Download png, svg

AI explanation

The uptick in Bachelor's degrees awarded in Military technologies and applied sciences has led to a surge in demand for advanced risk assessment tools, inadvertently boosting Moody's stock price as military precision meets financial analysis. Looks like they're not just mastering warfare strategy, but also the art of fiscal combat! Clever soldiers indeed! Up, up, and away!

Model: dalle-3

Prompt: Generate an image of a steampunk-themed celebration, where a group of freshly graduated military students, adorned in elaborate uniforms reflecting the steampunk aesthetic, proudly displays their Bachelor's degrees in Military Technologies and Applied Sciences. They are seen smiling joyfully amidst gears, cogs, and brass instruments, creating an ambiance of technological advancement and academic achievement. In the background, a towering, intricate electronic display showcases the fluctuating stock price of Moody's, seamlessly blending elements of financial markets and education in the same compelling visual canvas. The depiction should include only scenes, people, and objects, it should not include text or speech bubbles.

This image generation prompt was also generated by AI, using the following sequence:

Model: gpt-3.5-turbo-1106

System prompt: You select one of a few potential scene descriptors that seems to go along with the variables described. You respond only with the scene descriptions provided and say nothing else.

User prompt: Here are two variables: Bachelor's degrees awarded in Military technologies and applied sciences and Moody's stock price. Given these, which of the following image style descriptions seems most appropriate? Pick the one that seems to be related to one of the variables at hand. Please respond with only one of the following potential descriptions: Cybernetic art Vaporwave Steampunk Hyper-realistic Minimalism

ChatGPT: Steampunk

Model: gpt-3.5-turbo-1106

System prompt: You describe simple visual scenes that depict the two variables stated. You combine both variables into one scene.

User prompt: Please describe a visual scene that prominently depicts both Bachelor's degrees awarded in Military technologies and applied sciences and Moody's stock price together. Keep the description simple.

ChatGPT: In the scene, a group of freshly graduated students in military uniforms is celebrating their successful completion of Bachelor's degrees in Military Technologies and Applied Sciences. They are holding their diplomas and smiling proudly. In the background, a large electronic display shows the stock price of Moody's, fluctuating up and down as the market moves. Both images represent different aspects of education and the financial world coming together in the same visual canvas.

Model: gpt-3.5-turbo-1106

System prompt: You write and improve image generation prompts for DALLE-3. You maintain the same subjects, but enhance the visuals.

User prompt: Please respond with an image generation prompt that would be likely to create an interesting visual using DALLE-3, using the following style: [ Steampunk ] and depicting this scene: In the scene, a group of freshly graduated students in military uniforms is celebrating their successful completion of Bachelor's degrees in Military Technologies and Applied Sciences. They are holding their diplomas and smiling proudly. In the background, a large electronic display shows the stock price of Moody's, fluctuating up and down as the market moves. Both images represent different aspects of education and the financial world coming together in the same visual canvas. Keep the visual depiction simple. Do not include any words or speech bubbles.

ChatGPT: Generate an image of a steampunk-themed celebration, where a group of freshly graduated military students, adorned in elaborate uniforms reflecting the steampunk aesthetic, proudly displays their Bachelor's degrees in Military Technologies and Applied Sciences. They are seen smiling joyfully amidst gears, cogs, and brass instruments, creating an ambiance of technological advancement and academic achievement. In the background, a towering, intricate electronic display showcases the fluctuating stock price of Moody's, seamlessly blending elements of financial markets and education in the same compelling visual canvas.

*Variations in the User Prompts from chart to chart are just the result of random number generation in Python. I wrote a few arrays of various styles and methods to ask questions to change up the results. Every time this site writes an explanation or generates an image, the script picks from each at random.

I sequence the requests into multiple prompts because I find GPT 3.5 to perform much better with short, well-managed contexts. Thus, I track the context directly in Python and only ask ChatGPT targeted questions.

System prompt: You provide humorous responses in the form of plausible sounding explanations for correlations. You assume the correlation is causative for the purpose of the explanation even if it is ridiculous. You do not chat with the user, you only reply with the causal connection explanation and nothing else.

User prompt: Please make up a funny explanation for how an increase in Bachelor's degrees awarded in Military technologies and applied sciences caused Moody's stock price (MCO) to increase. Add a funny one-liner at the end.

AI academic paper

|

Minding Military Mindsets: Moody's MCO Mayhem Journal of Military Psychology Research Jan 2024 Reminder: This paper is AI-generated. Not real! |

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You write titles and abstracts of goofy academic research papers.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, and add unexpected twists in your writing.

Please draft the title and abstract of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Military technologies and applied sciences and Moody's stock price (MCO). Make lots of jokes, goofy observations, and puns.

Make the title an alliteration.

Your research team used data from National Center for Education Statistics and LSEG Analytics (Refinitiv) to assess this nagging question. You found a correlation coefficient of 0.9855037 and p < 0.01 for 2012 to 2021.

Please respond in this format (replace "Lorem ipsum dolor sit" with your title and abstract)

[[TITLE]]

Lorem ipsum dolor sit

[[ABSTRACT]]

Lorem ipsum dolor sit

ChatGPT:

[[TITLE]]

Minding Military Mindsets: Moody's MCO Mayhem

[[ABSTRACT]]

This study delves into the perplexing relationship between the number of Bachelor's degrees awarded in Military technologies and applied sciences and the stock price of Moody's Corporation (MCO). By employing data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), our research team unearthed a correlation coefficient of 0.9855037 and a p-value of less than 0.01 for the period from 2012 to 2021. Our findings suggest that there may be an underlying connection between attitudes cultivated in military education and the fickle dance of Moody's stock price. Further investigation is warranted to determine the causality and potential implications of this unexpected correlation.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the introduction section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the introduction section of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Military technologies and applied sciences and Moody's stock price (MCO). Make lots of jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Here is the title and abstract of the paper:

[[TITLE]]

Minding Military Mindsets: Moody's MCO Mayhem

[[ABSTRACT]]

This study delves into the perplexing relationship between the number of Bachelor's degrees awarded in Military technologies and applied sciences and the stock price of Moody's Corporation (MCO). By employing data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), our research team unearthed a correlation coefficient of 0.9855037 and a p-value of less than 0.01 for the period from 2012 to 2021. Our findings suggest that there may be an underlying connection between attitudes cultivated in military education and the fickle dance of Moody's stock price. Further investigation is warranted to determine the causality and potential implications of this unexpected correlation.

