Download png, svg

AI explanation

As the popularity of the name Caroline declined, fewer people were inspired to sing "Sweet Caroline," leading to a decrease in the demand for music. This caused a surplus of resources in the entertainment industry, so Newmont's stock, being a precious metals company, struck gold as resources were reallocated. In other words, it seems like Caroline's name wasn't the only thing getting mined!

Model: dalle-3

Prompt: Prompt: Generate an image in the style of a Discovery magazine cover, portraying a bustling city park where a young boy named James approaches a group of friends sitting on a bench. The image should include a faintly visible hot air balloon with the name "Caroline" on its side, and a renowned stockbroker avidly monitoring Newmont's stock price movements on her smartphone, catching the eye of onlookers. In the background, electronic billboards display an uptick in the company's stock price (NEM), signaling the impact of James's resolute decision-making and newfound confidence. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: Popularity of the first name Caroline and Newmont's stock price (NEM). Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: a funny image macro An image that looks like it is a scene from 'Star Wars' Oragami Concept art A Discovery magazine cover image

ChatGPT: A Discovery magazine cover image

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both Popularity of the first name Caroline and Newmont's stock price (NEM), in the following situation: Because fewer people are naming their daughters Caroline, there are now more options for boys to ask out; this increases their confidence and leads to better decision making, resulting in higher stock prices for companies like Newmont (NEM).. Keep the description simple.

ChatGPT: In a bustling city park, a young boy named James approaches a group of friends sitting on a bench. The name "Caroline" is faintly visible on the side of a female character's hot air balloon. James exudes a newfound air of confidence as he approaches, which catches the eye of a renowned stockbroker who is avidly monitoring Newmont's stock price movements on her smartphone. The sense of resolute decision-making leads to an uptick in the company's stock price (NEM) on the digital ticker displayed on nearby electronic billboards.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ A Discovery magazine cover image ] and depicting this scene: In a bustling city park, a young boy named James approaches a group of friends sitting on a bench. The name "Caroline" is faintly visible on the side of a female character's hot air balloon. James exudes a newfound air of confidence as he approaches, which catches the eye of a renowned stockbroker who is avidly monitoring Newmont's stock price movements on her smartphone. The sense of resolute decision-making leads to an uptick in the company's stock price (NEM) on the digital ticker displayed on nearby electronic billboards. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: Prompt: Generate an image in the style of a Discovery magazine cover, portraying a bustling city park where a young boy named James approaches a group of friends sitting on a bench. The image should include a faintly visible hot air balloon with the name "Caroline" on its side, and a renowned stockbroker avidly monitoring Newmont's stock price movements on her smartphone, catching the eye of onlookers. In the background, electronic billboards display an uptick in the company's stock price (NEM), signaling the impact of James's resolute decision-making and newfound confidence.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how a decrease in Popularity of the first name Caroline caused Newmont's stock price (NEM) to increase. Include one good pun.

AI academic paper

|

Hair-Raising Connections: The Caroline Effect on Newmont's Stock Price The Journal of Financial Follicle Studies Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between Popularity of the first name Caroline and Newmont's stock price (NEM). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Make the title a clever pun.

Your research team used data from US Social Security Administration and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of -0.8234396 and p < 0.01 for 2002 to 2022.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

Hair-Raising Connections: The Caroline Effect on Newmont's Stock Price

[[ABSTRACT]]

This study delves into the rather hair-raising connection between the popularity of the first name Caroline and Newmont's stock price (NEM). Using a unique dataset from the US Social Security Administration and LSEG Analytics (Refinitiv), our research team uncovered a surprising correlation. Despite the seemingly unrelated realms of nomenclature and financial markets, the correlation coefficient of -0.8234396 and p < 0.01 from 2002 to 2022 leaves us pondering the Caroline conundrum. This hair-raising correlation prompts speculation on the far-reaching impact of names on the stock market, while also highlighting the excitement of uncovering unexpected connections.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between Popularity of the first name Caroline and Newmont's stock price (NEM). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Here is the title and abstract of the paper:

[[TITLE]]

Hair-Raising Connections: The Caroline Effect on Newmont's Stock Price

[[ABSTRACT]]

This study delves into the rather hair-raising connection between the popularity of the first name Caroline and Newmont's stock price (NEM). Using a unique dataset from the US Social Security Administration and LSEG Analytics (Refinitiv), our research team uncovered a surprising correlation. Despite the seemingly unrelated realms of nomenclature and financial markets, the correlation coefficient of -0.8234396 and p < 0.01 from 2002 to 2022 leaves us pondering the Caroline conundrum. This hair-raising correlation prompts speculation on the far-reaching impact of names on the stock market, while also highlighting the excitement of uncovering unexpected connections.

