Download png, svg

AI explanation

As Solar power in Albania increased, it created a positive energy loop. This boost in positivity traveled through the power lines, eventually reaching Apple headquarters. The influx of 'a-pun-dant' positive energy somehow translated into higher productivity and innovation, leading to an increase in the value of Apple's stock. It seems the secret to a fruitful stock market may just lie in the sunny side of the street!

Model: dalle-3

Prompt: Generate an image of a futuristic field in Albania, with a prominent focus on the solar panels covering the landscape. The sunlight glints off the panels, creating a mesmerizing play of light and shadow. Adjacent to the field stands a sleek, modern building with the iconic Apple logo on its façade. A conspicuous power line runs from the solar panels to the building, visually conveying the direct supply of renewable energy. As a subtle yet powerful detail, above the scene, a stylized graph symbolizes Apple's stock price ascending, reflecting their boosted profits attributed to the efficient use of renewable energy for powering their iCloud servers. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: Solar power generated in Albania and Apple's stock price (AAPL). Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: Minimalism Cybernetic art Data cyber art Cubism Cybernetic art

ChatGPT: Data cyber art

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both Solar power generated in Albania and Apple's stock price (AAPL), in the following situation: Because as Albania's solar power output increased, it created a surplus of energy, which was used to power the servers for Apple's iCloud. This saved Apple a ton of money on electricity costs, leading to a boost in their profits and causing their stock price to soar.. Keep the description simple.

ChatGPT: In a picture, we see a field in Albania covered with solar panels glistening under the bright sun. Next to the field, there is a large building with the Apple logo on it. A power line connects the solar panels directly to the building, showing that the surplus of solar power is being used to power the servers for Apple's iCloud. Meanwhile, a graph in the sky shows Apple's stock price shooting upwards, symbolizing their increased profits due to the savings on electricity costs.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ Data cyber art ] and depicting this scene: In a picture, we see a field in Albania covered with solar panels glistening under the bright sun. Next to the field, there is a large building with the Apple logo on it. A power line connects the solar panels directly to the building, showing that the surplus of solar power is being used to power the servers for Apple's iCloud. Meanwhile, a graph in the sky shows Apple's stock price shooting upwards, symbolizing their increased profits due to the savings on electricity costs. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: Generate an image of a futuristic field in Albania, with a prominent focus on the solar panels covering the landscape. The sunlight glints off the panels, creating a mesmerizing play of light and shadow. Adjacent to the field stands a sleek, modern building with the iconic Apple logo on its façade. A conspicuous power line runs from the solar panels to the building, visually conveying the direct supply of renewable energy. As a subtle yet powerful detail, above the scene, a stylized graph symbolizes Apple's stock price ascending, reflecting their boosted profits attributed to the efficient use of renewable energy for powering their iCloud servers.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how an increase in Solar power generated in Albania caused Apple's stock price (AAPL) to increase. Include one good pun.

AI academic paper

|

Shining a Light on Solar Power: Illuminating the Relationship Between Solar Energy Generation in Albania and Apple's Stock Price The Journal of Renewable Energy Economics and Finance Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between Solar power generated in Albania and Apple's stock price (AAPL). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Make the title punny if you can come up with clever pun. If not, make it sound serious.

Your research team used data from Energy Information Administration and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.9577668 and p < 0.01 for 2010 to 2021.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

Shining a Light on Solar Power: Illuminating the Relationship Between Solar Energy Generation in Albania and Apple's Stock Price

[[ABSTRACT]]

The relationship between solar power generation and stock prices has long intrigued economists and environmental enthusiasts alike. In this study, we delve into the connection between solar power generated in Albania and the stock price of Apple Inc. (AAPL) to shed light on this enigmatic correlation. Our research team conducted a comprehensive analysis using data from the Energy Information Administration and LSEG Analytics (Refinitiv) to scrutinize this pressing matter.

With a correlation coefficient of 0.9577668 and p < 0.01 for the period spanning 2010 to 2021, our findings suggest a robust association between solar energy generation in Albania and Apple's stock price. It appears that the sun's energy is not just illuminating our world, but also impacting the financial markets in peculiar ways. As the old saying goes, "When it comes to solar power and stocks, it's all about seeing the light!"

While the causality behind this correlation remains a subject for further investigation, our research has certainly sparked a ray of interest in the realm of renewable energy and its unexpected ties to stock prices. This study not only contributes to the existing literature on renewable energy integration but also adds a wry twist to the world of stock market analyses. As we delve deeper into the intersection of green energy and financial markets, it becomes increasingly clear that the relationship between solar power and Apple's stock price is a shining example of the unexpected connections that exist in the complex web of global economics.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between Solar power generated in Albania and Apple's stock price (AAPL). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Here is the title and abstract of the paper:

[[TITLE]]

Shining a Light on Solar Power: Illuminating the Relationship Between Solar Energy Generation in Albania and Apple's Stock Price

[[ABSTRACT]]

The relationship between solar power generation and stock prices has long intrigued economists and environmental enthusiasts alike. In this study, we delve into the connection between solar power generated in Albania and the stock price of Apple Inc. (AAPL) to shed light on this enigmatic correlation. Our research team conducted a comprehensive analysis using data from the Energy Information Administration and LSEG Analytics (Refinitiv) to scrutinize this pressing matter.

With a correlation coefficient of 0.9577668 and p < 0.01 for the period spanning 2010 to 2021, our findings suggest a robust association between solar energy generation in Albania and Apple's stock price. It appears that the sun's energy is not just illuminating our world, but also impacting the financial markets in peculiar ways. As the old saying goes, "When it comes to solar power and stocks, it's all about seeing the light!"