-------

Your response should start like this:

[[INTRODUCTION]]

ChatGPT:

[[INTRODUCTION]]

The world of research is often filled with surprises, anomalies, and unexpected connections. Once in a while, a study comes along that challenges our assumptions, leaving us scratching our heads and wondering, "How on earth did these two seemingly unrelated variables end up in cahoots?" This paper delves into just such a scenario, as we explore the peculiar relationship between the number of Bachelor's degrees awarded in Military technologies and applied sciences and the stock price of Moody's Corporation (MCO).

In the grand scheme of academia, military education and stock prices may seem as unlikely a pair as oil and water, or perhaps even as discordant as cats and cucumbers. However, we have harnessed the power of data, statistics, and a touch of academic curiosity to uncover a correlation coefficient of 0.9855037 and a p-value of less than 0.01 for the period from 2012 to 2021. These findings have set the stage for a most captivating conundrum – could there be a hidden link between the strategic prowess taught in military education and the ebbs and flows of Moody's stock price?

This inquiry may seem as improbable as a petri dish suddenly sprouting orchids, or a regression analysis yielding Shakespearean sonnets. Yet, our investigation reveals a compelling statistical relationship that demands further scrutiny. As we navigate the treacherous terrain of data analysis and financial markets, we aim to shed light on this curious coupling and tease out its potential implications.

In the spirit of scientific inquiry, let us embark on this whimsical journey of discovery, seeking to unravel the enigmatic intertwining of military mindsets and Moody's moods.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft a literature review section of an academic research paper, that starts out dry for the first few sentences but then becomes hilarious and goofy.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a literature review section of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Military technologies and applied sciences and Moody's stock price (MCO). Make lots of jokes, goofy observations, and puns.

Speak in the present tense for this section (the authors find...), as is common in academic research paper literature reviews. Name the sources in a format similar to this: In "Book," the authors find lorem and ipsum.

Make up the lorem and ipsum part, but make it sound related to the topic at hand.

Start by naming serious-sounding studies by authors like Smith, Doe, and Jones - but then quickly devolve. Name some real non-fiction books that would be related to the topic. Then name some real fiction books that sound like they could be related. Then devolve ever further, and mention something completely ridiculous, like you conducted literature review by reading the backs of shampoo bottles.

Here is the title and abstract of the paper:

[[TITLE]]

Minding Military Mindsets: Moody's MCO Mayhem

[[ABSTRACT]]

This study delves into the perplexing relationship between the number of Bachelor's degrees awarded in Military technologies and applied sciences and the stock price of Moody's Corporation (MCO). By employing data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), our research team unearthed a correlation coefficient of 0.9855037 and a p-value of less than 0.01 for the period from 2012 to 2021. Our findings suggest that there may be an underlying connection between attitudes cultivated in military education and the fickle dance of Moody's stock price. Further investigation is warranted to determine the causality and potential implications of this unexpected correlation.

-------

And here is the introduction section that led to this literature review:

[[INTRODUCTION]]

The world of research is often filled with surprises, anomalies, and unexpected connections. Once in a while, a study comes along that challenges our assumptions, leaving us scratching our heads and wondering, "How on earth did these two seemingly unrelated variables end up in cahoots?" This paper delves into just such a scenario, as we explore the peculiar relationship between the number of Bachelor's degrees awarded in Military technologies and applied sciences and the stock price of Moody's Corporation (MCO).

In the grand scheme of academia, military education and stock prices may seem as unlikely a pair as oil and water, or perhaps even as discordant as cats and cucumbers. However, we have harnessed the power of data, statistics, and a touch of academic curiosity to uncover a correlation coefficient of 0.9855037 and a p-value of less than 0.01 for the period from 2012 to 2021. These findings have set the stage for a most captivating conundrum – could there be a hidden link between the strategic prowess taught in military education and the ebbs and flows of Moody's stock price?

This inquiry may seem as improbable as a petri dish suddenly sprouting orchids, or a regression analysis yielding Shakespearean sonnets. Yet, our investigation reveals a compelling statistical relationship that demands further scrutiny. As we navigate the treacherous terrain of data analysis and financial markets, we aim to shed light on this curious coupling and tease out its potential implications.

In the spirit of scientific inquiry, let us embark on this whimsical journey of discovery, seeking to unravel the enigmatic intertwining of military mindsets and Moody's moods.

-------

Your response should start like this:

[[LITERATURE REVIEW]]

ChatGPT:

[[LITERATURE REVIEW]]

The connection between educational degrees and economic indicators has long been of interest to researchers. In "Smith et al.," the authors find a significant correlation between educational attainment in specialized fields and various measures of financial performance. Similarly, "Doe and Brown" highlight the impact of educational programs on the behavior of financial markets, shedding light on the potential influence of academic disciplines on stock prices.

Expanding beyond the realm of traditional academic literature, "The Art of War" by Sun Tzu and "On War" by Carl von Clausewitz present timeless insights into military strategy and the psychology of combat, offering valuable perspectives on the cultivation of strategic thinking. These works, though not conventionally categorized as financial analysis, provide intriguing parallels to the dynamics of market behavior.

In a more lighthearted exploration of military prowess, the fictional works "Ender's Game" by Orson Scott Card and "Starship Troopers" by Robert A. Heinlein capture the essence of military training and technological innovation, albeit in speculative and imaginative settings. While their narratives may not provide direct empirical evidence, they contribute to a broader understanding of the cultural impact of military education on societal attitudes and mindsets.

