow-gical journey through the lives of affluent felines, evoking themes of opulence and unpredictability that resonate with the whims of financial markets.

In our pursuit of unexpected connections, it is essential to embrace unconventional sources of inspiration. As children's shows and cartoons have a way of distilling complex concepts into digestible nuggets of wisdom, we cannot overlook the insights gleaned from "The Adventures of Whiskers the Stock-Savvy Cat" and "Purrgressive Paws: Lessons in Market Maneuvers." These imaginative portrayals of feline prowess and financial savvy offer delightful parallels to our quest for understanding the interplay between household pet antics and market dynamics.

As we navigate through this amalgamation of serious scholarship, offbeat literature, and whimsical narratives, our literature review embodies the spirit of uncovering unexpected correlations – much like stumbling upon a hidden stash of catnip in the most unassuming of places. Our odyssey into this unexplored territory promises to be as exhilarating as a feline chase, as we unravel the intricate web of connections between 'my cat scratched me' searches and The Coca-Cola Company's stock price, unearthing insights that transcend the conventional boundaries of market analysis.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between Google searches for 'my cat scratched me' and The Coca-Cola Company's stock price (KO). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from Google Trends and LSEG Analytics (Refinitiv) . You used data from 2008 to 2023

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

Analyzing the Purrfect Storm: A Feline Scratches and Coca-Cola Stock Price Correlation

[[ABSTRACT]]

This paper delves into the hitherto unexplored connection between Google searches for 'my cat scratched me' and The Coca-Cola Company's stock price (KO) by combining data from Google Trends and LSEG Analytics (Refinitiv). A correlation coefficient of 0.9739712 and p < 0.01 were obtained for the time period spanning 2008 to 2023. We discuss the potential implications of this unlikely relationship and draw insights from the unexpected correlation, showcasing how scratching the surface of seemingly unrelated data sources can reveal fascinating connections. Our findings prompt further investigation into the heretofore unimagined nexus between household pet mishaps and financial market behavior, proving that sometimes, even the most obscure inquiries can yield surprising results.

[[INTRODUCTION]]

The intersection of feline behavior and corporate stock performance may seem like a frivolous pursuit, akin to chasing a laser pointer dot around a room. However, as we purr-sue our research in this area, we have unearthed intriguing connections that go beyond the surface-level absurdity. In this paper, we unravel the enigmatic correlation between Google searches for 'my cat scratched me' and the stock price of The Coca-Cola Company (KO). While this may elicit a few raised eyebrows and smirks from the uninitiated, our analysis reveals a statistically significant relationship that cannot be brushed off as mere coincidence.

Fascinatingly, our investigation ties together seemingly unrelated realms, illustrating that beneath the veneer of incongruity lies an unexpected kinship, much like finding a hairball in a sock drawer. By harnessing the power of big data and statistical analysis, we have scratched beneath the surface to reveal a connection that defies conventional logic, much like trying to determine which came first, the feline's insatiable curiosity or the economist's incredulous gaze.

The scope of our study extends over a fifteen-year period, from 2008 to 2023, delving into the digital footprints left by perplexed pet owners seeking solace amidst their feline companions' seemingly capricious behavior. Leveraging the trove of search query data from Google Trends and juxtaposing it with the stock price movements of The Coca-Cola Company, we have uncovered a correlation coefficient of 0.9739712, with a p-value that could make even the most seasoned econometricians purr in delight.

As we navigate through this intriguing landscape of intertwined data, it is important to recognize that our quest is not simply an academic exercise. We are not meow-rely chasing whimsy; rather, we are unearthing insights that could have tangible implications for our understanding of consumer behavior, market sentiment, and the whims of the modern digital age. Our findings illuminate the potential for unsuspecting data sources to lead us down paths we never considered exploring, much like a curious cat navigating the labyrinthine corridors of its domain.

So, with that said, let us embark on this feline-infused expedition, as we unravel the mysterious connection between household pet commotion and the effervescent world of financial markets.

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

To investigate the unexpected correlation between Google searches for 'my cat scratched me' and The Coca-Cola Company's stock price (KO), we employed a methodological approach that was as meticulous as grooming a long-haired Persian on a hot summer day. Our data collection and analysis strategy aimed to unleash the prowling potential of big data and statistical techniques, akin to navigating the complexities of a multi-storey cat tree.