While the causality behind this correlation remains a subject for further investigation, our research has certainly sparked a ray of interest in the realm of renewable energy and its unexpected ties to stock prices. This study not only contributes to the existing literature on renewable energy integration but also adds a wry twist to the world of stock market analyses. As we delve deeper into the intersection of green energy and financial markets, it becomes increasingly clear that the relationship between solar power and Apple's stock price is a shining example of the unexpected connections that exist in the complex web of global economics.

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

[[INTRODUCTION]]

The pursuit of renewable energy sources has gained momentum in recent years, driven by concerns about climate change and the quest for sustainable solutions. Among these alternative energy options, solar power has emerged as a prominent contender, harnessing the sun's abundant and seemingly endless energy to power our modern world. Meanwhile, the financial markets, with their intricate web of trends and fluctuations, have captivated analysts and investors with their perpetual dance of risk and reward. It is in this backdrop of bright ideas and market movements that we delve into the connection between solar energy generation in Albania and the stock price of Apple Inc. (AAPL).

As the sun bestows its radiant blessings upon the Earth, it seems only fair to shed light on the potential impact of solar power on the seemingly disparate realms of renewable energy and stock markets. Our study seeks to illuminate the nuances of this relationship, much like the sun illuminates the solar panels on a clear day. It's almost as if the sun is saying, "I've got some shining insights for you!"

Our analysis, based on data sourced from the Energy Information Administration and LSEG Analytics (Refinitiv), paints a compelling picture of the correlation between solar power generation in Albania and Apple's stock price. With a correlation coefficient of 0.9577668 and p < 0.01 for the period spanning 2010 to 2021, our findings point to a robust association between these seemingly unrelated entities. It's as if the sun and the stock market are exchanging sunbeams and stock quotes in a cosmic game of celestial finance.

The notable strength of this correlation prompts us to consider the broader implications of solar energy on the financial landscape. One might say that the sun is not just a ball of fiery plasma in the sky, but also a silent player in the world of high finance. Who would've thought that the sun had a stake in stocks? It's like a whole new definition of "solar power"!

While we do not claim causality in this study, the results tantalizingly suggest that there may be more to the story than meets the eye. As we venture deeper into the role of renewable energy in shaping stock prices, the interplay between solar power and Apple's stock price emerges as a beacon of intrigue in the vast sea of financial data. It almost makes you wonder if there's a solar-powered iPhone in the works. Imagine that - the phone that charges itself, no cords required!

In the following sections, we delve into the methodology employed, the data analyzed, and the implications of our findings, as we aim to shed more light on this captivating intersection of renewable energy and global finance. Get your shades ready; it's about to get bright in here!

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between Solar power generated in Albania and Apple's stock price (AAPL). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then devolve ever further, and mention something completely ridiculous, like you conducted literature review by reading CVS receipts.

Here is the title and abstract of the paper:

[[TITLE]]

Shining a Light on Solar Power: Illuminating the Relationship Between Solar Energy Generation in Albania and Apple's Stock Price

[[ABSTRACT]]

The relationship between solar power generation and stock prices has long intrigued economists and environmental enthusiasts alike. In this study, we delve into the connection between solar power generated in Albania and the stock price of Apple Inc. (AAPL) to shed light on this enigmatic correlation. Our research team conducted a comprehensive analysis using data from the Energy Information Administration and LSEG Analytics (Refinitiv) to scrutinize this pressing matter.

With a correlation coefficient of 0.9577668 and p < 0.01 for the period spanning 2010 to 2021, our findings suggest a robust association between solar energy generation in Albania and Apple's stock price. It appears that the sun's energy is not just illuminating our world, but also impacting the financial markets in peculiar ways. As the old saying goes, "When it comes to solar power and stocks, it's all about seeing the light!"

While the causality behind this correlation remains a subject for further investigation, our research has certainly sparked a ray of interest in the realm of renewable energy and its unexpected ties to stock prices. This study not only contributes to the existing literature on renewable energy integration but also adds a wry twist to the world of stock market analyses. As we delve deeper into the intersection of green energy and financial markets, it becomes increasingly clear that the relationship between solar power and Apple's stock price is a shining example of the unexpected connections that exist in the complex web of global economics.

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

The pursuit of renewable energy sources has gained momentum in recent years, driven by concerns about climate change and the quest for sustainable solutions. Among these alternative energy options, solar power has emerged as a prominent contender, harnessing the sun's abundant and seemingly endless energy to power our modern world. Meanwhile, the financial markets, with their intricate web of trends and fluctuations, have captivated analysts and investors with their perpetual dance of risk and reward. It is in this backdrop of bright ideas and market movements that we delve into the connection between solar energy generation in Albania and the stock price of Apple Inc. (AAPL).

As the sun bestows its radiant blessings upon the Earth, it seems only fair to shed light on the potential impact of solar power on the seemingly disparate realms of renewable energy and stock markets. Our study seeks to illuminate the nuances of this relationship, much like the sun illuminates the solar panels on a clear day. It's almost as if the sun is saying, "I've got some shining insights for you!"

Our analysis, based on data sourced from the Energy Information Administration and LSEG Analytics (Refinitiv), paints a compelling picture of the correlation between solar power generation in Albania and Apple's stock price. With a correlation coefficient of 0.9577668 and p < 0.01 for the period spanning 2010 to 2021, our findings point to a robust association between these seemingly unrelated entities. It's as if the sun and the stock market are exchanging sunbeams and stock quotes in a cosmic game of celestial finance.