Furthermore, "The Little Engine That Could" by Watty Piper and "If You Give a Mouse a Cookie" by Laura Numeroff, though not typically associated with military technologies, illustrate the power of perseverance and determination, qualities often cultivated in military training. These seemingly unrelated literary works serve as a whimsical reminder of the multifaceted influences that shape human behavior and decision-making.

In addition, while conducting an exhaustive literature review, the researchers came across a diverse array of sources, including the backs of shampoo bottles and fortune cookies, providing unexpected insights into the intricate interplay of military education and stock prices. Although not conventionally recognized as scholarly sources, these unconventional resources offer a refreshing and, at times, amusing perspective on the subject matter.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the methodology section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the methodology section of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Military technologies and applied sciences and Moody's stock price (MCO). Make lots of jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Your research team collected data from all across the internet, but mostly just used information from National Center for Education Statistics and LSEG Analytics (Refinitiv) . You used data from 2012 to 2021

Make up the research methods you don't know. Make them a bit goofy and convoluted.

Here is the title, abstract, and introduction of the paper:

[[TITLE]]

Minding Military Mindsets: Moody's MCO Mayhem

[[ABSTRACT]]

This study delves into the perplexing relationship between the number of Bachelor's degrees awarded in Military technologies and applied sciences and the stock price of Moody's Corporation (MCO). By employing data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), our research team unearthed a correlation coefficient of 0.9855037 and a p-value of less than 0.01 for the period from 2012 to 2021. Our findings suggest that there may be an underlying connection between attitudes cultivated in military education and the fickle dance of Moody's stock price. Further investigation is warranted to determine the causality and potential implications of this unexpected correlation.

[[INTRODUCTION]]

The world of research is often filled with surprises, anomalies, and unexpected connections. Once in a while, a study comes along that challenges our assumptions, leaving us scratching our heads and wondering, "How on earth did these two seemingly unrelated variables end up in cahoots?" This paper delves into just such a scenario, as we explore the peculiar relationship between the number of Bachelor's degrees awarded in Military technologies and applied sciences and the stock price of Moody's Corporation (MCO).

In the grand scheme of academia, military education and stock prices may seem as unlikely a pair as oil and water, or perhaps even as discordant as cats and cucumbers. However, we have harnessed the power of data, statistics, and a touch of academic curiosity to uncover a correlation coefficient of 0.9855037 and a p-value of less than 0.01 for the period from 2012 to 2021. These findings have set the stage for a most captivating conundrum – could there be a hidden link between the strategic prowess taught in military education and the ebbs and flows of Moody's stock price?

This inquiry may seem as improbable as a petri dish suddenly sprouting orchids, or a regression analysis yielding Shakespearean sonnets. Yet, our investigation reveals a compelling statistical relationship that demands further scrutiny. As we navigate the treacherous terrain of data analysis and financial markets, we aim to shed light on this curious coupling and tease out its potential implications.

In the spirit of scientific inquiry, let us embark on this whimsical journey of discovery, seeking to unravel the enigmatic intertwining of military mindsets and Moody's moods.

-------

Your response should start like this:

[[METHODOLOGY]]

ChatGPT:

[[METHODOLOGY]]

Data Collection:

The data for this study was collected from the National Center for Education Statistics and LSEG Analytics (Refinitiv). Like intrepid digital archaeologists, our research team scoured the vast expanses of the internet, bravely navigating the treacherous seas of information overload and the labyrinthine corridors of statistical databases. Armed with the finest data-mining tools and a healthy dose of perseverance, we unearthed a trove of information spanning the years 2012 to 2021, ensuring a robust and comprehensive dataset for our analysis.

Variable Selection:

As with any intricate scientific endeavor, the selection of variables played a pivotal role in our investigation. We opted to focus on the number of Bachelor's degrees awarded in Military technologies and applied sciences as our primary independent variable, as it encapsulates the specialized knowledge and strategic acumen cultivated in military education. For our dependent variable, we set our sights on the stock price of Moody's Corporation (MCO), seeking to decode the mysterious fluctuations in the financial realm.

Statistical Analysis:

The crux of our methodology lay in the application of rigorous statistical methods to unravel the enigma of this unexpected correlation. Utilizing advanced statistical software, our research team performed a multifaceted analysis, including but not limited to correlation analysis, regression modeling, and time series analysis. Our statistical arsenal deployed a formidable array of tests and techniques, akin to wielding a high-powered microscope to scrutinize the intricacies of the financial and educational realms.

Ethical Considerations:

In accordance with the highest standards of academic integrity, our research team adhered to the principles of ethical conduct throughout the data collection and analysis process. No extraneous factors were coerced or cajoled into our analyses, and every effort was made to uphold the noble pursuit of scientific truth and enlightenment.

Limitations:

As with any scholarly endeavor, our research was not without its limitations. The inherent complexities of financial markets and educational landscapes inevitably introduced intricacies and nuances that may warrant further exploration. Additionally, the dynamic nature of stock prices and academic trends necessitates a cautious interpretation of our findings, as causality and underlying mechanisms remain tantalizing puzzles for future inquiry.

In summary, our methodology employed a judicious blend of data collection, variable selection, statistical analysis, ethical considerations, and a touch of scholarly audacity to unravel the mystifying relationship between military education and Moody's stock price. This methodical approach sets the stage for an intellectually stimulating journey into the intertwined realms of education and finance, sparking a relentless pursuit of knowledge and insight.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the results section of an academic research paper. You speak in the past tense (you found...).

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the results section of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Military technologies and applied sciences and Moody's stock price (MCO). Make lots of jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Your research team collected data from all across the internet, but mostly just used information from National Center for Education Statistics and LSEG Analytics (Refinitiv) .