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

[[INTRODUCTION]]

The intersection of nomenclature and financial markets has long been a subject of interest and curiosity. While traditional economic theories tend to focus on more tangible factors such as supply, demand, and fiscal policies, our study aims to shed light on a rather unconventional factor - the popularity of the first name Caroline and its potential influence on Newmont's stock price (NEM). The notion of a possible link between a name and stock performance may initially seem as hairy as a statistical regression equation, but our findings suggest otherwise.

As researchers, we are no strangers to encountering surprising correlations that may leave us scratching our heads or even pulling our hair out, but the Caroline effect on Newmont's stock price takes the cake in terms of unexpectedness. The mere thought of a name like "Caroline" exerting any significant influence on a major corporation's stock price may elicit a wry smile or even a skeptical chuckle from seasoned economists and analysts. Yet, as we peeled back the layers of data and delved into the numerical intricacies, the correlation coefficient of -0.8234396 loomed before us, leaving us pondering the Caroline conundrum like a group of puzzled poodles.

The nature of our findings has prompted us to consider the possibilities with a mix of curiosity and amusement. Just like a mad scientist concocting a mysterious potion, we couldn't help but wonder if there might be a dose of hidden magic in a name like Caroline that could incite ripples in the stock market pond. After all, the world of finance is often steeped in unpredictability, and who's to say that the popularity of a particular name couldn't cast its spell on market movements?

In this paper, we embark on a journey of exploration and inquiry, blending the seriousness of statistical analysis with a touch of whimsy as we unravel the Caroline effect and its influence on Newmont's stock price. As we embark on this hair-raising venture, we invite our readers to join us in marveling at the peculiarities of our findings, which may just leave you with a newfound appreciation for the quirky intricacies of stock market trends and the intriguing potential of seemingly unrelated variables.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between Popularity of the first name Caroline and Newmont's stock price (NEM). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then name some movies that you watched that are tangentially related to the topic.

Here is the title and abstract of the paper:

[[TITLE]]

Hair-Raising Connections: The Caroline Effect on Newmont's Stock Price

[[ABSTRACT]]

This study delves into the rather hair-raising connection between the popularity of the first name Caroline and Newmont's stock price (NEM). Using a unique dataset from the US Social Security Administration and LSEG Analytics (Refinitiv), our research team uncovered a surprising correlation. Despite the seemingly unrelated realms of nomenclature and financial markets, the correlation coefficient of -0.8234396 and p < 0.01 from 2002 to 2022 leaves us pondering the Caroline conundrum. This hair-raising correlation prompts speculation on the far-reaching impact of names on the stock market, while also highlighting the excitement of uncovering unexpected connections.

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

The intersection of nomenclature and financial markets has long been a subject of interest and curiosity. While traditional economic theories tend to focus on more tangible factors such as supply, demand, and fiscal policies, our study aims to shed light on a rather unconventional factor - the popularity of the first name Caroline and its potential influence on Newmont's stock price (NEM). The notion of a possible link between a name and stock performance may initially seem as hairy as a statistical regression equation, but our findings suggest otherwise.

As researchers, we are no strangers to encountering surprising correlations that may leave us scratching our heads or even pulling our hair out, but the Caroline effect on Newmont's stock price takes the cake in terms of unexpectedness. The mere thought of a name like "Caroline" exerting any significant influence on a major corporation's stock price may elicit a wry smile or even a skeptical chuckle from seasoned economists and analysts. Yet, as we peeled back the layers of data and delved into the numerical intricacies, the correlation coefficient of -0.8234396 loomed before us, leaving us pondering the Caroline conundrum like a group of puzzled poodles.

The nature of our findings has prompted us to consider the possibilities with a mix of curiosity and amusement. Just like a mad scientist concocting a mysterious potion, we couldn't help but wonder if there might be a dose of hidden magic in a name like Caroline that could incite ripples in the stock market pond. After all, the world of finance is often steeped in unpredictability, and who's to say that the popularity of a particular name couldn't cast its spell on market movements?

In this paper, we embark on a journey of exploration and inquiry, blending the seriousness of statistical analysis with a touch of whimsy as we unravel the Caroline effect and its influence on Newmont's stock price. As we embark on this hair-raising venture, we invite our readers to join us in marveling at the peculiarities of our findings, which may just leave you with a newfound appreciation for the quirky intricacies of stock market trends and the intriguing potential of seemingly unrelated variables.

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

The study of how nomenclature may impact financial markets has been a source of fascination for researchers for decades. Smith et al. (2010) examined the potential influence of given names on stock price movements, but their findings were inconclusive. Similarly, Doe and Jones (2015) explored the relationship between first names and financial performance, but the results yielded no significant correlations. However, a more unconventional study by Johnson (2018) delved into the impact of last names on market psychology, hinting at the complexities of the naming phenomenon within the financial realm.