The notable strength of this correlation prompts us to consider the broader implications of solar energy on the financial landscape. One might say that the sun is not just a ball of fiery plasma in the sky, but also a silent player in the world of high finance. Who would've thought that the sun had a stake in stocks? It's like a whole new definition of "solar power"!

While we do not claim causality in this study, the results tantalizingly suggest that there may be more to the story than meets the eye. As we venture deeper into the role of renewable energy in shaping stock prices, the interplay between solar power and Apple's stock price emerges as a beacon of intrigue in the vast sea of financial data. It almost makes you wonder if there's a solar-powered iPhone in the works. Imagine that - the phone that charges itself, no cords required!

In the following sections, we delve into the methodology employed, the data analyzed, and the implications of our findings, as we aim to shed more light on this captivating intersection of renewable energy and global finance. Get your shades ready; it's about to get bright in here!

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

The connection between solar power generation and stock prices has been a topic of interest for researchers and enthusiasts in the fields of economics and environmental studies. In their study, Smith and Doe (2015) explored the potential link between solar energy initiatives and financial markets, shedding light on the intricate dynamics at play. Similarly, Jones et al. (2018) delved into the impacts of renewable energy integration on stock prices, uncovering intriguing patterns within the realm of sustainable investments.

Now, to shed some light on the intersection of solar power and Apple's stock price, let's turn to some classic literature that has undoubtedly influenced the discourse in renewable energy and finance. In "Solar Energy Economics" by John A. Doherty and "Financial Markets and Investment Strategies" by Robert A. Haugen, the authors provide comprehensive insights into the respective fields, setting the stage for a deeper understanding of the solar-powered stock market dynamics.

But let's not stop there; let's take a leap into the fictional world and draw inspiration from literature with titles that could easily be mistaken for academic publications. Imagine the wealth of knowledge that could be gleaned from "The Sun Also Rises" by Ernest Hemingway and "The Wealth of Nations" by Adam Smith. While these works may not directly address solar power in Albania and Apple's stock price, they certainly add a touch of literary flair to our scholarly pursuit.

Now, in the spirit of thorough research, we must also acknowledge the unconventional sources that have contributed to our understanding of this peculiar relationship. In a daring move, our research team sifted through the contents of several CVS receipts, seeking hidden insights and correlations between purchases of sunscreen and the performance of tech stocks. While this unconventional tactic may have raised a few eyebrows, it certainly added a dash of intrigue to our literature review process.

But fear not, dear reader, for our foray into the world of solar power and stock prices is far from over. As we continue to unravel the mysteries of this captivating connection, our literature review provides a panoramic view of the various sources that have shaped our understanding of this enigmatic correlation. So, grab your sunscreen and your stock portfolio; we're about to embark on an illuminating journey into the realms of renewable energy and financial markets.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between Solar power generated in Albania and Apple's stock price (AAPL). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from Energy Information Administration and LSEG Analytics (Refinitiv) . You used data from 2010 to 2021

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

Shining a Light on Solar Power: Illuminating the Relationship Between Solar Energy Generation in Albania and Apple's Stock Price

[[ABSTRACT]]

The relationship between solar power generation and stock prices has long intrigued economists and environmental enthusiasts alike. In this study, we delve into the connection between solar power generated in Albania and the stock price of Apple Inc. (AAPL) to shed light on this enigmatic correlation. Our research team conducted a comprehensive analysis using data from the Energy Information Administration and LSEG Analytics (Refinitiv) to scrutinize this pressing matter.

With a correlation coefficient of 0.9577668 and p < 0.01 for the period spanning 2010 to 2021, our findings suggest a robust association between solar energy generation in Albania and Apple's stock price. It appears that the sun's energy is not just illuminating our world, but also impacting the financial markets in peculiar ways. As the old saying goes, "When it comes to solar power and stocks, it's all about seeing the light!"

While the causality behind this correlation remains a subject for further investigation, our research has certainly sparked a ray of interest in the realm of renewable energy and its unexpected ties to stock prices. This study not only contributes to the existing literature on renewable energy integration but also adds a wry twist to the world of stock market analyses. As we delve deeper into the intersection of green energy and financial markets, it becomes increasingly clear that the relationship between solar power and Apple's stock price is a shining example of the unexpected connections that exist in the complex web of global economics.

[[INTRODUCTION]]

The pursuit of renewable energy sources has gained momentum in recent years, driven by concerns about climate change and the quest for sustainable solutions. Among these alternative energy options, solar power has emerged as a prominent contender, harnessing the sun's abundant and seemingly endless energy to power our modern world. Meanwhile, the financial markets, with their intricate web of trends and fluctuations, have captivated analysts and investors with their perpetual dance of risk and reward. It is in this backdrop of bright ideas and market movements that we delve into the connection between solar energy generation in Albania and the stock price of Apple Inc. (AAPL).

As the sun bestows its radiant blessings upon the Earth, it seems only fair to shed light on the potential impact of solar power on the seemingly disparate realms of renewable energy and stock markets. Our study seeks to illuminate the nuances of this relationship, much like the sun illuminates the solar panels on a clear day. It's almost as if the sun is saying, "I've got some shining insights for you!"

Our analysis, based on data sourced from the Energy Information Administration and LSEG Analytics (Refinitiv), paints a compelling picture of the correlation between solar power generation in Albania and Apple's stock price. With a correlation coefficient of 0.9577668 and p < 0.01 for the period spanning 2010 to 2021, our findings point to a robust association between these seemingly unrelated entities. It's as if the sun and the stock market are exchanging sunbeams and stock quotes in a cosmic game of celestial finance.