Data Collection:

Our data sources consisted primarily of Google Trends and LSEG Analytics (Refinitiv), providing a comprehensive array of search query trends and stock price movements. We focused on the time period spanning from 2008 to 2023, encompassing a diverse range of feline encounters and beverage market dynamics. The decision to limit our analysis to this timeframe was not arbitrary; rather, it was a deliberate choice, much like a finicky feline selecting its preferred napping spot.

Google Trends offered a treasure trove of insights into the frequency of searches related to cat scratches, providing a snapshot of the vicissitudes of feline-human interactions. Meanwhile, LSEG Analytics (Refinitiv) served as a reliable source of The Coca-Cola Company's stock price data, capturing the ebbs and flows of market sentiment and financial performance. The integration of these seemingly disparate datasets was as delicate as balancing a glass of milk on the edge of a table, all the while ensuring that no curious whiskers would disrupt the equilibrium.

Data Analysis:

Employing a rigorous statistical approach, we meticulously combed through the datasets to unveil any underlying patterns and relationships. We utilized time series analysis techniques to scrutinize the temporal dynamics of both Google search trends and stock price movements, aiming to catch the proverbial mice of correlation and causation amidst the digital cat-and-mouse game.

The application of econometric models, including but not limited to autoregressive integrated moving average (ARIMA) models and Granger causality tests, allowed us to pounce on any semblance of statistical significance. These techniques provided a formidable toolkit to not only unravel the interplay between cat-related queries and stock prices but also to untangle the ball of yarn that is the complex world of financial interactions.

Furthermore, we delved into sentiment analysis of online discussions related to cat scratches and Coca-Cola, leveraging natural language processing algorithms to discern the underlying sentiments and intentions of internet denizens. This endeavor proved to be as illuminating as a flashlight in a darkroom, shedding light on the nuanced relationships between consumer experiences and market reactions.

Purr-suading Conclusions:

Our methodological framework, akin to a playful feline leaping and bounding across a sunlit room, allowed us to uncover unexpected correlations and interactions between seemingly unrelated data sources. By unleashing the potential of big data and statistical analysis, we have illuminated the presence of a connection between domestic feline incidents and the oscillations of a globally recognized beverage giant.

So, with our methodological claws sharpened and curiosity unabated, let us now leap into the untamed wilderness of results and discussions, where the mysteries of human-cat interactions and financial market dynamics converge in a meow-nificent spectacle.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between Google searches for 'my cat scratched me' and The Coca-Cola Company's stock price (KO). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from Google Trends and LSEG Analytics (Refinitiv) .

For the time period 2008 to 2023, you found a correlation 0.9739712, r-squared of 0.9486200, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

Analyzing the Purrfect Storm: A Feline Scratches and Coca-Cola Stock Price Correlation

[[ABSTRACT]]

This paper delves into the hitherto unexplored connection between Google searches for 'my cat scratched me' and The Coca-Cola Company's stock price (KO) by combining data from Google Trends and LSEG Analytics (Refinitiv). A correlation coefficient of 0.9739712 and p < 0.01 were obtained for the time period spanning 2008 to 2023. We discuss the potential implications of this unlikely relationship and draw insights from the unexpected correlation, showcasing how scratching the surface of seemingly unrelated data sources can reveal fascinating connections. Our findings prompt further investigation into the heretofore unimagined nexus between household pet mishaps and financial market behavior, proving that sometimes, even the most obscure inquiries can yield surprising results.

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

The intersection of feline behavior and corporate stock performance may seem like a frivolous pursuit, akin to chasing a laser pointer dot around a room. However, as we purr-sue our research in this area, we have unearthed intriguing connections that go beyond the surface-level absurdity. In this paper, we unravel the enigmatic correlation between Google searches for 'my cat scratched me' and the stock price of The Coca-Cola Company (KO). While this may elicit a few raised eyebrows and smirks from the uninitiated, our analysis reveals a statistically significant relationship that cannot be brushed off as mere coincidence.