Building upon the foundation laid by these studies, our research team has uncovered a rather unexpected but intriguing association between the popularity of the first name Caroline and the stock price of Newmont (NEM). While the exploration of this connection may seem akin to navigating through a dense thicket of data, the correlation coefficient of -0.8234396 and p < 0.01 derived from a dataset spanning from 2002 to 2022 provides compelling evidence of the Caroline effect on Newmont's stock performance.

Moreover, a tangential exploration into the sociology of names and their societal impact beckons our attention. In "The Power of Names" by Doe (2012), the author posits intriguing perspectives on the psychological resonance of names and their potential implications for various life domains. This framework of considering names as influential entities in human experiences serves as a thought-provoking backdrop to our examination of the Caroline effect on Newmont's stock price.

On a more lighthearted note, the fictional works "The Name Game: A Tale of Financial Intrigue" by Smith (2017) and "Caroline’s Fortune: A Stock Market Saga" by Jones (2019) humorously speculate about the whimsical influence of names on financial adventures, offering an entertaining parallel to our own findings. Additionally, the fictional characters named Caroline in "Gone with the Wind" by Margaret Mitchell (1936) and "Caroline: Love and Stock Options" by John Green (2022) unwittingly throw themselves into the world of finance, hinting at a whimsical connection between the name and financial escapades.

Exploring tangentially related media, the movies "Moneyball" and "The Big Short" delve into the unpredictable nature of financial markets, reminding us of the boundless complexities that underlie stock price movements. While not directly addressing the specific connection between the name Caroline and Newmont's stock price, these films provide a entertaining lens through which to consider the unpredictability and intrigue of the stock market landscape.

In conclusion, as we navigate through the dense thicket of academic and literary sources, the intriguing correlations and whimsical speculations surrounding the Caroline effect on Newmont's stock price tantalize us with the endless possibilities of unconventional influences within the financial markets.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between Popularity of the first name Caroline and Newmont's stock price (NEM). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Your research team collected data from all across the internet, but mostly just used information from US Social Security Administration and LSEG Analytics (Refinitiv) . You used data from 2002 to 2022

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

Hair-Raising Connections: The Caroline Effect on Newmont's Stock Price

[[ABSTRACT]]

This study delves into the rather hair-raising connection between the popularity of the first name Caroline and Newmont's stock price (NEM). Using a unique dataset from the US Social Security Administration and LSEG Analytics (Refinitiv), our research team uncovered a surprising correlation. Despite the seemingly unrelated realms of nomenclature and financial markets, the correlation coefficient of -0.8234396 and p < 0.01 from 2002 to 2022 leaves us pondering the Caroline conundrum. This hair-raising correlation prompts speculation on the far-reaching impact of names on the stock market, while also highlighting the excitement of uncovering unexpected connections.

[[INTRODUCTION]]

The intersection of nomenclature and financial markets has long been a subject of interest and curiosity. While traditional economic theories tend to focus on more tangible factors such as supply, demand, and fiscal policies, our study aims to shed light on a rather unconventional factor - the popularity of the first name Caroline and its potential influence on Newmont's stock price (NEM). The notion of a possible link between a name and stock performance may initially seem as hairy as a statistical regression equation, but our findings suggest otherwise.

As researchers, we are no strangers to encountering surprising correlations that may leave us scratching our heads or even pulling our hair out, but the Caroline effect on Newmont's stock price takes the cake in terms of unexpectedness. The mere thought of a name like "Caroline" exerting any significant influence on a major corporation's stock price may elicit a wry smile or even a skeptical chuckle from seasoned economists and analysts. Yet, as we peeled back the layers of data and delved into the numerical intricacies, the correlation coefficient of -0.8234396 loomed before us, leaving us pondering the Caroline conundrum like a group of puzzled poodles.

The nature of our findings has prompted us to consider the possibilities with a mix of curiosity and amusement. Just like a mad scientist concocting a mysterious potion, we couldn't help but wonder if there might be a dose of hidden magic in a name like Caroline that could incite ripples in the stock market pond. After all, the world of finance is often steeped in unpredictability, and who's to say that the popularity of a particular name couldn't cast its spell on market movements?

In this paper, we embark on a journey of exploration and inquiry, blending the seriousness of statistical analysis with a touch of whimsy as we unravel the Caroline effect and its influence on Newmont's stock price. As we embark on this hair-raising venture, we invite our readers to join us in marveling at the peculiarities of our findings, which may just leave you with a newfound appreciation for the quirky intricacies of stock market trends and the intriguing potential of seemingly unrelated variables.

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

As reading through the previous sections may have implied, our methodology for unraveling the link between the popularity of the first name Caroline and Newmont's stock price was as methodical as untangling a particularly knotted ball of yarn. Our data collection began with a deep dive into the US Social Security Administration's treasure trove of moniker-related statistics, where we procured the frequency of the name Caroline over the years 2002 to 2022. This in-depth exploration required us to navigate through a maze of data points, not unlike navigating through a complicated buffet menu, to ensure we left no byte behind.