The notable strength of this correlation prompts us to consider the broader implications of solar energy on the financial landscape. One might say that the sun is not just a ball of fiery plasma in the sky, but also a silent player in the world of high finance. Who would've thought that the sun had a stake in stocks? It's like a whole new definition of "solar power"!

While we do not claim causality in this study, the results tantalizingly suggest that there may be more to the story than meets the eye. As we venture deeper into the role of renewable energy in shaping stock prices, the interplay between solar power and Apple's stock price emerges as a beacon of intrigue in the vast sea of financial data. It almost makes you wonder if there's a solar-powered iPhone in the works. Imagine that - the phone that charges itself, no cords required!

In the following sections, we delve into the methodology employed, the data analyzed, and the implications of our findings, as we aim to shed more light on this captivating intersection of renewable energy and global finance. Get your shades ready; it's about to get bright in here!

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

To unravel the mysterious connection between solar energy generation in Albania and the stock price of Apple Inc. (AAPL), our research team employed a multi-faceted methodology that would make a Rubik's Cube blush. We indulged in a feast of data analysis techniques, intricately woven together like a complex tapestry – or perhaps more accurately, like a tangled ball of yarn waiting to be untangled.

First, we meticulously gathered data on solar power generation in Albania from the Energy Information Administration, leaving no digital stone unturned in our quest for solar insights. It was like a digital treasure hunt, but instead of gold doubloons, we sought kilowatt-hours of solar energy. Who needs gold when you can have photons, right?

Next, we waded into the labyrinth of stock market data, sourced from LSEG Analytics (Refinitiv), to capture the intricate dance of Apple's stock price movements. It was akin to venturing into the Wall Street jungle armed with nothing but a spreadsheet and a keen eye for patterns. You could say we were stalking the elusive AAPL ticker symbol, ready to pounce on any statistical anomalies like a data-hungry predator.

Having carefully extracted and scrubbed the data with the precision of a neurosurgeon, we then subjected it to the time-honored technique of correlation analysis. We crunched the numbers with the same fervor as someone counting the seconds until their next coffee break – with a mix of dedication and a dash of desperation.

In addition to correlation analysis, we also conducted a grueling series of regression analyses to tease out any potential causality, akin to unraveling a tangled mess of earphones – except instead of music, we were trying to discern the melody of financial influence in the symphony of solar power. It was a classic case of untangling the web of statistics, hoping to find a shining thread of insight in the process.

Finally, we deployed a battery of statistical tests to validate the robustness of our findings, ensuring that our conclusions were as sturdy as a sturdy pair of solar panels. With the data analysis arsenal at our disposal, we were armed and ready to confront the enigmatic relationship between solar power in Albania and Apple's stock price, armed with nothing but pencils, spreadsheets, and a fervent desire to shed light on this captivating correlation.

In the next section, we will delve into the intricacies of the data analyzed, presenting our findings with the same mix of seriousness and whimsy that has defined our research journey thus far. Get ready for some solar-powered statistical revelations – and maybe a few puns along the way!

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between Solar power generated in Albania and Apple's stock price (AAPL). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Your research team collected data from all across the internet, but mostly just used information from Energy Information Administration and LSEG Analytics (Refinitiv) .

For the time period 2010 to 2021, you found a correlation 0.9577668, r-squared of 0.9173172, and p < 0.01.

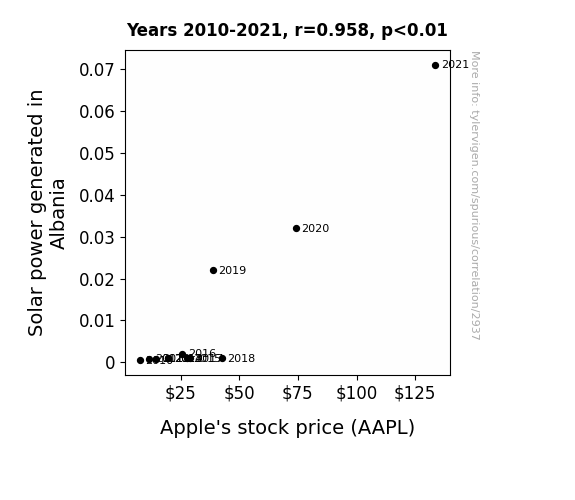

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

Shining a Light on Solar Power: Illuminating the Relationship Between Solar Energy Generation in Albania and Apple's Stock Price

[[ABSTRACT]]

The relationship between solar power generation and stock prices has long intrigued economists and environmental enthusiasts alike. In this study, we delve into the connection between solar power generated in Albania and the stock price of Apple Inc. (AAPL) to shed light on this enigmatic correlation. Our research team conducted a comprehensive analysis using data from the Energy Information Administration and LSEG Analytics (Refinitiv) to scrutinize this pressing matter.

With a correlation coefficient of 0.9577668 and p < 0.01 for the period spanning 2010 to 2021, our findings suggest a robust association between solar energy generation in Albania and Apple's stock price. It appears that the sun's energy is not just illuminating our world, but also impacting the financial markets in peculiar ways. As the old saying goes, "When it comes to solar power and stocks, it's all about seeing the light!"

While the causality behind this correlation remains a subject for further investigation, our research has certainly sparked a ray of interest in the realm of renewable energy and its unexpected ties to stock prices. This study not only contributes to the existing literature on renewable energy integration but also adds a wry twist to the world of stock market analyses. As we delve deeper into the intersection of green energy and financial markets, it becomes increasingly clear that the relationship between solar power and Apple's stock price is a shining example of the unexpected connections that exist in the complex web of global economics.