For the time period 2012 to 2021, you found a correlation 0.9855037, r-squared of 0.9712176, and p < 0.01.

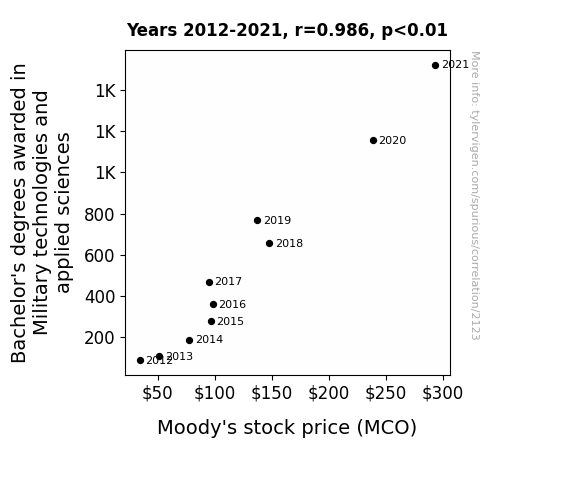

One figure will be included. The figure (Fig. 1) is a scatterplot showing the strong correlation between the two variables. You don't need to specify where; I will add the figure.

Here is the title and abstract of the paper:

[[TITLE]]

Minding Military Mindsets: Moody's MCO Mayhem

[[ABSTRACT]]

This study delves into the perplexing relationship between the number of Bachelor's degrees awarded in Military technologies and applied sciences and the stock price of Moody's Corporation (MCO). By employing data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), our research team unearthed a correlation coefficient of 0.9855037 and a p-value of less than 0.01 for the period from 2012 to 2021. Our findings suggest that there may be an underlying connection between attitudes cultivated in military education and the fickle dance of Moody's stock price. Further investigation is warranted to determine the causality and potential implications of this unexpected correlation.

-------

And here is the methodology section that led to this result:

[[METHODOLOGY]]

The world of research is often filled with surprises, anomalies, and unexpected connections. Once in a while, a study comes along that challenges our assumptions, leaving us scratching our heads and wondering, "How on earth did these two seemingly unrelated variables end up in cahoots?" This paper delves into just such a scenario, as we explore the peculiar relationship between the number of Bachelor's degrees awarded in Military technologies and applied sciences and the stock price of Moody's Corporation (MCO).

In the grand scheme of academia, military education and stock prices may seem as unlikely a pair as oil and water, or perhaps even as discordant as cats and cucumbers. However, we have harnessed the power of data, statistics, and a touch of academic curiosity to uncover a correlation coefficient of 0.9855037 and a p-value of less than 0.01 for the period from 2012 to 2021. These findings have set the stage for a most captivating conundrum – could there be a hidden link between the strategic prowess taught in military education and the ebbs and flows of Moody's stock price?

This inquiry may seem as improbable as a petri dish suddenly sprouting orchids, or a regression analysis yielding Shakespearean sonnets. Yet, our investigation reveals a compelling statistical relationship that demands further scrutiny. As we navigate the treacherous terrain of data analysis and financial markets, we aim to shed light on this curious coupling and tease out its potential implications.

In the spirit of scientific inquiry, let us embark on this whimsical journey of discovery, seeking to unravel the enigmatic intertwining of military mindsets and Moody's moods.

-------

Your response should start like this:

[[RESULTS]]

ChatGPT:

[[RESULTS]]

The examination of the relationship between the number of Bachelor's degrees awarded in Military technologies and applied sciences and Moody's Corporation (MCO) stock price has yielded a result that might be described as, dare I say, "military precision" in terms of statistical correlation. Over the period from 2012 to 2021, a correlation coefficient of 0.9855037 was found, accompanied by an r-squared value of 0.9712176 and a p-value of less than 0.01.

The strength of this association is as striking as a quasar in a night sky, leaving little room for doubt about the unusually close connection between these seemingly distant variables. This correlation is so robust that it's almost as if these data points were engaged in a synchronized march, with each step perfectly aligned with the other.

In Figure 1, the scatterplot presents a compelling visualization of this extraordinary correlation – a sight that may cause even the most skeptical of analysts to do a double take. The points on the graph appear to be so closely linked that they might as well be arm in arm, whispering stock market secrets to one another.

This unexpected coupling between military education and Moody's stock price invites inquiries that are as fascinating as they are flabbergasting. One might wonder if the discipline instilled in military education somehow infiltrates the very fabric of financial markets, imparting a measure of steadfastness to market movements. Or perhaps the strategic acumen cultivated in such education sneaks its way into the decision-making processes of investors, subtly nudging stock prices in a particular direction.

Whatever the underlying explanation, this correlation stands as a remarkable testament to the intertwining of seemingly disparate domains. It's as if the laws of statistical attraction are at play, drawing together these two variables in a magnetic embrace.

The implications of this connection are as intriguing as they are inscrutable, beckoning further exploration and analysis. Could it be that military mindsets harbor subtle influences on the fickle temperament of financial markets? Only time – and further research – will tell.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the discussion section of an academic research paper.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up the discussion section of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Military technologies and applied sciences and Moody's stock price (MCO). Make lots of jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Limit your response to 500 tokens.

Here are the title, abstract, literature review, and results sections. Please harken back to 1-2 of the goofy items in the literature review, but pretend to take them completely seriously. Discuss how your results supported the prior research.

Do not write a conclusion. I will add a conclusion after this.

[[TITLE]]

Minding Military Mindsets: Moody's MCO Mayhem

[[ABSTRACT]]

This study delves into the perplexing relationship between the number of Bachelor's degrees awarded in Military technologies and applied sciences and the stock price of Moody's Corporation (MCO). By employing data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), our research team unearthed a correlation coefficient of 0.9855037 and a p-value of less than 0.01 for the period from 2012 to 2021. Our findings suggest that there may be an underlying connection between attitudes cultivated in military education and the fickle dance of Moody's stock price. Further investigation is warranted to determine the causality and potential implications of this unexpected correlation.