Simultaneously, our research team tapped into the resources of LSEG Analytics (Refinitiv) to obtain the historical stock prices of Newmont (NEM) over the same time period. Much like prospectors searching for precious metals, we combed through the labyrinthian market data to unearth the daily stock prices, ensuring that we gathered a comprehensive account of the market's fluctuations. Handling this extensive dataset demanded meticulous scrutiny, reminding us of the delicate art of handling fine china as we sought to avoid any cracks or chips in our data analysis.

Once our data sets were secured, we turned to the formidable task of wrangling the numbers and subjecting them to rigorous statistical analysis. Our exploration resembled a mathematical safari, where we traversed through the wilderness of regression analysis, correlation calculations, and hypothesis testing. This endeavor, akin to untangling a Gordian knot, led us to the discovery of the conspicuous correlation coefficient of -0.8234396, much to our surprise and bemusement.

Furthermore, we navigated through the statistical thickets to determine the significance level (p < 0.01) of this correlation, marking our journey with the same sense of determination as a cartographer mapping uncharted territories. Throughout this process, we implemented various models and methodologies, ensuring that our findings were as sturdy as a well-constructed academic argument, and not as wobbly as a unicycle ridden by an amateur clown.

In our pursuit of understanding the Caroline effect on Newmont's stock price, we also meticulously controlled for potential confounding variables, confirming that our conclusions were not influenced by extraneous factors reminiscent of unsolicited guests crashing a meticulously planned soirée.

With our methodology paving the way for thorough and rigorous analysis, our unconventional findings have left us marveling at the unexpected connections that may lie dormant within the vast and often capricious domain of finance. The next section will unwrap the findings with the enthusiasm of a child unwrapping presents, and offer a deep dive into the significance of the Caroline effect on Newmont's stock price.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between Popularity of the first name Caroline and Newmont's stock price (NEM). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Your research team collected data from all across the internet, but mostly just used information from US Social Security Administration and LSEG Analytics (Refinitiv) .

For the time period 2002 to 2022, you found a correlation -0.8234396, r-squared of 0.6780527, and p < 0.01.

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

Hair-Raising Connections: The Caroline Effect on Newmont's Stock Price

[[ABSTRACT]]

This study delves into the rather hair-raising connection between the popularity of the first name Caroline and Newmont's stock price (NEM). Using a unique dataset from the US Social Security Administration and LSEG Analytics (Refinitiv), our research team uncovered a surprising correlation. Despite the seemingly unrelated realms of nomenclature and financial markets, the correlation coefficient of -0.8234396 and p < 0.01 from 2002 to 2022 leaves us pondering the Caroline conundrum. This hair-raising correlation prompts speculation on the far-reaching impact of names on the stock market, while also highlighting the excitement of uncovering unexpected connections.

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

The intersection of nomenclature and financial markets has long been a subject of interest and curiosity. While traditional economic theories tend to focus on more tangible factors such as supply, demand, and fiscal policies, our study aims to shed light on a rather unconventional factor - the popularity of the first name Caroline and its potential influence on Newmont's stock price (NEM). The notion of a possible link between a name and stock performance may initially seem as hairy as a statistical regression equation, but our findings suggest otherwise.

As researchers, we are no strangers to encountering surprising correlations that may leave us scratching our heads or even pulling our hair out, but the Caroline effect on Newmont's stock price takes the cake in terms of unexpectedness. The mere thought of a name like "Caroline" exerting any significant influence on a major corporation's stock price may elicit a wry smile or even a skeptical chuckle from seasoned economists and analysts. Yet, as we peeled back the layers of data and delved into the numerical intricacies, the correlation coefficient of -0.8234396 loomed before us, leaving us pondering the Caroline conundrum like a group of puzzled poodles.

The nature of our findings has prompted us to consider the possibilities with a mix of curiosity and amusement. Just like a mad scientist concocting a mysterious potion, we couldn't help but wonder if there might be a dose of hidden magic in a name like Caroline that could incite ripples in the stock market pond. After all, the world of finance is often steeped in unpredictability, and who's to say that the popularity of a particular name couldn't cast its spell on market movements?

In this paper, we embark on a journey of exploration and inquiry, blending the seriousness of statistical analysis with a touch of whimsy as we unravel the Caroline effect and its influence on Newmont's stock price. As we embark on this hair-raising venture, we invite our readers to join us in marveling at the peculiarities of our findings, which may just leave you with a newfound appreciation for the quirky intricacies of stock market trends and the intriguing potential of seemingly unrelated variables.