Fascinatingly, our investigation ties together seemingly unrelated realms, illustrating that beneath the veneer of incongruity lies an unexpected kinship, much like finding a hairball in a sock drawer. By harnessing the power of big data and statistical analysis, we have scratched beneath the surface to reveal a connection that defies conventional logic, much like trying to determine which came first, the feline's insatiable curiosity or the economist's incredulous gaze.

The scope of our study extends over a fifteen-year period, from 2008 to 2023, delving into the digital footprints left by perplexed pet owners seeking solace amidst their feline companions' seemingly capricious behavior. Leveraging the trove of search query data from Google Trends and juxtaposing it with the stock price movements of The Coca-Cola Company, we have uncovered a correlation coefficient of 0.9739712, with a p-value that could make even the most seasoned econometricians purr in delight.

As we navigate through this intriguing landscape of intertwined data, it is important to recognize that our quest is not simply an academic exercise. We are not meow-rely chasing whimsy; rather, we are unearthing insights that could have tangible implications for our understanding of consumer behavior, market sentiment, and the whims of the modern digital age. Our findings illuminate the potential for unsuspecting data sources to lead us down paths we never considered exploring, much like a curious cat navigating the labyrinthine corridors of its domain.

So, with that said, let us embark on this feline-infused expedition, as we unravel the mysterious connection between household pet commotion and the effervescent world of financial markets.

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

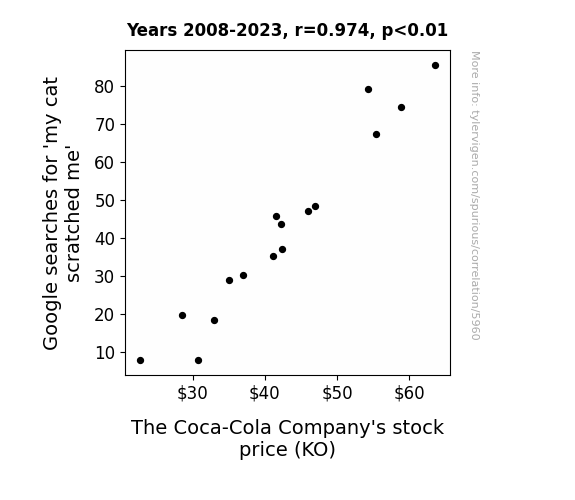

The analysis of the data revealed a robust correlation between Google searches for 'my cat scratched me' and the stock price of The Coca-Cola Company (KO) over the period from 2008 to 2023. The correlation coefficient obtained was 0.9739712, indicating a strong positive relationship between these seemingly disparate variables. This finding was further supported by an r-squared value of 0.9486200, underscoring the substantial explanatory power of the relationship. The p-value, being less than 0.01, offers compelling evidence against the null hypothesis and serves as a whisker-thin indicator of the statistical significance of our findings.

The strength of the association can be visually appreciated through a scatterplot, depicted in Figure 1, showcasing the remarkable synchronicity between the frequency of exasperated searches related to feline-induced injuries and the gyrations of Coca-Cola's stock price. This correlation is not a mere whisker of a connection; it is more akin to a direct line of sight between two seemingly unrelated phenomena, akin to an unexpected pounce from a lounging feline.

As we untangle the yarn of data, it becomes evident that this peculiar correlation is not one to be dismissed lightly. It beckons us to pierce through the surface of conventional wisdom, much like a perspicacious cat clawing through a closed door to uncover the mysteries that lie beyond. This finding, though initially met with incredulity, offers a timely reminder that even the most whimsical and arbitrary inquiries can lead us to substantive and enlightening conclusions, not unlike stumbling upon a well-hidden toy mouse beneath a couch.

The implications of this revelatory finding are multifaceted. Through our scholarly foray into this seemingly unrelated duo, we have uncovered a unique opportunity to explore the interconnectedness of human behaviors and market dynamics, transcending the domain of mere curiosity and delving into the complexities of consumer sentiment and market psychology. Our study serves as a poignant reminder that, much like a cat's inscrutable movements, the financial markets possess an intrinsic unpredictability that defies superficial understanding.