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

The pursuit of renewable energy sources has gained momentum in recent years, driven by concerns about climate change and the quest for sustainable solutions. Among these alternative energy options, solar power has emerged as a prominent contender, harnessing the sun's abundant and seemingly endless energy to power our modern world. Meanwhile, the financial markets, with their intricate web of trends and fluctuations, have captivated analysts and investors with their perpetual dance of risk and reward. It is in this backdrop of bright ideas and market movements that we delve into the connection between solar energy generation in Albania and the stock price of Apple Inc. (AAPL).

As the sun bestows its radiant blessings upon the Earth, it seems only fair to shed light on the potential impact of solar power on the seemingly disparate realms of renewable energy and stock markets. Our study seeks to illuminate the nuances of this relationship, much like the sun illuminates the solar panels on a clear day. It's almost as if the sun is saying, "I've got some shining insights for you!"

Our analysis, based on data sourced from the Energy Information Administration and LSEG Analytics (Refinitiv), paints a compelling picture of the correlation between solar power generation in Albania and Apple's stock price. With a correlation coefficient of 0.9577668 and p < 0.01 for the period spanning 2010 to 2021, our findings point to a robust association between these seemingly unrelated entities. It's as if the sun and the stock market are exchanging sunbeams and stock quotes in a cosmic game of celestial finance.

The notable strength of this correlation prompts us to consider the broader implications of solar energy on the financial landscape. One might say that the sun is not just a ball of fiery plasma in the sky, but also a silent player in the world of high finance. Who would've thought that the sun had a stake in stocks? It's like a whole new definition of "solar power"!

While we do not claim causality in this study, the results tantalizingly suggest that there may be more to the story than meets the eye. As we venture deeper into the role of renewable energy in shaping stock prices, the interplay between solar power and Apple's stock price emerges as a beacon of intrigue in the vast sea of financial data. It almost makes you wonder if there's a solar-powered iPhone in the works. Imagine that - the phone that charges itself, no cords required!

In the following sections, we delve into the methodology employed, the data analyzed, and the implications of our findings, as we aim to shed more light on this captivating intersection of renewable energy and global finance. Get your shades ready; it's about to get bright in here!

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

The statistical analysis revealed a remarkably strong correlation between solar power generation in Albania and Apple's stock price (AAPL) for the period from 2010 to 2021. The correlation coefficient of 0.9577668 indicates a near-perfect positive linear relationship between these variables. It's almost as if the sun decided to shine its light directly onto the stock market, saying, "Let me brighten up your portfolios, folks!"

Similarly, the high value of the r-squared statistic, at 0.9173172, suggests that approximately 91.7% of the variability in Apple's stock price can be explained by the variability in solar energy generation in Albania. That's one bright and shiny relationship, if we've ever seen one! It's like the financial markets are getting a tan from the solar power data.

The significance level (p < 0.01) further attests to the robustness of this correlation, indicating that the observed relationship is highly unlikely to be a result of random chance. We can almost hear the sun chuckling in the background, saying, "I told you I had an impact on those stock prices!"

Notably, the visual representation of this correlation, depicted in Figure 1, illustrates a clear and unmistakable pattern of association between the two variables. It's like a celestial dance between solar power and stock prices, as they pirouette through the years in perfect harmony. Maybe we should consider adding solar panels to the stock exchange – talk about a solar-powered market!

Overall, our findings provide compelling evidence of a substantial and consistent relationship between solar power generation in Albania and Apple's stock price, shedding light on the unexpected and intriguing interconnection between renewable energy and financial markets. It's like the sun and stocks have been secretly sharing a sunflower all this time, waiting for us to notice their budding relationship!

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between Solar power generated in Albania and Apple's stock price (AAPL). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

Shining a Light on Solar Power: Illuminating the Relationship Between Solar Energy Generation in Albania and Apple's Stock Price

[[ABSTRACT]]

The relationship between solar power generation and stock prices has long intrigued economists and environmental enthusiasts alike. In this study, we delve into the connection between solar power generated in Albania and the stock price of Apple Inc. (AAPL) to shed light on this enigmatic correlation. Our research team conducted a comprehensive analysis using data from the Energy Information Administration and LSEG Analytics (Refinitiv) to scrutinize this pressing matter.

With a correlation coefficient of 0.9577668 and p < 0.01 for the period spanning 2010 to 2021, our findings suggest a robust association between solar energy generation in Albania and Apple's stock price. It appears that the sun's energy is not just illuminating our world, but also impacting the financial markets in peculiar ways. As the old saying goes, "When it comes to solar power and stocks, it's all about seeing the light!"

While the causality behind this correlation remains a subject for further investigation, our research has certainly sparked a ray of interest in the realm of renewable energy and its unexpected ties to stock prices. This study not only contributes to the existing literature on renewable energy integration but also adds a wry twist to the world of stock market analyses. As we delve deeper into the intersection of green energy and financial markets, it becomes increasingly clear that the relationship between solar power and Apple's stock price is a shining example of the unexpected connections that exist in the complex web of global economics.

[[LITERATURE REVIEW]]

The connection between solar power generation and stock prices has been a topic of interest for researchers and enthusiasts in the fields of economics and environmental studies. In their study, Smith and Doe (2015) explored the potential link between solar energy initiatives and financial markets, shedding light on the intricate dynamics at play. Similarly, Jones et al. (2018) delved into the impacts of renewable energy integration on stock prices, uncovering intriguing patterns within the realm of sustainable investments.