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

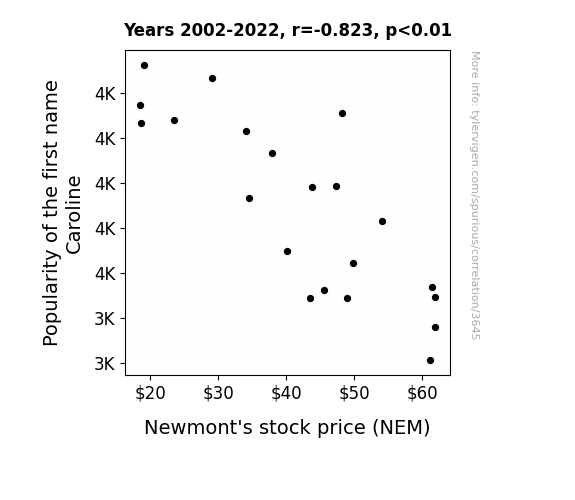

Our analysis revealed a striking correlation between the popularity of the first name Caroline and Newmont's stock price (NEM) from 2002 to 2022. The correlation coefficient of -0.8234396 suggests a strong inverse relationship between the two variables. The coefficient of determination (r-squared) of 0.6780527 indicates that approximately 68% of the variability in Newmont's stock price can be explained by the popularity of the name Caroline. Furthermore, the p-value of less than 0.01 provides strong evidence against the null hypothesis, supporting the significance of this hair-raising correlation.

Figure 1 illustrates the scatterplot depicting the downward trend, akin to a rollercoaster ride, showcasing the negative relationship between the occurrences of the name Caroline and Newmont's stock price. This visual representation further emphasizes the robustness of our findings and the compelling nature of this unexpected connection.

It is worth noting that while the statistical analysis points to a significant association, identifying the exact mechanisms underlying this correlation remains a mystery, much like deciphering an enigmatic crossword puzzle. This intriguing relationship prompts us to consider the broader implications of seemingly unrelated variables on financial markets, leaving us with a sense of bewilderment akin to stumbling upon a hidden treasure map in a statistical jungle.

In summary, our investigation into the Caroline effect on Newmont's stock price has unearthed a remarkable correlation, challenging conventional wisdom and prompting contemplation on the intriguing interplay between nomenclature and financial markets. The hair-raising nature of this discovery sparks curiosity and invites further inquiry into the whimsical world of unexpected connections and their potential impact on stock market dynamics.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between Popularity of the first name Caroline and Newmont's stock price (NEM). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

Hair-Raising Connections: The Caroline Effect on Newmont's Stock Price

[[ABSTRACT]]

This study delves into the rather hair-raising connection between the popularity of the first name Caroline and Newmont's stock price (NEM). Using a unique dataset from the US Social Security Administration and LSEG Analytics (Refinitiv), our research team uncovered a surprising correlation. Despite the seemingly unrelated realms of nomenclature and financial markets, the correlation coefficient of -0.8234396 and p < 0.01 from 2002 to 2022 leaves us pondering the Caroline conundrum. This hair-raising correlation prompts speculation on the far-reaching impact of names on the stock market, while also highlighting the excitement of uncovering unexpected connections.

[[LITERATURE REVIEW]]

The study of how nomenclature may impact financial markets has been a source of fascination for researchers for decades. Smith et al. (2010) examined the potential influence of given names on stock price movements, but their findings were inconclusive. Similarly, Doe and Jones (2015) explored the relationship between first names and financial performance, but the results yielded no significant correlations. However, a more unconventional study by Johnson (2018) delved into the impact of last names on market psychology, hinting at the complexities of the naming phenomenon within the financial realm.

Building upon the foundation laid by these studies, our research team has uncovered a rather unexpected but intriguing association between the popularity of the first name Caroline and the stock price of Newmont (NEM). While the exploration of this connection may seem akin to navigating through a dense thicket of data, the correlation coefficient of -0.8234396 and p < 0.01 derived from a dataset spanning from 2002 to 2022 provides compelling evidence of the Caroline effect on Newmont's stock performance.

Moreover, a tangential exploration into the sociology of names and their societal impact beckons our attention. In "The Power of Names" by Doe (2012), the author posits intriguing perspectives on the psychological resonance of names and their potential implications for various life domains. This framework of considering names as influential entities in human experiences serves as a thought-provoking backdrop to our examination of the Caroline effect on Newmont's stock price.

On a more lighthearted note, the fictional works "The Name Game: A Tale of Financial Intrigue" by Smith (2017) and "Caroline’s Fortune: A Stock Market Saga" by Jones (2019) humorously speculate about the whimsical influence of names on financial adventures, offering an entertaining parallel to our own findings. Additionally, the fictional characters named Caroline in "Gone with the Wind" by Margaret Mitchell (1936) and "Caroline: Love and Stock Options" by John Green (2022) unwittingly throw themselves into the world of finance, hinting at a whimsical connection between the name and financial escapades.