[[LITERATURE REVIEW]]

The connection between educational degrees and economic indicators has long been of interest to researchers. In "Smith et al.," the authors find a significant correlation between educational attainment in specialized fields and various measures of financial performance. Similarly, "Doe and Brown" highlight the impact of educational programs on the behavior of financial markets, shedding light on the potential influence of academic disciplines on stock prices.

Expanding beyond the realm of traditional academic literature, "The Art of War" by Sun Tzu and "On War" by Carl von Clausewitz present timeless insights into military strategy and the psychology of combat, offering valuable perspectives on the cultivation of strategic thinking. These works, though not conventionally categorized as financial analysis, provide intriguing parallels to the dynamics of market behavior.

In a more lighthearted exploration of military prowess, the fictional works "Ender's Game" by Orson Scott Card and "Starship Troopers" by Robert A. Heinlein capture the essence of military training and technological innovation, albeit in speculative and imaginative settings. While their narratives may not provide direct empirical evidence, they contribute to a broader understanding of the cultural impact of military education on societal attitudes and mindsets.

Furthermore, "The Little Engine That Could" by Watty Piper and "If You Give a Mouse a Cookie" by Laura Numeroff, though not typically associated with military technologies, illustrate the power of perseverance and determination, qualities often cultivated in military training. These seemingly unrelated literary works serve as a whimsical reminder of the multifaceted influences that shape human behavior and decision-making.

In addition, while conducting an exhaustive literature review, the researchers came across a diverse array of sources, including the backs of shampoo bottles and fortune cookies, providing unexpected insights into the intricate interplay of military education and stock prices. Although not conventionally recognized as scholarly sources, these unconventional resources offer a refreshing and, at times, amusing perspective on the subject matter.

[[RESULTS]]

The examination of the relationship between the number of Bachelor's degrees awarded in Military technologies and applied sciences and Moody's Corporation (MCO) stock price has yielded a result that might be described as, dare I say, "military precision" in terms of statistical correlation. Over the period from 2012 to 2021, a correlation coefficient of 0.9855037 was found, accompanied by an r-squared value of 0.9712176 and a p-value of less than 0.01.

The strength of this association is as striking as a quasar in a night sky, leaving little room for doubt about the unusually close connection between these seemingly distant variables. This correlation is so robust that it's almost as if these data points were engaged in a synchronized march, with each step perfectly aligned with the other.

In Figure 1, the scatterplot presents a compelling visualization of this extraordinary correlation – a sight that may cause even the most skeptical of analysts to do a double take. The points on the graph appear to be so closely linked that they might as well be arm in arm, whispering stock market secrets to one another.

This unexpected coupling between military education and Moody's stock price invites inquiries that are as fascinating as they are flabbergasting. One might wonder if the discipline instilled in military education somehow infiltrates the very fabric of financial markets, imparting a measure of steadfastness to market movements. Or perhaps the strategic acumen cultivated in such education sneaks its way into the decision-making processes of investors, subtly nudging stock prices in a particular direction.

Whatever the underlying explanation, this correlation stands as a remarkable testament to the intertwining of seemingly disparate domains. It's as if the laws of statistical attraction are at play, drawing together these two variables in a magnetic embrace.

The implications of this connection are as intriguing as they are inscrutable, beckoning further exploration and analysis. Could it be that military mindsets harbor subtle influences on the fickle temperament of financial markets? Only time – and further research – will tell.

-------

Your response should start like this:

[[DISCUSSION]]

ChatGPT:

[[DISCUSSION]]

The findings of our study offer compelling evidence of an unexpectedly robust association between the number of Bachelor's degrees awarded in Military technologies and applied sciences and Moody's Corporation (MCO) stock price. The eyebrow-raising correlation coefficient of 0.9855037 and a p-value of less than 0.01 certainly raise a few eyebrows and, dare I say, stock a sense of wonder among the research community. This correlation is more closely knit than a well-tailored military uniform, leaving little room for doubt about the significantly close connection between these seemingly unrelated realms.

Our results build upon prior research that has explored the influence of academic disciplines on economic indicators. The literature has delved into the impact of educational programs on market behavior, shedding light on the potential sway of specialized fields on stock prices. Our findings add a new dimension to this discussion, demonstrating that military education might possess an unexpected gravitational force in the financial cosmos.

Moreover, the whimsical and seemingly incongruous references in our literature review, such as "The Little Engine That Could" and the backs of shampoo bottles, assume a remarkable relevance in light of our results. These seemingly tangential sources, in their own idiosyncratic ways, hint at the multidimensional influences that shape human behavior and decision-making. In the spirit of scholarly inquiry, we must not discount the potential for unexpected sources to offer valuable insights, even if they are tucked away in the most unlikely of places.

The strength of the association between military education and MCO stock price is as formidable as a phalanx of data points advancing in lockstep. This almost uncanny alignment of variables beckons further investigation into the underlying mechanisms at play. It is as if the discipline and strategic acumen cultivated in military education have insinuated themselves into the very fabric of financial markets, exerting a subtle yet perceptible influence on stock price movements.

However, our study is not without its limitations. While the statistical relationship is undeniable, establishing causality remains a task more complex than a Rubik's Cube in the hands of an amateur. Further research is warranted to disentangle the web of influences that may underpin this association and unravel the intricate dynamics between military mindsets and market movements.

In conclusion, our results underscore the need to embrace curiosity and open-minded inquiry, even when it leads us down unconventional paths. The scholarly pursuit of knowledge requires a willingness to entertain unexpected connections and to explore the full spectrum of influences that shape our world, whether they are as subtle as the whisper of stock market secrets or as bold as a resolute military mindset.

Model: gpt-3.5-turbo-1106

System prompt: You are a dry but witty academic researcher. You speak in the passive voice, and your writing sounds like it belongs in a medical or economics journal.You draft the discussion section of goofy academic research papers that sounds like it belongs based on the title and abstract provided.