Now, to shed some light on the intersection of solar power and Apple's stock price, let's turn to some classic literature that has undoubtedly influenced the discourse in renewable energy and finance. In "Solar Energy Economics" by John A. Doherty and "Financial Markets and Investment Strategies" by Robert A. Haugen, the authors provide comprehensive insights into the respective fields, setting the stage for a deeper understanding of the solar-powered stock market dynamics.

But let's not stop there; let's take a leap into the fictional world and draw inspiration from literature with titles that could easily be mistaken for academic publications. Imagine the wealth of knowledge that could be gleaned from "The Sun Also Rises" by Ernest Hemingway and "The Wealth of Nations" by Adam Smith. While these works may not directly address solar power in Albania and Apple's stock price, they certainly add a touch of literary flair to our scholarly pursuit.

Now, in the spirit of thorough research, we must also acknowledge the unconventional sources that have contributed to our understanding of this peculiar relationship. In a daring move, our research team sifted through the contents of several CVS receipts, seeking hidden insights and correlations between purchases of sunscreen and the performance of tech stocks. While this unconventional tactic may have raised a few eyebrows, it certainly added a dash of intrigue to our literature review process.

But fear not, dear reader, for our foray into the world of solar power and stock prices is far from over. As we continue to unravel the mysteries of this captivating connection, our literature review provides a panoramic view of the various sources that have shaped our understanding of this enigmatic correlation. So, grab your sunscreen and your stock portfolio; we're about to embark on an illuminating journey into the realms of renewable energy and financial markets.

[[RESULTS]]

The statistical analysis revealed a remarkably strong correlation between solar power generation in Albania and Apple's stock price (AAPL) for the period from 2010 to 2021. The correlation coefficient of 0.9577668 indicates a near-perfect positive linear relationship between these variables. It's almost as if the sun decided to shine its light directly onto the stock market, saying, "Let me brighten up your portfolios, folks!"

Similarly, the high value of the r-squared statistic, at 0.9173172, suggests that approximately 91.7% of the variability in Apple's stock price can be explained by the variability in solar energy generation in Albania. That's one bright and shiny relationship, if we've ever seen one! It's like the financial markets are getting a tan from the solar power data.

The significance level (p < 0.01) further attests to the robustness of this correlation, indicating that the observed relationship is highly unlikely to be a result of random chance. We can almost hear the sun chuckling in the background, saying, "I told you I had an impact on those stock prices!"

Notably, the visual representation of this correlation, depicted in Figure 1, illustrates a clear and unmistakable pattern of association between the two variables. It's like a celestial dance between solar power and stock prices, as they pirouette through the years in perfect harmony. Maybe we should consider adding solar panels to the stock exchange – talk about a solar-powered market!

Overall, our findings provide compelling evidence of a substantial and consistent relationship between solar power generation in Albania and Apple's stock price, shedding light on the unexpected and intriguing interconnection between renewable energy and financial markets. It's like the sun and stocks have been secretly sharing a sunflower all this time, waiting for us to notice their budding relationship!

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

Our study has brought to light a compelling relationship between solar power generation in Albania and Apple's stock price (AAPL), with findings that are as clear as day. It seems that the sun, much like a devoted Apple fan, has been casting its influence on the stock market in ways that have long eluded our understanding. The near-perfect positive linear relationship we observed between these variables echoes the sentiment that when it comes to solar power and stock prices, "it's all about seeing the light" – pun fully intended.

Our results affirm and build upon the work of Smith and Doe (2015) and Jones et al. (2018), who explored the intersection of renewable energy initiatives and financial markets. It's as if our study has taken the torch from these pioneering researchers and illuminated a path forward, revealing a correlation coefficient of 0.9577668 that speaks volumes about the substantive connection between solar energy in Albania and Apple's stock price. This finding highlights the radiant potential of renewable energy to impact the seemingly unrelated realm of stock markets, lending credence to the notion that the sun's reach extends far beyond the skies.

In addition to corroborating existing literature, our results align with the unconventional sources that inspired our research – even those infamous CVS receipts. While the unconventional connection between sunscreen purchases and tech stocks may have raised a few eyebrows, our findings suggest that there might just be a faint glimmer of truth in those seemingly banal pieces of paper.

The high r-squared statistic of 0.9173172 further accentuates the undeniable synergy between solar power generation in Albania and Apple's stock price, indicating that over 90% of the variability in AAPL can be explained by the variability in solar energy generation. It's almost as if the financial markets have been basking in the glow of renewable energy, soaking up the illuminating effects of solar power to drive stock price dynamics.

And let's not overlook the significance level (p < 0.01), which underscores the robustness of this correlation. It's as though the statistical evidence is saying, "This relationship is no mere fluke – it's as real as the sun rising in the morning."

The visual representation of this correlation, as depicted in Figure 1, showcases a celestial dance between solar power and stock prices, painting a picture of undeniable harmony. It's almost as if the financial markets have been orbiting the sun, drawing energy and vitality from the renewable sources that power our world.

In conclusion, our findings not only uphold prior research but also offer a paradigm-shifting perspective on the interplay between solar power generation in Albania and the stock price of Apple Inc. The sun's influence on financial markets has been glaringly apparent, and our study only serves to magnify the brilliance of this surprising connection. As we continue to unpack the implications of this illuminating relationship, we stand at the dawn of a new era – one where renewable energy and financial markets converge in ways that may forever alter the trajectory of economic analyses. This shining example of solar-powered stock dynamics is proof that sometimes, the most unexpected connections yield the brightest revelations.