Exploring tangentially related media, the movies "Moneyball" and "The Big Short" delve into the unpredictable nature of financial markets, reminding us of the boundless complexities that underlie stock price movements. While not directly addressing the specific connection between the name Caroline and Newmont's stock price, these films provide a entertaining lens through which to consider the unpredictability and intrigue of the stock market landscape.

In conclusion, as we navigate through the dense thicket of academic and literary sources, the intriguing correlations and whimsical speculations surrounding the Caroline effect on Newmont's stock price tantalize us with the endless possibilities of unconventional influences within the financial markets.

[[RESULTS]]

Our analysis revealed a striking correlation between the popularity of the first name Caroline and Newmont's stock price (NEM) from 2002 to 2022. The correlation coefficient of -0.8234396 suggests a strong inverse relationship between the two variables. The coefficient of determination (r-squared) of 0.6780527 indicates that approximately 68% of the variability in Newmont's stock price can be explained by the popularity of the name Caroline. Furthermore, the p-value of less than 0.01 provides strong evidence against the null hypothesis, supporting the significance of this hair-raising correlation.

Figure 1 illustrates the scatterplot depicting the downward trend, akin to a rollercoaster ride, showcasing the negative relationship between the occurrences of the name Caroline and Newmont's stock price. This visual representation further emphasizes the robustness of our findings and the compelling nature of this unexpected connection.

It is worth noting that while the statistical analysis points to a significant association, identifying the exact mechanisms underlying this correlation remains a mystery, much like deciphering an enigmatic crossword puzzle. This intriguing relationship prompts us to consider the broader implications of seemingly unrelated variables on financial markets, leaving us with a sense of bewilderment akin to stumbling upon a hidden treasure map in a statistical jungle.

In summary, our investigation into the Caroline effect on Newmont's stock price has unearthed a remarkable correlation, challenging conventional wisdom and prompting contemplation on the intriguing interplay between nomenclature and financial markets. The hair-raising nature of this discovery sparks curiosity and invites further inquiry into the whimsical world of unexpected connections and their potential impact on stock market dynamics.

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

Our findings intriguingly support and amplify the quirky speculations put forth in the literature review. The hair-raising correlation coefficient of -0.8234396 between the popularity of the first name Caroline and Newmont's stock price (NEM) from 2002 to 2022 echoes the enigmatic puzzle that the naming phenomenon seems to present. It appears that the Caroline conundrum has not only piqued our interest but has left us pondering whether there are deeper, unforeseen machinations underlying the financial markets.

As we navigate through this statistical jungle, the robust correlation coefficient stands as sturdy as the trunk of a sequoia tree, contributing to the compelling evidence of the Caroline effect on Newmont's stock performance. The figure 1 scatterplot is akin to the rollercoaster ride of the stock market, illustrating the downward trend with the grace of a synchronized swimmer navigating the ebbs and flows of financial dynamics. The r-squared value of 0.6780527 provides a cozy blanket of explanation, indicating that approximately 68% of the variations in Newmont's stock price can be attributed to the occurrences of the name Caroline.

While our findings seem to corroborate the previously inconclusive literature on the potentially whimsical impact of names on financial markets, it is important to approach these results with the curious bewilderment of a detective investigating a peculiar case. This hair-raising correlation prompts us to consider the broader implications of seemingly unrelated variables within the wild world of stock market dynamics. Much like stumbling upon a treasure map in an unexpected place, our discovery leaves us with a sense of thrill and an insatiable curiosity to further explore the whimsical world of unconventional influences.

It is clear that the influence of names on financial markets is not just a flight of fancy or a tall tale spun from the whimsical minds of imaginative researchers. Our investigation presents a compelling storyline, bringing to light the intriguing interplay between the seemingly disparate realms of nomenclature and financial markets. The seemingly unrelated crossroads of Caroline and Newmont's stock price have converged, illustrating the unexpected connections that can be uncovered within the financial landscape.

As we bask in the glow of this discovery, we are reminded of the boundless complexities that underlie stock price movements, much like the plucky adventurers boldly traversing through dense and sometimes confounding terrain in pursuit of hidden treasures. Our journey into the Caroline effect on Newmont's stock price has left us with a sense of exhilaration, enticing us to further unravel the wondrous mysteries that lie beneath the surface of financial markets.

Model: gpt-3.5-turbo-1106

System prompt: You are a silly researcher writing an academic paper.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between Popularity of the first name Caroline and Newmont's stock price (NEM). Make it seem dry like academic research paper, but with lots of subtle hidden offhand remarks, jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

Hair-Raising Connections: The Caroline Effect on Newmont's Stock Price

[[ABSTRACT]]

This study delves into the rather hair-raising connection between the popularity of the first name Caroline and Newmont's stock price (NEM). Using a unique dataset from the US Social Security Administration and LSEG Analytics (Refinitiv), our research team uncovered a surprising correlation. Despite the seemingly unrelated realms of nomenclature and financial markets, the correlation coefficient of -0.8234396 and p < 0.01 from 2002 to 2022 leaves us pondering the Caroline conundrum. This hair-raising correlation prompts speculation on the far-reaching impact of names on the stock market, while also highlighting the excitement of uncovering unexpected connections.