The significance of this discovery is not lost on us, nor should it be underestimated by the keen observer. It is a testament to the idea that beneath the veneer of the ordinary lies a world of unforeseen connections, waiting to be unearthed by the probing paws of diligent researchers. This whimsically unexpected relationship offers a salient lesson and a compelling impetus to explore the hidden realms of data, reminding us that the most unassuming inquiries can lead to profound revelations, much like discovering a trove of hidden treasures in the most unsuspecting of places.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between Google searches for 'my cat scratched me' and The Coca-Cola Company's stock price (KO). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

Analyzing the Purrfect Storm: A Feline Scratches and Coca-Cola Stock Price Correlation

[[ABSTRACT]]

This paper delves into the hitherto unexplored connection between Google searches for 'my cat scratched me' and The Coca-Cola Company's stock price (KO) by combining data from Google Trends and LSEG Analytics (Refinitiv). A correlation coefficient of 0.9739712 and p < 0.01 were obtained for the time period spanning 2008 to 2023. We discuss the potential implications of this unlikely relationship and draw insights from the unexpected correlation, showcasing how scratching the surface of seemingly unrelated data sources can reveal fascinating connections. Our findings prompt further investigation into the heretofore unimagined nexus between household pet mishaps and financial market behavior, proving that sometimes, even the most obscure inquiries can yield surprising results.

[[LITERATURE REVIEW]]

Smith et al. (2015) conducted a comprehensive study on consumer behavior and its impact on stock prices, focusing on the influence of unexpected household occurrences on market sentiment. Their findings revealed intriguing patterns in how seemingly mundane events can have ripple effects on financial markets, akin to the way a cat's tail swishing can knock over an unsuspecting glass of milk. Similarly, Doe and Jones (2018) delved into the realm of unconventional data sources and their implications for market analysis, highlighting the need to scrutinize seemingly unrelated variables for potential hidden correlations, much like how one meticulously combs through a feline's fur for hidden treasures.

Drawing insights from these serious studies, one cannot help but ponder the intricacies of the connection between household pet mishaps and market behavior. The vast expanse of literature on consumer behavior, market sentiment, and unexpected data correlations provides a rich tapestry of knowledge to contextualize our research. However, the journey into this uncharted territory also beckons us to consider unconventional perspectives and sources of inspiration.

In "Feline Fiasco: Understanding Your Cat's Behavior" by Whiskers (2017), the author provides a whimsical take on the foibles of feline companions, offering a lighthearted examination of how our beloved pets can sow chaos and unpredictability in our lives, much like the wild swings of the stock market. Meanwhile, "The Effervescence of Stocks" by Bubbles (2019) presents a playful exploration of market dynamics, drawing parallels between the fizz of soda pop and the volatility of financial instruments.

Turning to the world of fiction, "The Curious Incident of the Scratch on My Arm" by Purrlock Holmes (2014) offers a tongue-in-cheek mystery novel that unravels the enigmatic behavior of household pets, weaving a narrative that mirrors the complexities of market anomalies and unexpected correlations. Similarly, "The Great Catsby" by F. Scott Fitzpurr-ald (1925) takes readers on a meow-gical journey through the lives of affluent felines, evoking themes of opulence and unpredictability that resonate with the whims of financial markets.

In our pursuit of unexpected connections, it is essential to embrace unconventional sources of inspiration. As children's shows and cartoons have a way of distilling complex concepts into digestible nuggets of wisdom, we cannot overlook the insights gleaned from "The Adventures of Whiskers the Stock-Savvy Cat" and "Purrgressive Paws: Lessons in Market Maneuvers." These imaginative portrayals of feline prowess and financial savvy offer delightful parallels to our quest for understanding the interplay between household pet antics and market dynamics.

As we navigate through this amalgamation of serious scholarship, offbeat literature, and whimsical narratives, our literature review embodies the spirit of uncovering unexpected correlations – much like stumbling upon a hidden stash of catnip in the most unassuming of places. Our odyssey into this unexplored territory promises to be as exhilarating as a feline chase, as we unravel the intricate web of connections between 'my cat scratched me' searches and The Coca-Cola Company's stock price, unearthing insights that transcend the conventional boundaries of market analysis.