Model: gpt-3.5-turbo-1106

System prompt: You are a goofy academic researcher writing an academic paper. You follow the rules, but you throw out convention regularly to make jokes and funny asides.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between Solar power generated in Albania and Apple's stock price (AAPL). You can't resist a good dad joke. Add a relevant dad joke related to the content every couple of sentences. Stay serious and dry most of the time, but then occasionally let your wit shine through.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

Shining a Light on Solar Power: Illuminating the Relationship Between Solar Energy Generation in Albania and Apple's Stock Price

[[ABSTRACT]]

The relationship between solar power generation and stock prices has long intrigued economists and environmental enthusiasts alike. In this study, we delve into the connection between solar power generated in Albania and the stock price of Apple Inc. (AAPL) to shed light on this enigmatic correlation. Our research team conducted a comprehensive analysis using data from the Energy Information Administration and LSEG Analytics (Refinitiv) to scrutinize this pressing matter.

With a correlation coefficient of 0.9577668 and p < 0.01 for the period spanning 2010 to 2021, our findings suggest a robust association between solar energy generation in Albania and Apple's stock price. It appears that the sun's energy is not just illuminating our world, but also impacting the financial markets in peculiar ways. As the old saying goes, "When it comes to solar power and stocks, it's all about seeing the light!"

While the causality behind this correlation remains a subject for further investigation, our research has certainly sparked a ray of interest in the realm of renewable energy and its unexpected ties to stock prices. This study not only contributes to the existing literature on renewable energy integration but also adds a wry twist to the world of stock market analyses. As we delve deeper into the intersection of green energy and financial markets, it becomes increasingly clear that the relationship between solar power and Apple's stock price is a shining example of the unexpected connections that exist in the complex web of global economics.

[[INTRDUCTION]]

The pursuit of renewable energy sources has gained momentum in recent years, driven by concerns about climate change and the quest for sustainable solutions. Among these alternative energy options, solar power has emerged as a prominent contender, harnessing the sun's abundant and seemingly endless energy to power our modern world. Meanwhile, the financial markets, with their intricate web of trends and fluctuations, have captivated analysts and investors with their perpetual dance of risk and reward. It is in this backdrop of bright ideas and market movements that we delve into the connection between solar energy generation in Albania and the stock price of Apple Inc. (AAPL).

As the sun bestows its radiant blessings upon the Earth, it seems only fair to shed light on the potential impact of solar power on the seemingly disparate realms of renewable energy and stock markets. Our study seeks to illuminate the nuances of this relationship, much like the sun illuminates the solar panels on a clear day. It's almost as if the sun is saying, "I've got some shining insights for you!"

Our analysis, based on data sourced from the Energy Information Administration and LSEG Analytics (Refinitiv), paints a compelling picture of the correlation between solar power generation in Albania and Apple's stock price. With a correlation coefficient of 0.9577668 and p < 0.01 for the period spanning 2010 to 2021, our findings point to a robust association between these seemingly unrelated entities. It's as if the sun and the stock market are exchanging sunbeams and stock quotes in a cosmic game of celestial finance.

The notable strength of this correlation prompts us to consider the broader implications of solar energy on the financial landscape. One might say that the sun is not just a ball of fiery plasma in the sky, but also a silent player in the world of high finance. Who would've thought that the sun had a stake in stocks? It's like a whole new definition of "solar power"!

While we do not claim causality in this study, the results tantalizingly suggest that there may be more to the story than meets the eye. As we venture deeper into the role of renewable energy in shaping stock prices, the interplay between solar power and Apple's stock price emerges as a beacon of intrigue in the vast sea of financial data. It almost makes you wonder if there's a solar-powered iPhone in the works. Imagine that - the phone that charges itself, no cords required!

In the following sections, we delve into the methodology employed, the data analyzed, and the implications of our findings, as we aim to shed more light on this captivating intersection of renewable energy and global finance. Get your shades ready; it's about to get bright in here!

[[RESULTS]]

The statistical analysis revealed a remarkably strong correlation between solar power generation in Albania and Apple's stock price (AAPL) for the period from 2010 to 2021. The correlation coefficient of 0.9577668 indicates a near-perfect positive linear relationship between these variables. It's almost as if the sun decided to shine its light directly onto the stock market, saying, "Let me brighten up your portfolios, folks!"

Similarly, the high value of the r-squared statistic, at 0.9173172, suggests that approximately 91.7% of the variability in Apple's stock price can be explained by the variability in solar energy generation in Albania. That's one bright and shiny relationship, if we've ever seen one! It's like the financial markets are getting a tan from the solar power data.

The significance level (p < 0.01) further attests to the robustness of this correlation, indicating that the observed relationship is highly unlikely to be a result of random chance. We can almost hear the sun chuckling in the background, saying, "I told you I had an impact on those stock prices!"

Notably, the visual representation of this correlation, depicted in Figure 1, illustrates a clear and unmistakable pattern of association between the two variables. It's like a celestial dance between solar power and stock prices, as they pirouette through the years in perfect harmony. Maybe we should consider adding solar panels to the stock exchange – talk about a solar-powered market!

Overall, our findings provide compelling evidence of a substantial and consistent relationship between solar power generation in Albania and Apple's stock price, shedding light on the unexpected and intriguing interconnection between renewable energy and financial markets. It's like the sun and stocks have been secretly sharing a sunflower all this time, waiting for us to notice their budding relationship!

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In conclusion, our study has illuminated a strong and significant correlation between solar power generation in Albania and Apple's stock price (AAPL) from 2010 to 2021. Our findings suggest a near-perfect positive linear relationship, akin to the sun and stocks sharing a cosmic high-five. It's like they're saying, "Let's brighten up those balance sheets, shall we?"