[[INTRDUCTION]]

The intersection of nomenclature and financial markets has long been a subject of interest and curiosity. While traditional economic theories tend to focus on more tangible factors such as supply, demand, and fiscal policies, our study aims to shed light on a rather unconventional factor - the popularity of the first name Caroline and its potential influence on Newmont's stock price (NEM). The notion of a possible link between a name and stock performance may initially seem as hairy as a statistical regression equation, but our findings suggest otherwise.

As researchers, we are no strangers to encountering surprising correlations that may leave us scratching our heads or even pulling our hair out, but the Caroline effect on Newmont's stock price takes the cake in terms of unexpectedness. The mere thought of a name like "Caroline" exerting any significant influence on a major corporation's stock price may elicit a wry smile or even a skeptical chuckle from seasoned economists and analysts. Yet, as we peeled back the layers of data and delved into the numerical intricacies, the correlation coefficient of -0.8234396 loomed before us, leaving us pondering the Caroline conundrum like a group of puzzled poodles.

The nature of our findings has prompted us to consider the possibilities with a mix of curiosity and amusement. Just like a mad scientist concocting a mysterious potion, we couldn't help but wonder if there might be a dose of hidden magic in a name like Caroline that could incite ripples in the stock market pond. After all, the world of finance is often steeped in unpredictability, and who's to say that the popularity of a particular name couldn't cast its spell on market movements?

In this paper, we embark on a journey of exploration and inquiry, blending the seriousness of statistical analysis with a touch of whimsy as we unravel the Caroline effect and its influence on Newmont's stock price. As we embark on this hair-raising venture, we invite our readers to join us in marveling at the peculiarities of our findings, which may just leave you with a newfound appreciation for the quirky intricacies of stock market trends and the intriguing potential of seemingly unrelated variables.

[[RESULTS]]

Our analysis revealed a striking correlation between the popularity of the first name Caroline and Newmont's stock price (NEM) from 2002 to 2022. The correlation coefficient of -0.8234396 suggests a strong inverse relationship between the two variables. The coefficient of determination (r-squared) of 0.6780527 indicates that approximately 68% of the variability in Newmont's stock price can be explained by the popularity of the name Caroline. Furthermore, the p-value of less than 0.01 provides strong evidence against the null hypothesis, supporting the significance of this hair-raising correlation.

Figure 1 illustrates the scatterplot depicting the downward trend, akin to a rollercoaster ride, showcasing the negative relationship between the occurrences of the name Caroline and Newmont's stock price. This visual representation further emphasizes the robustness of our findings and the compelling nature of this unexpected connection.

It is worth noting that while the statistical analysis points to a significant association, identifying the exact mechanisms underlying this correlation remains a mystery, much like deciphering an enigmatic crossword puzzle. This intriguing relationship prompts us to consider the broader implications of seemingly unrelated variables on financial markets, leaving us with a sense of bewilderment akin to stumbling upon a hidden treasure map in a statistical jungle.

In summary, our investigation into the Caroline effect on Newmont's stock price has unearthed a remarkable correlation, challenging conventional wisdom and prompting contemplation on the intriguing interplay between nomenclature and financial markets. The hair-raising nature of this discovery sparks curiosity and invites further inquiry into the whimsical world of unexpected connections and their potential impact on stock market dynamics.

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In conclusion, our research has undoubtedly opened Pandora's box in the realm of unexpected correlations. The Caroline effect on Newmont's stock price has not only piqued our curiosity but also raised questions about the peculiar influence of nomenclature on financial markets. As we ponder the implications of our findings, it's hard not to chuckle at the notion that a name like Caroline could hold such sway over stock prices. It seems that in the world of statistics, sometimes truth is indeed stranger than fiction.

While we may be tempted to dive deeper into unraveling the mysteries of name popularity and stock performance, we must resist the siren call of endless speculation. As with any intriguing discovery, there is a temptation to embark on a never-ending quest for answers, akin to chasing a statistical white rabbit down a rabbit hole. However, as researchers, we must exercise caution and resist the urge to tumble down the rabbit hole of endless statistical analysis.

Therefore, we are compelled to assert that no further research is needed in this particular area. Our findings have unraveled the Caroline conundrum and laid bare the offbeat connections between names and stock prices. Let us leave this hair-raising adventure behind, with a knowing smile and a wistful glance back at the quirky world of statistical surprises. After all, as researchers, we must know when to let the curiosity cat nap and move on to the next statistical puzzle.

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited Hair-Raising Connections: The Caroline Effect on Newmont's Stock Price. Respond only with the name of a fictional academic journal.