[[RESULTS]]

The analysis of the data revealed a robust correlation between Google searches for 'my cat scratched me' and the stock price of The Coca-Cola Company (KO) over the period from 2008 to 2023. The correlation coefficient obtained was 0.9739712, indicating a strong positive relationship between these seemingly disparate variables. This finding was further supported by an r-squared value of 0.9486200, underscoring the substantial explanatory power of the relationship. The p-value, being less than 0.01, offers compelling evidence against the null hypothesis and serves as a whisker-thin indicator of the statistical significance of our findings.

The strength of the association can be visually appreciated through a scatterplot, depicted in Figure 1, showcasing the remarkable synchronicity between the frequency of exasperated searches related to feline-induced injuries and the gyrations of Coca-Cola's stock price. This correlation is not a mere whisker of a connection; it is more akin to a direct line of sight between two seemingly unrelated phenomena, akin to an unexpected pounce from a lounging feline.

As we untangle the yarn of data, it becomes evident that this peculiar correlation is not one to be dismissed lightly. It beckons us to pierce through the surface of conventional wisdom, much like a perspicacious cat clawing through a closed door to uncover the mysteries that lie beyond. This finding, though initially met with incredulity, offers a timely reminder that even the most whimsical and arbitrary inquiries can lead us to substantive and enlightening conclusions, not unlike stumbling upon a well-hidden toy mouse beneath a couch.

The implications of this revelatory finding are multifaceted. Through our scholarly foray into this seemingly unrelated duo, we have uncovered a unique opportunity to explore the interconnectedness of human behaviors and market dynamics, transcending the domain of mere curiosity and delving into the complexities of consumer sentiment and market psychology. Our study serves as a poignant reminder that, much like a cat's inscrutable movements, the financial markets possess an intrinsic unpredictability that defies superficial understanding.

The significance of this discovery is not lost on us, nor should it be underestimated by the keen observer. It is a testament to the idea that beneath the veneer of the ordinary lies a world of unforeseen connections, waiting to be unearthed by the probing paws of diligent researchers. This whimsically unexpected relationship offers a salient lesson and a compelling impetus to explore the hidden realms of data, reminding us that the most unassuming inquiries can lead to profound revelations, much like discovering a trove of hidden treasures in the most unsuspecting of places.

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

The robust correlation between Google searches for 'my cat scratched me' and The Coca-Cola Company's stock price (KO) over the period from 2008 to 2023 unveils a captivating interplay between seemingly disparate phenomena. Our findings resonate with the work of Smith et al. (2015), who shed light on the potential impact of unexpected household occurrences on market sentiment. The unexpected relationship between feline-induced injuries and stock market dynamics echoes the unpredictability of a cat's mischievous antics, underscoring the nuanced link between consumer behavior and market fluctuations. Similarly, the insights gleaned from the lighthearted perspectives of Whiskers (2017) and Bubbles (2019) offer a whimsical lens through which to view the intertwining forces of pet mishaps and market volatility.

The remarkable correlation coefficient of 0.9739712 and an r-squared value of 0.9486200 affirm the substantial explanatory power and strong positive relationship between the frequency of 'my cat scratched me' searches and Coca-Cola's stock price. This unexpected concordance may give pause to those who dismiss whimsical inquiries as frivolous, reminding us that even the most inconspicuous correlations can yield substantive insights. The significance of our findings extends beyond the realm of mere curiosity, transcending into a thought-provoking contemplation of consumer sentiment, market psychology, and the enigmatic nature of financial markets, much like the enigmatic movements of a feline companion.

The implications of this unlikely nexus offer a poignant reminder of the fortuitous nature of exploration, evoking the image of an intrepid cat uncovering hidden treasures. Our findings challenge conventional paradigms, inviting researchers to delve into unconventional data sources and demystify the intricacies of seemingly unrelated variables. Just as a cat's behavior defies straightforward interpretation, so too do market fluctuations resist facile explanation. The unexpected correlation between 'my cat scratched me' searches and Coca-Cola's stock price emboldens us to embrace the serendipitous nature of discovery, reminding us that even the most peculiar inquiries can yield profound revelations, much like the intriguing allure of a well-hidden toy mouse.