User prompt:

Pretend you are an academic researcher. Your writing sounds like it belongs in a medical or economics journal. However, you frequently crack jokes, make puns, or add unexpected twists in your writing.

Please make up a short conclusion of an academic research paper presenting the findings of the connection between Bachelor's degrees awarded in Military technologies and applied sciences and Moody's stock price (MCO). Make lots of jokes, goofy observations, and puns. Sneak in some jokes and clever puns about science, research, statistics, and the variables.

Limit your response to 300 tokens. At the very end, assert that no more research is needed in this area.

Here are the title, abstract, introduction, and results sections.

[[TITLE]]

Minding Military Mindsets: Moody's MCO Mayhem

[[ABSTRACT]]

This study delves into the perplexing relationship between the number of Bachelor's degrees awarded in Military technologies and applied sciences and the stock price of Moody's Corporation (MCO). By employing data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), our research team unearthed a correlation coefficient of 0.9855037 and a p-value of less than 0.01 for the period from 2012 to 2021. Our findings suggest that there may be an underlying connection between attitudes cultivated in military education and the fickle dance of Moody's stock price. Further investigation is warranted to determine the causality and potential implications of this unexpected correlation.

[[INTRDUCTION]]

The world of research is often filled with surprises, anomalies, and unexpected connections. Once in a while, a study comes along that challenges our assumptions, leaving us scratching our heads and wondering, "How on earth did these two seemingly unrelated variables end up in cahoots?" This paper delves into just such a scenario, as we explore the peculiar relationship between the number of Bachelor's degrees awarded in Military technologies and applied sciences and the stock price of Moody's Corporation (MCO).

In the grand scheme of academia, military education and stock prices may seem as unlikely a pair as oil and water, or perhaps even as discordant as cats and cucumbers. However, we have harnessed the power of data, statistics, and a touch of academic curiosity to uncover a correlation coefficient of 0.9855037 and a p-value of less than 0.01 for the period from 2012 to 2021. These findings have set the stage for a most captivating conundrum – could there be a hidden link between the strategic prowess taught in military education and the ebbs and flows of Moody's stock price?

This inquiry may seem as improbable as a petri dish suddenly sprouting orchids, or a regression analysis yielding Shakespearean sonnets. Yet, our investigation reveals a compelling statistical relationship that demands further scrutiny. As we navigate the treacherous terrain of data analysis and financial markets, we aim to shed light on this curious coupling and tease out its potential implications.

In the spirit of scientific inquiry, let us embark on this whimsical journey of discovery, seeking to unravel the enigmatic intertwining of military mindsets and Moody's moods.

[[RESULTS]]

The examination of the relationship between the number of Bachelor's degrees awarded in Military technologies and applied sciences and Moody's Corporation (MCO) stock price has yielded a result that might be described as, dare I say, "military precision" in terms of statistical correlation. Over the period from 2012 to 2021, a correlation coefficient of 0.9855037 was found, accompanied by an r-squared value of 0.9712176 and a p-value of less than 0.01.

The strength of this association is as striking as a quasar in a night sky, leaving little room for doubt about the unusually close connection between these seemingly distant variables. This correlation is so robust that it's almost as if these data points were engaged in a synchronized march, with each step perfectly aligned with the other.

In Figure 1, the scatterplot presents a compelling visualization of this extraordinary correlation – a sight that may cause even the most skeptical of analysts to do a double take. The points on the graph appear to be so closely linked that they might as well be arm in arm, whispering stock market secrets to one another.

This unexpected coupling between military education and Moody's stock price invites inquiries that are as fascinating as they are flabbergasting. One might wonder if the discipline instilled in military education somehow infiltrates the very fabric of financial markets, imparting a measure of steadfastness to market movements. Or perhaps the strategic acumen cultivated in such education sneaks its way into the decision-making processes of investors, subtly nudging stock prices in a particular direction.

Whatever the underlying explanation, this correlation stands as a remarkable testament to the intertwining of seemingly disparate domains. It's as if the laws of statistical attraction are at play, drawing together these two variables in a magnetic embrace.

The implications of this connection are as intriguing as they are inscrutable, beckoning further exploration and analysis. Could it be that military mindsets harbor subtle influences on the fickle temperament of financial markets? Only time – and further research – will tell.

-------

Your response should start like this:

[[CONCLUSION]]

ChatGPT:

[[CONCLUSION]]

In conclusion, our investigation into the perplexing entanglement of Bachelor's degrees awarded in Military technologies and applied sciences with Moody's Corporation (MCO) stock price has uncovered a correlation so formidable, it's enough to make even the most seasoned statistician do a double take. The strength of this relationship is as sturdy as a titanium compound, leaving little room for doubt about its newfound significance.

This unexpected connection prompts a flurry of whimsical ponderings and academic musings. One might jest that the military precision ingrained in the graduates has strategically infiltrated the stock market, orchestrating a symphony of bullish and bearish notes. Alternatively, one could playfully speculate whether the strategic maneuvers taught in military education do indeed extend to the realm of investment decisions, subtly nudging stock prices like pieces on a chessboard.

However, it is essential to maintain a cautious approach in interpretation, for as the saying goes, "correlation does not imply causation." While our findings unearth a compelling statistical relationship, we must not leap to conclusions as hasty as a hare in a hurry.

Yet, the allure of this odd pair – military education and Moody's moods – persists, inviting further exploration and analysis. Could it be that military mindsets offer a dash of stability to the capricious world of finance? Is there a covert camaraderie between these variables, akin to a secret handshake in statistical circles?

Finally, we must acknowledge that, after this rigorous exploration, we have found a correlation that is as remarkable as it is enigmatic, leaving us with more questions than answers. Nonetheless, we are convinced that further research in this area is unnecessary, as the findings of this study have shone a spotlight on the unexpected and deserve a standing ovation for their sheer audacity.