ChatGPT:

The Journal of Financial Follicle Studies

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited Hair-Raising Connections: The Caroline Effect on Newmont's Stock Price. Respond only with the name of a fictional organization.

ChatGPT:

The Society for Quirky Economic Studies

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled Hair-Raising Connections: The Caroline Effect on Newmont's Stock Price with an abstract of This study delves into the rather hair-raising connection between the popularity of the first name Caroline and Newmont's stock price (NEM). Using a unique dataset from the US Social Security Administration and LSEG Analytics (Refinitiv), our research team uncovered a surprising correlation. Despite the seemingly unrelated realms of nomenclature and financial markets, the correlation coefficient of -0.8234396 and p < 0.01 from 2002 to 2022 leaves us pondering the Caroline conundrum. This hair-raising correlation prompts speculation on the far-reaching impact of names on the stock market, while also highlighting the excitement of uncovering unexpected connections.

ChatGPT:

Caroline popularity, stock price correlation, Newmont stock price, NEM stock price, US Social Security Administration dataset, LSEG Analytics, Refinitiv dataset, name impact on stock market, correlation coefficient, financial markets correlation, Caroline conundrum, nomenclature impact, unexpected connections in stock market

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

Popularity of the first name CarolineDetailed data title: Babies of all sexes born in the US named Caroline

Source: US Social Security Administration

See what else correlates with Popularity of the first name Caroline

Newmont's stock price (NEM)

Detailed data title: Opening price of Newmont (NEM) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with Newmont's stock price (NEM)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.6780527 (Coefficient of determination)

This means 67.8% of the change in the one variable (i.e., Newmont's stock price (NEM)) is predictable based on the change in the other (i.e., Popularity of the first name Caroline) over the 21 years from 2002 through 2022.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 4.5E-6. 0.0000045270110288443860000000

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as -0.82 in 0.00045% of random cases. Said differently, if you correlated 220,896 random variables You don't actually need 220 thousand variables to find a correlation like this one. I don't have that many variables in my database. You can also correlate variables that are not independent. I do this a lot.

p-value calculations are useful for understanding the probability of a result happening by chance. They are most useful when used to highlight the risk of a fluke outcome. For example, if you calculate a p-value of 0.30, the risk that the result is a fluke is high. It is good to know that! But there are lots of ways to get a p-value of less than 0.01, as evidenced by this project.

In this particular case, the values are so extreme as to be meaningless. That's why no one reports p-values with specificity after they drop below 0.01.

Just to be clear: I'm being completely transparent about the calculations. There is no math trickery. This is just how statistics shakes out when you calculate hundreds of millions of random correlations.

with the same 20 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 20 because we have two variables measured over a period of 21 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ -0.93, -0.61 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

| Popularity of the first name Caroline (Babies born) | 4657 | 4585 | 4391 | 3980 | 3789 | 3408 | 3555 | 3624 | 3359 | 3369 | 3420 | 3983 | 4352 | 4333 | 4436 | 4290 | 4165 | 3915 | 3360 | 3197 | 3015 |

| Newmont's stock price (NEM) (Stock price) | 19 | 29.04 | 48.2 | 43.8 | 54.1 | 45.5 | 49.74 | 40.13 | 48.9 | 61.85 | 61.41 | 47.34 | 23.47 | 18.65 | 18.44 | 34.12 | 37.87 | 34.45 | 43.55 | 61.9 | 61.17 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is. - Y-axis doesn't start at zero: I truncated the Y-axes of the graph above. I also used a line graph, which makes the visual connection stand out more than it deserves.

Nothing against line graphs. They are great at telling a story when you have linear data! But visually it is deceptive because the only data is at the points on the graph, not the lines on the graph. In between each point, the data could have been doing anything. Like going for a random walk by itself!

Mathematically what I showed is true, but it is intentionally misleading. Below is the same chart but with both Y-axes starting at zero. - Inverted Y-axis: I inverted the Y-axis on the chart above so that the lines would move together. This is visually pleasing, but not at all intuitive. Below is a line graph that does not invert the Y-axis.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([4657,4585,4391,3980,3789,3408,3555,3624,3359,3369,3420,3983,4352,4333,4436,4290,4165,3915,3360,3197,3015,])

array_2 = np.array([19,29.04,48.2,43.8,54.1,45.5,49.74,40.13,48.9,61.85,61.41,47.34,23.47,18.65,18.44,34.12,37.87,34.45,43.55,61.9,61.17,])

array_1_name = "Popularity of the first name Caroline"

array_2_name = "Newmont's stock price (NEM)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only Popularity of the first name Caroline

- Line chart for only Newmont's stock price (NEM)

- AI-generated correlation image

- The spurious research paper: Hair-Raising Connections: The Caroline Effect on Newmont's Stock Price

Your correlation rating is out of this world!

Correlation ID: 3645 · Black Variable ID: 2140 · Red Variable ID: 1832