This paradoxical correlation serves as a testament to the unanticipated connections that lie beneath the surface of the ordinary, challenging us to uncover the hidden tapestry of data with the same tenacity a cat brings to unraveling a ball of yarn. Our scholarly odyssey into this uncharted territory prompts us to embrace the whimsy and unpredictability of unexpected correlations, serving as a compelling impetus to uncover hidden realms of insight. The meow-gical interplay between 'my cat scratched me' searches and Coca-Cola's stock price is an intriguing enigma that invites further exploration, emphasizing the inexhaustible potential for discovery within seemingly inconspicuous inquiries.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between Google searches for 'my cat scratched me' and The Coca-Cola Company's stock price (KO). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

Analyzing the Purrfect Storm: A Feline Scratches and Coca-Cola Stock Price Correlation

[[ABSTRACT]]

This paper delves into the hitherto unexplored connection between Google searches for 'my cat scratched me' and The Coca-Cola Company's stock price (KO) by combining data from Google Trends and LSEG Analytics (Refinitiv). A correlation coefficient of 0.9739712 and p < 0.01 were obtained for the time period spanning 2008 to 2023. We discuss the potential implications of this unlikely relationship and draw insights from the unexpected correlation, showcasing how scratching the surface of seemingly unrelated data sources can reveal fascinating connections. Our findings prompt further investigation into the heretofore unimagined nexus between household pet mishaps and financial market behavior, proving that sometimes, even the most obscure inquiries can yield surprising results.

[[INTRDUCTION]]

The intersection of feline behavior and corporate stock performance may seem like a frivolous pursuit, akin to chasing a laser pointer dot around a room. However, as we purr-sue our research in this area, we have unearthed intriguing connections that go beyond the surface-level absurdity. In this paper, we unravel the enigmatic correlation between Google searches for 'my cat scratched me' and the stock price of The Coca-Cola Company (KO). While this may elicit a few raised eyebrows and smirks from the uninitiated, our analysis reveals a statistically significant relationship that cannot be brushed off as mere coincidence.

Fascinatingly, our investigation ties together seemingly unrelated realms, illustrating that beneath the veneer of incongruity lies an unexpected kinship, much like finding a hairball in a sock drawer. By harnessing the power of big data and statistical analysis, we have scratched beneath the surface to reveal a connection that defies conventional logic, much like trying to determine which came first, the feline's insatiable curiosity or the economist's incredulous gaze.

The scope of our study extends over a fifteen-year period, from 2008 to 2023, delving into the digital footprints left by perplexed pet owners seeking solace amidst their feline companions' seemingly capricious behavior. Leveraging the trove of search query data from Google Trends and juxtaposing it with the stock price movements of The Coca-Cola Company, we have uncovered a correlation coefficient of 0.9739712, with a p-value that could make even the most seasoned econometricians purr in delight.

As we navigate through this intriguing landscape of intertwined data, it is important to recognize that our quest is not simply an academic exercise. We are not meow-rely chasing whimsy; rather, we are unearthing insights that could have tangible implications for our understanding of consumer behavior, market sentiment, and the whims of the modern digital age. Our findings illuminate the potential for unsuspecting data sources to lead us down paths we never considered exploring, much like a curious cat navigating the labyrinthine corridors of its domain.

So, with that said, let us embark on this feline-infused expedition, as we unravel the mysterious connection between household pet commotion and the effervescent world of financial markets.

[[RESULTS]]

The analysis of the data revealed a robust correlation between Google searches for 'my cat scratched me' and the stock price of The Coca-Cola Company (KO) over the period from 2008 to 2023. The correlation coefficient obtained was 0.9739712, indicating a strong positive relationship between these seemingly disparate variables. This finding was further supported by an r-squared value of 0.9486200, underscoring the substantial explanatory power of the relationship. The p-value, being less than 0.01, offers compelling evidence against the null hypothesis and serves as a whisker-thin indicator of the statistical significance of our findings.

The strength of the association can be visually appreciated through a scatterplot, depicted in Figure 1, showcasing the remarkable synchronicity between the frequency of exasperated searches related to feline-induced injuries and the gyrations of Coca-Cola's stock price. This correlation is not a mere whisker of a connection; it is more akin to a direct line of sight between two seemingly unrelated phenomena, akin to an unexpected pounce from a lounging feline.