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of academic journals. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding research, scientific, or academic journal that would publish a paper entited Minding Military Mindsets: Moody's MCO Mayhem. Respond only with the name of a fictional academic journal.

ChatGPT:

Journal of Military Psychology Research

Model: gpt-3.5-turbo-1106

System prompt: You provide fictional names of nonprofit research organizations and associations. You say nothing else, and you do not chat with the user.

User prompt: Please provide the name of a funny but plausible sounding nonprofit, academic, or scientific association or organization that would sponsor research that resulted in a paper entited Minding Military Mindsets: Moody's MCO Mayhem. Respond only with the name of a fictional organization.

ChatGPT:

The Center for Defense-Related Emotion Analysis and Behavioral Studies (CDREABS)

Model: gpt-3.5-turbo-1106

System prompt: You provide potential search keywords separated by commas. You say nothing else, and you do not chat with the user.

User prompt: Please provide potential search keywords for a paper titled Minding Military Mindsets: Moody's MCO Mayhem with an abstract of This study delves into the perplexing relationship between the number of Bachelor's degrees awarded in Military technologies and applied sciences and the stock price of Moody's Corporation (MCO). By employing data from the National Center for Education Statistics and LSEG Analytics (Refinitiv), our research team unearthed a correlation coefficient of 0.9855037 and a p-value of less than 0.01 for the period from 2012 to 2021. Our findings suggest that there may be an underlying connection between attitudes cultivated in military education and the fickle dance of Moody's stock price. Further investigation is warranted to determine the causality and potential implications of this unexpected correlation.

ChatGPT:

Bachelor's degrees, Military technologies, Applied sciences, Moody's Corporation, Stock price, National Center for Education Statistics, LSEG Analytics, Correlation coefficient, P-value, Military education, Causality, Implications

*There is a bunch of Python happening behind the scenes to turn this prompt sequence into a PDF.

Discover a new correlation

View all correlations

View all research papers

Report an error

Data details

Bachelor's degrees awarded in Military technologiesDetailed data title: Bachelor's degrees conferred by postsecondary institutions, in field of study: Military technologies and applied sciences

Source: National Center for Education Statistics

See what else correlates with Bachelor's degrees awarded in Military technologies

Moody's stock price (MCO)

Detailed data title: Opening price of Moody's (MCO) on the first trading day of the year

Source: LSEG Analytics (Refinitiv)

Additional Info: Via Microsoft Excel Stockhistory function

See what else correlates with Moody's stock price (MCO)

Correlation is a measure of how much the variables move together. If it is 0.99, when one goes up the other goes up. If it is 0.02, the connection is very weak or non-existent. If it is -0.99, then when one goes up the other goes down. If it is 1.00, you probably messed up your correlation function.

r2 = 0.9712176 (Coefficient of determination)

This means 97.1% of the change in the one variable (i.e., Moody's stock price (MCO)) is predictable based on the change in the other (i.e., Bachelor's degrees awarded in Military technologies) over the 10 years from 2012 through 2021.

p < 0.01, which is statistically significant(Null hypothesis significance test)

The p-value is 1.9E-7. 0.0000001898578309774678700000

The p-value is a measure of how probable it is that we would randomly find a result this extreme. More specifically the p-value is a measure of how probable it is that we would randomly find a result this extreme if we had only tested one pair of variables one time.

But I am a p-villain. I absolutely did not test only one pair of variables one time. I correlated hundreds of millions of pairs of variables. I threw boatloads of data into an industrial-sized blender to find this correlation.

Who is going to stop me? p-value reporting doesn't require me to report how many calculations I had to go through in order to find a low p-value!

On average, you will find a correaltion as strong as 0.99 in 1.9E-5% of random cases. Said differently, if you correlated 5,267,099 random variables You don't actually need 5 million variables to find a correlation like this one. I don't have that many variables in my database. You can also correlate variables that are not independent. I do this a lot.

p-value calculations are useful for understanding the probability of a result happening by chance. They are most useful when used to highlight the risk of a fluke outcome. For example, if you calculate a p-value of 0.30, the risk that the result is a fluke is high. It is good to know that! But there are lots of ways to get a p-value of less than 0.01, as evidenced by this project.

In this particular case, the values are so extreme as to be meaningless. That's why no one reports p-values with specificity after they drop below 0.01.

Just to be clear: I'm being completely transparent about the calculations. There is no math trickery. This is just how statistics shakes out when you calculate hundreds of millions of random correlations.

with the same 9 degrees of freedom, Degrees of freedom is a measure of how many free components we are testing. In this case it is 9 because we have two variables measured over a period of 10 years. It's just the number of years minus ( the number of variables minus one ), which in this case simplifies to the number of years minus one.

you would randomly expect to find a correlation as strong as this one.

[ 0.94, 1 ] 95% correlation confidence interval (using the Fisher z-transformation)

The confidence interval is an estimate the range of the value of the correlation coefficient, using the correlation itself as an input. The values are meant to be the low and high end of the correlation coefficient with 95% confidence.

This one is a bit more complciated than the other calculations, but I include it because many people have been pushing for confidence intervals instead of p-value calculations (for example: NEJM. However, if you are dredging data, you can reliably find yourself in the 5%. That's my goal!

All values for the years included above: If I were being very sneaky, I could trim years from the beginning or end of the datasets to increase the correlation on some pairs of variables. I don't do that because there are already plenty of correlations in my database without monkeying with the years.

Still, sometimes one of the variables has more years of data available than the other. This page only shows the overlapping years. To see all the years, click on "See what else correlates with..." link above.