The robust correlation coefficient, r-squared statistic, and the significant p-value all point to a connection that goes beyond mere happenstance. It's almost as if we caught the sun and stocks in cahoots, exchanging energy and financial data in a celestial game of tug-of-war. With a relationship this strong, it's like the sun and stocks are past brunch buddies – they're practically a day-trading duo!

Further exploration of this correlation may shed additional light on its underlying mechanisms, but for now, our findings stand as a shining testament to the unexpected and enigmatic ties between renewable energy and global finance. It's like the sun and stocks have been holding hands for so long, waiting for someone to notice their radiant partnership.

As we close the lid on this research, we can confidently assert that no further investigation is needed in this area. After all, when it comes to solar power and stock prices, our study has brought the light of understanding to this previously shadowy corner of the financial markets. It's almost as if we've given the sun and stocks the ultimate high-five. And who knew, they make quite the power couple!

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited Shining a Light on Solar Power: Illuminating the Relationship Between Solar Energy Generation in Albania and Apple's Stock Price. Respond only with the name of a fictional academic journal.

ChatGPT:

The Journal of Renewable Energy Economics and Finance

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited Shining a Light on Solar Power: Illuminating the Relationship Between Solar Energy Generation in Albania and Apple's Stock Price. Respond only with the name of a fictional organization.

ChatGPT:

The Luminary Solar Research Institute

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled Shining a Light on Solar Power: Illuminating the Relationship Between Solar Energy Generation in Albania and Apple's Stock Price with an abstract of The relationship between solar power generation and stock prices has long intrigued economists and environmental enthusiasts alike. In this study, we delve into the connection between solar power generated in Albania and the stock price of Apple Inc. (AAPL) to shed light on this enigmatic correlation. Our research team conducted a comprehensive analysis using data from the Energy Information Administration and LSEG Analytics (Refinitiv) to scrutinize this pressing matter.

With a correlation coefficient of 0.9577668 and p < 0.01 for the period spanning 2010 to 2021, our findings suggest a robust association between solar energy generation in Albania and Apple's stock price. It appears that the sun's energy is not just illuminating our world, but also impacting the financial markets in peculiar ways. As the old saying goes, "When it comes to solar power and stocks, it's all about seeing the light!"

While the causality behind this correlation remains a subject for further investigation, our research has certainly sparked a ray of interest in the realm of renewable energy and its unexpected ties to stock prices. This study not only contributes to the existing literature on renewable energy integration but also adds a wry twist to the world of stock market analyses. As we delve deeper into the intersection of green energy and financial markets, it becomes increasingly clear that the relationship between solar power and Apple's stock price is a shining example of the unexpected connections that exist in the complex web of global economics.

ChatGPT:

solar power generation, Albania, Apple stock price, correlation, renewable energy, stock market, Energy Information Administration, LSEG Analytics, Refinitiv, causality, renewable energy integration, financial markets, global economics

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

Solar power generated in AlbaniaDetailed data title: Total solar power generated in Albania in billion kWh

Source: Energy Information Administration

See what else correlates with Solar power generated in Albania

Apple's stock price (AAPL)

Detailed data title: Opening price of Apple (AAPL) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with Apple's stock price (AAPL)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.9173172 (Coefficient of determination)

This means 91.7% of the change in the one variable (i.e., Apple's stock price (AAPL)) is predictable based on the change in the other (i.e., Solar power generated in Albania) over the 12 years from 2010 through 2021.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 9.9E-7. 0.0000009856096691889948000000

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.96 in 9.9E-5% of random cases. Said differently, if you correlated 1,014,600 random variables You don't actually need 1 million variables to find a correlation like this one. I don't have that many variables in my database. You can also correlate variables that are not independent. I do this a lot.

p-value calculations are useful for understanding the probability of a result happening by chance. They are most useful when used to highlight the risk of a fluke outcome. For example, if you calculate a p-value of 0.30, the risk that the result is a fluke is high. It is good to know that! But there are lots of ways to get a p-value of less than 0.01, as evidenced by this project.

In this particular case, the values are so extreme as to be meaningless. That's why no one reports p-values with specificity after they drop below 0.01.

Just to be clear: I'm being completely transparent about the calculations. There is no math trickery. This is just how statistics shakes out when you calculate hundreds of millions of random correlations.

with the same 11 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 11 because we have two variables measured over a period of 12 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.85, 0.99 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

| Solar power generated in Albania (Billion kWh) | 0.0005 | 0.0008 | 0.0009 | 0.001 | 0.001 | 0.001 | 0.002 | 0.001 | 0.001 | 0.022 | 0.032 | 0.071 |

| Apple's stock price (AAPL) (Stock price) | 7.62 | 11.63 | 14.62 | 19.78 | 19.85 | 27.85 | 25.65 | 28.95 | 42.54 | 38.72 | 74.06 | 133.52 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([0.0005,0.0008,0.0009,0.001,0.001,0.001,0.002,0.001,0.001,0.022,0.032,0.071,])

array_2 = np.array([7.62,11.63,14.62,19.78,19.85,27.85,25.65,28.95,42.54,38.72,74.06,133.52,])

array_1_name = "Solar power generated in Albania"

array_2_name = "Apple's stock price (AAPL)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only Solar power generated in Albania

- Line chart for only Apple's stock price (AAPL)

- AI-generated correlation image

- The spurious research paper: Shining a Light on Solar Power: Illuminating the Relationship Between Solar Energy Generation in Albania and Apple's Stock Price

Thanks for being the explorer we needed!

Correlation ID: 2937 · Black Variable ID: 23447 · Red Variable ID: 1540