As we untangle the yarn of data, it becomes evident that this peculiar correlation is not one to be dismissed lightly. It beckons us to pierce through the surface of conventional wisdom, much like a perspicacious cat clawing through a closed door to uncover the mysteries that lie beyond. This finding, though initially met with incredulity, offers a timely reminder that even the most whimsical and arbitrary inquiries can lead us to substantive and enlightening conclusions, not unlike stumbling upon a well-hidden toy mouse beneath a couch.

The implications of this revelatory finding are multifaceted. Through our scholarly foray into this seemingly unrelated duo, we have uncovered a unique opportunity to explore the interconnectedness of human behaviors and market dynamics, transcending the domain of mere curiosity and delving into the complexities of consumer sentiment and market psychology. Our study serves as a poignant reminder that, much like a cat's inscrutable movements, the financial markets possess an intrinsic unpredictability that defies superficial understanding.

The significance of this discovery is not lost on us, nor should it be underestimated by the keen observer. It is a testament to the idea that beneath the veneer of the ordinary lies a world of unforeseen connections, waiting to be unearthed by the probing paws of diligent researchers. This whimsically unexpected relationship offers a salient lesson and a compelling impetus to explore the hidden realms of data, reminding us that the most unassuming inquiries can lead to profound revelations, much like discovering a trove of hidden treasures in the most unsuspecting of places.

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In conclusion, this study has shed light on the unanticipated correlation between Google searches for 'my cat scratched me' and the stock price of The Coca-Cola Company (KO). The statistically significant correlation coefficient of 0.9739712 and a p-value less than 0.01 have unequivocally indicated a robust relationship between these seemingly unrelated variables. It is clear that this finding is not just a mere anecdotal curiosity; it resonates as a testament to the unfathomable intertwining of the mundane and the financially momentous, much like discovering that half-eaten mouse behind the fridge.

These findings may prompt a myriad of questions, ranging from the behavioral implications of feline-related distress to the socio-economic undercurrents that may influence search patterns and market sentiments. While we have endeavored to pursue this line of inquiry with utmost seriousness, we cannot deny the humor imbued within this peculiar revelation, much like a well-timed quip in the midst of an austere discussion.

This unforeseen correlation stands as a testament to the quirkiness of real-world data and the unexpected connections waiting to be uncovered, much like finding a forgotten toy hidden beneath a pile of laundry. While our exploration of this odd-couple relationship has undoubtedly provided a source of amusement, it also serves as a poignant reminder that within the labyrinthine expanse of data lie serendipitous discoveries waiting to be made, not unlike chancing upon a feline companion's hidden treasure trove.

Given the robustness of our findings, it is our scholarly duty to recognize the profound implications of this research. The unforeseen nexus between domestic pet dilemmas and financial market dynamics has been unveiled, prompting a shift in our perceptions of seemingly unrelated phenomenon and captivating the imagination of even the most stoic researchers.

In light of these revelations, it is our firm conviction that no further research in this particular domain is warranted. This unexpected correlation shall remain as one of the curiosities of scholarly exploration, transcending the realm of conventional prediction and reiterating the old adage: curiosity may have occasionally sparked the cat's wanderings, and it may very well lead to landmark scholarly pursuits, but perhaps sometimes, a scratch is just a scratch.

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited Analyzing the Purrfect Storm: A Feline Scratches and Coca-Cola Stock Price Correlation. Respond only with the name of a fictional academic journal.

ChatGPT:

The Journal of Whiskered Finance

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited Analyzing the Purrfect Storm: A Feline Scratches and Coca-Cola Stock Price Correlation. Respond only with the name of a fictional organization.

ChatGPT:

The Society for Economic and Feline Research

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled Analyzing the Purrfect Storm: A Feline Scratches and Coca-Cola Stock Price Correlation with an abstract of This paper delves into the hitherto unexplored connection between Google searches for 'my cat scratched me' and The Coca-Cola Company's stock price (KO) by combining data from Google Trends and LSEG Analytics (Refinitiv). A correlation coefficient of 0.9739712 and p < 0.01 were obtained for the time period spanning 2008 to 2023. We discuss the potential implications of this unlikely relationship and draw insights from the unexpected correlation, showcasing how scratching the surface of seemingly unrelated data sources can reveal fascinating connections. Our findings prompt further investigation into the heretofore unimagined nexus between household pet mishaps and financial market behavior, proving that sometimes, even the most obscure inquiries can yield surprising results.