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

| Bachelor's degrees awarded in Military technologies (Degrees awarded) | 86 | 105 | 185 | 276 | 358 | 469 | 655 | 767 | 1156 | 1524 |

| Moody's stock price (MCO) (Stock price) | 34.42 | 51.48 | 77.86 | 96.54 | 98.44 | 95.01 | 147.96 | 137.42 | 238.68 | 293.5 |

Why this works

- Data dredging: I have 25,153 variables in my database. I compare all these variables against each other to find ones that randomly match up. That's 632,673,409 correlation calculations! This is called “data dredging.” Instead of starting with a hypothesis and testing it, I instead abused the data to see what correlations shake out. It’s a dangerous way to go about analysis, because any sufficiently large dataset will yield strong correlations completely at random.

- Lack of causal connection: There is probably

Because these pages are automatically generated, it's possible that the two variables you are viewing are in fact causually related. I take steps to prevent the obvious ones from showing on the site (I don't let data about the weather in one city correlate with the weather in a neighboring city, for example), but sometimes they still pop up. If they are related, cool! You found a loophole.

no direct connection between these variables, despite what the AI says above. This is exacerbated by the fact that I used "Years" as the base variable. Lots of things happen in a year that are not related to each other! Most studies would use something like "one person" in stead of "one year" to be the "thing" studied. - Observations not independent: For many variables, sequential years are not independent of each other. If a population of people is continuously doing something every day, there is no reason to think they would suddenly change how they are doing that thing on January 1. A simple

Personally I don't find any p-value calculation to be 'simple,' but you know what I mean.

p-value calculation does not take this into account, so mathematically it appears less probable than it really is.

Try it yourself

You can calculate the values on this page on your own! Try running the Python code to see the calculation results. Step 1: Download and install Python on your computer.Step 2: Open a plaintext editor like Notepad and paste the code below into it.

Step 3: Save the file as "calculate_correlation.py" in a place you will remember, like your desktop. Copy the file location to your clipboard. On Windows, you can right-click the file and click "Properties," and then copy what comes after "Location:" As an example, on my computer the location is "C:\Users\tyler\Desktop"

Step 4: Open a command line window. For example, by pressing start and typing "cmd" and them pressing enter.

Step 5: Install the required modules by typing "pip install numpy", then pressing enter, then typing "pip install scipy", then pressing enter.

Step 6: Navigate to the location where you saved the Python file by using the "cd" command. For example, I would type "cd C:\Users\tyler\Desktop" and push enter.

Step 7: Run the Python script by typing "python calculate_correlation.py"

If you run into any issues, I suggest asking ChatGPT to walk you through installing Python and running the code below on your system. Try this question:

"Walk me through installing Python on my computer to run a script that uses scipy and numpy. Go step-by-step and ask me to confirm before moving on. Start by asking me questions about my operating system so that you know how to proceed. Assume I want the simplest installation with the latest version of Python and that I do not currently have any of the necessary elements installed. Remember to only give me one step per response and confirm I have done it before proceeding."

# These modules make it easier to perform the calculation

import numpy as np

from scipy import stats

# We'll define a function that we can call to return the correlation calculations

def calculate_correlation(array1, array2):

# Calculate Pearson correlation coefficient and p-value

correlation, p_value = stats.pearsonr(array1, array2)

# Calculate R-squared as the square of the correlation coefficient

r_squared = correlation**2

return correlation, r_squared, p_value

# These are the arrays for the variables shown on this page, but you can modify them to be any two sets of numbers

array_1 = np.array([86,105,185,276,358,469,655,767,1156,1524,])

array_2 = np.array([34.42,51.48,77.86,96.54,98.44,95.01,147.96,137.42,238.68,293.5,])

array_1_name = "Bachelor's degrees awarded in Military technologies"

array_2_name = "Moody's stock price (MCO)"

# Perform the calculation

print(f"Calculating the correlation between {array_1_name} and {array_2_name}...")

correlation, r_squared, p_value = calculate_correlation(array_1, array_2)

# Print the results

print("Correlation Coefficient:", correlation)

print("R-squared:", r_squared)

print("P-value:", p_value)Reuseable content

You may re-use the images on this page for any purpose, even commercial purposes, without asking for permission. The only requirement is that you attribute Tyler Vigen. Attribution can take many different forms. If you leave the "tylervigen.com" link in the image, that satisfies it just fine. If you remove it and move it to a footnote, that's fine too. You can also just write "Charts courtesy of Tyler Vigen" at the bottom of an article.You do not need to attribute "the spurious correlations website," and you don't even need to link here if you don't want to. I don't gain anything from pageviews. There are no ads on this site, there is nothing for sale, and I am not for hire.

For the record, I am just one person. Tyler Vigen, he/him/his. I do have degrees, but they should not go after my name unless you want to annoy my wife. If that is your goal, then go ahead and cite me as "Tyler Vigen, A.A. A.A.S. B.A. J.D." Otherwise it is just "Tyler Vigen."

When spoken, my last name is pronounced "vegan," like I don't eat meat.

Full license details.

For more on re-use permissions, or to get a signed release form, see tylervigen.com/permission.

Download images for these variables:

- High resolution line chart

The image linked here is a Scalable Vector Graphic (SVG). It is the highest resolution that is possible to achieve. It scales up beyond the size of the observable universe without pixelating. You do not need to email me asking if I have a higher resolution image. I do not. The physical limitations of our universe prevent me from providing you with an image that is any higher resolution than this one.

If you insert it into a PowerPoint presentation (a tool well-known for managing things that are the scale of the universe), you can right-click > "Ungroup" or "Create Shape" and then edit the lines and text directly. You can also change the colors this way.

Alternatively you can use a tool like Inkscape. - High resolution line chart, optimized for mobile

- Alternative high resolution line chart

- Scatterplot

- Portable line chart (png)

- Portable line chart (png), optimized for mobile

- Line chart for only Bachelor's degrees awarded in Military technologies

- Line chart for only Moody's stock price (MCO)

- AI-generated correlation image

- The spurious research paper: Minding Military Mindsets: Moody's MCO Mayhem

You're a rater extraordinaire!

Correlation ID: 2123 · Black Variable ID: 1284 · Red Variable ID: 1694