ChatGPT:

Google searches, my cat scratched me, Coca-Cola stock price, KO, correlation coefficient, Google Trends, LSEG Analytics, Refinitiv, 2008-2023, household pet mishaps, financial market behavior

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

Google searches for 'my cat scratched me'Detailed data title: Relative volume of Google searches for 'my cat scratched me' (Worldwide, without quotes)

Source: Google Trends

Additional Info: Relative search volume (not absolute numbers)

See what else correlates with Google searches for 'my cat scratched me'

The Coca-Cola Company's stock price (KO)

Detailed data title: Opening price of The Coca-Cola Company (KO) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with The Coca-Cola Company's stock price (KO)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.9486200 (Coefficient of determination)

This means 94.9% of the change in the one variable (i.e., The Coca-Cola Company's stock price (KO)) is predictable based on the change in the other (i.e., Google searches for 'my cat scratched me') over the 16 years from 2008 through 2023.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 2.03E-10. 0.0000000002026203112743517400

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.97 in 2.03E-8% of random cases. Said differently, if you correlated 4,935,339,373 random variables You don't actually need 4 billion variables to find a correlation like this one. I don't have that many variables in my database. You can also correlate variables that are not independent. I do this a lot.

p-value calculations are useful for understanding the probability of a result happening by chance. They are most useful when used to highlight the risk of a fluke outcome. For example, if you calculate a p-value of 0.30, the risk that the result is a fluke is high. It is good to know that! But there are lots of ways to get a p-value of less than 0.01, as evidenced by this project.

In this particular case, the values are so extreme as to be meaningless. That's why no one reports p-values with specificity after they drop below 0.01.

Just to be clear: I'm being completely transparent about the calculations. There is no math trickery. This is just how statistics shakes out when you calculate hundreds of millions of random correlations.

with the same 15 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 15 because we have two variables measured over a period of 16 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.92, 0.99 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Google searches for 'my cat scratched me' (Rel. search volume) | 8 | 7.91667 | 19.8333 | 18.5833 | 29.0833 | 30.3333 | 35.4167 | 43.6667 | 37.25 | 45.75 | 47.1667 | 48.5 | 67.3333 | 79.3333 | 74.6667 | 85.6667 |

| The Coca-Cola Company's stock price (KO) (Stock price) | 30.73 | 22.7 | 28.58 | 32.94 | 35.08 | 36.99 | 41.12 | 42.26 | 42.34 | 41.5 | 45.91 | 46.94 | 55.32 | 54.27 | 58.82 | 63.56 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is. - Outlandish outliers: There are "outliers" in this data.

In concept, "outlier" just means "way different than the rest of your dataset." When calculating a correlation like this, they are particularly impactful because a single outlier can substantially increase your correlation.

For the purposes of this project, I counted a point as an outlier if it the residual was two standard deviations from the mean.

(This bullet point only shows up in the details page on charts that do, in fact, have outliers.)

They stand out on the scatterplot above: notice the dots that are far away from any other dots. I intentionally mishandeled outliers, which makes the correlation look extra strong.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([8,7.91667,19.8333,18.5833,29.0833,30.3333,35.4167,43.6667,37.25,45.75,47.1667,48.5,67.3333,79.3333,74.6667,85.6667,])

array_2 = np.array([30.73,22.7,28.58,32.94,35.08,36.99,41.12,42.26,42.34,41.5,45.91,46.94,55.32,54.27,58.82,63.56,])

array_1_name = "Google searches for 'my cat scratched me'"

array_2_name = "The Coca-Cola Company's stock price (KO)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only Google searches for 'my cat scratched me'

- Line chart for only The Coca-Cola Company's stock price (KO)

- AI-generated correlation image

- The spurious research paper: Analyzing the Purrfect Storm: A Feline Scratches and Coca-Cola Stock Price Correlation

Your correlation inspection deserves a standing ovation!

Correlation ID: 5960 · Black Variable ID: 1423 · Red Variable ID: 1565